Professional Documents

Culture Documents

New Highs/new Lows: by Arthur A. Merrill, C. M. T

New Highs/new Lows: by Arthur A. Merrill, C. M. T

Uploaded by

Hendra SetiawanCopyright:

Available Formats

You might also like

- Bob Volman-Understanding Price Action - Practical Analysis of The 5-Minute Time Frame-Light Tower Publishing (2014) PDFDocument438 pagesBob Volman-Understanding Price Action - Practical Analysis of The 5-Minute Time Frame-Light Tower Publishing (2014) PDFKumaranSuresh100% (55)

- Value Investing: From Graham to Buffett and BeyondFrom EverandValue Investing: From Graham to Buffett and BeyondRating: 4 out of 5 stars4/5 (24)

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Crabel T. Trading Close-To-close Patterns 1989Document4 pagesCrabel T. Trading Close-To-close Patterns 1989Om PrakashNo ratings yet

- Fin 645 - Assign 1 - FTPDocument20 pagesFin 645 - Assign 1 - FTPJalni100% (1)

- The ConstructDocument36 pagesThe Constructjadie aliNo ratings yet

- Relative Strength RankingDocument12 pagesRelative Strength Rankingscriberone0% (1)

- Expert Advisor and Forex Trading Strategies: Take Your Expert Advisor and Forex Trading To The Next LevelFrom EverandExpert Advisor and Forex Trading Strategies: Take Your Expert Advisor and Forex Trading To The Next LevelRating: 3 out of 5 stars3/5 (1)

- Sample CMT Level II ExamDocument67 pagesSample CMT Level II ExamHendra SetiawanNo ratings yet

- SUPPLY AND DEMAND MADE EASY by Bossman FXDocument13 pagesSUPPLY AND DEMAND MADE EASY by Bossman FXBoyka Kirov75% (4)

- 2 Elements of ChartingDocument8 pages2 Elements of ChartingDeepak Paul TirkeyNo ratings yet

- Supply and Demand Trading: The Definitive Guide (2020 Update)Document25 pagesSupply and Demand Trading: The Definitive Guide (2020 Update)ian metili80% (5)

- Rare Geometry of Stock Market ProfitsDocument160 pagesRare Geometry of Stock Market Profitsmerc297% (37)

- Price/Earnings Ratios: The High P/E of The Growing Companies This Year Is OminousDocument3 pagesPrice/Earnings Ratios: The High P/E of The Growing Companies This Year Is OminousHendra SetiawanNo ratings yet

- Moving Average CrossoversDocument10 pagesMoving Average CrossoversHendra SetiawanNo ratings yet

- Volume Indices: by Arthur MerrillDocument5 pagesVolume Indices: by Arthur MerrillHendra SetiawanNo ratings yet

- Price VolumeDocument3 pagesPrice VolumeCryptoFX96% (24)

- Lin80357 ch16Document35 pagesLin80357 ch16awaisjinnahNo ratings yet

- Technical AnalysisDocument36 pagesTechnical AnalysisAli Hyder100% (2)

- Victor Niederhoffer On Trend FollowingDocument9 pagesVictor Niederhoffer On Trend FollowingJack JensenNo ratings yet

- Time Series and Forecasting: Learning ObjectivesDocument33 pagesTime Series and Forecasting: Learning ObjectivesAkhlaq Ul HassanNo ratings yet

- New Complete Market Breadth IndicatorsDocument30 pagesNew Complete Market Breadth Indicatorsemirav2100% (2)

- Technical Trading Techniques With Statistical ProfitabilityDocument41 pagesTechnical Trading Techniques With Statistical ProfitabilityErezwaNo ratings yet

- SSRN Id3929119Document64 pagesSSRN Id3929119Fábio GabrielNo ratings yet

- Resistance: by Arthur A. Merrill, C.M.TDocument3 pagesResistance: by Arthur A. Merrill, C.M.THendra SetiawanNo ratings yet

- Chapter3 Investmentanalysis1 120919045823 Phpapp01Document38 pagesChapter3 Investmentanalysis1 120919045823 Phpapp01jaspreetNo ratings yet

- Time of Daily High and LowDocument3 pagesTime of Daily High and LowHendra SetiawanNo ratings yet

- Timothy Ord - Picking Tops and Bottoms With The Tick IndexDocument4 pagesTimothy Ord - Picking Tops and Bottoms With The Tick IndexAlberto Pedroni100% (1)

- Stock Selection - A Test of Relative Stock Values Reported Over 17.5 YearsDocument5 pagesStock Selection - A Test of Relative Stock Values Reported Over 17.5 YearsLooseNo ratings yet

- TRIGGER$ - May 2011Document37 pagesTRIGGER$ - May 2011goldenphiNo ratings yet

- Stock Selection: A Test of Relative Stock Values Reported Over 17 YearsDocument19 pagesStock Selection: A Test of Relative Stock Values Reported Over 17 YearsalexmorenoasuarNo ratings yet

- A Quantitative Approach To Tactical Asset Allocation Mebane FaberDocument47 pagesA Quantitative Approach To Tactical Asset Allocation Mebane FaberaliasadsjNo ratings yet

- Technical Analysis: DR - Manish Dadhich Mba, Net, SetDocument51 pagesTechnical Analysis: DR - Manish Dadhich Mba, Net, Setrseminar2024idsjNo ratings yet

- Price Pattern StudiesDocument6 pagesPrice Pattern StudiesjoeNo ratings yet

- TacticalAssetAllocation MFaberDocument11 pagesTacticalAssetAllocation MFabercsp69No ratings yet

- Tactical Asset Allocation, Mebane FaberDocument13 pagesTactical Asset Allocation, Mebane FabersashavladNo ratings yet

- Market Valuation StrategyDocument15 pagesMarket Valuation StrategyMailtodisposableMailtodisposableNo ratings yet

- Emh (Efficient Market Hypothesis)Document6 pagesEmh (Efficient Market Hypothesis)Sumit SrivastavNo ratings yet

- Highs and Lows: A Behavioral and Technical AnalysisDocument20 pagesHighs and Lows: A Behavioral and Technical AnalysisLawrence EmmanuelNo ratings yet

- Alpha-Beta Trend-Following Revisited: Summary of MethodDocument5 pagesAlpha-Beta Trend-Following Revisited: Summary of MethodPRABHASH SINGHNo ratings yet

- Momentum, Acceleration, and Reversal - 0Document12 pagesMomentum, Acceleration, and Reversal - 0Loulou DePanamNo ratings yet

- The Monthly Effect in International Stock Markets: Evidence and ImplicationsDocument6 pagesThe Monthly Effect in International Stock Markets: Evidence and Implicationsmehul_mistry_3No ratings yet

- ValuEngine Weekly Newsletter February 2, 2012, 2012Document10 pagesValuEngine Weekly Newsletter February 2, 2012, 2012ValuEngine.comNo ratings yet

- TechnicalAnalyst MarketBottoms1 09Document5 pagesTechnicalAnalyst MarketBottoms1 09applicoreNo ratings yet

- Trading The Election CycleDocument7 pagesTrading The Election Cyclestummel6636No ratings yet

- Artikel Internasional Abnormal ReturnDocument32 pagesArtikel Internasional Abnormal ReturnI Nyoman EndraNo ratings yet

- Value Versus Growth: The International EvidenceDocument30 pagesValue Versus Growth: The International Evidenceluv_y_kush3575No ratings yet

- 1 - Dollar Cost Averaging: Stock Market TimingDocument30 pages1 - Dollar Cost Averaging: Stock Market TimingkenNo ratings yet

- Technical S AnalysisDocument3 pagesTechnical S AnalysisSarvesh SinghNo ratings yet

- Intraday Time Analysis FINALDocument6 pagesIntraday Time Analysis FINALTradingSystemNo ratings yet

- Channel Centred Ma2Document9 pagesChannel Centred Ma2ppfahdNo ratings yet

- Cambria Tactical Asset AllocationDocument48 pagesCambria Tactical Asset Allocationemirav2No ratings yet

- The News in Financial Asset Returns: Gerald P. Dwyer Jr. and Cesare RobottiDocument23 pagesThe News in Financial Asset Returns: Gerald P. Dwyer Jr. and Cesare RobottiIqra JawedNo ratings yet

- 2.security AnalysisDocument18 pages2.security AnalysisSabarni ChatterjeeNo ratings yet

- Absolut (E) RetracementsDocument3 pagesAbsolut (E) Retracementslector_961No ratings yet

- Firm Performance and Stock Returns - Docx5Document5 pagesFirm Performance and Stock Returns - Docx5Shoaib Ahmed JunejoNo ratings yet

- MTA Symposium - My Notes (Vipul H. Ramaiya)Document12 pagesMTA Symposium - My Notes (Vipul H. Ramaiya)vipulramaiya100% (2)

- Momentum TradingDocument7 pagesMomentum TradingInversiones BvlNo ratings yet

- Technical and Fundamental Stock Analysis: The Essential Guide for InvestorsFrom EverandTechnical and Fundamental Stock Analysis: The Essential Guide for InvestorsNo ratings yet

- Use of Vectors in Financial Graphs: by Dr Abdul Rahim WongFrom EverandUse of Vectors in Financial Graphs: by Dr Abdul Rahim WongNo ratings yet

- Strategize Your Investment In 30 Minutes A Day (Steps)From EverandStrategize Your Investment In 30 Minutes A Day (Steps)No ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- The Importance of Time in Price Action TradingDocument2 pagesThe Importance of Time in Price Action TradingHendra SetiawanNo ratings yet

- Trend Detection: by Arthur MerrillDocument3 pagesTrend Detection: by Arthur MerrillHendra SetiawanNo ratings yet

- Who Needs Elliott Wave?: AppendixaDocument5 pagesWho Needs Elliott Wave?: AppendixaHendra SetiawanNo ratings yet

- FX Startegies CompressDocument26 pagesFX Startegies CompressHendra Setiawan100% (1)

- The Art of The ChartDocument130 pagesThe Art of The ChartHendra Setiawan100% (4)

- FX Startegies CompressDocument26 pagesFX Startegies CompressHendra SetiawanNo ratings yet

- Moving Average CrossoversDocument10 pagesMoving Average CrossoversHendra SetiawanNo ratings yet

- Time of Daily High and LowDocument3 pagesTime of Daily High and LowHendra SetiawanNo ratings yet

- Resistance: by Arthur A. Merrill, C.M.TDocument3 pagesResistance: by Arthur A. Merrill, C.M.THendra SetiawanNo ratings yet

- Price/Earnings Ratios: The High P/E of The Growing Companies This Year Is OminousDocument3 pagesPrice/Earnings Ratios: The High P/E of The Growing Companies This Year Is OminousHendra SetiawanNo ratings yet

- How Important Is A Turning PointDocument3 pagesHow Important Is A Turning PointHendra SetiawanNo ratings yet

- Cycles: by Arthur MerrillDocument3 pagesCycles: by Arthur MerrillHendra SetiawanNo ratings yet

- Closing Tick: Buyers' Market or Sellers' Market? Counting The Upticks and Downticks Can Give You A Clue, Merrill SaysDocument3 pagesClosing Tick: Buyers' Market or Sellers' Market? Counting The Upticks and Downticks Can Give You A Clue, Merrill SaysHendra SetiawanNo ratings yet

- Based On Current Trends of Volume and PriceDocument11 pagesBased On Current Trends of Volume and PriceHendra SetiawanNo ratings yet

- Strategies For The Simple Timing Indicator (STI) and Macd To Improve Investment PerformanceDocument22 pagesStrategies For The Simple Timing Indicator (STI) and Macd To Improve Investment PerformanceHendra SetiawanNo ratings yet

- Volume Is What Drives The MarketDocument1 pageVolume Is What Drives The MarketHendra SetiawanNo ratings yet

- Wyckoff Wave - Week in Review, May 6, 2016Document3 pagesWyckoff Wave - Week in Review, May 6, 2016Hendra SetiawanNo ratings yet

- Chart Analysis Pattern - Head and ShoulderDocument24 pagesChart Analysis Pattern - Head and ShoulderHendra Setiawan100% (2)

- CMT - CAPT Skills ChecklistDocument122 pagesCMT - CAPT Skills ChecklistHendra SetiawanNo ratings yet

- MarketScalper v5.5Document24 pagesMarketScalper v5.5Amir Fakhrunnizam SalingNo ratings yet

- 24 Never Failing RulesDocument2 pages24 Never Failing RulestamiyanvaradaNo ratings yet

- How To Trade Pivots and CPRDocument69 pagesHow To Trade Pivots and CPRutkarsh pathakNo ratings yet

- How To Trade Triangle Chart Patterns Like A ProDocument15 pagesHow To Trade Triangle Chart Patterns Like A ProLINDOH100% (1)

- Profitable Candlestick PatternsDocument13 pagesProfitable Candlestick PatternsVicaas VSNo ratings yet

- Equity Research Fundamental and Technical Analysis and Its Impact On Stock Prices With Reliance MoneyDocument81 pagesEquity Research Fundamental and Technical Analysis and Its Impact On Stock Prices With Reliance MoneyRs rs100% (2)

- In-Class Example 01Document31 pagesIn-Class Example 01Thịnh TrươngNo ratings yet

- GS Techs Charts For The Week Ahead Jun-20Document19 pagesGS Techs Charts For The Week Ahead Jun-20garag muniNo ratings yet

- Cryptoupdate MayDocument3 pagesCryptoupdate MayOwen FillmoreNo ratings yet

- Moving AverageDocument36 pagesMoving AverageFaisal KorothNo ratings yet

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocument1 pageAlphaex Capital Candlestick Pattern Cheat Sheet InfographAlfian Amin100% (1)

- Intraday Trading With The TickDocument5 pagesIntraday Trading With The Tickthecrew67100% (1)

- Animals in A MarketDocument3 pagesAnimals in A MarketMirudhulla BalanathanNo ratings yet

- Atlas Battery Limited: Group Project By: Aqsa A. Khan Rounaq QaiserDocument21 pagesAtlas Battery Limited: Group Project By: Aqsa A. Khan Rounaq QaiserROUNAQ 11952No ratings yet

- Investor Sentiment.Document12 pagesInvestor Sentiment.o_alolahNo ratings yet

- Day Trading EdgeDocument10 pagesDay Trading Edgemleefx0% (1)

- Trendline Breakout Trading Strategy PDF FreeDocument63 pagesTrendline Breakout Trading Strategy PDF FreeAssad Saghir100% (1)

- Zero Based Budgeting - ZBBDocument58 pagesZero Based Budgeting - ZBBTulasi Nadh MtnNo ratings yet

- Point and Figure PatternsDocument12 pagesPoint and Figure PatternsRavi VarakalaNo ratings yet

- Mayank Mehta Final ProjectDocument41 pagesMayank Mehta Final ProjectMayank MehtaNo ratings yet

- Gautam Baid - The Making of A Value Investor-HarperCollins India (2023)Document260 pagesGautam Baid - The Making of A Value Investor-HarperCollins India (2023)vijaygawdeNo ratings yet

- Gunner Newsletter On YEars Prediction in Stock MKTDocument7 pagesGunner Newsletter On YEars Prediction in Stock MKTPasupathi SNo ratings yet

- Chart Patterns Cheat SheetDocument3 pagesChart Patterns Cheat SheetAnh Duc HungNo ratings yet

New Highs/new Lows: by Arthur A. Merrill, C. M. T

New Highs/new Lows: by Arthur A. Merrill, C. M. T

Uploaded by

Hendra SetiawanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Highs/new Lows: by Arthur A. Merrill, C. M. T

New Highs/new Lows: by Arthur A. Merrill, C. M. T

Uploaded by

Hendra SetiawanCopyright:

Available Formats

Stocks & Commodities V. 8:6 (228-229): New highs/new lows by Arthur A. Merrill, C. M. T.

New highs/new lows

by Arthur A. Merrill, C. M. T.

E ach day the number of stocks making new highs and the number making new lows are reported in the

financial press. Are these statistics useful? To find out whether they were, I constructed an index of new

highs/new lows by calculating the percentage of new highs made over the preceding 10 days to the sum

of new highs and new lows in the same 10 days:

100(10 - day total highs)

10 - day total new highs and lows

I tested the index with two sets of benchmarks: two-thirds of a standard deviation above and below the

mean, and a full standard deviation above and below the mean. Data points exceeding these benchmarks

were considered unusually high or low and were tested over a 10-year period.

Then I counted the number of times the indicator successfully called the direction of the Dow Jones

Industrial Average (DJIA) over the next week, the next five, 13 and 26 weeks and the next year. This test

provided 10 batting averages: five for the two-thirds standard deviation benchmarks and five for the full

standard deviation.

Results? Of the 10 batting averages, only one highly significant success appeared: Using the benchmark

of one standard deviation, the indicator succeeded 65% of the time in calling the direction of the DJIA

over the next year. The upper benchmark was 92.4% new highs and the lower, 35.7% new highs. The

index turned out to be an overbought/oversold indicator. An excess of new highs is a bearish signal and

an excess of new lows is bullish.

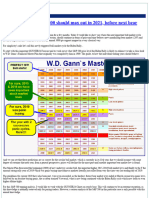

Figure 1 shows the performance of the indicator over the past six years. Figure 2 is the DJIA over the past

six years. The most impressive call by the indicator visible in Figure 1 is the quantity of bullish signals in

1984. Beautiful ! I wouldn't give good grades for the bearish signals in 1985 and 1986,but the bear call in

early 1987 was excellent. Following the 1987 crash, the bullish indications were right on the mark.

Incidentally, the scores for the indicator in 1980 and 1981 were very good. These years were in my test

period but aren't shown on the chart.

My conclusion is that we should listen to this indicator for long-term swings when it exceeds 92.4% or

falls below 35.7%. Note the latest figures in Figure 1. Bullish!

Arthur A . Merill is a Chartered Market Technician and the author of many reports and books including

Behavior of Prices on Wall Street and Filtered Waves, Basic Theory.

Figures Copyright (c) Technical Analysis Inc. 1

Stocks & Commodities V. 8:6 (228-229): New highs/new lows by Arthur A. Merrill, C. M. T.

FIGURE 1: The new highs/new lows indicator gives accurate calls for long-term swings when it

exceeds 92.4% or falls below 35. 7%.

FIGURE 2:

Figures Copyright (c) Technical Analysis Inc. 2

You might also like

- Bob Volman-Understanding Price Action - Practical Analysis of The 5-Minute Time Frame-Light Tower Publishing (2014) PDFDocument438 pagesBob Volman-Understanding Price Action - Practical Analysis of The 5-Minute Time Frame-Light Tower Publishing (2014) PDFKumaranSuresh100% (55)

- Value Investing: From Graham to Buffett and BeyondFrom EverandValue Investing: From Graham to Buffett and BeyondRating: 4 out of 5 stars4/5 (24)

- The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsFrom EverandThe Intelligent REIT Investor: How to Build Wealth with Real Estate Investment TrustsRating: 4.5 out of 5 stars4.5/5 (4)

- Crabel T. Trading Close-To-close Patterns 1989Document4 pagesCrabel T. Trading Close-To-close Patterns 1989Om PrakashNo ratings yet

- Fin 645 - Assign 1 - FTPDocument20 pagesFin 645 - Assign 1 - FTPJalni100% (1)

- The ConstructDocument36 pagesThe Constructjadie aliNo ratings yet

- Relative Strength RankingDocument12 pagesRelative Strength Rankingscriberone0% (1)

- Expert Advisor and Forex Trading Strategies: Take Your Expert Advisor and Forex Trading To The Next LevelFrom EverandExpert Advisor and Forex Trading Strategies: Take Your Expert Advisor and Forex Trading To The Next LevelRating: 3 out of 5 stars3/5 (1)

- Sample CMT Level II ExamDocument67 pagesSample CMT Level II ExamHendra SetiawanNo ratings yet

- SUPPLY AND DEMAND MADE EASY by Bossman FXDocument13 pagesSUPPLY AND DEMAND MADE EASY by Bossman FXBoyka Kirov75% (4)

- 2 Elements of ChartingDocument8 pages2 Elements of ChartingDeepak Paul TirkeyNo ratings yet

- Supply and Demand Trading: The Definitive Guide (2020 Update)Document25 pagesSupply and Demand Trading: The Definitive Guide (2020 Update)ian metili80% (5)

- Rare Geometry of Stock Market ProfitsDocument160 pagesRare Geometry of Stock Market Profitsmerc297% (37)

- Price/Earnings Ratios: The High P/E of The Growing Companies This Year Is OminousDocument3 pagesPrice/Earnings Ratios: The High P/E of The Growing Companies This Year Is OminousHendra SetiawanNo ratings yet

- Moving Average CrossoversDocument10 pagesMoving Average CrossoversHendra SetiawanNo ratings yet

- Volume Indices: by Arthur MerrillDocument5 pagesVolume Indices: by Arthur MerrillHendra SetiawanNo ratings yet

- Price VolumeDocument3 pagesPrice VolumeCryptoFX96% (24)

- Lin80357 ch16Document35 pagesLin80357 ch16awaisjinnahNo ratings yet

- Technical AnalysisDocument36 pagesTechnical AnalysisAli Hyder100% (2)

- Victor Niederhoffer On Trend FollowingDocument9 pagesVictor Niederhoffer On Trend FollowingJack JensenNo ratings yet

- Time Series and Forecasting: Learning ObjectivesDocument33 pagesTime Series and Forecasting: Learning ObjectivesAkhlaq Ul HassanNo ratings yet

- New Complete Market Breadth IndicatorsDocument30 pagesNew Complete Market Breadth Indicatorsemirav2100% (2)

- Technical Trading Techniques With Statistical ProfitabilityDocument41 pagesTechnical Trading Techniques With Statistical ProfitabilityErezwaNo ratings yet

- SSRN Id3929119Document64 pagesSSRN Id3929119Fábio GabrielNo ratings yet

- Resistance: by Arthur A. Merrill, C.M.TDocument3 pagesResistance: by Arthur A. Merrill, C.M.THendra SetiawanNo ratings yet

- Chapter3 Investmentanalysis1 120919045823 Phpapp01Document38 pagesChapter3 Investmentanalysis1 120919045823 Phpapp01jaspreetNo ratings yet

- Time of Daily High and LowDocument3 pagesTime of Daily High and LowHendra SetiawanNo ratings yet

- Timothy Ord - Picking Tops and Bottoms With The Tick IndexDocument4 pagesTimothy Ord - Picking Tops and Bottoms With The Tick IndexAlberto Pedroni100% (1)

- Stock Selection - A Test of Relative Stock Values Reported Over 17.5 YearsDocument5 pagesStock Selection - A Test of Relative Stock Values Reported Over 17.5 YearsLooseNo ratings yet

- TRIGGER$ - May 2011Document37 pagesTRIGGER$ - May 2011goldenphiNo ratings yet

- Stock Selection: A Test of Relative Stock Values Reported Over 17 YearsDocument19 pagesStock Selection: A Test of Relative Stock Values Reported Over 17 YearsalexmorenoasuarNo ratings yet

- A Quantitative Approach To Tactical Asset Allocation Mebane FaberDocument47 pagesA Quantitative Approach To Tactical Asset Allocation Mebane FaberaliasadsjNo ratings yet

- Technical Analysis: DR - Manish Dadhich Mba, Net, SetDocument51 pagesTechnical Analysis: DR - Manish Dadhich Mba, Net, Setrseminar2024idsjNo ratings yet

- Price Pattern StudiesDocument6 pagesPrice Pattern StudiesjoeNo ratings yet

- TacticalAssetAllocation MFaberDocument11 pagesTacticalAssetAllocation MFabercsp69No ratings yet

- Tactical Asset Allocation, Mebane FaberDocument13 pagesTactical Asset Allocation, Mebane FabersashavladNo ratings yet

- Market Valuation StrategyDocument15 pagesMarket Valuation StrategyMailtodisposableMailtodisposableNo ratings yet

- Emh (Efficient Market Hypothesis)Document6 pagesEmh (Efficient Market Hypothesis)Sumit SrivastavNo ratings yet

- Highs and Lows: A Behavioral and Technical AnalysisDocument20 pagesHighs and Lows: A Behavioral and Technical AnalysisLawrence EmmanuelNo ratings yet

- Alpha-Beta Trend-Following Revisited: Summary of MethodDocument5 pagesAlpha-Beta Trend-Following Revisited: Summary of MethodPRABHASH SINGHNo ratings yet

- Momentum, Acceleration, and Reversal - 0Document12 pagesMomentum, Acceleration, and Reversal - 0Loulou DePanamNo ratings yet

- The Monthly Effect in International Stock Markets: Evidence and ImplicationsDocument6 pagesThe Monthly Effect in International Stock Markets: Evidence and Implicationsmehul_mistry_3No ratings yet

- ValuEngine Weekly Newsletter February 2, 2012, 2012Document10 pagesValuEngine Weekly Newsletter February 2, 2012, 2012ValuEngine.comNo ratings yet

- TechnicalAnalyst MarketBottoms1 09Document5 pagesTechnicalAnalyst MarketBottoms1 09applicoreNo ratings yet

- Trading The Election CycleDocument7 pagesTrading The Election Cyclestummel6636No ratings yet

- Artikel Internasional Abnormal ReturnDocument32 pagesArtikel Internasional Abnormal ReturnI Nyoman EndraNo ratings yet

- Value Versus Growth: The International EvidenceDocument30 pagesValue Versus Growth: The International Evidenceluv_y_kush3575No ratings yet

- 1 - Dollar Cost Averaging: Stock Market TimingDocument30 pages1 - Dollar Cost Averaging: Stock Market TimingkenNo ratings yet

- Technical S AnalysisDocument3 pagesTechnical S AnalysisSarvesh SinghNo ratings yet

- Intraday Time Analysis FINALDocument6 pagesIntraday Time Analysis FINALTradingSystemNo ratings yet

- Channel Centred Ma2Document9 pagesChannel Centred Ma2ppfahdNo ratings yet

- Cambria Tactical Asset AllocationDocument48 pagesCambria Tactical Asset Allocationemirav2No ratings yet

- The News in Financial Asset Returns: Gerald P. Dwyer Jr. and Cesare RobottiDocument23 pagesThe News in Financial Asset Returns: Gerald P. Dwyer Jr. and Cesare RobottiIqra JawedNo ratings yet

- 2.security AnalysisDocument18 pages2.security AnalysisSabarni ChatterjeeNo ratings yet

- Absolut (E) RetracementsDocument3 pagesAbsolut (E) Retracementslector_961No ratings yet

- Firm Performance and Stock Returns - Docx5Document5 pagesFirm Performance and Stock Returns - Docx5Shoaib Ahmed JunejoNo ratings yet

- MTA Symposium - My Notes (Vipul H. Ramaiya)Document12 pagesMTA Symposium - My Notes (Vipul H. Ramaiya)vipulramaiya100% (2)

- Momentum TradingDocument7 pagesMomentum TradingInversiones BvlNo ratings yet

- Technical and Fundamental Stock Analysis: The Essential Guide for InvestorsFrom EverandTechnical and Fundamental Stock Analysis: The Essential Guide for InvestorsNo ratings yet

- Use of Vectors in Financial Graphs: by Dr Abdul Rahim WongFrom EverandUse of Vectors in Financial Graphs: by Dr Abdul Rahim WongNo ratings yet

- Strategize Your Investment In 30 Minutes A Day (Steps)From EverandStrategize Your Investment In 30 Minutes A Day (Steps)No ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- The Importance of Time in Price Action TradingDocument2 pagesThe Importance of Time in Price Action TradingHendra SetiawanNo ratings yet

- Trend Detection: by Arthur MerrillDocument3 pagesTrend Detection: by Arthur MerrillHendra SetiawanNo ratings yet

- Who Needs Elliott Wave?: AppendixaDocument5 pagesWho Needs Elliott Wave?: AppendixaHendra SetiawanNo ratings yet

- FX Startegies CompressDocument26 pagesFX Startegies CompressHendra Setiawan100% (1)

- The Art of The ChartDocument130 pagesThe Art of The ChartHendra Setiawan100% (4)

- FX Startegies CompressDocument26 pagesFX Startegies CompressHendra SetiawanNo ratings yet

- Moving Average CrossoversDocument10 pagesMoving Average CrossoversHendra SetiawanNo ratings yet

- Time of Daily High and LowDocument3 pagesTime of Daily High and LowHendra SetiawanNo ratings yet

- Resistance: by Arthur A. Merrill, C.M.TDocument3 pagesResistance: by Arthur A. Merrill, C.M.THendra SetiawanNo ratings yet

- Price/Earnings Ratios: The High P/E of The Growing Companies This Year Is OminousDocument3 pagesPrice/Earnings Ratios: The High P/E of The Growing Companies This Year Is OminousHendra SetiawanNo ratings yet

- How Important Is A Turning PointDocument3 pagesHow Important Is A Turning PointHendra SetiawanNo ratings yet

- Cycles: by Arthur MerrillDocument3 pagesCycles: by Arthur MerrillHendra SetiawanNo ratings yet

- Closing Tick: Buyers' Market or Sellers' Market? Counting The Upticks and Downticks Can Give You A Clue, Merrill SaysDocument3 pagesClosing Tick: Buyers' Market or Sellers' Market? Counting The Upticks and Downticks Can Give You A Clue, Merrill SaysHendra SetiawanNo ratings yet

- Based On Current Trends of Volume and PriceDocument11 pagesBased On Current Trends of Volume and PriceHendra SetiawanNo ratings yet

- Strategies For The Simple Timing Indicator (STI) and Macd To Improve Investment PerformanceDocument22 pagesStrategies For The Simple Timing Indicator (STI) and Macd To Improve Investment PerformanceHendra SetiawanNo ratings yet

- Volume Is What Drives The MarketDocument1 pageVolume Is What Drives The MarketHendra SetiawanNo ratings yet

- Wyckoff Wave - Week in Review, May 6, 2016Document3 pagesWyckoff Wave - Week in Review, May 6, 2016Hendra SetiawanNo ratings yet

- Chart Analysis Pattern - Head and ShoulderDocument24 pagesChart Analysis Pattern - Head and ShoulderHendra Setiawan100% (2)

- CMT - CAPT Skills ChecklistDocument122 pagesCMT - CAPT Skills ChecklistHendra SetiawanNo ratings yet

- MarketScalper v5.5Document24 pagesMarketScalper v5.5Amir Fakhrunnizam SalingNo ratings yet

- 24 Never Failing RulesDocument2 pages24 Never Failing RulestamiyanvaradaNo ratings yet

- How To Trade Pivots and CPRDocument69 pagesHow To Trade Pivots and CPRutkarsh pathakNo ratings yet

- How To Trade Triangle Chart Patterns Like A ProDocument15 pagesHow To Trade Triangle Chart Patterns Like A ProLINDOH100% (1)

- Profitable Candlestick PatternsDocument13 pagesProfitable Candlestick PatternsVicaas VSNo ratings yet

- Equity Research Fundamental and Technical Analysis and Its Impact On Stock Prices With Reliance MoneyDocument81 pagesEquity Research Fundamental and Technical Analysis and Its Impact On Stock Prices With Reliance MoneyRs rs100% (2)

- In-Class Example 01Document31 pagesIn-Class Example 01Thịnh TrươngNo ratings yet

- GS Techs Charts For The Week Ahead Jun-20Document19 pagesGS Techs Charts For The Week Ahead Jun-20garag muniNo ratings yet

- Cryptoupdate MayDocument3 pagesCryptoupdate MayOwen FillmoreNo ratings yet

- Moving AverageDocument36 pagesMoving AverageFaisal KorothNo ratings yet

- Alphaex Capital Candlestick Pattern Cheat Sheet InfographDocument1 pageAlphaex Capital Candlestick Pattern Cheat Sheet InfographAlfian Amin100% (1)

- Intraday Trading With The TickDocument5 pagesIntraday Trading With The Tickthecrew67100% (1)

- Animals in A MarketDocument3 pagesAnimals in A MarketMirudhulla BalanathanNo ratings yet

- Atlas Battery Limited: Group Project By: Aqsa A. Khan Rounaq QaiserDocument21 pagesAtlas Battery Limited: Group Project By: Aqsa A. Khan Rounaq QaiserROUNAQ 11952No ratings yet

- Investor Sentiment.Document12 pagesInvestor Sentiment.o_alolahNo ratings yet

- Day Trading EdgeDocument10 pagesDay Trading Edgemleefx0% (1)

- Trendline Breakout Trading Strategy PDF FreeDocument63 pagesTrendline Breakout Trading Strategy PDF FreeAssad Saghir100% (1)

- Zero Based Budgeting - ZBBDocument58 pagesZero Based Budgeting - ZBBTulasi Nadh MtnNo ratings yet

- Point and Figure PatternsDocument12 pagesPoint and Figure PatternsRavi VarakalaNo ratings yet

- Mayank Mehta Final ProjectDocument41 pagesMayank Mehta Final ProjectMayank MehtaNo ratings yet

- Gautam Baid - The Making of A Value Investor-HarperCollins India (2023)Document260 pagesGautam Baid - The Making of A Value Investor-HarperCollins India (2023)vijaygawdeNo ratings yet

- Gunner Newsletter On YEars Prediction in Stock MKTDocument7 pagesGunner Newsletter On YEars Prediction in Stock MKTPasupathi SNo ratings yet

- Chart Patterns Cheat SheetDocument3 pagesChart Patterns Cheat SheetAnh Duc HungNo ratings yet