Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

29 viewsMinimum Corporate Income Tax 3

Minimum Corporate Income Tax 3

Uploaded by

Naik1) Any excess minimum corporate income tax (MCIT) over regular corporate income tax (RCIT) can be carried forward and credited against RCIT for the next 3 years, provided the RCIT is higher than the MCIT in those years.

2) For a company with income of P10M in 2018, P12M in 2019, and P14M in 2020, the income tax payables would be P200k, P240k, and P10k respectively after applying excess MCIT from prior years.

3) When computing quarterly tax payments, excess MCIT from prior years cannot be credited if the current quarter's MCIT is higher than RCIT, but withholding and other quarter

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Income Tax Study MaterialDocument303 pagesIncome Tax Study MaterialAbith Mathew77% (217)

- Income TAX: Prof. Jeanefer Reyes CPA, MPADocument37 pagesIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (2)

- LBO Modeling Test ExampleDocument19 pagesLBO Modeling Test ExampleJorgeNo ratings yet

- REVIEWER-NI-LOVE HeheDocument6 pagesREVIEWER-NI-LOVE HeheSteph GonzagaNo ratings yet

- RR 12-2007Document9 pagesRR 12-2007Aris Basco DuroyNo ratings yet

- RR No. 12-2007 PDFDocument7 pagesRR No. 12-2007 PDFAbbey LiNo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionNo ratings yet

- Corporate Income Taxation 2024Document152 pagesCorporate Income Taxation 2024angelo eleazarNo ratings yet

- RR 12-2007 PDFDocument7 pagesRR 12-2007 PDFnaldsdomingoNo ratings yet

- Lesson 1 - 2 Tax On The Self Employed Andor Professional 2Document4 pagesLesson 1 - 2 Tax On The Self Employed Andor Professional 2Aaron HernandezNo ratings yet

- Module 6 - Income Tax On Corporations - Part 2Document5 pagesModule 6 - Income Tax On Corporations - Part 2Never Letting GoNo ratings yet

- 2018-Tax Reform For Acceleration and Inclusion2Document14 pages2018-Tax Reform For Acceleration and Inclusion2Sinetch EteyNo ratings yet

- Tax XXXXDocument60 pagesTax XXXXGerald Bowe ResuelloNo ratings yet

- CPAT Reviewer - TRAIN (Tax Reform) #1Document8 pagesCPAT Reviewer - TRAIN (Tax Reform) #1Zaaavnn VannnnnNo ratings yet

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- TRAIN LAW - Individual Income TaxationDocument25 pagesTRAIN LAW - Individual Income TaxationJennilyn SantosNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroNo ratings yet

- Taxation Material 4Document36 pagesTaxation Material 4Shaira BugayongNo ratings yet

- Chapter 23 IAS 12 Income TaxesDocument26 pagesChapter 23 IAS 12 Income TaxesKelvin Chu JY100% (1)

- Of Shares Of: ST ND RDDocument6 pagesOf Shares Of: ST ND RDKingChryshAnneNo ratings yet

- Income Tax Due and PayableDocument2 pagesIncome Tax Due and PayableJpoy RiveraNo ratings yet

- Individual Income Tax May 2020Document6 pagesIndividual Income Tax May 2020ziikerr99No ratings yet

- Taxation On IndividualsDocument10 pagesTaxation On IndividualsHERNANDO REYESNo ratings yet

- FBRDocument28 pagesFBRAnonymous ykFLSpIWNo ratings yet

- Primer On Train LawDocument8 pagesPrimer On Train LawVeronica ChanNo ratings yet

- 2.0 Estimate Tax Payable - CompanyDocument3 pages2.0 Estimate Tax Payable - CompanycarazamanNo ratings yet

- Week 6 - ch19Document55 pagesWeek 6 - ch19bafsvideo4No ratings yet

- Tax 1 Tax On Corporations - Part 1Document8 pagesTax 1 Tax On Corporations - Part 1Rhea BadanaNo ratings yet

- A Study On Income Tax Law & Accounting 2019Document26 pagesA Study On Income Tax Law & Accounting 2019Novelyn Hiso-anNo ratings yet

- Quiz 3 Key To CorrectionDocument5 pagesQuiz 3 Key To CorrectionanimeilaaaaNo ratings yet

- BIR ComputationsDocument10 pagesBIR Computationsbull jack100% (1)

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- Regular Income Taxation: Individuals: Chapter Overview and ObjectivesDocument27 pagesRegular Income Taxation: Individuals: Chapter Overview and ObjectivesJane HandumonNo ratings yet

- BLT 134 Chapter 4Document4 pagesBLT 134 Chapter 4MJNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- P&A Briefing - Income Tax Rates 2080-2081 (2023-2024 A.D.) 20.07.23Document10 pagesP&A Briefing - Income Tax Rates 2080-2081 (2023-2024 A.D.) 20.07.23alpha NEPALNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- 1997 Tax Code vs. TRAINDocument4 pages1997 Tax Code vs. TRAINCyrine CalagosNo ratings yet

- Train I.ppt - Vers. 10.21.2018Document103 pagesTrain I.ppt - Vers. 10.21.2018Ellard28 saturnoNo ratings yet

- 3.3 Exercise Key AnswerDocument2 pages3.3 Exercise Key AnswerKHAkadsbdhsgNo ratings yet

- New Tax ReformDocument4 pagesNew Tax ReformEDISON SAGUIRERNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- Individual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )Document12 pagesIndividual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )jimmatthamNo ratings yet

- RR 12-2007Document6 pagesRR 12-2007Irish BalabaNo ratings yet

- IFBPDocument11 pagesIFBPmohanraokp2279No ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- 2019 Year End AdjustmentDocument86 pages2019 Year End AdjustmentATRIYO ENTERPRISESNo ratings yet

- Far Eastern University - Manila Income Taxation TAX1101 PartnershipDocument3 pagesFar Eastern University - Manila Income Taxation TAX1101 PartnershipRyan Christian BalanquitNo ratings yet

- Finance Bill 2014Document18 pagesFinance Bill 2014Tanvir Ahmed SyedNo ratings yet

- 5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedDocument5 pages5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedKiara Marie P. LAGUDANo ratings yet

- Tax Computation - 2019 PDFDocument1 pageTax Computation - 2019 PDFJurex JustinianNo ratings yet

- Domestic CorporationsDocument4 pagesDomestic CorporationsRandy FuentesNo ratings yet

- Train Law - 17mar2018Document63 pagesTrain Law - 17mar2018Janelle ManzanoNo ratings yet

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- Republic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Document24 pagesRepublic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Johayra AbbasNo ratings yet

- Auditing-Chap4 Risk Assesment-4Document3 pagesAuditing-Chap4 Risk Assesment-4NaikNo ratings yet

- The Pines Hotel: Julian Felipe Street, Baguio City (088) 858-1434Document1 pageThe Pines Hotel: Julian Felipe Street, Baguio City (088) 858-1434NaikNo ratings yet

- Personal-Business Letter Full-Block StyleDocument4 pagesPersonal-Business Letter Full-Block StyleNaikNo ratings yet

- Personal-Business Letter Full-Block StyleDocument3 pagesPersonal-Business Letter Full-Block StyleNaikNo ratings yet

- Malling Manila - Images of A City, Fragments of A CenturyDocument2 pagesMalling Manila - Images of A City, Fragments of A CenturyNaikNo ratings yet

- Filipino ScientistDocument1 pageFilipino ScientistNaikNo ratings yet

- Bonifacio ST., Estaka, Dipolog City 7103 0912-345-6789Document1 pageBonifacio ST., Estaka, Dipolog City 7103 0912-345-6789NaikNo ratings yet

- Ageas Fashion: Bonifacio St. Dipolog CityDocument1 pageAgeas Fashion: Bonifacio St. Dipolog CityNaikNo ratings yet

- Template BDocument1 pageTemplate BNaikNo ratings yet

- Gender and Development (GAD) Project ProposalDocument5 pagesGender and Development (GAD) Project ProposalNaikNo ratings yet

- So AssDocument3 pagesSo AssNaikNo ratings yet

- Offshore Banking Units (Obus)Document5 pagesOffshore Banking Units (Obus)NaikNo ratings yet

- Jubilee Annual Report Final - WebDocument140 pagesJubilee Annual Report Final - WebEdward NjorogeNo ratings yet

- CH 28 - Employee Benefits PDFDocument7 pagesCH 28 - Employee Benefits PDFJm SevallaNo ratings yet

- The Cpa Licensure Examination Syllabus Financial Accounting and ReportingDocument43 pagesThe Cpa Licensure Examination Syllabus Financial Accounting and ReportingRisalyn BiongNo ratings yet

- Sampoorna Surkasha Claim Form Employer Employee Non EdliDocument2 pagesSampoorna Surkasha Claim Form Employer Employee Non EdlisreenathNo ratings yet

- HC 4.3: Financial Services: Merchant Banking and UnderwritingDocument14 pagesHC 4.3: Financial Services: Merchant Banking and UnderwritingAishwaryaNo ratings yet

- Chapter 2 - Investment AlternativesDocument12 pagesChapter 2 - Investment AlternativesSinpaoNo ratings yet

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- American International Group IncDocument30 pagesAmerican International Group IncMirindra RobijaonaNo ratings yet

- Ebs Enterprise Command Center Quick Start GuideDocument45 pagesEbs Enterprise Command Center Quick Start GuideMaqbulhusenNo ratings yet

- Redemption of Debentures: Debenture Redemption Reserve (D.R.R)Document4 pagesRedemption of Debentures: Debenture Redemption Reserve (D.R.R)binuNo ratings yet

- Tax ComputationDocument4 pagesTax Computationrfso16No ratings yet

- The Grip of Death PDFDocument3 pagesThe Grip of Death PDFMaxim Hristiniuc0% (1)

- Media Contacts by Region: AtlanticDocument8 pagesMedia Contacts by Region: Atlanticdeals4kbNo ratings yet

- Ratio Analysis AllDocument78 pagesRatio Analysis AllSuraj GawandeNo ratings yet

- Ncert Sol Class 12 Accountancy Chapter 4 PDFDocument41 pagesNcert Sol Class 12 Accountancy Chapter 4 PDFAnupam DasNo ratings yet

- Press Release: Detailed Rationale & Key Rating Drivers For The Credit Enhanced DebtDocument8 pagesPress Release: Detailed Rationale & Key Rating Drivers For The Credit Enhanced DebtANUBHAVCFANo ratings yet

- Ericsson Telecommunications, Inc. vs. City of PasigDocument9 pagesEricsson Telecommunications, Inc. vs. City of PasigChristian Joe QuimioNo ratings yet

- Bihar State Milk Co-Operative Federation Limited, Patna Balance Sheet As at 31st March, 2014Document1 pageBihar State Milk Co-Operative Federation Limited, Patna Balance Sheet As at 31st March, 2014SATYAM KUMARNo ratings yet

- Solving Problems Involving Simple InterestDocument28 pagesSolving Problems Involving Simple InterestCarbon Copy67% (3)

- AAA HOME BUILDER 3844 Blue Ridge - Tax Foreclosure SaleDocument8 pagesAAA HOME BUILDER 3844 Blue Ridge - Tax Foreclosure Saledarrd2010No ratings yet

- Balance of Payments: Chapter Learning ObjectivesDocument74 pagesBalance of Payments: Chapter Learning ObjectivesShuvro RahmanNo ratings yet

- Banco de Oro vs. Bayuga, 93 SCRA 443Document18 pagesBanco de Oro vs. Bayuga, 93 SCRA 443Jillian Batac100% (1)

- Additional Notes For Adjustments To The Financial StatementsDocument2 pagesAdditional Notes For Adjustments To The Financial StatementsDebbie DebzNo ratings yet

- Accounts ProblemsDocument30 pagesAccounts ProblemsBalasaranyasiddhuNo ratings yet

- Stop & Shop Fact SheetDocument3 pagesStop & Shop Fact SheetLaborUnionNews.comNo ratings yet

- Club RulesDocument60 pagesClub Rulestsrajan0% (1)

- Cred - Statement SbiDocument6 pagesCred - Statement SbiKENA PATELNo ratings yet

- 36 Loss DisallowanceDocument159 pages36 Loss DisallowanceCourt RobertsNo ratings yet

Minimum Corporate Income Tax 3

Minimum Corporate Income Tax 3

Uploaded by

Naik0 ratings0% found this document useful (0 votes)

29 views5 pages1) Any excess minimum corporate income tax (MCIT) over regular corporate income tax (RCIT) can be carried forward and credited against RCIT for the next 3 years, provided the RCIT is higher than the MCIT in those years.

2) For a company with income of P10M in 2018, P12M in 2019, and P14M in 2020, the income tax payables would be P200k, P240k, and P10k respectively after applying excess MCIT from prior years.

3) When computing quarterly tax payments, excess MCIT from prior years cannot be credited if the current quarter's MCIT is higher than RCIT, but withholding and other quarter

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) Any excess minimum corporate income tax (MCIT) over regular corporate income tax (RCIT) can be carried forward and credited against RCIT for the next 3 years, provided the RCIT is higher than the MCIT in those years.

2) For a company with income of P10M in 2018, P12M in 2019, and P14M in 2020, the income tax payables would be P200k, P240k, and P10k respectively after applying excess MCIT from prior years.

3) When computing quarterly tax payments, excess MCIT from prior years cannot be credited if the current quarter's MCIT is higher than RCIT, but withholding and other quarter

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

29 views5 pagesMinimum Corporate Income Tax 3

Minimum Corporate Income Tax 3

Uploaded by

Naik1) Any excess minimum corporate income tax (MCIT) over regular corporate income tax (RCIT) can be carried forward and credited against RCIT for the next 3 years, provided the RCIT is higher than the MCIT in those years.

2) For a company with income of P10M in 2018, P12M in 2019, and P14M in 2020, the income tax payables would be P200k, P240k, and P10k respectively after applying excess MCIT from prior years.

3) When computing quarterly tax payments, excess MCIT from prior years cannot be credited if the current quarter's MCIT is higher than RCIT, but withholding and other quarter

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 5

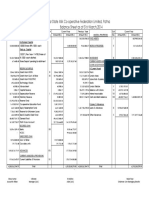

EXCESS MCIT OR MCIT CARRY-OVER

Any excess of the minimum corporate income tax

over the normal corporate income tax shall be carried

forward and credited (deducted) against the regular

income tax for the three succeeding taxable years,

provided, that the RCIT should be higher than the

MCIT in the year to which the excess MCIT is

forwarded.

COMPUTATION:

A domestic corporation which commenced

operations in 2014 provided the following data:

2018 2019 2020

Gross Income P10MP12M P14M

Allowable deductions (9.5M) (12.2M) (12.8M)

Net Income (loss) P500k P(200k) P1.2M

Determine the income tax payable for 2018, 2019 and

2020.

EXCESS MCIT OR MCIT CARRY-OVER

2018 2020

RCIT or Basic tax (P500k P150,000 Net income P1,200,000

x 30%) Less: 2019 NOLCO (200,000)

MCIT (P10M x 2%) 200,000 Taxable income 1,000,000

Tax Due/payable (Higher P200,000

amount) RCIT or Basic Tax (P1M x P300,000

30%)

Excess MCIT 2018 P50,000

MCIT (P14M x 2%) 280,000

2019 Tax Due/payable (Higher P300,000

RCIT or Basic tax P0 amount)

MCIT (P12M x 2%) 240,000 Less: Excess MCIT

Tax Due/payable (Higher P240,000 2018 (50,000)

amount) 2019 (240,000)

Excess MCIT 2019 P240,000 Income Tax Payable 2020 P10,000

QUARTERLY AND ANNUAL CORPORATE TAX DUE

✔ If the computed quarterly MCIT is higher than the quarterly normal

income tax, the tax due to be paid is 2% of the gross income

✔ In payment of said ‘quarterly’ MCIT:

1. Excess MCIT from the previous taxable year(s)

shall not be allowed to be credited if the MCIT

is higher tha RCIT.

2. The expanded witholding tax, quarterly

corporate income tax and income paid in the

previous taxable quarter(s) are allowed to be

applied regardless if the MCIT is higher or not.

COMPUTATION:

A corporation’s computed Regular Corporate Income Tax

(RCIT), MCIT and Income Taxes withheld from 1st to 4th quarters

including excess , MCIT and Excess withholding taxes from

prior year(s) are as follows:

Quarter RCIT MCIT Taxes Excess MCIT Excess

Withheld Prior Year Withholding

during the Tax (Prior

year Year)

1st P200,000 160,000 40,000 60,000 20,000

2nd 240,000 500,000 60,000 - -

3rd 500,000 200,000 80,000 - -

4th 400,000 200,000 70,000 - -

You might also like

- Income Tax Study MaterialDocument303 pagesIncome Tax Study MaterialAbith Mathew77% (217)

- Income TAX: Prof. Jeanefer Reyes CPA, MPADocument37 pagesIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (2)

- LBO Modeling Test ExampleDocument19 pagesLBO Modeling Test ExampleJorgeNo ratings yet

- REVIEWER-NI-LOVE HeheDocument6 pagesREVIEWER-NI-LOVE HeheSteph GonzagaNo ratings yet

- RR 12-2007Document9 pagesRR 12-2007Aris Basco DuroyNo ratings yet

- RR No. 12-2007 PDFDocument7 pagesRR No. 12-2007 PDFAbbey LiNo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionNo ratings yet

- Corporate Income Taxation 2024Document152 pagesCorporate Income Taxation 2024angelo eleazarNo ratings yet

- RR 12-2007 PDFDocument7 pagesRR 12-2007 PDFnaldsdomingoNo ratings yet

- Lesson 1 - 2 Tax On The Self Employed Andor Professional 2Document4 pagesLesson 1 - 2 Tax On The Self Employed Andor Professional 2Aaron HernandezNo ratings yet

- Module 6 - Income Tax On Corporations - Part 2Document5 pagesModule 6 - Income Tax On Corporations - Part 2Never Letting GoNo ratings yet

- 2018-Tax Reform For Acceleration and Inclusion2Document14 pages2018-Tax Reform For Acceleration and Inclusion2Sinetch EteyNo ratings yet

- Tax XXXXDocument60 pagesTax XXXXGerald Bowe ResuelloNo ratings yet

- CPAT Reviewer - TRAIN (Tax Reform) #1Document8 pagesCPAT Reviewer - TRAIN (Tax Reform) #1Zaaavnn VannnnnNo ratings yet

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- TRAIN LAW - Individual Income TaxationDocument25 pagesTRAIN LAW - Individual Income TaxationJennilyn SantosNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroNo ratings yet

- Taxation Material 4Document36 pagesTaxation Material 4Shaira BugayongNo ratings yet

- Chapter 23 IAS 12 Income TaxesDocument26 pagesChapter 23 IAS 12 Income TaxesKelvin Chu JY100% (1)

- Of Shares Of: ST ND RDDocument6 pagesOf Shares Of: ST ND RDKingChryshAnneNo ratings yet

- Income Tax Due and PayableDocument2 pagesIncome Tax Due and PayableJpoy RiveraNo ratings yet

- Individual Income Tax May 2020Document6 pagesIndividual Income Tax May 2020ziikerr99No ratings yet

- Taxation On IndividualsDocument10 pagesTaxation On IndividualsHERNANDO REYESNo ratings yet

- FBRDocument28 pagesFBRAnonymous ykFLSpIWNo ratings yet

- Primer On Train LawDocument8 pagesPrimer On Train LawVeronica ChanNo ratings yet

- 2.0 Estimate Tax Payable - CompanyDocument3 pages2.0 Estimate Tax Payable - CompanycarazamanNo ratings yet

- Week 6 - ch19Document55 pagesWeek 6 - ch19bafsvideo4No ratings yet

- Tax 1 Tax On Corporations - Part 1Document8 pagesTax 1 Tax On Corporations - Part 1Rhea BadanaNo ratings yet

- A Study On Income Tax Law & Accounting 2019Document26 pagesA Study On Income Tax Law & Accounting 2019Novelyn Hiso-anNo ratings yet

- Quiz 3 Key To CorrectionDocument5 pagesQuiz 3 Key To CorrectionanimeilaaaaNo ratings yet

- BIR ComputationsDocument10 pagesBIR Computationsbull jack100% (1)

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- Regular Income Taxation: Individuals: Chapter Overview and ObjectivesDocument27 pagesRegular Income Taxation: Individuals: Chapter Overview and ObjectivesJane HandumonNo ratings yet

- BLT 134 Chapter 4Document4 pagesBLT 134 Chapter 4MJNo ratings yet

- CpaDocument37 pagesCparav danoNo ratings yet

- P&A Briefing - Income Tax Rates 2080-2081 (2023-2024 A.D.) 20.07.23Document10 pagesP&A Briefing - Income Tax Rates 2080-2081 (2023-2024 A.D.) 20.07.23alpha NEPALNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- 1997 Tax Code vs. TRAINDocument4 pages1997 Tax Code vs. TRAINCyrine CalagosNo ratings yet

- Train I.ppt - Vers. 10.21.2018Document103 pagesTrain I.ppt - Vers. 10.21.2018Ellard28 saturnoNo ratings yet

- 3.3 Exercise Key AnswerDocument2 pages3.3 Exercise Key AnswerKHAkadsbdhsgNo ratings yet

- New Tax ReformDocument4 pagesNew Tax ReformEDISON SAGUIRERNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- Individual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )Document12 pagesIndividual Income Tax Rate Schedule - (Sec. 24 (A) (2) (A) )jimmatthamNo ratings yet

- RR 12-2007Document6 pagesRR 12-2007Irish BalabaNo ratings yet

- IFBPDocument11 pagesIFBPmohanraokp2279No ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- 2019 Year End AdjustmentDocument86 pages2019 Year End AdjustmentATRIYO ENTERPRISESNo ratings yet

- Far Eastern University - Manila Income Taxation TAX1101 PartnershipDocument3 pagesFar Eastern University - Manila Income Taxation TAX1101 PartnershipRyan Christian BalanquitNo ratings yet

- Finance Bill 2014Document18 pagesFinance Bill 2014Tanvir Ahmed SyedNo ratings yet

- 5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedDocument5 pages5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedKiara Marie P. LAGUDANo ratings yet

- Tax Computation - 2019 PDFDocument1 pageTax Computation - 2019 PDFJurex JustinianNo ratings yet

- Domestic CorporationsDocument4 pagesDomestic CorporationsRandy FuentesNo ratings yet

- Train Law - 17mar2018Document63 pagesTrain Law - 17mar2018Janelle ManzanoNo ratings yet

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- Republic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Document24 pagesRepublic Act No. 10963: Tax Reform For Acceleration and Inclusion (Train)Johayra AbbasNo ratings yet

- Auditing-Chap4 Risk Assesment-4Document3 pagesAuditing-Chap4 Risk Assesment-4NaikNo ratings yet

- The Pines Hotel: Julian Felipe Street, Baguio City (088) 858-1434Document1 pageThe Pines Hotel: Julian Felipe Street, Baguio City (088) 858-1434NaikNo ratings yet

- Personal-Business Letter Full-Block StyleDocument4 pagesPersonal-Business Letter Full-Block StyleNaikNo ratings yet

- Personal-Business Letter Full-Block StyleDocument3 pagesPersonal-Business Letter Full-Block StyleNaikNo ratings yet

- Malling Manila - Images of A City, Fragments of A CenturyDocument2 pagesMalling Manila - Images of A City, Fragments of A CenturyNaikNo ratings yet

- Filipino ScientistDocument1 pageFilipino ScientistNaikNo ratings yet

- Bonifacio ST., Estaka, Dipolog City 7103 0912-345-6789Document1 pageBonifacio ST., Estaka, Dipolog City 7103 0912-345-6789NaikNo ratings yet

- Ageas Fashion: Bonifacio St. Dipolog CityDocument1 pageAgeas Fashion: Bonifacio St. Dipolog CityNaikNo ratings yet

- Template BDocument1 pageTemplate BNaikNo ratings yet

- Gender and Development (GAD) Project ProposalDocument5 pagesGender and Development (GAD) Project ProposalNaikNo ratings yet

- So AssDocument3 pagesSo AssNaikNo ratings yet

- Offshore Banking Units (Obus)Document5 pagesOffshore Banking Units (Obus)NaikNo ratings yet

- Jubilee Annual Report Final - WebDocument140 pagesJubilee Annual Report Final - WebEdward NjorogeNo ratings yet

- CH 28 - Employee Benefits PDFDocument7 pagesCH 28 - Employee Benefits PDFJm SevallaNo ratings yet

- The Cpa Licensure Examination Syllabus Financial Accounting and ReportingDocument43 pagesThe Cpa Licensure Examination Syllabus Financial Accounting and ReportingRisalyn BiongNo ratings yet

- Sampoorna Surkasha Claim Form Employer Employee Non EdliDocument2 pagesSampoorna Surkasha Claim Form Employer Employee Non EdlisreenathNo ratings yet

- HC 4.3: Financial Services: Merchant Banking and UnderwritingDocument14 pagesHC 4.3: Financial Services: Merchant Banking and UnderwritingAishwaryaNo ratings yet

- Chapter 2 - Investment AlternativesDocument12 pagesChapter 2 - Investment AlternativesSinpaoNo ratings yet

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- American International Group IncDocument30 pagesAmerican International Group IncMirindra RobijaonaNo ratings yet

- Ebs Enterprise Command Center Quick Start GuideDocument45 pagesEbs Enterprise Command Center Quick Start GuideMaqbulhusenNo ratings yet

- Redemption of Debentures: Debenture Redemption Reserve (D.R.R)Document4 pagesRedemption of Debentures: Debenture Redemption Reserve (D.R.R)binuNo ratings yet

- Tax ComputationDocument4 pagesTax Computationrfso16No ratings yet

- The Grip of Death PDFDocument3 pagesThe Grip of Death PDFMaxim Hristiniuc0% (1)

- Media Contacts by Region: AtlanticDocument8 pagesMedia Contacts by Region: Atlanticdeals4kbNo ratings yet

- Ratio Analysis AllDocument78 pagesRatio Analysis AllSuraj GawandeNo ratings yet

- Ncert Sol Class 12 Accountancy Chapter 4 PDFDocument41 pagesNcert Sol Class 12 Accountancy Chapter 4 PDFAnupam DasNo ratings yet

- Press Release: Detailed Rationale & Key Rating Drivers For The Credit Enhanced DebtDocument8 pagesPress Release: Detailed Rationale & Key Rating Drivers For The Credit Enhanced DebtANUBHAVCFANo ratings yet

- Ericsson Telecommunications, Inc. vs. City of PasigDocument9 pagesEricsson Telecommunications, Inc. vs. City of PasigChristian Joe QuimioNo ratings yet

- Bihar State Milk Co-Operative Federation Limited, Patna Balance Sheet As at 31st March, 2014Document1 pageBihar State Milk Co-Operative Federation Limited, Patna Balance Sheet As at 31st March, 2014SATYAM KUMARNo ratings yet

- Solving Problems Involving Simple InterestDocument28 pagesSolving Problems Involving Simple InterestCarbon Copy67% (3)

- AAA HOME BUILDER 3844 Blue Ridge - Tax Foreclosure SaleDocument8 pagesAAA HOME BUILDER 3844 Blue Ridge - Tax Foreclosure Saledarrd2010No ratings yet

- Balance of Payments: Chapter Learning ObjectivesDocument74 pagesBalance of Payments: Chapter Learning ObjectivesShuvro RahmanNo ratings yet

- Banco de Oro vs. Bayuga, 93 SCRA 443Document18 pagesBanco de Oro vs. Bayuga, 93 SCRA 443Jillian Batac100% (1)

- Additional Notes For Adjustments To The Financial StatementsDocument2 pagesAdditional Notes For Adjustments To The Financial StatementsDebbie DebzNo ratings yet

- Accounts ProblemsDocument30 pagesAccounts ProblemsBalasaranyasiddhuNo ratings yet

- Stop & Shop Fact SheetDocument3 pagesStop & Shop Fact SheetLaborUnionNews.comNo ratings yet

- Club RulesDocument60 pagesClub Rulestsrajan0% (1)

- Cred - Statement SbiDocument6 pagesCred - Statement SbiKENA PATELNo ratings yet

- 36 Loss DisallowanceDocument159 pages36 Loss DisallowanceCourt RobertsNo ratings yet