Professional Documents

Culture Documents

10

10

Uploaded by

sudeep shakyaCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- (CITATION Kot19 /L 1033) : 1. People, The Social Bottom LineDocument3 pages(CITATION Kot19 /L 1033) : 1. People, The Social Bottom Linesudeep shakyaNo ratings yet

- Caobisco 16022018090629 Caobisco 29062017163536 2018 Statistics ExtractDocument4 pagesCaobisco 16022018090629 Caobisco 29062017163536 2018 Statistics ExtractMilica BarjaktarevicNo ratings yet

- 9Document2 pages9sudeep shakyaNo ratings yet

- Introduction of Ralph Lauren:: (CITATION Rol16 /L 1033)Document3 pagesIntroduction of Ralph Lauren:: (CITATION Rol16 /L 1033)sudeep shakyaNo ratings yet

- Spot Market in Foreign Exchange by WalmartDocument2 pagesSpot Market in Foreign Exchange by Walmartsudeep shakyaNo ratings yet

- Meaning:: (CITATION Kha15 /L 1033)Document4 pagesMeaning:: (CITATION Kha15 /L 1033)sudeep shakyaNo ratings yet

- It Provides Up To Date Information To The Managers:: (CITATION Pau14 /L 1033)Document5 pagesIt Provides Up To Date Information To The Managers:: (CITATION Pau14 /L 1033)sudeep shakyaNo ratings yet

- Abstract:: (Citation Sbe99 /L 1033)Document3 pagesAbstract:: (Citation Sbe99 /L 1033)sudeep shakyaNo ratings yet

- Shubham PIDocument1 pageShubham PIVarsha JiNo ratings yet

- Blotter - Journal de Transactions en Devises - Mauritanie Avril - 2019Document493 pagesBlotter - Journal de Transactions en Devises - Mauritanie Avril - 2019BrehmattNo ratings yet

- Poland Eastern Europe's Economic MiracleDocument1 pagePoland Eastern Europe's Economic MiracleJERALDINE CANARIANo ratings yet

- Intermediate - Collocations and Prepsitions, Reported SpeechDocument6 pagesIntermediate - Collocations and Prepsitions, Reported SpeechLaura Mostafa LínguasNo ratings yet

- 10 Balance of PaymentDocument9 pages10 Balance of PaymentP Janaki Raman100% (1)

- Deflation, Depression StagflationDocument2 pagesDeflation, Depression StagflationUwuNo ratings yet

- OD426681185912189100Document1 pageOD426681185912189100SethuNo ratings yet

- 4.1.4 Terms of TradeDocument22 pages4.1.4 Terms of Tradelapl78875No ratings yet

- Implementasi Insentif Pajak Menurut Model G Edward IiiDocument13 pagesImplementasi Insentif Pajak Menurut Model G Edward Iii03Ni Putu Widya AntariNo ratings yet

- Tax HavensDocument28 pagesTax HavensAgha WaseemNo ratings yet

- Bharti Airtel and MTN The Deal Is Dead: Presented byDocument21 pagesBharti Airtel and MTN The Deal Is Dead: Presented byneha160No ratings yet

- Duck Special Release - JulytoSep2019 - Final - 0Document6 pagesDuck Special Release - JulytoSep2019 - Final - 0Adel MercadejasNo ratings yet

- N4Document2 pagesN4Lazy LeathNo ratings yet

- Azrul Ikhwan Bin Azmi (2020414356) - Self ReflectionDocument8 pagesAzrul Ikhwan Bin Azmi (2020414356) - Self ReflectionAZRUL IKHWAN AZMINo ratings yet

- Nov17.2012 BDocument2 pagesNov17.2012 Bpribhor2No ratings yet

- Headway: Clil WorksheetsDocument2 pagesHeadway: Clil WorksheetsAmina VeladžićNo ratings yet

- Faraz Case StudyDocument4 pagesFaraz Case StudyDrMunir Hussain SiddiquiNo ratings yet

- Free TradeDocument9 pagesFree TradePatrick Jake DimapilisNo ratings yet

- Title Mko SMJH Ni Aarha Kya Likhu..: Toh Agar Rushfi or Venom Tumhe Idea Ho Toh Likh DenaDocument13 pagesTitle Mko SMJH Ni Aarha Kya Likhu..: Toh Agar Rushfi or Venom Tumhe Idea Ho Toh Likh DenaDisha MondalNo ratings yet

- CISS12Document14 pagesCISS12anahh ramakNo ratings yet

- Total BCs-1Document360 pagesTotal BCs-1naina saxenaNo ratings yet

- Mrunal Economy Classes Links 2020 PDFDocument4 pagesMrunal Economy Classes Links 2020 PDFSANTHAN KUMARNo ratings yet

- GED103 TermPaper2Document4 pagesGED103 TermPaper2Kenneth Dela cruzNo ratings yet

- Chapter 2 Literature Review: Mehul Kapadia (2011) Every Bit of Capital Investment Is Crucial For An SMEDocument2 pagesChapter 2 Literature Review: Mehul Kapadia (2011) Every Bit of Capital Investment Is Crucial For An SMEMohit SinghNo ratings yet

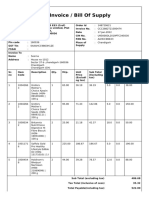

- Tax Invoice / Bill of SupplyDocument2 pagesTax Invoice / Bill of SupplySeema SainiNo ratings yet

- Dangote Press ReleaseDocument2 pagesDangote Press ReleasePrincpris Silayo ClaudNo ratings yet

- BA106 Group 5 Interactive Group Work Classification and Concept MapDocument3 pagesBA106 Group 5 Interactive Group Work Classification and Concept MapVince CedricNo ratings yet

- Acct Statement - XX6735 - 18112023Document28 pagesAcct Statement - XX6735 - 18112023Mr קΐメelNo ratings yet

- Final Paper Topic Proposal: Export Malunggay Coffee To FinlandDocument4 pagesFinal Paper Topic Proposal: Export Malunggay Coffee To FinlandRina TugadeNo ratings yet

10

10

Uploaded by

sudeep shakyaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10

10

Uploaded by

sudeep shakyaCopyright:

Available Formats

Analysis of the usage of the spot market in foreign exchange by Walmart outlets in China

The market of foreign exchange permits the international exchange of products, services,

and securities through the purchase and sale of. The foreign exchange market is not confined to

a single location but rather constitute of large banks around the globe which acts as

intermediaries among those business and lenders who want to purchase and sell a particular

currency. One of the dominant constituents of the foreign exchange market is the spot market

which refers to the public financial market that allows immediate foreign exchange transaction.

As per Basu (2020), the spot market is a market that facilities immediate sale and purchase of

commodities or financial instruments. The spot rate determines the exchange rate at which one

currency is traded for another in the spot market (Madura, 2018).

Walmart outlets in China require other currencies to purchase commodities from other

countries and should alter the Chinese currency (Yuan) into other currencies in the spot market

for the payment of the imports. Furthermore, the Walmart stores could also use the spot market

foreign currencies to remit the earnings to the U.S. parent company by converting the excess

income denominated in yuan into dollars.

Utilization of the international money markets by Walmart while establishing other

Walmart stores in Asia.

The international money market is also known as foreign exchange trading, or forex

refers to the market where the international trading of currency between different countries takes

place. The international money market functions in pairs to estimate the exchange rate between

currencies. For instance, EUR/USD indicates the exchange rate of Euros for U.S. dollars. Even

though certain pairs compare currencies other than the U.S. dollar, the majority of pairs

determine the rate of one currency against the U.S. dollar. Thus, making the U.S. dollar the

highly active trading currency (International Money Markets: Features & Opportunities, 2018).

Since the money market includes numerous banks which facilitate short term loan and

accept deposits, Walmart can utilize it by taking short term loans to support its operations and

fulfill the requirement of the working capital by establishing new units. Likewise, to establish

other Walmart Outlets in Asis, Wal-Mart may preserve certain deposits in the Eurocurrency

market which can be utilized in the time of need to finance the development of Wal-Mart stores

in foreign markets. In case of funds deficit, the Wal-Mart outlets in foreign markets can borrow

from banks in the Eurocurrency market. Hence, serving as a the source of deposit or lending on

a short-term basis.

Determine how Walmart could use the international bond market to finance the

establishment of new outlets in foreign markets

The international bond market aids in the movement of funds amongst borrowers who

demand long-term funds and investors who have surplus long-term funds (Madura, 2018). This

market facilitates long-term finances for various multinational corporations. Hence, Walmart

can employ the international bond market to accumulate finances to meet the substantial capital

expenses. Furthermore, Wal-Mart can issue bonds in the Eurobond market to create funds

required to set up new stores. The bonds may be denominated in the currency which is required

and after the establishment of the outlet, the earning generates can be utilized to repay the bond's

interest.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- (CITATION Kot19 /L 1033) : 1. People, The Social Bottom LineDocument3 pages(CITATION Kot19 /L 1033) : 1. People, The Social Bottom Linesudeep shakyaNo ratings yet

- Caobisco 16022018090629 Caobisco 29062017163536 2018 Statistics ExtractDocument4 pagesCaobisco 16022018090629 Caobisco 29062017163536 2018 Statistics ExtractMilica BarjaktarevicNo ratings yet

- 9Document2 pages9sudeep shakyaNo ratings yet

- Introduction of Ralph Lauren:: (CITATION Rol16 /L 1033)Document3 pagesIntroduction of Ralph Lauren:: (CITATION Rol16 /L 1033)sudeep shakyaNo ratings yet

- Spot Market in Foreign Exchange by WalmartDocument2 pagesSpot Market in Foreign Exchange by Walmartsudeep shakyaNo ratings yet

- Meaning:: (CITATION Kha15 /L 1033)Document4 pagesMeaning:: (CITATION Kha15 /L 1033)sudeep shakyaNo ratings yet

- It Provides Up To Date Information To The Managers:: (CITATION Pau14 /L 1033)Document5 pagesIt Provides Up To Date Information To The Managers:: (CITATION Pau14 /L 1033)sudeep shakyaNo ratings yet

- Abstract:: (Citation Sbe99 /L 1033)Document3 pagesAbstract:: (Citation Sbe99 /L 1033)sudeep shakyaNo ratings yet

- Shubham PIDocument1 pageShubham PIVarsha JiNo ratings yet

- Blotter - Journal de Transactions en Devises - Mauritanie Avril - 2019Document493 pagesBlotter - Journal de Transactions en Devises - Mauritanie Avril - 2019BrehmattNo ratings yet

- Poland Eastern Europe's Economic MiracleDocument1 pagePoland Eastern Europe's Economic MiracleJERALDINE CANARIANo ratings yet

- Intermediate - Collocations and Prepsitions, Reported SpeechDocument6 pagesIntermediate - Collocations and Prepsitions, Reported SpeechLaura Mostafa LínguasNo ratings yet

- 10 Balance of PaymentDocument9 pages10 Balance of PaymentP Janaki Raman100% (1)

- Deflation, Depression StagflationDocument2 pagesDeflation, Depression StagflationUwuNo ratings yet

- OD426681185912189100Document1 pageOD426681185912189100SethuNo ratings yet

- 4.1.4 Terms of TradeDocument22 pages4.1.4 Terms of Tradelapl78875No ratings yet

- Implementasi Insentif Pajak Menurut Model G Edward IiiDocument13 pagesImplementasi Insentif Pajak Menurut Model G Edward Iii03Ni Putu Widya AntariNo ratings yet

- Tax HavensDocument28 pagesTax HavensAgha WaseemNo ratings yet

- Bharti Airtel and MTN The Deal Is Dead: Presented byDocument21 pagesBharti Airtel and MTN The Deal Is Dead: Presented byneha160No ratings yet

- Duck Special Release - JulytoSep2019 - Final - 0Document6 pagesDuck Special Release - JulytoSep2019 - Final - 0Adel MercadejasNo ratings yet

- N4Document2 pagesN4Lazy LeathNo ratings yet

- Azrul Ikhwan Bin Azmi (2020414356) - Self ReflectionDocument8 pagesAzrul Ikhwan Bin Azmi (2020414356) - Self ReflectionAZRUL IKHWAN AZMINo ratings yet

- Nov17.2012 BDocument2 pagesNov17.2012 Bpribhor2No ratings yet

- Headway: Clil WorksheetsDocument2 pagesHeadway: Clil WorksheetsAmina VeladžićNo ratings yet

- Faraz Case StudyDocument4 pagesFaraz Case StudyDrMunir Hussain SiddiquiNo ratings yet

- Free TradeDocument9 pagesFree TradePatrick Jake DimapilisNo ratings yet

- Title Mko SMJH Ni Aarha Kya Likhu..: Toh Agar Rushfi or Venom Tumhe Idea Ho Toh Likh DenaDocument13 pagesTitle Mko SMJH Ni Aarha Kya Likhu..: Toh Agar Rushfi or Venom Tumhe Idea Ho Toh Likh DenaDisha MondalNo ratings yet

- CISS12Document14 pagesCISS12anahh ramakNo ratings yet

- Total BCs-1Document360 pagesTotal BCs-1naina saxenaNo ratings yet

- Mrunal Economy Classes Links 2020 PDFDocument4 pagesMrunal Economy Classes Links 2020 PDFSANTHAN KUMARNo ratings yet

- GED103 TermPaper2Document4 pagesGED103 TermPaper2Kenneth Dela cruzNo ratings yet

- Chapter 2 Literature Review: Mehul Kapadia (2011) Every Bit of Capital Investment Is Crucial For An SMEDocument2 pagesChapter 2 Literature Review: Mehul Kapadia (2011) Every Bit of Capital Investment Is Crucial For An SMEMohit SinghNo ratings yet

- Tax Invoice / Bill of SupplyDocument2 pagesTax Invoice / Bill of SupplySeema SainiNo ratings yet

- Dangote Press ReleaseDocument2 pagesDangote Press ReleasePrincpris Silayo ClaudNo ratings yet

- BA106 Group 5 Interactive Group Work Classification and Concept MapDocument3 pagesBA106 Group 5 Interactive Group Work Classification and Concept MapVince CedricNo ratings yet

- Acct Statement - XX6735 - 18112023Document28 pagesAcct Statement - XX6735 - 18112023Mr קΐメelNo ratings yet

- Final Paper Topic Proposal: Export Malunggay Coffee To FinlandDocument4 pagesFinal Paper Topic Proposal: Export Malunggay Coffee To FinlandRina TugadeNo ratings yet