Professional Documents

Culture Documents

Govbusman Midterms Handout

Govbusman Midterms Handout

Uploaded by

Ann SantosOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Govbusman Midterms Handout

Govbusman Midterms Handout

Uploaded by

Ann SantosCopyright:

Available Formats

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK MANAGEMENT

And INTERNAL CONTROL 2019-2020

COURSE SYLLABUS

Course Code: GOVBUSMAN

Course Title: Corporate Governance, Business Ethics, Risk Management and Internal Control

No. of Units: 3

Course Description:

The business environment continues to change in dramatic ways and university graduates

joining the corporate world or entering the accountancy profession, whether it be in the public practice

sector, management accounting practice, internal audit or accounting information system management,

must be prepared for a high standard of responsibility. This textbook aims to equip its readers the basic

knowledge, skills and perspective that are necessary in facing its challenge.

Having a solid understanding of fundamental business, its governance, risk management, ethical

practices and internal control will become even more important in a world of advancing technology.

While businesses in different industry have strikingly different characteristics, most have some

fundamental characteristics in common. A fundamental widely accepted model of business consists of

governance, objectives, strategies, business processes, risks, controls and reporting.

Course Objectives:

At the end of the semester, the students should be able to:

1. Define and discuss the principles and goals of Corporate Governance, Business Ethics, Risk

Management and Internal Control.

2. Explain the core principles underlying fairness, accountability and transparency in corporate

governance and how the said principles are applied within the corporate context.

3. Understand how integrity, transparency and proper governance of a company could be ensured

through effective internal control system and enterprise risk management framework.

4. Enumerate and describe the basic characteristics and values associated with ethical behavior.

5. Appreciate why ethical behavior in personal, professional, and business dealings is necessary.

6. Explain why professional ethics is important and why a code of conduct should be adopted.

7. Learn and familiarize of the impact of corruption in the Philippines as well the efforts both of the

public and private sectors to curb it.

8. Define, explain, and describe risk management, its basic principles and the elements associated

with risk management.

9. Explain, describe and define the nature and purpose of internal control system.

2nd Semester 2019-2020 GOVBUSMAN Page 1

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

10. Understand the potential misstatements due to fraud and errors of the asset accounts, liability

and equity accounts and how weakness in internal control contributes to the risks of

misstatements.

Course Outline

Unit I CORPORATE GOVERNANCE

Chapter 1 Introduction to Corporate Governance

Chapter 2 Corporate Governance Responsibilities and Accountabilities

Chapter 3 Securities and Exchange (SEC) Commission Code of Corporate Governance

Chapter 4 SEC Code of Corporate Governance, Continued

Unit II BUSINESS ETHICS

Chapter 5 Introduction to Ethics

Chapter 6 Business Ethics

Chapter 7 Common Unethical Practices of Business Establishments

Chapter 8 Ethical Dilemma

Chapter 9 Advocacy against Corruption

Chapter 10 Initiatives to improve Business Ethics and reduce Corruption

MIDTERM EXAMINATIONS

Unit III INTRODUCTION TO RISK MANAGEMENT

Chapter 11 Risk Management

Chapter 12 Practical Insights in Reducing and Managing Business Risks

Unit IV INTERNAL CONTROL: A VITAL TOOL IN MANAGING RISK

Chapter 13 Overview of Internal Control

Chapter 14 Fraud and Error

Chapter 15 Errors and Irregularities in the Transaction Cycles of the Business Entity

Chapter 16 Internal Control Affecting Assets

Chapter 17 Internal Control Affecting Liabilities and Equity

FINAL EXAMINATIONS

FINAL GRADE: (MID TERM GRADE + FINAL TERM GRADE) / 2

2nd Semester 2019-2020 GOVBUSMAN Page 2

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Reference/s:

Cabrera, Ma. Elenita, Cabrera, Gilbert, Auditing Theory, 2017 Edition, Manila, Philippines

Cabrera, Ma. Elenita, Cabrera, Gilbert, Strategic Cost Management, 2019 Edition, Manila, Philippines

Whittington / Pany, Principles of Auditing and Other Assurance Services, 15 th Edition

Internet Websites:

Gan Business Anti-Corruption Portal (www.business-anti-corruption.com)

Catholics Bishops-Businessmen Conference Philippines (cbcpwebsite.com)

Integrity Initiative (integrityinitiative.com)

International Organization for Standardization (www.iso.org)

Securities and Exchange Commission (www.sec.gov.ph)

Board of Accountancy (boa.com.ph)

2nd Semester 2019-2020 GOVBUSMAN Page 3

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

CHAPTER 1: INTRODUCTION TO CORPORATE GOVERNANCE

Expected Learning Outcomes

After studying the chapter, you should be able to …

1. Describe what governance involves.

2. Enumerate the different contexts in which governance can be applied.

3. Name and explain the characteristics of good governance.

4. Explain the meaning, purpose and objectives of corporate governance.

5. Know and describe the principles of effective corporate governance.

6. Understand how the principles of good corporate governance can be applied.

WHAT IS GOVERNANCE?

Generally, governance refers to a process whereby elements in society wield power, authority

and influence and enact policies and decisions concerning public life and social upliftment. It comprises

all the processes of governing – whether undertaken by the government of a country, by a market or by

a network – over a social system and whether through the laws, power or language of an organized

society. Governance therefore means the process of decision-making and the process by which decisions

are implemented (or not) through the exercise of power or authority by leaders of the country and/or

organizations.

Governance can be used in several contexts such as corporate governance, international

governance, national governance and local governance.

CHARACTERISTICS OF GOOD GOVERNANCE

Whatever context good governance is used, the following major characteristics should be

present:

2nd Semester 2019-2020 GOVBUSMAN Page 4

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

These characteristics are briefly described as follows:

Participation – it could either be direct or through legitimate institutions or representatives. It is

important to point out that representative democracy does not necessarily mean that the concern of

the most vulnerable in society would not be taken into consideration in decision making. It needs to be

informed and organized. This means freedom of association and expression on one hand and an

organized civil society on the other hand.

Rule of Law – good governance requires fair legal frameworks that are enforced impartially. It also

requires full protection of human rights, particularly those of minorities.

Transparency – it means that decisions taken and their enforcement are done in a manner that follows

rules and regulations.

Responsiveness – good governance requires that institutions and processes try to serve the needs of all

stakeholders within a reasonable timeframe.

Consensus Oriented – good governance requires mediation of the different interests in society to reach

a broad consensus on what is in the best interest of the whole community and how this can be achieved.

It also requires a broad and long-term perspective on what is needed for sustainable human

development and how to achieve the goals of such development.

Equity and Inclusiveness – ensures that all its members feel that they have a stake in it and do not feel

excluded from the mainstream of society.

Effectiveness and Efficiency – it means that processes and institutions produce results that meet the

needs of society while making the best use of resources at their disposal. The concept of efficiency in

the context of good governance also covers the sustainable use of natural resources and the protection

of the environment.

Accountability – who is accountable to whom varies depending on whether decisions or actions taken

are internal or external to an organization or institution. In general, an organization or an institution is

accountable to those who will be affected by its decisions or actions. Accountability cannot be enforced

without transparency and the rule of law.

CORPORATE GOVERNANCE: AN OVERVIEW

Corporate Governance is defined as the system of rules, practices and processes by which business

corporations are directed and controlled. It basically involves balancing the interests of a company’s

many stakeholders, such as shareholders, management, customers, suppliers, financiers, government

and the community.

Good corporate governance is all about controlling one’s business and so is relevant, and indeed vital,

for all organizations whatever size or structure. The corporate governance structure specifies the

2nd Semester 2019-2020 GOVBUSMAN Page 5

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

distribution of rights and responsibilities among different participants in the corporation, such as the

board, managers, shareholders, and other stakeholders, and spells out the rules and procedures for

making decisions on corporate affairs.

PURPOSE OF CORPORATE GOVERNANCE

The purpose of corporate is to facilitate effective, entrepreneurial and prudent management that can

deliver long-term success of the company. In simple terms, the fundamental aim of corporate

governance is to enhance shareholders’ value and protect the interests of other stakeholders by

improving the corporate performance and accountability.

OBJECTIVES OF CORPORATE GOVERNANCE

The following are the basic objectives of corporate governance:

1. Fair and Equitable Treatment of Shareholders

A corporate governance structure ensures equitable and fair treatment of all shareholders of

the company. All shareholders deserve equitable treatment and this equity is safeguarded by a

good governance structure in the organization.

2. Self-Assessment

Corporate governance enables firms to assess their behavior and actions before they are

scrutinized by regulatory agencies. Business establishments with a strong corporate governance

system are better able to limit exposure to regulatory risks and fines.

3. Increase Shareholders’ Wealth

Firms with strong corporate governance structure are seen to have higher valuation attached to

their shares by businessmen. This only reflects the positive perception that good governance

induces potential investors to decide to invest in a company.

4. Transparency and Full Disclosure

Good corporate governance aims at ensuring a higher degree of transparency in an organization

by encouraging full disclosure of transactions in the company accounts.

BASIC PRINCIPLES OF EFFECTIVE CORPORATE GOVERNANCE

Effective corporate governance is transparent, protects the rights of shareholders and includes both

strategic and operational risk management. It is concerned in both the long-term earning potential as

well as actual short-term earnings and holds directors accountable for their stewardship of the business.

The basic principles of effective corporate governance are threefold as presented below:

2nd Semester 2019-2020 GOVBUSMAN Page 6

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Transparency and Full Disclosure Accountability

Is the board telling us what is going

on? Is the board taking responsibility?

Good and Effective Governance

Corporate Control

Is the board doing the right thing?

ILLUSTRATIVE APPLICATION OF THE BASIC PRINCIPOLES OF CORPORATE GOVERNANCE AND BEST

PRACTICE RECOMMENDATIONS

Principles of Good Corporate Governance Best Practice Recommendations

1. Accompany should lay solid foundation 1-a. Formalize and disclose the functions

for management and oversight. It should reserved to the board and those delegated to

recognize and publish the respective management.

roles and responsibilities of board and

management.

2. Structure the board to add value. Have a 2-a. A board should have independent directors.

board of an effective composition, size 2-b. The roles of chairperson and chief executive

and commitment to adequately officer should not be exercised by the same

discharge its responsibilities and duties. individual.

2-b. The board should establish a nomination

committee.

3. Promote ethical and responsible 3-a. Establish a code of conduct to guide the

decision-making. Actively promote directors, the chief executive officer (or

ethical and responsible decision-making. equivalent), the chief financial officer (or

equivalent) and any other key executives as to:

The practices necessary to maintain

confidence in the company’s integrity;

and

The responsibility and accountability of

individuals for reporting and investigating

reports of unethical practices.

3-b. Disclose the policy concerning trading in

company securities by directors, officers and

2nd Semester 2019-2020 GOVBUSMAN Page 7

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

employees.

4. Safeguard integrity in financial reporting. 4-a. Require the chief executive of (or equivalent)

Have a structure to independently verify and the chief financial officer (or equivalent) to

and safeguard the integrity of the state in writing to the board that the company’s

company’s financial reporting. financial reports present a true and fair view, in

all material respects, of the company’s financial

condition and operational results and are in

accordance with relevant accounting standards.

4-b. The board should establish an audit

committee.

4-c. Structure the audit committee so that it

consists of :

Only non-executive or independent

directors;

An independent chairperson, who is not

chairperson; and

At least three (3) members.

5. Make timely and balanced disclosure. 5-a. Establish written policies and procedures

Promote timely and balanced disclosure designed to ensure compliance with IFRS.

of all material matters concerning the 5-b. Listing Rule disclosure requirements and to

company. ensure accountability at a senior management

level for compliance.

6. Respect the rights of shareholders and 6-a. Design and disclose a communications

facilitate the effective exercise of those strategy to promote effective communication

rights. with shareholders and encourage effective

participation at general meetings.

6-b. Request the external auditor to attend the

annual general meeting and be available to

answer shareholder questions about the audit.

7. Recognize and manage risk. Establish a 7-a. The board or appropriate board committee

sound system of risk oversight and should establish policies on risk oversight and

management and internal control. management.

7-b. The chief executive (or equivalent) and the

chief financial officer (or equivalent) should state

to the board in writing that:

The statement given in accordance with

best practice recommendation 4-a (the

integrity of financial statements) is

founded on a sound system of risk

management and internal compliance

and control which implements the

policies adopted by the board; and

2nd Semester 2019-2020 GOVBUSMAN Page 8

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

The company’s risk management and

internal compliance and control system is

operating efficiently in all material

respects.

8. Encouraged enhanced performance. 8-a. Disclose the process for performance

Fairly review and actively encourage evaluation of the board, its committees and

enhanced board and management individual directors, and key executives.

effectiveness.

9. Remunerate fairly and responsibly. 9-a. Provide disclosure in relation to the

Ensure that the level and composition of company’s remuneration policies to enable

remuneration is sufficient and reasonable investors to understand:

and that its relationship to corporate and The costs and benefits of those policies;

individual performance is defined. and

The link between remuneration paid to

directors and key executives and

corporate performance.

9-b. The board should establish a remuneration

committee.

9-c. Clearly distinguish the structure of non-

executive director’s remuneration from that of

executives.

9-d. Ensure that payment of equity-based

executive remuneration is made in accordance

with thresholds set in plans approved by

shareholders.

10. Recognize the legitimate interests of 10-a. Establish and disclose a code of conduct to

stakeholders. Recognize legal and other guide compliance with legal and other obligations

obligations to all legitimate stakeholders. to legitimate stakeholders.

2nd Semester 2019-2020 GOVBUSMAN Page 9

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Chapter 2: CORPORATE GOVERNANCE RESPONSIBILITIES AND ACCOUNTABILITIES

Expected Learning Outcomes

After studying the chapter, you should be able to …

1. Explain the relevance of good governance to both large publicly-listed companied and SMEs.

2. Know the relationship between shareholders or owners and other stakeholders.

3. Identify the parties involved in Corporate Governance.

4. Describe the respective broad rate and specific responsibilities of the different parties in a

corporate setting.

INTRODUCTION

Many of the characteristics of good governance described in Chapter 1 are relevant to both SME’s and

large listed public companies. As an organization grows in size and influence, these issues become

increasingly important.

However, it is also important to recognize that good governance is based on principles underpinned by

consensus and continually developing notions of good practice. There are no absolute rules which must

be adopted by all organizations. “There is no simple universal formula for good governance.” Instead,

emphasis in many localities has been to encourage organizations to give appropriate attention to the

principles and adopt approaches which are tailored to the specific needs of an organization at a given

point in time.

The essence of any system of good governance is to allow the board and management the freedom to

drive their organization forward and to exercise that freedom within a framework of effective

accountability.

2nd Semester 2019-2020 GOVBUSMAN Page 10

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

RELATIONSHIP BETWEEN SHAREHOLDERS / OWNER(S) AND OTHER STAKEHOLDERS

The relationship between the shareholders / owners, management and other stakeholders in a

corporation is shown below.

Public Corporation Stakeholders

Shareholders /

Board of Directors Owners

Delegate Have

Executive External

Management Auditors

Shareholder

s

Accountabilities

Responsibilities Operational Regulators

Management

Internal Auditors

Society and Others

Governance starts with the shareholders/owner delegating responsibilities through an elected board of

directors to management and, in turn, to operating units with oversight and assistance from internal

auditors. The board of directors and its audit committee oversee management and, in that role, are

expected to protect the shareholders’ rights. However, it is important to recognize that management is

part of the governance framework; management can influence who sits on the board and the audit

committee as well as other governance controls that might be put into place.

In return for the responsibilities (and power) given to management and the board, governance demands

accountability back through the system to the shareholders. However, the accountabilities do not

extend only to the shareholders. Companies also have responsibilities to other stakeholders.

Stakeholders can be anyone who is influenced, whether directly or indirectly, by the actions of the

company. Management and the board have responsibilities to act within the laws of society and to

meet various requirements of creditors, employees, and the stakeholders.

While shareholders/owners delegate responsibilities to various parties within the corporation, they also

require accountability as to how well the resources that have been entrusted to management and the

board have been used. For example, the owners want accountability on such things as:

2nd Semester 2019-2020 GOVBUSMAN Page 11

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Financial performance

Financial transparency – financial statements that are clear with full disclosure and that reflect

the underlying economics of the company.

Stewardship, including how well the company protects and manages the resources entrusted

to it.

Quality of internal control

Composition of the board of directors and the nature of its activities, including information on

how well management incentive systems are aligned with the shareholders’ best interests.

The owners want disclosures from management that are accurate and objectively verifiable.

Management has always had the primary responsibility for the accuracy and completeness of an

organization’s financial statements. From a financial reporting perspective, it is management’s

responsibility to:

Choose which accounting principles best portray the economic substance of company

transactions.

Implement a system of internal control that assures completeness and accuracy in financial

reporting.

Ensure that the financial statements contain accurate and complete.

PARTIES INVOLVED IN CORPORATE GOVERNANCE: THEIR RESPECTIVE BROAD ROLE AND SPECIFIC

RESPONSIBILITIES

PARTY OVERVIEW OF RESPONSIBILITIES

1. Shareholders Broad Role:

Provide effective oversight through election of board members, approval

of major initiatives such as buying or selling stock, annual reports on

management compensation from the board.

2. Board of Broad Role:

Directors

The major representatives of stockholders to ensure that the organization

is run according to the organization’s charter and that there is proper

accountability.

Specific activities include among others:

1. Overall Operations

Establishing the organizations vision, mission, values and

2nd Semester 2019-2020 GOVBUSMAN Page 12

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

ethical standards.

Delegating an appropriate level of authority to

management

Demonstrating leadership

Assuming responsibility for the business relationship with

CEO including his or her appointment, succession,

performance remuneration and dismissal.

Overseeing aspects of the employment of the

management team including management remuneration,

performance and succession planning.

Recommending auditors and new directors to

shareholders.

Ensuring effective communicating with shareholders

other stakeholders

Crisis management

Appointment of the CFO and corporate secretary.

2. Performance

Ensuring the organization’s long term viability and

enhancing the financial position.

Formulating and overseeing implementation of corporate

strategy.

Approving the plan, budget and corporate policies.

Agreeing key performance indicators (KPIs)

Monitoring/assessing assessment, performance of the

organization, the board itself, management and major

projects.

Overseeing the risk management framework and

monitoring business risks.

Monitoring developments in the industry and the

operating environment.

Oversight of the organization, including its control and

accountability systems.

Approving and monitoring the progress of major capital

expenditure, capital management and acquisitions and

divestitures.

3. Compliance / Legal Conformance

Understanding and protecting the organization’s

financial position.

Requiring and monitoring legal and regulatory

compliance including compliance with accounting

standards, unfair trading legislations, occupational

health and safety and environmental standards.

Approving annual financial reports, annual reports and

other public documents / sensitive reports.

Ensuring an effective system of internal controls exists

and is operating as expected.

2nd Semester 2019-2020 GOVBUSMAN Page 13

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

3. Non-Executive or Broad Role:

Independent

Directors The same as the broad role of the entire board of directors

Specific activities include among others:

To understand the organization, its business, its operating

environment and its financial position.

To apply expertise and skills in the organization’s best interests.

To assist management to keep performance objectives at the top

of its agenda.

To understand that his/her role is not to act as auditor, nor to act

as a member of the management team.

To respect the collective, cabinet nature of the board’s decisions

To prepare for and attend board meetings

To seek information on a timely basis to ensure that he/she is in a

position to contribute to the discussion when a matter comes

before the board, or alert the chairman in advance to the need for

further information in relation to a particular matter, and

To ask appropriate questions relative to operations

4. Management Broad Role:

Operations and accountability. Manage the organization effectively;

provide accurate and timely reports to shareholders and other

stakeholders.

Specific activities include among others:

Recommend the strategic direction and translate the strategic

plan into the operations of the business

Manage the company’s human, physical and financial resources to

achieve the organization’s objectives – run the business.

Assume day to day responsibility for the organization’s

conformance with relevant laws and regulations and its

compliance framework.

Develop, implement and manage the organization’s risk

management and internal control frameworks.

Develop, implement and update policies and procedures

Be alert to relevant trends in the industry and the organization’s

operating environment

Provide information to the board.

Act as conduit between the board and the organization

Developing financial and other reports that meet public,

stakeholder and regulatory requirements

2nd Semester 2019-2020 GOVBUSMAN Page 14

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

5. Audit Broad Role:

Committees of

the Board of Provide oversight of the internal and external audit function and the

Directors process of preparing the annual financial statements as well as public

reports on internal control

Specific activities include among others:

Selecting the external audit firm.

Approving any non-audit work performed by the audit firm

Selecting and / or approving appointment of the Chief Audit

Executive (Internal Auditor)

Reviewing and approving the scope and budget of the internal

audit function

Discussing audit findings with internal auditor and external

auditor and advising the board (and management) on specific

actions that should be taken.

6. Regulators Broad Role:

a. Board of

Accountancy Set accounting and auditing standards dictating underlying financial

reporting and auditing concepts; set the expectations of audit quality and

accounting quality.

Specific activities include among others:

Conducting CPA Licensure Board Examinations

Approving accounting principles

Approving auditing standards

Interpreting previously issued standards implementing quality

control processes to ensure audit quality

Educating members on audit and accounting requirements

b. Securities Broad Role:

and

Exchange Ensure the accuracy, timeliness and fairness of public reporting of

Commission financial and other information for public companies.

Specific activities include among others:

Reviewing filings with the SEC

Interacting with the Financial Reporting Standards Council in

setting accounting standards

Specifying independence standards required of auditors that

report on public financial statements

Identify corporate frauds, investigate causes, and suggest

remedial actions

2nd Semester 2019-2020 GOVBUSMAN Page 15

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

7. External Broad Roles:

Auditors Perform audits of company financial statements to ensure that the

statements are free of material misstatements including misstatements

that may be due to fraud.

Specific activities include among others:

Audit of public company financial statements

Audits of non-public company financial statements

Other services such as tax or consulting

8. Internal Auditors Broad Role:

Perform audits of company for compliance with company policies and

laws, audits to evaluate the efficiency of operations and periodic

evaluation and tests of controls.

Specific activities include among others:

Reporting results and analyses to management (including

operational management) and audit committees

Evaluating internal controls

2nd Semester 2019-2020 GOVBUSMAN Page 16

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Chapter 3 & 4: SECURITIES and EXCHANGE COMMISSION (SEC) CODE of CORPORATE GOVERNANCE

Expected Learning Outcomes

After studying the chapter, you should be able to …

1. Understand the need for the Code of Governance for publicly-listed companies.

2. Know the Sixteen (16) governance responsibilities of the Board of Directors of publicly-listed

companies.

3. Explain the meaning of ‘comply and explain” approach.

4. Describe the three aspects of the Code, namely:

Principles

Recommendations

Explanations

5. Know what constitutes a competent board and how can it be established.

6. Understand the composition, functions and responsibilities of the board committees that can be

established such as

Audit Committee

Corporate Governance Committee

Board Risk Oversight Committee

Related Party Transaction Committee

7. Know how the directors can show full commitment to the company.

8. Understand how independence and objectivity of the board can be reinforced and enhanced.

9. Describe how the performance and effectiveness of the board can be assessed.

SEC CODE OF CORPORATE GOVERNANCE FOR PUBLICLY-LISTED COMPANIES (“CG Code for PLC’s)

Securities and Exchange Commission SEC MC No. 19, Series of 2016

On November 10, 2016, the Securities and Exchange Commission approved the Code of Corporate

Governance for publicly-listed companies. Its goal is to help companies develop and sustain an ethical

corporate culture and keep abreast with recent developments in corporate governance.

One of its salient provisions is for publicly-listed companies to establish a code of business conduct and

submit a new manual on Corporate Governance that would “provide standards for professional and

ethical behavior as well as articulate acceptable and unacceptable conduct and practices”. The Board of

Directors is required to implement the code and make sure that management and employees comply

with the internal policies set.

2nd Semester 2019-2020 GOVBUSMAN Page 17

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

CODE OF CORPORATE GOVERNANCE FOR PUBLICLY-LISTED COMPANIES

The Board’s Governance Responsibilities

Principle 1: The Company should be headed by a competent, working board to foster the long-term

success of the corporation, and to sustain its competitiveness and profitability in a

manner consistent with its corporate objectives and the long-term best interests of its

shareholders and other stakeholders.

Principle 2: The fiduciary roles, responsibilities and accountabilities of the Board as provided under

The law, the company’s articles and by-laws, and other legal pronouncements and

guidelines should be clearly made known to all directors as well as to stockholders and

other stakeholders.

Principle 3: Board committees should be set up to the extent possible to support the effective

performance of the Board’s functions, particularly with respect to audit, risk

management, related party transactions, and other key corporate governance concerns,

such as nomination and remuneration. The composition, functions and responsibilities

of all committees established should be contained in a publicly available Committee

Charter.

Principle 4: To show full commitment to the company, the directors should devote the time and

attention necessary to properly and effectively perform their duties and responsibilities,

including sufficient time to be familiar with the corporation’s business.

Principle 5: The Board should endeavor to exercise objective and independent judgment on all

corporate affairs.

Principle 6: The best measure of the Board’s effectiveness is through an assessment process. The

Board should regularly carry out evaluations to appraise its performance as a body, and

assess whether it possesses the right mix of backgrounds and competencies.

Principle 7: Members of the Board are duty-bound to apply high ethical standards, taking into

account the interests of all stakeholders.

DISCLOSURE AND TRANSPARENCY

Principle 8: The company should establish corporate disclosure policies and procedures that are

practical and in accordance with best practices and regulatory expectations.

Principle 9: The Company should establish standards for the appropriate selection of an external

auditor, and exercise effective oversight of the same to strengthen the external

auditor’s independence and enhance audit quality.

Principle 10: The Company should ensure that material and reportable non-financial and

sustainability issues are disclosed.

2nd Semester 2019-2020 GOVBUSMAN Page 18

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Principle 11: The Company should maintain a comprehensive and cost-efficient communication

channel for disseminating relevant information. This channel is crucial for informed

decision-making by investors, stakeholders and other interested users.

INTERNAL CONTROL SYSTEM AND RISK MANAGEMENT FRAMEWORK

Principle 12: To ensure the integrity, transparency and proper governance in the conduct of its

affairs, the company should have a strong and effective internal control system and

enterprise risk management framework.

CULTIVATING A SYNERGIC RELATIONSHIP WITH SHAREHOLDERS

Principle 13: The Company should treat all shareholders fairly and equitably, and also recognize,

protect and facilitate the exercise of their rights.

DUTIES TO STAKEHOLDERS

Principle 14: The rights of stakeholders established by law, by contractual relations and through

voluntary commitments must be respected. Where stakeholders’ rights and/or

interests are at stake, stakeholders should have the opportunity to obtain prompt

effective redress for the violation of their rights.

Principle 15: A mechanism for employee participation should be developed to create a symbiotic

environment, realize the company’s goals and participate in its corporate governance

process.

Principle 16: The Company should be socially responsible in all its dealings with the communities

where it operates. It should ensure that its interactions serve its environment and

stakeholders in a positive and progressive manner that is fully supportive of its

comprehensive and balanced development.

INTRODUCTION

1. The Code of Corporate Governance is intended to raise the corporate governance standards of

Philippine corporations to a level at par with its regional and global counterparts.

2. The Code will adopt the “comply and explain” approach. This approach combines voluntary

compliance with mandatory disclosure.

3. The Code is arranged as follows: Principles, Recommendations and Explanations. The Principles

can be considered as high-level statements of corporate governance good practice, and are

applicable to all companies.

4. The Recommendations are objective criteria that are intended to identify the specific features of

corporate governance good practice that are recommended for companies operating according

to the Code. Alternatives to a Recommendation may be justified in particular circumstances if

2nd Semester 2019-2020 GOVBUSMAN Page 19

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

good governance can be achieved by other means. When a Recommendation is not complied

with, the company must disclose and describe this non-compliance; and explain how the overall

Principle is being achieved. The alternative should be consistent with the overall Principle.

Descriptions and explanations should be written in plain language and in a clear, complete,

objective and precise manner, so that shareholders and other stakeholders can assess the

company’s governance framework.

5. The Explanations strive to provide companies with additional information on the recommended

best practice.

This Code does not, in any way, prescribe a “one size fits all” framework. It is designed to allow

boards some flexibility in establishing their corporate governance arrangements. Larger

companies and financial institutions would generally be expected to follow most of the Code’s

provisions. Smaller companies may decide that the costs of some of the provisions outweigh

the benefits, or are less relevant in their case. Hence, the Principle of Proportionality is

considered in the application of its provisions.

6. The Code of Corporate Governance for publicly-listed companies is the first of a series of Codes

that is intended to cover all types of corporations in the Philippines under supervision of the

Securities and Exchange Commission (SEC).

7. Definition of Terms:

Corporate Governance – the system of stewardship and control to guide organizations

in fulfilling their long-term economic, moral, legal and social obligations towards their

stakeholders.

Board of Directors – the governing body elected by the stockholders the exercises the

corporate powers of a corporation, conducts all its business and control its properties.

Management – a group of executives given the authority by the Board of Directors to

implement the policies or has laid down in the conduct of the business of the

corporation.

Independent Director – a person who is independent of management and the

controlling shareholder, and is free from any business or other relationship which could,

or could reasonably perceived to, materially interfere with his exercise of independent

judgment in carrying out his responsibilities as a director.

Executive Director – a director who has executive responsibility of day-to-day

operations of a part or the whole of the organization.

Non-executive director – a director who has no executive responsibility and does not

perform any work related to the operations of the corporation.

Conglomerate – a group of corporations that has diversified business activities in

various industries, whereby the operations of such businesses are controlled and

managed by a parent corporate entity.

Internal control – a process designed and effected by the board of directors, senior

management, and all levels of personnel to provide reasonable assurance on the

achievement of objectives through efficient and effective operations; reliable, complete

and timely financial and management information; and compliance with applicable

laws, regulations, and the organization’s policies and procedures.

2nd Semester 2019-2020 GOVBUSMAN Page 20

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Enterprise Risk Management – a process, effected by an entity’s Board of Directors,

management and other personnel, applied in the strategy setting and across the

enterprise that is designed to identify potential events that may affect the entity,

manage risks to be within its risk appetite, and provide reasonable assurance regarding

the achievement of entity objectives.

Related Party – shall cover the company’s subsidiaries as well as affiliates and any party

(including their subsidiaries, affiliates and special purpose entities), that the company

exerts direct or indirect control over the company; the company’s directors; officers;

shareholders and related interest (DOSRI), and their close family members as well, as

well as corresponding persons on affiliate companies. This shall also include such other

persons or juridical entity whose interests may pose a potential conflict with the

interest of the company.

Related Party Transactions – a transfer of resources, services or obligations between a

reporting entity and a related party, regardless of whether a price is charged. It should

be interpreted broadly to include not only transactions that are entered into with an

unrelated party that subsequently becomes a related party.

Stakeholders – any individual, organization or society at large who can either affect

and/or be affected by the company’s strategies, policies, business decisions and

operations, in general. This includes, among others, customers, creditors, employees,

suppliers, investors, as well as the government and community in which it operates.

2nd Semester 2019-2020 GOVBUSMAN Page 21

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Chapter 5: INTRODUCTION TO ETHICS

Expected Learning Outcomes

After studying the chapter, you should be able to …

1. Define Ethics.

2. Enumerate and describe the basic characteristics and values associated with ethical behavior.

3. Appreciate why ethical behavior in personal, professional and business dealings is necessary.

4. Understand the reasons why people act unethically.

5. Give and explain the categories of ethical principles.

6. Give and describe the ethical principles related to:

a. Personal ethics

b. Professional ethics

c. Business ethics

7. Explain why professional ethics is important and why a code of conduct should be adopted.

INTRODUCTION TO ETHICS

Introduction

Ethics can be defined broadly as a set of moral principles or values that govern the actions and decisions

of an individual or group. While personal ethics vary from individual to individual at any point in time,

most people within a society are able to agree about what is considered ethical and unethical behavior.

In fact, a society passes laws that define what its citizens consider to be the more extreme forms of

unethical behavior.

Each of us has such a set of values, although we may or may not have considered them explicitly.

Philosophers, religious organizations, and other groups have defined various ways ideal sets of moral

principles or values. Examples of prescribed sets of moral principles or values at the implementation

level include laws and regulations, church doctrine, code of business ethics for professional groups such

as CPAs, and codes of conduct within individual organizations.

It is common for people to differ in their moral principles or values. Even if two people agree on the

ethical principles that determine ethical behavior, it is unlikely that they will agree on the relative

importance of each principle. These differences result from all of our life experiences. Parents,

teachers, friends and employers are known to influence our values, but so do television, team sports,

life successes and failures, and thousands of other experiences.

2nd Semester 2019-2020 GOVBUSMAN Page 22

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

CHARACTERISTICS AND VALUES ASSOCIATED WITH ETHICAL BEHAVIOR

Integrity

Be principled, honorable, upright, and courageous and act on convictions; do not be two-faced

or unscrupulous, or adopt an end-justifies-the means philosophy that ignores principles.

Honesty

Be truthful, sincere, forthright, straightforward, frank, and candid; do not cheat, steal, lie,

deceive or act deviously.

Trustworthiness and Promise Keeping

Be worthy of trust, keep promises, full commitments abide by the spirit as well as the letter of

an agreement; do not interpret agreements in an unreasonably technical or legalistic manner in order to

rationalize non-compliance or create excuses and justification for breaking commitments.

Loyalty (Fidelity) and Confidentiality

Be faithful and loyal to family, friends, employers, client and country; do not use or disclose

information learned in confidence; in a professional context, safeguard the influences and conflicts of

interest.

Fairness and Openness

Be fair and open-minded, be willing to admit error and, where appropriate, change positions

and beliefs, demonstrate a commitment to justice, the equal treatment of individuals, and tolerance for

acceptance of diversity; do not overreach or take advantage of another’s mistakes or diversities.

Caring for Others

Be caring, kind, compassionate; share, be giving, be of service to others; help those in need and

avoid harming others.

Respect for Others

Demonstrate respect for human dignity, privacy, and the right to self-determination of all

people; be courteous, prompt, and decent; provide others with the information they need to make

informed decisions about their own lives; do not patronize, embarrass, or demean.

Responsible Citizenship

Obey just laws; if a law is unjust, openly protest it; exercise all democratic rights and privileged

responsibly by participation (voting and expressing informed views) social consciousness, and public

service; when in a position of leadership or authority, openly respect and honor democratic processes of

2nd Semester 2019-2020 GOVBUSMAN Page 23

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

decision-making, avoid unnecessary secrecy or concealment of information, and assure that others have

all the information they need to make intelligent choices and exercise their rights.

Pursuit of Excellence

Pursue excellence in all matters; in meeting your personal and professional responsibilities, be

diligent, reliable, industrious and committed; perform all tasks to the best of your ability, develop and

maintain a high degree of competence, be well informed and well prepared; do not be content with

mediocrity; do not “win at any cost”.

Accountability

Be accountable; accept responsibility for decisions, for the foreseeable consequences of actions

and inactions, and for setting an example for others.

WHY IS ETHICAL BEHAVIOR NECESSARY?

Ethical behavior is necessary for a society to function in an orderly manner. It can be argued that ethics

is the glue that holds a society together. The need for ethics in society I sufficiently important that many

commonly held ethical values are incorporated into laws. A considerable portion of the ethical values of

a society cannot be incorporated into laws because of the judgmental nature of certain values. Looking

at the honesty principle, it is practical to have laws that deal with cheating, stealing, lying, or deceiving

others. It is far more difficult to establish meaningful laws that deal with many aspects of principles such

as integrity, loyalty and pursuit of excellence. That does not imply that these principles are less

important for an orderly society. Business decisions influence employees, customers, suppliers, and

competitors, while company operations affect communities, governments and the environment.

WHY DO PEOPLE ACT UNETHICALLY?

There are two primary reasons why people act unethically:

1. The person’s ethical standards are different from those of society as a whole, or;

2. The person chooses to act selfishly.

In many instances, both reasons exist.

2nd Semester 2019-2020 GOVBUSMAN Page 24

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

CATEGORIES OF ETHICAL PRINCIPLES

Principles of Personal Ethics include among others;

Basic justice, fairness

Respect for the right of others

Concern for the right of others

Concern for the well-being on welfare of others

Benevolence, trustworthiness, honesty

Compliance with the law

Professional Ethics include among others;

Integrity, impartiality, objectivity

Professional competence

Confidentiality

Professional behavior

Avoidance of potential or apparent conflict of interest

Business Ethics include among others;

Fair competition

Global as well as domestic justice

Social responsibility

Concern for environment

The Need for Professional Ethics

To understand the importance of a Code of Ethics to professionals, one must understand the nature of a

profession as opposed to other vocations. There is no universally accepted definition of what

constitutes a profession; yet, for generations, certain types of activities have been recognized as

professions while others have not.

All the recognized professions have several common characteristics. The most important of these

characteristics are:

1. A responsibility to serve the public

2. A complex body of knowledge

3. Standards of admission to the profession

4. A need for public confidence

2nd Semester 2019-2020 GOVBUSMAN Page 25

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Chapter 6: BUSINESS ETHICS

Expected Learning Outcomes

After studying the chapter, you should be able to …

1. Explain what business ethics is.

2. Discuss the purposes of business ethics.

3. Describe the scope and impact of business ethics on

a. the economy

b. society

c. environment

d. business managers

4. Explain the ethical challenges in today’s world.

BASIC CONCEPT OF BUSINESS ETHICS

Business ethics refers to standards of moral conduct, behavior and judgment in business. It involves

making the moral and right decisions while engaging in such business activities as manufacturing and

selling a product and providing a service to customers. Business ethics is an area of corporate

responsibility where businesses are legally bound and socially obligated to conduct business in an ethical

manner. Business ethics is based on the personal values and standards of each person engaged in

business.

PURPOSES OF BUSINESS ETHICS

Main Purpose

The main purpose of business ethics is to help business and would-be business to determine what

business practices are right and what are wrong.

Special Purpose

There are other purposes which are corollary to the main purpose. These purposes include the

following;

1. To make businessmen realize that they cannot employ double standards to the actions of other

people and to their own actions.

2. To show businessmen that common practices which they have thought to be right because they

see other businessmen doing it, are really wrong.

3. To serve as a standard or ideal upon which business conduct should be based.

2nd Semester 2019-2020 GOVBUSMAN Page 26

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

SCOPE AND IMPACT OF BUSINESS ETHICS

Business ethics covers all conduct, behavior and judgment in business. This includes the slightest

deviation from what is right to illegal and dishonest acts that are punishable by law. It involves making

the right choices while engaging in such business activities as manufacturing and selling a product or

selling and rendering a service.

Business ethics is based on the personal values and standards of each person engaged in business. Since

individual values differ, what is ethical or unethical in making profit also varies from person to person.

There is still no uniform standards of right and wrong from which all business ay base their actions. The

businessman who provides fair business competition is the most likely to observe the business ethical

rules of conduct, behavior, and judgment.

Economic Impact

A business has an economic impact on society through the wages it pays to its employees, the

materials that it buys from their suppliers and the prices it charges its customers.

Social Impact

The social impact of corporate governance contributes to the ethical climate of society. If

businesses offer bribes to secure work or other benefits, engage in accounting fraud or breach

regulatory and legal limitations on their operations, the ethics of society suffer. In addition to a

deteriorating ethical environment, such as corruption may unfairly raise the price of goods for

consumers or the quality of the product or service compromised.

Environmental Impact

Environmental protection is a key area of business influence on society. Businesses that

implement good environmental policies to use energy more efficiently, reduce waste and in general

lighten their environmental footprint can reduce their internal costs and promote a positive image of

their company.

Impact on Business Managers

The concepts and principles for the ethical conduct in business are relegated to the managers of the

business enterprise. Thus, although the manager is expected to act in the best interest of the business,

he cannot be expected to at in a manner that is contrary to the law or to his conscience.

In particular, a manager should:

Acknowledge that his role is to serve the business enterprise and the community;

Avoid all abuses of executive power for personal gain, advantage or prestige;

2nd Semester 2019-2020 GOVBUSMAN Page 27

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Reveal the fact to his superior whenever his personal business of financial interests conflicts

with those of the company;

Be actively concerned with the difficulties and problems of subordinates, treat them fairly and

by example, lead them effectively, assuring to all the right of reasonable access and appeal to

superiors;

Recognize that his subordinates have a right to information on matter affecting them, and make

provision for its prompt communication unless such communication is likely to undermine the

security and efficiency of the business;

Fully evaluate the likely effects on employees and the community of the business plans for the

future before taking a final decision and

Cooperate with his colleagues and not attempt to secure personal advantage at their expense.

2nd Semester 2019-2020 GOVBUSMAN Page 28

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Chapter 7: COMMON UNETHICAL PRACTICES OF BUSINESS ESTABLISHMENTS

Expected Learning Outcomes

After studying the chapter, you should be able to …

1. To familiarize yourself of the common unethical practices of business establishments such as

Misrepresentation and

Over-Persuasion

2. Describe how direct misrepresentation is committed by business firms such as

a. Deceptive packaging

b. Misbranding or mislabeling

c. False and misleading advertising

d. Adulteration

e. Weight understatement

f. Measurement understatement

g. Quantity understatement

3. Describe how indirect misrepresentation is done by business firms such as

a. Caveat emptor

b. Deliberate withholding of information

c. Passive deception

4. Describe how over-persuasion becomes unethical

5. Describe some unethical corporate practices of the

a. Board of Directors

b. Executive officers and lower level manager

c. Employees

2nd Semester 2019-2020 GOVBUSMAN Page 29

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

COMMON UNETHICAL PRACTICESOF BUSINESS ESTABLISHMENTS

Unethical problems in business ethics occur in many forms and types. The most common of these

unethical practices of business establishments are misrepresentation and over-persuasion.

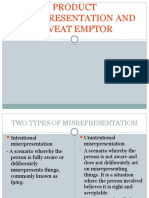

Misrepresentation may be classified into two types: direct misrepresentation and indirect

misrepresentation.

Direct Misrepresentation is characterized by actively misrepresenting about the product or customers.

This includes:

Deceptive packaging. Deceptive packaging takes many forms and is of many types. One type is

the practice of placing the product in containers of exaggerated sizes and misleading shapes to

give a false impression of its actual contents.

Misbranding or Mislabeling. Is the practice of making false statements on the label of a product

or making its container similar to a well-known product for the purpose of deceiving the

customer as to the quality and/or quantity of a product being sold.

False or Misleading Advertising. Advertising serves a useful purpose if it conveys the right

information. However, advertising does not always tell the “whole truth and nothing but the

truth” if it greatly exaggerates the virtues of a product and tells only half of the truth or else

sings praises to its non-existent virtues. If advertising does not provide a useful service anymore

to the customers, it can become the agent of misrepresentation.

Adulteration. Is the unethical practice of debasing a pure or genuine commodity by imitating or

counterfeiting it, by adding something to increase its bulk or volume, or by substituting an

inferior product for a superior one for the purpose of profit or gain.

Weight understatement or short weighing. In short weighing, the mechanism of the weighing

scale is tampered with or something is unobtrusively attached to it so that the scale registers

more than the actual weight.

Measurement understatement or short measurement. In short measurement, the measuring

stick or standard is shorter than the real length or smaller in volume than the standard.

Quality understatement or short numbering. In this unethical practice, the seller gives the

customer less than the number asked for or paid for.

Indirect Misrepresentation is characterized by omitting adverse or unfavorable information about the

product or service. Among the most common practices involving indirect misrepresentations are caveat

emptor, deliberate withholding of information and business ignorance.

Caveat emptor is a practice very common among salesmen. Translated, caveat emptor means “let the

buyer beware”. Under this concept, the seller is not obligated to reveal any defect in the product or

service he is selling. It is the responsibility of the customer to determine for himself the defects of the

product.

2nd Semester 2019-2020 GOVBUSMAN Page 30

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Deliberate withholding of Information. Following the argument that caveat emptor is unethical, the

deliberate withholding of significant information in a business transaction, is also unethical. No business

transaction is fair where one of the parties does not exactly know what he is giving away or receiving in

return.

Passive deception. Direct misrepresentation gives business a bad name while indirect misrepresentation

or passive deception is not as obvious, it nonetheless contributes to the impression that businessmen

are liars and are out to make a fast buck. Business ignorance is passive deception because the

businessman is unable to provide the customer with the complete information that the latter needs to

make a fair decision.

Over-persuasion. Persuasion is the process of appealing to the emotions of a prospective customer and

urging him to buy an item of merchandise he needs. Persuasion is legitimate and necessary in the

selling of goods if it is done in the interest of a buyer such as persuading him/her to get a hospitalization

insurance policy. The common instances of ever-persuasion include the following:

1. Urging a customer to satisfy a low priority need for merchandise.

2. Playing upon intense emotional agitation to convince a person to buy.

3. Convincing a person to buy what he does not need just because he has the capacity or

money to do so.

CORPORATE ETHICS

Unethical practices of Corporate Management

Practices of corporate management that involve ethical considerations may be classified into two:

practices of the Board of Directors and practices of executive officers. In many cases, the practices may

apply to both categories of corporate management and the only dividing line is in the financial

magnitude and implications of a particular corporate management practice.

Some Unethical Practices of the Board of Directors

1. Plain Graft

Some of the Board of Directors help themselves to the earnings that otherwise would go to

other stockholders. This is done by voting for themselves and the executive officers huge per

diems, large salaries, big bonuses that do not commensurate to the value of their services.

2. Interlocking Directorship

Interlocking directorship is often practiced by a person who holds directorial positions in two or

more corporations that do business with each other. This practice may involve conflict of

interest and can result to disloyal selling.

2nd Semester 2019-2020 GOVBUSMAN Page 31

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

3. Insider trading

Insider trading occurs when a broker or another person with access to confidential information

uses that information to trade in shares and securities of a corporation, thus giving him an unfair

advantage over the other purchasers of these securities.

4. Negligence of Duty

A more common failure of the members of the Board of Directors than breach of trust is neglect

of duties when they fail to attend board meetings regularly.

Some Unethical Practices of Executive Officers and Lower Level Managers

Unethical practices that are more common to executive officers and lower level managers are:

1. Claiming a vacation trip to be a business trip.

2. Having employees do work unrelated to the business.

3. Loose or ineffective controls.

4. Unfair labor practices.

a. To interfere with, restrain or coerce employees in the exercise of their right to self-

organization;

b. To require as a condition of employment that a person or an employee shall not join a labor

organization or shall withdraw from one to which he belongs;

c. To contract out services or functions being performed by union members when such will

interfere with, restrain or coerce employees in the exercise of their rights to self-

organization;

d. To initiate, dominate, assist or otherwise with the formulation or administration of any labor

organization, including the giving of financial or other support to it;

e. To discriminate with regards to wages, hours of work, and other terms or conditions of

employment in order to encourage or discourage membership in any labor organization.

f. To dismiss, discharge, or otherwise prejudice or discriminate, against an employee for

having given or being about to give testimony under the Labor Code;

g. To violate the duty to bargain collectively as prescribed by the Labor Code.

h. To pay negotiation or attorney’s fees to the union or its officers or agents as part of the

settlement of any issue in collective bargaining or any other dispute;

i. To violate or refuse to comply with voluntary arbitration awards or decisions relating to the

implementation or interpretation of a collective bargaining agreement;

j. To violate a collective bargaining agreement.

5. Making false claims about losses to free themselves from paying the compensation and benefits

provided by law.

6. Making employees sign documents showing they are receiving fully what they are entitled to

under the law when in fact they are only receiving a fraction of what they are supposed to get.

7. Sexual Harassment.

2nd Semester 2019-2020 GOVBUSMAN Page 32

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Some Unethical Practices by Employees

1. Conflicts of Interest. A conflict of interest arises when an employee who is duty bound to protect

and promote the interests of his employer violates this obligation by getting himself into a

situation where his decision or actuation is influenced by what he can gain personally from it

rather than what his employer can gain from it.

a. An employee who holds a significant interest or shares of stock of a competitor, supplier,

customer or dealer favors this party to the prejudice of his employer.

b. The employee accepts cash, a gift or a lavish entertainment or a loan from a supplier,

customer, competitor, or contractor. As a result, he therefore cannot act impartially.

c. The employee uses or discloses confidential company information for his or someone else’s

personal gain.

d. The employee engages in the same type of business as his employer.

e. The employee uses for his own benefit a business opportunity in which his employer has or

might be expected to have an interest.

2. Dishonesty. Business ethics is not just limited to business transactions with outside parties. It

also covers employee-employer relationship, especially with respect to an employee’s honesty

as he carries out his assigned duties in the office.

a. Taking office supplies home for personal use.

b. Padding an expense account through the use of fake receipts when claiming

reimbursements.

c. Taking credit for another employee’s idea.

2nd Semester 2019-2020 GOVBUSMAN Page 33

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Chapter 8: ETHICAL DILEMMA

Expected Learning Outcomes

After studying the chapter, you should be able to …

1. Explain what ethical dilemma is.

2. Describe the steps in resolving ethical dilemma.

3. Apply the steps in resolving ethical dilemma.

INTRODUCTION

An ethical dilemma is a situation a person faces in which a decision must be made about the appropriate

behavior. A simple example of an ethical dilemma is finding a diamond ring, which necessitates deciding

whether to find the owner or to keep it.

RESOLVING ETHICAL DILEMMAS

In recent years, formal frameworks have been developed to help people resolve ethical dilemmas. The

purpose of such a framework is in identifying the ethical issues and deciding on an appropriate course of

action using the person’s own values.

The six-step approach that follows is intended to be a relatively simple approach to resolving ethical

dilemmas:

1. Obtain the relevant facts.

2. Identify the ethical issues from the facts.

3. Determine who is affected by the outcome of the dilemma and how each person or group is

affected.

4. Identify the alternatives available to the person who must resolve the dilemma.

5. Identify the likely consequences of each alternative.

6. Decide the appropriate action.

2nd Semester 2019-2020 GOVBUSMAN Page 34

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Chapter 9: ADVOCACY AGAINST CORRUPTION

Expected Learning Outcomes

After studying the chapter, you should be able to …

1. Understand what corruption is.

2. Know how corruption may look like.

3. Know why and how does a person become corrupt.

4. Explain the ill effects of corruption.

5. Describe the characteristics of corruption.

6. Learn and familiarize himself/herself of the impact of corruption in the Philippines as well the

efforts both of the public and private sectors to curb it.

7. Know how corruption may be prevented.

ADVOCACY AGAINST CORRUPTION

What is Corruption?

Corruption is the abuse of private and public office for personal gain. It includes acts of bribery,

embezzlement, nepotism, kickbacks and state capture. This is often associated with and reinforced by

other illegal practices such as bid rigging, fraud, or money laundering, extortion.

Simply defined, corruption is receiving, asking for or giving any gratification to induce a person to do a

favor for private gain. This act covers not only public corruption involving misuse of public power by

elected politician or appointed civil servant but also private corruption between individuals and

businesses.

Corruption is the misuse of entrusted power (by heritage, education, marriage, election, appointment)

for private gain. It covers not only the politician and the public servant but also the CEO, CFO and other

employees of a company. Corruption often results from patronage and is associated with bribery.

Corruption is an improbity or decay in the decision-making process in which a decision-maker consents

to deviate or demands deviation from the criterion which should rule his or her decision-making, in

exchange for a reward or for the promise or expectation of a reward, while these motives influencing his

or her decision-making cannot be part of the justification of the decision.

In general, corruption is a form of dishonesty or criminal activity undertaken by a person in an

organization entrusted with a position of authority, often to acquire illicit benefit.

2nd Semester 2019-2020 GOVBUSMAN Page 35

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

Corruption may take place in any of the following forms / ways:

A company paying a bribe to win the public contract to build the local highway, despite

proposing a sub-standard offer.

A politician redirecting investments to his own hometown rather than to the region most in

need.

Public official embezzling funds for school renovation to build his private villa.

A private company manager recruiting an ill-suited friend for a high level position.

Or, local officials, demanding bribes from ordinary citizens to get access to a new water pipe.

A salesman bribing the purchasing manager of a company to give preference to his products.

At the end of the day, those hurt most by corruption are the world’s weakest and most vulnerable.

2nd Semester 2019-2020 GOVBUSMAN Page 36

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

WHY AND HOW DOES A PERSON BECOME CORRUPT

Corruptions spread when there are opportunities, when risk is minimal in comparison to benefits

obtained or when one is confronted with issues like:

Career advancement

Earnings of more income

Financial problems caused by illness, loss of property etc.

Those engaged in corruption learn how to be dishonest. The next corrupt actions becomes easier to do

unless one is firmly rooted on solid principles and has been nurtured in an upright manner.

ILL EFFECTS OF CORRUPTION

Economically,

Corruptions add up to 10% of the total costs of doing business in any part of the world and up to

25% of the cost of procurement programs in developing countries.

Corruption leads to waste or the inefficient use of public resources.

Corruption corrodes public trust, undermines the rule of law, and ultimately delegitimizes the

state.

Other significant and serious repercussions of corruption are:

1. If allowed to take root in society, it can lead to a breakdown in social order and lives are affected

when ordinary people are prevented from receiving all the essential services that they are

entitled to.

2. It creates unfair competition and increases the cost of doing business.

3. Corruption is cancer that spreads rapidly all over the body.

CHARACTERISTICS OF CORRUPTION

A. Recipients and payers

B. Extortion

C. Lubricant of society

D. An ethical dilemma

E. Poverty alleviation

F. Culture

G. ‘Kindness among friends’

2nd Semester 2019-2020 GOVBUSMAN Page 37

CORPORATE GOVERNANCE, BUSINESS ETHICS, RISK

MANAGEMENT and INTERNAL CONTROL

PREVENTION OF CORRUPTION

Corruption in Singapore is under control. However, a clean system is not a natural state of affairs.

Corruption comes from weakness of human nature – greed, temptation, the desire to amass wealth or

to obtain business through unfair means. Even with harsh penalties, corruption cannot be eradicated

completely.

Below are some measures businesses and organizations can adopt to help prevent corruption in the

work place.

1. Clear Business Processes. Having defined workflows, clear directives on financial approving

authorities, and standard procurement instructions can help flag irregularities in a business or

organization.

2. Policy on Gifts and Entertainment. Gifts and entertainment are often offered in the legitimate

course of business to promote good relations. However, if it is too frequent or lavish, or done

with the deliberate intention to gain an unfair business advantage, such gifts and entertainment

can be tantamount to corruption, regardless of whether the recipient is able to fulfill the

request of the giver.

3. Declaration of Conflict of Interest. Conflict of interest occur when a personal interest or

relationships is placed before the business interest, and can lead to corrupt activities, such as

giving or accepting bribes. In order to safeguard the business interest, a declaration system that

is applicable to all levels of employees may be instituted.

4. Convenient Corruption Reporting System. The corruption reporting system is a key function to

control corruption and bribery risks, and can comprise a whistle-blowing policy or feedback

channel where staff can conveniently raise concerns and feel protected from being identified or

retaliated against. One way to do this would be by allowing reports to be filed anonymously

through a publicized email address or phone number.