Professional Documents

Culture Documents

Products Agro Services: Rationale For Recommendation

Products Agro Services: Rationale For Recommendation

Uploaded by

rahul kumarCopyright:

Available Formats

You might also like

- FIDP Business Ethics and Social Responsibility PDFDocument7 pagesFIDP Business Ethics and Social Responsibility PDFRachell Mae Bondoc 1100% (2)

- Business Plan For HelmetsDocument24 pagesBusiness Plan For HelmetsVishmita Vanage100% (1)

- Uniluv PharmaDocument17 pagesUniluv PharmaCzarina GeronaNo ratings yet

- Comparative Analysis of Two Companies From FMCG SectorDocument17 pagesComparative Analysis of Two Companies From FMCG Sectorhonda5768100% (7)

- Peanut - Butter Report PDFDocument8 pagesPeanut - Butter Report PDFUrvi Shah100% (2)

- Nimir Industrial Chemicals Limited: Corporate Briefing SessionDocument14 pagesNimir Industrial Chemicals Limited: Corporate Briefing SessionIlyas FaizNo ratings yet

- Tata ChemicalsDocument19 pagesTata ChemicalsPraveen R V100% (1)

- Nima GTL Icb Presentation Akwa Ibom New 1Document16 pagesNima GTL Icb Presentation Akwa Ibom New 1Ifeanyichukwu Longinus NwaziriNo ratings yet

- BCL IndustriesDocument1 pageBCL IndustriesRanjan BeheraNo ratings yet

- Analysis of Mini Dal Mill: Ankur Federation GajargotaDocument18 pagesAnalysis of Mini Dal Mill: Ankur Federation GajargotaAjay kumar yadavNo ratings yet

- Group 1 (Bio)Document29 pagesGroup 1 (Bio)Elilisya MarooskinNo ratings yet

- 100 KLPDDocument81 pages100 KLPDANDREW JOHNNo ratings yet

- Project Profile On Tomato ProductsDocument2 pagesProject Profile On Tomato ProductsKhalid AhmedNo ratings yet

- Daily Flash ReportDocument8 pagesDaily Flash ReportAshwin KumarNo ratings yet

- CESC Limited CESC Limited: Investor Update - Q3 FY11Document14 pagesCESC Limited CESC Limited: Investor Update - Q3 FY11Namuduri RamakanthNo ratings yet

- Jahnvi Mini ProjectDocument37 pagesJahnvi Mini ProjectAnkit PandeyNo ratings yet

- Sharekhan Morning Tiger - 22th April 2022Document7 pagesSharekhan Morning Tiger - 22th April 2022Deepak BhattNo ratings yet

- Cleanoorja Systems PVT LTDDocument35 pagesCleanoorja Systems PVT LTDganesh zoreNo ratings yet

- Bussiness Plan For Manufacturing of Guar Gum: Submitted By: E.Mounika VH/16-58Document35 pagesBussiness Plan For Manufacturing of Guar Gum: Submitted By: E.Mounika VH/16-58eerla mounikaNo ratings yet

- The Central Arecanut & Cocoa Marketing and Processing Cooperative LTD., (Campco) 'Varanashi Towers', Mission Street, Mangalore - 575 001Document7 pagesThe Central Arecanut & Cocoa Marketing and Processing Cooperative LTD., (Campco) 'Varanashi Towers', Mission Street, Mangalore - 575 001ANUSHA TomyNo ratings yet

- Presentation To The Public Sector Consultative Forum: Supplier Collaborations and Competition Law ComplianceDocument19 pagesPresentation To The Public Sector Consultative Forum: Supplier Collaborations and Competition Law ComplianceKKMP2010No ratings yet

- Project Profile Rice MillDocument1 pageProject Profile Rice Millhoquetradeintl100% (2)

- Project Profile NeeraDocument5 pagesProject Profile NeeraTejas KotwalNo ratings yet

- Project Profile On Oil Crusher Expeller PDFDocument2 pagesProject Profile On Oil Crusher Expeller PDFMallikarjunReddyObbineniNo ratings yet

- In Line Performance... : (Natmin) HoldDocument10 pagesIn Line Performance... : (Natmin) HoldMani SeshadrinathanNo ratings yet

- Transaction Overview Merger of EBG and TTBDocument10 pagesTransaction Overview Merger of EBG and TTBVirginis NuwoatiNo ratings yet

- VEDL Press Release Q2 FY23 VFDocument7 pagesVEDL Press Release Q2 FY23 VFbsrchandruNo ratings yet

- Update On Commodity Hedging - Mar'20Document5 pagesUpdate On Commodity Hedging - Mar'20umakanthraokNo ratings yet

- BUA Cement Annual Report and Accounts 2022 CompressedDocument152 pagesBUA Cement Annual Report and Accounts 2022 CompressedOlumideNo ratings yet

- GAR PPT 4Q 2018 Mar 2019 1Document24 pagesGAR PPT 4Q 2018 Mar 2019 1jagrat_pNo ratings yet

- 5 Flexible Budget and VarianceDocument18 pages5 Flexible Budget and VarianceSunny XuNo ratings yet

- Andhra Petrochemicals Stock PitchDocument2 pagesAndhra Petrochemicals Stock PitchSampann PatodiNo ratings yet

- 17-18 Annual Report Ongc PDFDocument517 pages17-18 Annual Report Ongc PDFYogeshPooniaNo ratings yet

- RIL 3Q FY20 Analyst Presentation 17jan20Document94 pagesRIL 3Q FY20 Analyst Presentation 17jan20prince9sanjuNo ratings yet

- Total Raw Material CostDocument2 pagesTotal Raw Material Costpriska jesikaNo ratings yet

- Explain (Simply and in Your Own Words) What The Company DoesDocument8 pagesExplain (Simply and in Your Own Words) What The Company DoesShreyas LakshminarayanNo ratings yet

- ZuTUyraRFBJJZGiGLn15982462649080 2Document45 pagesZuTUyraRFBJJZGiGLn15982462649080 2Kassa HailuNo ratings yet

- Pertamina - Indonesia LPG Chalenge & Opportunities PDFDocument18 pagesPertamina - Indonesia LPG Chalenge & Opportunities PDFDony Antarius100% (1)

- BPP Presentation (1) - 1Document7 pagesBPP Presentation (1) - 1Didane FrancisNo ratings yet

- BPP PresentationDocument7 pagesBPP PresentationDidane FrancisNo ratings yet

- Sub: Submission of Analysts/Investors Presentation Ref: Letter Dated October 19, 2021 Providing Details of The Analysts/Investors CallDocument25 pagesSub: Submission of Analysts/Investors Presentation Ref: Letter Dated October 19, 2021 Providing Details of The Analysts/Investors CallAMRISH SATISH DOLASNo ratings yet

- Business Plan For PlantDocument4 pagesBusiness Plan For PlantIsmail AdebiyiNo ratings yet

- KOEL Investor Presentation March 2015Document17 pagesKOEL Investor Presentation March 2015Yash PatelNo ratings yet

- EMP - 2009 Annual Reports PDFDocument116 pagesEMP - 2009 Annual Reports PDFpuput utomoNo ratings yet

- Annual Accounts 2018Document100 pagesAnnual Accounts 2018Syed Arham MurtazaNo ratings yet

- Project Profile For Coir Paper or Paper Products Making UnitDocument6 pagesProject Profile For Coir Paper or Paper Products Making Unitavinash sainiNo ratings yet

- National Stock Exchange of India Limited Scrip Code: JYOTHYLABDocument28 pagesNational Stock Exchange of India Limited Scrip Code: JYOTHYLABABHISHEK KUMARNo ratings yet

- ONGC Media Presentation-29082023Document44 pagesONGC Media Presentation-29082023RACHNA SAHANo ratings yet

- Andhra Petrochemicals LTD: Investment SummaryDocument4 pagesAndhra Petrochemicals LTD: Investment Summaryjobs rkNo ratings yet

- Chemfab InvDocument7 pagesChemfab Invrchawdhry123No ratings yet

- Financial Accounting and Management: Group Project - Investor'S PresentationDocument10 pagesFinancial Accounting and Management: Group Project - Investor'S PresentationBhavikNo ratings yet

- Projet de Terrasses Radicales Nyankenke 2014-2015Document13 pagesProjet de Terrasses Radicales Nyankenke 2014-2015Bizimenyera Zenza TheonesteNo ratings yet

- Numis June 2018 Teach-In 28 JunDocument34 pagesNumis June 2018 Teach-In 28 JunAyo OgunkanmiNo ratings yet

- 2016ye LuccpDocument32 pages2016ye LuccpkaiselkNo ratings yet

- 5000 TCD Sugar Plant 35 MW Co-Generation Power Plant Along With 80 KLPD DistilleryDocument24 pages5000 TCD Sugar Plant 35 MW Co-Generation Power Plant Along With 80 KLPD DistilleryServinorca, C.A.No ratings yet

- Investorpresentation 230319 202305Document40 pagesInvestorpresentation 230319 202305CHETAN R KNo ratings yet

- Winners' Financial ModelDocument5 pagesWinners' Financial ModelARCHIT KUMARNo ratings yet

- Flyash Bricks: Profile No.: 17 NIC CodeDocument6 pagesFlyash Bricks: Profile No.: 17 NIC Codeesha108No ratings yet

- Retailer Price 2.85 Retailer Margin Distributor Price Distributor Margin Wholesaler Price Wholesaler MarginDocument8 pagesRetailer Price 2.85 Retailer Margin Distributor Price Distributor Margin Wholesaler Price Wholesaler MarginJash LakhanpalNo ratings yet

- Anshu Kumar 54475Document19 pagesAnshu Kumar 54475Pallav ChhawanNo ratings yet

- Silicon Carbide Solid & Grains & Powders & Flour Abrasives World Summary: Market Sector Values & Financials by CountryFrom EverandSilicon Carbide Solid & Grains & Powders & Flour Abrasives World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Term-Ii Summary and Important Questions For Revision Class - Ix PackingDocument9 pagesTerm-Ii Summary and Important Questions For Revision Class - Ix PackingAditya NarayanNo ratings yet

- Charismatic Leadership and Social Change: A Weberian PrespectiveDocument9 pagesCharismatic Leadership and Social Change: A Weberian PrespectiveAnonymous CwJeBCAXpNo ratings yet

- Aria - AddendaDocument84 pagesAria - AddendaFrankie BlankenshipNo ratings yet

- Keeley Hudson Long Way Down Final EssayDocument3 pagesKeeley Hudson Long Way Down Final Essayapi-610030933No ratings yet

- (ICP) A1 Research Report - Team Uncensored - Class Group 2 PDFDocument28 pages(ICP) A1 Research Report - Team Uncensored - Class Group 2 PDFLan HuynhNo ratings yet

- A Collegiate Research Project StudyDocument30 pagesA Collegiate Research Project StudyRuzel DayluboNo ratings yet

- Price Vs United LabDocument5 pagesPrice Vs United Labangelosantiago08No ratings yet

- June 23Document8 pagesJune 23danielrevanNo ratings yet

- Customer Service Exceeding Expectations1 Day Training CourseDocument2 pagesCustomer Service Exceeding Expectations1 Day Training CourseOhms BrangueloNo ratings yet

- Face2face Starter Second Edition, 2013. Cambridge: Cambridge University PressDocument14 pagesFace2face Starter Second Edition, 2013. Cambridge: Cambridge University PressTika VirginiyaNo ratings yet

- Fire InsuranceDocument1 pageFire InsuranceJeorge Ryan MangubatNo ratings yet

- Genesis Exodus Leviticus Numbers Deuteronomy: The PentateuchDocument8 pagesGenesis Exodus Leviticus Numbers Deuteronomy: The PentateuchAleah LS Kim100% (1)

- The Tyranny of Usa Civil InjusticeDocument38 pagesThe Tyranny of Usa Civil InjusticeJoshua J. IsraelNo ratings yet

- Letter To FTC From Sen. Warren On Amazon-MGM DealDocument7 pagesLetter To FTC From Sen. Warren On Amazon-MGM DealGeekWireNo ratings yet

- Classification of MenusDocument12 pagesClassification of Menusliewin langiNo ratings yet

- Leuchtturm Catalog For Philately 2009 by KibelaDocument73 pagesLeuchtturm Catalog For Philately 2009 by KibelaLuka Mitrovic100% (1)

- Analogies and Antonyms PDF Ebook PDFDocument41 pagesAnalogies and Antonyms PDF Ebook PDFAmman SoomroNo ratings yet

- 04 Review-1Document1 page04 Review-1agathavillagracia4No ratings yet

- Liderazgo en Enfermería y Burnout (Pucheu, 2010)Document8 pagesLiderazgo en Enfermería y Burnout (Pucheu, 2010)Carolina Oyarzún PérezNo ratings yet

- TravelogueDocument2 pagesTravelogueAldrin Zolina0% (1)

- 12814/STEEL EXP Second Sitting (2S)Document2 pages12814/STEEL EXP Second Sitting (2S)AYUSH SINGHNo ratings yet

- Corporation Law CasesDocument22 pagesCorporation Law CasesJessica Joyce PenalosaNo ratings yet

- 5.2 Graphic Spatial Programming: Table No. 12 Space Programming - Administrative BuildingDocument10 pages5.2 Graphic Spatial Programming: Table No. 12 Space Programming - Administrative BuildingSaileneGuemoDellosaNo ratings yet

- Jeepney PhaseoutDocument3 pagesJeepney PhaseoutboolnivaNo ratings yet

- Some Geographical Facts and Features About North AmericaDocument15 pagesSome Geographical Facts and Features About North AmericaSuraj KarkiNo ratings yet

- Cost Sheet TheoryDocument3 pagesCost Sheet TheorySurojit SahaNo ratings yet

- Re-Arranged Rankwise ListDocument282 pagesRe-Arranged Rankwise ListSuneel ReddyNo ratings yet

- Swot Analysis of Revlon IncDocument5 pagesSwot Analysis of Revlon IncSubhana AsimNo ratings yet

Products Agro Services: Rationale For Recommendation

Products Agro Services: Rationale For Recommendation

Uploaded by

rahul kumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Products Agro Services: Rationale For Recommendation

Products Agro Services: Rationale For Recommendation

Uploaded by

rahul kumarCopyright:

Available Formats

TP: ₹125

CMP ₹ 67.90

Face Value ₹ 2

Market Cap ₹ 2705 crores

Rationale for Recommendation Promoters holding 37.84%

• Debt free as quoted investments of ₹1,610 crores are higher than Funds, BCs, HNIs 27.95%

borrowing of ₹1505 crores. Others 34.21%

Book Value ₹ 172.22

• “For the first time, we have filed an application for sunset review for

Price/Book 0.4

caprolactam and the notice has been issued by Directorate General

Dividend (%) 60

of Trade Remedies (DGTR).” – Arvind Agarwal, CMD

• GSFC produces 56% of caprolactam for industrial requirement in India whereas the remaining 44% is

imported. Similarly, GSFC produces 29% melamine of the total requirement in India while the remaining

71% is imported. In the FY2019-20, GSFC has produced 83,093 meter tons of caprolactam and 29,215

metric tons of melamine. It expects to increase the production up to 90,000 metric tons and 40,000 metric

tons for caprolactam and melamine, respectively.

• Big improvement in Caprolactum & Melamine margin. As a result, Q2 onwards PAT is estimated to be ₹ 100-

110 crore each quarter.

• Diversified product of Polyester raw materials, fertilizer, specialty chemicals/industrial products.

• Stock is trading at 7.4x of FY21E-EPS & 5.9x of FY22E-EPS and 0.4x of Book Value.

• Technical. The stock made a decadal low at ₹29.80 on March 23, 2020 & from thereon it has made a slow

ascent to ₹67.90. The stock faces its first resistance at ₹68 & then at ₹80 in the short term. The medium

term outlook for the stock will turn for the better on a close above ₹100.

Products Agro Services Future Projects

o Fertilizers Fertilizers o Agrinet o Phosphoric Acid

o Industrial Products-Major ▪ Neem Urea - 367K tpa o Micro Irrigation - 1.65 lakh MTPA

o Industrial Products-Other ▪ Ammonium Sulphate - 196K tpa o Farm Youth Training

o Water Soluble Fertilizers Program o Sulphuric Acid

▪ DAP - 434K tpa

o Sulphur Based Products o Crop Demonstrations - 6 lakh MTPA

▪ APS – 256K tpa

o Plant Tissue Culture o Krishi Jivan

o Micro Nutrients Industrial o Horticulture

o Plant Growth Promoters ▪ Caprolactam - 90K tpa e Department

o Soil Conditioners ▪ Malamine - 40K tpa e o Soil Testing Laboratory

o Organic Products ▪ Nylon-6 – 7K tpa

o Seeds ▪ Methyl Ethyl Ketoxime – 4.45K tpa

o Trading ▪ Methanol - 525 MTPD

▪ Argon Gas - 3.2 mln NM3 pa

▪ Sulphuric Acid - 1750 MTPD

▪ Oleum - 28K tpa

▪ Nitric Acid – 8.3K tpa

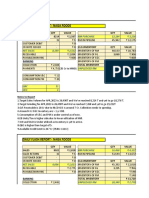

Financials (₹ crores)

Particulars 2022E 2021E Q1-2021 2020

Revenue 9,785 7,828 1,648 7,904

EBIDTA 1,027 822 101 424

Profit Before Tax 627 501 38 138

Net Profit 445 356 30 107

EPS ₹ 11.44 9.15 0.76 2.75

Dividend (%) 110 110 - 60

▪ Target Price of ₹85 by November end and ₹125 in 6-9 months

You might also like

- FIDP Business Ethics and Social Responsibility PDFDocument7 pagesFIDP Business Ethics and Social Responsibility PDFRachell Mae Bondoc 1100% (2)

- Business Plan For HelmetsDocument24 pagesBusiness Plan For HelmetsVishmita Vanage100% (1)

- Uniluv PharmaDocument17 pagesUniluv PharmaCzarina GeronaNo ratings yet

- Comparative Analysis of Two Companies From FMCG SectorDocument17 pagesComparative Analysis of Two Companies From FMCG Sectorhonda5768100% (7)

- Peanut - Butter Report PDFDocument8 pagesPeanut - Butter Report PDFUrvi Shah100% (2)

- Nimir Industrial Chemicals Limited: Corporate Briefing SessionDocument14 pagesNimir Industrial Chemicals Limited: Corporate Briefing SessionIlyas FaizNo ratings yet

- Tata ChemicalsDocument19 pagesTata ChemicalsPraveen R V100% (1)

- Nima GTL Icb Presentation Akwa Ibom New 1Document16 pagesNima GTL Icb Presentation Akwa Ibom New 1Ifeanyichukwu Longinus NwaziriNo ratings yet

- BCL IndustriesDocument1 pageBCL IndustriesRanjan BeheraNo ratings yet

- Analysis of Mini Dal Mill: Ankur Federation GajargotaDocument18 pagesAnalysis of Mini Dal Mill: Ankur Federation GajargotaAjay kumar yadavNo ratings yet

- Group 1 (Bio)Document29 pagesGroup 1 (Bio)Elilisya MarooskinNo ratings yet

- 100 KLPDDocument81 pages100 KLPDANDREW JOHNNo ratings yet

- Project Profile On Tomato ProductsDocument2 pagesProject Profile On Tomato ProductsKhalid AhmedNo ratings yet

- Daily Flash ReportDocument8 pagesDaily Flash ReportAshwin KumarNo ratings yet

- CESC Limited CESC Limited: Investor Update - Q3 FY11Document14 pagesCESC Limited CESC Limited: Investor Update - Q3 FY11Namuduri RamakanthNo ratings yet

- Jahnvi Mini ProjectDocument37 pagesJahnvi Mini ProjectAnkit PandeyNo ratings yet

- Sharekhan Morning Tiger - 22th April 2022Document7 pagesSharekhan Morning Tiger - 22th April 2022Deepak BhattNo ratings yet

- Cleanoorja Systems PVT LTDDocument35 pagesCleanoorja Systems PVT LTDganesh zoreNo ratings yet

- Bussiness Plan For Manufacturing of Guar Gum: Submitted By: E.Mounika VH/16-58Document35 pagesBussiness Plan For Manufacturing of Guar Gum: Submitted By: E.Mounika VH/16-58eerla mounikaNo ratings yet

- The Central Arecanut & Cocoa Marketing and Processing Cooperative LTD., (Campco) 'Varanashi Towers', Mission Street, Mangalore - 575 001Document7 pagesThe Central Arecanut & Cocoa Marketing and Processing Cooperative LTD., (Campco) 'Varanashi Towers', Mission Street, Mangalore - 575 001ANUSHA TomyNo ratings yet

- Presentation To The Public Sector Consultative Forum: Supplier Collaborations and Competition Law ComplianceDocument19 pagesPresentation To The Public Sector Consultative Forum: Supplier Collaborations and Competition Law ComplianceKKMP2010No ratings yet

- Project Profile Rice MillDocument1 pageProject Profile Rice Millhoquetradeintl100% (2)

- Project Profile NeeraDocument5 pagesProject Profile NeeraTejas KotwalNo ratings yet

- Project Profile On Oil Crusher Expeller PDFDocument2 pagesProject Profile On Oil Crusher Expeller PDFMallikarjunReddyObbineniNo ratings yet

- In Line Performance... : (Natmin) HoldDocument10 pagesIn Line Performance... : (Natmin) HoldMani SeshadrinathanNo ratings yet

- Transaction Overview Merger of EBG and TTBDocument10 pagesTransaction Overview Merger of EBG and TTBVirginis NuwoatiNo ratings yet

- VEDL Press Release Q2 FY23 VFDocument7 pagesVEDL Press Release Q2 FY23 VFbsrchandruNo ratings yet

- Update On Commodity Hedging - Mar'20Document5 pagesUpdate On Commodity Hedging - Mar'20umakanthraokNo ratings yet

- BUA Cement Annual Report and Accounts 2022 CompressedDocument152 pagesBUA Cement Annual Report and Accounts 2022 CompressedOlumideNo ratings yet

- GAR PPT 4Q 2018 Mar 2019 1Document24 pagesGAR PPT 4Q 2018 Mar 2019 1jagrat_pNo ratings yet

- 5 Flexible Budget and VarianceDocument18 pages5 Flexible Budget and VarianceSunny XuNo ratings yet

- Andhra Petrochemicals Stock PitchDocument2 pagesAndhra Petrochemicals Stock PitchSampann PatodiNo ratings yet

- 17-18 Annual Report Ongc PDFDocument517 pages17-18 Annual Report Ongc PDFYogeshPooniaNo ratings yet

- RIL 3Q FY20 Analyst Presentation 17jan20Document94 pagesRIL 3Q FY20 Analyst Presentation 17jan20prince9sanjuNo ratings yet

- Total Raw Material CostDocument2 pagesTotal Raw Material Costpriska jesikaNo ratings yet

- Explain (Simply and in Your Own Words) What The Company DoesDocument8 pagesExplain (Simply and in Your Own Words) What The Company DoesShreyas LakshminarayanNo ratings yet

- ZuTUyraRFBJJZGiGLn15982462649080 2Document45 pagesZuTUyraRFBJJZGiGLn15982462649080 2Kassa HailuNo ratings yet

- Pertamina - Indonesia LPG Chalenge & Opportunities PDFDocument18 pagesPertamina - Indonesia LPG Chalenge & Opportunities PDFDony Antarius100% (1)

- BPP Presentation (1) - 1Document7 pagesBPP Presentation (1) - 1Didane FrancisNo ratings yet

- BPP PresentationDocument7 pagesBPP PresentationDidane FrancisNo ratings yet

- Sub: Submission of Analysts/Investors Presentation Ref: Letter Dated October 19, 2021 Providing Details of The Analysts/Investors CallDocument25 pagesSub: Submission of Analysts/Investors Presentation Ref: Letter Dated October 19, 2021 Providing Details of The Analysts/Investors CallAMRISH SATISH DOLASNo ratings yet

- Business Plan For PlantDocument4 pagesBusiness Plan For PlantIsmail AdebiyiNo ratings yet

- KOEL Investor Presentation March 2015Document17 pagesKOEL Investor Presentation March 2015Yash PatelNo ratings yet

- EMP - 2009 Annual Reports PDFDocument116 pagesEMP - 2009 Annual Reports PDFpuput utomoNo ratings yet

- Annual Accounts 2018Document100 pagesAnnual Accounts 2018Syed Arham MurtazaNo ratings yet

- Project Profile For Coir Paper or Paper Products Making UnitDocument6 pagesProject Profile For Coir Paper or Paper Products Making Unitavinash sainiNo ratings yet

- National Stock Exchange of India Limited Scrip Code: JYOTHYLABDocument28 pagesNational Stock Exchange of India Limited Scrip Code: JYOTHYLABABHISHEK KUMARNo ratings yet

- ONGC Media Presentation-29082023Document44 pagesONGC Media Presentation-29082023RACHNA SAHANo ratings yet

- Andhra Petrochemicals LTD: Investment SummaryDocument4 pagesAndhra Petrochemicals LTD: Investment Summaryjobs rkNo ratings yet

- Chemfab InvDocument7 pagesChemfab Invrchawdhry123No ratings yet

- Financial Accounting and Management: Group Project - Investor'S PresentationDocument10 pagesFinancial Accounting and Management: Group Project - Investor'S PresentationBhavikNo ratings yet

- Projet de Terrasses Radicales Nyankenke 2014-2015Document13 pagesProjet de Terrasses Radicales Nyankenke 2014-2015Bizimenyera Zenza TheonesteNo ratings yet

- Numis June 2018 Teach-In 28 JunDocument34 pagesNumis June 2018 Teach-In 28 JunAyo OgunkanmiNo ratings yet

- 2016ye LuccpDocument32 pages2016ye LuccpkaiselkNo ratings yet

- 5000 TCD Sugar Plant 35 MW Co-Generation Power Plant Along With 80 KLPD DistilleryDocument24 pages5000 TCD Sugar Plant 35 MW Co-Generation Power Plant Along With 80 KLPD DistilleryServinorca, C.A.No ratings yet

- Investorpresentation 230319 202305Document40 pagesInvestorpresentation 230319 202305CHETAN R KNo ratings yet

- Winners' Financial ModelDocument5 pagesWinners' Financial ModelARCHIT KUMARNo ratings yet

- Flyash Bricks: Profile No.: 17 NIC CodeDocument6 pagesFlyash Bricks: Profile No.: 17 NIC Codeesha108No ratings yet

- Retailer Price 2.85 Retailer Margin Distributor Price Distributor Margin Wholesaler Price Wholesaler MarginDocument8 pagesRetailer Price 2.85 Retailer Margin Distributor Price Distributor Margin Wholesaler Price Wholesaler MarginJash LakhanpalNo ratings yet

- Anshu Kumar 54475Document19 pagesAnshu Kumar 54475Pallav ChhawanNo ratings yet

- Silicon Carbide Solid & Grains & Powders & Flour Abrasives World Summary: Market Sector Values & Financials by CountryFrom EverandSilicon Carbide Solid & Grains & Powders & Flour Abrasives World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Term-Ii Summary and Important Questions For Revision Class - Ix PackingDocument9 pagesTerm-Ii Summary and Important Questions For Revision Class - Ix PackingAditya NarayanNo ratings yet

- Charismatic Leadership and Social Change: A Weberian PrespectiveDocument9 pagesCharismatic Leadership and Social Change: A Weberian PrespectiveAnonymous CwJeBCAXpNo ratings yet

- Aria - AddendaDocument84 pagesAria - AddendaFrankie BlankenshipNo ratings yet

- Keeley Hudson Long Way Down Final EssayDocument3 pagesKeeley Hudson Long Way Down Final Essayapi-610030933No ratings yet

- (ICP) A1 Research Report - Team Uncensored - Class Group 2 PDFDocument28 pages(ICP) A1 Research Report - Team Uncensored - Class Group 2 PDFLan HuynhNo ratings yet

- A Collegiate Research Project StudyDocument30 pagesA Collegiate Research Project StudyRuzel DayluboNo ratings yet

- Price Vs United LabDocument5 pagesPrice Vs United Labangelosantiago08No ratings yet

- June 23Document8 pagesJune 23danielrevanNo ratings yet

- Customer Service Exceeding Expectations1 Day Training CourseDocument2 pagesCustomer Service Exceeding Expectations1 Day Training CourseOhms BrangueloNo ratings yet

- Face2face Starter Second Edition, 2013. Cambridge: Cambridge University PressDocument14 pagesFace2face Starter Second Edition, 2013. Cambridge: Cambridge University PressTika VirginiyaNo ratings yet

- Fire InsuranceDocument1 pageFire InsuranceJeorge Ryan MangubatNo ratings yet

- Genesis Exodus Leviticus Numbers Deuteronomy: The PentateuchDocument8 pagesGenesis Exodus Leviticus Numbers Deuteronomy: The PentateuchAleah LS Kim100% (1)

- The Tyranny of Usa Civil InjusticeDocument38 pagesThe Tyranny of Usa Civil InjusticeJoshua J. IsraelNo ratings yet

- Letter To FTC From Sen. Warren On Amazon-MGM DealDocument7 pagesLetter To FTC From Sen. Warren On Amazon-MGM DealGeekWireNo ratings yet

- Classification of MenusDocument12 pagesClassification of Menusliewin langiNo ratings yet

- Leuchtturm Catalog For Philately 2009 by KibelaDocument73 pagesLeuchtturm Catalog For Philately 2009 by KibelaLuka Mitrovic100% (1)

- Analogies and Antonyms PDF Ebook PDFDocument41 pagesAnalogies and Antonyms PDF Ebook PDFAmman SoomroNo ratings yet

- 04 Review-1Document1 page04 Review-1agathavillagracia4No ratings yet

- Liderazgo en Enfermería y Burnout (Pucheu, 2010)Document8 pagesLiderazgo en Enfermería y Burnout (Pucheu, 2010)Carolina Oyarzún PérezNo ratings yet

- TravelogueDocument2 pagesTravelogueAldrin Zolina0% (1)

- 12814/STEEL EXP Second Sitting (2S)Document2 pages12814/STEEL EXP Second Sitting (2S)AYUSH SINGHNo ratings yet

- Corporation Law CasesDocument22 pagesCorporation Law CasesJessica Joyce PenalosaNo ratings yet

- 5.2 Graphic Spatial Programming: Table No. 12 Space Programming - Administrative BuildingDocument10 pages5.2 Graphic Spatial Programming: Table No. 12 Space Programming - Administrative BuildingSaileneGuemoDellosaNo ratings yet

- Jeepney PhaseoutDocument3 pagesJeepney PhaseoutboolnivaNo ratings yet

- Some Geographical Facts and Features About North AmericaDocument15 pagesSome Geographical Facts and Features About North AmericaSuraj KarkiNo ratings yet

- Cost Sheet TheoryDocument3 pagesCost Sheet TheorySurojit SahaNo ratings yet

- Re-Arranged Rankwise ListDocument282 pagesRe-Arranged Rankwise ListSuneel ReddyNo ratings yet

- Swot Analysis of Revlon IncDocument5 pagesSwot Analysis of Revlon IncSubhana AsimNo ratings yet