Professional Documents

Culture Documents

W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue Service

W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue Service

Uploaded by

Megan AndreaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue Service

W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue Service

Uploaded by

Megan AndreaCopyright:

Available Formats

7 Social security tips

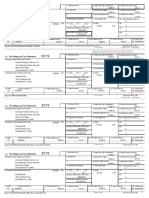

Form W-2 Wage and Tax Statement 2020 1 Wages, tips, other compensation

14,489.48

2 Federal income tax withheld

1,153.00

c Employer's name, address, and ZIP code 8 Allocated tips 3 Social security wages 4 Social security tax withheld

14,489.48 898.38

Walden Security

9 5 Medicare wages and tips 6 Medicare tax withheld

A Division Of Metropolitan Security 14,489.48 210.14

100 East 10th Street 10 Dependent care benefits 11 Nonqualified plans C 12a See instructions for box 12

o

Chattanooga TN 37402 d

e

Statutory Retirement Third-party

e Employee's name, address, and ZIP code 13434 Suff. 13 employee Plan Sick pay

14 Other C 12b

o

d

e

Megan A Dunbar b Employer identification number (EIN) C 12c

o

3387 Wagener Rd

d

621448519 e

Aiken SC 29801-8130 a Employee's social security number C

o

12d

251-95-4982

d

e

15 State Employer's state ID no. 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

SC 254892987 14,489.48 634.67

Copy B To Be Filed With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. Dept of the Treasury - IRS

OMB No. 1545-0008 Visit the IRS Web Site at www.irs.gov/efile

.

This information is being furnished to the Internal Revenue Service. If you are required to file a tax return, a

negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

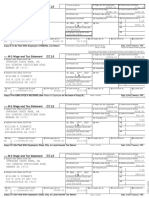

7 Social security tips 1 Wages, tips, other compensation

Form W-2 Wage and Tax Statement 2020 14,489.48

2 Federal income tax withheld

1,153.00

c Employer's name, address, and ZIP code 8 Allocated tips 3 Social security wages 4 Social security tax withheld

14,489.48 898.38

Walden Security

9 5 Medicare wages and tips 6 Medicare tax withheld

A Division Of Metropolitan Security 14,489.48 210.14

100 East 10th Street 10 Dependent care benefits 11 Nonqualified plans C 12a See instructions for box 12

o

Chattanooga TN 37402 d

e

Statutory Retirement Third-party

e Employee's name, address, and ZIP code 13434 Suff. 13 employee Plan Sick pay

14 Other C

o

12b

d

e

Megan A Dunbar b Employer identification number (EIN) C 12c

o

3387 Wagener Rd 621448519

d

e

Aiken SC 29801-8130 a Employee's social security number C

o

12d

***-**-4982

d

e

15 State Employer's state ID no. 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

SC 254892987 14,489.48 634.67

Copy C For EMPLOYEE'S RECORDS OMB No. 1545-0008 Dept of the Treasury - IRS

Visit the IRS Web Site at www.irs.gov/efile

.

2020

7 Social security tips 1 Wages, tips, other compensation 2 Federal income tax withheld

Form W-2 Wage and Tax Statement 14,489.48 1,153.00

c Employer's name, address, and ZIP code 8 Allocated tips 3 Social security wages 4 Social security tax withheld

14,489.48 898.38

Walden Security

9 5 Medicare wages and tips 6 Medicare tax withheld

A Division Of Metropolitan Security 14,489.48 210.14

100 East 10th Street 10 Dependent care benefits 11 Nonqualified plans C 12a See instructions for box 12

o

Chattanooga TN 37402

d

e

Statutory Retirement Third-party

e Employee's name, address, and ZIP code Suff. 13 14 Other 12b

13434 employee Plan Sick pay C

o

d

e

Megan A Dunbar b Employer identification number (EIN) C 12c

o

d

3387 Wagener Rd 621448519 e

Aiken SC 29801-8130 a Employee's social security number C 12d

o

251-95-4982

d

e

15 State Employer's state ID no. 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

SC 254892987 14,489.48 634.67

OMB No. 1545-0008 Dept of the Treasury - IRS

Copy 2 To Be Filed With Employee's State, City, or Local Income Tax Return

Form W-2 Wage and Tax Statement 2020 7 Social security tips 1 Wages, tips, other compensation

14,489.48

2 Federal income tax withheld

1,153.00

c Employer's name, address, and ZIP code 8 Allocated tips 3 Social security wages 4 Social security tax withheld

14,489.48 898.38

Walden Security

9 5 Medicare wages and tips 6 Medicare tax withheld

A Division Of Metropolitan Security 14,489.48 210.14

100 East 10th Street 10 Dependent care benefits 11 Nonqualified plans C 12a See instructions for box 12

o

Chattanooga TN 37402

d

e

Statutory Retirement Third-party

e Employee's name, address, and ZIP code 13434 Suff. 13 employee Plan Sick pay

14 Other C 12b

o

d

e

Megan A Dunbar b Employer identification number (EIN) C 12c

o

3387 Wagener Rd

d

621448519 e

Aiken SC 29801-8130 a Employee's social security number C

o

12d

251-95-4982

d

e

15 State Employer's state ID no. 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

SC 254892987 14,489.48 634.67

Copy 2 To Be Filed With Employee's State, City, or Local Income Tax OMB No. 1545-0008 Dept of the Treasury - IRS

You might also like

- Wage and Tax Statement: OMB No. 1545-0008Document3 pagesWage and Tax Statement: OMB No. 1545-0008h6bnyrr9mrNo ratings yet

- Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Document1 pageThink Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Humayon MalekNo ratings yet

- C89ST + C89IM - Solutions - J14 - Timezone 1Document10 pagesC89ST + C89IM - Solutions - J14 - Timezone 1MM Fakhrul IslamNo ratings yet

- Deloitte The Tokenization of Assets Disrupting Financial IndustryDocument6 pagesDeloitte The Tokenization of Assets Disrupting Financial IndustryPatrickZitignaniNo ratings yet

- 1 - Legal System of PakistanDocument20 pages1 - Legal System of PakistanSalman Shahzad40% (5)

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument2 pagesW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceJunk BoxNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008SuheilNo ratings yet

- Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageWage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesse Nichols100% (1)

- Adeccow 215Document2 pagesAdeccow 215ier362No ratings yet

- 2020 W2 FormDocument7 pages2020 W2 FormMaria HowellNo ratings yet

- Wage and Tax Statement: Copy C-For Employee'S RecordsDocument1 pageWage and Tax Statement: Copy C-For Employee'S RecordslidiaNo ratings yet

- Wage and Tax StatementDocument6 pagesWage and Tax StatementNick RubleNo ratings yet

- W-2 Wage and Tax Statement: J-EE Ret - 1983.18Document1 pageW-2 Wage and Tax Statement: J-EE Ret - 1983.18what is thisNo ratings yet

- Monday Debra PYW216S EEDocument2 pagesMonday Debra PYW216S EEDeb LewisNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- Magnum Management Corp One Cedar Point DR Sandusky Oh 44870Document7 pagesMagnum Management Corp One Cedar Point DR Sandusky Oh 44870Hermes Andrés LugmañaNo ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument1 pageW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceKyngleaf DamnNo ratings yet

- W-2 Wage and Tax Statement: I I I IDocument1 pageW-2 Wage and Tax Statement: I I I Imichelle analieNo ratings yet

- W-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageW-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesus GarciaNo ratings yet

- Wage and Tax Statement: Employee's Social Security NumberDocument6 pagesWage and Tax Statement: Employee's Social Security NumberErma MonieNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document4 pagesWage and Tax Statement: OMB No. 1545-0008jgoldson235No ratings yet

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- Pyw219s Ee PDFDocument1 pagePyw219s Ee PDFBeyonceNo ratings yet

- Magnum Management Corp 8039 Beach BLVD Buena Park Ca 90620Document7 pagesMagnum Management Corp 8039 Beach BLVD Buena Park Ca 90620SamNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument1 pageWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atHenry KilmekNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atDocument3 pagesWage and Tax Statement: OMB No. 1545-0008 Visit The IRS Website atcofi kenteNo ratings yet

- 2020 W2 Forms CaseyDocument9 pages2020 W2 Forms CaseyjuliusomotayooluwagbemiNo ratings yet

- Wage and Tax Statement: Last Name SuffDocument1 pageWage and Tax Statement: Last Name SuffDavid RadNo ratings yet

- Wage and Tax Statement: Copy C-For Employee'S RecordsDocument3 pagesWage and Tax Statement: Copy C-For Employee'S RecordsyoNo ratings yet

- Your 2021 Forms W-2 Are EnclosedDocument7 pagesYour 2021 Forms W-2 Are Enclosednethpas622No ratings yet

- Your 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2Document7 pagesYour 2020 Forms W-2 Are Enclosed: What You Should Do With Form W-2bassomassi sanogoNo ratings yet

- Wage and Tax Statement: Copy 1-For State, City, or Local Tax DepartmentDocument2 pagesWage and Tax Statement: Copy 1-For State, City, or Local Tax DepartmentVicky KeNo ratings yet

- 2021 W2 Marcus RobertsDocument1 page2021 W2 Marcus RobertsDAISY CRAINNo ratings yet

- IRS Form W2Document1 pageIRS Form W2nurulamin00023No ratings yet

- Untitled 3Document1 pageUntitled 3Gregory SMithNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008jacqueline corral0% (1)

- 623 Cce 3 BD 2 FB 0Document1 page623 Cce 3 BD 2 FB 0mondol miaNo ratings yet

- Bank Document - 1024889356736934991Document7 pagesBank Document - 1024889356736934991alexanderlucasnicolasNo ratings yet

- LA w2 NewDocument1 pageLA w2 Newchde795No ratings yet

- Pyw223s EeDocument1 pagePyw223s Eedanielman956No ratings yet

- Pyw223s EeDocument1 pagePyw223s EeSean KingNo ratings yet

- XXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084Document6 pagesXXX-XX-1785 18704.00 116.62 18704.00 1159.65 18704.00 271.21 Houston TX 77084CR FNo ratings yet

- Matthew Wozniak W2 2021 W2 202233131923Document3 pagesMatthew Wozniak W2 2021 W2 202233131923MwNo ratings yet

- w-2 2019 Form - LOUISA - BOKACHEVADocument1 pagew-2 2019 Form - LOUISA - BOKACHEVAKeller Brown JnrNo ratings yet

- Annemarie BednarDocument3 pagesAnnemarie BednarSmerling PaulinoNo ratings yet

- w2 Efile 2023Document10 pagesw2 Efile 2023latrellNo ratings yet

- PDF PreviewDocument5 pagesPDF PreviewJosephNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument9 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerImran SadiqNo ratings yet

- 2021 W2 Angela LiDocument1 page2021 W2 Angela LiDAISY CRAINNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- Wage and Tax Statement: Copy C-For EMPLOYEE'S RECORDS (See Notice To On The Back of Copy B.)Document1 pageWage and Tax Statement: Copy C-For EMPLOYEE'S RECORDS (See Notice To On The Back of Copy B.)Steven LinNo ratings yet

- w2 - Blankss FillableDocument3 pagesw2 - Blankss Fillablemuhammad mudassarNo ratings yet

- form-w2-Ramona-Crawford 2Document9 pagesform-w2-Ramona-Crawford 2Nicole CarutherNo ratings yet

- Justin w2Document2 pagesJustin w2jusditzNo ratings yet

- W2 DataDocument2 pagesW2 Dataahasgahsg031No ratings yet

- FOLYD D Form W-2Document1 pageFOLYD D Form W-2bucks tomNo ratings yet

- Wage and Tax StatementDocument10 pagesWage and Tax Statementjennamayer2No ratings yet

- w2 FINALDocument10 pagesw2 FINALmuhammad mudassarNo ratings yet

- US Internal Revenue Service: fw2 - 2001Document12 pagesUS Internal Revenue Service: fw2 - 2001IRSNo ratings yet

- W2Form 2020Document10 pagesW2Form 2020bassomassi sanogoNo ratings yet

- W e ND A Statement 2020: Ag A T XDocument2 pagesW e ND A Statement 2020: Ag A T Xadam burdNo ratings yet

- Penal Provisions Under The Wbvat Act, 2003Document31 pagesPenal Provisions Under The Wbvat Act, 2003Anshuman ChakrabortyNo ratings yet

- Vanishing Deductions X Estate Tax ComputationDocument2 pagesVanishing Deductions X Estate Tax ComputationShiela Mae OblanNo ratings yet

- Online MutationDocument2 pagesOnline MutationBHAVANA SHARMA VELLIKANTINo ratings yet

- PT FormatDocument7 pagesPT FormatRavi YadavNo ratings yet

- Invoice DocumentDocument1 pageInvoice Documentpgpm20 SANCHIT GARGNo ratings yet

- Basic Concepts of Macroeconomics: Question BankDocument2 pagesBasic Concepts of Macroeconomics: Question BankChinmay AgarwalNo ratings yet

- Maintain New Tax Codes and Tax Boxing - LegacyDocument5 pagesMaintain New Tax Codes and Tax Boxing - LegacymmtNo ratings yet

- 2224 Payslip Feb2023 PDFDocument1 page2224 Payslip Feb2023 PDFTirumalesha DadigeNo ratings yet

- Power Sector Assets and Liabilities Management Corporation, v. Commissioner of InternalDocument4 pagesPower Sector Assets and Liabilities Management Corporation, v. Commissioner of InternalewnesssNo ratings yet

- Quiznet: Topic: Financial VocabularyDocument4 pagesQuiznet: Topic: Financial VocabularydawnontheseaNo ratings yet

- The Covid-19 (Miscellaneous Provisions) BillDocument84 pagesThe Covid-19 (Miscellaneous Provisions) BillION News0% (1)

- Scheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Document20 pagesScheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Shyam SunderNo ratings yet

- 5 - ERC Rate-Setting Methodologies - AJMO PDFDocument47 pages5 - ERC Rate-Setting Methodologies - AJMO PDFCavinti LagunaNo ratings yet

- Externalities: Problems and Solutions: ExternalityDocument15 pagesExternalities: Problems and Solutions: ExternalityBin BIn100% (1)

- Cbse Guide Question BankDocument30 pagesCbse Guide Question Bank8s6s22mzk2No ratings yet

- Tax Final Part 5Document37 pagesTax Final Part 5Angelica Jane AradoNo ratings yet

- Section 56 - Decoding Section 56 of The Income-Tax Act, 1961 (ITDocument5 pagesSection 56 - Decoding Section 56 of The Income-Tax Act, 1961 (ITNavyaNo ratings yet

- Implementation Guide - India LocalizationDocument181 pagesImplementation Guide - India Localizationmaneeshnarayan0% (1)

- Mark Scheme Q3 MicroeconomicsDocument5 pagesMark Scheme Q3 MicroeconomicsVittoria RussoNo ratings yet

- Letter of Atty. Cecilio Y. Arevalo, JR., Requesting Exemption From Payment of Ibp Dues.Document3 pagesLetter of Atty. Cecilio Y. Arevalo, JR., Requesting Exemption From Payment of Ibp Dues.Rose De JesusNo ratings yet

- MultiPaySlip 2022 12 05T18 31 31Document1 pageMultiPaySlip 2022 12 05T18 31 31Navin JhqNo ratings yet

- Iedman Milton Friedman and The Social Responsibility of Business Is To Increase Its Profits The New York Times Magazine, September 13, 1970Document14 pagesIedman Milton Friedman and The Social Responsibility of Business Is To Increase Its Profits The New York Times Magazine, September 13, 1970SFLDNo ratings yet

- Isb535 Individual Assignment-1Document14 pagesIsb535 Individual Assignment-1Raziq ProNo ratings yet

- Manual of Practice For Handling Customer Complaints: Vodafone India LimitedDocument16 pagesManual of Practice For Handling Customer Complaints: Vodafone India LimitedsaivsNo ratings yet

- CIR v. LednickyDocument2 pagesCIR v. LednickyBananaNo ratings yet

- IDM-33 Joint Ventures and Privatization in Infrastructure ProjectsDocument23 pagesIDM-33 Joint Ventures and Privatization in Infrastructure ProjectsSam RogerNo ratings yet

- Acjc H1 Econs P1 QP PDFDocument9 pagesAcjc H1 Econs P1 QP PDFokiidiniNo ratings yet