Professional Documents

Culture Documents

And Send It As Attachments

And Send It As Attachments

Uploaded by

Allen Kate0 ratings0% found this document useful (0 votes)

14 views2 pagesThe document provides instructions for a problem involving the balance sheet of MAZK Investments Bank. It lists the bank's original balance sheet and asks how the balance sheet would change if a preferred client exercises a $15 million loan commitment. It provides two options for satisfying the commitment: (1) asset management, where the bank uses stored liquidity by reducing cash reserves and selling other assets, and (2) liability management, where the bank offsets the deposit drain by adjusting the liability side of the balance sheet without changing assets.

Original Description:

Original Title

RISKFQUIZZ3 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides instructions for a problem involving the balance sheet of MAZK Investments Bank. It lists the bank's original balance sheet and asks how the balance sheet would change if a preferred client exercises a $15 million loan commitment. It provides two options for satisfying the commitment: (1) asset management, where the bank uses stored liquidity by reducing cash reserves and selling other assets, and (2) liability management, where the bank offsets the deposit drain by adjusting the liability side of the balance sheet without changing assets.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views2 pagesAnd Send It As Attachments

And Send It As Attachments

Uploaded by

Allen KateThe document provides instructions for a problem involving the balance sheet of MAZK Investments Bank. It lists the bank's original balance sheet and asks how the balance sheet would change if a preferred client exercises a $15 million loan commitment. It provides two options for satisfying the commitment: (1) asset management, where the bank uses stored liquidity by reducing cash reserves and selling other assets, and (2) liability management, where the bank offsets the deposit drain by adjusting the liability side of the balance sheet without changing assets.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

INSTRUCTIONS : ENCODE YOUR SOLUTIONS IN WORD AND SAVE IN PDF.

And SEND IT AS ATTACHMENTS.

PROBLEM

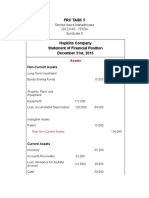

Consider the balance sheet of MAZK Investments Bank listed below:

MAZK INVESTMENTS BANK

Balance Sheet

As of March 31, 2021

In millions of pesos

ASSETS LIABILITIES AND EQUITY

Cash 10 Deposits 68

Loans 50 Equity 7

Securities 15

Total 75 Total

What if its preferred client decides to exercise a 15 million loan commitment,

show the new structure of the balance sheet if MAZK uses:

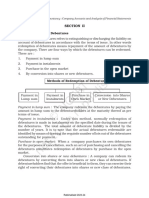

a. Asset management (STORED LIQUIDITY MANAGEMENT) with the following

conditions:

Assuming that the BSP restricts the investment bank to have an

operating cash balance of 50 percent of the current cash balance,

That the bank has to consider the order of priority in disposing the

other assets in order to exercise its commitment.

Only 20% of the bank loans assets can be discounted at 50%

Securities can be disposed at 80% less of the original value.

ASSETS LIABILITIES AND EQUITY

Cash 8 Deposits 53

Loans 40 Equity 7

Securities 12

Total 60 Total 60

b. Liability management (PURCHASED LIQUIDITY MANAGEMENT

ASSETS LIABILITIES AND EQUITY

Cash 5 Deposits 53

Loans 40 Equity 7

Securities 12

Total 60 Total 60

c. Show your solutions and interpret the results.

In the asset management (store liquidity management), the FI satisfies this

requirement by using surplus cash deposited in its vaults or kept on account at

other FI’s, since the client debt is $15 million in deposits. The FI's balance sheet

would improve if the $15 million drop in bank liabilities were offset by a $15

million reduction in cash reserves.

On the liability management (purchased liquidity management). The FI to keep

its overall balance sheet value of $75 million without affecting the size and

structure of the asset side balance sheet—that is, the deposit drain is fully

adjusted on the liability side of the balance sheet. To put it another way, bought

liquidity control will protect the asset side of the balance sheet from regular

liability-side drains. A financial institution may deal with a deposit drain in one of

two ways: (1) acquired liquidity management or (2) stored liquidity management.

MAKE YOUR WORK AS YOUR OWN

Good luck

You might also like

- Accounting Principles 12th Edition Weygandt Solutions Manual Full Chapter PDFDocument37 pagesAccounting Principles 12th Edition Weygandt Solutions Manual Full Chapter PDFEdwardBishopacsy100% (14)

- Financial Institutions Management A Risk Management Approach 8th Edition Saunders Solutions Manual 1Document17 pagesFinancial Institutions Management A Risk Management Approach 8th Edition Saunders Solutions Manual 1iva100% (45)

- Wells Fargo Everyday Checking: Important Account InformationDocument3 pagesWells Fargo Everyday Checking: Important Account Informationbreanne100% (3)

- Mid Sem Solution 2Document7 pagesMid Sem Solution 2dipono6356No ratings yet

- Ia 1Document14 pagesIa 1redolvrs.28No ratings yet

- Ga PP Module 3 Dec2022Document125 pagesGa PP Module 3 Dec2022preethi alNo ratings yet

- Managing in A Global Economy Demystifying International Macroeconomics 2nd Edition Marthinsen Solutions ManualDocument9 pagesManaging in A Global Economy Demystifying International Macroeconomics 2nd Edition Marthinsen Solutions Manualreumetampoeqnb100% (36)

- Functions of Bank CapitalDocument4 pagesFunctions of Bank CapitalG117100% (1)

- Take Print - Adv AccDocument11 pagesTake Print - Adv AccManikandanNo ratings yet

- Bank Financial Statements: Format of Bank Balance SheetDocument10 pagesBank Financial Statements: Format of Bank Balance SheetMannavan ThiruNo ratings yet

- FIN4646Final Summer2020sec7Document2 pagesFIN4646Final Summer2020sec7Mahi100% (1)

- Internal Reconstruction NotesDocument16 pagesInternal Reconstruction NotesAkash Mehta100% (1)

- Chapter 3 Fa5Document22 pagesChapter 3 Fa5Noriani Binti SambriNo ratings yet

- Redemption of Debentures (Inter CA) PDFDocument4 pagesRedemption of Debentures (Inter CA) PDFvenkata srikanth topalliNo ratings yet

- Chapter 17 Liquidity Risk Math Problems and SolutionsDocument4 pagesChapter 17 Liquidity Risk Math Problems and SolutionsRiyad100% (1)

- Key Risk Managemen Issues (5) Liquidity Risk: Sakamaki Tsuzuri JICA Chief Advisor To The State Bank of VietnamDocument63 pagesKey Risk Managemen Issues (5) Liquidity Risk: Sakamaki Tsuzuri JICA Chief Advisor To The State Bank of VietnamNGUYEN HUU THUNo ratings yet

- Pub CH Other AssetsDocument20 pagesPub CH Other AssetsAra AnatasyaNo ratings yet

- General Principles of Operations IIDocument26 pagesGeneral Principles of Operations IIICBS EducationNo ratings yet

- Brigham Book Ed 13 - Dividend Policy SolutionsDocument9 pagesBrigham Book Ed 13 - Dividend Policy SolutionsNarmeen Khan0% (1)

- Chapter017 SolutionsDocument3 pagesChapter017 SolutionsSumbul JavedNo ratings yet

- Corporate Liquidation HandoutDocument7 pagesCorporate Liquidation HandoutRhaegneNo ratings yet

- Ch29 Chapter Answers AidDocument9 pagesCh29 Chapter Answers AidAshura ShaibNo ratings yet

- North East University Bangladesh Assignment OnDocument9 pagesNorth East University Bangladesh Assignment OnSahriar EmonNo ratings yet

- CH 3 Ifa I@2014Document68 pagesCH 3 Ifa I@2014kitababekele26No ratings yet

- Fina h-3 6th-Sem 2022Document3 pagesFina h-3 6th-Sem 2022Gopinath MondalNo ratings yet

- Lecture 1 - FMDocument32 pagesLecture 1 - FMJack JackNo ratings yet

- FRC Task 5Document4 pagesFRC Task 5Denisa Naura MahadhiyasaNo ratings yet

- Capital Structure & FinancingDocument13 pagesCapital Structure & FinancingNazia EnayetNo ratings yet

- 73153bos58999 p8Document27 pages73153bos58999 p8Sagar GuptaNo ratings yet

- Chapter 6 Solutions To Problems and CasesDocument24 pagesChapter 6 Solutions To Problems and Caseschandel08No ratings yet

- BUS 505 - Final Exam - Fall 2021Document2 pagesBUS 505 - Final Exam - Fall 2021Rafid AhnafNo ratings yet

- Fina H 6th-Sem 2022Document4 pagesFina H 6th-Sem 2022dapurva134No ratings yet

- Liquidity Requirement Model AnswersDocument3 pagesLiquidity Requirement Model AnswersHadeerMounirNo ratings yet

- 6 Liquidity Analysis and Risk Management Aug 2014Document35 pages6 Liquidity Analysis and Risk Management Aug 2014SaemonInc.100% (1)

- Basel II, A Risk Based Capital Adequacy Framework, and Its Implementation Status in BangladeshDocument10 pagesBasel II, A Risk Based Capital Adequacy Framework, and Its Implementation Status in BangladeshNowshad AyubNo ratings yet

- 01 CashandCashEquivalentsNotesDocument7 pages01 CashandCashEquivalentsNotesVeroNo ratings yet

- Redemption of Debentures NewDocument12 pagesRedemption of Debentures NewDebjit RahaNo ratings yet

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDocument29 pagesPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementPhein ArtNo ratings yet

- CAMELS Analysis of City BankDocument25 pagesCAMELS Analysis of City Bankzain zamanNo ratings yet

- Chapter 15 Slides MHKB FIN201Document40 pagesChapter 15 Slides MHKB FIN201ashikur rahmanNo ratings yet

- LPGBDocument179 pagesLPGBMohammad Marjk SaburNo ratings yet

- FMT - Chap 9 - SolutionsDocument6 pagesFMT - Chap 9 - SolutionsVũ Hương ChiNo ratings yet

- Question #:: A) - How Does A Commercial Bank Create Credit?Document4 pagesQuestion #:: A) - How Does A Commercial Bank Create Credit?Bilal IqbalNo ratings yet

- Credit Creation by Commercial Banks and It's LimitationsDocument3 pagesCredit Creation by Commercial Banks and It's LimitationsShivaNo ratings yet

- FM Add Q Bank W RsDocument208 pagesFM Add Q Bank W RsSomisetty ArjunNo ratings yet

- Fund Management in Commercial Bank: Assignment-1Document21 pagesFund Management in Commercial Bank: Assignment-1Nikita ParidaNo ratings yet

- 2015 Liquidity Risk Management For BanksDocument21 pages2015 Liquidity Risk Management For Bankssitholek296No ratings yet

- RBI Circular For FourclosureDocument58 pagesRBI Circular For FourclosureRajesh BogulNo ratings yet

- Notes - General Banking LawDocument4 pagesNotes - General Banking LawJingle BellsNo ratings yet

- 10-PDIC2017 - Part2-Observations and RecommendationsDocument15 pages10-PDIC2017 - Part2-Observations and Recommendationsarellano lawschoolNo ratings yet

- 66649bos53803 Cp8u4 PDFDocument30 pages66649bos53803 Cp8u4 PDFpratham.mishra1809No ratings yet

- Structured Finance: Nerva Limited Series IDocument4 pagesStructured Finance: Nerva Limited Series Inick.dunbar2790No ratings yet

- Text Book Money, Banking & Financial Institution-284-371-71-73Document3 pagesText Book Money, Banking & Financial Institution-284-371-71-73Zefanya abigael AngkouwNo ratings yet

- Leac 202Document34 pagesLeac 202Shreyas BansalNo ratings yet

- Master Circular - Single Borrower Exposure Limit 09.04.2005Document3 pagesMaster Circular - Single Borrower Exposure Limit 09.04.2005tazim07No ratings yet

- MARTIN Policy Implementation With A Large Central BankDocument52 pagesMARTIN Policy Implementation With A Large Central BankAlex ZhongNo ratings yet

- Financial Management BasicsDocument19 pagesFinancial Management BasicsAnkith NukulNo ratings yet

- Prudential Regulation For Banks andDocument57 pagesPrudential Regulation For Banks andFarzad TouhidNo ratings yet

- FM Sanyam Jain Cia 1.2Document7 pagesFM Sanyam Jain Cia 1.2ALLIED AGENCIESNo ratings yet

- Fa 5Document14 pagesFa 5divyayella024No ratings yet

- Braced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationFrom EverandBraced for Impact: Reforming Kazakhstan's National Financial Holding for Development Effectiveness and Market CreationNo ratings yet

- No Definite Shape and Volume: Science (1) GasesDocument2 pagesNo Definite Shape and Volume: Science (1) GasesAllen KateNo ratings yet

- Knowledge, Wisdom and OpinionDocument50 pagesKnowledge, Wisdom and OpinionAllen KateNo ratings yet

- Org and ManagementDocument6 pagesOrg and ManagementAllen KateNo ratings yet

- OrgDocument13 pagesOrgAllen KateNo ratings yet

- Newtons Laws of Motion 1Document12 pagesNewtons Laws of Motion 1Allen KateNo ratings yet

- History Timeline of BadmintonDocument3 pagesHistory Timeline of BadmintonAllen KateNo ratings yet

- Capital Budgeting Under Conditions OF CertaintyDocument7 pagesCapital Budgeting Under Conditions OF CertaintyAllen KateNo ratings yet

- Part 1-Donor'S TaxDocument2 pagesPart 1-Donor'S TaxAllen KateNo ratings yet

- This Study Resource WasDocument8 pagesThis Study Resource WasAllen KateNo ratings yet

- This Study Resource Was: Value Added Tax (CPAR) TheoriesDocument6 pagesThis Study Resource Was: Value Added Tax (CPAR) TheoriesAllen KateNo ratings yet

- What Is A Contract of Partnership?: Midterm ExamDocument4 pagesWhat Is A Contract of Partnership?: Midterm ExamAllen KateNo ratings yet

- BL 102 QuizDocument5 pagesBL 102 QuizAllen KateNo ratings yet

- Vat 4Document4 pagesVat 4Allen KateNo ratings yet

- Vat 4Document4 pagesVat 4Allen KateNo ratings yet

- Vat 6Document2 pagesVat 6Allen KateNo ratings yet

- Vat 3Document2 pagesVat 3Allen KateNo ratings yet

- DepreciationDocument7 pagesDepreciationAllen KateNo ratings yet

- Vat 5Document3 pagesVat 5Allen KateNo ratings yet

- Second Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who Is Not ADocument2 pagesSecond Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who Is Not AAllen KateNo ratings yet

- Vat 2Document4 pagesVat 2Allen KateNo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxAllen KateNo ratings yet

- Determine The Donor's Tax Due AnswerDocument3 pagesDetermine The Donor's Tax Due AnswerAllen KateNo ratings yet

- English Final Test 1 2021Document2 pagesEnglish Final Test 1 2021Anggita AryantiNo ratings yet

- ACC203 Summary 2Document45 pagesACC203 Summary 2patriciajacob211No ratings yet

- Model Bank Islamic Banking: Pre-Sales Demo User GuideDocument9 pagesModel Bank Islamic Banking: Pre-Sales Demo User GuideigomezNo ratings yet

- Literature Review On Financial Performance of BanksDocument4 pagesLiterature Review On Financial Performance of BanksafdtzvbexNo ratings yet

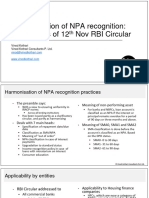

- NPA Recognition 12 Nov RBI CircularDocument30 pagesNPA Recognition 12 Nov RBI CircularNarayani TripathiNo ratings yet

- FINMARDocument28 pagesFINMARrou ziaNo ratings yet

- Financial Accounting 4th Edition Spiceland Solutions Manual DownloadDocument45 pagesFinancial Accounting 4th Edition Spiceland Solutions Manual DownloadMark Arteaga100% (21)

- 2021 JC1 Promo Practice Paper BDocument4 pages2021 JC1 Promo Practice Paper Bvincesee85No ratings yet

- Ally Financial Trademarks MoneyVerseDocument2 pagesAlly Financial Trademarks MoneyVerseCharlesGrossNo ratings yet

- Fintech Laws and Regulations 2021 - USADocument28 pagesFintech Laws and Regulations 2021 - USAmiguelNo ratings yet

- Phone Pe Vs Paytm NewDocument11 pagesPhone Pe Vs Paytm NewAjz FaNo ratings yet

- HDFC Bank Was Amongst The First To Receive An PDFDocument83 pagesHDFC Bank Was Amongst The First To Receive An PDFSairam SajaneNo ratings yet

- Corporate Murabaha - User Guide: Release R15.000Document42 pagesCorporate Murabaha - User Guide: Release R15.000Yousra HafidNo ratings yet

- Types of Financial InstitutionsDocument3 pagesTypes of Financial Institutionswahid_04050% (2)

- Cash & Cash Equivalents Composition & Other Topics CashDocument5 pagesCash & Cash Equivalents Composition & Other Topics CashEurich Gibarr Gavina EstradaNo ratings yet

- ASBADocument870 pagesASBAParth PatelNo ratings yet

- SCO AU Hallm +400k MTH CIF To Dubai or ASWP 12% 9 Clos 1,5 LF - Hi.DTDocument2 pagesSCO AU Hallm +400k MTH CIF To Dubai or ASWP 12% 9 Clos 1,5 LF - Hi.DTLuis Fernando Parra Zapata Medellín Líderes INo ratings yet

- Fundamentals of Accountancy, Business, and Management 2Document11 pagesFundamentals of Accountancy, Business, and Management 2Honey ShenNo ratings yet

- Landbank Cash Card/Prepaid Card Enrollment Form: Jehiah Javid GarciaDocument2 pagesLandbank Cash Card/Prepaid Card Enrollment Form: Jehiah Javid GarciaJehiahNo ratings yet

- Initial Fund Transfer Approval of 45,000 For Mr.j.a.desphy JRDocument2 pagesInitial Fund Transfer Approval of 45,000 For Mr.j.a.desphy JREmeka AmaliriNo ratings yet

- Ch-9 Advance Tax, TDS, TCSDocument122 pagesCh-9 Advance Tax, TDS, TCSrinkal jethiNo ratings yet

- UBL Annual Report 2020Document286 pagesUBL Annual Report 2020arham buttNo ratings yet

- Hibret Bank's History: United Bank Announces Strategic Road MapDocument2 pagesHibret Bank's History: United Bank Announces Strategic Road Mapsamuel debebe100% (3)

- Idp 4353Document87 pagesIdp 4353MANSINo ratings yet

- Lekha Book Final 5-29Document69 pagesLekha Book Final 5-29hrisabNo ratings yet

- Depository and Custodial Services Notes M.Com Sem-IV - Sukumar PalDocument25 pagesDepository and Custodial Services Notes M.Com Sem-IV - Sukumar PalRiya Das RdNo ratings yet

- History Bank RakyatDocument6 pagesHistory Bank Rakyathafis82No ratings yet

- Branch Less Form MandatoryDocument2 pagesBranch Less Form Mandatorykashan.ahmed1985No ratings yet