Professional Documents

Culture Documents

Acctg Lab 7

Acctg Lab 7

Uploaded by

AngieOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acctg Lab 7

Acctg Lab 7

Uploaded by

AngieCopyright:

Available Formats

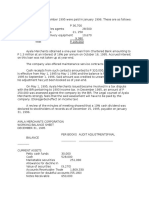

Problem 7-1

Requirement 1: Prepare related journal entries to record the transactions that transpire during the year 2020.

Show necessary computations for the right of use asset, lease liability, interest expense and depreciation.

GENERAL JOURNAL

Date Page Number 01

Decriptions

2020 PR Debit

Mar-01 1. Right of use asset 6,668,150.00

Lease liability

Cash

Present value of lease liability (1,500,000 x 4.3121) 6,468,150.00

Add: Initial Direct costs 200,000.00

Right of use asset 6,668,150.00

Mar-01 2. Lease liability 1,500,000.00

Prepaid Executory Cost (Insurance expense) 100,000.00

Cash

Dec-31 3. Depreciation (6,668,150 x (10/60 months)) 1,111,358.33

Accumulated Depreciation

Dec-31 4. Interest expense 397,452.00

Accrued interest payable

Dec-31 Executory Cost 100,000.00

Prepaid Executory Cost (Insurance expense)

Dec-31 Executory Cost (Tax expense) 41,666.67

Cash

Requirement 2: How much is the carrying amount of the right of use asset on December 31, 2022?

Right of use asset 6,668,150.00

Less: Accumulated Depreciation ((6,668,150/60) x 34 months) 3,778,618.33

Carrying Amount 2,889,531.67

Requirement 3: How much is to be reported as expenses related to the lease contract for December 31, 2020?

Interest expense 397,452.00

Executory Cost (Tax expense) 41,666.67

Executory Cost (Insurance expense) 100,000.00

Depreciation Expense 1,111,358.33

Total ₱ 1,650,477.00

Requirement 4: How much is the carrying amount of the lease liability on December 31, 2021? Determine the

current and non-current portion?

Lease liability - March 1, 2020

Less: First payment on March 1, 2020 -

Balance: Lease Liability - March 1, 2020

Less: Interest expense for 2020 - Dec. 31, 2020 (4,968,150*8%)

Lease liability - December 31, 2020

Less: Second payment on January 1, 2021

Payment 1,500,000.00

Less: Interest expense for 2021 - Dec. 31, 2020 - 365,655.84

Principal payment

Lease liability - December 31, 2021

Lease liability - December 31, 2021

Current portion

Noncurrent portion

Problem 7-2

Requirement 1: How much should be capitalized as the cost of right of use asset?

Present value of rental payment (720,000 x 6.3282) 4,556,304.00

Total cost of right of use asset/ Present value of lease asset ₱ 4,556,304.00

Requirement 2: How much should be included in the current liabilities section of RLC’s Statement of Financial

Position at December 31, 2020?

Current liabilities for RLC's Statement of Financial Position at Dec. 31, 2020

Lease Liability (Current Portion) ₱ 231,973.92

Lease liability - December 31, 2019

Less: First payment on December 31, 2019 720,000.00

Less: Executory costs *deduct on yearly rental payment* - 24,705.00

Lease liability - December 31, 2019

Less: Second payment on December 31, 2020

Payment 720,000.00

Less: Executory costs *deduct on yearly rental payment* - 24,705.00

Interest for 2019 (12% x 3,861,009) - 463,321.08

Principal payment

Lease liability - December 31, 2020

Lease liability - December 31, 2020

Current portion

Noncurrent portion

Requirement 3: How much should be included in the noncurrent liabilities section of RLC’s statement of financial

position at December 31, 2020?

Noncurrent liabilities for RLC's Statement of Financial Position at Dec. 31, 2020

Lease Liability (Noncurrent Portion) ₱ 3,397,061.16

Requirement 4: How much is the total lease-related expenses to be reported in RLC’s Income Statement for the

year ended December 31, 2020?

Lease-related expenses for RLC's Income Statement at Dec. 31, 2020

Executory costs ₱ 24,705.00

Interest expense 463,321.08

Depreciation expense (4,556,304 / 10) 455,630.40

Total ₱ 943,656.48

e during the year 2020.

e and depreciation.

Number 01

Credit

6,468,150.00

200,000.00

1,600,000.00

1,111,358.33

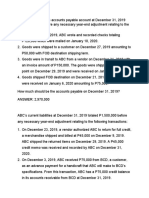

Year (Payment of interest) Payment 8% interest Principal

March 1, 2020

397,452.00 March 1, 2020 1,500,000.00 1,500,000.00

Dec. 31, 2020 - 397,452.00 -

2021 1,500,000.00 365,655.84 1,134,344.16

100,000.00 2022 1,500,000.00 274,908.31 1,225,091.69

2023 1,500,000.00 176,900.97 1,323,099.03

41,666.67

er 31, 2022?

or December 31, 2020?

1, 2021? Determine the

₱ 6,468,150.00

1,500,000.00

₱ 4,968,150.00

- 397,452.00

4,570,698.00

1,134,344.16

3,436,353.84

₱ 3,436,353.84

1,134,344.16

₱ 2,302,009.68

Statement of Financial

Date Payment Interest Principal

Dec. 31, 2019

Dec. 31, 2019 695,295.00 695,295.00

Dec. 31, 2020 695,295.00 463,321.08 231,973.92

₱ 4,556,304.00 Dec. 31, 2021 695,295.00 435,484.21 259,810.79

Dec. 31, 2022 695,295.00 404,306.91 290,988.09

695,295.00 Dec. 31, 2023 695,295.00 369,388.34 325,906.66

3,861,009.00 Dec. 31, 2024 695,295.00 330,279.55 365,015.45

Dec. 31, 2025 695,295.00 286,477.69 408,817.31

Dec. 31, 2026 695,295.00 237,419.61 457,875.39

Dec. 31, 2027 695,295.00 182,474.57 512,820.43

Dec. 31, 2028 695,295.00 120,936.12 574,358.88

Dec. 31, 2029 695,295.00 52,013.05 643,281.95

231,973.92

3,629,035.08

₱ 3,629,035.08

231,973.92

₱ 3,397,061.16

LC’s statement of financial

ncome Statement for the

Present value

6,468,150.00

4,968,150.00

4,570,698.00

3,436,353.84

2,211,262.15

-

Present value

4,556,304.00

3,861,009.00

3,629,035.08

3,369,224.29

3,078,236.20

2,752,329.55

2,387,314.09

1,978,496.79

1,520,621.40

1,007,800.97

433,442.08

-

You might also like

- Due Diligence Report SampleDocument30 pagesDue Diligence Report Samplestsui83% (6)

- 1 2 PracticeDocument11 pages1 2 PracticecsolutionNo ratings yet

- UCU Audit ProblemsDocument9 pagesUCU Audit ProblemsTCC FreezeNo ratings yet

- PSBA - Accounting 13 Long Quiz - Applied Auditing (Finals)Document14 pagesPSBA - Accounting 13 Long Quiz - Applied Auditing (Finals)Patty Lacson100% (2)

- Module 4 Technical WritingDocument4 pagesModule 4 Technical WritingSJ AjineNo ratings yet

- Chapter 1 Succession and Transfer Taxes Part 1Document2 pagesChapter 1 Succession and Transfer Taxes Part 1AngieNo ratings yet

- Bonds Payable Issued at A PremiumDocument6 pagesBonds Payable Issued at A PremiumCris Ann Marie ESPAnOLANo ratings yet

- Liabilities Long TermDocument3 pagesLiabilities Long TermEngel QuimsonNo ratings yet

- Quiz Week 8 Akm 2Document6 pagesQuiz Week 8 Akm 2Tiara Eva TresnaNo ratings yet

- Cost Accounting 2014Document94 pagesCost Accounting 2014Juliet Leron MediloNo ratings yet

- Bonds Payable by J. GonzalesDocument7 pagesBonds Payable by J. GonzalesGonzales JhayVeeNo ratings yet

- Pcpar Insurance ContractDocument2 pagesPcpar Insurance Contractdoora keysNo ratings yet

- Umuc Acc311 - Acc 311 Quiz 1 2015Document5 pagesUmuc Acc311 - Acc 311 Quiz 1 2015teacher.theacestudNo ratings yet

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Document18 pagesShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)AdrianBrionesGallardoNo ratings yet

- Financial Accounting: Share-Based Compensation Share-Based Compensation Book Value Per ShareDocument11 pagesFinancial Accounting: Share-Based Compensation Share-Based Compensation Book Value Per ShareairaNo ratings yet

- Mas Chapter 1Document45 pagesMas Chapter 1Gianina de GuzmanNo ratings yet

- Auditing ProblemsDocument9 pagesAuditing ProblemsJillNo ratings yet

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Document18 pagesShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)nmdl123No ratings yet

- Aud Prob Part 2Document52 pagesAud Prob Part 2Ma. Hazel Donita DiazNo ratings yet

- Migriño - Quizzer 2 - Employee Benefits Part 1Document13 pagesMigriño - Quizzer 2 - Employee Benefits Part 1jessamaeNo ratings yet

- p1 QuizDocument3 pagesp1 QuizEvita Faith LeongNo ratings yet

- First Exam Review WithSolutionDocument6 pagesFirst Exam Review WithSolutionLexter Dave C EstoqueNo ratings yet

- Accounting For Employment BenefitsDocument5 pagesAccounting For Employment BenefitsiamacrusaderNo ratings yet

- Five Debates Over Macroeconomic PolicyDocument4 pagesFive Debates Over Macroeconomic PolicyPatel ChiragNo ratings yet

- Answers - Chapter 2 Vol 2 2009Document13 pagesAnswers - Chapter 2 Vol 2 2009Crystin Marie Tiu100% (1)

- Acc 223a CH 5 AnswersDocument13 pagesAcc 223a CH 5 Answersjr centenoNo ratings yet

- MODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALDocument3 pagesMODAUD2 Unit 4 Audit of Bonds Payable T31516 FINALmimi960% (2)

- First QuizDocument4 pagesFirst QuizArn HicoNo ratings yet

- Ac3a Qe Oct2014 (TQ)Document15 pagesAc3a Qe Oct2014 (TQ)Julrick Cubio EgbusNo ratings yet

- Quiz FarDocument4 pagesQuiz Farfrancis dungcaNo ratings yet

- PDF Quiz Bee Leases With Ans Copy - CompressDocument3 pagesPDF Quiz Bee Leases With Ans Copy - CompressGarp BarrocaNo ratings yet

- Unit Vi - Audit of Leases - Final - T11415 PDFDocument4 pagesUnit Vi - Audit of Leases - Final - T11415 PDFSed ReyesNo ratings yet

- N. Cruz-Course Material For Strategic Cost ManagementDocument134 pagesN. Cruz-Course Material For Strategic Cost ManagementEmmanuel VillafuerteNo ratings yet

- Reaction Paper On GRP 12Document2 pagesReaction Paper On GRP 12Ayen YambaoNo ratings yet

- Discussion 2 CHAPDocument4 pagesDiscussion 2 CHAPHannah LegaspiNo ratings yet

- Quiz - M1 M2Document12 pagesQuiz - M1 M2Jenz Crisha PazNo ratings yet

- RR 10-02Document5 pagesRR 10-02matinikkiNo ratings yet

- File 4795281140322753513Document10 pagesFile 4795281140322753513Akako MatsumotoNo ratings yet

- TOA Book Value, Basic and Diluted Per ShareDocument1 pageTOA Book Value, Basic and Diluted Per SharePatrick BacongalloNo ratings yet

- Intermediate Accounting 1 WeekDocument32 pagesIntermediate Accounting 1 Weekimsana minatozakiNo ratings yet

- 103 CompilationDocument12 pages103 CompilationLyn AbudaNo ratings yet

- True/False Questions: labor-intensive (cần nhiều nhân công)Document31 pagesTrue/False Questions: labor-intensive (cần nhiều nhân công)Ngọc MinhNo ratings yet

- Stock Edited PDFDocument29 pagesStock Edited PDFCzarina PanganibanNo ratings yet

- Chapter 14Document4 pagesChapter 14Richard Jay CamaNo ratings yet

- TaxationDocument7 pagesTaxationDorothy ApolinarioNo ratings yet

- Chapter 2 - Intro To ITDocument12 pagesChapter 2 - Intro To ITMakiri Sajili IINo ratings yet

- LiquidationDocument2 pagesLiquidationMaria LopezNo ratings yet

- Section 19 Business Combination and Goodwill 1Document17 pagesSection 19 Business Combination and Goodwill 1AdrianneNo ratings yet

- Bus Trans Taxes Key Solution PTVAT 2013 2014Document17 pagesBus Trans Taxes Key Solution PTVAT 2013 2014Jandave ApinoNo ratings yet

- Ia3 BSDocument5 pagesIa3 BSMary Joy CabilNo ratings yet

- CGT Drill Answers and ExplanationsDocument4 pagesCGT Drill Answers and ExplanationsMarianne Portia SumabatNo ratings yet

- Gross Profit Analysis: Multiple ChoiceDocument20 pagesGross Profit Analysis: Multiple ChoiceMaryferd SisanteNo ratings yet

- Problem 4Document2 pagesProblem 4mhikeedelantarNo ratings yet

- Case 9-30 Master Budget With Supporting SchedulesDocument2 pagesCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- Notes in Fi4Document1 pageNotes in Fi4Gray JavierNo ratings yet

- Change in Unit Cost From Prior Department and Valuation of InventoryDocument8 pagesChange in Unit Cost From Prior Department and Valuation of InventoryHarzen Joy SampolloNo ratings yet

- Cash and Cash Equivalents QuizDocument2 pagesCash and Cash Equivalents QuizMarkJoven Bergantin100% (1)

- Multiple Choice Questions 1 A Method That Excludes Residual Value FromDocument1 pageMultiple Choice Questions 1 A Method That Excludes Residual Value FromHassan JanNo ratings yet

- ch13 - Current LiabilitiesDocument85 pagesch13 - Current LiabilitiesAhmad FauziNo ratings yet

- DocxDocument12 pagesDocxNothingNo ratings yet

- Date Descriptions 2020: General JournalDocument10 pagesDate Descriptions 2020: General JournalDanica RamosNo ratings yet

- Problem 7-1 Requirement 1: Date Payment Interest PrincipalDocument9 pagesProblem 7-1 Requirement 1: Date Payment Interest PrincipalMarya GonzalesNo ratings yet

- Lease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestDocument4 pagesLease 2. Incremental Borrowing Rate of The Lessee Is Used in The Absence of Implicit InterestQueen Valle100% (2)

- Proof of Cash Problems 4 PDF FreeDocument9 pagesProof of Cash Problems 4 PDF FreeAngieNo ratings yet

- Review Audit of C Ce PDFDocument129 pagesReview Audit of C Ce PDFAngieNo ratings yet

- Acctg Lab 2.Document110 pagesAcctg Lab 2.AngieNo ratings yet

- Problem 6-1: Interest Expense Present ValueDocument3 pagesProblem 6-1: Interest Expense Present ValueAngieNo ratings yet

- This Study Resource Was Shared Via: Problem 3 Bank Statement Date Check # Charges CreditsDocument2 pagesThis Study Resource Was Shared Via: Problem 3 Bank Statement Date Check # Charges CreditsAngieNo ratings yet

- General Journal Date Decriptions PR Page Number 01 2020 Debit CreditDocument3 pagesGeneral Journal Date Decriptions PR Page Number 01 2020 Debit CreditAngieNo ratings yet

- Acctg Lab 5.Document4 pagesAcctg Lab 5.AngieNo ratings yet

- Chapter 1 Succession and Transfer Taxes Part 4Document2 pagesChapter 1 Succession and Transfer Taxes Part 4Angie100% (1)

- Acctg Lab 4Document3 pagesAcctg Lab 4AngieNo ratings yet

- Chapter 1 Succession and Transfer Taxes Part 3Document2 pagesChapter 1 Succession and Transfer Taxes Part 3AngieNo ratings yet

- Chapter 1 Succession and Transfer Taxes Part 5Document2 pagesChapter 1 Succession and Transfer Taxes Part 5Angie100% (1)

- Chapter 1 Succession and Transfer Taxes Part 2Document2 pagesChapter 1 Succession and Transfer Taxes Part 2AngieNo ratings yet

- Thune 2022 Ye FecDocument40 pagesThune 2022 Ye FecPat PowersNo ratings yet

- Cost & Management AccountingDocument5 pagesCost & Management AccountingRupal Rohan DalalNo ratings yet

- (Download PDF) Corporate Financial Accounting 16Th Edition Carl S Warren Full Chapter PDFDocument69 pages(Download PDF) Corporate Financial Accounting 16Th Edition Carl S Warren Full Chapter PDFgidneyaruci100% (9)

- Mis For HDFCDocument16 pagesMis For HDFCAlankrita Mayura MinzNo ratings yet

- Tele BankingDocument12 pagesTele BankingSakib TalukdarNo ratings yet

- Amara Raja - Q1FY22 - MOStDocument10 pagesAmara Raja - Q1FY22 - MOStRahul JakhariaNo ratings yet

- Chapter 1 - TutorialDocument13 pagesChapter 1 - TutorialPro TenNo ratings yet

- High Variation in R&D Expenditure by Australian Firms: Department of Industry Tourism and ResourcesDocument20 pagesHigh Variation in R&D Expenditure by Australian Firms: Department of Industry Tourism and ResourcesSayla SiddiquiNo ratings yet

- SHAKEY'SDocument76 pagesSHAKEY'SSheila Mae AramanNo ratings yet

- Business Math - Technology and Livelihood EducationDocument8 pagesBusiness Math - Technology and Livelihood EducationFerrer BenedickNo ratings yet

- ABSLI Assured Income Plus V04 - PresentationDocument22 pagesABSLI Assured Income Plus V04 - Presentationshreeya akNo ratings yet

- Book Summit 1 Unit 3Document10 pagesBook Summit 1 Unit 3yubercamoreno2019No ratings yet

- Law II R. Kit Final As at 3 July 2006Document248 pagesLaw II R. Kit Final As at 3 July 2006kevoh1No ratings yet

- Income Tax Calculator Ay 2015-16 For Resident Individuals & HufsDocument3 pagesIncome Tax Calculator Ay 2015-16 For Resident Individuals & HufsVasan GovindNo ratings yet

- Annual Report 2017 of BSRM Steels LimitedDocument177 pagesAnnual Report 2017 of BSRM Steels LimitedZakaria SakibNo ratings yet

- QuestionDocument17 pagesQuestionpranalimodak123No ratings yet

- Bega Cheese Annual Report 2015Document92 pagesBega Cheese Annual Report 2015Princess JoyNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument11 pagesMobile Services: Your Account Summary This Month'S ChargesgeniluniNo ratings yet

- Donors' Tax (NA)Document6 pagesDonors' Tax (NA)Diane PascualNo ratings yet

- Gujarat State Road Transport Corporation: Franchisee Reservation Voucher Tin: PQMFX2Document2 pagesGujarat State Road Transport Corporation: Franchisee Reservation Voucher Tin: PQMFX2vipulNo ratings yet

- "Study of Different Loans Provided by SBI Bank": Project Report ONDocument55 pages"Study of Different Loans Provided by SBI Bank": Project Report ONAnonymous g7uPednINo ratings yet

- RenewalPremium 10985841Document1 pageRenewalPremium 10985841AreyouNo ratings yet

- Financial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYDocument23 pagesFinancial Acctg & Reporting 1 - CASE ANALYSIS SUMMARYJaquelyn ClataNo ratings yet

- Math Sample Assessment Tool With TosDocument4 pagesMath Sample Assessment Tool With TosMark Kiven Martinez100% (1)

- MS 04 PDFDocument380 pagesMS 04 PDFtashi anu100% (1)

- Process Extra QNSDocument4 pagesProcess Extra QNSkajaleNo ratings yet

- BAR EXAMINATION 2013 Compilation of Questions With Answers and JurisprudenceDocument20 pagesBAR EXAMINATION 2013 Compilation of Questions With Answers and JurisprudenceRon AceroNo ratings yet