Professional Documents

Culture Documents

Activity in Class 01 - Operations II - Basic Concepts Review

Activity in Class 01 - Operations II - Basic Concepts Review

Uploaded by

Kira NikiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity in Class 01 - Operations II - Basic Concepts Review

Activity in Class 01 - Operations II - Basic Concepts Review

Uploaded by

Kira NikiCopyright:

Available Formats

Activity in Class 01 – Operations II

Basic Concepts Review

Solve the following problems in groups of three students and discuss the results in class:

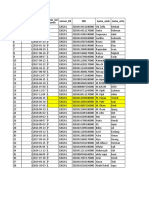

Problem. A chemical manufacturer wants to forecast the demand of the single product that it offers for

each of the next 12 months of year 2016 in order to establish an aggregate plan. The historical demand is

summarized in the table below.

Demand Demand Demand

Month (tons) Month (tons) Month (tons)

2013/01 171 2014/01 266 2015/01 187

2013/02 220 2014/02 368 2015/02 180

2013/03 254 2014/03 338 2015/03 265

2013/04 282 2014/04 368 2015/04 326

2013/05 185 2014/05 438 2015/05 219

2013/06 443 2014/06 647 2015/06 488

2013/07 348 2014/07 495 2015/07 283

2013/08 170 2014/08 311 2015/08 258

2013/09 501 2014/09 464 2015/09 502

2013/10 385 2014/10 289 2015/10 460

2013/11 444 2014/11 409 2015/11 565

2013/12 525 2014/12 264 2015/12 415

(1) Use Minitab to forecast demand using the multiplicative Winter’s method with parameters α=0.30,

β=0.10 and γ=0.35.

(2) Based on the MAD criterion, estimate monthly forecast error.

(3) Based on the MSE criterion, estimate monthly forecast error.

(4) The mean lead time for this product (production and transportation time to the main warehouse) is 10

days. If the company wants to set the safety stock for this product using a cycle service level of 95%, how

much inventory should the company hold as safety stock? Assume 360 days per year. Use the MSE

criterion to estimate forecast error, and Excel to calculate safety stock.

(5) The manager wants to define the optimal production lot-size for 2016 using the EPQ model. The fixed

cost of preparing the process for production is $10,500, the unit cost is $2,600 per ton, the annual inventory

holding cost rate is 20% and the cost of capital 18%, and the plant can produce 8,000 tons per year. What

is the optimal lot-size? If the optimal lot size is implemented, what would be the average inventory? On

average, how many days of inventory would the company hold?

(6) On average, how much money must the company invest in inventory of finished goods, considering

the safety stock defined previously on question #4 and the inventory policy defined on question #5.

You might also like

- OET Future Land Full Book Final Edition July 2018Document893 pagesOET Future Land Full Book Final Edition July 2018Haytham Saadon83% (30)

- Futuristic Technology Conference PresentationDocument8 pagesFuturistic Technology Conference Presentationapi-674115930No ratings yet

- Implementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesFrom EverandImplementing Integrated Business Planning: A Guide Exemplified With Process Context and SAP IBP Use CasesNo ratings yet

- Cm1 Assignment Y1 q1 - Solution (Final)Document79 pagesCm1 Assignment Y1 q1 - Solution (Final)Swapnil SinghNo ratings yet

- Yo e Capstone CostumesDocument15 pagesYo e Capstone CostumesTRY ANTOMO50% (2)

- Demand Forecasting Excel by Fathi MatbaqDocument61 pagesDemand Forecasting Excel by Fathi MatbaqFathi Salem Mohammed AbdullahNo ratings yet

- Jute Shopping Bags Manufacturing Business 945553 PDFDocument65 pagesJute Shopping Bags Manufacturing Business 945553 PDFMarienNo ratings yet

- Algorithm QPDocument52 pagesAlgorithm QPNayabNo ratings yet

- Advanced Excel TestDocument980 pagesAdvanced Excel TestsinghsanjNo ratings yet

- SD 2015 - Ea Preparation StatusDocument7 pagesSD 2015 - Ea Preparation StatushichemokokNo ratings yet

- Multi KPIDocument818 pagesMulti KPIAdemarNo ratings yet

- Seassion 1Document3 pagesSeassion 1terezaNo ratings yet

- Preliminarni Raspored Nastave Drugi Ciklus Studija - Energetsko Mašinstvo Šk. 2018./2019. Usmjerenje: (Učionica MF - 05B)Document2 pagesPreliminarni Raspored Nastave Drugi Ciklus Studija - Energetsko Mašinstvo Šk. 2018./2019. Usmjerenje: (Učionica MF - 05B)almir_brčaninovićNo ratings yet

- Laboratory Manual: Production Technology LabDocument218 pagesLaboratory Manual: Production Technology LabAshok PradhanNo ratings yet

- Gantt-Chart ExampleDocument2 pagesGantt-Chart ExampleBenjabenjaNo ratings yet

- Practica Hidro 4.1Document113 pagesPractica Hidro 4.1Eugenio Sebastian AndradeNo ratings yet

- Neraca Perdagangan Indonesia Total: NO Description 2011 2012 2013 2014 2015 Trend (%) 2011-2015Document7 pagesNeraca Perdagangan Indonesia Total: NO Description 2011 2012 2013 2014 2015 Trend (%) 2011-2015Anonymous eCws3ENo ratings yet

- HouseSales Quarterly SolutionsDocument11 pagesHouseSales Quarterly Solutionsprosup987No ratings yet

- CocorahsDocument3 pagesCocorahsapi-285720668No ratings yet

- Learning Records-20190125124807Document4 pagesLearning Records-20190125124807juanmorenojkNo ratings yet

- B3 BTDocument2,939 pagesB3 BTizombie22101997No ratings yet

- Lesson4 SalesDocument1,301 pagesLesson4 SaleshuyennnNo ratings yet

- Nielsen Piata Mezeluri Ian Aug 2014Document15 pagesNielsen Piata Mezeluri Ian Aug 2014Alexandra CioriiaNo ratings yet

- OPSCM Project - Mahima SharmaDocument8 pagesOPSCM Project - Mahima SharmamahimatejpalsharmaNo ratings yet

- Income Tax Department Inflation IndexDocument1 pageIncome Tax Department Inflation IndexSujesh GangadharanNo ratings yet

- Date Quantity Sold Transaction Revenue Sales Price/unit Item CodeDocument13 pagesDate Quantity Sold Transaction Revenue Sales Price/unit Item CodeDeepika DhimanNo ratings yet

- Final AnswersDocument115 pagesFinal Answersm.umefarwa7No ratings yet

- Obs Food and Beverages Periode RS EPS ROE DER TatoDocument1 pageObs Food and Beverages Periode RS EPS ROE DER Tatoratna komalaNo ratings yet

- 321b0800 4111smartDocument11 pages321b0800 4111smartpankajNo ratings yet

- OSCM Assignment - Vivek SengarDocument8 pagesOSCM Assignment - Vivek SengarsengarNo ratings yet

- Project Name Category Sub-Category Estimated Start: TotalDocument6 pagesProject Name Category Sub-Category Estimated Start: TotallynnNo ratings yet

- Report On RMG Sector of BangladeshDocument6 pagesReport On RMG Sector of BangladeshFida Al HasanNo ratings yet

- MargarineDocument25 pagesMargarineyenealem AbebeNo ratings yet

- ruhaima raheem business insertsDocument128 pagesruhaima raheem business insertsghousiyashums123No ratings yet

- APRCET 2019 Schedule 27012020Document5 pagesAPRCET 2019 Schedule 27012020Viswa Mohan Reddy KaipaNo ratings yet

- 2015 KOICA Fellowship Program PlanDocument19 pages2015 KOICA Fellowship Program PlanMusa KhanNo ratings yet

- O Haga Clic Aquí para Crear Su Propio Diagrama de Gantt en SmartsheetDocument8 pagesO Haga Clic Aquí para Crear Su Propio Diagrama de Gantt en SmartsheetEdwin J Gerena TNo ratings yet

- PDC - Answersheet For CandidatesDocument5 pagesPDC - Answersheet For CandidatesvinaysinghtiensNo ratings yet

- Individual Assignment - Operations and Supply Chain Management - Raghavan RajamanickamDocument13 pagesIndividual Assignment - Operations and Supply Chain Management - Raghavan RajamanickamBalakrishnan SoundararajanNo ratings yet

- Pembagian TitikDocument40 pagesPembagian TitikWeni RenNo ratings yet

- Archit Patel - Analysis FileDocument21 pagesArchit Patel - Analysis FileJashvant PatelNo ratings yet

- 1-Wheelers Assembly PlantDocument25 pages1-Wheelers Assembly PlantFekadie TesfaNo ratings yet

- Appending TablesDocument2 pagesAppending TablesGomishChawlaNo ratings yet

- No Anak - Ke TGL - Lahir Nomor - KK NIK Nama - Anak Nama - Ortu Jenis - Kel AminDocument3 pagesNo Anak - Ke TGL - Lahir Nomor - KK NIK Nama - Anak Nama - Ortu Jenis - Kel Aminrimun qidahNo ratings yet

- Operations Management ProjectDocument12 pagesOperations Management Projectkrishnan MishraNo ratings yet

- 8663 - Tests For AS A Level Year 1 Edexcel Stats Mechanics Expert Set A v1.1Document9 pages8663 - Tests For AS A Level Year 1 Edexcel Stats Mechanics Expert Set A v1.1Cherie ChowNo ratings yet

- Model Stocuri ExcelDocument6 pagesModel Stocuri ExcelBuliga AdrianNo ratings yet

- Clinical Pathway HemofiliaDocument12 pagesClinical Pathway HemofiliaAnonymous aPWkG93No ratings yet

- Alicorp - EcoeficiencyDocument8 pagesAlicorp - EcoeficiencyDoris Cabrera IrigoinNo ratings yet

- Stasiun Kemayoran 2015-2020Document30 pagesStasiun Kemayoran 2015-2020Vin BettaNo ratings yet

- Bus115 Project 08Document6 pagesBus115 Project 08Marvin CincoNo ratings yet

- Cambridge International Advanced LevelDocument4 pagesCambridge International Advanced LevelmahamNo ratings yet

- Patel Profiles PVT LTD: Supply Progress Plan Year Month WeekDocument2 pagesPatel Profiles PVT LTD: Supply Progress Plan Year Month WeekAayushi PatelNo ratings yet

- 1 Ban Hiep Lens MPL Term Project AITVNDocument14 pages1 Ban Hiep Lens MPL Term Project AITVNLe BanNo ratings yet

- Software Project ManagementDocument2 pagesSoftware Project ManagementD DNo ratings yet

- 01-02-03-Aggregate Sales & Operations PlanningDocument65 pages01-02-03-Aggregate Sales & Operations Planningfriendajeet123No ratings yet

- Capital FijocoolDocument3 pagesCapital FijocoolCintia FraustoNo ratings yet

- Practice Sheet 1Document53 pagesPractice Sheet 1Rishabh VermaNo ratings yet

- Current Account Balance - USD BillionDocument53 pagesCurrent Account Balance - USD BillionChetan NagarNo ratings yet

- December-Staff Database: Id No. Name Date HiredDocument4 pagesDecember-Staff Database: Id No. Name Date HiredwelpNo ratings yet

- 2014-Kinetic-Planning-Guide (2017 - 04 - 19 16 - 41 - 43 UTC)Document86 pages2014-Kinetic-Planning-Guide (2017 - 04 - 19 16 - 41 - 43 UTC)Ion100% (1)

- SME Internationalization Strategies: Innovation to Conquer New MarketsFrom EverandSME Internationalization Strategies: Innovation to Conquer New MarketsNo ratings yet

- 2009.SIPOC - A Six Sigma Tool Helping On ISO 9000 Quality Management Systems PDFDocument10 pages2009.SIPOC - A Six Sigma Tool Helping On ISO 9000 Quality Management Systems PDFjosmanccNo ratings yet

- ContinueDocument5 pagesContinueChintuNo ratings yet

- Final Draft - Mainstreaming ManualDocument42 pagesFinal Draft - Mainstreaming ManualRamilNo ratings yet

- I-14 Central Texas Corridor StudyDocument2 pagesI-14 Central Texas Corridor StudyKBTXNo ratings yet

- International Standard: Risk Management - GuidelinesDocument8 pagesInternational Standard: Risk Management - GuidelinesSafety Event50% (4)

- 18 Special Purpose Audit EngagementDocument2 pages18 Special Purpose Audit EngagementIrish SanchezNo ratings yet

- 14 Steps of A PM Optimization Process (PMO)Document5 pages14 Steps of A PM Optimization Process (PMO)BassieNo ratings yet

- Hesham El Ghoul CVDocument2 pagesHesham El Ghoul CVzahraaanas40No ratings yet

- Yuki Diens CV-2Document2 pagesYuki Diens CV-2Yuki Diens SeptianandaNo ratings yet

- c9104 Certified Procurement Contracts Manager CPCM Brochure 2Document11 pagesc9104 Certified Procurement Contracts Manager CPCM Brochure 2Assaad BensaoudNo ratings yet

- Mall Customer Segmentation: Submitted By: Batch No:8Document17 pagesMall Customer Segmentation: Submitted By: Batch No:8divya garikapatiNo ratings yet

- Operations Management-Crocs Shoes Case StudyDocument19 pagesOperations Management-Crocs Shoes Case StudyBhooshan Parikh95% (21)

- Thesis Venture CapitalDocument7 pagesThesis Venture CapitalDaniel Wachtel100% (2)

- Legal Focus Dec 2023Document3 pagesLegal Focus Dec 2023jianNo ratings yet

- RFM/S Checklist: Emp Bentu OperationDocument1 pageRFM/S Checklist: Emp Bentu OperationMaintenance BentuNo ratings yet

- Iso 45001-2018Document19 pagesIso 45001-2018Scientific KingNo ratings yet

- MMVA ZG 522 Total Quality Management: Rajiv Gupta BITS PilaniDocument54 pagesMMVA ZG 522 Total Quality Management: Rajiv Gupta BITS PilanihariNo ratings yet

- 360 Degree Performance AppraisalDocument15 pages360 Degree Performance AppraisalEverstudy Online ClassesNo ratings yet

- BIOLOGY Educart Sample Papers Term 2 C-12 - Watermark-CompressedDocument104 pagesBIOLOGY Educart Sample Papers Term 2 C-12 - Watermark-CompressedDeepti PrarupNo ratings yet

- 44-Article Text-108-1-10-20180821Document12 pages44-Article Text-108-1-10-20180821Sheren sitohangNo ratings yet

- 3rd Quarter Summative Test in CCS For Week 3&4 in TLE-ICT10Document2 pages3rd Quarter Summative Test in CCS For Week 3&4 in TLE-ICT10heidee carpioNo ratings yet

- Chapter 07. Customer-Driven Marketing Strategy: Segmentation, Targeting & PositioningDocument35 pagesChapter 07. Customer-Driven Marketing Strategy: Segmentation, Targeting & PositioningReem AlAssirNo ratings yet

- A Study On Inventory Management at Anantha PVC Pipes PVT LTD, AnanthapurDocument8 pagesA Study On Inventory Management at Anantha PVC Pipes PVT LTD, AnanthapurEditor IJTSRDNo ratings yet

- ArtikelShobikin 8Document17 pagesArtikelShobikin 8Dandi HermawanNo ratings yet

- Control of Monitoring and Measuring EquipmentDocument3 pagesControl of Monitoring and Measuring EquipmentLinda Setya WatiNo ratings yet

- Growth Experiment Outline Card ENDocument2 pagesGrowth Experiment Outline Card ENMahesh SrinivasanNo ratings yet

- PAS 2 and 41Document28 pagesPAS 2 and 41Renz NgohoNo ratings yet

- Unit 3 - Accounting For Overheads (Students)Document28 pagesUnit 3 - Accounting For Overheads (Students)Ceila FerronNo ratings yet