Professional Documents

Culture Documents

Illustration - Chapter 2

Illustration - Chapter 2

Uploaded by

Jahzceel CecelOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration - Chapter 2

Illustration - Chapter 2

Uploaded by

Jahzceel CecelCopyright:

Available Formats

Page |1

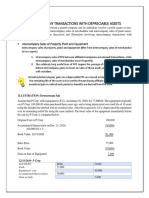

On January 1, 20x1, COLLOQUY Co. acquired all of the identifiable assets and assumed all of the

liabilities of CONVERSATION, Inc. by issuing its own ordinary shares. Information at acquisition

date is shown below:

Combined

COLLOQUY Co. CONVERSATION, Co. entity

(carrying amounts) (fair values)

Identifiable assets 9,600,000 6,400,000 16,000,000

Goodwill - - ?

Total assets 9,600,000 6,400,000 ?

Liabilities 2,800,000 3,600,000 6,400,000

Share capital 2,400,000 1,200,000 2,800,000

Share premium 1,200,000 1,000,000 4,800,000

Retained earnings 3,200,000 600,000 ?

Total liabilities & equity 9,600,000 6,400,000 ?

Additional information:

COLLOQUY’s share capital consists of 60,000 ordinary shares with par value of ₱40 per share.

CONVERSATION’s share capital consists of 3,000 ordinary shares with par value of ₱400 per

share.

1. How much is the fair value of consideration transferred on the business combination?

a. 4,000,000 b . 2,400,000 c. 4,400,000 d. 4,800,000

A

Solution:

COLLOQUY Co. Combined entity Increase

Share capital 2,400,000 2,800,000 400,000

Share premium 1,200,000 4,800,000 3,600,000

Totals 3,600,000 7,600,000 4,000,000

The fair value of the shares transferred as consideration for the business combination is ₱4,000,000 (i.e.,

total increase in share capital and share premium accounts).

2. How many shares were issued in the business combination?

a. 40,000 b. 12,000 c. 36,000 d. 10,000

D

Solution:

Increase in COLLOQUY’s share capital account

(see table above) 400,000

Divide by: ABC’s par value per share 40

Number of shares issued 10,000

3. How much is the acquisition-date fair value per share?

Page |2

a. 400 b. 440 c. 280 d. 360

A

Solution:

Fair value of consideration transferred 4,000,000

Divide by: Number of shares issued 10,000

Acquisition-date fair value per share 400

4. How much goodwill was recognized on acquisition date?

a. 980,000 b. 1,200,000 c. 1,280,000 d. 1,080,000

B

Solution:

Consideration transferred 4,000,000

Non-controlling interest in the acquiree -

Previously held equity interest in the acquiree -

Total 4,000,000

Fair value of net identifiable assets acquired (6.4M - 3.6M) (2,800,000)

Goodwill 1,200,000

5. What is the retained earnings of the combined entity immediately after the business

combination?

a. 3,120,000 b. 3,320,000 c. 3,280,000 d. 3,200,000

D 3,200,000 – COLLOQUY’s retained earnings

You might also like

- Midterm ReviewDocument40 pagesMidterm ReviewVanessa BatallaNo ratings yet

- Accounting For Business Combinations Second Grading ExaminationDocument21 pagesAccounting For Business Combinations Second Grading ExaminationMjoyce A. Bruan86% (29)

- Organisation and Management: Revision AnswersDocument3 pagesOrganisation and Management: Revision AnswersJane Lea50% (2)

- Dividend and BondsDocument3 pagesDividend and BondsJanuary Ann Bete100% (1)

- Consolidation Exercises With AsnwerDocument47 pagesConsolidation Exercises With Asnwerjessica amorosoNo ratings yet

- Output 6 - StatDocument2 pagesOutput 6 - StatPhebe Lagutao0% (1)

- HB - Forex Midterm 2021Document5 pagesHB - Forex Midterm 2021Allyssa Kassandra LucesNo ratings yet

- Partnership Liquidation May 13 C PDFDocument3 pagesPartnership Liquidation May 13 C PDFElla AlmazanNo ratings yet

- Discussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Document1 pageDiscussion Problem No. 1 - (Estimating Goodwill - Direct Valuation)Jean Kathyrine Chiong100% (1)

- Intercompany Sale of Depreciable AssetsDocument2 pagesIntercompany Sale of Depreciable AssetsTriechia LaudNo ratings yet

- File: Chapter 04 - Consolidated Financial Statements and Outside Ownership Multiple ChoiceDocument48 pagesFile: Chapter 04 - Consolidated Financial Statements and Outside Ownership Multiple Choicejana ayoubNo ratings yet

- Notes To Partnership Liquidation Final PDFDocument6 pagesNotes To Partnership Liquidation Final PDFKristel SumabatNo ratings yet

- StudyDocument10 pagesStudyirahQNo ratings yet

- HahahahaDocument3 pagesHahahahaTyrelle Dela Cruz100% (1)

- Accounting For Special Transaction C8 Prob 5Document2 pagesAccounting For Special Transaction C8 Prob 5skilled legilimenceNo ratings yet

- Y1 Exam BM HL M2022 With Formula SheetDocument8 pagesY1 Exam BM HL M2022 With Formula Sheetss-alshehriNo ratings yet

- 5 - WQU - 622 CTSP - M5 - CompiledContentDocument34 pages5 - WQU - 622 CTSP - M5 - CompiledContentJoe NgNo ratings yet

- Pre Buscomok PDF FreeDocument9 pagesPre Buscomok PDF FreeheyNo ratings yet

- BSA2201 BDD MBCarolino M8Activityno.2Document5 pagesBSA2201 BDD MBCarolino M8Activityno.2Earl Carolino100% (1)

- Activity-Chapter 7: Ans. None of These SolutionDocument1 pageActivity-Chapter 7: Ans. None of These SolutionRandelle James FiestaNo ratings yet

- Business Combination - Subsequent - PunzalanDocument22 pagesBusiness Combination - Subsequent - PunzalanCelen OchocoNo ratings yet

- Business Combination Part 2Document6 pagesBusiness Combination Part 2cpacpacpaNo ratings yet

- 8 - PFRS 15 Five Step Model PDFDocument6 pages8 - PFRS 15 Five Step Model PDFDarlene Faye Cabral RosalesNo ratings yet

- Profe03 - Chapter 2 Business Combinations Specific CasesDocument12 pagesProfe03 - Chapter 2 Business Combinations Specific CasesSteffany RoqueNo ratings yet

- Business Combi Quiz (Part1)Document9 pagesBusiness Combi Quiz (Part1)Rica Joy RuzgalNo ratings yet

- Consolidated FS - QUIZ PART 2Document5 pagesConsolidated FS - QUIZ PART 2Christine Jane RamosNo ratings yet

- Problem 4: Multiple Choice - ComputationalDocument5 pagesProblem 4: Multiple Choice - ComputationalKATHRYN CLAUDETTE RESENTENo ratings yet

- Chapter 7 BusscomDocument65 pagesChapter 7 BusscomJM Valonda Villena, CPA, MBANo ratings yet

- Problems 13 14Document13 pagesProblems 13 14heyNo ratings yet

- Exercises Revenue and Labor Budgeting-University SettingDocument14 pagesExercises Revenue and Labor Budgeting-University SettingJenelyn UbananNo ratings yet

- Percentage of Completion 33.33%Document6 pagesPercentage of Completion 33.33%AlexNo ratings yet

- Chapter 9 - Auditing ResourcesDocument10 pagesChapter 9 - Auditing ResourcesSteffany RoqueNo ratings yet

- Module 3 CVP AnswersDocument18 pagesModule 3 CVP AnswersSophia DayaoNo ratings yet

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership LiquidationJessica C. Dela CruzNo ratings yet

- ShortproblemDocument2 pagesShortproblemLabLab ChattoNo ratings yet

- This Study Resource Was: QuestionsDocument5 pagesThis Study Resource Was: QuestionsXNo ratings yet

- AT ExamDocument9 pagesAT ExamKwatro SankaiNo ratings yet

- Chapter 1 The Context of Systems Analysis and Design MethodsDocument5 pagesChapter 1 The Context of Systems Analysis and Design MethodsAlta SophiaNo ratings yet

- Problem 31.2Document4 pagesProblem 31.2Arian AmuraoNo ratings yet

- Quiz Chapter 1 Business Combinations Part 1Document6 pagesQuiz Chapter 1 Business Combinations Part 1Kaye L. Dela CruzNo ratings yet

- Business Com Theories (Q1)Document10 pagesBusiness Com Theories (Q1)수지No ratings yet

- Consolidated FS - QUIZ PART 3Document4 pagesConsolidated FS - QUIZ PART 3Christine Jane Ramos100% (1)

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Acctg 11 PDFDocument77 pagesAcctg 11 PDFKilimanjaroNo ratings yet

- Lesson Title: Home Office, Branch and Agency: AccountingDocument14 pagesLesson Title: Home Office, Branch and Agency: AccountingFeedback Or BawiNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- Auditing Problems SOLUTION v.1 - 2018Document12 pagesAuditing Problems SOLUTION v.1 - 2018Ramainne RonquilloNo ratings yet

- Notes Quiz PDFDocument2 pagesNotes Quiz PDFkim cheNo ratings yet

- Buscom Quiz 2 MidtermDocument2 pagesBuscom Quiz 2 MidtermRafael Capunpon VallejosNo ratings yet

- ABC-01 Business CombinationDocument19 pagesABC-01 Business CombinationJoshuji LaneNo ratings yet

- Answer Key - Importing and ExportingDocument4 pagesAnswer Key - Importing and Exportingmaria ronoraNo ratings yet

- Profe03 Activity Chapter 7Document5 pagesProfe03 Activity Chapter 7eloisa celisNo ratings yet

- Chapter 7 Construction Contracts 2021 EditionDocument40 pagesChapter 7 Construction Contracts 2021 Editionregine bacabagNo ratings yet

- Chapter 7 Accounting For Franchise Operations FranchisorDocument15 pagesChapter 7 Accounting For Franchise Operations FranchisorKaren BalibalosNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- Acc 223 CB PS3 AkDocument19 pagesAcc 223 CB PS3 AkAeyjay ManangaranNo ratings yet

- Chapter 20 Consolidated Fs Part 4 Afar Part 2Document22 pagesChapter 20 Consolidated Fs Part 4 Afar Part 2trishaNo ratings yet

- VELUNTA - Ass. in ASTDocument4 pagesVELUNTA - Ass. in ASTLiberty VeluntaNo ratings yet

- Buscom Midterm PDF FreeDocument29 pagesBuscom Midterm PDF FreeheyNo ratings yet

- Solved Problem 1 A Partial List of The Accounts and Ending Accounts... - Course HeroDocument5 pagesSolved Problem 1 A Partial List of The Accounts and Ending Accounts... - Course Herojau chiNo ratings yet

- Accounting For Business Combinations ExaminationDocument20 pagesAccounting For Business Combinations ExaminationJanella Umieh De UngriaNo ratings yet

- Quiz 1 AnswersDocument6 pagesQuiz 1 AnswersAlyssa CasimiroNo ratings yet

- 1 What Implications Do You Draw From The Graph ForDocument2 pages1 What Implications Do You Draw From The Graph ForAmit PandeyNo ratings yet

- Tutorial 6Document5 pagesTutorial 6mohamed ahmedNo ratings yet

- Agreement On Asean Harmonized Cosmetic Regulatory SchemeDocument23 pagesAgreement On Asean Harmonized Cosmetic Regulatory SchemeThida WinNo ratings yet

- Street DoctorDocument31 pagesStreet Doctormarcar1No ratings yet

- TNC Driver License ApplicationTutorialDocument13 pagesTNC Driver License ApplicationTutorialSissy la brujita buenaNo ratings yet

- At Kearney On Wholesaler PDFDocument12 pagesAt Kearney On Wholesaler PDFRudini SudewaNo ratings yet

- Module II. Business Combination - Date of Acquisition (Consolidation)Document3 pagesModule II. Business Combination - Date of Acquisition (Consolidation)Melanie Samsona100% (1)

- Balabac Executive Summary 2022Document5 pagesBalabac Executive Summary 2022Gray XoxoNo ratings yet

- Conveyor Belt SplicingDocument5 pagesConveyor Belt SplicingBahador KavianiNo ratings yet

- Convention CentreDocument4 pagesConvention CentreMohd Amaan SheikhNo ratings yet

- Research Paper 0333Document25 pagesResearch Paper 0333Ranjith GNo ratings yet

- Startup AssignmentDocument6 pagesStartup AssignmentUMAIR TARIQ L1F17BBAM0054No ratings yet

- Bowes ExploringInnovationinHousing 2018CFRDocument97 pagesBowes ExploringInnovationinHousing 2018CFRCecil SolomonNo ratings yet

- Aranya Housing FinalDocument11 pagesAranya Housing FinalJulia PatelNo ratings yet

- FIN3120 Exam Paper May 2022Document4 pagesFIN3120 Exam Paper May 2022Risvana RizzNo ratings yet

- Economics Paper 2 Question-Answer Book: 2019-DSE EconDocument24 pagesEconomics Paper 2 Question-Answer Book: 2019-DSE Econdf fungNo ratings yet

- Rupabarna DastidarDocument1 pageRupabarna DastidarDesign KIITNo ratings yet

- Bizsmart Service Request FormDocument1 pageBizsmart Service Request Formardian syah mumingNo ratings yet

- Solutions - Summer Exam 2019 PDFDocument56 pagesSolutions - Summer Exam 2019 PDFaliakhtar02No ratings yet

- Comprehensive Reviewer Auditing TheoryDocument91 pagesComprehensive Reviewer Auditing TheoryMary Rose JuanNo ratings yet

- Full and Final-Chipale-Kadam Agent-Tipnis and Patil-Riviera Society-24-1-20Document11 pagesFull and Final-Chipale-Kadam Agent-Tipnis and Patil-Riviera Society-24-1-20supriya kadamNo ratings yet

- Risk Management Slides - Part 3Document9 pagesRisk Management Slides - Part 3nhloniphointelligenceNo ratings yet

- FM 1610 DI Pipe and Fittings, Flexible Fittings and Couplings 2016Document23 pagesFM 1610 DI Pipe and Fittings, Flexible Fittings and Couplings 2016andyNo ratings yet

- Hyderabad Lecture Notes April 2010 Raghu IyerDocument76 pagesHyderabad Lecture Notes April 2010 Raghu Iyeraradhana avinashNo ratings yet

- Full Chapter The Good Hawk Shadow Skye 1 1St Edition Joseph Elliott PDFDocument16 pagesFull Chapter The Good Hawk Shadow Skye 1 1St Edition Joseph Elliott PDFleslie.dobey577100% (6)

- IA Chapter-1-3Document7 pagesIA Chapter-1-3Christine Joyce EnriquezNo ratings yet

- BSHM3C Tastebuds-CateringDocument4 pagesBSHM3C Tastebuds-CateringJoana Faye A. MendozaNo ratings yet