Professional Documents

Culture Documents

3pg Itr SMII

3pg Itr SMII

Uploaded by

Ric Dela CruzCopyright:

Available Formats

You might also like

- Food Stamps ApplicationDocument10 pagesFood Stamps ApplicationboydreamwonderNo ratings yet

- Ganpact CompanyDocument1 pageGanpact CompanyAsmin Sultana Ahmed100% (1)

- June SalaryDocument1 pageJune Salaryaruna nadagouniNo ratings yet

- SOA Exam MLC - FormulasDocument17 pagesSOA Exam MLC - FormulasCarrie Jimenez100% (1)

- Itr 3Document1 pageItr 3olfuqc.3rdyearrep2324No ratings yet

- Page 3Document1 pagePage 3Carol MNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJheza Mae PitogoNo ratings yet

- For. Retefte Jasm Oct 2023Document1 pageFor. Retefte Jasm Oct 2023osoriomartinezd26No ratings yet

- Sample ITR Page 3Document1 pageSample ITR Page 3Eduardo BallesterNo ratings yet

- Laetitia Kalunga - Payslip February 2021Document1 pageLaetitia Kalunga - Payslip February 2021officialteeyaNo ratings yet

- Page 3 ItrDocument1 pagePage 3 ItrariannemungcalcpaNo ratings yet

- StocksDocument3 pagesStocksnagaraja h iNo ratings yet

- Load Auto EstimateDocument2 pagesLoad Auto EstimatedlovasibongileNo ratings yet

- 1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Document2 pages1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Vince Alvin DaquizNo ratings yet

- Itr-V Aagca7888p 2020-21 251075181110221Document1 pageItr-V Aagca7888p 2020-21 251075181110221Balwant SinghNo ratings yet

- Ack 2020-21Document1 pageAck 2020-21mailinspectoryadavNo ratings yet

- PaySlip Dec 2021Document30 pagesPaySlip Dec 2021Pushparaj BNo ratings yet

- Crystal Report Viewer 2Document1 pageCrystal Report Viewer 2Rahul JadhavNo ratings yet

- Sarath 201-21 NewDocument1 pageSarath 201-21 Newbindu mathaiNo ratings yet

- ITR-2020-21.pdf (MIRZA)Document1 pageITR-2020-21.pdf (MIRZA)yogiprathmeshNo ratings yet

- PDF 912540700271220Document1 pagePDF 912540700271220Dhruv KNo ratings yet

- 2020 12 15 12 04 44 882 - 1608014084882 - XXXPM7948X - AcknowledgementDocument1 page2020 12 15 12 04 44 882 - 1608014084882 - XXXPM7948X - Acknowledgementarpan mukherjeeNo ratings yet

- Ack Abrpb9358a 2021-22 389091440190322Document1 pageAck Abrpb9358a 2021-22 389091440190322Ayush BhandarkarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- 2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFDocument1 page2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFLokeshNo ratings yet

- 1655200445Document3 pages1655200445avdesh7777No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJaydeep WayalNo ratings yet

- Itr Sag Pipes 21 22Document1 pageItr Sag Pipes 21 22prateek gangwaniNo ratings yet

- JulyDocument1 pageJulychiruNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKaka JENo ratings yet

- Associate Payment Slip - HarmonyDocument1 pageAssociate Payment Slip - Harmonythebhavesh93No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKaka JENo ratings yet

- 2020 09 04 21 12 58 581 - 1599234178581 - XXXPP0300X - AcknowledgementDocument1 page2020 09 04 21 12 58 581 - 1599234178581 - XXXPP0300X - AcknowledgementAnshu SinghNo ratings yet

- Ack Aacar1829b 2021-22 562508250310322Document1 pageAck Aacar1829b 2021-22 562508250310322Amma FoundationNo ratings yet

- Itr 21-22Document1 pageItr 21-22MoghAKaranNo ratings yet

- Screenshot 2023-10-16 at 11.38.24 AMDocument1 pageScreenshot 2023-10-16 at 11.38.24 AMappurajan51No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun KumarNo ratings yet

- RK 1Document1 pageRK 1Sharada ShankarNo ratings yet

- Ilovepdf MergedDocument3 pagesIlovepdf MergedBHASKAR pNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJai GaneshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun VeeraniNo ratings yet

- Ramavath A.Y 2020-21 Tax - AcknowledgementDocument1 pageRamavath A.Y 2020-21 Tax - AcknowledgementBhashya RamavathNo ratings yet

- Neetu Singh - FY 2019 20 - Detailed ITRVDocument1 pageNeetu Singh - FY 2019 20 - Detailed ITRVRakesh PatilNo ratings yet

- 2020 12 28 22 12 10 345 - 1609173730345 - XXXPR1222X - AcknowledgementDocument1 page2020 12 28 22 12 10 345 - 1609173730345 - XXXPR1222X - Acknowledgementsekhar bandiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKyra MehtaNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Itr-V Bogpp6352h 2020-21 767088050301120Document1 pageItr-V Bogpp6352h 2020-21 767088050301120DEVIL RDXNo ratings yet

- PDF 870515920231220Document1 pagePDF 870515920231220b2bservices007No ratings yet

- PDF 870515920231220Document1 pagePDF 870515920231220b2bservices007No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBANDARU SRINUNo ratings yet

- Samvith - Financials - FY 2020-21Document6 pagesSamvith - Financials - FY 2020-21raghav shettyNo ratings yet

- ITR Acknowledgement FY 2019-20Document1 pageITR Acknowledgement FY 2019-20taramaNo ratings yet

- 2020-21 ItDocument95 pages2020-21 Itsriharidhana.financialservicesNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusameer bakshiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNavis AntonyNo ratings yet

- 2020 07 22 22 44 18 838 - 1595438058838 - XXXPK9292X - AcknowledgementDocument1 page2020 07 22 22 44 18 838 - 1595438058838 - XXXPK9292X - AcknowledgementGautam MNo ratings yet

- Itr 20-21Document1 pageItr 20-21Rohit kandpalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRohit kandpalNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Knot Wedding Planning SpreadsheetDocument46 pagesThe Knot Wedding Planning SpreadsheetRic Dela CruzNo ratings yet

- PayrollDocument553 pagesPayrollRic Dela CruzNo ratings yet

- Uid 10052022Document11 pagesUid 10052022Ric Dela CruzNo ratings yet

- Financial Requirements - V1 Ver.1Document3 pagesFinancial Requirements - V1 Ver.1Ric Dela CruzNo ratings yet

- Legal Ethic1Document12 pagesLegal Ethic1Ric Dela CruzNo ratings yet

- Template SummaryDocument1 pageTemplate SummaryRic Dela CruzNo ratings yet

- Meralco Bill 470322010101 04142023Document2 pagesMeralco Bill 470322010101 04142023Ric Dela CruzNo ratings yet

- Film Viewing IIDocument7 pagesFilm Viewing IIRic Dela CruzNo ratings yet

- Leg Ethics DigestDocument5 pagesLeg Ethics DigestRic Dela CruzNo ratings yet

- Legal Writing TSN With Direct and CrossDocument12 pagesLegal Writing TSN With Direct and CrossRic Dela Cruz100% (1)

- Legal LogicDocument7 pagesLegal LogicRic Dela CruzNo ratings yet

- Leg Ethics DigestDocument5 pagesLeg Ethics DigestRic Dela CruzNo ratings yet

- Bulacan State University College of Law: Atty. Jonieve P. Ramos-Gabriel, LLM, DCLDocument8 pagesBulacan State University College of Law: Atty. Jonieve P. Ramos-Gabriel, LLM, DCLRic Dela Cruz100% (1)

- Memorandum For The AccusedDocument6 pagesMemorandum For The AccusedRic Dela CruzNo ratings yet

- Nature: Petition For Review On Certiorari of A Judgment of The CADocument10 pagesNature: Petition For Review On Certiorari of A Judgment of The CARic Dela CruzNo ratings yet

- p1 p446 Legal Ethics PinedaDocument446 pagesp1 p446 Legal Ethics PinedaRic Dela CruzNo ratings yet

- Ricardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityDocument2 pagesRicardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityRic Dela CruzNo ratings yet

- Judicial Affidavit of Paul David C. ZaldivarDocument6 pagesJudicial Affidavit of Paul David C. ZaldivarRic Dela CruzNo ratings yet

- Alex Ong vs. Atty. Elpidio Unto, Adm. Case No. 2417, February 6, 2002Document11 pagesAlex Ong vs. Atty. Elpidio Unto, Adm. Case No. 2417, February 6, 2002Ric Dela CruzNo ratings yet

- Annual FactorDocument1 pageAnnual FactorRic Dela CruzNo ratings yet

- College of Law: Bulacan State UniversityDocument2 pagesCollege of Law: Bulacan State UniversityRic Dela CruzNo ratings yet

- Alpha ListDocument8 pagesAlpha ListRic Dela CruzNo ratings yet

- Alphalist Sched 1Document29 pagesAlphalist Sched 1Ric Dela CruzNo ratings yet

- U.S. Individu T Income Tax Return Owe Rao.,Sgs-Oo A Trsu C ,-Ap A ,+Document4 pagesU.S. Individu T Income Tax Return Owe Rao.,Sgs-Oo A Trsu C ,-Ap A ,+Stephanie Dube DwilsonNo ratings yet

- Unit 4 - DPSPS, RRSPs and TFSAsDocument61 pagesUnit 4 - DPSPS, RRSPs and TFSAsMITALI SWADIYANo ratings yet

- Exide Commission Structure AdvisorDocument5 pagesExide Commission Structure Advisorashok7jNo ratings yet

- Consumer Awareness Towards Insurance ProductsDocument86 pagesConsumer Awareness Towards Insurance ProductsMohit kolliNo ratings yet

- What Is Tax Equalisation?: How Does It Work in Principle?Document2 pagesWhat Is Tax Equalisation?: How Does It Work in Principle?Max Reyes SubiabreNo ratings yet

- All India Bank Employees' Association: "Prabhat Nivas"Document3 pagesAll India Bank Employees' Association: "Prabhat Nivas"Abhinav KumarNo ratings yet

- Finance Module 10 Managing Personal FinanceDocument5 pagesFinance Module 10 Managing Personal FinanceJOHN PAUL LAGAONo ratings yet

- Fixed Medical AllowanceDocument1 pageFixed Medical Allowancev.s.r.srikanth08No ratings yet

- A Brief On NPS & RFBDocument2 pagesA Brief On NPS & RFBRushikeshRameshchandraLachureNo ratings yet

- YSR Pension KanukaDocument7 pagesYSR Pension KanukaALLUR NAGAR PANCHAYATNo ratings yet

- Glosario: Traducción JurídicaDocument66 pagesGlosario: Traducción JurídicaSurvival Horror DownloadsNo ratings yet

- Ap PRC 2022Document25 pagesAp PRC 2022Harish SatyaNo ratings yet

- 0968 Hostplus Additional Contributions BrochureDocument9 pages0968 Hostplus Additional Contributions BrochureSepehrNo ratings yet

- 2016 - Tax ReturnDocument37 pages2016 - Tax Returncara harrisNo ratings yet

- Module 2 Concepts and Pervasive Principles Version 2013Document63 pagesModule 2 Concepts and Pervasive Principles Version 2013Kathy CeracasNo ratings yet

- 21191ILCB0323BDDocument22 pages21191ILCB0323BDSimon BrennanNo ratings yet

- Chapter 4 Income From SalariesDocument106 pagesChapter 4 Income From SalariesYogesh Sahani50% (2)

- Liheap 1Document6 pagesLiheap 1Lauren ZaleNo ratings yet

- Candidate Pre-Screening FormDocument4 pagesCandidate Pre-Screening Formkmanas153No ratings yet

- Testbank Finals 2021 Income TaxDocument11 pagesTestbank Finals 2021 Income Taxynasings.21No ratings yet

- New Tax Regime Vs Old Tax RegimeDocument11 pagesNew Tax Regime Vs Old Tax RegimevinishchandraaNo ratings yet

- Lesson 4.4 General AnnuityDocument22 pagesLesson 4.4 General AnnuityJomel RositaNo ratings yet

- You Are The Auditor of Beaton and Gunter Inc The PDFDocument2 pagesYou Are The Auditor of Beaton and Gunter Inc The PDFHassan JanNo ratings yet

- Telefónica UK Pension Plan: Expression of Wish FormDocument1 pageTelefónica UK Pension Plan: Expression of Wish FormDipesh LimbachiaNo ratings yet

- CA Tax NotesDocument616 pagesCA Tax NotesvijayNo ratings yet

- CaritasDocument15 pagesCaritasHedrix Ar-ar CaballeNo ratings yet

- Please Input: Formula, Do Not Change: Required Minimum DataDocument117 pagesPlease Input: Formula, Do Not Change: Required Minimum DataDwiputra SetiabudhiNo ratings yet

3pg Itr SMII

3pg Itr SMII

Uploaded by

Ric Dela CruzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3pg Itr SMII

3pg Itr SMII

Uploaded by

Ric Dela CruzCopyright:

Available Formats

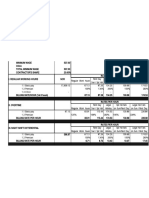

BIR Form No.

1702RTv2018 Page 1 of 1

BIR Form No.

1702-RT Annual Income Tax Return

Corporation, Partnership and Other Non-Individual

January 2018(ENCS)

Taxpayer Subject Only to REGULAR Income Tax Rate

Page 3 1702-RT 01/18ENCS P3

Taxpayer Identification Number(TIN) Registered Name

000 659 238 00000 SECURITY MASTERS INVESTIGATION INC

Part VI - Schedules (DO NOT enter Centavos; 49 Centavos or Less drop down; 50 or more round up)

Schedule I - Ordinary Allowable Itemized Deductions (Attach additional sheet/s if necessary)

1 Amortization 0

2 Bad Debts 0

3 Charitable and Other Contributions 0

4 Depletion 0

5 Depreciation 30,166

6 Entertainment, Amusement and Recreation 136,294

7 Fringe Benefits 0

8 Interest 0

9 Losses 0

10 Pension Trusts 134,691

11 Rental 703,525

12 Research and Development 0

13 Salaries, Wages and Allowances 4,337,482

14 SSS, GSIS, Philhealth, HDMF and Other Contributions 110,314

15 Taxes and Licenses 280,663

16 Transportation and Travel 772,299

17 Others(Deductions Subject to Withholding Tax and Other Expenses) (Specify below; Add additional sheet(s), if necessary)

a Janitorial and Messengerial Services 0

b Professional Fees 123,800

c Security Services 0

d COMMUNICATION, LIGHT AND WATER 434,185

e OTHER SERVICES 163,690

f MATERIALS AND SUPPLIES 363,009

g REPAIRS AND MAINTENANCE 518,662

h MISCELLANEOUS 170,342

i 0

18 Total Ordinary Allowable Itemized Deductions (Sum of Items 1 to 17i) 8,279,122

Schedule II - Special Allowable Itemized Deductions (Attach additional sheet/s, if necessary)

Description Legal Basis Amount

1 AMORTIZATION OF PAST SERVICE COST NIRC SEC. 34 J 1,052,064

2 0

3 0

4 0

5 Total Special Allowable Itemized Deductions (Sum of Items 1 to 4) 1,052,064

file:///C:/Users/RICARDO/AppData/Local/Temp/%7BA715DF5E-0954-4777-A1C4-A... 04/14/21

You might also like

- Food Stamps ApplicationDocument10 pagesFood Stamps ApplicationboydreamwonderNo ratings yet

- Ganpact CompanyDocument1 pageGanpact CompanyAsmin Sultana Ahmed100% (1)

- June SalaryDocument1 pageJune Salaryaruna nadagouniNo ratings yet

- SOA Exam MLC - FormulasDocument17 pagesSOA Exam MLC - FormulasCarrie Jimenez100% (1)

- Itr 3Document1 pageItr 3olfuqc.3rdyearrep2324No ratings yet

- Page 3Document1 pagePage 3Carol MNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJheza Mae PitogoNo ratings yet

- For. Retefte Jasm Oct 2023Document1 pageFor. Retefte Jasm Oct 2023osoriomartinezd26No ratings yet

- Sample ITR Page 3Document1 pageSample ITR Page 3Eduardo BallesterNo ratings yet

- Laetitia Kalunga - Payslip February 2021Document1 pageLaetitia Kalunga - Payslip February 2021officialteeyaNo ratings yet

- Page 3 ItrDocument1 pagePage 3 ItrariannemungcalcpaNo ratings yet

- StocksDocument3 pagesStocksnagaraja h iNo ratings yet

- Load Auto EstimateDocument2 pagesLoad Auto EstimatedlovasibongileNo ratings yet

- 1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Document2 pages1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Vince Alvin DaquizNo ratings yet

- Itr-V Aagca7888p 2020-21 251075181110221Document1 pageItr-V Aagca7888p 2020-21 251075181110221Balwant SinghNo ratings yet

- Ack 2020-21Document1 pageAck 2020-21mailinspectoryadavNo ratings yet

- PaySlip Dec 2021Document30 pagesPaySlip Dec 2021Pushparaj BNo ratings yet

- Crystal Report Viewer 2Document1 pageCrystal Report Viewer 2Rahul JadhavNo ratings yet

- Sarath 201-21 NewDocument1 pageSarath 201-21 Newbindu mathaiNo ratings yet

- ITR-2020-21.pdf (MIRZA)Document1 pageITR-2020-21.pdf (MIRZA)yogiprathmeshNo ratings yet

- PDF 912540700271220Document1 pagePDF 912540700271220Dhruv KNo ratings yet

- 2020 12 15 12 04 44 882 - 1608014084882 - XXXPM7948X - AcknowledgementDocument1 page2020 12 15 12 04 44 882 - 1608014084882 - XXXPM7948X - Acknowledgementarpan mukherjeeNo ratings yet

- Ack Abrpb9358a 2021-22 389091440190322Document1 pageAck Abrpb9358a 2021-22 389091440190322Ayush BhandarkarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- 2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFDocument1 page2020 07 07 09 18 12 832 - 1594093692832 - XXXPC2200X - Acknowledgement PDFLokeshNo ratings yet

- 1655200445Document3 pages1655200445avdesh7777No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJaydeep WayalNo ratings yet

- Itr Sag Pipes 21 22Document1 pageItr Sag Pipes 21 22prateek gangwaniNo ratings yet

- JulyDocument1 pageJulychiruNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKaka JENo ratings yet

- Associate Payment Slip - HarmonyDocument1 pageAssociate Payment Slip - Harmonythebhavesh93No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKaka JENo ratings yet

- 2020 09 04 21 12 58 581 - 1599234178581 - XXXPP0300X - AcknowledgementDocument1 page2020 09 04 21 12 58 581 - 1599234178581 - XXXPP0300X - AcknowledgementAnshu SinghNo ratings yet

- Ack Aacar1829b 2021-22 562508250310322Document1 pageAck Aacar1829b 2021-22 562508250310322Amma FoundationNo ratings yet

- Itr 21-22Document1 pageItr 21-22MoghAKaranNo ratings yet

- Screenshot 2023-10-16 at 11.38.24 AMDocument1 pageScreenshot 2023-10-16 at 11.38.24 AMappurajan51No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun KumarNo ratings yet

- RK 1Document1 pageRK 1Sharada ShankarNo ratings yet

- Ilovepdf MergedDocument3 pagesIlovepdf MergedBHASKAR pNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruJai GaneshNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruArun VeeraniNo ratings yet

- Ramavath A.Y 2020-21 Tax - AcknowledgementDocument1 pageRamavath A.Y 2020-21 Tax - AcknowledgementBhashya RamavathNo ratings yet

- Neetu Singh - FY 2019 20 - Detailed ITRVDocument1 pageNeetu Singh - FY 2019 20 - Detailed ITRVRakesh PatilNo ratings yet

- 2020 12 28 22 12 10 345 - 1609173730345 - XXXPR1222X - AcknowledgementDocument1 page2020 12 28 22 12 10 345 - 1609173730345 - XXXPR1222X - Acknowledgementsekhar bandiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKyra MehtaNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Itr-V Bogpp6352h 2020-21 767088050301120Document1 pageItr-V Bogpp6352h 2020-21 767088050301120DEVIL RDXNo ratings yet

- PDF 870515920231220Document1 pagePDF 870515920231220b2bservices007No ratings yet

- PDF 870515920231220Document1 pagePDF 870515920231220b2bservices007No ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBANDARU SRINUNo ratings yet

- Samvith - Financials - FY 2020-21Document6 pagesSamvith - Financials - FY 2020-21raghav shettyNo ratings yet

- ITR Acknowledgement FY 2019-20Document1 pageITR Acknowledgement FY 2019-20taramaNo ratings yet

- 2020-21 ItDocument95 pages2020-21 Itsriharidhana.financialservicesNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengalurusameer bakshiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruNavis AntonyNo ratings yet

- 2020 07 22 22 44 18 838 - 1595438058838 - XXXPK9292X - AcknowledgementDocument1 page2020 07 22 22 44 18 838 - 1595438058838 - XXXPK9292X - AcknowledgementGautam MNo ratings yet

- Itr 20-21Document1 pageItr 20-21Rohit kandpalNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruRohit kandpalNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Knot Wedding Planning SpreadsheetDocument46 pagesThe Knot Wedding Planning SpreadsheetRic Dela CruzNo ratings yet

- PayrollDocument553 pagesPayrollRic Dela CruzNo ratings yet

- Uid 10052022Document11 pagesUid 10052022Ric Dela CruzNo ratings yet

- Financial Requirements - V1 Ver.1Document3 pagesFinancial Requirements - V1 Ver.1Ric Dela CruzNo ratings yet

- Legal Ethic1Document12 pagesLegal Ethic1Ric Dela CruzNo ratings yet

- Template SummaryDocument1 pageTemplate SummaryRic Dela CruzNo ratings yet

- Meralco Bill 470322010101 04142023Document2 pagesMeralco Bill 470322010101 04142023Ric Dela CruzNo ratings yet

- Film Viewing IIDocument7 pagesFilm Viewing IIRic Dela CruzNo ratings yet

- Leg Ethics DigestDocument5 pagesLeg Ethics DigestRic Dela CruzNo ratings yet

- Legal Writing TSN With Direct and CrossDocument12 pagesLegal Writing TSN With Direct and CrossRic Dela Cruz100% (1)

- Legal LogicDocument7 pagesLegal LogicRic Dela CruzNo ratings yet

- Leg Ethics DigestDocument5 pagesLeg Ethics DigestRic Dela CruzNo ratings yet

- Bulacan State University College of Law: Atty. Jonieve P. Ramos-Gabriel, LLM, DCLDocument8 pagesBulacan State University College of Law: Atty. Jonieve P. Ramos-Gabriel, LLM, DCLRic Dela Cruz100% (1)

- Memorandum For The AccusedDocument6 pagesMemorandum For The AccusedRic Dela CruzNo ratings yet

- Nature: Petition For Review On Certiorari of A Judgment of The CADocument10 pagesNature: Petition For Review On Certiorari of A Judgment of The CARic Dela CruzNo ratings yet

- p1 p446 Legal Ethics PinedaDocument446 pagesp1 p446 Legal Ethics PinedaRic Dela CruzNo ratings yet

- Ricardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityDocument2 pagesRicardo Dela Cruz, CTT, Mritax, Mba: City of Malabon UniversityRic Dela CruzNo ratings yet

- Judicial Affidavit of Paul David C. ZaldivarDocument6 pagesJudicial Affidavit of Paul David C. ZaldivarRic Dela CruzNo ratings yet

- Alex Ong vs. Atty. Elpidio Unto, Adm. Case No. 2417, February 6, 2002Document11 pagesAlex Ong vs. Atty. Elpidio Unto, Adm. Case No. 2417, February 6, 2002Ric Dela CruzNo ratings yet

- Annual FactorDocument1 pageAnnual FactorRic Dela CruzNo ratings yet

- College of Law: Bulacan State UniversityDocument2 pagesCollege of Law: Bulacan State UniversityRic Dela CruzNo ratings yet

- Alpha ListDocument8 pagesAlpha ListRic Dela CruzNo ratings yet

- Alphalist Sched 1Document29 pagesAlphalist Sched 1Ric Dela CruzNo ratings yet

- U.S. Individu T Income Tax Return Owe Rao.,Sgs-Oo A Trsu C ,-Ap A ,+Document4 pagesU.S. Individu T Income Tax Return Owe Rao.,Sgs-Oo A Trsu C ,-Ap A ,+Stephanie Dube DwilsonNo ratings yet

- Unit 4 - DPSPS, RRSPs and TFSAsDocument61 pagesUnit 4 - DPSPS, RRSPs and TFSAsMITALI SWADIYANo ratings yet

- Exide Commission Structure AdvisorDocument5 pagesExide Commission Structure Advisorashok7jNo ratings yet

- Consumer Awareness Towards Insurance ProductsDocument86 pagesConsumer Awareness Towards Insurance ProductsMohit kolliNo ratings yet

- What Is Tax Equalisation?: How Does It Work in Principle?Document2 pagesWhat Is Tax Equalisation?: How Does It Work in Principle?Max Reyes SubiabreNo ratings yet

- All India Bank Employees' Association: "Prabhat Nivas"Document3 pagesAll India Bank Employees' Association: "Prabhat Nivas"Abhinav KumarNo ratings yet

- Finance Module 10 Managing Personal FinanceDocument5 pagesFinance Module 10 Managing Personal FinanceJOHN PAUL LAGAONo ratings yet

- Fixed Medical AllowanceDocument1 pageFixed Medical Allowancev.s.r.srikanth08No ratings yet

- A Brief On NPS & RFBDocument2 pagesA Brief On NPS & RFBRushikeshRameshchandraLachureNo ratings yet

- YSR Pension KanukaDocument7 pagesYSR Pension KanukaALLUR NAGAR PANCHAYATNo ratings yet

- Glosario: Traducción JurídicaDocument66 pagesGlosario: Traducción JurídicaSurvival Horror DownloadsNo ratings yet

- Ap PRC 2022Document25 pagesAp PRC 2022Harish SatyaNo ratings yet

- 0968 Hostplus Additional Contributions BrochureDocument9 pages0968 Hostplus Additional Contributions BrochureSepehrNo ratings yet

- 2016 - Tax ReturnDocument37 pages2016 - Tax Returncara harrisNo ratings yet

- Module 2 Concepts and Pervasive Principles Version 2013Document63 pagesModule 2 Concepts and Pervasive Principles Version 2013Kathy CeracasNo ratings yet

- 21191ILCB0323BDDocument22 pages21191ILCB0323BDSimon BrennanNo ratings yet

- Chapter 4 Income From SalariesDocument106 pagesChapter 4 Income From SalariesYogesh Sahani50% (2)

- Liheap 1Document6 pagesLiheap 1Lauren ZaleNo ratings yet

- Candidate Pre-Screening FormDocument4 pagesCandidate Pre-Screening Formkmanas153No ratings yet

- Testbank Finals 2021 Income TaxDocument11 pagesTestbank Finals 2021 Income Taxynasings.21No ratings yet

- New Tax Regime Vs Old Tax RegimeDocument11 pagesNew Tax Regime Vs Old Tax RegimevinishchandraaNo ratings yet

- Lesson 4.4 General AnnuityDocument22 pagesLesson 4.4 General AnnuityJomel RositaNo ratings yet

- You Are The Auditor of Beaton and Gunter Inc The PDFDocument2 pagesYou Are The Auditor of Beaton and Gunter Inc The PDFHassan JanNo ratings yet

- Telefónica UK Pension Plan: Expression of Wish FormDocument1 pageTelefónica UK Pension Plan: Expression of Wish FormDipesh LimbachiaNo ratings yet

- CA Tax NotesDocument616 pagesCA Tax NotesvijayNo ratings yet

- CaritasDocument15 pagesCaritasHedrix Ar-ar CaballeNo ratings yet

- Please Input: Formula, Do Not Change: Required Minimum DataDocument117 pagesPlease Input: Formula, Do Not Change: Required Minimum DataDwiputra SetiabudhiNo ratings yet