Professional Documents

Culture Documents

Equity Theory: Contract Receivable $653,000 Contract Payable $653,000

Equity Theory: Contract Receivable $653,000 Contract Payable $653,000

Uploaded by

GabyVionidyaCopyright:

Available Formats

You might also like

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- Sol. Man. Chapter 4 Consol. Fs Part 1Document37 pagesSol. Man. Chapter 4 Consol. Fs Part 1itsmenatoy43% (7)

- Business Combinations (Part 2) : Problem 1: True or FalseDocument12 pagesBusiness Combinations (Part 2) : Problem 1: True or FalseAlexanderJacobVielMartinez100% (3)

- Kelompok3 Tugas3 AKLDocument4 pagesKelompok3 Tugas3 AKLsyifa fr100% (1)

- Consolidation Theories, Push-Down Accounting, and Corporate Joint VenturesDocument28 pagesConsolidation Theories, Push-Down Accounting, and Corporate Joint VenturesRiska Azahra NNo ratings yet

- Applied Group Fin Reporting-Changes in Group Structure PDFDocument25 pagesApplied Group Fin Reporting-Changes in Group Structure PDFObey SitholeNo ratings yet

- Exploring Wildlife: Stock Market GitaDocument10 pagesExploring Wildlife: Stock Market Gita01ankuNo ratings yet

- Tutorial 6 For Instructor PDFDocument5 pagesTutorial 6 For Instructor PDFsherynNo ratings yet

- Assignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliDocument5 pagesAssignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliReema SajuNo ratings yet

- AKL - Kasus Chapter 6 (P6-45)Document5 pagesAKL - Kasus Chapter 6 (P6-45)raqhelziuNo ratings yet

- Premium Liab To Effective Interest Method Quiz Integ 1Document11 pagesPremium Liab To Effective Interest Method Quiz Integ 1John Lexter MacalberNo ratings yet

- 1Document4 pages1NURHAM SUMLAYNo ratings yet

- Problem 10-8 (Banco)Document7 pagesProblem 10-8 (Banco)Roy Mitz Aggabao Bautista VNo ratings yet

- XLSXDocument10 pagesXLSXezar zacharyNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- Problem 8-9 Akl 2Document4 pagesProblem 8-9 Akl 2andi nanaNo ratings yet

- This Study Resource Was Shared Via: Solution 23-2 Answer DDocument5 pagesThis Study Resource Was Shared Via: Solution 23-2 Answer DDummy GoogleNo ratings yet

- ORQUIA AssignmentDocument4 pagesORQUIA AssignmentClint RoblesNo ratings yet

- Peerless Products CorpDocument2 pagesPeerless Products CorpMarsha SaviraNo ratings yet

- Contoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Document10 pagesContoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Kusnul WidiyaniNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Aud1 022424 LectureDocument1 pageAud1 022424 LectureJessie PaterezNo ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Enriquez, Michaella Activity1 Bsa3203Document13 pagesEnriquez, Michaella Activity1 Bsa3203Miks EnriquezNo ratings yet

- Business Combi. Chapter 1 PROBLEM 3Document4 pagesBusiness Combi. Chapter 1 PROBLEM 3latte aeriNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- Business Combination ExercisesDocument5 pagesBusiness Combination ExercisesmmNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Solution E2-3 1: Preliminary ComputationsDocument3 pagesSolution E2-3 1: Preliminary ComputationsRifda AmaliaNo ratings yet

- Of Financial PositionDocument3 pagesOf Financial PositionIrah LouiseNo ratings yet

- Quiz Advanced Accounting 2 - Anggelina Ariresta 008201900008Document4 pagesQuiz Advanced Accounting 2 - Anggelina Ariresta 008201900008anggelina arirestaNo ratings yet

- Ebook Canadian Income Taxation 2018 2019 21St Edition Buckwold Test Bank Full Chapter PDFDocument36 pagesEbook Canadian Income Taxation 2018 2019 21St Edition Buckwold Test Bank Full Chapter PDFpearlgregoryspx100% (13)

- Canadian Income Taxation 2018 2019 21st Edition Buckwold Test BankDocument38 pagesCanadian Income Taxation 2018 2019 21st Edition Buckwold Test Banklochaphasiawdjits100% (14)

- Buenaventura PREA4Document9 pagesBuenaventura PREA4Buenaventura, Elijah B.No ratings yet

- Chapter 3 - Consolidated Statements: Subsequent To AcquisitionDocument36 pagesChapter 3 - Consolidated Statements: Subsequent To AcquisitionJean De GuzmanNo ratings yet

- PANOPIO Activity1 BLOCK3209Document6 pagesPANOPIO Activity1 BLOCK3209panopiojessiemae4No ratings yet

- REVISI P2.1 SD P2.12Document24 pagesREVISI P2.1 SD P2.12yusufahriza25No ratings yet

- Quiz and Major Exam Accounting For Special Transactions 1Document38 pagesQuiz and Major Exam Accounting For Special Transactions 1CmNo ratings yet

- NOTES RECEIVABLE (Continuation) : Due To Rounding Off 51,310Document4 pagesNOTES RECEIVABLE (Continuation) : Due To Rounding Off 51,310ela kikayNo ratings yet

- ACCA SBR PapersDocument9 pagesACCA SBR PapersKaran KumarNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document11 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Kathrina RoxasNo ratings yet

- Far320 Capital Reduction ExercisesDocument7 pagesFar320 Capital Reduction ExercisesALIA MAISARA MD AKHIRNo ratings yet

- Business Combi Quiz (Part1)Document9 pagesBusiness Combi Quiz (Part1)Rica Joy RuzgalNo ratings yet

- PREA4Document9 pagesPREA4Buenaventura, Elijah B.No ratings yet

- Goodwill Calculation ExercisesDocument8 pagesGoodwill Calculation ExercisesAikal HakimNo ratings yet

- CH - 04 SolutionDocument3 pagesCH - 04 SolutionSaifur R. SabbirNo ratings yet

- Financial Ratios IIDocument27 pagesFinancial Ratios IIMohamad Gammaz0% (1)

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- Problem 7-3 Akl 2Document3 pagesProblem 7-3 Akl 2andi nanaNo ratings yet

- May-June 2011Document10 pagesMay-June 2011Usuf JabedNo ratings yet

- Adv Acc 2 Module 1 Topic1.2Document5 pagesAdv Acc 2 Module 1 Topic1.2James CantorneNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Group FinancialDocument8 pagesGroup FinancialNever GonondoNo ratings yet

- Akl Week 8Document5 pagesAkl Week 8Rifda AmaliaNo ratings yet

- ASSIGNMENT 2 Business CombinationDocument3 pagesASSIGNMENT 2 Business CombinationApril ManjaresNo ratings yet

- U1911118 Final AssigmentDocument5 pagesU1911118 Final AssigmentAziza 191x118No ratings yet

- Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)Document36 pagesSolutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)sunnyauliaNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 2Document20 pages2076 - Varias, Aizel Ann B - Module 2Aizel Ann VariasNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- B. Essay Questions: False True True FalseDocument1 pageB. Essay Questions: False True True FalseGabyVionidyaNo ratings yet

- Exercise For Final Exam, May 28, 2019: A. True and False QuestionsDocument1 pageExercise For Final Exam, May 28, 2019: A. True and False QuestionsGabyVionidyaNo ratings yet

- Test Bank 3Document1 pageTest Bank 3GabyVionidyaNo ratings yet

- Test Bankk Teori (Dragged) 5Document1 pageTest Bankk Teori (Dragged) 5GabyVionidyaNo ratings yet

- Accounting For Derivatives and Hedging Activities: Answers To QuestionsDocument22 pagesAccounting For Derivatives and Hedging Activities: Answers To QuestionsGabyVionidyaNo ratings yet

- Management Incentivisation Trends in The Infrastructure Sector - Infrastructure IntelligenceDocument4 pagesManagement Incentivisation Trends in The Infrastructure Sector - Infrastructure IntelligencemayorladNo ratings yet

- Elliott Wave Theory BasicsDocument7 pagesElliott Wave Theory BasicsSarat KumarNo ratings yet

- Lecture 020 FTR Failed To Return PDFDocument10 pagesLecture 020 FTR Failed To Return PDFHicham MAYANo ratings yet

- Risk Parity PortfoliosDocument11 pagesRisk Parity PortfoliosvettebeatsNo ratings yet

- HW For M8 - Hedging With OptionsDocument3 pagesHW For M8 - Hedging With OptionsNiyati ShahNo ratings yet

- PPT - PPTBankingAwarenessStaticBaselNormsDocument37 pagesPPT - PPTBankingAwarenessStaticBaselNormscricketprediction8271No ratings yet

- Stock Options - Basic Strategies For A Lifetime of Option InvestingDocument19 pagesStock Options - Basic Strategies For A Lifetime of Option Investingrkumar123No ratings yet

- Financial Analysis of Tata Steel LTDDocument12 pagesFinancial Analysis of Tata Steel LTDHeather ElliottNo ratings yet

- The Best Investor Pitch Deck OutlineDocument28 pagesThe Best Investor Pitch Deck OutlineEugene M. BijeNo ratings yet

- Lecture - Big Mac IndexDocument11 pagesLecture - Big Mac IndexKatherine SauerNo ratings yet

- Technical AnalysisDocument97 pagesTechnical AnalysisMasoom Tekwani100% (1)

- Grey Minimalist Business Project PresentationDocument11 pagesGrey Minimalist Business Project PresentationAbdul MuqitNo ratings yet

- PhilEquity ProspectusDocument25 pagesPhilEquity ProspectusgwapongkabayoNo ratings yet

- Esma50-165-1524 TRV 1 2021Document119 pagesEsma50-165-1524 TRV 1 2021ForkLogNo ratings yet

- Quiz 2 - Business ValuationDocument17 pagesQuiz 2 - Business ValuationJacinta Fatima ChingNo ratings yet

- Student Ch007Document28 pagesStudent Ch007Marius AndreiNo ratings yet

- SMM List 2021-10-19Document9 pagesSMM List 2021-10-19Ivan PridorojnovNo ratings yet

- Aero Inc Had The Following Statement of Financial Position at PDFDocument2 pagesAero Inc Had The Following Statement of Financial Position at PDFLet's Talk With HassanNo ratings yet

- Nptel IitkgpDocument3 pagesNptel IitkgpDr.Narayana Gowd TallaNo ratings yet

- 00 Fischer10e SM ContentsDocument2 pages00 Fischer10e SM ContentsAnton VitaliNo ratings yet

- Stock Up - Overstock - Com UpgradedDocument5 pagesStock Up - Overstock - Com UpgradedValuEngine.comNo ratings yet

- Mirae Asset Emerging Bluechip Fund (MAEBF) : Product Update April 2019Document2 pagesMirae Asset Emerging Bluechip Fund (MAEBF) : Product Update April 2019Sudheer GangisettyNo ratings yet

- Securities and Regulation Code - MIDTERMDocument9 pagesSecurities and Regulation Code - MIDTERMJanelle TabuzoNo ratings yet

- Es130617 1Document4 pagesEs130617 1satish sNo ratings yet

- Deluxe Corporation Case StudyDocument3 pagesDeluxe Corporation Case StudyHEM BANSALNo ratings yet

- Candlestick CourseDocument80 pagesCandlestick Courseamolkupwad100% (2)

- Battah, Angela - BigFishDocument3 pagesBattah, Angela - BigFishGeraldJadeLazaroNo ratings yet

- Friheden Invest ASDocument13 pagesFriheden Invest ASiuliaNo ratings yet

- Valuation: Packet 2 Relative Valuation, Asset-Based Valuation and Private Company ValuationDocument23 pagesValuation: Packet 2 Relative Valuation, Asset-Based Valuation and Private Company Valuationnino laoshviliNo ratings yet

Equity Theory: Contract Receivable $653,000 Contract Payable $653,000

Equity Theory: Contract Receivable $653,000 Contract Payable $653,000

Uploaded by

GabyVionidyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Theory: Contract Receivable $653,000 Contract Payable $653,000

Equity Theory: Contract Receivable $653,000 Contract Payable $653,000

Uploaded by

GabyVionidyaCopyright:

Available Formats

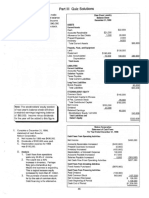

Preliminary computation Goodwill under entity theory $ 40,000 1.a. December 1, 2011 1a.

tity theory $ 40,000 1.a. December 1, 2011 1a. December 1, 2011 Comment: The contract receivable and payable

Total value of Sit implied by purchase price $1,800,000

Interest acquired in Sal: 36,000 shares 40,000 shares = 90% Undervalued plant assets $ 50,000 No entry is necessary No entry is necessary are both recorded instead of recording the contract

($1,440,000/80%)

Sal’s net assets under entity theory Excess over book value $ 90,000 b. December 31, 2011 b. December 31, 2011 net because Martin must deliver the euros to the

Noncontrolling interest percentage 20% exchange broker, net settlement is not allowed.

Noncontrolling interest $360,000 Implied value from purchase price: $1,000,000 Implied fair value (cost of interest $280,000 / 80%) Other Comprehensive Loss on forward contract (+Lo,-SE) 9,901

$350,000 October 2, 2011

Only the parent’s percentage of unrealized profits from upstream sales is $900,000/90% interest Income (-OCI,-SE) 9,901 Forward Contract (+L) 9,901

Book value of equity at 100% $260,000 Contract receivable $653,000

eliminated under parent company theory. Goodwill Forward Contract (+L) 9,901 Forward contract value 12/31/11

Contract payable $653,000

Subsidiary’s income of $400,000 10% noncontrolling interest $ 40,000 Entity theory Forward contract 12/31/11 ($1,000 - $980) x 500

Cost of 80% of interests $280,000 (1,000- 980) x 500 = $10,000/(1.005)2 = $10,000/(1.005)2 = $9,901 liability record contract to sell 1,000,000 euros

Less: Patent amortization ($140,000/10 years 10%) (1,400) Implied value $1,000,000 to exchange broker in 180 days for the

Less: Fair value and book value of net 855,000 Underlying equity (80% x book value of equity) $208,000 = $9,901 liability Firm Purchase Commitment (+A) 9,901

Noncontrolling interest share $ 38,600 Excess over book value $ 72,000 c. Settlement date February 28, 2012 forward rate of $.6530.

assets Gain on firm purchase commitment December 31, 2011

Goodwill $ 145,000 Undervalued plant assets (80% x $50,000) $(25,000) Forward Contract (-L) 9,901 (+Ga, +SE) 9,901

Implied fair value — $1,680,000 = patents at acquisition Contract payable 12,000

Parent company theory Alllocated to goodwill under parent company theory Forward Contract (+A)2,500 c. Settlement date February 28, 2012

Book value of 100% of identifiable net assets $1,680,000 $ 47,000 Exchange gain 12,000

Add: Patents at acquisition ($108,000/90%) 120,000 Cost of 90% interest $ 900,000 Other Comprehensive Forward Contract (-L) 9,901 adjust contract payable in euros to the

Total implied value 1,800,000 Fair values of net assets acquired ($855,000 90%) 769,500 Income (+OCI,+SE) 12,401 Forward Contract (+A) 2,500

Ping's portion of Singh's income (80% x $50,000) $ 40,000 Forward contract 2/28/12 90-day forward rate of $.6410.

Percent acquired 80% Goodwill $ 130,500 Gain on forward contract (+G,+SE) 12,401 March 31,2012

Traditional theory (same as parent theory) $ 130,500 Depreciation of excess (5 years x 80%) $ (4,000) ($1,000 - $1,005) x 500 = $2,500 asset. Forward contract value 2/28/12

Purchase price under entity theory $1,440,000 Income from Singh $ 36,000 Rice Inventory (+A) Contract payable 641,000

Investment income from Sal ($1,000 - $1,005) x 500 = $2,500 asset. Exchange loss 14,000

Purchase price — ($1,680,000 80%) = patents at acquisition ($1,005 x 500) 502,500 Loss on firm purchase

Equity theory Cash 655,000

Book value $1,680,000 80% = underlying equity $1,344,000 Cash (-A) 502,500 commitment (+Lo,-SE) 12,401

Ping's separate income $200,000 To record payment of 1,000,000 euros to

Add: Patents at acquisition ($108,000/90%) 120,000 Income from Sal ($40,000 1/2 year 90% interest) $ 18,000 Cash (+A) 2,500 Firm purchase commitment (-A) 9,901 exchange broker when spot rate is $.6550

Income from Singh $ 36,000 Forward Contract (-A) 2,500 Firm purchase commitment (+L) 2,500 Cash

Purchase price (traditional theory) $1,464,000 Noncontrolling interest under entity theory 653,000

Consolidated net income $236,000 2. Settlement date June 1, 2012 Rice Inventory (+A) 500,000 Contract receivable 653,000

Parent company theory Imputed value of Sal at July 1, 2012 $1,000,000 Cash (+A) 600,000 Firm purchase commitment (-L) 2,500

Singh separate income $ 50,000 To record receipt of U.S. dollars from exchange

Combined separate incomes of Pal and Sal $800,000 Add: Income for 1/2 year 20,000 Sales (+R) 600,000 Cash (-A) 502,500 broker in settlement of account.

Depreciation of excess (10 years) $ (5,000) Cost of Goods Sold (+E)500,000 Cash (+A) 2,500

Less: Pal’s share of unrealized profits from upstream 1,020,000

Singh's income $ 45,000 Other Comprehensive Forward Contract (-A) 2,500

inventory sales ($30,000 80%) (24,000) Noncontrolling percentage 10%

Noncontrolling interest share (20%) $ 9,000 Income (-OCI,-SE) 2,500 2. Cash (+A) 600,000

Less: Noncontrolling interest share ($300,000 20%) (60,000) Noncontrolling interest $ 102,000

Consolidated net income $716,000 Alternatively, $100,000 noncontrolling interest at July 1, Rice Inventory (-A) 502,500 Sales (+R,+SE) 600,000

Parent company theory Cost of Goods Sold (+E,-SE) 500,000

Entity theory plus $2,000 share of reported income = $102,000

Ping's separate income $200,000 Rice Inventory (-A) 500,000

Parent company theory Income from Singh $ 36,000 1.November 1, 2011 Memorandum entry only September 1, 2014

Combined separate incomes $800,000 Consolidated net income $236,000

Less: Unrealized profits from upstream sales (30,000) Cost to investment (80%) $ 280,000 2.December 31, 2011 Accounts receivable (fc) (+A) 15,400

Total consolidated income $770,000 Underlying equity [80% x (common stock Forward Contract (+A) 49,751 Sales (+R, +SE) 15,400

+ retained earnings)] $ (200,000) Noncontrolling interest share (20% x $50,000 Unrealized Gain on Forward Contract To record sales to Dimple AG; (€20,000 ´ $0.77 spot rate)

Excess of book value $80,000 Singh's separate income) $ 10,000 (+Ga, +SE) 49,751 Contract receivable (+A) 15,000

Income allocated to controlling stockholders ($50,000

+ Allocate excess to Preliminary computations (100,000x.50)/1.005 Contract payable (fc) (+L) 15,000

$716,000 Accounts receivables (80% x $50,000) $ 40,000 Retained earnings – beginning $ 500,000 To record forward contract to deliver €20,000 in 30 days.

[$270,000 80%])

Inventory (80% x $20,000) $ 16,000 Add: Net income for the year $ 300,000 Unrealized Loss on Firm Receivable: €20,000 ´ $0.75 forward rate.

Plant assets (80% x $20,000) $ 16,000 Less: Dividend $ (50,000) Sales Commitment (+Lo,-SE) 49,751 October 1, 2014

Income allocated to noncontrolling stockholders

($300,000 - $30,000) 20% $ 54,000 Retained earnings - ending $ 750,000 Firm Sales Commitment (+L) 49,751 Cash (fc) (+A) 15,800

Goodwill $ 8,000 Common stock $8,000,000 3.January 31, 2012 Exchange gain (+Ga, +SE) 400

Excess of book value $ 80,000 Total stockholders' equity Unrealized Loss on Accounts receivable (fc) (-A) 15,400

Goodwill Less: Retained earnings $(50,000) Forward Contract (+Lo,-SE) 149,751

on December 31, 2014 $8,750,000 To record collection of receivable from Dimple AG.

Parent company theory Push down capital $ 30,000 Forward Contract (+L) 100,000 Cash: €20,000 ´ $0.79.

Cost of investment in Sad $ 500,000 Forward Contract (-A) 49,751

40% 25% 20% 15% Exchange gain: [€20,000 ´ ($0.79 - $0.77)]

Fair value acquired ($400,000 80%) 320,000 Entity theory ($6-$5=1.00x100,000)

Corporate net income $ 300,000 Contract payable (fc) (-L) 15,000

Goodwill $ 180,000 Implied fair value of cost Firm Sales Commitment (+A)100,000 Exchange loss (+Lo, -SE) 800

Entity theory to investment ($280,000 / 80%) $ 350,000 Firm Sales Commitment (-L) 49,751

Stockholders' equity $8,750,000 Cash (fc) (+A) 15,800

Implied value based on purchase price ($500,000/80%) $ 625,000 Book value of equity $( 250,000) Unrealized Gain on Firm To record delivery of €20,000 from Dimple AG

Fair value of Sad’s net assets 400,000 Excess of book value $ 100,000 Income from Mill $120,000 $ 75,000 $ 60,000 $45,000 Sales Commitment (+G,+SE) 149,751 to foreign exchange broker in settlement of liability

Goodwill $ 225,000 Allocate excess to Forward Contract (-L) 100,000

Investment on and recognize exchange loss [€20,000 ´ ($0.79 - $0.75)]

Accounts receivable $ 50,000 December 31, 2014 $ 3,500,000 $2,187,500 $ 1,750,000 $1,312,500 Cash 100,000 Cash (+A) 15,000

Noncontrolling interest Inventory $ 20,000 Cash 600,000 Contract receivable (-A) 15,000

Parent company theory Plant asssets $ 20,000 Sales 600,000

1.October 1, 2011 Preliminary calculations To record receipt of cash from exchange broker.

Book value of Sad’s net assets $ 260,000 Sales 100,000

Forward contract(+A) 49,012 Value at spot rate $ 64,000

Noncontrolling interest percentage 20% Goodwill $ 10,000 Firm Sales Commitment (-A) 100,000

Gain on forward contract 49,012 Hedge contract ($ 62,500)

Noncontrolling interest $ 52,000 Excess of book value $100,000 100,000 x ($2.00 - $1.50))/(1.005)4 Discount $ 1,500

Entity theory Less: Retained earnings $(50,000) Inventory (+A) 50,000 1.Implicit rate of return (use formula) 1. Date Forward Contract Rate Forward Contract Difference x 2,000,000 Factor Present Value

Total valuation of Sad $ 625,000 Push down capital $ 50,000 Gain on inventory (+SE) 50,000 n = 90 days = 3 months Rate at This Date of Data Below

Noncontrolling interest percentage 20%

2.December 31, 2011 $64,000 (1 + i )n = $62,500 31-Dec 0.0095 0.0098 0.0003 600 1.01 594.06

Noncontrolling interest $ 125,000 Push down under parent company theory Loss on forward contract 98,763 3

$64,000 ( 1 + i ) = $62,500

Retained earnings 800,000 Forward contract(-A) 49,012 ( 1 + i )3 =0.976563

Total assets 2. Spot rate - January 30, 2015 $ 0.0120

Inventories 90,000 Forward contract(+L) 49,751 3√(1 + i )3 = 3√0.976563

Parent company theory 90-day forward rate - November 1, 2014 $ 0.0095

Land 450,000 (100,000 x ($2.00 - $2.50))/(1.005)= 49,751 1 + i=0.992126

Pod Sad Adjustment Total Difference $ 0.0025

Buildings — net 270,000 i = -0.00787

Current assets $ 20,000 $ 50,000 $ 40,000 80% $ 102,000 Goodwill 360,000 3.January 31, 2012 -0.7874% per month Merchandise price $ 2,000,000

Plant assets — net 480,000 250,000 110,000 80% 818,000 Equipment 180,000 Forward contract(-L) 49,751 2. Discount Balance Contract loss in January 30, 2015 $ 5,000

Goodwill 180,000 Other liabilities 90,000 Cash 30,000

$500,000 $300,000 $1,100,000 -0.79% $ 64,000

Push down equity 1,700,000 Gain on forward contract 19,751 30-Nov $ (504) $ 63,496

Push down under entity theory

30-Dec $ (500) $ 62,996

Entity theory Retained earnings 800,000

30-Jan $ (496) $ 62,500

Current assets $ 20,000 $ 50,000 $ 40,000 100% $ 110,000 Inventories 100,000

Total discount

Plant assets — net 480,000 250,000 110,000 100% 840,000 Land 500,000 amortization $(1,500)

Goodwill 225,000 Buildings — net 300,000

Total amortization needs

$500,000 $300,000 $1,175,000 Goodwill 400,000

adjustment on

Equipment — net 200,000

December 31, 2015 $1,003.90

Other liabilities 100,000

Push down equity 1,800,000

You might also like

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- Sol. Man. Chapter 4 Consol. Fs Part 1Document37 pagesSol. Man. Chapter 4 Consol. Fs Part 1itsmenatoy43% (7)

- Business Combinations (Part 2) : Problem 1: True or FalseDocument12 pagesBusiness Combinations (Part 2) : Problem 1: True or FalseAlexanderJacobVielMartinez100% (3)

- Kelompok3 Tugas3 AKLDocument4 pagesKelompok3 Tugas3 AKLsyifa fr100% (1)

- Consolidation Theories, Push-Down Accounting, and Corporate Joint VenturesDocument28 pagesConsolidation Theories, Push-Down Accounting, and Corporate Joint VenturesRiska Azahra NNo ratings yet

- Applied Group Fin Reporting-Changes in Group Structure PDFDocument25 pagesApplied Group Fin Reporting-Changes in Group Structure PDFObey SitholeNo ratings yet

- Exploring Wildlife: Stock Market GitaDocument10 pagesExploring Wildlife: Stock Market Gita01ankuNo ratings yet

- Tutorial 6 For Instructor PDFDocument5 pagesTutorial 6 For Instructor PDFsherynNo ratings yet

- Assignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliDocument5 pagesAssignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliReema SajuNo ratings yet

- AKL - Kasus Chapter 6 (P6-45)Document5 pagesAKL - Kasus Chapter 6 (P6-45)raqhelziuNo ratings yet

- Premium Liab To Effective Interest Method Quiz Integ 1Document11 pagesPremium Liab To Effective Interest Method Quiz Integ 1John Lexter MacalberNo ratings yet

- 1Document4 pages1NURHAM SUMLAYNo ratings yet

- Problem 10-8 (Banco)Document7 pagesProblem 10-8 (Banco)Roy Mitz Aggabao Bautista VNo ratings yet

- XLSXDocument10 pagesXLSXezar zacharyNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- Problem 8-9 Akl 2Document4 pagesProblem 8-9 Akl 2andi nanaNo ratings yet

- This Study Resource Was Shared Via: Solution 23-2 Answer DDocument5 pagesThis Study Resource Was Shared Via: Solution 23-2 Answer DDummy GoogleNo ratings yet

- ORQUIA AssignmentDocument4 pagesORQUIA AssignmentClint RoblesNo ratings yet

- Peerless Products CorpDocument2 pagesPeerless Products CorpMarsha SaviraNo ratings yet

- Contoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Document10 pagesContoh Akuisisi 100% Dan 100% Metode Cost (Tan Lee)Kusnul WidiyaniNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Aud1 022424 LectureDocument1 pageAud1 022424 LectureJessie PaterezNo ratings yet

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Enriquez, Michaella Activity1 Bsa3203Document13 pagesEnriquez, Michaella Activity1 Bsa3203Miks EnriquezNo ratings yet

- Business Combi. Chapter 1 PROBLEM 3Document4 pagesBusiness Combi. Chapter 1 PROBLEM 3latte aeriNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- Business Combination ExercisesDocument5 pagesBusiness Combination ExercisesmmNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Solution E2-3 1: Preliminary ComputationsDocument3 pagesSolution E2-3 1: Preliminary ComputationsRifda AmaliaNo ratings yet

- Of Financial PositionDocument3 pagesOf Financial PositionIrah LouiseNo ratings yet

- Quiz Advanced Accounting 2 - Anggelina Ariresta 008201900008Document4 pagesQuiz Advanced Accounting 2 - Anggelina Ariresta 008201900008anggelina arirestaNo ratings yet

- Ebook Canadian Income Taxation 2018 2019 21St Edition Buckwold Test Bank Full Chapter PDFDocument36 pagesEbook Canadian Income Taxation 2018 2019 21St Edition Buckwold Test Bank Full Chapter PDFpearlgregoryspx100% (13)

- Canadian Income Taxation 2018 2019 21st Edition Buckwold Test BankDocument38 pagesCanadian Income Taxation 2018 2019 21st Edition Buckwold Test Banklochaphasiawdjits100% (14)

- Buenaventura PREA4Document9 pagesBuenaventura PREA4Buenaventura, Elijah B.No ratings yet

- Chapter 3 - Consolidated Statements: Subsequent To AcquisitionDocument36 pagesChapter 3 - Consolidated Statements: Subsequent To AcquisitionJean De GuzmanNo ratings yet

- PANOPIO Activity1 BLOCK3209Document6 pagesPANOPIO Activity1 BLOCK3209panopiojessiemae4No ratings yet

- REVISI P2.1 SD P2.12Document24 pagesREVISI P2.1 SD P2.12yusufahriza25No ratings yet

- Quiz and Major Exam Accounting For Special Transactions 1Document38 pagesQuiz and Major Exam Accounting For Special Transactions 1CmNo ratings yet

- NOTES RECEIVABLE (Continuation) : Due To Rounding Off 51,310Document4 pagesNOTES RECEIVABLE (Continuation) : Due To Rounding Off 51,310ela kikayNo ratings yet

- ACCA SBR PapersDocument9 pagesACCA SBR PapersKaran KumarNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document11 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Kathrina RoxasNo ratings yet

- Far320 Capital Reduction ExercisesDocument7 pagesFar320 Capital Reduction ExercisesALIA MAISARA MD AKHIRNo ratings yet

- Business Combi Quiz (Part1)Document9 pagesBusiness Combi Quiz (Part1)Rica Joy RuzgalNo ratings yet

- PREA4Document9 pagesPREA4Buenaventura, Elijah B.No ratings yet

- Goodwill Calculation ExercisesDocument8 pagesGoodwill Calculation ExercisesAikal HakimNo ratings yet

- CH - 04 SolutionDocument3 pagesCH - 04 SolutionSaifur R. SabbirNo ratings yet

- Financial Ratios IIDocument27 pagesFinancial Ratios IIMohamad Gammaz0% (1)

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- Problem 7-3 Akl 2Document3 pagesProblem 7-3 Akl 2andi nanaNo ratings yet

- May-June 2011Document10 pagesMay-June 2011Usuf JabedNo ratings yet

- Adv Acc 2 Module 1 Topic1.2Document5 pagesAdv Acc 2 Module 1 Topic1.2James CantorneNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Group FinancialDocument8 pagesGroup FinancialNever GonondoNo ratings yet

- Akl Week 8Document5 pagesAkl Week 8Rifda AmaliaNo ratings yet

- ASSIGNMENT 2 Business CombinationDocument3 pagesASSIGNMENT 2 Business CombinationApril ManjaresNo ratings yet

- U1911118 Final AssigmentDocument5 pagesU1911118 Final AssigmentAziza 191x118No ratings yet

- Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)Document36 pagesSolutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)sunnyauliaNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 2Document20 pages2076 - Varias, Aizel Ann B - Module 2Aizel Ann VariasNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- B. Essay Questions: False True True FalseDocument1 pageB. Essay Questions: False True True FalseGabyVionidyaNo ratings yet

- Exercise For Final Exam, May 28, 2019: A. True and False QuestionsDocument1 pageExercise For Final Exam, May 28, 2019: A. True and False QuestionsGabyVionidyaNo ratings yet

- Test Bank 3Document1 pageTest Bank 3GabyVionidyaNo ratings yet

- Test Bankk Teori (Dragged) 5Document1 pageTest Bankk Teori (Dragged) 5GabyVionidyaNo ratings yet

- Accounting For Derivatives and Hedging Activities: Answers To QuestionsDocument22 pagesAccounting For Derivatives and Hedging Activities: Answers To QuestionsGabyVionidyaNo ratings yet

- Management Incentivisation Trends in The Infrastructure Sector - Infrastructure IntelligenceDocument4 pagesManagement Incentivisation Trends in The Infrastructure Sector - Infrastructure IntelligencemayorladNo ratings yet

- Elliott Wave Theory BasicsDocument7 pagesElliott Wave Theory BasicsSarat KumarNo ratings yet

- Lecture 020 FTR Failed To Return PDFDocument10 pagesLecture 020 FTR Failed To Return PDFHicham MAYANo ratings yet

- Risk Parity PortfoliosDocument11 pagesRisk Parity PortfoliosvettebeatsNo ratings yet

- HW For M8 - Hedging With OptionsDocument3 pagesHW For M8 - Hedging With OptionsNiyati ShahNo ratings yet

- PPT - PPTBankingAwarenessStaticBaselNormsDocument37 pagesPPT - PPTBankingAwarenessStaticBaselNormscricketprediction8271No ratings yet

- Stock Options - Basic Strategies For A Lifetime of Option InvestingDocument19 pagesStock Options - Basic Strategies For A Lifetime of Option Investingrkumar123No ratings yet

- Financial Analysis of Tata Steel LTDDocument12 pagesFinancial Analysis of Tata Steel LTDHeather ElliottNo ratings yet

- The Best Investor Pitch Deck OutlineDocument28 pagesThe Best Investor Pitch Deck OutlineEugene M. BijeNo ratings yet

- Lecture - Big Mac IndexDocument11 pagesLecture - Big Mac IndexKatherine SauerNo ratings yet

- Technical AnalysisDocument97 pagesTechnical AnalysisMasoom Tekwani100% (1)

- Grey Minimalist Business Project PresentationDocument11 pagesGrey Minimalist Business Project PresentationAbdul MuqitNo ratings yet

- PhilEquity ProspectusDocument25 pagesPhilEquity ProspectusgwapongkabayoNo ratings yet

- Esma50-165-1524 TRV 1 2021Document119 pagesEsma50-165-1524 TRV 1 2021ForkLogNo ratings yet

- Quiz 2 - Business ValuationDocument17 pagesQuiz 2 - Business ValuationJacinta Fatima ChingNo ratings yet

- Student Ch007Document28 pagesStudent Ch007Marius AndreiNo ratings yet

- SMM List 2021-10-19Document9 pagesSMM List 2021-10-19Ivan PridorojnovNo ratings yet

- Aero Inc Had The Following Statement of Financial Position at PDFDocument2 pagesAero Inc Had The Following Statement of Financial Position at PDFLet's Talk With HassanNo ratings yet

- Nptel IitkgpDocument3 pagesNptel IitkgpDr.Narayana Gowd TallaNo ratings yet

- 00 Fischer10e SM ContentsDocument2 pages00 Fischer10e SM ContentsAnton VitaliNo ratings yet

- Stock Up - Overstock - Com UpgradedDocument5 pagesStock Up - Overstock - Com UpgradedValuEngine.comNo ratings yet

- Mirae Asset Emerging Bluechip Fund (MAEBF) : Product Update April 2019Document2 pagesMirae Asset Emerging Bluechip Fund (MAEBF) : Product Update April 2019Sudheer GangisettyNo ratings yet

- Securities and Regulation Code - MIDTERMDocument9 pagesSecurities and Regulation Code - MIDTERMJanelle TabuzoNo ratings yet

- Es130617 1Document4 pagesEs130617 1satish sNo ratings yet

- Deluxe Corporation Case StudyDocument3 pagesDeluxe Corporation Case StudyHEM BANSALNo ratings yet

- Candlestick CourseDocument80 pagesCandlestick Courseamolkupwad100% (2)

- Battah, Angela - BigFishDocument3 pagesBattah, Angela - BigFishGeraldJadeLazaroNo ratings yet

- Friheden Invest ASDocument13 pagesFriheden Invest ASiuliaNo ratings yet

- Valuation: Packet 2 Relative Valuation, Asset-Based Valuation and Private Company ValuationDocument23 pagesValuation: Packet 2 Relative Valuation, Asset-Based Valuation and Private Company Valuationnino laoshviliNo ratings yet