Professional Documents

Culture Documents

April 5 Monetary Policy

April 5 Monetary Policy

Uploaded by

Adel JohnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

April 5 Monetary Policy

April 5 Monetary Policy

Uploaded by

Adel JohnCopyright:

Available Formats

April 5: Monetary Policy

Macrobite 3 Monetary Policy Expansionary and contractionary monetary policy Money Supply Central Bank Role Money

Understand movements of prices Change in money supply in Expansionary M1 Sole issuer of currency Anything that is generally accepted in payment

in short and medium run order to achieve a goal for goods or services or in repayment of debts

Aims to boost the Narrow money Monitors, supervises and regulates

Observe inflation rate Interest rate performance of the economy financial institutions It is a medium of exchange

Most liquid of all - can be used

Check basket of goods Control inflation Lowering directly for transactions Implements monetary policy A unit of account

interest rate

Take note of country Currency in circulation + demand deposits Manages both domestic and Put a price to a commodity and to a service

monetary policy More investors (checking accounts) + e-wallets international reserves

Fair and easier for comparison

Contractionary Demand deposits Lender of last resort

Used to store value

Increasing interest rate to Money that can be withdrawn Goals of central bank

Why do we need money?

control the flow of money and to on demand anytime Price stability

control inflation as well Transaction demand

M2 Keep inflation at bay

We use it for our

Broad money by setting a range

daily transaction

Close substitute for Create conditions for economic growth

Demand for money

transaction money Keep investor and lender confidence depends on your income

M1 + saving deposits + time deposits Maintain an exchange When income increases, demand

Can't use time deposits rate stability for money also increase

and savings deposits Through interest rate Precautionary demand

M3 that it implements

For emergency purposes

Domestic liquidity Serves as financial intermediaries

When income increase,

when the central bank implements

Less liquid of all precautionary demand increase

monetary policies

Treasury bills Speculative demand

Certificates Interest rate

of deposits We know that money

m2+ deposit substitutes creates future value

Interest rate go higher, transaction

demand for money goes lower

Money Supply

(MS)

m1+m2+m3

In equilibrium, MD = MS

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5833)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- City Bank StatementDocument1 pageCity Bank StatementAbu Shadot100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FININVE - K31 - The Way of The Turtle - 11901470 - He, AdelDocument2 pagesFININVE - K31 - The Way of The Turtle - 11901470 - He, AdelAdel JohnNo ratings yet

- (COBLAW2) He, Adel John - Case DigestDocument3 pages(COBLAW2) He, Adel John - Case DigestAdel JohnNo ratings yet

- HE - Article CritiqueDocument2 pagesHE - Article CritiqueAdel JohnNo ratings yet

- Economic Indicator - Philippines Industrial Production Index, Year On Year, Standardized, SA, CHG Y - Y, 2010 100 - 17 Aug 2023Document3 pagesEconomic Indicator - Philippines Industrial Production Index, Year On Year, Standardized, SA, CHG Y - Y, 2010 100 - 17 Aug 2023Adel JohnNo ratings yet

- Philippines - FX Market Overview - Aug 17, 2023T16 - 02Document4 pagesPhilippines - FX Market Overview - Aug 17, 2023T16 - 02Adel JohnNo ratings yet

- Economic Indicator - Taiwan TAIEX, Weighted Index, 1966JAN1 100 - 17 Aug 2023Document2 pagesEconomic Indicator - Taiwan TAIEX, Weighted Index, 1966JAN1 100 - 17 Aug 2023Adel JohnNo ratings yet

- March 1Document1 pageMarch 1Adel JohnNo ratings yet

- The GDP of Singapore and Japan: Table 1Document9 pagesThe GDP of Singapore and Japan: Table 1Adel JohnNo ratings yet

- Price History - 20230817 - 1550Document2 pagesPrice History - 20230817 - 1550Adel JohnNo ratings yet

- Self-Study Session 1: Optional OptionalDocument1 pageSelf-Study Session 1: Optional OptionalAdel JohnNo ratings yet

- Management and History (Group 2)Document1 pageManagement and History (Group 2)Adel JohnNo ratings yet

- Fuel Up With Mangos 2016 EngDocument4 pagesFuel Up With Mangos 2016 EngAdel JohnNo ratings yet

- 18C W/ 1 Parking Slot 3 Floor and Uptown Ritz Unit 32C W/ 1 Parking Slot at Basement 4Document1 page18C W/ 1 Parking Slot 3 Floor and Uptown Ritz Unit 32C W/ 1 Parking Slot at Basement 4Adel JohnNo ratings yet

- Mobile Refugee: Rohingya Refugees' Practices of Imaginary Citizenship in Klang Valley, MalaysiaDocument14 pagesMobile Refugee: Rohingya Refugees' Practices of Imaginary Citizenship in Klang Valley, MalaysiaAdel JohnNo ratings yet

- Official Receipt PDFDocument2 pagesOfficial Receipt PDFAdel JohnNo ratings yet

- How To Read The Candlestick Chart Candle Sticks and Market TerminologyDocument1 pageHow To Read The Candlestick Chart Candle Sticks and Market TerminologyAdel JohnNo ratings yet

- 1.) Picture of Maslow's Hierarchy of NeedsDocument3 pages1.) Picture of Maslow's Hierarchy of NeedsAdel JohnNo ratings yet

- Hjklkiuy 678Document1 pageHjklkiuy 678Adel JohnNo ratings yet

- LOYOLA SCHOOLS FORM (Rev. 05-2016)Document1 pageLOYOLA SCHOOLS FORM (Rev. 05-2016)Adel JohnNo ratings yet

- Nation's Problems Make Me Want To Hang Myself - DuterteDocument3 pagesNation's Problems Make Me Want To Hang Myself - DuterteAdel JohnNo ratings yet

- Fishing Deal With China: Palace Claims Duterte Made 'Undocumented, Informal Agreement'Document4 pagesFishing Deal With China: Palace Claims Duterte Made 'Undocumented, Informal Agreement'Adel JohnNo ratings yet

- Grade 8 Mathematics (MCAS) Portfolio: Name: Section: CDocument2 pagesGrade 8 Mathematics (MCAS) Portfolio: Name: Section: CAdel JohnNo ratings yet

- Bisawa 138 NoticeDocument4 pagesBisawa 138 Noticeanon_955473158100% (1)

- WDRA and AccreditationDocument5 pagesWDRA and AccreditationgkmandalNo ratings yet

- Internship Report OnDocument58 pagesInternship Report OnRaselNo ratings yet

- Muhammad's ResumeDocument1 pageMuhammad's ResumeTalha SiddiquiNo ratings yet

- Chapter 8 OSC PSC, Loan Capital and Bond ValuationDocument34 pagesChapter 8 OSC PSC, Loan Capital and Bond Valuationathirah jamaludinNo ratings yet

- Agent Question BankDocument47 pagesAgent Question BankshinukrajanNo ratings yet

- Week 13 Chapter 23Document35 pagesWeek 13 Chapter 23Dương Thanh HuyềnNo ratings yet

- Builder NOC Format 1Document3 pagesBuilder NOC Format 1zaraiftu100% (4)

- Rujukan: Jabatan Operasi Pelaburan Dan Pasaran Kewangan Bank Negara MalaysiaDocument1 pageRujukan: Jabatan Operasi Pelaburan Dan Pasaran Kewangan Bank Negara MalaysiaAry KurniaNo ratings yet

- Winding UpDocument13 pagesWinding UpFerial AfzalNo ratings yet

- Tudor Capital Europe LLP Pillar 3 Disclosure PDFDocument7 pagesTudor Capital Europe LLP Pillar 3 Disclosure PDFetravoNo ratings yet

- Supertech Apex TowerDocument12 pagesSupertech Apex TowerGreen Realtech Projects Pvt LtdNo ratings yet

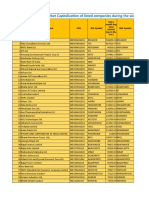

- Avg. Market Capitalization of Listed Companies During - Jul-Dec 2017Document232 pagesAvg. Market Capitalization of Listed Companies During - Jul-Dec 2017vineetksr1No ratings yet

- Rebate: Due DateDocument2 pagesRebate: Due DateRakesh Dey sarkarNo ratings yet

- Bank Reconciliation Statement in SAPDocument8 pagesBank Reconciliation Statement in SAPcharanNo ratings yet

- 2.Bsc Match Point AprilDocument2 pages2.Bsc Match Point AprilMahesh ChavanNo ratings yet

- ReferenceDocument12 pagesReferencealeneNo ratings yet

- Banking Cases Week 1Document5 pagesBanking Cases Week 1Katrina PerezNo ratings yet

- AssignmentDocument5 pagesAssignmentBijal ParekhNo ratings yet

- Credit Skills For Bankers Certificate Sme IndiaDocument4 pagesCredit Skills For Bankers Certificate Sme IndiaitsurarunNo ratings yet

- RCBC v. MarcopperDocument12 pagesRCBC v. MarcopperPrecious Grace Flores BoloniasNo ratings yet

- Time Value Money Questions AnswersDocument10 pagesTime Value Money Questions Answerssmsmba100% (1)

- Anita A. Ledda vs. Bank of The Philippine IslandsDocument2 pagesAnita A. Ledda vs. Bank of The Philippine IslandsblckwtrprkNo ratings yet

- Final PHD Commerce Thesis PDFDocument450 pagesFinal PHD Commerce Thesis PDFMegha Jain BhandariNo ratings yet

- Disruptive Agricultural Technology Challenge and Conference Program Skeleton v7Document19 pagesDisruptive Agricultural Technology Challenge and Conference Program Skeleton v7shadab0123No ratings yet

- Unicorn ValuationDocument12 pagesUnicorn ValuationTony TranNo ratings yet

- NMDCDocument417 pagesNMDCArumugam M Nadar0% (1)

- Banking of BPMDocument20 pagesBanking of BPMSai DheerajNo ratings yet

- 03082019051404nvxsmwloqt7g0ud4bh Estatement 072019 2407Document12 pages03082019051404nvxsmwloqt7g0ud4bh Estatement 072019 2407Manoj EmmidesettyNo ratings yet