Professional Documents

Culture Documents

Fund Fact Sheets - Prosperity Bond Fund

Fund Fact Sheets - Prosperity Bond Fund

Uploaded by

Jeuz Llorenz Colendra-ApitaCopyright:

Available Formats

You might also like

- CEIE 301 Textbook SDocument410 pagesCEIE 301 Textbook SSarmad Kayani75% (4)

- Fund Fact Sheets - Prosperity Bond FundDocument1 pageFund Fact Sheets - Prosperity Bond FundJohh-RevNo ratings yet

- Fund Fact Sheets - Prosperity Money Market FundDocument1 pageFund Fact Sheets - Prosperity Money Market FundRedStephenVillaramaNo ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajNo ratings yet

- Fund Fact Sheets - Prosperity Balanced FundDocument1 pageFund Fact Sheets - Prosperity Balanced FundJohh-RevNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushNo ratings yet

- Diversified JulyDocument1 pageDiversified JulyPiyushNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- Investment Objective Historical Performance: Pami Horizon Fund, IncDocument1 pageInvestment Objective Historical Performance: Pami Horizon Fund, IncRamil MontealtoNo ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- NWPCap PrivateDebt Q1-2023Document2 pagesNWPCap PrivateDebt Q1-2023zackzyp98No ratings yet

- Intermediate Term Bond FundDocument1 pageIntermediate Term Bond FundYannah HidalgoNo ratings yet

- Hybrid Fund Completes 5 Years NoteDocument3 pagesHybrid Fund Completes 5 Years NoteMohamed Rajiv AshaNo ratings yet

- Long Term Bond FundDocument1 pageLong Term Bond FundYannah HidalgoNo ratings yet

- Peso Powerhouse Fund - Fund Fact Sheet - December - 2020Document2 pagesPeso Powerhouse Fund - Fund Fact Sheet - December - 2020Jayr LegaspiNo ratings yet

- Viewpdf 2Document3 pagesViewpdf 2gqq68mrnpmNo ratings yet

- Diversified Equity FundDocument1 pageDiversified Equity FundHimanshu AgrawalNo ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- Fund Allocation Investment Objective: Pami Equity Index Fund, IncDocument1 pageFund Allocation Investment Objective: Pami Equity Index Fund, IncRamil MontealtoNo ratings yet

- Product Snapshot: DSP Bond FundDocument2 pagesProduct Snapshot: DSP Bond FundManoj SharmaNo ratings yet

- Medium Term Bond FundDocument1 pageMedium Term Bond FundYannah HidalgoNo ratings yet

- Conservative at Least Five (5) Years: Account of The ClientDocument2 pagesConservative at Least Five (5) Years: Account of The ClientkimencinaNo ratings yet

- What Does The Fund Invest In?: Sun Life Grepa Growth PLUS FundDocument1 pageWhat Does The Fund Invest In?: Sun Life Grepa Growth PLUS FundBee ThreeallNo ratings yet

- Fund Fact Sheets - Prosperity Equity FundDocument1 pageFund Fact Sheets - Prosperity Equity FundJohh-RevNo ratings yet

- Peso Wealth Optimizer Fund 2036 - Fund Fact Sheet - December - 2020Document3 pagesPeso Wealth Optimizer Fund 2036 - Fund Fact Sheet - December - 2020Jayr LegaspiNo ratings yet

- L&T Triple Ace Bond Fund - October 18 2021Document14 pagesL&T Triple Ace Bond Fund - October 18 2021Deepak Singh PundirNo ratings yet

- Philequity Peso Bond Fund: Navps As of Dec 27, 2019Document1 pagePhilequity Peso Bond Fund: Navps As of Dec 27, 2019Marlon DNo ratings yet

- Peso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Document2 pagesPeso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Jayr LegaspiNo ratings yet

- Fund Fact Sheet June 2020Document21 pagesFund Fact Sheet June 2020Devi TinawatiNo ratings yet

- Peso Emperor Fund - Fund Fact Sheet - October - 2020Document2 pagesPeso Emperor Fund - Fund Fact Sheet - October - 2020Jayr LegaspiNo ratings yet

- Fact Sheet - ICON Flexible Bond Fund (IOBZX)Document2 pagesFact Sheet - ICON Flexible Bond Fund (IOBZX)acie600No ratings yet

- Investment Objective NAVPS Graph: Philam Bond Fund, IncDocument1 pageInvestment Objective NAVPS Graph: Philam Bond Fund, IncRamil MontealtoNo ratings yet

- RHB Islamic Global Developed Markets FundDocument2 pagesRHB Islamic Global Developed Markets FundIrfan AzmiNo ratings yet

- Government Money Market I Fund (6) : Fixed Income Stable ValueDocument2 pagesGovernment Money Market I Fund (6) : Fixed Income Stable ValueiuxhpccxNo ratings yet

- FMR Feb 2010Document8 pagesFMR Feb 2010qasim_mahniNo ratings yet

- ALFM Peso Bond Fund Inc. - 202208Document2 pagesALFM Peso Bond Fund Inc. - 202208Megan CastilloNo ratings yet

- DSP Banking & PSU Debt FundDocument1 pageDSP Banking & PSU Debt FundTrivikram AsNo ratings yet

- NMMF May 2022Document1 pageNMMF May 2022chqaiserNo ratings yet

- DebtDocument9 pagesDebtapi-3705377No ratings yet

- First Metro Save and Learn Fixed Income FundDocument1 pageFirst Metro Save and Learn Fixed Income FundkimencinaNo ratings yet

- Equity Fund: % Top 10 Holding As On 31st March 2019Document1 pageEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarNo ratings yet

- 12.max Life Diversified Equity FundDocument1 page12.max Life Diversified Equity Fundgourab.1996paulNo ratings yet

- NBP Islamic Mahana Amdani Fund (Nimaf)Document1 pageNBP Islamic Mahana Amdani Fund (Nimaf)Afnan TariqNo ratings yet

- Home First Finance Company India LTD.: SubscribeDocument7 pagesHome First Finance Company India LTD.: SubscribeVanshajNo ratings yet

- NIOF-Dec 2020Document1 pageNIOF-Dec 2020chqaiserNo ratings yet

- ALFM Peso Bond FundDocument2 pagesALFM Peso Bond FundkimencinaNo ratings yet

- Fund Fact Sheet - March 2019Document20 pagesFund Fact Sheet - March 2019Afthon Ilman Huda Isyfi100% (1)

- Online Mutual Funds Case - Group #5 - Fund FactDocument15 pagesOnline Mutual Funds Case - Group #5 - Fund FactSailesh KattelNo ratings yet

- NBP Riba Free Savings Fund (NRFSF)Document1 pageNBP Riba Free Savings Fund (NRFSF)HIRA -No ratings yet

- Asset Allocation Fund (5) : Hybrid Hybrid BalancedDocument2 pagesAsset Allocation Fund (5) : Hybrid Hybrid BalancedHayston DezmenNo ratings yet

- Unit-Linked Fund: Balancer II (Open Fund)Document1 pageUnit-Linked Fund: Balancer II (Open Fund)sandeepNo ratings yet

- VPC - Accelerated Growth FundDocument1 pageVPC - Accelerated Growth FundKareemAdams9029No ratings yet

- ALFM Peso Bond Fund Inc. - 202205 1Document2 pagesALFM Peso Bond Fund Inc. - 202205 1C KNo ratings yet

- Handbook Budgeting Investment BasicsDocument12 pagesHandbook Budgeting Investment Basicsmanmadha.sharmaNo ratings yet

- Product Snapshot: DSP 10Y G-Sec FundDocument2 pagesProduct Snapshot: DSP 10Y G-Sec FundManoj SharmaNo ratings yet

- Managed Fund January 2021Document3 pagesManaged Fund January 2021CHEONG WEI HAONo ratings yet

- Project ProposalDocument2 pagesProject ProposalFranz Daniel Ebron100% (1)

- Types of Societies - General ClassificationDocument28 pagesTypes of Societies - General ClassificationMd. RakibNo ratings yet

- ECCS-Behaviour and Design of Steel Plated StructuresDocument124 pagesECCS-Behaviour and Design of Steel Plated StructuresAlexandros GiNo ratings yet

- Torres, Concepcion Vienice M. Valtiendaz, Honeylet ADocument5 pagesTorres, Concepcion Vienice M. Valtiendaz, Honeylet AVienice TorresNo ratings yet

- Haut Lac Postion PaperDocument4 pagesHaut Lac Postion Paperbm9gvfxj6hNo ratings yet

- Cost of Capital QuestionsDocument18 pagesCost of Capital QuestionsRonmaty VixNo ratings yet

- Identifying and Analyzing Domestic and International OpportunitiesDocument28 pagesIdentifying and Analyzing Domestic and International OpportunitiesDani DaniNo ratings yet

- Paper 3 Stlye Questions On Economic DevelopmentDocument4 pagesPaper 3 Stlye Questions On Economic DevelopmentzaraongkoNo ratings yet

- CIC 3019 Tutorial Ch3 - SolutionsDocument5 pagesCIC 3019 Tutorial Ch3 - SolutionsYen Yen BiiNo ratings yet

- Numbers and Narratives (Compact)Document4 pagesNumbers and Narratives (Compact)anshu kumarNo ratings yet

- Welcome To KBDA - Members Details PDFDocument7 pagesWelcome To KBDA - Members Details PDFSuresh KumarNo ratings yet

- Financial Markets (Chapter 3)Document1 pageFinancial Markets (Chapter 3)Kyla DayawonNo ratings yet

- Financial AccountingDocument18 pagesFinancial AccountingSimmi KhuranaNo ratings yet

- No Endowment No ULIPsDocument15 pagesNo Endowment No ULIPsApacheBullNo ratings yet

- Full Download Solution Manual For Global 4 4th Edition Mike Peng PDF Full ChapterDocument36 pagesFull Download Solution Manual For Global 4 4th Edition Mike Peng PDF Full Chapterwaycotgareb5ewy100% (21)

- S&P 500 Index Duke Energy StockDocument12 pagesS&P 500 Index Duke Energy Stockshrijit “shri” tembheharNo ratings yet

- Pel 23 24 132 1Document1 pagePel 23 24 132 1Harikrishan BhattNo ratings yet

- OG Catalogue 2020 CompressedDocument103 pagesOG Catalogue 2020 CompressedGaspar SalasNo ratings yet

- Allahabad BankDocument7 pagesAllahabad Bankincentives vacationsNo ratings yet

- LSP PresentationDocument17 pagesLSP Presentationd2qbjbxk7hNo ratings yet

- Principles of Auditing: VouchingDocument12 pagesPrinciples of Auditing: Vouchingilyas muhammadNo ratings yet

- Financial Management: Week 1Document314 pagesFinancial Management: Week 1Hien NguyenNo ratings yet

- Stock Screener, Technical Analysis ScannerDocument32 pagesStock Screener, Technical Analysis Scanneriamsam4uNo ratings yet

- Food SI 2023 GK Practice Set 002 by Tapas KumbhakarDocument4 pagesFood SI 2023 GK Practice Set 002 by Tapas Kumbhakarkaustav royNo ratings yet

- Gra C03S03Document2 pagesGra C03S03Natalia ShubinaNo ratings yet

- Adv Econ Theory Solution Guide 10-12Document19 pagesAdv Econ Theory Solution Guide 10-12Kim Chi LeNo ratings yet

- 1.what Is GDR?Document2 pages1.what Is GDR?btamilarasan88No ratings yet

- Indian Economy 2nd SemDocument4 pagesIndian Economy 2nd SemPooja SanwalNo ratings yet

- TransferconfirmationDocument2 pagesTransferconfirmationidriss deby itnoNo ratings yet

Fund Fact Sheets - Prosperity Bond Fund

Fund Fact Sheets - Prosperity Bond Fund

Uploaded by

Jeuz Llorenz Colendra-ApitaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fund Fact Sheets - Prosperity Bond Fund

Fund Fact Sheets - Prosperity Bond Fund

Uploaded by

Jeuz Llorenz Colendra-ApitaCopyright:

Available Formats

FUND FACTS

Sun Life of Canada Prosperity Bond Fund

February 26, 2021

This document contains key information clients of Sun Life of Canada Prosperity Bond Fund should know about. More information can be found in the Fund’s prospectus. Ask a

Sun Life Financial Advisor or contact Sun Life Asset Management Company, Inc., at 8-849-9888 or Phil-MF-Products@sunlife.com or visit www.sunlifefunds.com.

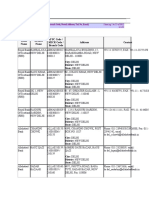

Launch Date April 5, 2000 Fund Structure Mutual Fund (Shares) Transfer Agency Fee 0.15%

Fund Size PHP 5,186,794,120.08 Fund Classification Fixed Income Fund Minimum Holding Period None

Net Asset Value Per Share 3.1832 Minimum Subscription PHP 1,000 Early Redemption Fee None

Benchmark 95% Bloomberg Sovereign Bond Minimum Subsequent PHP 1,000 Redemption Settlement T+3 business days

Index 1 to 5 Year + 5% 30-day SSA Management and Distribution Fee 1.00%

What does the Fund invest in?

The Sun Life of Canada Prosperity Bond Fund aims to provide regular interest and principal preservation through investments in

government and high quality corporate debt securities.

The Fund is suitable for investors with a moderate risk profile and a medium-term investment horizon. This is for investors who

want relatively stable and reasonable returns.

Top Fixed Income Holdings Investment Mix Maturity Profile

1. Treasury Notes 2025, 42.5%

Government Bonds 0-3 years

2. Money Market - Other Banks, 14.85% 46.06% 20.65%

Corporate Bonds 3-5 years

3. Sun Life Prosperity Money Market Fund, 4.44%

20.46% 60.86%

4. Commercial Paper 2021, 3.78% Money Market 5-7 years

Placements 19.39% 8.48%

5. Treasury Notes 2030, 3.56% Corporate Loans 7-10 years

7.06% 5.93%

Cash and Other 10-20 years

Liquid Assets 7.03% 4.08%

How has the Fund performed? Market Review

• Peso bond yields skyrocketed over the month,

YTD Return -0.60% though front-end yields were somewhat shielded

-0.71%

from this move. Short-term bond indices moved flat

1-Year Return 6.87% over the month.

2.72% • Rising US yields were the primary catalyst for the hit

on yields 5Y and longer, while still-abundant liquidity

20.74%

3-year Return

14.29%

continued to keep the front end of the curve

anchored (rising only 10-20 bps).

26.49% • The Bureau of Treasury also issued a 3Y Retail

5-year Return

15.92% Treasury Bond priced at 2.375%, while initially giving

a good premium over secondary market levels, the

-7.00% 3.00% 13.00% 23.00% 33.00%

extreme rise in yields have eroded the premium.

Benchmark: 95% Bloomberg Sovereign Bond Index (1 to 5 Year)* + 5% 30-day SSA**

Sun Life of Canada Prosperity Bond Fund

Issue date is March 9, 2021.

*Benchmark Effectivity Date: • Philippine February inflation printed higher than the

HSBC Local Currency Bond Philippines Liquid Total Return: May 25, 2009 to April 29, 2016

Bloomberg Sovereign Bond Index: May 1, 2016 to February 28, 2017 January figure with a +4.7% increase year-on-year.

Bloomberg Sovereign Bond Index (1 to 5 Year): March 1, 2017 to present

**The Philippines 30-day Special Savings Rate General Average (PSAVAVE Index) was last updated in Bloomberg on 27

• The Prosperity Bond Fund (-0.71%) lagged the year-

December 2019. The source of the PSAVAVE Index is the Bangko Sentral ng Pilipinas (BSP). The BSP required universal

and commercial banks to submit the amended reporting templates on Interest Rates on Loans and Deposits (IRLD)

to-date return of its benchmark (-0.60%) due to its

effective 1 January 2020 in accordance with Circular Nos. 1029 and 1037, series of 2019. Due to COVID-19, per BSP

Memorandum No. M-2020-049 dated 9 June 2020, amending BSP Memorandum M-2020-011 dated 19 March 2020,

overweight duration position.

banks' submission of IRLD weekly reports that fall due within the months March-June 2020 is suspended until further

notice.

Disclaimer: Mutual Fund performance depends on various market and economic conditions. Past performance is not a guarantee or an indication of future results. Thus, returns

are not guaranteed and may differ from the original investment. Information contained in this Fund Fact Sheet do not constitute investment advice. For more information on our

mutual funds, please consult a Sun Life Financial Advisor.

You might also like

- CEIE 301 Textbook SDocument410 pagesCEIE 301 Textbook SSarmad Kayani75% (4)

- Fund Fact Sheets - Prosperity Bond FundDocument1 pageFund Fact Sheets - Prosperity Bond FundJohh-RevNo ratings yet

- Fund Fact Sheets - Prosperity Money Market FundDocument1 pageFund Fact Sheets - Prosperity Money Market FundRedStephenVillaramaNo ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- HDFC Diversified Equity FundDocument1 pageHDFC Diversified Equity FundMayank RajNo ratings yet

- Fund Fact Sheets - Prosperity Balanced FundDocument1 pageFund Fact Sheets - Prosperity Balanced FundJohh-RevNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- Blue Chip JulyDocument1 pageBlue Chip JulyPiyushNo ratings yet

- Diversified JulyDocument1 pageDiversified JulyPiyushNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- Investment Objective Historical Performance: Pami Horizon Fund, IncDocument1 pageInvestment Objective Historical Performance: Pami Horizon Fund, IncRamil MontealtoNo ratings yet

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandNo ratings yet

- NWPCap PrivateDebt Q1-2023Document2 pagesNWPCap PrivateDebt Q1-2023zackzyp98No ratings yet

- Intermediate Term Bond FundDocument1 pageIntermediate Term Bond FundYannah HidalgoNo ratings yet

- Hybrid Fund Completes 5 Years NoteDocument3 pagesHybrid Fund Completes 5 Years NoteMohamed Rajiv AshaNo ratings yet

- Long Term Bond FundDocument1 pageLong Term Bond FundYannah HidalgoNo ratings yet

- Peso Powerhouse Fund - Fund Fact Sheet - December - 2020Document2 pagesPeso Powerhouse Fund - Fund Fact Sheet - December - 2020Jayr LegaspiNo ratings yet

- Viewpdf 2Document3 pagesViewpdf 2gqq68mrnpmNo ratings yet

- Diversified Equity FundDocument1 pageDiversified Equity FundHimanshu AgrawalNo ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- Fund Allocation Investment Objective: Pami Equity Index Fund, IncDocument1 pageFund Allocation Investment Objective: Pami Equity Index Fund, IncRamil MontealtoNo ratings yet

- Product Snapshot: DSP Bond FundDocument2 pagesProduct Snapshot: DSP Bond FundManoj SharmaNo ratings yet

- Medium Term Bond FundDocument1 pageMedium Term Bond FundYannah HidalgoNo ratings yet

- Conservative at Least Five (5) Years: Account of The ClientDocument2 pagesConservative at Least Five (5) Years: Account of The ClientkimencinaNo ratings yet

- What Does The Fund Invest In?: Sun Life Grepa Growth PLUS FundDocument1 pageWhat Does The Fund Invest In?: Sun Life Grepa Growth PLUS FundBee ThreeallNo ratings yet

- Fund Fact Sheets - Prosperity Equity FundDocument1 pageFund Fact Sheets - Prosperity Equity FundJohh-RevNo ratings yet

- Peso Wealth Optimizer Fund 2036 - Fund Fact Sheet - December - 2020Document3 pagesPeso Wealth Optimizer Fund 2036 - Fund Fact Sheet - December - 2020Jayr LegaspiNo ratings yet

- L&T Triple Ace Bond Fund - October 18 2021Document14 pagesL&T Triple Ace Bond Fund - October 18 2021Deepak Singh PundirNo ratings yet

- Philequity Peso Bond Fund: Navps As of Dec 27, 2019Document1 pagePhilequity Peso Bond Fund: Navps As of Dec 27, 2019Marlon DNo ratings yet

- Peso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Document2 pagesPeso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Jayr LegaspiNo ratings yet

- Fund Fact Sheet June 2020Document21 pagesFund Fact Sheet June 2020Devi TinawatiNo ratings yet

- Peso Emperor Fund - Fund Fact Sheet - October - 2020Document2 pagesPeso Emperor Fund - Fund Fact Sheet - October - 2020Jayr LegaspiNo ratings yet

- Fact Sheet - ICON Flexible Bond Fund (IOBZX)Document2 pagesFact Sheet - ICON Flexible Bond Fund (IOBZX)acie600No ratings yet

- Investment Objective NAVPS Graph: Philam Bond Fund, IncDocument1 pageInvestment Objective NAVPS Graph: Philam Bond Fund, IncRamil MontealtoNo ratings yet

- RHB Islamic Global Developed Markets FundDocument2 pagesRHB Islamic Global Developed Markets FundIrfan AzmiNo ratings yet

- Government Money Market I Fund (6) : Fixed Income Stable ValueDocument2 pagesGovernment Money Market I Fund (6) : Fixed Income Stable ValueiuxhpccxNo ratings yet

- FMR Feb 2010Document8 pagesFMR Feb 2010qasim_mahniNo ratings yet

- ALFM Peso Bond Fund Inc. - 202208Document2 pagesALFM Peso Bond Fund Inc. - 202208Megan CastilloNo ratings yet

- DSP Banking & PSU Debt FundDocument1 pageDSP Banking & PSU Debt FundTrivikram AsNo ratings yet

- NMMF May 2022Document1 pageNMMF May 2022chqaiserNo ratings yet

- DebtDocument9 pagesDebtapi-3705377No ratings yet

- First Metro Save and Learn Fixed Income FundDocument1 pageFirst Metro Save and Learn Fixed Income FundkimencinaNo ratings yet

- Equity Fund: % Top 10 Holding As On 31st March 2019Document1 pageEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarNo ratings yet

- 12.max Life Diversified Equity FundDocument1 page12.max Life Diversified Equity Fundgourab.1996paulNo ratings yet

- NBP Islamic Mahana Amdani Fund (Nimaf)Document1 pageNBP Islamic Mahana Amdani Fund (Nimaf)Afnan TariqNo ratings yet

- Home First Finance Company India LTD.: SubscribeDocument7 pagesHome First Finance Company India LTD.: SubscribeVanshajNo ratings yet

- NIOF-Dec 2020Document1 pageNIOF-Dec 2020chqaiserNo ratings yet

- ALFM Peso Bond FundDocument2 pagesALFM Peso Bond FundkimencinaNo ratings yet

- Fund Fact Sheet - March 2019Document20 pagesFund Fact Sheet - March 2019Afthon Ilman Huda Isyfi100% (1)

- Online Mutual Funds Case - Group #5 - Fund FactDocument15 pagesOnline Mutual Funds Case - Group #5 - Fund FactSailesh KattelNo ratings yet

- NBP Riba Free Savings Fund (NRFSF)Document1 pageNBP Riba Free Savings Fund (NRFSF)HIRA -No ratings yet

- Asset Allocation Fund (5) : Hybrid Hybrid BalancedDocument2 pagesAsset Allocation Fund (5) : Hybrid Hybrid BalancedHayston DezmenNo ratings yet

- Unit-Linked Fund: Balancer II (Open Fund)Document1 pageUnit-Linked Fund: Balancer II (Open Fund)sandeepNo ratings yet

- VPC - Accelerated Growth FundDocument1 pageVPC - Accelerated Growth FundKareemAdams9029No ratings yet

- ALFM Peso Bond Fund Inc. - 202205 1Document2 pagesALFM Peso Bond Fund Inc. - 202205 1C KNo ratings yet

- Handbook Budgeting Investment BasicsDocument12 pagesHandbook Budgeting Investment Basicsmanmadha.sharmaNo ratings yet

- Product Snapshot: DSP 10Y G-Sec FundDocument2 pagesProduct Snapshot: DSP 10Y G-Sec FundManoj SharmaNo ratings yet

- Managed Fund January 2021Document3 pagesManaged Fund January 2021CHEONG WEI HAONo ratings yet

- Project ProposalDocument2 pagesProject ProposalFranz Daniel Ebron100% (1)

- Types of Societies - General ClassificationDocument28 pagesTypes of Societies - General ClassificationMd. RakibNo ratings yet

- ECCS-Behaviour and Design of Steel Plated StructuresDocument124 pagesECCS-Behaviour and Design of Steel Plated StructuresAlexandros GiNo ratings yet

- Torres, Concepcion Vienice M. Valtiendaz, Honeylet ADocument5 pagesTorres, Concepcion Vienice M. Valtiendaz, Honeylet AVienice TorresNo ratings yet

- Haut Lac Postion PaperDocument4 pagesHaut Lac Postion Paperbm9gvfxj6hNo ratings yet

- Cost of Capital QuestionsDocument18 pagesCost of Capital QuestionsRonmaty VixNo ratings yet

- Identifying and Analyzing Domestic and International OpportunitiesDocument28 pagesIdentifying and Analyzing Domestic and International OpportunitiesDani DaniNo ratings yet

- Paper 3 Stlye Questions On Economic DevelopmentDocument4 pagesPaper 3 Stlye Questions On Economic DevelopmentzaraongkoNo ratings yet

- CIC 3019 Tutorial Ch3 - SolutionsDocument5 pagesCIC 3019 Tutorial Ch3 - SolutionsYen Yen BiiNo ratings yet

- Numbers and Narratives (Compact)Document4 pagesNumbers and Narratives (Compact)anshu kumarNo ratings yet

- Welcome To KBDA - Members Details PDFDocument7 pagesWelcome To KBDA - Members Details PDFSuresh KumarNo ratings yet

- Financial Markets (Chapter 3)Document1 pageFinancial Markets (Chapter 3)Kyla DayawonNo ratings yet

- Financial AccountingDocument18 pagesFinancial AccountingSimmi KhuranaNo ratings yet

- No Endowment No ULIPsDocument15 pagesNo Endowment No ULIPsApacheBullNo ratings yet

- Full Download Solution Manual For Global 4 4th Edition Mike Peng PDF Full ChapterDocument36 pagesFull Download Solution Manual For Global 4 4th Edition Mike Peng PDF Full Chapterwaycotgareb5ewy100% (21)

- S&P 500 Index Duke Energy StockDocument12 pagesS&P 500 Index Duke Energy Stockshrijit “shri” tembheharNo ratings yet

- Pel 23 24 132 1Document1 pagePel 23 24 132 1Harikrishan BhattNo ratings yet

- OG Catalogue 2020 CompressedDocument103 pagesOG Catalogue 2020 CompressedGaspar SalasNo ratings yet

- Allahabad BankDocument7 pagesAllahabad Bankincentives vacationsNo ratings yet

- LSP PresentationDocument17 pagesLSP Presentationd2qbjbxk7hNo ratings yet

- Principles of Auditing: VouchingDocument12 pagesPrinciples of Auditing: Vouchingilyas muhammadNo ratings yet

- Financial Management: Week 1Document314 pagesFinancial Management: Week 1Hien NguyenNo ratings yet

- Stock Screener, Technical Analysis ScannerDocument32 pagesStock Screener, Technical Analysis Scanneriamsam4uNo ratings yet

- Food SI 2023 GK Practice Set 002 by Tapas KumbhakarDocument4 pagesFood SI 2023 GK Practice Set 002 by Tapas Kumbhakarkaustav royNo ratings yet

- Gra C03S03Document2 pagesGra C03S03Natalia ShubinaNo ratings yet

- Adv Econ Theory Solution Guide 10-12Document19 pagesAdv Econ Theory Solution Guide 10-12Kim Chi LeNo ratings yet

- 1.what Is GDR?Document2 pages1.what Is GDR?btamilarasan88No ratings yet

- Indian Economy 2nd SemDocument4 pagesIndian Economy 2nd SemPooja SanwalNo ratings yet

- TransferconfirmationDocument2 pagesTransferconfirmationidriss deby itnoNo ratings yet