Professional Documents

Culture Documents

Procedures To Follow in Direct Extension Approach

Procedures To Follow in Direct Extension Approach

Uploaded by

EMZy ChannelCopyright:

Available Formats

You might also like

- Blue Ocean ShiftDocument20 pagesBlue Ocean ShiftMarQ SiewNo ratings yet

- Chapter 5 - Inventories: Revised EditionDocument7 pagesChapter 5 - Inventories: Revised EditionMelyssa Dawn Gullon0% (1)

- Ohio Department of Job and Family Services Contract Amendment #9 C-2021-14-0677-9Document21 pagesOhio Department of Job and Family Services Contract Amendment #9 C-2021-14-0677-9Dan MonkNo ratings yet

- Module 3 - InventoryDocument12 pagesModule 3 - InventoryJehPoyNo ratings yet

- Principles of Acc. II Lecture NoteDocument54 pagesPrinciples of Acc. II Lecture NoteJemal Musa83% (6)

- FOB (Free On Board) AccountingDocument18 pagesFOB (Free On Board) AccountingMichelle GoNo ratings yet

- Excavation Job Safety AnalysisDocument1 pageExcavation Job Safety AnalysisVishal Upadhyay100% (3)

- HRM Issues Analysis of Uber: Mohedul AhashanDocument28 pagesHRM Issues Analysis of Uber: Mohedul AhashanMuhammad Tamzeed Amin 2115209660No ratings yet

- CoffeeDocument107 pagesCoffeeyes yesnoNo ratings yet

- Merchandising OperationsDocument41 pagesMerchandising OperationsRogelio ParanNo ratings yet

- Final Inventories PresentationDocument45 pagesFinal Inventories PresentationmysiebongabongNo ratings yet

- Inventories NotesDocument7 pagesInventories NotesJessel Ann MontecilloNo ratings yet

- Inventories Basic PrinciplesDocument7 pagesInventories Basic PrinciplesSandia EspejoNo ratings yet

- Basic FAR by Ballada - 2023 - Chapter 7Document44 pagesBasic FAR by Ballada - 2023 - Chapter 7Edrian Genesis SebleroNo ratings yet

- Inventory: Financial Accounting Volume 1 6:30 - 7:30Document35 pagesInventory: Financial Accounting Volume 1 6:30 - 7:30Juliet Leron MediloNo ratings yet

- Periodic and Perpetual Inventory SystemsDocument17 pagesPeriodic and Perpetual Inventory SystemsMichael Brian TorresNo ratings yet

- Inventories: Inventories Net Sales FormulaDocument6 pagesInventories: Inventories Net Sales Formulagab camonNo ratings yet

- InventoriesDocument6 pagesInventoriesElla Mae VergaraNo ratings yet

- Chapter 8 - Merchandising Operations PDFDocument28 pagesChapter 8 - Merchandising Operations PDFCarlos Juliano ImportanteNo ratings yet

- Inventory Lecture NotesDocument15 pagesInventory Lecture NotesMinh ThưNo ratings yet

- Discussion - InventoriesDocument3 pagesDiscussion - InventoriesVel JuneNo ratings yet

- The Recording ProcessDocument23 pagesThe Recording ProcessfrancismarkmesiaNo ratings yet

- Conceptual Framework - InventoriesDocument22 pagesConceptual Framework - InventoriesDewdrop Mae RafananNo ratings yet

- Topic 9 - Inventories - Rev (Students)Document42 pagesTopic 9 - Inventories - Rev (Students)RomziNo ratings yet

- Chapter 5 - 6 - Inventory Accounting and ValuationDocument61 pagesChapter 5 - 6 - Inventory Accounting and ValuationNaeemullah baig100% (1)

- Chapter InventoriesDocument38 pagesChapter InventoriesJustine ReyesNo ratings yet

- College of Accountancy and Business Administration Marjorie F. Rivera Bsba3D Application/Activity Discuss and Research The Following ExtensivelyDocument2 pagesCollege of Accountancy and Business Administration Marjorie F. Rivera Bsba3D Application/Activity Discuss and Research The Following ExtensivelyMarj MagalongNo ratings yet

- Accounts ReceivableDocument6 pagesAccounts Receivablejustinenakpil09No ratings yet

- Accounting For Merchandising Operations: Key Terms and Concepts To KnowDocument25 pagesAccounting For Merchandising Operations: Key Terms and Concepts To KnowMinji LeeNo ratings yet

- CH 10 InventoriesDocument25 pagesCH 10 InventorieslalaNo ratings yet

- Chapter 10 - Inventories (Gatdc)Document19 pagesChapter 10 - Inventories (Gatdc)Joan LeonorNo ratings yet

- FDNACCT Unit 4 - Part 4 - Accounting For Purchases and Accounts Payable - Study GuideDocument2 pagesFDNACCT Unit 4 - Part 4 - Accounting For Purchases and Accounts Payable - Study GuideJames de LeonNo ratings yet

- Chapter 6 PowerpointDocument34 pagesChapter 6 Powerpointapi-248607804No ratings yet

- FABM2 First Grading Study GuideDocument3 pagesFABM2 First Grading Study GuideGwyneth BundaNo ratings yet

- ACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I Accounting For Merchandising BusinessDocument14 pagesACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I Accounting For Merchandising BusinessRyan CapiliNo ratings yet

- Fundamentals of Financial AccountingDocument42 pagesFundamentals of Financial Accountingbarron avenidaNo ratings yet

- JPIAN - S Digest - InventoriesDocument12 pagesJPIAN - S Digest - InventoriesMyrrh ErosNo ratings yet

- Far Eastern University-Diliman: Department of Accounts and BusinessDocument8 pagesFar Eastern University-Diliman: Department of Accounts and BusinessJohn Paul PolicarpioNo ratings yet

- Merchandising CompaniesDocument7 pagesMerchandising CompaniesGoogle UserNo ratings yet

- Accounting 101: Merchandising OperationsDocument14 pagesAccounting 101: Merchandising OperationsLove AmorNo ratings yet

- Intermediate-Accounting Handout Chap 10Document4 pagesIntermediate-Accounting Handout Chap 10Joanne Rheena BooNo ratings yet

- Inventories: By: Herbert B. SumalinogDocument30 pagesInventories: By: Herbert B. Sumalinogmarites yuNo ratings yet

- 10 InventoriesDocument29 pages10 InventoriesCarmela BuluranNo ratings yet

- Inventories Lecture - ContinuedDocument2 pagesInventories Lecture - ContinuedAdri SampangNo ratings yet

- FINACTDocument15 pagesFINACTsheengaleria11No ratings yet

- P2 Notes MerchandisingDocument14 pagesP2 Notes Merchandisingchen.abellar.swuNo ratings yet

- FOB Shipping PointDocument1 pageFOB Shipping PointkhandakeralihossainNo ratings yet

- GROUP 2 - PAS 2 InventoriesDocument7 pagesGROUP 2 - PAS 2 InventoriesNhicoleChoiNo ratings yet

- InventoriesDocument8 pagesInventoriesangel ciiiNo ratings yet

- Cost of Goods Old Transport Operating ExpDocument24 pagesCost of Goods Old Transport Operating Expapi-3705996No ratings yet

- Chapter 7 - BookNotes - 07242021Document4 pagesChapter 7 - BookNotes - 07242021JulietNo ratings yet

- ACCT 1A&B: Fundamentals of Accounting BCSVDocument14 pagesACCT 1A&B: Fundamentals of Accounting BCSVDanicaZhayneValdezNo ratings yet

- InventoriesDocument35 pagesInventoriesJay PinedaNo ratings yet

- Accounting For Purchases of Merchandise and PaymentsDocument22 pagesAccounting For Purchases of Merchandise and PaymentsAthena ShaeNo ratings yet

- Inventory Average Cost TransactionsDocument70 pagesInventory Average Cost TransactionsMuhammad Wasim QureshiNo ratings yet

- Inventory Lecture NotesDocument15 pagesInventory Lecture NotessibivjohnNo ratings yet

- ch05 Accounting For Merchandising OperationDocument59 pagesch05 Accounting For Merchandising OperationJawad Arko100% (1)

- Inventories - Items Included in Inventory - Inventory Cost FlowDocument38 pagesInventories - Items Included in Inventory - Inventory Cost FlowmarkNo ratings yet

- Understanding ASCP Dataflow PDFDocument18 pagesUnderstanding ASCP Dataflow PDFPrahant Kumar0% (1)

- 8 ACCT 1A&B MerchandisingDocument13 pages8 ACCT 1A&B MerchandisingShannon MojicaNo ratings yet

- FAR 214 Inventory ConceptsDocument17 pagesFAR 214 Inventory ConceptsJai BacalsoNo ratings yet

- Saint Mary's University: Chapter FiveDocument63 pagesSaint Mary's University: Chapter FivehenockNo ratings yet

- Title 4Document5 pagesTitle 4EMZy ChannelNo ratings yet

- Title VII - Stocks and StockholdersDocument38 pagesTitle VII - Stocks and StockholdersEMZy ChannelNo ratings yet

- Survey of Accounting Homework Written AssignmentDocument22 pagesSurvey of Accounting Homework Written AssignmentEMZy ChannelNo ratings yet

- Indecisive LeadershipDocument1 pageIndecisive LeadershipEMZy ChannelNo ratings yet

- Law On Partnership ReviewerDocument2 pagesLaw On Partnership ReviewerEMZy ChannelNo ratings yet

- General Banking Activities of EXIM Bank LTDDocument18 pagesGeneral Banking Activities of EXIM Bank LTDtarique al ziad100% (1)

- $1 ProductsDocument17 pages$1 ProductsMichaelNo ratings yet

- Minimum Expense Form 2020-2021: School of Graduate StudiesDocument3 pagesMinimum Expense Form 2020-2021: School of Graduate StudiesTHE ROOT OF PIENo ratings yet

- Mass Balance Recycle Paper 2Document8 pagesMass Balance Recycle Paper 2Rahmah Tasha FebrinaNo ratings yet

- Final Exam MGR ECON - MMUT - BATCH2Document5 pagesFinal Exam MGR ECON - MMUT - BATCH2Dani KurniawanNo ratings yet

- 11A. HDFC Estatement FEB 2018Document6 pages11A. HDFC Estatement FEB 2018Nanu PatelNo ratings yet

- Simple Interest: 1. If A Businessman Applies For A Loan Amounting ToDocument6 pagesSimple Interest: 1. If A Businessman Applies For A Loan Amounting ToCHRISTIAN CUARESMANo ratings yet

- Soal Sap Ac010Document2 pagesSoal Sap Ac010Celine LianataNo ratings yet

- Interest Calculation in Investment ProjectsDocument26 pagesInterest Calculation in Investment Projectsnageswara kuchipudiNo ratings yet

- Contingent Contracts-7Document8 pagesContingent Contracts-7spark_123100% (2)

- Problems Holder in Due Course - 1Document2 pagesProblems Holder in Due Course - 1DanicaNo ratings yet

- Om 4 4th Edition Collier Solutions ManualDocument17 pagesOm 4 4th Edition Collier Solutions Manualhangnhanb7cvf100% (36)

- Expansionary Vs Contractionary Monetary PolicyDocument4 pagesExpansionary Vs Contractionary Monetary PolicySamme Ezekiel RynjahNo ratings yet

- (Microsoft Dynamics Navision Technical Consultant) : Building, and MS Power BIDocument8 pages(Microsoft Dynamics Navision Technical Consultant) : Building, and MS Power BIHR Recruiter100% (1)

- HPM 34 346Document24 pagesHPM 34 346Htet Lynn HtunNo ratings yet

- Power Plant Design TerminologiesDocument12 pagesPower Plant Design TerminologiesJohn Mark James GaloNo ratings yet

- Ajol File Journals - 463 - Articles - 151750 - Submission - Proof - 151750 5461 398082 1 10 20170217Document22 pagesAjol File Journals - 463 - Articles - 151750 - Submission - Proof - 151750 5461 398082 1 10 20170217lucìaNo ratings yet

- Higher Education Loans BoardDocument6 pagesHigher Education Loans Boardkihikogladys7No ratings yet

- Stock 20307082 36662477Document1 pageStock 20307082 36662477Moisés BoquinNo ratings yet

- MPR Project Report Sample FormatDocument24 pagesMPR Project Report Sample FormatArya khattarNo ratings yet

- Met 2Document7 pagesMet 2alya nurNo ratings yet

- AP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSDocument40 pagesAP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSBebie Joy Urbano100% (1)

- The Woodworker and Woodturner 2015 01Document93 pagesThe Woodworker and Woodturner 2015 01Liz HigueraNo ratings yet

- Product Concepts, Branding, and PackagingDocument56 pagesProduct Concepts, Branding, and PackagingHunain ZiaNo ratings yet

- Sentiment Analysis of Restaurant CustomerDocument6 pagesSentiment Analysis of Restaurant CustomerAC CahuloganNo ratings yet

- Accelerated DepreciationDocument4 pagesAccelerated DepreciationaaaaNo ratings yet

Procedures To Follow in Direct Extension Approach

Procedures To Follow in Direct Extension Approach

Uploaded by

EMZy ChannelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Procedures To Follow in Direct Extension Approach

Procedures To Follow in Direct Extension Approach

Uploaded by

EMZy ChannelCopyright:

Available Formats

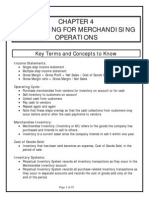

Added to the account purchases to come up with gross purchases and a product

Freight In

cost

Freight In An adjunct account

Freight Out An operating expense account period cost

Deliver (seller) the merchandise from the seller’s warehouse to the shipping

FOB shipping point

point

Free on Board (FOB) Deliver from seller’s warehouse to buyer’s warehouse free of charge, the seller

Destination should pay the freight charges

Delivery charges using an air transportation (airplane) or water transportation

Freight

(ship)

Direct Extension Approach Directly extended to financial columns (that’s why have no adjusting entries)

Freight In Goods (purchase) in supplier

Freight Out Goods (sales) to customer

Closing Entry Approach Identical with the working paper of a service concern business enterprise

In adjustment column all adjusting entries are plotted plus one closing entry

Closing Entry Approach

that will close the beginning merchandise inventory

In adjustment columns will no longer contain adjusting entry related to

Direct Extension Approach

merchandise inventory

Trade Discount Motivate customers to buy in commercial quantity

Cash Discount Motivate customers to pay their account on time

Freight Collect Pay (buyer) the freight charges

FOB Destination Collect Pay (buyer) the freight charges after he receives the merchandise

FOB shipping point collect Pay (buyer) the freight charges for delivery of merchandise to shipping point

Freight Prepaid Pay (seller) the freight charges

FOB shipping point prepaid Pay (seller) the freight charges for delivery of merchandise to shipping point

FOB Destination Prepaid Pay (seller) the freight charges, prior to release at his warehouse

Sales Allowance Reduces sales price because of defect

Sales Allowance Return (not really) the merchandise

Sales Return Returns physically the merchandise by the customer

Sales Revenue account

Enumeration

A. Sales Account – sales, sales return and allowances

Types of Discount – trade discount cash discount

B. Purchase Account – purchase discount, purchase returns and allowances

C. Mode of Delivery (Freight) – FOB Destination, FOB Shipping point

D. Mode of Payment (Freight) – Freight collect, Freight prepaid

E. Freight Arrangements – Freight in and out

F. Approaches for Trading concern business enterprise – Closing entry, direct extension

Procedures to follow in Direct Extension Approach

1. Don’t plot the adjusting entry related to the merchandise inventory end

2. Extend the merchandise and inventor shown in adjusted trial balance in the debit income statement

column

3. Plot the ending inventory as follows

a. Credit to income statement column

b. Debit to balance sheet column

CHECKING: The net income under the closing entry approach will yield same net income under direct extension

approach.

Preparing Income Statement

1. There are no more debits and credits in the formal income statement presentation

2. The date is expressed as “for the period ending,” which means that the content of the report is one year

3. The net income shown in the income statements columns of the working paper is the same net income

shown in the income statement of the formal presentation

You might also like

- Blue Ocean ShiftDocument20 pagesBlue Ocean ShiftMarQ SiewNo ratings yet

- Chapter 5 - Inventories: Revised EditionDocument7 pagesChapter 5 - Inventories: Revised EditionMelyssa Dawn Gullon0% (1)

- Ohio Department of Job and Family Services Contract Amendment #9 C-2021-14-0677-9Document21 pagesOhio Department of Job and Family Services Contract Amendment #9 C-2021-14-0677-9Dan MonkNo ratings yet

- Module 3 - InventoryDocument12 pagesModule 3 - InventoryJehPoyNo ratings yet

- Principles of Acc. II Lecture NoteDocument54 pagesPrinciples of Acc. II Lecture NoteJemal Musa83% (6)

- FOB (Free On Board) AccountingDocument18 pagesFOB (Free On Board) AccountingMichelle GoNo ratings yet

- Excavation Job Safety AnalysisDocument1 pageExcavation Job Safety AnalysisVishal Upadhyay100% (3)

- HRM Issues Analysis of Uber: Mohedul AhashanDocument28 pagesHRM Issues Analysis of Uber: Mohedul AhashanMuhammad Tamzeed Amin 2115209660No ratings yet

- CoffeeDocument107 pagesCoffeeyes yesnoNo ratings yet

- Merchandising OperationsDocument41 pagesMerchandising OperationsRogelio ParanNo ratings yet

- Final Inventories PresentationDocument45 pagesFinal Inventories PresentationmysiebongabongNo ratings yet

- Inventories NotesDocument7 pagesInventories NotesJessel Ann MontecilloNo ratings yet

- Inventories Basic PrinciplesDocument7 pagesInventories Basic PrinciplesSandia EspejoNo ratings yet

- Basic FAR by Ballada - 2023 - Chapter 7Document44 pagesBasic FAR by Ballada - 2023 - Chapter 7Edrian Genesis SebleroNo ratings yet

- Inventory: Financial Accounting Volume 1 6:30 - 7:30Document35 pagesInventory: Financial Accounting Volume 1 6:30 - 7:30Juliet Leron MediloNo ratings yet

- Periodic and Perpetual Inventory SystemsDocument17 pagesPeriodic and Perpetual Inventory SystemsMichael Brian TorresNo ratings yet

- Inventories: Inventories Net Sales FormulaDocument6 pagesInventories: Inventories Net Sales Formulagab camonNo ratings yet

- InventoriesDocument6 pagesInventoriesElla Mae VergaraNo ratings yet

- Chapter 8 - Merchandising Operations PDFDocument28 pagesChapter 8 - Merchandising Operations PDFCarlos Juliano ImportanteNo ratings yet

- Inventory Lecture NotesDocument15 pagesInventory Lecture NotesMinh ThưNo ratings yet

- Discussion - InventoriesDocument3 pagesDiscussion - InventoriesVel JuneNo ratings yet

- The Recording ProcessDocument23 pagesThe Recording ProcessfrancismarkmesiaNo ratings yet

- Conceptual Framework - InventoriesDocument22 pagesConceptual Framework - InventoriesDewdrop Mae RafananNo ratings yet

- Topic 9 - Inventories - Rev (Students)Document42 pagesTopic 9 - Inventories - Rev (Students)RomziNo ratings yet

- Chapter 5 - 6 - Inventory Accounting and ValuationDocument61 pagesChapter 5 - 6 - Inventory Accounting and ValuationNaeemullah baig100% (1)

- Chapter InventoriesDocument38 pagesChapter InventoriesJustine ReyesNo ratings yet

- College of Accountancy and Business Administration Marjorie F. Rivera Bsba3D Application/Activity Discuss and Research The Following ExtensivelyDocument2 pagesCollege of Accountancy and Business Administration Marjorie F. Rivera Bsba3D Application/Activity Discuss and Research The Following ExtensivelyMarj MagalongNo ratings yet

- Accounts ReceivableDocument6 pagesAccounts Receivablejustinenakpil09No ratings yet

- Accounting For Merchandising Operations: Key Terms and Concepts To KnowDocument25 pagesAccounting For Merchandising Operations: Key Terms and Concepts To KnowMinji LeeNo ratings yet

- CH 10 InventoriesDocument25 pagesCH 10 InventorieslalaNo ratings yet

- Chapter 10 - Inventories (Gatdc)Document19 pagesChapter 10 - Inventories (Gatdc)Joan LeonorNo ratings yet

- FDNACCT Unit 4 - Part 4 - Accounting For Purchases and Accounts Payable - Study GuideDocument2 pagesFDNACCT Unit 4 - Part 4 - Accounting For Purchases and Accounts Payable - Study GuideJames de LeonNo ratings yet

- Chapter 6 PowerpointDocument34 pagesChapter 6 Powerpointapi-248607804No ratings yet

- FABM2 First Grading Study GuideDocument3 pagesFABM2 First Grading Study GuideGwyneth BundaNo ratings yet

- ACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I Accounting For Merchandising BusinessDocument14 pagesACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I Accounting For Merchandising BusinessRyan CapiliNo ratings yet

- Fundamentals of Financial AccountingDocument42 pagesFundamentals of Financial Accountingbarron avenidaNo ratings yet

- JPIAN - S Digest - InventoriesDocument12 pagesJPIAN - S Digest - InventoriesMyrrh ErosNo ratings yet

- Far Eastern University-Diliman: Department of Accounts and BusinessDocument8 pagesFar Eastern University-Diliman: Department of Accounts and BusinessJohn Paul PolicarpioNo ratings yet

- Merchandising CompaniesDocument7 pagesMerchandising CompaniesGoogle UserNo ratings yet

- Accounting 101: Merchandising OperationsDocument14 pagesAccounting 101: Merchandising OperationsLove AmorNo ratings yet

- Intermediate-Accounting Handout Chap 10Document4 pagesIntermediate-Accounting Handout Chap 10Joanne Rheena BooNo ratings yet

- Inventories: By: Herbert B. SumalinogDocument30 pagesInventories: By: Herbert B. Sumalinogmarites yuNo ratings yet

- 10 InventoriesDocument29 pages10 InventoriesCarmela BuluranNo ratings yet

- Inventories Lecture - ContinuedDocument2 pagesInventories Lecture - ContinuedAdri SampangNo ratings yet

- FINACTDocument15 pagesFINACTsheengaleria11No ratings yet

- P2 Notes MerchandisingDocument14 pagesP2 Notes Merchandisingchen.abellar.swuNo ratings yet

- FOB Shipping PointDocument1 pageFOB Shipping PointkhandakeralihossainNo ratings yet

- GROUP 2 - PAS 2 InventoriesDocument7 pagesGROUP 2 - PAS 2 InventoriesNhicoleChoiNo ratings yet

- InventoriesDocument8 pagesInventoriesangel ciiiNo ratings yet

- Cost of Goods Old Transport Operating ExpDocument24 pagesCost of Goods Old Transport Operating Expapi-3705996No ratings yet

- Chapter 7 - BookNotes - 07242021Document4 pagesChapter 7 - BookNotes - 07242021JulietNo ratings yet

- ACCT 1A&B: Fundamentals of Accounting BCSVDocument14 pagesACCT 1A&B: Fundamentals of Accounting BCSVDanicaZhayneValdezNo ratings yet

- InventoriesDocument35 pagesInventoriesJay PinedaNo ratings yet

- Accounting For Purchases of Merchandise and PaymentsDocument22 pagesAccounting For Purchases of Merchandise and PaymentsAthena ShaeNo ratings yet

- Inventory Average Cost TransactionsDocument70 pagesInventory Average Cost TransactionsMuhammad Wasim QureshiNo ratings yet

- Inventory Lecture NotesDocument15 pagesInventory Lecture NotessibivjohnNo ratings yet

- ch05 Accounting For Merchandising OperationDocument59 pagesch05 Accounting For Merchandising OperationJawad Arko100% (1)

- Inventories - Items Included in Inventory - Inventory Cost FlowDocument38 pagesInventories - Items Included in Inventory - Inventory Cost FlowmarkNo ratings yet

- Understanding ASCP Dataflow PDFDocument18 pagesUnderstanding ASCP Dataflow PDFPrahant Kumar0% (1)

- 8 ACCT 1A&B MerchandisingDocument13 pages8 ACCT 1A&B MerchandisingShannon MojicaNo ratings yet

- FAR 214 Inventory ConceptsDocument17 pagesFAR 214 Inventory ConceptsJai BacalsoNo ratings yet

- Saint Mary's University: Chapter FiveDocument63 pagesSaint Mary's University: Chapter FivehenockNo ratings yet

- Title 4Document5 pagesTitle 4EMZy ChannelNo ratings yet

- Title VII - Stocks and StockholdersDocument38 pagesTitle VII - Stocks and StockholdersEMZy ChannelNo ratings yet

- Survey of Accounting Homework Written AssignmentDocument22 pagesSurvey of Accounting Homework Written AssignmentEMZy ChannelNo ratings yet

- Indecisive LeadershipDocument1 pageIndecisive LeadershipEMZy ChannelNo ratings yet

- Law On Partnership ReviewerDocument2 pagesLaw On Partnership ReviewerEMZy ChannelNo ratings yet

- General Banking Activities of EXIM Bank LTDDocument18 pagesGeneral Banking Activities of EXIM Bank LTDtarique al ziad100% (1)

- $1 ProductsDocument17 pages$1 ProductsMichaelNo ratings yet

- Minimum Expense Form 2020-2021: School of Graduate StudiesDocument3 pagesMinimum Expense Form 2020-2021: School of Graduate StudiesTHE ROOT OF PIENo ratings yet

- Mass Balance Recycle Paper 2Document8 pagesMass Balance Recycle Paper 2Rahmah Tasha FebrinaNo ratings yet

- Final Exam MGR ECON - MMUT - BATCH2Document5 pagesFinal Exam MGR ECON - MMUT - BATCH2Dani KurniawanNo ratings yet

- 11A. HDFC Estatement FEB 2018Document6 pages11A. HDFC Estatement FEB 2018Nanu PatelNo ratings yet

- Simple Interest: 1. If A Businessman Applies For A Loan Amounting ToDocument6 pagesSimple Interest: 1. If A Businessman Applies For A Loan Amounting ToCHRISTIAN CUARESMANo ratings yet

- Soal Sap Ac010Document2 pagesSoal Sap Ac010Celine LianataNo ratings yet

- Interest Calculation in Investment ProjectsDocument26 pagesInterest Calculation in Investment Projectsnageswara kuchipudiNo ratings yet

- Contingent Contracts-7Document8 pagesContingent Contracts-7spark_123100% (2)

- Problems Holder in Due Course - 1Document2 pagesProblems Holder in Due Course - 1DanicaNo ratings yet

- Om 4 4th Edition Collier Solutions ManualDocument17 pagesOm 4 4th Edition Collier Solutions Manualhangnhanb7cvf100% (36)

- Expansionary Vs Contractionary Monetary PolicyDocument4 pagesExpansionary Vs Contractionary Monetary PolicySamme Ezekiel RynjahNo ratings yet

- (Microsoft Dynamics Navision Technical Consultant) : Building, and MS Power BIDocument8 pages(Microsoft Dynamics Navision Technical Consultant) : Building, and MS Power BIHR Recruiter100% (1)

- HPM 34 346Document24 pagesHPM 34 346Htet Lynn HtunNo ratings yet

- Power Plant Design TerminologiesDocument12 pagesPower Plant Design TerminologiesJohn Mark James GaloNo ratings yet

- Ajol File Journals - 463 - Articles - 151750 - Submission - Proof - 151750 5461 398082 1 10 20170217Document22 pagesAjol File Journals - 463 - Articles - 151750 - Submission - Proof - 151750 5461 398082 1 10 20170217lucìaNo ratings yet

- Higher Education Loans BoardDocument6 pagesHigher Education Loans Boardkihikogladys7No ratings yet

- Stock 20307082 36662477Document1 pageStock 20307082 36662477Moisés BoquinNo ratings yet

- MPR Project Report Sample FormatDocument24 pagesMPR Project Report Sample FormatArya khattarNo ratings yet

- Met 2Document7 pagesMet 2alya nurNo ratings yet

- AP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSDocument40 pagesAP-115-Unit-4 RECORDING BUSINESS TRANSACTIONSBebie Joy Urbano100% (1)

- The Woodworker and Woodturner 2015 01Document93 pagesThe Woodworker and Woodturner 2015 01Liz HigueraNo ratings yet

- Product Concepts, Branding, and PackagingDocument56 pagesProduct Concepts, Branding, and PackagingHunain ZiaNo ratings yet

- Sentiment Analysis of Restaurant CustomerDocument6 pagesSentiment Analysis of Restaurant CustomerAC CahuloganNo ratings yet

- Accelerated DepreciationDocument4 pagesAccelerated DepreciationaaaaNo ratings yet