Professional Documents

Culture Documents

Unitron - Teuku Aldefa

Unitron - Teuku Aldefa

Uploaded by

Teuku AldefaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unitron - Teuku Aldefa

Unitron - Teuku Aldefa

Uploaded by

Teuku AldefaCopyright:

Available Formats

Unitron Corporation

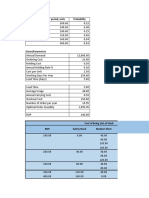

1 Produced As/Sold As

Annual Sales Order (Units) Product Annual Production

100,000.00 401 90,000.00

402 10,000.00

140,000.00 402 110,000.00

403 30,000.00

100,000.00 403 60,000.00

404 40,000.00

40,000.00 404 20,000.00

405 20,000.00

20,000.00 405 20,000.00

Total 400,000.00 Equal 400,000.00

2 Average Costing System

Total Manufacturing Cost / Output Produced 0.50

(200.000/400.000)

Product Cost / Unit

401 0.50

402 0.50

403 0.50

404 0.50

405 0.50

Sales Value System

Product Unit Ordered Sales Price / Unit Percent of Market Value Percent Sales Value Allocated Join Cost

401 100,000.00 0.40 40,000.00 16% 32,520

402 140,000.00 0.60 84,000.00 34% 68,293

403 100,000.00 0.70 70,000.00 28% 56,911

404 40,000.00 0.80 32,000.00 13% 26,016

405 20,000.00 1.00 20,000.00 8% 16,260

Total 400,000.00 246,000.00 100.00% 200,000.00

Product Allocated Join Cost Unit Produced Cost / Unit

401 32,520 90,000.00 0.36

402 68,293 120,000.00 0.57

403 56,911 90,000.00 0.63

404 26,016 60,000.00 0.43

405 16,260 40,000.00 0.41

200,000.00 400,000.00

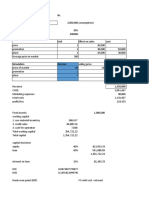

3 What if 6000 ordered for product 401

A.

Revenue 6000 x 0.40 $2,400.00

Physical Unit

Because there is still beginning inventory, It should be counted

Beginning Inventory 3,000.00

Cost / Unit 0.50

$1,500.00

Unit Sales 3,000.00

Cost / Unit 0.36

$1,080.00

Total Cost $2,580.00

Profit (Loss) ($ (180.00)

Sales Value

Total Cost 6000 x 0.36 $2,160.00

Profit (Loss) ($ 240.00)

B

Helen should took the Sales Value Split-Off Method.

The simplest reason why helen choose this method, because it make a proft for the company

The sales value method gives $240 in profit, meanwhile with the physical unit gives $180 in loss.

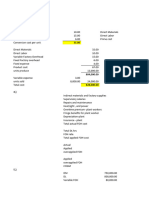

4 Maybe, Helen might be considered to accept the offer from the toys company.

In the information said that Unitron offered a "seconds" at a price $25. definitely,

offering from the toys company below the standard price stated by Unitron.

But, there is no doubt to try accept the offer. Moreover, this item is a slow moving in a past year.

5 Considering from the number 3, Unitron should imply the relative sales value approach.

Using this approach, Unitron can identified cost/unit more precisely. So they know how

much it cost allocation out per product.

6 A government purchasing agent inquirred 404 for 100.000

They stated that 10% profit margin would probably allowable.

If Unitron use 2 of approaches (Physical and Relative Sales)

Cost / Unit Cost / Unit (Exhibit 4) Profit Margin

Physical Unit 0.50 0.80 0.30

Relative Sales 0.43 0.80 0.37

Inquirred 10 percent of profit margin

Profit Margin Cost / Unit after margin Profit Margin after include 10% Different profit Margin Percentage of Changes

Physical Unit 10% 0.55 0.05 ($ (0.25) -83.33%

Relative Sales 10% 0.47 0.04 ($ (0.33) -88.38%

According to the table shown above, I think they should not to accept the offer from the government. Because the decreased profit is significant.

But, it goes back to the management's decision.

You might also like

- Creative Thinking Thinking MmunicationDocument334 pagesCreative Thinking Thinking Mmunicationimminseo6No ratings yet

- CRO Startup Crochet Headband BacaDocument3 pagesCRO Startup Crochet Headband BacaAlina100% (1)

- UnitRon Case SolutionDocument5 pagesUnitRon Case SolutionsaNo ratings yet

- Process Validation ReportDocument4 pagesProcess Validation ReportSUBODHH100% (1)

- Solved in 1998 Big Skye Partnership Paid 695 500 For A ChristmasDocument1 pageSolved in 1998 Big Skye Partnership Paid 695 500 For A ChristmasAnbu jaromia0% (1)

- Case LETADocument12 pagesCase LETAJemarse GumpalNo ratings yet

- UnitronDocument9 pagesUnitronIvan Naufal PriadyNo ratings yet

- Project 2 BT2Document3 pagesProject 2 BT2Võ Thị Thanh NgânNo ratings yet

- Project 2Document3 pagesProject 2Mai HàNo ratings yet

- Monthly Business Budget1Document1 pageMonthly Business Budget1Vu PhungNo ratings yet

- Pasicolan, Mark Joshua BSA 3206: Absorption CostingDocument6 pagesPasicolan, Mark Joshua BSA 3206: Absorption CostingMark Joshua PasicolanNo ratings yet

- Monthly Budget: Company NameDocument2 pagesMonthly Budget: Company NameJo ReenNo ratings yet

- May TechDocument6 pagesMay TechMonica LlenaresasNo ratings yet

- 1 Minimum Price Per ShortsDocument5 pages1 Minimum Price Per Shortsboerd77No ratings yet

- 03 - Group (Unitron Corp) - EssayDocument6 pages03 - Group (Unitron Corp) - EssayNurul Meutia SalsabilaNo ratings yet

- Sample Problems Solutions On BE, & SensitivityDocument5 pagesSample Problems Solutions On BE, & SensitivityJedrek DyNo ratings yet

- Monthly Business BudgetDocument4 pagesMonthly Business BudgetOkasha HafeezNo ratings yet

- BA 117 SolutionsDocument19 pagesBA 117 SolutionsAlaine Milka GosycoNo ratings yet

- Budget Template With ChartsDocument1 pageBudget Template With ChartsAli ErlanggaNo ratings yet

- LQ3 FinalDocument6 pagesLQ3 FinalRaz MahariNo ratings yet

- DividendsDocument13 pagesDividendsTrixieNo ratings yet

- UNITRONDocument5 pagesUNITRONMonika SindyNo ratings yet

- Bai Tap 7Document6 pagesBai Tap 7Bích DiệuNo ratings yet

- Laboratory Activity 7 Westside AutoDocument4 pagesLaboratory Activity 7 Westside AutoAtiene VillanuevaNo ratings yet

- Project Income CalculatorDocument4 pagesProject Income CalculatorMahmoud ElmohamdyNo ratings yet

- Accounting RefresherDocument2 pagesAccounting RefresherAlbert MorenoNo ratings yet

- Rs. Total Demand in Product CategoryDocument4 pagesRs. Total Demand in Product CategorySichen UpretyNo ratings yet

- Actual Material Qty Schedule Units WD EUPDocument10 pagesActual Material Qty Schedule Units WD EUPJuMakMat MacNo ratings yet

- Budget ControllingDocument1 pageBudget ControllingLester ErlanoNo ratings yet

- Chapter 7 and 9 Execises Problems - SolutionsDocument33 pagesChapter 7 and 9 Execises Problems - SolutionsVenus PalmencoNo ratings yet

- IA Chapter-11-14Document7 pagesIA Chapter-11-14Christine Joyce EnriquezNo ratings yet

- Handout - Week 6 - Financial Planning and Forecasting-1662440842139Document8 pagesHandout - Week 6 - Financial Planning and Forecasting-1662440842139Muhammad Raihan AzicaNo ratings yet

- P and L and BSDocument1 pageP and L and BSgautam48128No ratings yet

- Rapprochement Automatique (Compta/banque Ou Compte À Compte)Document4 pagesRapprochement Automatique (Compta/banque Ou Compte À Compte)Mamadou ThioyeNo ratings yet

- Paw and Saw DownstreamDocument3 pagesPaw and Saw DownstreamLorie Roncal JimenezNo ratings yet

- Project Plan For Law Firms1Document6 pagesProject Plan For Law Firms1Gray stoneNo ratings yet

- Proforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Document6 pagesProforma Retail Inventory With Solutions To Given Activities and Book Problems Cont..Kelsey VersaceNo ratings yet

- Total Current Assets 500,000.00 61,000.00Document4 pagesTotal Current Assets 500,000.00 61,000.00Windy ArwindasariNo ratings yet

- Bizcom Problem 3-2Document1 pageBizcom Problem 3-2kate trishaNo ratings yet

- Production Budget Initial Budgeted Actual In% In% In%Document2 pagesProduction Budget Initial Budgeted Actual In% In% In%Anushka SinghNo ratings yet

- Infrastructure Qty Cost AmountDocument7 pagesInfrastructure Qty Cost AmountSanjeev MiglaniNo ratings yet

- Monthly Budget: Chicken StarDocument4 pagesMonthly Budget: Chicken StarFathy ManzanillaNo ratings yet

- Monthly Budget Test: Company NameDocument4 pagesMonthly Budget Test: Company NameveeraaaNo ratings yet

- Windowlux - Case SolutionDocument2 pagesWindowlux - Case SolutionanisaNo ratings yet

- Project Analysis (NPV)Document20 pagesProject Analysis (NPV)EW1587100% (1)

- Income StatementDocument26 pagesIncome StatementRm NeneNo ratings yet

- Capital Budgeting Activity 3Document12 pagesCapital Budgeting Activity 3Corporate Accountant Marayo BankNo ratings yet

- Chapter 9 Exam AnswersDocument5 pagesChapter 9 Exam AnswersJatha JamolodNo ratings yet

- BAFACR16 04 Answer Key To Post TestsDocument5 pagesBAFACR16 04 Answer Key To Post TestsThats BellaNo ratings yet

- 5 - ABC (Solution)Document32 pages5 - ABC (Solution)Mubashir HasanNo ratings yet

- BoQ EstimasiDocument22 pagesBoQ EstimasiHidma RofiNo ratings yet

- BoQ EstimasiDocument22 pagesBoQ EstimasiHidma RofiNo ratings yet

- Company Report: Baideanu Talida Inc. Q0Document1 pageCompany Report: Baideanu Talida Inc. Q0Andreea SmileNo ratings yet

- Activities 11&12Document6 pagesActivities 11&12MPCINo ratings yet

- Accounting EquationnnnDocument9 pagesAccounting Equationnnnshrestha.aryxnNo ratings yet

- Alaire CorporationDocument2 pagesAlaire CorporationChleo EsperaNo ratings yet

- Gross Profit For The Year 2021-2023Document6 pagesGross Profit For The Year 2021-2023Beverly DatuNo ratings yet

- Sba AssignmentDocument8 pagesSba AssignmentjuniordelossantospenasNo ratings yet

- Capital Budgeting Techniques and Cash Flows Class ExerciseDocument6 pagesCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasNo ratings yet

- Ch07 Red Tomato ToolsDocument8 pagesCh07 Red Tomato ToolsReisya NurriantiNo ratings yet

- Bai Tap 7Document7 pagesBai Tap 7k60.2114113119No ratings yet

- ROI BaripadaDocument1 pageROI BaripadaTanmay AgarwalaNo ratings yet

- Database Management Systems: Understanding and Applying Database TechnologyFrom EverandDatabase Management Systems: Understanding and Applying Database TechnologyRating: 4 out of 5 stars4/5 (8)

- Wahdathul Wujood Aur Peer Aamir Kaleemi Shah (Revised Edition)Document227 pagesWahdathul Wujood Aur Peer Aamir Kaleemi Shah (Revised Edition)waris_jamaal100% (2)

- Mark Scheme (Results) : Summer 2018 Pearson Edexcel International GCSE in Further Pure Mathematics (4PM0) Paper 01Document26 pagesMark Scheme (Results) : Summer 2018 Pearson Edexcel International GCSE in Further Pure Mathematics (4PM0) Paper 01Newton JohnNo ratings yet

- CGR Project Report DDGGDDDocument21 pagesCGR Project Report DDGGDDTanvi KodoliNo ratings yet

- Welcome To Fourtower Bridge: A Paths Peculiar Module For Fantasy Roleplaying GamesDocument7 pagesWelcome To Fourtower Bridge: A Paths Peculiar Module For Fantasy Roleplaying GamesTapanco BarerraNo ratings yet

- Notch 8 Status - Jan 23 - v2Document1 pageNotch 8 Status - Jan 23 - v2qhq9w86txhNo ratings yet

- The Tale of The Three BrothersDocument2 pagesThe Tale of The Three BrothersDéboraNo ratings yet

- Theis Topics - MA in Teaching English As A Foreign LanguageDocument14 pagesTheis Topics - MA in Teaching English As A Foreign LanguageAnadilBatoolNo ratings yet

- CLPWPost War Literary WorksDocument4 pagesCLPWPost War Literary WorksRohann Ban0% (1)

- Criminal Law I SyllabusDocument4 pagesCriminal Law I SyllabusNashiba Dida-AgunNo ratings yet

- Frank Lloyd WrightDocument16 pagesFrank Lloyd WrightKhiZra ShahZadNo ratings yet

- Chapter 6 Learning English For Specific PurposesDocument19 pagesChapter 6 Learning English For Specific PurposesMaRy ChUy HRNo ratings yet

- المؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةDocument16 pagesالمؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةoussama bekhitNo ratings yet

- Reactivity of Metals: Learning GoalDocument36 pagesReactivity of Metals: Learning GoalRyanNo ratings yet

- June 2013 Intake: Programmes OfferedDocument2 pagesJune 2013 Intake: Programmes OfferedThuran NathanNo ratings yet

- Clinical Practice Guideline - Ménière's Disease PDFDocument56 pagesClinical Practice Guideline - Ménière's Disease PDFCarol Natalia Fonseca SalgadoNo ratings yet

- Introduction To PBL at Hull York Medical School - TranscriptDocument4 pagesIntroduction To PBL at Hull York Medical School - TranscriptTrx AntraxNo ratings yet

- Solutions OSI ExercisesDocument50 pagesSolutions OSI ExercisesHussam AlwareethNo ratings yet

- Evaluating Tilting Pad - PaperDocument10 pagesEvaluating Tilting Pad - PaperAsit SuyalNo ratings yet

- Physics MicroprojectDocument12 pagesPhysics Microproject134 Bilolikar AdityaNo ratings yet

- Advent Jesse Tree - 2013Document35 pagesAdvent Jesse Tree - 2013Chad Bragg100% (1)

- Cupid and PsycheDocument3 pagesCupid and PsycheRolex Daclitan BajentingNo ratings yet

- Demonstrating Value With BMC Server Automation (Bladelogic)Document56 pagesDemonstrating Value With BMC Server Automation (Bladelogic)abishekvsNo ratings yet

- OceanofPDF - Com Return To The Carnival of Horrors - RL StineDocument170 pagesOceanofPDF - Com Return To The Carnival of Horrors - RL Stinedinulaka kaluthanthireeNo ratings yet

- Aluminium Phosphide, A Highly Hazardous Pesticide, and A Suicide Poison in Southern Province of ZambiaDocument2 pagesAluminium Phosphide, A Highly Hazardous Pesticide, and A Suicide Poison in Southern Province of ZambiaSimon TemboNo ratings yet

- First Certificate Booklet 2Document89 pagesFirst Certificate Booklet 2Alina TeranNo ratings yet

- A History of Forestry in SarawakDocument9 pagesA History of Forestry in SarawakNur HaleemNo ratings yet