Professional Documents

Culture Documents

Exercise No.4 (Acctg 7) - Tan

Exercise No.4 (Acctg 7) - Tan

Uploaded by

Faith Reyna Tan0 ratings0% found this document useful (0 votes)

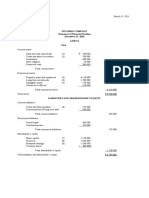

8 views1 page1) The Youth Company reported net income of P1,000,000 for the year ended December 31, 2020. Net sales were P8,870,000 with cost of goods sold of P5,900,000, resulting in gross income of P2,970,000.

2) Expenses included distribution costs of P690,000 and administrative expenses of P580,000. An uninsured flood loss of P340,000 was also incurred.

3) After accounting for income tax expense of P360,000, net income for the year was P1,000,000.

Original Description:

Original Title

Exercise no.4 (Acctg 7)_Tan

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The Youth Company reported net income of P1,000,000 for the year ended December 31, 2020. Net sales were P8,870,000 with cost of goods sold of P5,900,000, resulting in gross income of P2,970,000.

2) Expenses included distribution costs of P690,000 and administrative expenses of P580,000. An uninsured flood loss of P340,000 was also incurred.

3) After accounting for income tax expense of P360,000, net income for the year was P1,000,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views1 pageExercise No.4 (Acctg 7) - Tan

Exercise No.4 (Acctg 7) - Tan

Uploaded by

Faith Reyna Tan1) The Youth Company reported net income of P1,000,000 for the year ended December 31, 2020. Net sales were P8,870,000 with cost of goods sold of P5,900,000, resulting in gross income of P2,970,000.

2) Expenses included distribution costs of P690,000 and administrative expenses of P580,000. An uninsured flood loss of P340,000 was also incurred.

3) After accounting for income tax expense of P360,000, net income for the year was P1,000,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Ma. Faith R.

Tan March 15, 2021

BSA-2A | Acctg 7

Exercise no. 4

YOUTH COMPANY

Income Statement

Year ended December 31, 2020

Note

Net sales (1) P 8 870 000

Cost of goods sold (2) ( 5 900 000)

Gross income P 2 970 000

Expenses:

Distribution costs (3) P 690 000

Administrative expenses (4) 580 000

Uninsured flood loss 340 000 ( 1 610 000)

Income before tax 1 360 000

Income tax expense ( 360 000)

Net income P 1000 000

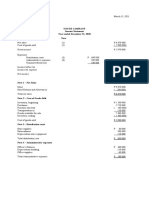

Note 1 – Net Sales

Sales P 9 070 000

Sales Returns and Allowances ( 200 000)

Total net sales P 8 870 000

Note 2 – Cost of Goods Sold

Inventory, beginning P 1 500 000

Purchases 5 750 000

Purchase discount ( 100 000)

Transportation in 150 000

Goods available for sale 7 300 000

Inventory, ending ( 1 400 000)

Cost of goods sold P 5 900 000

Note 3 – Distribution costs

Store supplies P 80 000

Sales salaries 500 000

Depreciation-store equipment 110 000

Total distribution cost P 690 000

Note 4 – Administrative expenses

Officer’s Salaries P 400 000

Depreciation-building 120 000

Office supplies 60 000

Total Administrative expenses P 580 000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Case Study of La Posta Mexican RestaurantsDocument1 pageCase Study of La Posta Mexican RestaurantsFatima Atiq80% (5)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Opgave 1: Side 1 Af 11Document11 pagesOpgave 1: Side 1 Af 11shamoNo ratings yet

- Linear Programming Models: Graphical and Computer MethodsDocument91 pagesLinear Programming Models: Graphical and Computer MethodsFaith Reyna TanNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Exercise No.4 (Acctg 7) - TanDocument1 pageExercise No.4 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Chapter Test - Expenditure CycleDocument4 pagesChapter Test - Expenditure CycleFaith Reyna TanNo ratings yet

- FSAQ1Document1 pageFSAQ1Faith Reyna TanNo ratings yet

- Chapter Test - Revenue CycleDocument3 pagesChapter Test - Revenue CycleFaith Reyna TanNo ratings yet

- Disclaimer: College of Information and Communications TechnologyDocument33 pagesDisclaimer: College of Information and Communications TechnologyFaith Reyna TanNo ratings yet

- Chapter Test - Production CycleDocument3 pagesChapter Test - Production CycleFaith Reyna TanNo ratings yet

- Chapter Test - HRM&Payroll CycleDocument3 pagesChapter Test - HRM&Payroll CycleFaith Reyna TanNo ratings yet

- Chapter Test - Gen Ledger & RPTG CycleDocument3 pagesChapter Test - Gen Ledger & RPTG CycleFaith Reyna TanNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Chapter01 IntroductionToComputerProgrammingDocument23 pagesChapter01 IntroductionToComputerProgrammingFaith Reyna TanNo ratings yet

- Sonargaon University (SU) Dhaka, Bangladesh: Grade Sheet Date: 22.12.2020Document1 pageSonargaon University (SU) Dhaka, Bangladesh: Grade Sheet Date: 22.12.2020Shuvo Biswas TopuNo ratings yet

- Making Tomorrow's Workforce Fit For The Future of Industry: Siemens Mechatronic Systems Certification Program (SMSCP)Document6 pagesMaking Tomorrow's Workforce Fit For The Future of Industry: Siemens Mechatronic Systems Certification Program (SMSCP)Shobanraj LetchumananNo ratings yet

- Organic Solvent Solubility DataBookDocument130 pagesOrganic Solvent Solubility DataBookXimena RuizNo ratings yet

- Bricked N910FDocument2 pagesBricked N910FPhan Mem Tien ÍchNo ratings yet

- Symptoms of HypoglycemiaDocument20 pagesSymptoms of Hypoglycemiakenny StefNo ratings yet

- LG W1943C Chass LM92C PDFDocument23 pagesLG W1943C Chass LM92C PDFDaniel Paguay100% (1)

- Zon Kota Damansara-2Document29 pagesZon Kota Damansara-2amirul rashidNo ratings yet

- Marcopolo Is A Leading Brazilian Bus Body ManufacturerDocument4 pagesMarcopolo Is A Leading Brazilian Bus Body ManufacturerCH NAIRNo ratings yet

- Thesis FinalDocument91 pagesThesis FinalSheikh Zabed MoyeenNo ratings yet

- George David Case 1Document2 pagesGeorge David Case 1Anonymous vZzAGTw9oNo ratings yet

- Oracle Certified Professional Java Programmer (OCPJP 7) BookDocument38 pagesOracle Certified Professional Java Programmer (OCPJP 7) BookDhivya Ganesh100% (2)

- Brainy kl7 Unit Test 7 CDocument5 pagesBrainy kl7 Unit Test 7 CMateusz NochNo ratings yet

- Fast Food Waiting TimeDocument32 pagesFast Food Waiting TimebossdudeNo ratings yet

- Magic SquaresDocument1 pageMagic SquaresplmokmNo ratings yet

- Corporations: Organization and Capital Stock Transaction: Corporation Second GradeDocument113 pagesCorporations: Organization and Capital Stock Transaction: Corporation Second GradePeter WagdyNo ratings yet

- Gass Et Al v. Schlotfeldt Et Al - Document No. 4Document2 pagesGass Et Al v. Schlotfeldt Et Al - Document No. 4Justia.comNo ratings yet

- 13L00501A - 7P-A: General NotesDocument7 pages13L00501A - 7P-A: General NotesCLS AKNo ratings yet

- Physica A: Bilal Saoud, Abdelouahab MoussaouiDocument9 pagesPhysica A: Bilal Saoud, Abdelouahab MoussaouiHaroonRashidNo ratings yet

- Quarter 3 MAPEH 7Document5 pagesQuarter 3 MAPEH 7Michelle Jane JapsonNo ratings yet

- PFW - Vol. 23, Issue 08 (August 18, 2008) Escape To New YorkDocument0 pagesPFW - Vol. 23, Issue 08 (August 18, 2008) Escape To New YorkskanzeniNo ratings yet

- A Burdizzo Is Used For: A. Branding B. Dehorning C. Castration D. All of The AboveDocument54 pagesA Burdizzo Is Used For: A. Branding B. Dehorning C. Castration D. All of The AboveMac Dwayne CarpesoNo ratings yet

- Spinal StabilizationDocument32 pagesSpinal StabilizationLakshita PrajapatiNo ratings yet

- Applied Economics Module 3 Q1Document21 pagesApplied Economics Module 3 Q1Jefferson Del Rosario100% (1)

- 2020 Updated Resume FinalDocument2 pages2020 Updated Resume Finalapi-523816461No ratings yet

- Near Source Fault Effects On The Performance of Base-Isolated Hospital Building vs. A BRBF Hospital BuildingDocument6 pagesNear Source Fault Effects On The Performance of Base-Isolated Hospital Building vs. A BRBF Hospital BuildingJosé Antonio Alarcón LeónNo ratings yet

- Ib Phys DC ESQ ADocument30 pagesIb Phys DC ESQ AkjsaccsNo ratings yet

- Rahmawati IndikatorDocument2 pagesRahmawati IndikatorDaffa amri MaulanaNo ratings yet

- PMP Exam EVOVLE Free SampleDocument47 pagesPMP Exam EVOVLE Free SampleEvolve trainingmaterialsNo ratings yet