Professional Documents

Culture Documents

State Excise and Sales Taxes Per Pack of Cigarettes Total Amounts & State Rankings

State Excise and Sales Taxes Per Pack of Cigarettes Total Amounts & State Rankings

Uploaded by

nbvnvnvOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State Excise and Sales Taxes Per Pack of Cigarettes Total Amounts & State Rankings

State Excise and Sales Taxes Per Pack of Cigarettes Total Amounts & State Rankings

Uploaded by

nbvnvnvCopyright:

Available Formats

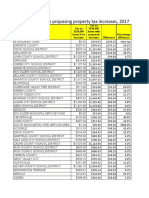

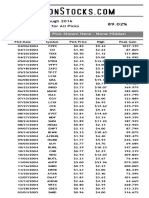

STATE EXCISE AND SALES TAXES PER PACK OF CIGARETTES

TOTAL AMOUNTS & STATE RANKINGS

Average Retail Cigarette Excise Tax State Sales Total Tax

Price Per Pack Excise Tax Rank State Sales Tax Per Total State Rank

States (with all taxes) Per Pack (Highest = 1) Tax Rate Pack Tax Per Pack (Highest = 1)

States’ Average $7.22 $1.91 -- 5.2% $0.37 $2.28 --

Alabama $6.03 $0.675 41st 4.0% $0.21 $0.88 46th

Alaska $9.54 $2.00 19th 0.0% $0.00 $2.00 27th

Arizona $7.88 $2.00 19th 5.6% $0.42 $2.42 18th

Arkansas $6.68 $1.15 36th 6.5% $0.41 $1.56 36th

California $8.90 $2.87 13th 8.25% $0.68 $3.55 12th

Colorado $7.36 $1.94 24th 2.9% $0.21 $2.15 22nd

Connecticut $10.79 $4.35 2nd 6.35% $0.64 $4.99 2nd

Delaware $7.14 $2.10 17th 0.0% $0.00 $2.10 24th

DC $11.29 $4.50 1st 6.0% $0.50 $5.00 1st

Florida $6.57 $1.339 33rd 6.0% $0.37 $1.71 32nd

Georgia $5.53 $0.37 50th 5.0% $0.25 $0.62 50th

Hawaii $9.75 $3.20 8th 4.0% $0.37 $3.57 10th

Idaho $6.04 $0.57 46th 6.0% $0.34 $0.91 44th

Illinois $9.72 $2.98 12th 6.25% $0.57 $3.55 11th

Indiana $6.28 $0.995 39th 7.0% $0.41 $1.41 38th

Iowa $6.68 $1.36 32nd 6.0% $0.38 $1.74 31st

Kansas $6.73 $1.29 34th 6.5% $0.41 $1.70 33rd

Kentucky $6.25 $1.10 37th 6.0% $0.35 $1.45 37th

Louisiana $6.34 $1.08 38th 4.45% $0.27 $1.35 39th

Maine $7.61 $2.00 19th 5.5% $0.40 $2.40 19th

Maryland $9.71 $3.75 5th 6.0% $0.55 $4.30 5th

Massachusetts $10.32 $3.51 6th 6.25% $0.61 $4.12 6th

Michigan $7.67 $2.00 19th 6.0% $0.43 $2.43 17th

Minnesota $9.76 $3.04 10th 6.875% $0.63 $3.67 7th

Mississippi $6.12 $0.68 40th 7.0% $0.40 $1.08 41st

Missouri $5.51 $0.17 51st 4.725% $0.24 $0.41 51st

Montana $6.95 $1.70 27th 0.0% $0.00 $1.70 34th

Nebraska $6.14 $0.64 42nd 5.5% $0.32 $0.96 42nd

Nevada $7.18 $1.80 25th 6.85% $0.46 $2.26 21st

New Hampshire $6.77 $1.78 26th 0.0% $0.00 $1.78 30th

New Jersey $8.81 $2.70 14th 6.625% $0.55 $3.25 14th

New Mexico $7.56 $2.00 19th 5.5% $0.39 $2.39 20th

New York $11.06 $4.35 2nd 4.00% $0.43 $4.78 4th

North Carolina $5.72 $0.45 48th 6.75% $0.36 $0.81 48th

North Dakota $5.69 $0.44 49th 5.0% $0.27 $0.71 49th

1400 I Street NW - Suite 1200 - Washington, DC 20005

Phone (202) 296-5469 · Fax (202) 296-5427 · www.tobaccofreekids.org

State Excise & Sales Taxes Per Pack of Cigarettes / 2

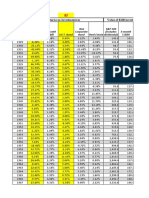

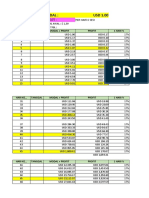

Average Retail Cigarette Excise Tax State Sales Total Tax

Price Per Pack Excise Tax Rank State Sales Tax Per Total State Rank

States (with all taxes) Per Pack (Highest = 1) Tax Rate Pack Tax Per Pack (Highest = 1)

Ohio $7.05 $1.60 29th 6.5% $0.43 $2.03 25th

Oklahoma $7.40 $2.03 18th 4.5% $0.00 $2.03 26th

Oregon $8.46 $3.33 7th 0.0% $0.00 $3.33 13th

Pennsylvania $8.76 $2.60 15th 6.0% $0.50 $3.10 15th

Rhode Island $10.77 $4.25 4th 7.0% $0.70 $4.95 3rd

South Carolina $5.96 $0.57 46th 6.0% $0.34 $0.91 45th

South Dakota $6.96 $1.53 30th 4.5% $0.30 $1.83 28th

Tennessee $6.09 $0.62 43rd 8.5% $0.48 $1.10 40th

Texas $6.86 $1.41 31st 6.25% $0.40 $1.81 29th

Utah $7.40 $1.70 27th 6.1% $0.43 $2.13 23rd

Vermont $9.40 $3.08 9th 6.0% $0.53 $3.61 8th

Virginia $6.45 $0.60 44th 5.3% $0.32 $0.92 43rd

Washington $9.19 $3.025 11th 6.5% $0.56 $3.59 9th

West Virginia $6.62 $1.20 35th 6.0% $0.37 $1.57 35th

Wisconsin $8.42 $2.52 16th 5.0% $0.40 $2.92 16th

Wyoming $5.94 $0.60 44th 4.0% $0.23 $0.83 47th

Table shows state cigarette tax rates and the state average currently in effect. The states in red have not increased

their tax for at least 10 years (since 2011 or earlier). Sales tax amount per pack is based on state sales tax

percentage and average price of a pack of cigarettes in each state. In the vast majority of states with sales taxes,

the sales tax percentage is applied to the total retail price of a pack of cigarettes, including all applicable federal and

state cigarette excise taxes. Oklahoma has a state sales tax, but does not apply it to cigarettes; Minnesota and

Washington, DC apply a per-pack sales tax at the wholesale level; and Alabama, Georgia, and Missouri do not

apply their state sales tax to that portion of retail cigarette prices that represents the state’s cigarette excise tax.

The federal cigarette tax is $1.01 per pack (there is no federal sales tax). In the last several years, the major

cigarette companies have increased their product prices by almost $1.00 per pack.

Campaign for Tobacco-Free Kids, March 15, 2021 / Ann Boonn

Additional information on state cigarette taxes and the many benefits from increasing them is available at

https://global.tobaccofreekids.org/fact-sheets/tobacco-control-policies/tobacco-taxes and

https://global.tobaccofreekids.org/what-we-do/us/state-tobacco-taxes.

Sources: Orzechowski & Walker, Tax Burden on Tobacco, 2019; media reports; state tax officials; U.S. Department of

Agriculture, Economic Research Service.

You might also like

- OIDD6360 - Peapod ROICTreeDocument6 pagesOIDD6360 - Peapod ROICTreeA JNo ratings yet

- Money Management System Binary SinhalaDocument64 pagesMoney Management System Binary SinhalaDilhani DanasiriNo ratings yet

- Team Team Marketing Report Fan Cost IndexDocument1 pageTeam Team Marketing Report Fan Cost IndexWGRZ-TVNo ratings yet

- Post-Independence Income Tax Legislation in The Commonwealth CaribbeanDocument3 pagesPost-Independence Income Tax Legislation in The Commonwealth CaribbeanKerwin AlexanderNo ratings yet

- 2008 Domestic Water SurveyDocument1 page2008 Domestic Water SurveyCaroline Nordahl BrosioNo ratings yet

- U.S. R&D Spending by State, 2006-11 (In USD Millions)Document2 pagesU.S. R&D Spending by State, 2006-11 (In USD Millions)Sunil KumarNo ratings yet

- State Federal Spending Per Dollar of Federal Taxes RankDocument1 pageState Federal Spending Per Dollar of Federal Taxes Rankapi-2822775No ratings yet

- Property Taxes On Owner-Occupied Housing, by State 2008Document10 pagesProperty Taxes On Owner-Occupied Housing, by State 20082391136No ratings yet

- Binary Campus Money Management Strategy: Days Balance % Per Day T/ Profit Withdraw St/Amount To Trade M/DifDocument64 pagesBinary Campus Money Management Strategy: Days Balance % Per Day T/ Profit Withdraw St/Amount To Trade M/Difදුටුගැමුණු බණ්ඩාරNo ratings yet

- Companies Poised To Benefit From Biden's Infrastructure Plan (Sources: Seeking Alpha, Investors, Yahoo, Kiplinger)Document1 pageCompanies Poised To Benefit From Biden's Infrastructure Plan (Sources: Seeking Alpha, Investors, Yahoo, Kiplinger)fcsamscribdNo ratings yet

- 01560-Designated Statestable7-7-06-JT 4Document5 pages01560-Designated Statestable7-7-06-JT 4losangelesNo ratings yet

- ROI CallsDocument3 pagesROI CallsramojiraNo ratings yet

- CB SpotPriceSnapshot 03 April 2020 PDFDocument1 pageCB SpotPriceSnapshot 03 April 2020 PDFKeithNo ratings yet

- Data For Personal Project On RevenueDocument3 pagesData For Personal Project On RevenueoriginbdteamNo ratings yet

- Economics Assignment 1 MSJDocument22 pagesEconomics Assignment 1 MSJmuhammad shoaibNo ratings yet

- Best States To Practice 2010Document2 pagesBest States To Practice 2010kaustin718No ratings yet

- Tabela TraderDocument18 pagesTabela TraderVENHAN PARA O MUNDO PES.No ratings yet

- Local Governments Proposing Property Tax Increases in 2017Document2 pagesLocal Governments Proposing Property Tax Increases in 2017The Salt Lake TribuneNo ratings yet

- Compounding StrategyDocument4 pagesCompounding StrategyDhanil LangkersNo ratings yet

- The Mobile Massage StoreDocument2 pagesThe Mobile Massage Storeapi-361715282No ratings yet

- Gestão de Banca TraderDocument6 pagesGestão de Banca TraderAnderson DevNo ratings yet

- Roberts Excel1Document3 pagesRoberts Excel1api-384482953No ratings yet

- 2023.02.11 Data Rebate ExnessDocument2 pages2023.02.11 Data Rebate ExnessMakmunNo ratings yet

- Patreon Income: Initial Amount PaidDocument6 pagesPatreon Income: Initial Amount PaidDavid LouNo ratings yet

- Costo de Capital - ExcelDocument25 pagesCosto de Capital - ExcelJhonatan Cabel PozoNo ratings yet

- Vuksinick Excel1Document4 pagesVuksinick Excel1api-418450750No ratings yet

- Binary Campus MANAGEMENT STRATEGYDocument64 pagesBinary Campus MANAGEMENT STRATEGYdilina.vishwaNo ratings yet

- Obama ClintonDocument10 pagesObama ClintonVishal GhuleNo ratings yet

- Aged-Care Menu Sales AnalysisDocument4 pagesAged-Care Menu Sales AnalysisSehaj SharmaNo ratings yet

- $/KG Trimming Net Yeild/kg Net Cost/kg Portions/kg Net Portion CostDocument1 page$/KG Trimming Net Yeild/kg Net Cost/kg Portions/kg Net Portion CostTikaram GhimireNo ratings yet

- $/KG Trimming Net Yeild/kg Net Cost/kg Portions/kg Net Portion CostDocument1 page$/KG Trimming Net Yeild/kg Net Cost/kg Portions/kg Net Portion CostTikaram GhimireNo ratings yet

- Administracion 1Document4 pagesAdministracion 1AGUSTIN VALDEZ AMAYANo ratings yet

- FX Money ManagementDocument4 pagesFX Money ManagementFazlee ZulkifliNo ratings yet

- Data Viz HomeworkDocument245 pagesData Viz HomeworkPedroFernandezNo ratings yet

- Every Stock Pick Shown Here - None Hidden: 2004 Through 2016 Average Gain For All PicksDocument14 pagesEvery Stock Pick Shown Here - None Hidden: 2004 Through 2016 Average Gain For All PicksYagnesh Patel100% (1)

- Minimum Wage Chart: Static Increases vs. Annual Adjustment Via CPIDocument1 pageMinimum Wage Chart: Static Increases vs. Annual Adjustment Via CPIdavidualNo ratings yet

- Book 1Document2 pagesBook 1arorapooja12No ratings yet

- Alex Sharpe Data V2-Team DylanDocument15 pagesAlex Sharpe Data V2-Team DylanPrajwal KumarNo ratings yet

- Teknik Trading H-L CompoundDocument174 pagesTeknik Trading H-L Compoundzahrul umamNo ratings yet

- Classroom-Stu-Learn About Your State-Handout-2-Reals - FinalDocument2 pagesClassroom-Stu-Learn About Your State-Handout-2-Reals - Finalbdr363581No ratings yet

- ARP National FactsheetDocument4 pagesARP National FactsheetNo CappinNo ratings yet

- Area 08/30/2018 Week Ago Week Ago Difference Year AgoDocument2 pagesArea 08/30/2018 Week Ago Week Ago Difference Year AgoAdrian GarciaNo ratings yet

- Pay Stub Tmplates 1Document1 pagePay Stub Tmplates 1Lekan iskilu AbdulkareemNo ratings yet

- Stakeborg ALTSDocument1 pageStakeborg ALTSPetrik PeNo ratings yet

- ABC Inventory Analysis Based On A Real-Life Data SetDocument4 pagesABC Inventory Analysis Based On A Real-Life Data SetAlejandro OcañaNo ratings yet

- Actions ElasticDocument11 pagesActions Elasticniranjan08565No ratings yet

- Module 3 - Data Viz Pro (Extra Practice File)Document217 pagesModule 3 - Data Viz Pro (Extra Practice File)DavidNo ratings yet

- Discounted P&H Rate: 18.5%Document27 pagesDiscounted P&H Rate: 18.5%savagelaNo ratings yet

- Create A Report That Displays The Quarterly Sales by TerritoryDocument454 pagesCreate A Report That Displays The Quarterly Sales by TerritoryVINENNo ratings yet

- Meta SemanalDocument21 pagesMeta SemanalJunior FreitasNo ratings yet

- Taller Costo de Capital ValDocument34 pagesTaller Costo de Capital ValJoseph Rojo ChNo ratings yet

- Round 2 Allocation CD BGDocument2 pagesRound 2 Allocation CD BGNEWS CENTER MaineNo ratings yet

- ITF Sample Open Position SpreadsheetDocument5 pagesITF Sample Open Position SpreadsheetSilat KaliNo ratings yet

- WDW2008 IncreaseDocument1 pageWDW2008 Increaseahecht100% (1)

- TareaDocument2 pagesTareaCortez Nava Alison MonserratNo ratings yet

- Cada 4 Dias: Capital Invertido $ 300.00 200% Fee Por Reinversion $ 0.10Document1 pageCada 4 Dias: Capital Invertido $ 300.00 200% Fee Por Reinversion $ 0.10Marcos Danilo Santos PrgNo ratings yet

- OB - Gerenciamento de Banca - 3 AnosDocument52 pagesOB - Gerenciamento de Banca - 3 AnosAcauã Suassuna DutraNo ratings yet

- Superstore Dashboard: Top Ten Highest Sales W.R.T To States Top Ten Lowest Sale W.R.T To States State SaleDocument2 pagesSuperstore Dashboard: Top Ten Highest Sales W.R.T To States Top Ten Lowest Sale W.R.T To States State Salesumaira khanNo ratings yet

- Net ProviderDocument2 pagesNet ProvideribtiNo ratings yet

- Manitoba School Funding 2024-25Document2 pagesManitoba School Funding 2024-25ChrisDcaNo ratings yet

- ECONOMICS Problem SetDocument8 pagesECONOMICS Problem SetnbvnvnvNo ratings yet

- Predicting Sales For The Next Generation of Consoles in 2020Document18 pagesPredicting Sales For The Next Generation of Consoles in 2020nbvnvnvNo ratings yet

- Price Elasticity of Demand Excel Template: Visit: EmailDocument4 pagesPrice Elasticity of Demand Excel Template: Visit: Emailnbvnvnv100% (1)

- LG Electronics-Company ProfileDocument8 pagesLG Electronics-Company ProfilenbvnvnvNo ratings yet

- Company Address List TemplateDocument30 pagesCompany Address List TemplatenbvnvnvNo ratings yet

- Dupont DPC LBO AssignmentDocument3 pagesDupont DPC LBO Assignmentw_fibNo ratings yet

- Compensation and Benefits: Designing CTCDocument19 pagesCompensation and Benefits: Designing CTCTufail MohammedNo ratings yet

- Gross Estate Tax Quizzer 1103aDocument6 pagesGross Estate Tax Quizzer 1103aCharry Ramos67% (3)

- 2316Document1 page2316FedsNo ratings yet

- Withholding Tax Rates MalawiDocument2 pagesWithholding Tax Rates Malawianraomca100% (1)

- Sales Tax - An Easy To Understand Reference GuideDocument50 pagesSales Tax - An Easy To Understand Reference GuideEmran AkbarNo ratings yet

- Practice Exercise - Journalizing Government Accounting Transactions-NAVEDocument12 pagesPractice Exercise - Journalizing Government Accounting Transactions-NAVEJanielle NaveNo ratings yet

- Bir Form 0605Document2 pagesBir Form 0605alona_245883% (6)

- Caltex V Coa Case DigestDocument3 pagesCaltex V Coa Case DigestJefferson NunezaNo ratings yet

- 2022 Turbo Tax ReturnDocument14 pages2022 Turbo Tax ReturndsutetyrNo ratings yet

- BIR Ruling 359-17Document5 pagesBIR Ruling 359-17Bobby Olavides SebastianNo ratings yet

- Salaryslip June 2022Document2 pagesSalaryslip June 2022Raja BabuNo ratings yet

- Fiscal Policy and It's Impact On IndiaDocument13 pagesFiscal Policy and It's Impact On IndiaHimanshu RatnaniNo ratings yet

- We Wish You Wellness Forever!Document1 pageWe Wish You Wellness Forever!rohan NagpureNo ratings yet

- Invoice Finolex Feb-2023Document1 pageInvoice Finolex Feb-2023deeptimayee pattanayakNo ratings yet

- Module 2 Intro To Business TaxationDocument33 pagesModule 2 Intro To Business TaxationHeart Lissie SantosNo ratings yet

- Circulars/Notifications: Legal UpdateDocument11 pagesCirculars/Notifications: Legal Updatesundar4444No ratings yet

- Solved This Year Fig Corporation Made A 100 000 Contribution To CharityDocument1 pageSolved This Year Fig Corporation Made A 100 000 Contribution To CharityAnbu jaromiaNo ratings yet

- Tax RemediesDocument19 pagesTax RemediesRocky MarcianoNo ratings yet

- Black Book Final Project - GST: Manish TiwariDocument28 pagesBlack Book Final Project - GST: Manish TiwariJatin PoojariNo ratings yet

- Unit 1 - Income Study SlidesDocument20 pagesUnit 1 - Income Study SlidesPanda squadNo ratings yet

- Chatto Interim Financial ReportingDocument6 pagesChatto Interim Financial ReportingLabLab ChattoNo ratings yet

- Research Proposal GSTDocument8 pagesResearch Proposal GSTpraveen p s100% (1)

- Solved April Company Has Five Salaried Employees Your Task Is To PDFDocument1 pageSolved April Company Has Five Salaried Employees Your Task Is To PDFAnbu jaromiaNo ratings yet

- Shyam Steel 146Document1 pageShyam Steel 146SUPRIYO PARAMANIKNo ratings yet

- Public Goods and ExternalitiesDocument17 pagesPublic Goods and ExternalitiesZenedel De JesusNo ratings yet

- Taxation MCQDocument6 pagesTaxation MCQJade Palma Salingay100% (8)

- MicrosoftDocument2 pagesMicrosoftKrisi MartinezNo ratings yet