Professional Documents

Culture Documents

Mera Pakistan Housing Document Req

Mera Pakistan Housing Document Req

Uploaded by

Aehtasham MumtazCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mera Pakistan Housing Document Req

Mera Pakistan Housing Document Req

Uploaded by

Aehtasham MumtazCopyright:

Available Formats

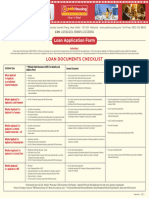

Documentation Requirement – Salaried Segment Original / Copy

Finance Application Form (FAF) Original

Product Disclosure Sheet (at the time of Musharakah signing) Original

Valid CNIC of applicant & Co-partner (where applicable) Copy

2 passport size color Photographs of applicant & Co-partner (where applicable) Original

Undertaking for first time homeowner Original

Proof of allotment, transfer and/or Title Document of the property to be

Copy

mortgaged

Direct Debit Authority (DDA) & Employer’s certificate mentioning that payroll

Original

account maintenance shall continue with the lending Bank (where applicable)

Proof of Employment (along with length of employment) for example:

• Employment letter

OR

Original / Copy

• Employment Certificate

OR

• Any valid documentary evidence from employer

Formal Sector Employees

Income Proof document (salary breakup and deductions to be clearly

mentioned) for example:

• Current Salary Slip Original / Copy

OR

• Salary Certificate Original

• Account Maintenance Certificate along with last 6-month Bank Original

statement with Salary Credits

Notes:

- Maximum of 60 days old salary slip & Bank Statement may be accepted

- Online / e-salary slips are acceptable with positive verification

- Original salary slip / e-slip does not require stamp or sign.

In case customer is employed in informal sector, one of the following

documents shall be required to assess customer based on proxy income or

repayment surrogates, for example:

Informal Sector Employees

• Rent Agreement Copy

OR

• Rent Payment declaration Original

OR

• Utility Bills Copy

OR

• Telco Bill Copy

OR

• School Fee Challan Copy

OR

• Any other valid expense document (as per defined Income proxy) Copy

Documentation Requirement – Self Employed Original / Copy

Finance Application Form (FAF) Original

Product Disclosure Sheet (at the time of Musharakah signing) Original

Valid CNIC of applicant & Co-partner (where applicable) Copy

2 passport size color Photographs of applicant & Co-partner (where applicable) Original

Undertaking for first time homeowner Original

Proof of allotment, transfer and/or Title Document of the property to be

Original

mortgaged

Direct Debit Authority (DDA) & Employer’s certificate mentioning that payroll

Copy

account maintenance shall continue with the lending Bank (where applicable)

Proof of Business (stating ownership and length of business) for example:

• Partnership Deed Copy

OR

• Bank Certificate for Sole Proprietor / Partnership Original

OR

• NTN Certificate Copy

OR

Formal Sector Self Employed

• Rent agreement of office Copy

OR

• Professional Degree / Diploma &/OR Valid Membership of applicable Copy

Professional body

OR

• Any other valid acceptable business document verifiable from authority Copy / Original

fulfilling minimum business tenor requirement.

Income assessment document

• Account Maintenance Letter along with at least recent 6 months Bank

Statement

Original

Notes:

- Maximum of 60 days Bank statement may be accepted

- Original Bank statement with bank stamp

In case customer is employed in informal sector, one of the following

documents shall be required to assess customer based on proxy income or

repayment surrogates, for example:

Informal Sector Self Employed

Copy

• Rent Agreement

OR

Original

• Rent Payment declaration

OR

Copy

• Utility Bills

OR

Copy

• Telco Bills

OR

Copy

• School Fee Challan

OR Copy

• Any other valid expense document (as per defined Income proxy)

You might also like

- Audit Program Accounts PayableDocument20 pagesAudit Program Accounts PayableSarang SinghNo ratings yet

- Basel II CheatsheetDocument8 pagesBasel II CheatsheetBhabaniParidaNo ratings yet

- Modes of Creating ChargeDocument22 pagesModes of Creating ChargeAdharsh Venkatesan100% (1)

- AsialinkDocument3 pagesAsialinkAlanlovely Arazaampong Amos100% (2)

- Documentation Requirement - Salaried Segment OriginalDocument3 pagesDocumentation Requirement - Salaried Segment OriginalAli Azhar KhanNo ratings yet

- List of Required Documents Saibaan V.02Document4 pagesList of Required Documents Saibaan V.02uzi faizNo ratings yet

- Document Checklist: Salaried Segment Self Employed OriginalDocument1 pageDocument Checklist: Salaried Segment Self Employed OriginalWaqas LuckyNo ratings yet

- Required Documents Mera GharDocument2 pagesRequired Documents Mera GharEngr Fahimuddin QureshiNo ratings yet

- Home Loan Application Form - WEBDocument8 pagesHome Loan Application Form - WEBanandNo ratings yet

- PNB Home Loan CircularDocument1 pagePNB Home Loan CircularNavdeep BainsNo ratings yet

- Loan Application FormDocument6 pagesLoan Application FormnavabharathsrinivasanNo ratings yet

- Hellenic Bank Association LeafletDocument2 pagesHellenic Bank Association LeafletKostas MokasNo ratings yet

- Documentation Required For Certification With WOSB - 2022Document6 pagesDocumentation Required For Certification With WOSB - 2022Verena StreberNo ratings yet

- Sistithikate en Forpreview2012Document2 pagesSistithikate en Forpreview2012lebaneg629No ratings yet

- Checklist Housing LoanDocument2 pagesChecklist Housing LoanJulius LuzonNo ratings yet

- Application Form For Formal Salaried Person (English Language)Document2 pagesApplication Form For Formal Salaried Person (English Language)profmabuzarNo ratings yet

- Industrial Department IncentivesDocument5 pagesIndustrial Department IncentivesKUMARNo ratings yet

- Onboarding EDD ChecklistDocument3 pagesOnboarding EDD Checklistisha AsdNo ratings yet

- Emergency Loan Application Form: CNX Confidential 10.2015Document1 pageEmergency Loan Application Form: CNX Confidential 10.2015von anthony TalaNo ratings yet

- Home - Loan - Application - Form 1Document8 pagesHome - Loan - Application - Form 1Salman KhanNo ratings yet

- Home, Mortgage, LAP, Reverse Mortgage - Loan ApplicationDocument10 pagesHome, Mortgage, LAP, Reverse Mortgage - Loan ApplicationReshma JoseNo ratings yet

- Home Loan Application IDBIDocument10 pagesHome Loan Application IDBIMuthuKumaran NadarNo ratings yet

- how_to_register_as_an_estate_agent_Document2 pageshow_to_register_as_an_estate_agent_Jaime Justine ScholzNo ratings yet

- Basic Requirements - Individual 2Document2 pagesBasic Requirements - Individual 2Rica Anne BangotNo ratings yet

- PAG IBIG Housing LoanDocument38 pagesPAG IBIG Housing LoanKrisha Jean ManzanoNo ratings yet

- Msme Finance RajeevDocument3 pagesMsme Finance RajeevniftamNo ratings yet

- HLF065 ChecklistRequirementsWindow1Accounts V05Document2 pagesHLF065 ChecklistRequirementsWindow1Accounts V05Jerson OboNo ratings yet

- Housing Loan Requirement PAGIBIGDocument2 pagesHousing Loan Requirement PAGIBIGMaria Lena HuecasNo ratings yet

- PaymentTypes 0Document13 pagesPaymentTypes 0Dean CelestineNo ratings yet

- KYC Document For Various AccountsDocument42 pagesKYC Document For Various AccountsprateekpikaNo ratings yet

- Zida Requirements of Renewal FormDocument1 pageZida Requirements of Renewal FormTafadzwa Matthew Gwekwerere P.B.CNo ratings yet

- Checklist of Requirements For Pag-Ibig Housing Loan Under Retail AccountsDocument2 pagesChecklist of Requirements For Pag-Ibig Housing Loan Under Retail AccountsDain MedinaNo ratings yet

- Static - File - Nigeria - Nigeriabank - Personal - Products - Borrow For Your Needs - Home Loan - Home Loan Application FormDocument7 pagesStatic - File - Nigeria - Nigeriabank - Personal - Products - Borrow For Your Needs - Home Loan - Home Loan Application Formvincent chiedozieNo ratings yet

- Application Form - FormatDocument6 pagesApplication Form - FormatAshish SinghNo ratings yet

- 2021 Contingent Letter OPTUM - Virtual Hiring September 17Document2 pages2021 Contingent Letter OPTUM - Virtual Hiring September 17PapaRey ChannelNo ratings yet

- Step 1: Check Your Qualifications: Bdo BankDocument4 pagesStep 1: Check Your Qualifications: Bdo BankCristy JavinarNo ratings yet

- Formal Salaried PersonDocument2 pagesFormal Salaried PersonSanam SadiaNo ratings yet

- Home Loan Application Form EnglishDocument8 pagesHome Loan Application Form EnglishAFFII MARKETINGNo ratings yet

- Document Transmittal & Checklist Form: Forms Date&Received By: Locally Employed Date&Received byDocument1 pageDocument Transmittal & Checklist Form: Forms Date&Received By: Locally Employed Date&Received byRonnel S. DabuNo ratings yet

- Fabm1-Additional Reading MaterialsDocument31 pagesFabm1-Additional Reading MaterialsAlexa AbaryNo ratings yet

- Key Doc ContDocument5 pagesKey Doc ContBeauTech Engg. & Construction Pvt. Ltd.No ratings yet

- TemplateDocument6 pagesTemplateahuja.3030No ratings yet

- Tip TopDocument8 pagesTip Topmani samiNo ratings yet

- SSS GroupDocument49 pagesSSS GroupKassandra Peralta MadarangNo ratings yet

- SEED ChecklistDocument1 pageSEED ChecklistTeasha Nika PetersNo ratings yet

- Check ListDocument3 pagesCheck Listabhishekdwivedi0% (1)

- Source of Funds - CEX - Io Help CenterDocument15 pagesSource of Funds - CEX - Io Help CenterBhoumika LucknauthNo ratings yet

- ANNEX A - DOCUMENT REQUIREMENTS v4Document5 pagesANNEX A - DOCUMENT REQUIREMENTS v4Jan Paolo CruzNo ratings yet

- Anti-Money Laundering Guide: C M Y KDocument7 pagesAnti-Money Laundering Guide: C M Y KAmenAllah DghimNo ratings yet

- FEECO Basic Export Finance InfoDocument1 pageFEECO Basic Export Finance InfoMoussa DieneNo ratings yet

- Supporting Documents ChecklistDocument5 pagesSupporting Documents ChecklistEmpathos XywinNo ratings yet

- Form 6 Other Personnel Benefits and HonorariaDocument1 pageForm 6 Other Personnel Benefits and Honorariaarfica zainal abidinNo ratings yet

- Identification Verification Idv CertificationDocument2 pagesIdentification Verification Idv CertificationJack DanielsNo ratings yet

- Account Opening PBDocument5 pagesAccount Opening PBHamid AnsariNo ratings yet

- Qna Dol English v1Document30 pagesQna Dol English v1Somasundaram SadushanNo ratings yet

- New Entrants Who Intend To Be A Principal Estate AgentDocument2 pagesNew Entrants Who Intend To Be A Principal Estate AgentLesego MoripeNo ratings yet

- Customer Request Form MortgagesDocument1 pageCustomer Request Form Mortgagessanjaybhaskar037No ratings yet

- Requirement For Show Money and Real StateDocument1 pageRequirement For Show Money and Real StateKah CaudillaNo ratings yet

- Pagibig RequirementsDocument4 pagesPagibig RequirementsDanzen SenolosNo ratings yet

- Business Plan Including Declaration of Personal Finances - 2Document10 pagesBusiness Plan Including Declaration of Personal Finances - 2hussen seidNo ratings yet

- how_to_register_as_an_estate_agentDocument2 pageshow_to_register_as_an_estate_agentJaime Justine ScholzNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- KRA 3.8 Travelling Crane ProcedureDocument11 pagesKRA 3.8 Travelling Crane ProcedureAhsan Farooq100% (1)

- 4 Busbar Combiner BoxDocument1 page4 Busbar Combiner BoxAhsan FarooqNo ratings yet

- Pipe Sizes Copper PDFDocument2 pagesPipe Sizes Copper PDFAhsan FarooqNo ratings yet

- Iso 3302Document2 pagesIso 3302Ahsan Farooq0% (1)

- 536570-316 Rev A Web PDFDocument1 page536570-316 Rev A Web PDFAhsan FarooqNo ratings yet

- The Ark Vehicle Trading & General Merchandise Inc.: Payment ContractDocument3 pagesThe Ark Vehicle Trading & General Merchandise Inc.: Payment ContractkeouhNo ratings yet

- Case Digest in Credit Transactions PDFDocument110 pagesCase Digest in Credit Transactions PDFMasterbolero100% (1)

- 1st Semester Transfer Taxation - Long Quiz 01Document6 pages1st Semester Transfer Taxation - Long Quiz 01Nah HamzaNo ratings yet

- Advanced Accounting - Test 1: B. Prepare The Journal Entries To Transfer Dan To Corp. Under TrusteeshipDocument6 pagesAdvanced Accounting - Test 1: B. Prepare The Journal Entries To Transfer Dan To Corp. Under TrusteeshipFrilincia Maria HosianaNo ratings yet

- Executive Order No. 228, S. 1987 - Official Gazette of The Republic of The Phili PDFDocument9 pagesExecutive Order No. 228, S. 1987 - Official Gazette of The Republic of The Phili PDFDarren RuelanNo ratings yet

- Hull OFOD10e MultipleChoice Questions Only Ch08Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch08Kevin Molly KamrathNo ratings yet

- Evaluation of The Federal Housing Finance Agency's Oversight of Freddie Mac's Repurchase Settlement With Bank of AmericaDocument44 pagesEvaluation of The Federal Housing Finance Agency's Oversight of Freddie Mac's Repurchase Settlement With Bank of AmericaForeclosure FraudNo ratings yet

- The VanCougar: January 26, 2009Document12 pagesThe VanCougar: January 26, 2009VanCougarNo ratings yet

- 1256-1561 DigestsDocument8 pages1256-1561 DigestsKim EcarmaNo ratings yet

- 2012-03 Ireland's Property Market - Ronan Lyons EU Conference GalwayDocument40 pages2012-03 Ireland's Property Market - Ronan Lyons EU Conference GalwayRonan LyonsNo ratings yet

- Villa Crista v. Equitable BankDocument3 pagesVilla Crista v. Equitable BankdelayinggratificationNo ratings yet

- LB0611 STMT 20090825 oDocument56 pagesLB0611 STMT 20090825 oBronteCapitalNo ratings yet

- Manual YbportDocument105 pagesManual YbportMan GeekaaNo ratings yet

- Halifax Intermediaries Product GuideDocument14 pagesHalifax Intermediaries Product Guidekkvv11No ratings yet

- Revocation and Reduction of DonationsDocument5 pagesRevocation and Reduction of DonationsFhem WagisNo ratings yet

- CHAPTER 2 Financial MarketsDocument17 pagesCHAPTER 2 Financial MarketsAEHYUN YENVYNo ratings yet

- International Films vs. Lyric Film, 63 Phil 778, November 19, 1936Document5 pagesInternational Films vs. Lyric Film, 63 Phil 778, November 19, 1936Revina EstradaNo ratings yet

- Employee Manual - For BanksDocument14 pagesEmployee Manual - For BanksSkanda KumarNo ratings yet

- FINM3006 - Supplementary Exam - S1 2022 - ATTACHMENTSDocument11 pagesFINM3006 - Supplementary Exam - S1 2022 - ATTACHMENTSNavya VinnyNo ratings yet

- DiamondDocument15 pagesDiamondMaxim FilippovNo ratings yet

- Mock Exam Part 1Document28 pagesMock Exam Part 1LJ SegoviaNo ratings yet

- Predicting Prepayment and Default Risks of Unsecured Consumer Loans in Online LendingDocument16 pagesPredicting Prepayment and Default Risks of Unsecured Consumer Loans in Online LendingFUDANI MANISHANo ratings yet

- Domain's Property Price ForecastsDocument18 pagesDomain's Property Price ForecastsYC TeoNo ratings yet

- IB Chapter08Document52 pagesIB Chapter08ismat arteeNo ratings yet

- NLA Tenant Check Form JULY 2016Document3 pagesNLA Tenant Check Form JULY 2016La SaNo ratings yet

- Phil-Am Gen Insurance Co. Vs Ramos GR No. L-20978Document2 pagesPhil-Am Gen Insurance Co. Vs Ramos GR No. L-20978Celver Joy Gaviola TampariaNo ratings yet

- Welcome To The MachineDocument26 pagesWelcome To The MachineDee RossNo ratings yet