Professional Documents

Culture Documents

Ertegergerg

Ertegergerg

Uploaded by

airarowenaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ertegergerg

Ertegergerg

Uploaded by

airarowenaCopyright:

Available Formats

TALACTAC, Aira Rowena A.

2017400080

April 16, 2021

Taxation 2 3C

1. Discuss the concept of vanishing deductions.

Vanishing deduction is the deduction to the gross estate of the decedent when

there have been five succeeding deaths in a span of five years. In vanishing deductions,

the rate of deductions to the gross estate diminishes over the period of five years. The

requisites of vanishing deductions are as follows: the death of present decedents within

five years; property is received from prior decedents; the estate tax was previously

determined and paid; and no previous deduction was allowed to the estate.

2. What are included in the decedent's gross estate?

The decedent’s gross estate includes transfers under a general power of

appointment, revocable transfers, transfers in contemplation of death, proceeds of life

insurance, transfer for insufficient consideration, and prior interests.

3. Discuss the rules on the proceeds of life insurance viz a vis its inclusion in or

exclusion to a decedent's gross estate.

As to the rules on the proceeds of life insurance viz a vis its inclusion in or

exclusion to a decedent’s gross estate, it is important to determine whether or not the

designation of beneficiary is revocable or irrevocable. In case of revocable designation,

the proceeds of the life insurance shall be reverted back to the decedent’s gross estate

for there was no vested right over the proceeds. And as for irrevocable designation, the

proceeds are not reverted back to the estate and not be computed as income of the

beneficiary as there is vested right over such.

4. What are donations that are not subject to tax?

The donations that are not subject to tax are merger of usufruct in the owner of

the naked title, fideicommissary substitutions, and all bequests, devisees, legacies or

transfer to social welfare, cultural, or charitable institution provided that there is actual,

direct, exclusive use and not more than 30% are used for administrative purposes.

5. What are the rules on taxing the estate of a non-resident alien who died in the

Philippines in respect to real and personal properties located here?

As for the estate of non-resident alien, the deductions allowed by law are the

standard deduction of P500,000.00, claims against the estate, claims of the deceased

against insolvent persons, unpaid mortgages, and the net share of the surviving spouse

in the conjugal property. In this case, there are no deductions as to real properties

because non-resident aliens are not authorized by law to own real properties in the

Philippines. Also, it is important to determine whether or not the laws of the non-resident

citizen applies with reciprocity to the laws of the Philippines to determine whether or not

the intangible properties of the non-resident alien can form part his or her gross estate.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- San Miguel vs. Magno (Case Digest)Document3 pagesSan Miguel vs. Magno (Case Digest)Dina PasionNo ratings yet

- IBM Capital StructureDocument53 pagesIBM Capital Structureyajkr0% (1)

- ANITA MANGILA, Petitioner, vs. COURT OF APPEALS and LORETA GUINA, RespondentsDocument144 pagesANITA MANGILA, Petitioner, vs. COURT OF APPEALS and LORETA GUINA, RespondentsairarowenaNo ratings yet

- Midterms Evidence Alar As NotesDocument53 pagesMidterms Evidence Alar As NotesairarowenaNo ratings yet

- Solicitor General For Petitioner. V .Jaime & L. E. Petilla For RespondentDocument152 pagesSolicitor General For Petitioner. V .Jaime & L. E. Petilla For RespondentairarowenaNo ratings yet

- The CaseDocument153 pagesThe CaseairarowenaNo ratings yet

- G.R. No. L-62952. October 9, 1985.Document63 pagesG.R. No. L-62952. October 9, 1985.airarowenaNo ratings yet

- SOLIMAN M. SANTOS, JR., Complainant, vs. ATTY. FRANCISCO R. LLAMAS, RespondentDocument12 pagesSOLIMAN M. SANTOS, JR., Complainant, vs. ATTY. FRANCISCO R. LLAMAS, RespondentairarowenaNo ratings yet

- TALACTAC, Aira Rowena A. - 2017400080 - CORPOMIDTERMSDocument2 pagesTALACTAC, Aira Rowena A. - 2017400080 - CORPOMIDTERMSairarowenaNo ratings yet

- Talactac Lip Reviewer: Trademarks 1. Relevant Provisions of The 1987 ConstitutionDocument27 pagesTalactac Lip Reviewer: Trademarks 1. Relevant Provisions of The 1987 ConstitutionairarowenaNo ratings yet

- Talactac, Aira Rowena A. 2017400080 Transport Law 2B 1 of 5: Transportation LawsDocument3 pagesTalactac, Aira Rowena A. 2017400080 Transport Law 2B 1 of 5: Transportation LawsairarowenaNo ratings yet

- Intellectual Property Code Republic Act No. 8293: (G.R. Nos. 160054-55. July 21, 2004.)Document4 pagesIntellectual Property Code Republic Act No. 8293: (G.R. Nos. 160054-55. July 21, 2004.)airarowenaNo ratings yet

- DFDFDDocument9 pagesDFDFDairarowenaNo ratings yet

- 1st Journal Entry For Philope 2015Document2 pages1st Journal Entry For Philope 2015airarowenaNo ratings yet

- Last Will and Testament of Aira Rowena Abad TalactacDocument4 pagesLast Will and Testament of Aira Rowena Abad TalactacairarowenaNo ratings yet

- Intervention,: (G.R. No. 230642. September 10, 2019.)Document130 pagesIntervention,: (G.R. No. 230642. September 10, 2019.)airarowenaNo ratings yet

- Favorite Fast Food Chain Chicken2: 17% 8% 17% Jolibee KFC Toribox Mcdonald'SDocument1 pageFavorite Fast Food Chain Chicken2: 17% 8% 17% Jolibee KFC Toribox Mcdonald'SairarowenaNo ratings yet

- Literary Genre (For Assignefd Discussion)Document15 pagesLiterary Genre (For Assignefd Discussion)airarowenaNo ratings yet

- Choosing A Career: Choose Career Options That Match Your ValuesDocument4 pagesChoosing A Career: Choose Career Options That Match Your ValuesairarowenaNo ratings yet

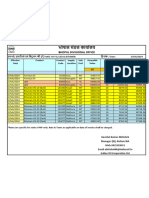

- Philope A55 Philope A55 Pollres A52 Polqual A52 Pollres A52 Polqual A52 Pollsea A51 Inttrel A51 Pollsea A51 Inttrel A51Document1 pagePhilope A55 Philope A55 Pollres A52 Polqual A52 Pollres A52 Polqual A52 Pollsea A51 Inttrel A51 Pollsea A51 Inttrel A51airarowenaNo ratings yet

- Mangerial EconomicsDocument90 pagesMangerial EconomicsSachin HolkarNo ratings yet

- E-Auctions - MSTC Limited-IOBL BGBG-01.12.2020Document4 pagesE-Auctions - MSTC Limited-IOBL BGBG-01.12.2020mannakauNo ratings yet

- Two Centuries of TariffsDocument146 pagesTwo Centuries of TariffsStephen LoiaconiNo ratings yet

- Shabaz Farukh Shaikh Payslip Jan 2024Document1 pageShabaz Farukh Shaikh Payslip Jan 2024eliajaun71No ratings yet

- Final Response Tianhe PDFDocument32 pagesFinal Response Tianhe PDFMelanie Newman0% (1)

- A Wealth Tax To Address Five Global DisruptionsDocument6 pagesA Wealth Tax To Address Five Global DisruptionsSibghat ShahNo ratings yet

- 1 Financial Statements Other Than SCFDocument15 pages1 Financial Statements Other Than SCFYassin DyabNo ratings yet

- Why South Africa's Apartheid Economy Failed.Document10 pagesWhy South Africa's Apartheid Economy Failed.IoproprioioNo ratings yet

- Feige APT Presentation To Tax Reform Panel 2005Document19 pagesFeige APT Presentation To Tax Reform Panel 2005delray151No ratings yet

- 2021 22 SARS ELogbookDocument17 pages2021 22 SARS ELogbookBlack Snow ServicesNo ratings yet

- Toms PR Plansbook PDFDocument32 pagesToms PR Plansbook PDFgagansrikankaNo ratings yet

- Tax Case Doctrines PDFDocument30 pagesTax Case Doctrines PDFAnony mousNo ratings yet

- 19 31 July Final B.Com SYLLABUSDocument105 pages19 31 July Final B.Com SYLLABUSGåúràv KûmárNo ratings yet

- Form 15CB - Filed FormDocument3 pagesForm 15CB - Filed Formprachi12gargNo ratings yet

- Alejandro Ty v. Hon. TrampeDocument13 pagesAlejandro Ty v. Hon. TrampeChristian Joe QuimioNo ratings yet

- 1st Feb-2024 IOCL RateDocument1 page1st Feb-2024 IOCL RateShalini BorkerNo ratings yet

- Macro Chapter 24 - Govt and Fiscal PolicyDocument34 pagesMacro Chapter 24 - Govt and Fiscal PolicyGenesis CagubcobNo ratings yet

- Dimaampao Tax Reviewer (E)Document53 pagesDimaampao Tax Reviewer (E)Camille100% (4)

- Research Report On The Financial Statement of NepalDocument4 pagesResearch Report On The Financial Statement of Nepalallinnepal86No ratings yet

- KPMG Direct-Selling-2015-India-Report PDFDocument58 pagesKPMG Direct-Selling-2015-India-Report PDFAnshu KashyapNo ratings yet

- 5.8 BDO V RepublicDocument21 pages5.8 BDO V Republicjay ugayNo ratings yet

- Dalberg Business Cost of Air Pollution Long Form ReportDocument19 pagesDalberg Business Cost of Air Pollution Long Form ReportOmkar ShindeNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Collection of HC and SC DecisionsDocument63 pagesCollection of HC and SC DecisionsDayavantiNo ratings yet

- Transfer and Business Taxation: Module WritersDocument129 pagesTransfer and Business Taxation: Module WritersPaulita GomezNo ratings yet

- SWAT RyanAir PDFDocument10 pagesSWAT RyanAir PDFronda_upld777No ratings yet

- Money Answer All ThingsDocument76 pagesMoney Answer All ThingsJose Artur PaixaoNo ratings yet

- ListDocument15 pagesListMuhammad JavedNo ratings yet