Professional Documents

Culture Documents

Advance Management Accounting: Individual Assignment

Advance Management Accounting: Individual Assignment

Uploaded by

Aditya AnandaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advance Management Accounting: Individual Assignment

Advance Management Accounting: Individual Assignment

Uploaded by

Aditya AnandaCopyright:

Available Formats

ADVANCE MANAGEMENT ACCOUNTING

INDIVIDUAL ASSIGNMENT:

PR Pertemuan 9

PREPARED BY:

ADITYA ANANDA (2006619463)

Copyright Aditya. pg. 1

STATEMENT OF RESPONSIBILITY

Hereby we declare that the workpaper herewith is an authentic writing done by ourselves. No

other work of authors have been used without any reference to it’s sources. This workpaper has

never been used as assignment except there is any clear statement from us.

We fully understand that this workpaper can be communicated for the purpose of detecting

plagiarism

Student Name and NIP : Aditya Ananda (2006619463)

Class : F202

Assignment : PR Pertemuan 9

Date : 8 May 2021

Lecturer : Dr. Dyah Setyaningrum S.E., M.S.M., CPMA., CA.

Copyright Aditya. pg. 2

Problem 8.36

Projected Sales in Units for the coming five months:

Projected

Month Sales

January 10,000

February 10,500

March 13,000

April 16,000

May 18,500

Finished Good January 1 = 900 units

Desired Ending = 20% of next month’s sales

Direct Per Unit Unit

Material Usage Cost

Part#K298 2 4

Part#C30 3 7

Direct Labor used per unit = 1 hour and 1.5 hour.

Average DL Cost Per hour = USD20,-

Overhead each month estimated using a flexible budget formula

Fixed Cost Variable Cost

Component Component

Supplies -‐ 1.00

Power -‐ 0.20

Maintenance 12,500.00 1.10

Supervision 14,000.00 -‐

Depreciation 45,000.00 -‐

Taxes 4,300.00 -‐

Other 86,000.00 1.60

Monthly selling and administrative expenses also estimated using a flexible budgeting formula

Fixed Cost Variable Cost

Salaries 88,500.00 -‐

Commisions -‐ 1.40

Depreciation 25,000.00 -‐

Shipping -‐ 3.60

Other 137,000.00 1.60

Copyright Aditya. pg. 3

Unit Selling Price = USD110,-

Sales and Purchase in cash.

Cash Beginning Balance = USD62.900,-

Ending Cash Balance = USD25.000,-

Cash shortage fill by borrowing in USD1.000,- increments and repaid the following month as

interest due. Interest rate is 12% per annum.

Jawab:

a. Sales Budget

Projected Projected

Month Sales Unit Price Sales

(unit) (amount)

January 10,000 110

1,100,000

February 10,500 110

1,155,000

March 13,000 110

1,430,000

April 16,000 110

1,760,000

May 18,500 110

2,035,000

b. Production Budget

Projected Desired

Begining Production

Month Sales Ending

Balance Budget

(unit) Inventory

January 10,000 2,100 -‐900

11,200

February 10,500 2,600 -‐2,100

11,000

March 13,000 3,200 -‐2,600

13,600

April 16,000 3,700 -‐3,200

16,500

c. Direct Material Purchase Budget

Month

January February March

Production Budget 11,200 11,000 13,600

DM Used

Part#K298 22,400 22,000 27,200

Part#C30 33,600 33,000 40,800

Copyright Aditya. pg. 4

Desired Ending

Balance

Part#K298 6,600 8,160 9,900

Part#C30 9,900 12,240 14,850

Beginning Balance

Part#K298 -‐6,720 -‐6,600 -‐8,160

Part#C30 -‐10,080 -‐9,900 -‐12,240

DM to Purchase

Part#K298 22,280 23,560 28,940

Part#C30 33,420 35,340 43,410

Purchase Cost

Part#K298 89,120 94,240 115,760

Part#C30 233,940 247,380 303,870

Total 323,060 341,620 419,630

d. Direcct Labor Budget

Month

January February March April

Production

Budget 11,200.00 11,000.00 13,600.00 16,500.00

Unit hours 1.50 1.50 1.50 1.50

Total Hours

Required 16,800.00 16,500.00 20,400.00 24,750.00

DL Rate 20.00 20.00 20.00 20.00

DL Cost 336,000.00 330,000.00 408,000.00 495,000.00

e. Overhead Budget

Month

January February March April

DL

Hours

16,800

16,500

20,400

24,750

Supplies

16,800

16,500

20,400

24,750

Power

3,360

3,300

4,080

4,950

Maintenance

30,980

30,650

34,940

39,725

Supervision

14,000

14,000

14,000

14,000

Copyright Aditya. pg. 5

Depreciation 45,000 45,000 45,000 45,000

Taxes 4,300 4,300 4,300 4,300

Other 112,880 112,400 118,640 125,600

Total Cost 227,320 226,150 241,360 258,325

f. Selling and Administrative Expense Budget

Month

January February March April May

Unit

Sold

10,000

10,500

13,000

16,000

18,500

Salaries

88,500

88,500

88,500

88,500

88,500

Commissions

14,000

14,700

18,200

22,400

25,900

Depreciation

25,000

25,000

25,000

25,000

25,000

Shipping

36,000

37,800

46,800

57,600

66,600

Other

153,000

153,800

157,800

162,600

166,600

Total

Cost

316,500

319,800

336,300

356,100

372,600

g. Ending finish Good Inventory Budget

Month

January

February

March

Direct

Material

Part#K298

8.00

8.00

8.00

Part#C30

21.00

21.00

21.00

DM

Used

29.00

29.00

29.00

DL

Cost

30.00

30.00

30.00

Overhead

cost

19.41

19.41

19.41

Total

Cost

78.41

78.41

78.41

FG

Unit

2,100.00

2,600.00

3,200.00

FG

Cost

164,661.00

203,866.00

250,912.00

h. COGS Budget

Month

January

February

March

DM

Used

Part#K298

89,600

88,000

108,800

Part#C30

235,200

231,000

285,600

DL

Used

336,000

330,000

408,000

Overhad

227,320

226,150

241,360

Copyright Aditya. pg. 6

Manufacturing

Cost 888,120 875,150 1,043,760

Beginning FG 70,569 164,661 203,866

Ending FG -‐164,661 -‐203,866 -‐250,912

COGS Budget 794,028 835,945 996,714

i. Budgeted Income Statement

Month

January

February

March

Sales

1,100,000

1,155,000

1,430,000

COGS

794,028

835,945

996,714

Gross

Profit

305,972

319,055

433,286

Operating

Expense

316,500

319,800

336,300

Income

Before

Taxes

-‐10,528

-‐745

96,986

j. Cash Budget

Month

January

February

March

Beginning

Balance

62,900

30,020

25,450

Cash

Receipt

1,100,000

1,155,000

1,430,000

Cash

Available

1,162,900

1,185,020

1,455,450

Disbursement

Purchase

323,060

341,620

419,630

DL

Payroll

336,000

330,000

408,000

Overhead

182,320

181,150

196,360

Marketing

and

Admin

291,500

294,800

311,300

Land

-‐

68,000

-‐

Total

Disbursement

1,132,880

1,215,570

1,335,290

Ending

Balance

30,020

-‐30,550

120,160

Financing

Borrow/Repaid

-‐

56,000

-‐56,000

Interest

Paid

-‐

-‐

-‐560

Ending

Cash

Balance

30,020

25,450

63,600

Copyright Aditya. pg. 7

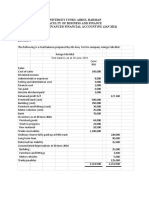

Problem 8.37

1. Balance Sheet

Account Assets Liabilities Owner Equity

Cash 19,200

Account Receivable 113,400

Inventory 24,300

Plant and Equipment 431,750

Account Payable -‐99,900

Common Stock -‐220,000

Retained Earnings -‐268,750

Total 588,650 -‐99,900 -‐488,750

2. Cash Budget

Sales

Collection

Budget

July

August

September

October

November

Sales

100,000

120,000

90,000

100,000

135,000

Cash

Sales

20,000

24,000

18,000

20,000

27,000

Credit

Sales

80,000

96,000

72,000

80,000

108,000

Collection

from

Debtors

20%

in

the

month

of

sale

16,000

19,200

14,400

16,000

21,600

50%

in

the

next

month

40,000

48,000

36,000

40,000

30%

in

the

second

month

following

24,000

28,800

21,600

Cash

from

Sales

36,000

83,200

104,400

100,800

110,200

Cash

Payment

Budget

July

August

September

October

November

Sales

100,000

120,000

90,000

100,000

135,000

COGS

75,000

90,000

67,500

75,000

101,250

Closing

Stock

36,000

27,000

30,000

40,500

-‐

Opening

Stock

36,000

27,000

30,000

40,500

Purchase

81,000

70,500

85,500

105,750

Copyright Aditya. pg. 8

Payment for

Purchase 81,000 70,500 85,500

Cash Budget

September October November

Opening Balance 10,200 10,900 17,463

Cash Collection 104,400 100,800 110,200

Payment for

Purchase 81,000 70,500 85,500

Salaries and

Wages 10,000 10,000 10,000

Utilities 1,000 1,000 1,000

Other 1,700 1,700 1,700

Property Taxes 15,000

Advertising 6,000

Lease Payment 5,000

Total Payment 108,700 89,200 103,200

Balance in Hand 5,900 22,500 24,463

Interest Payment

and Principal

Payment 5,038

Minimum

Balance 10,000

Borrowing -‐5,000

Closing Balance 10,900 17,463

3. Proforma Balance Sheet

Proforma Income Statement

Sales 325,000

COGS -‐243,750

Gross Profit 81,250

Opex

Salaries and Wages 30,000

Utilities 3,000

Other 5,100

Property Taxes 15,000

Advertising 6,000

Lease Payment 5,000

Depreciation 12,000

Interest Payment 38

Copyright Aditya. pg. 9

Net Profit 5,113

Proforma Balance Sheet

FSLI Assets Liabilities Equity

Cash 24,463

Account Receivable 78,000

Inventory 45,000

Short Term Marketable

Securities 32,400

Plant and Equipment 419,750

Account Payable -‐105,750

Common Stock -‐220,000

Retained Earnings -‐273,863

599,613 -‐105,750 -‐493,863

Copyright Aditya. pg. 10

You might also like

- SolutionDocument6 pagesSolutionJhazzie Dolor100% (1)

- Management AccountingDocument6 pagesManagement AccountingJohn Allen Cruz Caballa100% (2)

- Business Plan (Bigasan)Document10 pagesBusiness Plan (Bigasan)Harold Kent MendozaNo ratings yet

- 8.3 Burlingham Bees Using Anlaytical Procedures As Substantive TestsDocument5 pages8.3 Burlingham Bees Using Anlaytical Procedures As Substantive TestsSilvia SucelyNo ratings yet

- Static and Flexible Budget ExampleDocument12 pagesStatic and Flexible Budget ExampleAFSYARINA BT ZUNAIDI50% (2)

- Lastest Advancements in Process Control in RefineryDocument15 pagesLastest Advancements in Process Control in Refinerydiazf2004No ratings yet

- Year Accounting Income Taxable Income Timing Difference (Balance) Deferred Tax Liability (Balance)Document11 pagesYear Accounting Income Taxable Income Timing Difference (Balance) Deferred Tax Liability (Balance)anon_573519739No ratings yet

- Team 10Document2 pagesTeam 10api-314570886No ratings yet

- Assignment 1 - Joson Jenica - Bsa 2 2Document6 pagesAssignment 1 - Joson Jenica - Bsa 2 2CPAREVIEWNo ratings yet

- Sample Production PlanDocument2 pagesSample Production PlanSheila ivy p guyudNo ratings yet

- UV0806 North Mountain Nursery, Inc - Statement of Cahs FlowDocument3 pagesUV0806 North Mountain Nursery, Inc - Statement of Cahs Flowpaocvl892No ratings yet

- Assignment Cover Sheet Qualification Module Number and TitleDocument9 pagesAssignment Cover Sheet Qualification Module Number and Titlejey456No ratings yet

- Hansell Income Statement Group 1Document5 pagesHansell Income Statement Group 1Ashish RanjanNo ratings yet

- Business Budget - Assignment ProblemsDocument3 pagesBusiness Budget - Assignment ProblemsSHARATH JNo ratings yet

- Ifrs 9 Review Questions and Ias 1 QNSDocument4 pagesIfrs 9 Review Questions and Ias 1 QNSsaidkhatib368No ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementAtif SiddiquiNo ratings yet

- 7 Biscuit DistributorshipDocument8 pages7 Biscuit Distributorshiprachanabali1999No ratings yet

- (RM) (RM)Document2 pages(RM) (RM)Nurul Sabira RahmanNo ratings yet

- Managerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Document5 pagesManagerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Miral AqelNo ratings yet

- Lap Laba Rugi Tata SuryaDocument2 pagesLap Laba Rugi Tata SuryaFadillah RamadhaniNo ratings yet

- Exercises On Projected Financial StatementsDocument4 pagesExercises On Projected Financial StatementsMicca DeynNo ratings yet

- (C) San Antonio Home Furnishings Company-1Document3 pages(C) San Antonio Home Furnishings Company-1Mark OteroNo ratings yet

- Project Report PAPADDocument3 pagesProject Report PAPADsagayapriya50% (2)

- Final OutputDocument3 pagesFinal OutputJudith DurensNo ratings yet

- Budgeting OnlineDocument4 pagesBudgeting OnlineSoumendra RoyNo ratings yet

- Business Plan: Vela The Nepali KitchenDocument8 pagesBusiness Plan: Vela The Nepali KitchenAkash NeupaneNo ratings yet

- Tutorial Chapter 5Document8 pagesTutorial Chapter 5Aisyah SafiNo ratings yet

- Cost Accounting Budgets Case BookDocument10 pagesCost Accounting Budgets Case Bookms23a036No ratings yet

- Financial Management Master Budget ExerciseDocument10 pagesFinancial Management Master Budget ExerciseJerickho JNo ratings yet

- Excel For Project ValuationDocument10 pagesExcel For Project ValuationbhaumikgodhaniNo ratings yet

- Chapter 3and 4 Assignment-QDocument2 pagesChapter 3and 4 Assignment-QBLESSEDNo ratings yet

- Cost Accounting Week 3 - AnswersDocument10 pagesCost Accounting Week 3 - AnswersFiles OrganizedNo ratings yet

- AssignmentDocument11 pagesAssignmentKBA AMIRNo ratings yet

- Project ReportDocument6 pagesProject Reportrubi laariNo ratings yet

- Module 2 Key To CorrectionsDocument5 pagesModule 2 Key To CorrectionsPlame GaseroNo ratings yet

- WCM Sum IcaiDocument32 pagesWCM Sum IcaiKumardeep SinghaNo ratings yet

- Test 3, Montolalu, Wahyu YohanesDocument7 pagesTest 3, Montolalu, Wahyu YohanesDimas LimpongNo ratings yet

- Department AccountingDocument12 pagesDepartment AccountingRajesh NangaliaNo ratings yet

- Discussion Question 2Document6 pagesDiscussion Question 2Sadhna MaharjanNo ratings yet

- Laundry Dobi4Share ProjectionDocument13 pagesLaundry Dobi4Share ProjectionTalk 2meNo ratings yet

- Dec 2017 AnsDocument23 pagesDec 2017 AnsbinuNo ratings yet

- Profit Prior To IncorporationDocument12 pagesProfit Prior To IncorporationKalash SharmaNo ratings yet

- Tagala Aec 217 Week 4 ActivityDocument2 pagesTagala Aec 217 Week 4 ActivityDrewGuanzonGoboyTagalaNo ratings yet

- Problem On Cash Budget: 8 (The End of The Prior Quarter), The Company's Balance Were As FollowsDocument4 pagesProblem On Cash Budget: 8 (The End of The Prior Quarter), The Company's Balance Were As Followsshreya chapagainNo ratings yet

- ACT301 (Final), Spring-21Document4 pagesACT301 (Final), Spring-21Papon SarkerNo ratings yet

- Mba 104 PDFDocument2 pagesMba 104 PDFSimanta KalitaNo ratings yet

- NUMBER 1: Problem 2 On Page 391 - 392Document4 pagesNUMBER 1: Problem 2 On Page 391 - 392AIENNA GABRIELLE FABRONo ratings yet

- GivenDocument17 pagesGivenApurvAdarshNo ratings yet

- SM CSE ACT 301 Final AssessmentDocument4 pagesSM CSE ACT 301 Final AssessmentArifur Rahaman 182-15-2111No ratings yet

- Universiti Tunku Abdul Rahman Faculty of Business and Finance Ubaf 2113 Advanced Financial Accounting (Jan 2021) Tutorial 1Document5 pagesUniversiti Tunku Abdul Rahman Faculty of Business and Finance Ubaf 2113 Advanced Financial Accounting (Jan 2021) Tutorial 1KAY PHINE NGNo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsCha EsguerraNo ratings yet

- Lecture 11Document26 pagesLecture 11Riaz Baloch Notezai100% (1)

- Joint ArrangementDocument3 pagesJoint ArrangementAlliah Mae AcostaNo ratings yet

- FM AssignmentDocument6 pagesFM AssignmentDarshan MoreNo ratings yet

- 5th Year Pre-Final ExamDocument3 pages5th Year Pre-Final ExamJoshua UmaliNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- The Assembly Department Uses A Process Cost Accounting System and A Weighted-Average CostDocument5 pagesThe Assembly Department Uses A Process Cost Accounting System and A Weighted-Average CostSGNo ratings yet

- Dream World CompanyDocument9 pagesDream World CompanyJC NicaveraNo ratings yet

- BSBA2A Clothing-LineDocument10 pagesBSBA2A Clothing-LinePAULA MARQUEZNo ratings yet

- Crude Edible Oil Expeller: Nsic Project ProfilesDocument3 pagesCrude Edible Oil Expeller: Nsic Project Profilesgraj143No ratings yet

- Accounting For Tania MamDocument24 pagesAccounting For Tania MamTanjinNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- The Otis Absolutes: Made To Move YouDocument23 pagesThe Otis Absolutes: Made To Move Youmathi alaganNo ratings yet

- Return Authorization Form - PutzmeisterDocument2 pagesReturn Authorization Form - PutzmeisterBradley BergNo ratings yet

- Nanyang CaseDocument44 pagesNanyang CaseThirukumaren JeyasagarenNo ratings yet

- SG - Product CatalogueDocument12 pagesSG - Product CatalogueManish JhaNo ratings yet

- Accenture Global Boom in Fintech InvestmentDocument16 pagesAccenture Global Boom in Fintech InvestmentRachid IdbouzghibaNo ratings yet

- Supply Chain Management (Haya Ali Kazmi 12487)Document6 pagesSupply Chain Management (Haya Ali Kazmi 12487)HAYA ALI KAZMINo ratings yet

- EDMS For SP Package OptionDocument1 pageEDMS For SP Package OptionJames JamesNo ratings yet

- Agile Isap Improves Project Outcomes With Richer Customer CollaborationDocument8 pagesAgile Isap Improves Project Outcomes With Richer Customer CollaborationRohit TodkarNo ratings yet

- India Post + IPPBDocument19 pagesIndia Post + IPPBatharva sadvilkarNo ratings yet

- MSIT 205: Advanced Programming 3 Trimester SY 2019-2020Document37 pagesMSIT 205: Advanced Programming 3 Trimester SY 2019-2020Pequiro LiaNo ratings yet

- Cipla Case Study ATSC MBA PGDM ProjectDocument18 pagesCipla Case Study ATSC MBA PGDM Projectboby.prashantkumar.boby066No ratings yet

- Weighing of Stocks and PaymentDocument8 pagesWeighing of Stocks and PaymentPauline Caceres AbayaNo ratings yet

- 2009 IAME Notteboom & CariouDocument26 pages2009 IAME Notteboom & CarioupravanthbabuNo ratings yet

- PC GuideDocument447 pagesPC GuidePraveen KumarNo ratings yet

- Marketing Project Report: Submitted By: - Group 6Document12 pagesMarketing Project Report: Submitted By: - Group 6DeepNo ratings yet

- AFAR Preboards MergedDocument112 pagesAFAR Preboards Mergedpajarillagavincent15No ratings yet

- Vertex Trading NotebookDocument10 pagesVertex Trading Notebookbiz manNo ratings yet

- Bella Bolla - PrintInspectionDocument1 pageBella Bolla - PrintInspectionBryce AirgoodNo ratings yet

- Effects of Thrift and Credit Societies in Enchancing Member's Living StandardsDocument99 pagesEffects of Thrift and Credit Societies in Enchancing Member's Living StandardsDave FajardoNo ratings yet

- Constanta ShipyardDocument3 pagesConstanta ShipyardAndrei StanNo ratings yet

- SECTION 13-21 CORPO DigestsDocument13 pagesSECTION 13-21 CORPO Digestshmn_scribdNo ratings yet

- Edit - 5 Types of Forex Trading Strategies That Work PDFDocument18 pagesEdit - 5 Types of Forex Trading Strategies That Work PDFDereck Teveraishe100% (1)

- Chiến lược tổ chức Strength, weak Bỏ low price, high quality. Điểm mạnh về capability về khả năng mkt, khả năng của doanh nghiệpDocument3 pagesChiến lược tổ chức Strength, weak Bỏ low price, high quality. Điểm mạnh về capability về khả năng mkt, khả năng của doanh nghiệpĐằng TửNo ratings yet

- Customer GT2 ProDocument1 pageCustomer GT2 Proyunuskhan558800No ratings yet

- Gmail - Re - New Application Received For Process Engineer - 14651936 - Sateesh S - Viluppuram - Coromandel International Private Limited - Rs 5 - 6 Lakh - Yr - 0 Yr 0 MonthDocument1 pageGmail - Re - New Application Received For Process Engineer - 14651936 - Sateesh S - Viluppuram - Coromandel International Private Limited - Rs 5 - 6 Lakh - Yr - 0 Yr 0 Monthsunil AkhtarNo ratings yet

- Techno-Economic Assessment of Microbial Limonene PDocument8 pagesTechno-Economic Assessment of Microbial Limonene Ppaula martinezNo ratings yet

- 0450 7115 QP 1Document1,548 pages0450 7115 QP 1ShakhnozaNo ratings yet

- Management: Notes Prepared by Ar Esra GhalibDocument11 pagesManagement: Notes Prepared by Ar Esra GhalibEsra IrfanNo ratings yet