Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

26 viewsPunjab Group of Colleges

Punjab Group of Colleges

Uploaded by

muhammad ijazThis document contains 5 accounting questions involving journal entries, bank reconciliation, and preparation of financial statements.

Question 1 involves journalizing various business transactions for a trader, including starting business, purchases, sales, payments, and returns.

Question 2 involves journal entries for bills receivable and payable for the sale of goods from Shahid to Zahid, including discounting a bill and issuing a new bill.

Question 3 requires preparing a bank reconciliation statement to reconcile Mr. Saleem's overdraft balance based on various discrepancies between his cash book and bank statement.

Question 4 provides additional details to prepare a bank reconciliation statement, including uncleared deposits and outstanding checks.

Question 5 requires preparing trading

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- 605701b41234414fbf70f2a0d6734ae1Document3 pages605701b41234414fbf70f2a0d6734ae1BabaNo ratings yet

- Accounting Revision QuestionsDocument8 pagesAccounting Revision QuestionsFranswa MateteNo ratings yet

- List of Private Equity FirmsDocument10 pagesList of Private Equity FirmsJimmy Carlos Riojas MarquezNo ratings yet

- Prefab Houses Feasibility Complete)Document16 pagesPrefab Houses Feasibility Complete)Abrar HussainNo ratings yet

- Single & Double EntryDocument9 pagesSingle & Double EntryJoel VargheseNo ratings yet

- Accounting For Mgt.Document3 pagesAccounting For Mgt.RNo ratings yet

- Syjc Accounts Q.P. Final Accountand Admission 24.11.2015 With AnsDocument4 pagesSyjc Accounts Q.P. Final Accountand Admission 24.11.2015 With AnsRayan LoboNo ratings yet

- Commerce First YearDocument7 pagesCommerce First Yearravulapallysona93No ratings yet

- Accounting PracticeDocument9 pagesAccounting PracticeWinz QuitasolNo ratings yet

- Accounting Cycle. FAR1Document12 pagesAccounting Cycle. FAR1Gajulin, April JoyNo ratings yet

- 2010 DR CR December 1 Cash: Journal EntriesDocument14 pages2010 DR CR December 1 Cash: Journal EntriesRafe Alexis MiravillaNo ratings yet

- KFT Accounting Solutions: Instructions For TestDocument10 pagesKFT Accounting Solutions: Instructions For TestKanika Sharma100% (1)

- FS Withoutadj QuesDocument2 pagesFS Withoutadj QuesHimank SaklechaNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- Trial BalanceDocument4 pagesTrial BalanceHARIKIRAN PRNo ratings yet

- ACC311 November 2018Document5 pagesACC311 November 2018Sunday NgbokiNo ratings yet

- Questions Journal, Ledger & TBDocument9 pagesQuestions Journal, Ledger & TBHarsh GhaiNo ratings yet

- Banking 9 & 10 QuestionsDocument2 pagesBanking 9 & 10 Questionssara.028279No ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- Adv Accounting Part Accounts 2Document7 pagesAdv Accounting Part Accounts 2Srishti 2k22No ratings yet

- NTINDocument28 pagesNTINAkanshaNo ratings yet

- 3300 Question PaperDocument4 pages3300 Question PaperPacific TigerNo ratings yet

- Financial Statements Formate 3.4Document24 pagesFinancial Statements Formate 3.4vkvivekkm163No ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Unit 1 - Final Accounts - ProblemsDocument5 pagesUnit 1 - Final Accounts - Problemsxyz1No ratings yet

- Balance SheetDocument6 pagesBalance SheetMahima SheromiNo ratings yet

- Assignment 1 Financial Accounting and Control Name: Roll No: 2016PGP380 Section: H Problem Statement Solution: Serial No. TransactionsDocument16 pagesAssignment 1 Financial Accounting and Control Name: Roll No: 2016PGP380 Section: H Problem Statement Solution: Serial No. TransactionsSandesh SoniNo ratings yet

- Team Criminal NuisanceDocument4 pagesTeam Criminal NuisanceShreya ShrivastavaNo ratings yet

- Journal Entries (Llandino)Document12 pagesJournal Entries (Llandino)Joy Danielle LlandinoNo ratings yet

- Trial BalanceDocument14 pagesTrial Balanceswetha_makulaNo ratings yet

- P3 Set 1-1Document5 pagesP3 Set 1-1Shingirayi MazingaizoNo ratings yet

- Final Accounts: Problem SheetDocument2 pagesFinal Accounts: Problem SheetSaransh MaheshwariNo ratings yet

- Sem III Nov 2022 QP ..Document9 pagesSem III Nov 2022 QP ..pritika mishraNo ratings yet

- XI Accountancy Model Set 2078Document38 pagesXI Accountancy Model Set 2078kevin bhattaraiNo ratings yet

- Part 1 Accounting Cycle of A Service BusinessDocument23 pagesPart 1 Accounting Cycle of A Service BusinessMA. MICAH GIFT CALIBOSONo ratings yet

- Additional Illustrations-20Document16 pagesAdditional Illustrations-20Gulneer LambaNo ratings yet

- BC 304 PI Past PapersDocument25 pagesBC 304 PI Past PapersMuhammad Tayyab AttariNo ratings yet

- Class - 4 TransactionDocument8 pagesClass - 4 TransactionAkshay SinghNo ratings yet

- Questions On Trial Balance To StudentsDocument6 pagesQuestions On Trial Balance To Studentsveraji3735No ratings yet

- Assignment 2 ShyamDocument6 pagesAssignment 2 Shyamjennifersunny007No ratings yet

- Excise Tril Bal 8Document6 pagesExcise Tril Bal 8vihanjangid223No ratings yet

- Accounts QuestionDocument8 pagesAccounts QuestionMaitri SaraswatNo ratings yet

- Abm2 Week-5Document12 pagesAbm2 Week-5amorashella5No ratings yet

- Preparation of Statement of Financial PositionDocument21 pagesPreparation of Statement of Financial PositionAngel Nichole ValenciaNo ratings yet

- Null 33Document6 pagesNull 33ranganaitinotenda1No ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Accounting Send Up TestDocument3 pagesAccounting Send Up TestKashifNo ratings yet

- Practice Question and Answer On Preparing JournalDocument3 pagesPractice Question and Answer On Preparing JournalNaz JrNo ratings yet

- Bba 1 Sem Business Accounting 21102401 Oct 2021Document4 pagesBba 1 Sem Business Accounting 21102401 Oct 2021lizabnamazliaNo ratings yet

- Hsslive Xi Acc Prvs QN Ans 4 Recording of Transaction IIDocument27 pagesHsslive Xi Acc Prvs QN Ans 4 Recording of Transaction IIMuhammed Rasil NaseerNo ratings yet

- Notice - Ist Year 2nd Internal-2021Document2 pagesNotice - Ist Year 2nd Internal-2021Suryansh GuptaNo ratings yet

- Book Value Realizable ValueDocument4 pagesBook Value Realizable ValueGennia Mae Martinez100% (1)

- Assignment 1Document12 pagesAssignment 1anniekohliNo ratings yet

- Government Technical Institute Business Department Accounts Revision Worksheet ONEDocument4 pagesGovernment Technical Institute Business Department Accounts Revision Worksheet ONEKen GulliverNo ratings yet

- Revision Sheet - 2022-23Document27 pagesRevision Sheet - 2022-23addityawritesNo ratings yet

- CE Principles of Accounts 1995 PaperDocument6 pagesCE Principles of Accounts 1995 Paperapi-3747191No ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- IX Accounting MidDocument9 pagesIX Accounting MidArkar.myanmar 20180% (1)

- AssignmentDocument3 pagesAssignmentER ABHISHEK MISHRANo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document4 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document11 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document5 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- Punjab College Gojra: Result Sheet Test Series (T-2) Matric Block March, 2021Document4 pagesPunjab College Gojra: Result Sheet Test Series (T-2) Matric Block March, 2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document4 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document2 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document4 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- T-1 Second YearDocument2 pagesT-1 Second Yearmuhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document2 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document3 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document4 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- 2nd Year Computer T-IIDocument2 pages2nd Year Computer T-IImuhammad ijazNo ratings yet

- Punjab Group of Colleges: Test Series: T-2 2021 Name: - Roll No: - SectionDocument2 pagesPunjab Group of Colleges: Test Series: T-2 2021 Name: - Roll No: - Sectionmuhammad ijazNo ratings yet

- T-3 Chemistry 2ndyearDocument2 pagesT-3 Chemistry 2ndyearmuhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- Punjab Group of Colleges: Test Series: T-I 2021 Name: - Roll No: - SectionDocument2 pagesPunjab Group of Colleges: Test Series: T-I 2021 Name: - Roll No: - Sectionmuhammad ijazNo ratings yet

- 1st Year Bio T-IDocument2 pages1st Year Bio T-Imuhammad ijazNo ratings yet

- Punjab Group of CollegesDocument2 pagesPunjab Group of Collegesmuhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- 1st Year Bio T-IIDocument2 pages1st Year Bio T-IImuhammad ijazNo ratings yet

- Punjab Group of Colleges: Test Series: T-II 2021Document1 pagePunjab Group of Colleges: Test Series: T-II 2021muhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- Job Profit Document 1Document2 pagesJob Profit Document 1ZamurradNo ratings yet

- EGMC002 Final Edition YJDocument17 pagesEGMC002 Final Edition YJVikrant VatsNo ratings yet

- Acctg 11 Q1 - FinalsDocument8 pagesAcctg 11 Q1 - FinalsIvy SaliseNo ratings yet

- Loa-2b Certification Funds Nueva Interliver To 3M Global Nov 18 PDFDocument1 pageLoa-2b Certification Funds Nueva Interliver To 3M Global Nov 18 PDFMarco palaciosNo ratings yet

- The Wall Street Journal 20-01-24Document52 pagesThe Wall Street Journal 20-01-24milagrosNo ratings yet

- Chapter 5 Reilly and BrownDocument48 pagesChapter 5 Reilly and BrownM Azhar Mughal100% (1)

- Session 2 Practice Problem SolutionDocument15 pagesSession 2 Practice Problem SolutionRishika RathiNo ratings yet

- Executive Summary 2.odtDocument9 pagesExecutive Summary 2.odtcamilleNo ratings yet

- Budgeting 101: By: Limheya Lester Glenn National University-ManilaDocument42 pagesBudgeting 101: By: Limheya Lester Glenn National University-ManilaXXXXXXXXXXXXXXXXXXNo ratings yet

- Installment SalesDocument14 pagesInstallment SalesAlexandriteNo ratings yet

- Trucking and StorageDocument2 pagesTrucking and StorageMichael San Luis100% (1)

- Marginal CallDocument3 pagesMarginal Calllexredondo22No ratings yet

- Spas 5 13Document6 pagesSpas 5 13Adama GuilaoNo ratings yet

- Adjudication Order in Respect of M/s Sitapur Plywood Manufacturers LTDDocument6 pagesAdjudication Order in Respect of M/s Sitapur Plywood Manufacturers LTDShyam SunderNo ratings yet

- T24 R11 Release HighlightsDocument61 pagesT24 R11 Release HighlightsOscar RamoNo ratings yet

- What Is Good Corporate GovernanceDocument12 pagesWhat Is Good Corporate GovernanceJelly Anne100% (1)

- India's Auto Finance Market - 10 (1) .01.10Document26 pagesIndia's Auto Finance Market - 10 (1) .01.10Gogol SarinNo ratings yet

- PSPM MODEL 3 AA015/ KMM Session 2019/2020Document7 pagesPSPM MODEL 3 AA015/ KMM Session 2019/2020syahmiafndiNo ratings yet

- Simply Jordan TD Bank Statement Castillo Mar 2021Document2 pagesSimply Jordan TD Bank Statement Castillo Mar 2021MD MasumNo ratings yet

- Paper14 PDFDocument94 pagesPaper14 PDFShilpa Arora NarangNo ratings yet

- CREDIDCARDVerkoop Afstand Bankkaarten ENDocument12 pagesCREDIDCARDVerkoop Afstand Bankkaarten ENmatik5512No ratings yet

- Questionnaire For Early Stage Start UpDocument5 pagesQuestionnaire For Early Stage Start UpNeetika KatariaNo ratings yet

- Economic Benefits of Toll Road SystemDocument8 pagesEconomic Benefits of Toll Road SystemTahura Byali100% (1)

- Ross 7 e CH 04Document58 pagesRoss 7 e CH 04Antora HoqueNo ratings yet

- Course Module - Chapter 9 - Interest in Joint VenturesDocument9 pagesCourse Module - Chapter 9 - Interest in Joint VenturesMarianne DadullaNo ratings yet

- Different Types of Capital IssuesDocument5 pagesDifferent Types of Capital IssuesUdhayakumar ManickamNo ratings yet

- 2022.07.27 - Kambi Interim ReportDocument18 pages2022.07.27 - Kambi Interim ReportLexi EisenbergNo ratings yet

- De Castro Vs Field Investigaiton OfficeDocument11 pagesDe Castro Vs Field Investigaiton OfficeGlaize Shaye Cuaresma SantosNo ratings yet

Punjab Group of Colleges

Punjab Group of Colleges

Uploaded by

muhammad ijaz0 ratings0% found this document useful (0 votes)

26 views2 pagesThis document contains 5 accounting questions involving journal entries, bank reconciliation, and preparation of financial statements.

Question 1 involves journalizing various business transactions for a trader, including starting business, purchases, sales, payments, and returns.

Question 2 involves journal entries for bills receivable and payable for the sale of goods from Shahid to Zahid, including discounting a bill and issuing a new bill.

Question 3 requires preparing a bank reconciliation statement to reconcile Mr. Saleem's overdraft balance based on various discrepancies between his cash book and bank statement.

Question 4 provides additional details to prepare a bank reconciliation statement, including uncleared deposits and outstanding checks.

Question 5 requires preparing trading

Original Description:

Original Title

ADC-ACC

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains 5 accounting questions involving journal entries, bank reconciliation, and preparation of financial statements.

Question 1 involves journalizing various business transactions for a trader, including starting business, purchases, sales, payments, and returns.

Question 2 involves journal entries for bills receivable and payable for the sale of goods from Shahid to Zahid, including discounting a bill and issuing a new bill.

Question 3 requires preparing a bank reconciliation statement to reconcile Mr. Saleem's overdraft balance based on various discrepancies between his cash book and bank statement.

Question 4 provides additional details to prepare a bank reconciliation statement, including uncleared deposits and outstanding checks.

Question 5 requires preparing trading

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

26 views2 pagesPunjab Group of Colleges

Punjab Group of Colleges

Uploaded by

muhammad ijazThis document contains 5 accounting questions involving journal entries, bank reconciliation, and preparation of financial statements.

Question 1 involves journalizing various business transactions for a trader, including starting business, purchases, sales, payments, and returns.

Question 2 involves journal entries for bills receivable and payable for the sale of goods from Shahid to Zahid, including discounting a bill and issuing a new bill.

Question 3 requires preparing a bank reconciliation statement to reconcile Mr. Saleem's overdraft balance based on various discrepancies between his cash book and bank statement.

Question 4 provides additional details to prepare a bank reconciliation statement, including uncleared deposits and outstanding checks.

Question 5 requires preparing trading

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

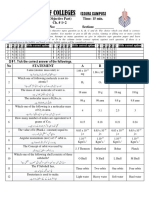

PUNJAB GROUP OF COLLEGES (GOJRA CAMPUS)

Marks: 20 Accounting Intermediate ADC-I Time: 20 Mint.

1st Term 2021

Name:- ____________ Section:- ________

Q:1 journalize the following transactions in the books of a trader.

December 1, 2005 Started business with cash 150000.

December 3 goods purchased for cash 90000.

December 3 furniture purchased for cash 15000.

December 7 sold goods for cash 30000.

December 9 sold goods to Mr. Rauf 24000.

December 12 goods purchased from Zulfiqar 15000.

December 16 goods sold to Ali an allowed him 10% trade discount 18000.

December 22 cash received from Rauf in full settlement of his account 22800.

December 25 cash paid to Zulfiqar 5700 and he allowed discount 300.

December 28 cash paid for purchase of stationary 750.

December 13 paid office rent 2400.

December 31 goods returned to Zulfiqar 1500.

December 31 paid salaries to staff 2700.

Q: 2 On 1st January, 2005 Shahid sold goods to Zahid for 15000 and drew a bill for 4 months on him. Zahid accepted the

bill and returned it to Shahid. Shahid got it discounted by his bank at 15% p.a.

On maturity Zahid was not in a position to meet his acceptance. He approaches Shahid and requested him to cancel the

old bill and draw on him a new bill for the amount of old bill plus interest at the rate of 12% p.a. at 3 month. Shahid

agreed to the proposal. On the due date of the new bill, Zahid honoured his acceptance. Give journal entries in books of

Shahid and Zahid.

Q:3 The bank statement of account no 16 of Mr. Saleem showed an overdraft of 134300 on 31st December 200. On

going through the pass book and cash book the accountant found the following

1. A cheque for 4320 wrongly credited in the bank statement on 28th December 2004 and being dishonoured again

debited in the bank statement on 1st January 2005. There was no entry in the cash book about the dishonour of

the cheque until 15 January 20055.

2. Interest collected and credited but the bank in the bank statement on Mr. Saleem’s behalf but the same had

not been recorded in his cash book 11200.

3. Cheque of 82000 paid into the bank for collection on 30th December but cheques amounted to 30000 were

collected on January 2005.

4. Out of cheques amounting to 31200 drawn by him on 27th December a cheque for 10000 was encashed on 3rd

January 2005.

5. The banker has given him a wrong credit for 2000 paid in by him in another account NO 17 and a wrong debit in

respect of a cheque for 1200 drawn on account No 17.

Q: 4 prepare a bank reconciliation statement from the following particulars.

1. Overdraft balance as per the pass book (Dr) on 31 12 2005 was 10000.

2. Bank charges for collecting an out station cheque 15 appeared only in the pass book.

3. Interest on overdraft charged by the bank for half year 550 debited in the pass book only.

4. Two cheques for 15000 and 10000 paid in on 30 December 2005 were not credited by bank.

5. Two cheques for 2100 and 8000 issued in December 2005 had not been presented at the bank during the

month.

Q: 5 Prepare Trading Account and profit and loss Account for the year ending 31 December 2005 and a Balance sheet

as at that date form the Trial Balance and adjustment given below.

Particular Dr Cr

Drawings 10500

Capital 60000

Opening Stock 41250

Purchases 363750

Sales 457500

Debtors 60000

Creditors 45375

Sales returns 3750

Carriage inward 4500

Salaries 21000

Rent rates taxes 11250

Insurance 3000

Machinery 37500

Furniture 3750

Cash in hand 2625

Total 562875 562875

Adjustments:

1- Depreciate plant and machinery at 10% p.a. 4- Maintain 5% reserve for doubtful debts on

2- Outstanding salaries 1500. debtors.

3- Insurance paid in advance 375. 5- Closing stock was valued at 45000.

You might also like

- 605701b41234414fbf70f2a0d6734ae1Document3 pages605701b41234414fbf70f2a0d6734ae1BabaNo ratings yet

- Accounting Revision QuestionsDocument8 pagesAccounting Revision QuestionsFranswa MateteNo ratings yet

- List of Private Equity FirmsDocument10 pagesList of Private Equity FirmsJimmy Carlos Riojas MarquezNo ratings yet

- Prefab Houses Feasibility Complete)Document16 pagesPrefab Houses Feasibility Complete)Abrar HussainNo ratings yet

- Single & Double EntryDocument9 pagesSingle & Double EntryJoel VargheseNo ratings yet

- Accounting For Mgt.Document3 pagesAccounting For Mgt.RNo ratings yet

- Syjc Accounts Q.P. Final Accountand Admission 24.11.2015 With AnsDocument4 pagesSyjc Accounts Q.P. Final Accountand Admission 24.11.2015 With AnsRayan LoboNo ratings yet

- Commerce First YearDocument7 pagesCommerce First Yearravulapallysona93No ratings yet

- Accounting PracticeDocument9 pagesAccounting PracticeWinz QuitasolNo ratings yet

- Accounting Cycle. FAR1Document12 pagesAccounting Cycle. FAR1Gajulin, April JoyNo ratings yet

- 2010 DR CR December 1 Cash: Journal EntriesDocument14 pages2010 DR CR December 1 Cash: Journal EntriesRafe Alexis MiravillaNo ratings yet

- KFT Accounting Solutions: Instructions For TestDocument10 pagesKFT Accounting Solutions: Instructions For TestKanika Sharma100% (1)

- FS Withoutadj QuesDocument2 pagesFS Withoutadj QuesHimank SaklechaNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- Trial BalanceDocument4 pagesTrial BalanceHARIKIRAN PRNo ratings yet

- ACC311 November 2018Document5 pagesACC311 November 2018Sunday NgbokiNo ratings yet

- Questions Journal, Ledger & TBDocument9 pagesQuestions Journal, Ledger & TBHarsh GhaiNo ratings yet

- Banking 9 & 10 QuestionsDocument2 pagesBanking 9 & 10 Questionssara.028279No ratings yet

- Financial Statements of NonDocument3 pagesFinancial Statements of NonYashi GuptaNo ratings yet

- Adv Accounting Part Accounts 2Document7 pagesAdv Accounting Part Accounts 2Srishti 2k22No ratings yet

- NTINDocument28 pagesNTINAkanshaNo ratings yet

- 3300 Question PaperDocument4 pages3300 Question PaperPacific TigerNo ratings yet

- Financial Statements Formate 3.4Document24 pagesFinancial Statements Formate 3.4vkvivekkm163No ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Unit 1 - Final Accounts - ProblemsDocument5 pagesUnit 1 - Final Accounts - Problemsxyz1No ratings yet

- Balance SheetDocument6 pagesBalance SheetMahima SheromiNo ratings yet

- Assignment 1 Financial Accounting and Control Name: Roll No: 2016PGP380 Section: H Problem Statement Solution: Serial No. TransactionsDocument16 pagesAssignment 1 Financial Accounting and Control Name: Roll No: 2016PGP380 Section: H Problem Statement Solution: Serial No. TransactionsSandesh SoniNo ratings yet

- Team Criminal NuisanceDocument4 pagesTeam Criminal NuisanceShreya ShrivastavaNo ratings yet

- Journal Entries (Llandino)Document12 pagesJournal Entries (Llandino)Joy Danielle LlandinoNo ratings yet

- Trial BalanceDocument14 pagesTrial Balanceswetha_makulaNo ratings yet

- P3 Set 1-1Document5 pagesP3 Set 1-1Shingirayi MazingaizoNo ratings yet

- Final Accounts: Problem SheetDocument2 pagesFinal Accounts: Problem SheetSaransh MaheshwariNo ratings yet

- Sem III Nov 2022 QP ..Document9 pagesSem III Nov 2022 QP ..pritika mishraNo ratings yet

- XI Accountancy Model Set 2078Document38 pagesXI Accountancy Model Set 2078kevin bhattaraiNo ratings yet

- Part 1 Accounting Cycle of A Service BusinessDocument23 pagesPart 1 Accounting Cycle of A Service BusinessMA. MICAH GIFT CALIBOSONo ratings yet

- Additional Illustrations-20Document16 pagesAdditional Illustrations-20Gulneer LambaNo ratings yet

- BC 304 PI Past PapersDocument25 pagesBC 304 PI Past PapersMuhammad Tayyab AttariNo ratings yet

- Class - 4 TransactionDocument8 pagesClass - 4 TransactionAkshay SinghNo ratings yet

- Questions On Trial Balance To StudentsDocument6 pagesQuestions On Trial Balance To Studentsveraji3735No ratings yet

- Assignment 2 ShyamDocument6 pagesAssignment 2 Shyamjennifersunny007No ratings yet

- Excise Tril Bal 8Document6 pagesExcise Tril Bal 8vihanjangid223No ratings yet

- Accounts QuestionDocument8 pagesAccounts QuestionMaitri SaraswatNo ratings yet

- Abm2 Week-5Document12 pagesAbm2 Week-5amorashella5No ratings yet

- Preparation of Statement of Financial PositionDocument21 pagesPreparation of Statement of Financial PositionAngel Nichole ValenciaNo ratings yet

- Null 33Document6 pagesNull 33ranganaitinotenda1No ratings yet

- Assignment 1 ACCOUNTANCYDocument3 pagesAssignment 1 ACCOUNTANCYCHINMAY AGRAWALNo ratings yet

- Accounting Send Up TestDocument3 pagesAccounting Send Up TestKashifNo ratings yet

- Practice Question and Answer On Preparing JournalDocument3 pagesPractice Question and Answer On Preparing JournalNaz JrNo ratings yet

- Bba 1 Sem Business Accounting 21102401 Oct 2021Document4 pagesBba 1 Sem Business Accounting 21102401 Oct 2021lizabnamazliaNo ratings yet

- Hsslive Xi Acc Prvs QN Ans 4 Recording of Transaction IIDocument27 pagesHsslive Xi Acc Prvs QN Ans 4 Recording of Transaction IIMuhammed Rasil NaseerNo ratings yet

- Notice - Ist Year 2nd Internal-2021Document2 pagesNotice - Ist Year 2nd Internal-2021Suryansh GuptaNo ratings yet

- Book Value Realizable ValueDocument4 pagesBook Value Realizable ValueGennia Mae Martinez100% (1)

- Assignment 1Document12 pagesAssignment 1anniekohliNo ratings yet

- Government Technical Institute Business Department Accounts Revision Worksheet ONEDocument4 pagesGovernment Technical Institute Business Department Accounts Revision Worksheet ONEKen GulliverNo ratings yet

- Revision Sheet - 2022-23Document27 pagesRevision Sheet - 2022-23addityawritesNo ratings yet

- CE Principles of Accounts 1995 PaperDocument6 pagesCE Principles of Accounts 1995 Paperapi-3747191No ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- IX Accounting MidDocument9 pagesIX Accounting MidArkar.myanmar 20180% (1)

- AssignmentDocument3 pagesAssignmentER ABHISHEK MISHRANo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document4 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document11 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document5 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- Punjab College Gojra: Result Sheet Test Series (T-2) Matric Block March, 2021Document4 pagesPunjab College Gojra: Result Sheet Test Series (T-2) Matric Block March, 2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document4 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document2 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document4 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- T-1 Second YearDocument2 pagesT-1 Second Yearmuhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document2 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document3 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- University of Health Sciences, Lahore. MBBS/BDS Session 2020-2021Document4 pagesUniversity of Health Sciences, Lahore. MBBS/BDS Session 2020-2021muhammad ijazNo ratings yet

- 2nd Year Computer T-IIDocument2 pages2nd Year Computer T-IImuhammad ijazNo ratings yet

- Punjab Group of Colleges: Test Series: T-2 2021 Name: - Roll No: - SectionDocument2 pagesPunjab Group of Colleges: Test Series: T-2 2021 Name: - Roll No: - Sectionmuhammad ijazNo ratings yet

- T-3 Chemistry 2ndyearDocument2 pagesT-3 Chemistry 2ndyearmuhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- Punjab Group of Colleges: Test Series: T-I 2021 Name: - Roll No: - SectionDocument2 pagesPunjab Group of Colleges: Test Series: T-I 2021 Name: - Roll No: - Sectionmuhammad ijazNo ratings yet

- 1st Year Bio T-IDocument2 pages1st Year Bio T-Imuhammad ijazNo ratings yet

- Punjab Group of CollegesDocument2 pagesPunjab Group of Collegesmuhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- 1st Year Bio T-IIDocument2 pages1st Year Bio T-IImuhammad ijazNo ratings yet

- Punjab Group of Colleges: Test Series: T-II 2021Document1 pagePunjab Group of Colleges: Test Series: T-II 2021muhammad ijazNo ratings yet

- Punjab Group of Colleges: (Gojra Campus)Document2 pagesPunjab Group of Colleges: (Gojra Campus)muhammad ijazNo ratings yet

- Job Profit Document 1Document2 pagesJob Profit Document 1ZamurradNo ratings yet

- EGMC002 Final Edition YJDocument17 pagesEGMC002 Final Edition YJVikrant VatsNo ratings yet

- Acctg 11 Q1 - FinalsDocument8 pagesAcctg 11 Q1 - FinalsIvy SaliseNo ratings yet

- Loa-2b Certification Funds Nueva Interliver To 3M Global Nov 18 PDFDocument1 pageLoa-2b Certification Funds Nueva Interliver To 3M Global Nov 18 PDFMarco palaciosNo ratings yet

- The Wall Street Journal 20-01-24Document52 pagesThe Wall Street Journal 20-01-24milagrosNo ratings yet

- Chapter 5 Reilly and BrownDocument48 pagesChapter 5 Reilly and BrownM Azhar Mughal100% (1)

- Session 2 Practice Problem SolutionDocument15 pagesSession 2 Practice Problem SolutionRishika RathiNo ratings yet

- Executive Summary 2.odtDocument9 pagesExecutive Summary 2.odtcamilleNo ratings yet

- Budgeting 101: By: Limheya Lester Glenn National University-ManilaDocument42 pagesBudgeting 101: By: Limheya Lester Glenn National University-ManilaXXXXXXXXXXXXXXXXXXNo ratings yet

- Installment SalesDocument14 pagesInstallment SalesAlexandriteNo ratings yet

- Trucking and StorageDocument2 pagesTrucking and StorageMichael San Luis100% (1)

- Marginal CallDocument3 pagesMarginal Calllexredondo22No ratings yet

- Spas 5 13Document6 pagesSpas 5 13Adama GuilaoNo ratings yet

- Adjudication Order in Respect of M/s Sitapur Plywood Manufacturers LTDDocument6 pagesAdjudication Order in Respect of M/s Sitapur Plywood Manufacturers LTDShyam SunderNo ratings yet

- T24 R11 Release HighlightsDocument61 pagesT24 R11 Release HighlightsOscar RamoNo ratings yet

- What Is Good Corporate GovernanceDocument12 pagesWhat Is Good Corporate GovernanceJelly Anne100% (1)

- India's Auto Finance Market - 10 (1) .01.10Document26 pagesIndia's Auto Finance Market - 10 (1) .01.10Gogol SarinNo ratings yet

- PSPM MODEL 3 AA015/ KMM Session 2019/2020Document7 pagesPSPM MODEL 3 AA015/ KMM Session 2019/2020syahmiafndiNo ratings yet

- Simply Jordan TD Bank Statement Castillo Mar 2021Document2 pagesSimply Jordan TD Bank Statement Castillo Mar 2021MD MasumNo ratings yet

- Paper14 PDFDocument94 pagesPaper14 PDFShilpa Arora NarangNo ratings yet

- CREDIDCARDVerkoop Afstand Bankkaarten ENDocument12 pagesCREDIDCARDVerkoop Afstand Bankkaarten ENmatik5512No ratings yet

- Questionnaire For Early Stage Start UpDocument5 pagesQuestionnaire For Early Stage Start UpNeetika KatariaNo ratings yet

- Economic Benefits of Toll Road SystemDocument8 pagesEconomic Benefits of Toll Road SystemTahura Byali100% (1)

- Ross 7 e CH 04Document58 pagesRoss 7 e CH 04Antora HoqueNo ratings yet

- Course Module - Chapter 9 - Interest in Joint VenturesDocument9 pagesCourse Module - Chapter 9 - Interest in Joint VenturesMarianne DadullaNo ratings yet

- Different Types of Capital IssuesDocument5 pagesDifferent Types of Capital IssuesUdhayakumar ManickamNo ratings yet

- 2022.07.27 - Kambi Interim ReportDocument18 pages2022.07.27 - Kambi Interim ReportLexi EisenbergNo ratings yet

- De Castro Vs Field Investigaiton OfficeDocument11 pagesDe Castro Vs Field Investigaiton OfficeGlaize Shaye Cuaresma SantosNo ratings yet