Professional Documents

Culture Documents

Lab Assignment A8.2 IRS: Background

Lab Assignment A8.2 IRS: Background

Uploaded by

Arnav LondheOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lab Assignment A8.2 IRS: Background

Lab Assignment A8.2 IRS: Background

Uploaded by

Arnav LondheCopyright:

Available Formats

Java Curriculum for AP Computer Science, Lab Assignment A8.

2 1

LAB ASSIGNMENT A8.2

IRS

Background:

Federal income tax rates can be calculated using tax rate schedules. The following are tax rates for

two out of the four categories used by the IRS in 2001:

Schedule X - Single

If your taxable income is:

over - but not over - your tax is of the amount

over -

$0 $ 27,050 15 % $0

27,050 65,550 $ 4,057.50 + 27.5 % 27,050

65,550 136,750 $ 14,645.00 + 30.5 % 65,550

136,750 297,350 $ 36,361.00 + 35.5 % 136,750

297,350 --------- $ 93,374.00 + 39.1 % 297,350

Schedule Y-1 - Married filing jointly

If your taxable income is:

over - but not over - your tax is of the amount

over -

$0 $ 45,200 15 % $0

45,200 109,250 $ 6,780.00 + 27.5 % 45,200

109,250 166,500 $ 24,393.75 + 30.5 % 109,250

166,500 297,350 $ 41,855.00 + 35.5 % 166,500

297,350 --------- $ 88,306.00 + 39.1 % 297,350

To test your understanding, follow this example of a single person with taxable income of $68,000:

Tax is $14,645.00 + 0.305*(68000-65550) = $14,645.00 + $747.25 = $15,392.25

Assignment:

1. One of the biggest mistakes that beginning programmers tend to make is to attempt solving

the problem within their code before they really understand how to work the problem. Use

the following values and solve each of them before you begin to write your program out.

2. See the PDF Help Document

© ICT 2006, www.ict.org, All Rights Reserved

Use permitted only by licensees in accordance with license terms (http://www.ict.org/javalicense.pdf)

You might also like

- Stryker Corporation - Assignment 22 March 17Document4 pagesStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- Assignment 1 - 2021 - 2022Document4 pagesAssignment 1 - 2021 - 2022Assya El MoukademNo ratings yet

- Introduction To Financial ManagementDocument9 pagesIntroduction To Financial ManagementRitesh ShreshthaNo ratings yet

- Financial Planning and Forecasting Brigham SolutionDocument29 pagesFinancial Planning and Forecasting Brigham SolutionShahid Mehmood100% (6)

- Practice Quesions Fin Planning ForecastingDocument19 pagesPractice Quesions Fin Planning ForecastingAli HussainNo ratings yet

- How To Formulate UVDocument16 pagesHow To Formulate UVtobass82100% (3)

- Provided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDocument5 pagesProvided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDebolina DasNo ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- Fundamentals of Capital BudgetingDocument54 pagesFundamentals of Capital BudgetingLee ChiaNo ratings yet

- Department of Finance and Administration: Withholding TaxDocument3 pagesDepartment of Finance and Administration: Withholding TaxJuan Daniel Garcia VeigaNo ratings yet

- FIT-Percentage Method ChartsDocument4 pagesFIT-Percentage Method ChartsMary67% (3)

- ExtraTaxProblem-TY2020 Student - SUSANDocument6 pagesExtraTaxProblem-TY2020 Student - SUSANhhunter530No ratings yet

- Tarea 2 Bis Caso Hemingway CorporationDocument10 pagesTarea 2 Bis Caso Hemingway CorporationChesse HerNo ratings yet

- Entity Tax ExamDocument7 pagesEntity Tax ExamWesley JacksonNo ratings yet

- FAQ On New Tax Regime - V3Document6 pagesFAQ On New Tax Regime - V3ash tiwariNo ratings yet

- CSCE 120: Learning To Code: Making Decisions Hacktivity 4.2Document3 pagesCSCE 120: Learning To Code: Making Decisions Hacktivity 4.2s_gamal15No ratings yet

- Tarea - 2 Bis - Caso - Hemingway - CorporationDocument8 pagesTarea - 2 Bis - Caso - Hemingway - CorporationMiguel VázquezNo ratings yet

- Chapter 4 - TaxesDocument28 pagesChapter 4 - TaxesabandcNo ratings yet

- Salary - Tax CalculatorDocument7 pagesSalary - Tax CalculatorsonamNo ratings yet

- (TUBONG) Module 3 - Activity 1Document9 pages(TUBONG) Module 3 - Activity 1CristopherNo ratings yet

- RMIT FR Week 2 Solutions PDFDocument173 pagesRMIT FR Week 2 Solutions PDFKiabu ParindaliNo ratings yet

- RMIT FR Week 2 Solutions PDFDocument173 pagesRMIT FR Week 2 Solutions PDFKiabu ParindaliNo ratings yet

- Essentials of Federal Income Taxation For Individuals and BusinessDocument860 pagesEssentials of Federal Income Taxation For Individuals and BusinessAbhisek chudalNo ratings yet

- Sec. 24 NircDocument17 pagesSec. 24 NircCharie Mae YdNo ratings yet

- S Corp vs. Sole Prop - LLC Tax Savings CalculatorDocument1 pageS Corp vs. Sole Prop - LLC Tax Savings CalculatorsomdivaNo ratings yet

- Tax Tables RTGS 2020Document1 pageTax Tables RTGS 2020Mai CarolNo ratings yet

- Solutions Nss NC 17Document13 pagesSolutions Nss NC 17lethiphuongdan50% (2)

- Tax Reform Acceleration and InclusionDocument28 pagesTax Reform Acceleration and InclusionWilliam Alexander Matsuhara AlegreNo ratings yet

- Tax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaDocument28 pagesTax On Individuals: Instructor: Cathryn Cyra I. Cordova, CpaEddie Mar JagunapNo ratings yet

- The Valuation and The Use of Free CashDocument29 pagesThe Valuation and The Use of Free CashAlkhair SangcopanNo ratings yet

- TestBank Chapter-1Document62 pagesTestBank Chapter-1Mallory CooperNo ratings yet

- NVDA F4Q24 Quarterly Presentation FINALDocument25 pagesNVDA F4Q24 Quarterly Presentation FINALMorby 10No ratings yet

- IAS#12Document31 pagesIAS#12Shah KamalNo ratings yet

- RTGS 2022 August-December 2022 Tax TablesDocument1 pageRTGS 2022 August-December 2022 Tax TablesGodfrey MakurumureNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (47)

- Budget 2023 2024Document12 pagesBudget 2023 2024finance bnbmNo ratings yet

- CASE 5-33 Solution: Nabeeda ShaheenDocument4 pagesCASE 5-33 Solution: Nabeeda ShaheenhadiNo ratings yet

- Math Assignment Print SheetDocument4 pagesMath Assignment Print Sheetluca.castelvetere04No ratings yet

- LAS Q2 Week6 FABM2Document8 pagesLAS Q2 Week6 FABM2Angela Delos ReyesNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Test BankDocument19 pagesIndividual Taxation 2013 Pratt 7th Edition Test BankCharles Davis100% (38)

- Solution 15 To 21Document9 pagesSolution 15 To 21pratham kannanNo ratings yet

- Nvda f4q23 Investor Presentation FinalDocument57 pagesNvda f4q23 Investor Presentation FinalDebarros MartinsNo ratings yet

- Team PRTC 1stPB May 2024 - TAXDocument7 pagesTeam PRTC 1stPB May 2024 - TAXAnne Marie SositoNo ratings yet

- Financial Management For Decision MakersDocument3 pagesFinancial Management For Decision MakerssgdrgsfNo ratings yet

- JANUARY To DECEMBER 2022 USD Tax TablesDocument1 pageJANUARY To DECEMBER 2022 USD Tax TablesAndrew MusarurwaNo ratings yet

- TABL 2751 Tax Rates 2022Document4 pagesTABL 2751 Tax Rates 2022Crystal CheahNo ratings yet

- Chapter 17 & 18 SolutionsDocument4 pagesChapter 17 & 18 SolutionsSheena CarrouthersNo ratings yet

- Income Tax 2008circluar06Document8 pagesIncome Tax 2008circluar06Qamar TanauliNo ratings yet

- Tax Changes You Need To Know Under RA 10963Document20 pagesTax Changes You Need To Know Under RA 10963Rosanno DavidNo ratings yet

- Trần Hoài Anh Hs150639 Ib1602Document3 pagesTrần Hoài Anh Hs150639 Ib1602Vũ Nhi AnNo ratings yet

- Dividend Tax CalculatorDocument2 pagesDividend Tax Calculatornoonetwothreefour56No ratings yet

- TABL2751 Tax Rates 2021 - UpdatedDocument4 pagesTABL2751 Tax Rates 2021 - UpdatedPeper12345No ratings yet

- Chapter 14 - Corporate OperationsDocument13 pagesChapter 14 - Corporate OperationscoconutisspecialNo ratings yet

- Full Download PDF of Individual Taxation 2013 Pratt 7th Edition Test Bank All ChapterDocument42 pagesFull Download PDF of Individual Taxation 2013 Pratt 7th Edition Test Bank All Chaptermaizonsudar100% (5)

- TM Cia 1BDocument5 pagesTM Cia 1BAdityansh AbhinavNo ratings yet

- Jan To Jul 2022 Tax TablesDocument1 pageJan To Jul 2022 Tax Tablesgracia murevanemweNo ratings yet

- High Performance Beverages Co. (TBEV)Document27 pagesHigh Performance Beverages Co. (TBEV)MNM MahmuddinNo ratings yet

- Park - 12011328 - BSBFIM601 - Ass 2 - Aaron - 280217Document6 pagesPark - 12011328 - BSBFIM601 - Ass 2 - Aaron - 280217EricKang67% (3)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- RTN 29.2023 - 2023 Annual AG Show - 2023 April 27 To April 29Document2 pagesRTN 29.2023 - 2023 Annual AG Show - 2023 April 27 To April 29Anonymous UpWci5No ratings yet

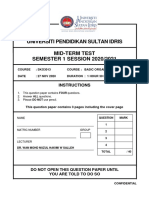

- Universiti Pendidikan Sultan Idris Mid-Term Test SEMESTER 1 SESSION 2020/2021Document3 pagesUniversiti Pendidikan Sultan Idris Mid-Term Test SEMESTER 1 SESSION 2020/2021rusnah chungNo ratings yet

- HZ 01Cpr: Material Safety Data SheetDocument6 pagesHZ 01Cpr: Material Safety Data SheetFakhreddine BousninaNo ratings yet

- Rija PEEEL-TEEEL Paragraph Structure - Questions and Sentence StartersDocument1 pageRija PEEEL-TEEEL Paragraph Structure - Questions and Sentence Starterssaira sNo ratings yet

- CDAP006 Subfloor Protection PDFDocument2 pagesCDAP006 Subfloor Protection PDFGustavo Márquez TorresNo ratings yet

- Xu and Zhang (2009) (ASCE) GT.1943-5606 - Dam BreachDocument14 pagesXu and Zhang (2009) (ASCE) GT.1943-5606 - Dam BreachCharumitra YadavNo ratings yet

- Safety Rules and Laboratory Equipment: Experiment 1Document5 pagesSafety Rules and Laboratory Equipment: Experiment 1ricardojosecortinaNo ratings yet

- Procurement PlanDocument32 pagesProcurement Planario widjaksono100% (1)

- Dokumen - Tips - Incalzire Cu Pompe de CalduraDocument34 pagesDokumen - Tips - Incalzire Cu Pompe de CalduraPitique De TarencriqueNo ratings yet

- Floating Boat Library-Mini Project-1Document37 pagesFloating Boat Library-Mini Project-1parmayadav56789No ratings yet

- The Microsoft-Nokia Strategic Alliance PDFDocument25 pagesThe Microsoft-Nokia Strategic Alliance PDFmehedee129No ratings yet

- Am at Photogr 21 February 2015Document92 pagesAm at Photogr 21 February 2015TraficantdePufarineNo ratings yet

- Shellscriptingbook-Sample - Steves Bourne-Bash Scripting Tutorial PDFDocument16 pagesShellscriptingbook-Sample - Steves Bourne-Bash Scripting Tutorial PDFAnonymous Wu14iV9dqNo ratings yet

- The Cost EngineersDocument24 pagesThe Cost Engineersluis carlosNo ratings yet

- 2.High-Confidence Behavior at Work The Exec SkillsDocument27 pages2.High-Confidence Behavior at Work The Exec SkillsRamiro BernalesNo ratings yet

- Imperial Remnant Rules SheetDocument1 pageImperial Remnant Rules SheetJd DibrellNo ratings yet

- Mechanics of Materials 9th Edition Hibbeler Solutions ManualDocument35 pagesMechanics of Materials 9th Edition Hibbeler Solutions Manualronbowmantdd2bh100% (29)

- Calculation of Potential Flow Around An Elliptic Cylinder Using Boundary Element MethodDocument15 pagesCalculation of Potential Flow Around An Elliptic Cylinder Using Boundary Element MethodDoğancan UzunNo ratings yet

- The Five Pillars of Effective WritingDocument4 pagesThe Five Pillars of Effective WritingPrecy M AgatonNo ratings yet

- Thermaltake Chaser A31 CaseDocument9 pagesThermaltake Chaser A31 CaseZameriuNo ratings yet

- Service Manual TTI TCB-771 ENGDocument13 pagesService Manual TTI TCB-771 ENGAdam100% (1)

- Chapter 2 - Equivalence Above Word LevelDocument23 pagesChapter 2 - Equivalence Above Word LevelNoo NooNo ratings yet

- February 2023Document4 pagesFebruary 2023Cresilda BiloyNo ratings yet

- Nynas Transformer Oil - Nytro 10GBN: Naphthenics Product Data SheetDocument1 pageNynas Transformer Oil - Nytro 10GBN: Naphthenics Product Data SheetAnonymous S29FwnFNo ratings yet

- Test Series Vikas RaDocument32 pagesTest Series Vikas RaChampakNo ratings yet

- 19Document227 pages19Miguel José DuarteNo ratings yet

- Rw15 ManualDocument314 pagesRw15 ManualpedrogerardohjNo ratings yet

- Electrical Fault Detection in Three Phase Squirrel Cage Induction Motor by Vibration Analysis Using MEMS Accelerometer.Document6 pagesElectrical Fault Detection in Three Phase Squirrel Cage Induction Motor by Vibration Analysis Using MEMS Accelerometer.Jose Luis Hernandez CoronaNo ratings yet

- FormDocument83 pagesFormAnimesh SinghNo ratings yet