Professional Documents

Culture Documents

PDF Edilberto Cruz Vs Bancom - Compress

PDF Edilberto Cruz Vs Bancom - Compress

Uploaded by

Florinda UrbiCopyright:

Available Formats

You might also like

- Khatiyan FormatDocument1 pageKhatiyan Formatafoysolahmed8No ratings yet

- Forge LTD ReportDocument10 pagesForge LTD Reportzahrahassan78No ratings yet

- Test Bank Using Financial Accounting Information The Alternative To Debits and Credits 10th Edition PDFDocument101 pagesTest Bank Using Financial Accounting Information The Alternative To Debits and Credits 10th Edition PDFAnonymous kimbxi4No ratings yet

- Contracts DigestDocument30 pagesContracts DigestChaNo ratings yet

- Solution MC Installment LiquidationDocument5 pagesSolution MC Installment LiquidationHoney OrdoñoNo ratings yet

- Dopplick SettlementDocument8 pagesDopplick SettlementNicole MillerNo ratings yet

- Strategy Analysis of TTK PrestigeDocument57 pagesStrategy Analysis of TTK PrestigeManak OberoiNo ratings yet

- Inter DT Day-17Document8 pagesInter DT Day-17snehadagarsd19No ratings yet

- WillDocument2 pagesWillJayesh BadnakheNo ratings yet

- Adobe Scan Nov 11, 2021Document5 pagesAdobe Scan Nov 11, 2021Asmita DivekarNo ratings yet

- Adobe Scan Apr 05, 2023 (1) - 1-11Document11 pagesAdobe Scan Apr 05, 2023 (1) - 1-11Akansha GargNo ratings yet

- UntitledDocument21 pagesUntitledpervez khanNo ratings yet

- Seva Ram 1992Document9 pagesSeva Ram 1992Rakesh SehrawatNo ratings yet

- Tankeh PDFDocument1 pageTankeh PDFLurine SmithNo ratings yet

- Zakir Nagar 18.Document4 pagesZakir Nagar 18.Pixel computerNo ratings yet

- Thenmozhi AOSDocument7 pagesThenmozhi AOSTaj xerox99No ratings yet

- Application For Restraining Order and Asset FreezeDocument52 pagesApplication For Restraining Order and Asset FreezeAnonymous Pb39klJNo ratings yet

- Specific Performance Act PlaintDocument3 pagesSpecific Performance Act PlaintSuranjanaNo ratings yet

- Deed of SaleDocument1 pageDeed of SaleAnnie Cepe TeodoroNo ratings yet

- Question 3Document11 pagesQuestion 3THEMBELIHLE NGCOBONo ratings yet

- 01 Rivera vs. ChuaDocument1 page01 Rivera vs. ChuaStefanRodriguez100% (1)

- Wransfer of Title: CertificateDocument4 pagesWransfer of Title: Certificateviktor samuel fontanillaNo ratings yet

- The Money CoachDocument2 pagesThe Money CoachPhonthakorn PhreuksaNo ratings yet

- Dogovor Za NaemDocument1 pageDogovor Za NaemKatya IvanovaNo ratings yet

- Bagus Lifestyle - Reservation FeeDocument2 pagesBagus Lifestyle - Reservation Feelleiryc7No ratings yet

- Small Claims RequirementDocument1 pageSmall Claims RequirementChai AquinoNo ratings yet

- Adobe Scan 28 Mar 2023Document25 pagesAdobe Scan 28 Mar 2023anushisrcasw2023No ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- Fiqh Muamalah: Al-KafalahDocument17 pagesFiqh Muamalah: Al-KafalahnadeemuzairNo ratings yet

- MR Najam CV - DocxDocument2 pagesMR Najam CV - DocxNajam MansuriNo ratings yet

- Magna Carta (England, 1215)Document7 pagesMagna Carta (England, 1215)Dustin Tyler Joyce100% (1)

- Pre Trial Brief DefendantDocument5 pagesPre Trial Brief DefendantvalNo ratings yet

- Digital Banking 4 Per PageDocument54 pagesDigital Banking 4 Per PageNivas GummadidalaNo ratings yet

- BRS QuestionsDocument4 pagesBRS QuestionsRahulNo ratings yet

- Obligations of The Seller: A. Preservation of The Object of The SaleDocument41 pagesObligations of The Seller: A. Preservation of The Object of The SaleLyka Dennese SalazarNo ratings yet

- Case DigestDocument4 pagesCase DigestTosh MANo ratings yet

- King Emon Duzan of Kilmoor: WVWVWVDocument2 pagesKing Emon Duzan of Kilmoor: WVWVWVmrkvosNo ratings yet

- Cases - Oblicon Meetings 20 To 23Document162 pagesCases - Oblicon Meetings 20 To 23MikhoYabutNo ratings yet

- Adobe Scan 28-Feb-2024Document4 pagesAdobe Scan 28-Feb-2024LUCIFERNo ratings yet

- y 1 Leisure Philippines Inc Vs YuDocument4 pagesy 1 Leisure Philippines Inc Vs YuMarco CruzNo ratings yet

- P P Namavati 019 EasementsDocument7 pagesP P Namavati 019 Easementsprajakta vaidyaNo ratings yet

- Ropa - Aug 2014Document65 pagesRopa - Aug 2014Mich FelloneNo ratings yet

- Our Town January 17, 1918Document4 pagesOur Town January 17, 1918narberthcivicNo ratings yet

- Contract 2Document25 pagesContract 2UttamNo ratings yet

- Resolution 25Document1 pageResolution 25Larry LeachNo ratings yet

- Road Concreting (Luayan Tagnucan)Document2 pagesRoad Concreting (Luayan Tagnucan)LycaNo ratings yet

- 3) Cagayan Fishing Development Co., Inc. v. SandikoDocument3 pages3) Cagayan Fishing Development Co., Inc. v. SandikoE SantosNo ratings yet

- Succession CertificateDocument2 pagesSuccession CertificateBilal MotorwalaNo ratings yet

- 57 - Salazar V J.Y. Brothers - AsuncionDocument2 pages57 - Salazar V J.Y. Brothers - AsuncionJoseph Lorenz AsuncionNo ratings yet

- Kafalah UtmDocument14 pagesKafalah UtmAQEEL RAJPOUTNo ratings yet

- Louis Battistoni Police and Cases DetailsDocument6 pagesLouis Battistoni Police and Cases DetailsLiz CahallNo ratings yet

- Abellana Vs Ponce - CompressDocument1 pageAbellana Vs Ponce - Compresspaul esparagozaNo ratings yet

- Digest Ucpb Vs Masagana GR No 137172 - CompressDocument1 pageDigest Ucpb Vs Masagana GR No 137172 - Compresspaul carmelo esparagozaNo ratings yet

- Transpacific V CADocument2 pagesTranspacific V CAVianca MiguelNo ratings yet

- 9 Feb 2017Document28 pages9 Feb 2017MikhoYabutNo ratings yet

- Account Part 2Document9 pagesAccount Part 2himanshubaranwal068No ratings yet

- Quasi LawDocument4 pagesQuasi LawBhavika KewalramaniNo ratings yet

- Janfeb 2005Document2 pagesJanfeb 2005Larry LeachNo ratings yet

- GG Ry: Caled - .:....... 3 Ro NiDocument1 pageGG Ry: Caled - .:....... 3 Ro NiPetrina MascarenhasNo ratings yet

- Roco Vs ContrerasDocument4 pagesRoco Vs ContrerasRex GodModeNo ratings yet

- Orca Share Media1580515457112Document65 pagesOrca Share Media1580515457112boerd77No ratings yet

- PDF Elisa Gabriel Vs Register of Deeds - CompressDocument2 pagesPDF Elisa Gabriel Vs Register of Deeds - CompressFlorinda UrbiNo ratings yet

- Administer, Dispose of and Preven T The Loss or Dissipation of The Real or PersonalDocument6 pagesAdminister, Dispose of and Preven T The Loss or Dissipation of The Real or PersonalFlorinda UrbiNo ratings yet

- PDF Estella Et Al Vs Register of Deeds of Rizal - CompressDocument1 pagePDF Estella Et Al Vs Register of Deeds of Rizal - CompressFlorinda UrbiNo ratings yet

- ALJ Legal Citation PrimerDocument35 pagesALJ Legal Citation PrimerFlorinda UrbiNo ratings yet

- Credtrans - Suico Vs PNBDocument16 pagesCredtrans - Suico Vs PNBFlorinda UrbiNo ratings yet

- GRADES 1 To 12 Daily Lesson Log: Isulat Ang Code NG Bawat KasanayanDocument8 pagesGRADES 1 To 12 Daily Lesson Log: Isulat Ang Code NG Bawat KasanayanFlorinda UrbiNo ratings yet

- School Form 1 (SF 1) School RegisterDocument3 pagesSchool Form 1 (SF 1) School RegisterFlorinda UrbiNo ratings yet

- Independence DAY: GRADES 1 To 12 Daily Lesson LogDocument8 pagesIndependence DAY: GRADES 1 To 12 Daily Lesson LogFlorinda UrbiNo ratings yet

- Article IiDocument1 pageArticle IiFlorinda UrbiNo ratings yet

- GRADES 1 To 12 Daily Lesson Log JUNE 3-7, 2019 (WEEK 1) )Document6 pagesGRADES 1 To 12 Daily Lesson Log JUNE 3-7, 2019 (WEEK 1) )Florinda UrbiNo ratings yet

- FM PFDocument12 pagesFM PFJenelle ReyesNo ratings yet

- Lanson Blueprint NewDocument35 pagesLanson Blueprint Newharish_inNo ratings yet

- JSPL Preliminary Placement DocumentDocument523 pagesJSPL Preliminary Placement Documentseeram varmaNo ratings yet

- Hester Bank StatementDocument4 pagesHester Bank Statementjohn yorkNo ratings yet

- MFE FormulaDocument28 pagesMFE Formulajes_kur100% (1)

- Business Law PDFDocument2 pagesBusiness Law PDFFaculty of Business and Economics, Monash University100% (1)

- 2020 Inspection Grant Thornton LLP: (Headquartered in Chicago, Illinois)Document24 pages2020 Inspection Grant Thornton LLP: (Headquartered in Chicago, Illinois)Jason BramwellNo ratings yet

- Money and Schools 7Th Edition PDF Full Chapter PDFDocument53 pagesMoney and Schools 7Th Edition PDF Full Chapter PDFtxelolandaa100% (6)

- General Principles of TaxationDocument8 pagesGeneral Principles of TaxationEllah MaeNo ratings yet

- Guidelines For Compromise Settlement of Dues of Banks and Financial Institutions Through Lok AdalatsDocument3 pagesGuidelines For Compromise Settlement of Dues of Banks and Financial Institutions Through Lok AdalatsMahesh Prasad PandeyNo ratings yet

- Overview of Financial Structure of BangladeshDocument7 pagesOverview of Financial Structure of BangladeshJakir_bnkNo ratings yet

- CGI5616P18Document322 pagesCGI5616P18Deepak YadavNo ratings yet

- Bank Statement 6 MonthsDocument57 pagesBank Statement 6 Monthssrinivas rao kNo ratings yet

- Item Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptDocument1 pageItem Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptGustu LiranNo ratings yet

- Markets Update Asset Class Returns: Ten Stupid Things People Do To Mess Up Their Investment PortfoliosDocument2 pagesMarkets Update Asset Class Returns: Ten Stupid Things People Do To Mess Up Their Investment Portfoliostscollin48No ratings yet

- Huff N PuffDocument1 pageHuff N PuffA. CampbellNo ratings yet

- Mini Steel Plant 790699Document57 pagesMini Steel Plant 790699Eyock PierreNo ratings yet

- Bank DefinationDocument2 pagesBank Definationgaurav069No ratings yet

- MCQ - Financial ServicesDocument22 pagesMCQ - Financial ServicesRamees KpNo ratings yet

- Problem #2 Lump-Sum Liquidation With Loss On RealizationDocument4 pagesProblem #2 Lump-Sum Liquidation With Loss On Realizationjelai anselmoNo ratings yet

- Currency Futures and Options - FinalDocument107 pagesCurrency Futures and Options - FinalRavindra BabuNo ratings yet

- Business Finance Long TestDocument4 pagesBusiness Finance Long TestSALES JENYCANo ratings yet

- A 85 A 0 Module 2 UpDocument39 pagesA 85 A 0 Module 2 UphimnnnNo ratings yet

- Business Plan For Smart BoutiqueDocument25 pagesBusiness Plan For Smart BoutiqueAnonymous NM7hmMfNo ratings yet

- May 2023 Pathfinder - Skills LevelDocument176 pagesMay 2023 Pathfinder - Skills LevelBrian DhliwayoNo ratings yet

- Mandate Form and UndertakingDocument2 pagesMandate Form and Undertakingmeditation spirtual guruNo ratings yet

PDF Edilberto Cruz Vs Bancom - Compress

PDF Edilberto Cruz Vs Bancom - Compress

Uploaded by

Florinda UrbiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF Edilberto Cruz Vs Bancom - Compress

PDF Edilberto Cruz Vs Bancom - Compress

Uploaded by

Florinda UrbiCopyright:

Available Formats

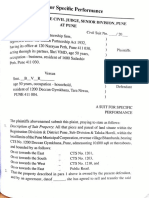

OBLIGATIONS AND CONTRACTS

G.R. No. 147788

Date: 19 March 2002

EDILBERTO CRUZ, ET AL. vs. BANCOM FINANCE

CORPORATION (NOW UNIONBANK OF THE

PHILIPPINES),

Petitioner(s): Edilberto Cruz ET AL

Petitioner(s):

Respondent: Bancom Finance Corporation.

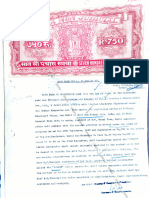

Facts:

In 19

1978

78,, Norm

Norma

a Suli

Sulitt offere

offered

d to pu

purch

rchase

ase an agric

agricult

ultur

ural

al la

land

nd owned

owned by

brother

brothers

s Rev. Fr.Edilb

Fr.Edilberto

erto Cruz and Simplicio

Simplicio Cruz.

Cruz. The asking price was

P700,000, but Sulit only had P25,000,which Fr. Cruz accepted as earnest

money. Sulit failed to pay the balance.Capitalizing on the close relationship

of a Candelaria Sanchez with the brothers, Sulit succeededin having Cruz

execute a document of sale of the land in favor of Sanchez for

P150,000.Pursuant to the sale, Sulit was able to transfer the title of the land

in her

her name

name.E

.Evi

vide

denc

nce

e sho

show th

that

at as

asid

ide

e from

from th

the

e P150

P150,0

,000

00,, Sanc

Sanch

hez

underto

undertook

ok to pay the bro

brother

thers

s the amou

amounto

ntoff P65

P655,00

5,000,

0, represen

representing

ting the

balance of the actual price of the land. Later, in a SpecialAgreement, Sulit

assumed Sanchez’s obligation to pay said amount. Unbeknownst to the Cruz

br

brot

othe

hers

rs,, Su

Suli

litt mana

manage

ged

d to ob

obta

tain

in a loloan

an from

from BaBanc

ncom

om secu

secure

red

d by a

mortgage over the land.Upon failure on the part of Sulit to pay the balance,

the Cruz brothers filed this complaint for reconveyance of the

land.Meanwhile, Sulit defaulted in her payment to the bank so her mortgage

was foreclosed. Bancomwas declared the highest bidder and was issued a

certificate of title over the land

Mark Buñag ART 1345-1346(Essential

1345-1346(Ess ential Requisites of

Contracts)

02/ 21/ 2013

OBLIGATIONS AND CONTRACTS

Issue(s):

• Whether or not Bancom was a mortgagee in good faith.

Held:

NO. As a general rule, every person dealing with registered land may safely

rely on the correctness of the certificate of title and is no longer required to

look behind the certificate in order todetermine

todetermine the actual owner.This

owner.This rule is,

however, subject to the right of a person deprived of land through fraud to

bring anaction for reconveyance, provided the rights of innocent purchasers

for value and in good faithare not prejudiced. An innocent purchaser for

value or any equivalent phrase shall be deemed,under Section 38 of the Act

496, to include an innocent lessee, mortgagee or any other encumbrancer

for value.Bancom claims that, being an innocent mortgagee, it should not be

re

requ

quir

ired

ed to cond

conduc

uctt anex

anexha

haus

usti

tive

ve in

inve

vest

stig

igat

atio

ion

n on th

the

e hi

hist

stor

ory

y of the

the

mortgagor’s title before it could extend a loan.Bancom, however, is not an

ordinary mortgagee; it is a mortgagee-bank. As such, unlike

privateindividual

privateindividuals,

s, it is expected to exercise greater care and prudence in its

dealings, including thoseinvolving registered lands. A banking institution is

expected to exercise due diligence beforeentering into a mortgage contract.

The ascertainment

ascertainment of the status or condition

condition of a propertyoffered

propertyoffered to it as

secu

securi

rity

ty fo

forr a lo

loan

an mu

must

st be a st

stan

anda

dard

rd and

and in

indi

disp

spen

ensa

sabl

ble

e part

part of it

its

s

operations

Mark Buñag ART 1345-1346(Essential

1345-1346(Ess ential Requisites of

Contracts)

02/ 21/ 2013

You might also like

- Khatiyan FormatDocument1 pageKhatiyan Formatafoysolahmed8No ratings yet

- Forge LTD ReportDocument10 pagesForge LTD Reportzahrahassan78No ratings yet

- Test Bank Using Financial Accounting Information The Alternative To Debits and Credits 10th Edition PDFDocument101 pagesTest Bank Using Financial Accounting Information The Alternative To Debits and Credits 10th Edition PDFAnonymous kimbxi4No ratings yet

- Contracts DigestDocument30 pagesContracts DigestChaNo ratings yet

- Solution MC Installment LiquidationDocument5 pagesSolution MC Installment LiquidationHoney OrdoñoNo ratings yet

- Dopplick SettlementDocument8 pagesDopplick SettlementNicole MillerNo ratings yet

- Strategy Analysis of TTK PrestigeDocument57 pagesStrategy Analysis of TTK PrestigeManak OberoiNo ratings yet

- Inter DT Day-17Document8 pagesInter DT Day-17snehadagarsd19No ratings yet

- WillDocument2 pagesWillJayesh BadnakheNo ratings yet

- Adobe Scan Nov 11, 2021Document5 pagesAdobe Scan Nov 11, 2021Asmita DivekarNo ratings yet

- Adobe Scan Apr 05, 2023 (1) - 1-11Document11 pagesAdobe Scan Apr 05, 2023 (1) - 1-11Akansha GargNo ratings yet

- UntitledDocument21 pagesUntitledpervez khanNo ratings yet

- Seva Ram 1992Document9 pagesSeva Ram 1992Rakesh SehrawatNo ratings yet

- Tankeh PDFDocument1 pageTankeh PDFLurine SmithNo ratings yet

- Zakir Nagar 18.Document4 pagesZakir Nagar 18.Pixel computerNo ratings yet

- Thenmozhi AOSDocument7 pagesThenmozhi AOSTaj xerox99No ratings yet

- Application For Restraining Order and Asset FreezeDocument52 pagesApplication For Restraining Order and Asset FreezeAnonymous Pb39klJNo ratings yet

- Specific Performance Act PlaintDocument3 pagesSpecific Performance Act PlaintSuranjanaNo ratings yet

- Deed of SaleDocument1 pageDeed of SaleAnnie Cepe TeodoroNo ratings yet

- Question 3Document11 pagesQuestion 3THEMBELIHLE NGCOBONo ratings yet

- 01 Rivera vs. ChuaDocument1 page01 Rivera vs. ChuaStefanRodriguez100% (1)

- Wransfer of Title: CertificateDocument4 pagesWransfer of Title: Certificateviktor samuel fontanillaNo ratings yet

- The Money CoachDocument2 pagesThe Money CoachPhonthakorn PhreuksaNo ratings yet

- Dogovor Za NaemDocument1 pageDogovor Za NaemKatya IvanovaNo ratings yet

- Bagus Lifestyle - Reservation FeeDocument2 pagesBagus Lifestyle - Reservation Feelleiryc7No ratings yet

- Small Claims RequirementDocument1 pageSmall Claims RequirementChai AquinoNo ratings yet

- Adobe Scan 28 Mar 2023Document25 pagesAdobe Scan 28 Mar 2023anushisrcasw2023No ratings yet

- Tax Unit 1-2 - 20Document1 pageTax Unit 1-2 - 20joy BoseNo ratings yet

- Fiqh Muamalah: Al-KafalahDocument17 pagesFiqh Muamalah: Al-KafalahnadeemuzairNo ratings yet

- MR Najam CV - DocxDocument2 pagesMR Najam CV - DocxNajam MansuriNo ratings yet

- Magna Carta (England, 1215)Document7 pagesMagna Carta (England, 1215)Dustin Tyler Joyce100% (1)

- Pre Trial Brief DefendantDocument5 pagesPre Trial Brief DefendantvalNo ratings yet

- Digital Banking 4 Per PageDocument54 pagesDigital Banking 4 Per PageNivas GummadidalaNo ratings yet

- BRS QuestionsDocument4 pagesBRS QuestionsRahulNo ratings yet

- Obligations of The Seller: A. Preservation of The Object of The SaleDocument41 pagesObligations of The Seller: A. Preservation of The Object of The SaleLyka Dennese SalazarNo ratings yet

- Case DigestDocument4 pagesCase DigestTosh MANo ratings yet

- King Emon Duzan of Kilmoor: WVWVWVDocument2 pagesKing Emon Duzan of Kilmoor: WVWVWVmrkvosNo ratings yet

- Cases - Oblicon Meetings 20 To 23Document162 pagesCases - Oblicon Meetings 20 To 23MikhoYabutNo ratings yet

- Adobe Scan 28-Feb-2024Document4 pagesAdobe Scan 28-Feb-2024LUCIFERNo ratings yet

- y 1 Leisure Philippines Inc Vs YuDocument4 pagesy 1 Leisure Philippines Inc Vs YuMarco CruzNo ratings yet

- P P Namavati 019 EasementsDocument7 pagesP P Namavati 019 Easementsprajakta vaidyaNo ratings yet

- Ropa - Aug 2014Document65 pagesRopa - Aug 2014Mich FelloneNo ratings yet

- Our Town January 17, 1918Document4 pagesOur Town January 17, 1918narberthcivicNo ratings yet

- Contract 2Document25 pagesContract 2UttamNo ratings yet

- Resolution 25Document1 pageResolution 25Larry LeachNo ratings yet

- Road Concreting (Luayan Tagnucan)Document2 pagesRoad Concreting (Luayan Tagnucan)LycaNo ratings yet

- 3) Cagayan Fishing Development Co., Inc. v. SandikoDocument3 pages3) Cagayan Fishing Development Co., Inc. v. SandikoE SantosNo ratings yet

- Succession CertificateDocument2 pagesSuccession CertificateBilal MotorwalaNo ratings yet

- 57 - Salazar V J.Y. Brothers - AsuncionDocument2 pages57 - Salazar V J.Y. Brothers - AsuncionJoseph Lorenz AsuncionNo ratings yet

- Kafalah UtmDocument14 pagesKafalah UtmAQEEL RAJPOUTNo ratings yet

- Louis Battistoni Police and Cases DetailsDocument6 pagesLouis Battistoni Police and Cases DetailsLiz CahallNo ratings yet

- Abellana Vs Ponce - CompressDocument1 pageAbellana Vs Ponce - Compresspaul esparagozaNo ratings yet

- Digest Ucpb Vs Masagana GR No 137172 - CompressDocument1 pageDigest Ucpb Vs Masagana GR No 137172 - Compresspaul carmelo esparagozaNo ratings yet

- Transpacific V CADocument2 pagesTranspacific V CAVianca MiguelNo ratings yet

- 9 Feb 2017Document28 pages9 Feb 2017MikhoYabutNo ratings yet

- Account Part 2Document9 pagesAccount Part 2himanshubaranwal068No ratings yet

- Quasi LawDocument4 pagesQuasi LawBhavika KewalramaniNo ratings yet

- Janfeb 2005Document2 pagesJanfeb 2005Larry LeachNo ratings yet

- GG Ry: Caled - .:....... 3 Ro NiDocument1 pageGG Ry: Caled - .:....... 3 Ro NiPetrina MascarenhasNo ratings yet

- Roco Vs ContrerasDocument4 pagesRoco Vs ContrerasRex GodModeNo ratings yet

- Orca Share Media1580515457112Document65 pagesOrca Share Media1580515457112boerd77No ratings yet

- PDF Elisa Gabriel Vs Register of Deeds - CompressDocument2 pagesPDF Elisa Gabriel Vs Register of Deeds - CompressFlorinda UrbiNo ratings yet

- Administer, Dispose of and Preven T The Loss or Dissipation of The Real or PersonalDocument6 pagesAdminister, Dispose of and Preven T The Loss or Dissipation of The Real or PersonalFlorinda UrbiNo ratings yet

- PDF Estella Et Al Vs Register of Deeds of Rizal - CompressDocument1 pagePDF Estella Et Al Vs Register of Deeds of Rizal - CompressFlorinda UrbiNo ratings yet

- ALJ Legal Citation PrimerDocument35 pagesALJ Legal Citation PrimerFlorinda UrbiNo ratings yet

- Credtrans - Suico Vs PNBDocument16 pagesCredtrans - Suico Vs PNBFlorinda UrbiNo ratings yet

- GRADES 1 To 12 Daily Lesson Log: Isulat Ang Code NG Bawat KasanayanDocument8 pagesGRADES 1 To 12 Daily Lesson Log: Isulat Ang Code NG Bawat KasanayanFlorinda UrbiNo ratings yet

- School Form 1 (SF 1) School RegisterDocument3 pagesSchool Form 1 (SF 1) School RegisterFlorinda UrbiNo ratings yet

- Independence DAY: GRADES 1 To 12 Daily Lesson LogDocument8 pagesIndependence DAY: GRADES 1 To 12 Daily Lesson LogFlorinda UrbiNo ratings yet

- Article IiDocument1 pageArticle IiFlorinda UrbiNo ratings yet

- GRADES 1 To 12 Daily Lesson Log JUNE 3-7, 2019 (WEEK 1) )Document6 pagesGRADES 1 To 12 Daily Lesson Log JUNE 3-7, 2019 (WEEK 1) )Florinda UrbiNo ratings yet

- FM PFDocument12 pagesFM PFJenelle ReyesNo ratings yet

- Lanson Blueprint NewDocument35 pagesLanson Blueprint Newharish_inNo ratings yet

- JSPL Preliminary Placement DocumentDocument523 pagesJSPL Preliminary Placement Documentseeram varmaNo ratings yet

- Hester Bank StatementDocument4 pagesHester Bank Statementjohn yorkNo ratings yet

- MFE FormulaDocument28 pagesMFE Formulajes_kur100% (1)

- Business Law PDFDocument2 pagesBusiness Law PDFFaculty of Business and Economics, Monash University100% (1)

- 2020 Inspection Grant Thornton LLP: (Headquartered in Chicago, Illinois)Document24 pages2020 Inspection Grant Thornton LLP: (Headquartered in Chicago, Illinois)Jason BramwellNo ratings yet

- Money and Schools 7Th Edition PDF Full Chapter PDFDocument53 pagesMoney and Schools 7Th Edition PDF Full Chapter PDFtxelolandaa100% (6)

- General Principles of TaxationDocument8 pagesGeneral Principles of TaxationEllah MaeNo ratings yet

- Guidelines For Compromise Settlement of Dues of Banks and Financial Institutions Through Lok AdalatsDocument3 pagesGuidelines For Compromise Settlement of Dues of Banks and Financial Institutions Through Lok AdalatsMahesh Prasad PandeyNo ratings yet

- Overview of Financial Structure of BangladeshDocument7 pagesOverview of Financial Structure of BangladeshJakir_bnkNo ratings yet

- CGI5616P18Document322 pagesCGI5616P18Deepak YadavNo ratings yet

- Bank Statement 6 MonthsDocument57 pagesBank Statement 6 Monthssrinivas rao kNo ratings yet

- Item Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptDocument1 pageItem Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptGustu LiranNo ratings yet

- Markets Update Asset Class Returns: Ten Stupid Things People Do To Mess Up Their Investment PortfoliosDocument2 pagesMarkets Update Asset Class Returns: Ten Stupid Things People Do To Mess Up Their Investment Portfoliostscollin48No ratings yet

- Huff N PuffDocument1 pageHuff N PuffA. CampbellNo ratings yet

- Mini Steel Plant 790699Document57 pagesMini Steel Plant 790699Eyock PierreNo ratings yet

- Bank DefinationDocument2 pagesBank Definationgaurav069No ratings yet

- MCQ - Financial ServicesDocument22 pagesMCQ - Financial ServicesRamees KpNo ratings yet

- Problem #2 Lump-Sum Liquidation With Loss On RealizationDocument4 pagesProblem #2 Lump-Sum Liquidation With Loss On Realizationjelai anselmoNo ratings yet

- Currency Futures and Options - FinalDocument107 pagesCurrency Futures and Options - FinalRavindra BabuNo ratings yet

- Business Finance Long TestDocument4 pagesBusiness Finance Long TestSALES JENYCANo ratings yet

- A 85 A 0 Module 2 UpDocument39 pagesA 85 A 0 Module 2 UphimnnnNo ratings yet

- Business Plan For Smart BoutiqueDocument25 pagesBusiness Plan For Smart BoutiqueAnonymous NM7hmMfNo ratings yet

- May 2023 Pathfinder - Skills LevelDocument176 pagesMay 2023 Pathfinder - Skills LevelBrian DhliwayoNo ratings yet

- Mandate Form and UndertakingDocument2 pagesMandate Form and Undertakingmeditation spirtual guruNo ratings yet