Professional Documents

Culture Documents

Melita-Vodafone: What's in It For You? The MCA Thinks Mobile Prices Could Rise

Melita-Vodafone: What's in It For You? The MCA Thinks Mobile Prices Could Rise

Uploaded by

Neacsu AdrianaCopyright:

Available Formats

You might also like

- MVNOs Key Legal IssuesDocument8 pagesMVNOs Key Legal IssuesSibel ÖçalNo ratings yet

- AQ Law Firm Profile PDFDocument13 pagesAQ Law Firm Profile PDFHaseeb Hassan0% (1)

- 9b4e4strategy Case Study Assignments 2Document19 pages9b4e4strategy Case Study Assignments 2Homework PingNo ratings yet

- 9b4e4strategy Case Study Assignments 2Document19 pages9b4e4strategy Case Study Assignments 2amitmbhandari25No ratings yet

- Handset Leasing - Unlock Opportunities To Regain Financial Position in Telecom IndustryDocument7 pagesHandset Leasing - Unlock Opportunities To Regain Financial Position in Telecom IndustryHoàng NguyễnNo ratings yet

- KuwaitTelecomIndustry (Update) Feb2011Document6 pagesKuwaitTelecomIndustry (Update) Feb2011akshit_375276572No ratings yet

- Topic of A ResearchDocument42 pagesTopic of A ResearchNhung DuckieNo ratings yet

- On The Economics of 3G Mobile Virtual Network Operators (Mvnos)Document14 pagesOn The Economics of 3G Mobile Virtual Network Operators (Mvnos)Tran Quoc TamNo ratings yet

- Economic Viability of 3G Mobile Virtual Network Operators: NtroductionDocument5 pagesEconomic Viability of 3G Mobile Virtual Network Operators: NtroductionMoe KyawNo ratings yet

- Executive SummaryDocument4 pagesExecutive Summary670620No ratings yet

- Ufone Assignment 2Document8 pagesUfone Assignment 2Shama KhanNo ratings yet

- StartgyDocument7 pagesStartgyshafeeqaliNo ratings yet

- Toyota Car's Strategic Analysis in Uk. and The Development of Customer ValueDocument7 pagesToyota Car's Strategic Analysis in Uk. and The Development of Customer ValueAliNo ratings yet

- White Paper Aug2013Document17 pagesWhite Paper Aug2013Arun MaithaniNo ratings yet

- As The MVNO Market Is Experiencing Exponential Growth WorldwideDocument2 pagesAs The MVNO Market Is Experiencing Exponential Growth WorldwideOmais SyedNo ratings yet

- Econex Researchnote 4Document4 pagesEconex Researchnote 4Sizakele Portia MbeleNo ratings yet

- Zong Pakistan CaseDocument5 pagesZong Pakistan CaseQiratNo ratings yet

- 2nd Business Análisis MOVISTARDocument6 pages2nd Business Análisis MOVISTARRicardo BazanteNo ratings yet

- Analysis of Operator Options To Reduce The Impact of The Revenue Gap Caused by Flat Rate Mobile Broadband SubscriptionsDocument8 pagesAnalysis of Operator Options To Reduce The Impact of The Revenue Gap Caused by Flat Rate Mobile Broadband SubscriptionsAli HassanNo ratings yet

- Telco 2020 - How Telcos Transform For The Smartphone SocietyDocument20 pagesTelco 2020 - How Telcos Transform For The Smartphone SocietygrahammcinnesNo ratings yet

- Project On Mobile Virtual Network Operator: Submitted To Submitted byDocument14 pagesProject On Mobile Virtual Network Operator: Submitted To Submitted byRam RaikwarNo ratings yet

- Presentation On MVNO (Mobile Virtual Network Operator)Document19 pagesPresentation On MVNO (Mobile Virtual Network Operator)Karan Arjun100% (1)

- Analysys Mason Predictions 2021 TMTDocument3 pagesAnalysys Mason Predictions 2021 TMTritamitsoukouoNo ratings yet

- Chapter - 1 Industry ProfileDocument12 pagesChapter - 1 Industry Profilesatya_parihar2011No ratings yet

- DMR Article: From King To King Maker - Mobile Service Strategies For The Telecom OperatorsDocument7 pagesDMR Article: From King To King Maker - Mobile Service Strategies For The Telecom OperatorsDetecon InternationalNo ratings yet

- Political DigiDocument5 pagesPolitical DigiJoelene ChewNo ratings yet

- Chapter One 1.1 Background To The ProjectDocument2 pagesChapter One 1.1 Background To The ProjectErnest Kwame BrawuaNo ratings yet

- Faculty Guide: Khusbu Sadhwani MemDocument6 pagesFaculty Guide: Khusbu Sadhwani MemPatel Dhirendrakumar GandalalNo ratings yet

- DOCOMO Assignment Questions-1Document4 pagesDOCOMO Assignment Questions-1nitishhere100% (2)

- Im SaDocument4 pagesIm SaSagar GuptaNo ratings yet

- Impact On FirmsDocument2 pagesImpact On FirmsAyushman AgarwalNo ratings yet

- Business Risk TelecomDocument1 pageBusiness Risk Telecomashfaqarooba11No ratings yet

- Telecom Sector Analysis ReportDocument4 pagesTelecom Sector Analysis Report9036280350No ratings yet

- Best Practice Guide West Africa (2013:4)Document8 pagesBest Practice Guide West Africa (2013:4)Kwame AsamoaNo ratings yet

- Competition Policy Ternds in TelecommunicationDocument3 pagesCompetition Policy Ternds in Telecommunicationphuonganh285No ratings yet

- Entry BarierDocument4 pagesEntry BarierSaket KumarNo ratings yet

- MVNOs - Key Legal IssuesDocument8 pagesMVNOs - Key Legal Issuesabgup12111953No ratings yet

- Mobile Virtual OperatorsDocument5 pagesMobile Virtual OperatorsdwiaryantaNo ratings yet

- Mobile Virtual Network Operators in The Sultanate of OmanDocument9 pagesMobile Virtual Network Operators in The Sultanate of Omanknpsingh7092No ratings yet

- University Assignment CT7075Document21 pagesUniversity Assignment CT7075Shakeel ShahidNo ratings yet

- Telecom Egypt Credit RatingDocument10 pagesTelecom Egypt Credit RatingHesham TabarNo ratings yet

- Comsumer Behaviour Project ReportDocument39 pagesComsumer Behaviour Project ReportAbhijeet VatsNo ratings yet

- PORTER 5 ForcesDocument4 pagesPORTER 5 ForcesMiley MartinNo ratings yet

- P Pwake 3 Z 8 ZE1 Yb LVX 2 WKBJDocument2 pagesP Pwake 3 Z 8 ZE1 Yb LVX 2 WKBJyogica3537No ratings yet

- City CellDocument27 pagesCity CellmonirNo ratings yet

- By Rafael Junquera,: Smartphones: Are They The Real Deal?Document5 pagesBy Rafael Junquera,: Smartphones: Are They The Real Deal?kallolshyam.roy2811No ratings yet

- Business Environment Assignmnt1Document4 pagesBusiness Environment Assignmnt1Mohd AnasNo ratings yet

- Us Telecom Outlook 2019 PDFDocument8 pagesUs Telecom Outlook 2019 PDFPNG networksNo ratings yet

- The Introduction of 5G TechnologyDocument2 pagesThe Introduction of 5G TechnologyrameshNo ratings yet

- IMS-IP Multimedia Subsystem: IMS Overview and The Unified Carrier NetworkDocument11 pagesIMS-IP Multimedia Subsystem: IMS Overview and The Unified Carrier NetworkManas RanjanNo ratings yet

- Telecommunications Network Development enDocument22 pagesTelecommunications Network Development enTôi Là TôiNo ratings yet

- More For Less: Telcos Will Continue To Stretch The Life of Copper NetworksDocument17 pagesMore For Less: Telcos Will Continue To Stretch The Life of Copper Networksvignesh_velappanNo ratings yet

- HRM RelianceDocument78 pagesHRM Reliancemanwanimuki12No ratings yet

- World Telecom Industry Is An Uprising Industry, Proceeding Towards A Goal of Achieving TwoDocument52 pagesWorld Telecom Industry Is An Uprising Industry, Proceeding Towards A Goal of Achieving Twomanwanimuki12No ratings yet

- The Impact of Over The Top Service Providers On THDocument28 pagesThe Impact of Over The Top Service Providers On THVictor Andrei BodiutNo ratings yet

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyFrom EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyNo ratings yet

- Future Telco: Successful Positioning of Network Operators in the Digital AgeFrom EverandFuture Telco: Successful Positioning of Network Operators in the Digital AgePeter KrüsselNo ratings yet

- Cellular Technologies for Emerging Markets: 2G, 3G and BeyondFrom EverandCellular Technologies for Emerging Markets: 2G, 3G and BeyondNo ratings yet

- A Day in The Life of A Management Consultant From McKinsey & Company - Management Consulting Case InterviewsDocument4 pagesA Day in The Life of A Management Consultant From McKinsey & Company - Management Consulting Case InterviewsAkhilGovindNo ratings yet

- Reverse A Cleared DocumentsDocument5 pagesReverse A Cleared Documentsdude28spNo ratings yet

- The Business Model Canvas: Customer Segments Value Propositions Key Activities Key Partners Customer RelationshipsDocument1 pageThe Business Model Canvas: Customer Segments Value Propositions Key Activities Key Partners Customer RelationshipsJAISHINI SIVARAM 2023259No ratings yet

- BUS 5110 Discussion Forum Unit-4 BUS 5110 Discussion Forum Unit-4Document3 pagesBUS 5110 Discussion Forum Unit-4 BUS 5110 Discussion Forum Unit-4Emmanuel Gift Bernard100% (1)

- Shapiro Chapter 20 SolutionsDocument13 pagesShapiro Chapter 20 SolutionsRuiting ChenNo ratings yet

- Chap 4 Books of Prime EntryDocument29 pagesChap 4 Books of Prime EntrynabkillNo ratings yet

- Session 10, Assignment QuestionsDocument5 pagesSession 10, Assignment QuestionsHAMZA HASSANNo ratings yet

- Module 6 Training Module On Material Management Final1Document28 pagesModule 6 Training Module On Material Management Final1miadjafar463No ratings yet

- B. Doors C. Plays D. Students: Try To Become A Better Version of Yourself!Document5 pagesB. Doors C. Plays D. Students: Try To Become A Better Version of Yourself!Anh NguyễnNo ratings yet

- Welfare Effects of Personalized RankingsDocument49 pagesWelfare Effects of Personalized RankingsHuy NguyenNo ratings yet

- Cañete Midterm ExamDocument4 pagesCañete Midterm ExamPark WangjaNo ratings yet

- Annex F - Sample Notes To FSDocument44 pagesAnnex F - Sample Notes To FSjaymark canayaNo ratings yet

- ANU - Time Table of P.G. II, IV Semesters Reg Examinations April-2013Document41 pagesANU - Time Table of P.G. II, IV Semesters Reg Examinations April-2013Siva MeruvaNo ratings yet

- Welcome To Quality SESSION: QC QADocument30 pagesWelcome To Quality SESSION: QC QAAbou Tebba SamNo ratings yet

- 20 RLII A5.7 Management Representation Letter-2Document10 pages20 RLII A5.7 Management Representation Letter-2Elizabeth BergundoNo ratings yet

- EL201 Accounting Learning Module Lessons 51Document19 pagesEL201 Accounting Learning Module Lessons 51BabyjoyNo ratings yet

- Bba Hult Brochure 2023 24Document67 pagesBba Hult Brochure 2023 24Alexis JulianoNo ratings yet

- Effects of Debt Financing On Financial Performance of Listed Consumer Goods Firms in NigeriaDocument13 pagesEffects of Debt Financing On Financial Performance of Listed Consumer Goods Firms in NigeriaSebsibe AshangoNo ratings yet

- 05302023PMR Format 051723Document4 pages05302023PMR Format 051723Devorah Jane A. AmoloNo ratings yet

- This Study Resource Was: Add Question HereDocument4 pagesThis Study Resource Was: Add Question HereJayvee Ramos RuedaNo ratings yet

- Garrison Lecture Chapter 2Document61 pagesGarrison Lecture Chapter 2Ahmad Tawfiq Darabseh100% (2)

- 6 Skin Pharmaceuticals Private Limited: Directors' ReportDocument12 pages6 Skin Pharmaceuticals Private Limited: Directors' ReportvineminaiNo ratings yet

- Brand ImageDocument3 pagesBrand Imagemoiz ahmedNo ratings yet

- Module 4-FriaDocument71 pagesModule 4-FriaAleah Jehan AbuatNo ratings yet

- Material (Formula Sheets) : Chapter 8 Material Quantitative Models For Planning and ControlDocument3 pagesMaterial (Formula Sheets) : Chapter 8 Material Quantitative Models For Planning and Controljgfjhf arwtrNo ratings yet

- Harish Kumar Kandoi: Contact: +91 9874472220/9830714467Document3 pagesHarish Kumar Kandoi: Contact: +91 9874472220/9830714467Sabuj SarkarNo ratings yet

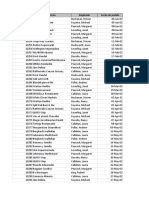

- Id. de Pedido Cliente Empleado Fecha de PedidoDocument10 pagesId. de Pedido Cliente Empleado Fecha de PedidoJessy Thalia Garcilazo TamayoNo ratings yet

- UntitledDocument2 pagesUntitledMamatha KerpudeNo ratings yet

- 4 5 6retailing PDFDocument61 pages4 5 6retailing PDFKimchhorng HokNo ratings yet

Melita-Vodafone: What's in It For You? The MCA Thinks Mobile Prices Could Rise

Melita-Vodafone: What's in It For You? The MCA Thinks Mobile Prices Could Rise

Uploaded by

Neacsu AdrianaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Melita-Vodafone: What's in It For You? The MCA Thinks Mobile Prices Could Rise

Melita-Vodafone: What's in It For You? The MCA Thinks Mobile Prices Could Rise

Uploaded by

Neacsu AdrianaCopyright:

Available Formats

Melita-Vodafone: What's in it for you?

The MCA

thinks mobile prices could rise

Publication info: MaltaToday ; San Gwann, Malta [San Gwann, Malta]27 July 2017.

ProQuest document link

FULL TEXT

Vodafone Malta is selling off to Melita: would a duopoly make consumers' lives better? The MCA thinks mobile

phone prices could rise, but we also asked Vodafone and Melita

Matthew Vella

27 July 2017, 7:54am

Print Version

The Malta Communications Authority has been clear about its position on the merger: its preliminary position is

that there are unpleasant risks when it comes to competition and consumer welfare, unless the competition

authority obtains guarantees that benefits will be won by clients.

Over the last two years, there have been a number of acquisitions affecting Melita and GO.

In July 2015, GO's majority shareholder Emirates International Telecommunications Malta (EITML) announced it

would dispose of its shareholding. In December 2015, Melita was sold by owners GMT Communications to Apax

Partners of France and Fortino Capital of Belgium. Six months later, Tunisie Telecom's subsidiary TTML acquired

65.4% of GO's share capital.

This wave of acquisitions did not dent the competition between the two players, and it is only the Melita-Vodafone

merger that has now given rise to what the MCA calls a new "mega-entity", because it brings two long-established

operators combining their resources to directly compete with GO.

Such a transaction would see the combination of two full-fledged mobile network operators, reducing the number

of such service providers. The Consumers Association has been the most virulent on the effects of the deal,

describing Malta's oligopolistic communications sector as one that charges high prices and offers "the same

shoddy service".

"Local consumers not only do not have a real choice but to add insult to injury have got to pay very high prices

when compared with the prices other consumers have to pay in other EU countries... the normal rate for a local

mobile phone call is 50c per minute while the new rate which will soon be enforced for roaming is 3c per minute,"

the CA's spokesperson, Benny Borg Bonello told the MCCAA in a letter of objection.

The CA also wants Vodafone clients to be granted the right to opt out of their contracts should the MCCAA

approve the deal, since ultimately their contracts would be taken on by Melita, which is retaining Vodafone as a

brand name.

Additionally, the merger will mean a convergence of a fixed network (Melita) and a mobile network (Vodafone) with

the general understanding that Vodafone will now become a player in the quad-play market.

The ensuing oligopoly, which already exists to a certain extent, would result in a "new duopolistic scenario in Malta

that may not be conducive to higher competition levels in the medium to long term," according to the MCA.

Whether the duopoly could give rise to an abusive market dominance remains to be seen, with the MCA saying it

should be subject to detailed studies. "Certainly, however, a Melita-Vodafone concentration would translate into

the elimination of an important competitive constraint that these two merging parties previously exerted upon

each other and separately on GO."

Impact on mobile telephone market

PDF GENERATED BY PROQUEST.COM Page 1 of 4

One glaring concern for the mobile telephony market would be the loss of one of the only three networks operating

in Malta. The new entity would have a market share of 60.5% - Vodafone has 44.1% and Melita has 17%, while GO

has 27.2% of the market (the smaller Redtouchfone caters for just 1.7%).

In itself, this concentration would be similar to that which GO enjoys in the fixed telephony market (65%), having

inherited the fixed line infrastructure of its state-owned predecessor Maltacom.

But the MCA also says that a new market entry and a larger presence of market players is beneficial to

competition. For example, in 2006 Melita's entry into the mobile market immediately resulted in increased

competitive pressure on the two largest service providers, namely Vodafone and GO. The swift process for number

portability enabled thousands of customers to switch to Melita. Other consumers adopted both a second Melita

number as well as their original GO and Vodafone connection.

Melita's entry also brought improved prices with declines over the last few years in the 'per minute rate' for mobile

telephony. Between 2006 and 2008, retail tariffs for GO and Vodafone were nearly identical, but by 2008 the sheer

threat of competition moved the two operators to lower the tariffs. Then in 2009 Melita joined the market with

lower than average tariffs, pushing Vodafone to match its prices, before being again undercut by Melita.

After 2012, the substantial decline stabilised. But the MCA says that since the merger will now see the loss of one

of the MNOs (mobile network operators), this competitive pressure on GO would be reduced. "[It] would effectively

translate into the elimination of an important competitive force that previously posed a direct price constraint on

GO and Vodafone Malta. The 'dilution' of competition forces raises the risk of a halt in the decline of the per minute

rate in mobile communications, or even a reversal in trends."

The MCA also fears that any pricing implications could also spill into mobile data services, which is becoming

more popular but where prices have not been reduced as yet.

"What happens to competition following a 3-to-2 player scenario... remains to be seen. However, various studies

show that mobile market consolidation in the form of mergers or acquisitions tends to have a significant impact

on prices, with call rates adjusting upwards in the medium- to long-term following the transaction," the MCA said.

A case in point was a study by the Austrian regulator on the Hutchison-Orange merger in 2013, which saw

smartphone prices rise by 50% on average. It was only years later that rates started falling when new entrant

Ventocom came into the market.

Even the European Commission has warned that a reduction of MNOs can lead to higher prices without even

translating into a higher investment for subscribers.

It could be argued that consolidation would see less duplication on network and non-network costs, if those

savings do get passed on to the consumer. The MCA says that is "far from a foregone conclusion... the crux of the

argument here is to what extent the parties could provide commitments that such efficiencies would offset the

disadvantages of concentration and ultimately result in clear benefits to the consumer."

Effects on other markets

With Melita and Vodafone joining forces, the latter company will be able to add its mobile data services to Melita's

strong fixed-line, internet and cable TV offering, in direct competition to GO's own quad-play offering.

Vodafone is offering a high 30Mbps speed that already poses a limited competitive constraint on GO's and Melita's

pricing on fixed broadband, which tend to be offered in bundles with other mobile telephony and television

services.

The merger would therefore 'eliminate' the prospect of broadband competitors emerging in the near future.

Additionally, the MCA says that GO and the new Melita-Vodafone merger may end up using their market shares as

a 'focal point' to slow down promotional efforts for stand-alone fixed broadband and pay TV products, and instead

give customers no choice but to take on bundled subscriptions.

"Based on the information gathered during the investigative stage, any competitive appraisal of the notified

concentration would have to determine whether the relevant transaction effectively translates into lower prices for

end-users and, ultimately, more investment," the MCA said, noting the possibility of "several downside risks" to

competition.

PDF GENERATED BY PROQUEST.COM Page 2 of 4

However, the MCCAA - the office for competition - will be in a position to demand safeguards that would mitigate

any shortcomings.

We asked Melita and Vodafone...

I'm a customer. When will I notice any changes?

The transaction is currently going through the regulatory approval process. This may take a few more months.

Once the transaction is complete, the combined company will be able to offer internet and TV services to Vodafone

mobile customers and, over time, Melita mobile customers may be able to benefit from higher mobile data speeds,

as well as the opportunity to upgrade to even faster 4G and 4G+. The timings of the potential changes from the

consumers' point of view are in the process of being mapped out.

What will happen when the merger is finalised?

Customers will benefit from nationwide, very high-speed internet on both mobile and fixed line as from 2018/19.

Business customers (large and small) will likewise benefit from this superfast internet. This will enable them to

equip their workforces with the very latest technology and to in turn serve their customers in a very agile and

digital way.

Maltese customers will be the first in Europe to experience such high speeds, pioneers on how to use such speeds

in day to day life. Examples would include seamless HD video streaming anywhere in Malta at superfast speeds,

being able to adopt Internet based services such as wirelessly-monitored security cameras, pet tracking, child and

elderly tracking as well as vehicle tracking. It would also lay the foundation for Malta being able to experience self-

driving cars in the foreseeable future.

Are Melita-Vodafone prices likely to fall as a result of the merger?

The two companies are currently still operating as competitors and therefore it is not possible to discuss future

strategies and prices. It is therefore too early to be able to say what the impact on prices will be. However, we

expect that GO will be pushed to compete more aggressively with the combination of Melita and Vodafone than it

currently does with two separate entities with different sets of strengths.

Am I likely to get good customer service through the merger?

Yes. This is a commitment we are making. We are completely focused on ensuring our customers get the best

experience possible. Melita has already made considerable improvements in its customer facing processes.

Vodafone has access to state of the art training on customer experience for all levels of staff and an accreditation

process for all frontline workers. That training will be fully available to the combined company and will be rolled out

to Melita staff.

Copyright ©MediaToday Co. Ltd. All rights reserved. Provided by SyndiGate Media Inc. (Syndigate.info).

DETAILS

Subject: Acquisitions &mergers; Cellular telephones; Prices; Internet; Telecommunications

industry; Customer services; Market entry; Tariffs; Regulatory approval; Consumers;

Competition

Location: Malta

Publication title: MaltaToday; San Gwann, Malta

Publication year: 2017

Publication date: Jul 27, 2017

Publisher: SyndiGate Media Inc

PDF GENERATED BY PROQUEST.COM Page 3 of 4

Place of publication: San Gwann, Malta

Country of publication: United States, San Gwann, Malta

Publication subject: General Interest Periodicals--Malta

e-ISSN: 16071832

Source type: Newspapers

Language of publication: English

Document type: News

ProQuest document ID: 1923659558

Document URL: https://search.proquest.com/newspapers/melita-vodafone-whats-you-mca-thinks-

mobile/docview/1923659558/se-2?accountid=136549

Copyright: Copyright © MediaToday Co. Ltd. All rights reserved. Provided by SyndiGate Media

Inc. (Syndigate.info).

Last updated: 2017-07-27

Database: ProQuest Central

LINKS

Database copyright 2021 ProQuest LLC. All rights reserved.

Terms and Conditions Contact ProQuest

PDF GENERATED BY PROQUEST.COM Page 4 of 4

You might also like

- MVNOs Key Legal IssuesDocument8 pagesMVNOs Key Legal IssuesSibel ÖçalNo ratings yet

- AQ Law Firm Profile PDFDocument13 pagesAQ Law Firm Profile PDFHaseeb Hassan0% (1)

- 9b4e4strategy Case Study Assignments 2Document19 pages9b4e4strategy Case Study Assignments 2Homework PingNo ratings yet

- 9b4e4strategy Case Study Assignments 2Document19 pages9b4e4strategy Case Study Assignments 2amitmbhandari25No ratings yet

- Handset Leasing - Unlock Opportunities To Regain Financial Position in Telecom IndustryDocument7 pagesHandset Leasing - Unlock Opportunities To Regain Financial Position in Telecom IndustryHoàng NguyễnNo ratings yet

- KuwaitTelecomIndustry (Update) Feb2011Document6 pagesKuwaitTelecomIndustry (Update) Feb2011akshit_375276572No ratings yet

- Topic of A ResearchDocument42 pagesTopic of A ResearchNhung DuckieNo ratings yet

- On The Economics of 3G Mobile Virtual Network Operators (Mvnos)Document14 pagesOn The Economics of 3G Mobile Virtual Network Operators (Mvnos)Tran Quoc TamNo ratings yet

- Economic Viability of 3G Mobile Virtual Network Operators: NtroductionDocument5 pagesEconomic Viability of 3G Mobile Virtual Network Operators: NtroductionMoe KyawNo ratings yet

- Executive SummaryDocument4 pagesExecutive Summary670620No ratings yet

- Ufone Assignment 2Document8 pagesUfone Assignment 2Shama KhanNo ratings yet

- StartgyDocument7 pagesStartgyshafeeqaliNo ratings yet

- Toyota Car's Strategic Analysis in Uk. and The Development of Customer ValueDocument7 pagesToyota Car's Strategic Analysis in Uk. and The Development of Customer ValueAliNo ratings yet

- White Paper Aug2013Document17 pagesWhite Paper Aug2013Arun MaithaniNo ratings yet

- As The MVNO Market Is Experiencing Exponential Growth WorldwideDocument2 pagesAs The MVNO Market Is Experiencing Exponential Growth WorldwideOmais SyedNo ratings yet

- Econex Researchnote 4Document4 pagesEconex Researchnote 4Sizakele Portia MbeleNo ratings yet

- Zong Pakistan CaseDocument5 pagesZong Pakistan CaseQiratNo ratings yet

- 2nd Business Análisis MOVISTARDocument6 pages2nd Business Análisis MOVISTARRicardo BazanteNo ratings yet

- Analysis of Operator Options To Reduce The Impact of The Revenue Gap Caused by Flat Rate Mobile Broadband SubscriptionsDocument8 pagesAnalysis of Operator Options To Reduce The Impact of The Revenue Gap Caused by Flat Rate Mobile Broadband SubscriptionsAli HassanNo ratings yet

- Telco 2020 - How Telcos Transform For The Smartphone SocietyDocument20 pagesTelco 2020 - How Telcos Transform For The Smartphone SocietygrahammcinnesNo ratings yet

- Project On Mobile Virtual Network Operator: Submitted To Submitted byDocument14 pagesProject On Mobile Virtual Network Operator: Submitted To Submitted byRam RaikwarNo ratings yet

- Presentation On MVNO (Mobile Virtual Network Operator)Document19 pagesPresentation On MVNO (Mobile Virtual Network Operator)Karan Arjun100% (1)

- Analysys Mason Predictions 2021 TMTDocument3 pagesAnalysys Mason Predictions 2021 TMTritamitsoukouoNo ratings yet

- Chapter - 1 Industry ProfileDocument12 pagesChapter - 1 Industry Profilesatya_parihar2011No ratings yet

- DMR Article: From King To King Maker - Mobile Service Strategies For The Telecom OperatorsDocument7 pagesDMR Article: From King To King Maker - Mobile Service Strategies For The Telecom OperatorsDetecon InternationalNo ratings yet

- Political DigiDocument5 pagesPolitical DigiJoelene ChewNo ratings yet

- Chapter One 1.1 Background To The ProjectDocument2 pagesChapter One 1.1 Background To The ProjectErnest Kwame BrawuaNo ratings yet

- Faculty Guide: Khusbu Sadhwani MemDocument6 pagesFaculty Guide: Khusbu Sadhwani MemPatel Dhirendrakumar GandalalNo ratings yet

- DOCOMO Assignment Questions-1Document4 pagesDOCOMO Assignment Questions-1nitishhere100% (2)

- Im SaDocument4 pagesIm SaSagar GuptaNo ratings yet

- Impact On FirmsDocument2 pagesImpact On FirmsAyushman AgarwalNo ratings yet

- Business Risk TelecomDocument1 pageBusiness Risk Telecomashfaqarooba11No ratings yet

- Telecom Sector Analysis ReportDocument4 pagesTelecom Sector Analysis Report9036280350No ratings yet

- Best Practice Guide West Africa (2013:4)Document8 pagesBest Practice Guide West Africa (2013:4)Kwame AsamoaNo ratings yet

- Competition Policy Ternds in TelecommunicationDocument3 pagesCompetition Policy Ternds in Telecommunicationphuonganh285No ratings yet

- Entry BarierDocument4 pagesEntry BarierSaket KumarNo ratings yet

- MVNOs - Key Legal IssuesDocument8 pagesMVNOs - Key Legal Issuesabgup12111953No ratings yet

- Mobile Virtual OperatorsDocument5 pagesMobile Virtual OperatorsdwiaryantaNo ratings yet

- Mobile Virtual Network Operators in The Sultanate of OmanDocument9 pagesMobile Virtual Network Operators in The Sultanate of Omanknpsingh7092No ratings yet

- University Assignment CT7075Document21 pagesUniversity Assignment CT7075Shakeel ShahidNo ratings yet

- Telecom Egypt Credit RatingDocument10 pagesTelecom Egypt Credit RatingHesham TabarNo ratings yet

- Comsumer Behaviour Project ReportDocument39 pagesComsumer Behaviour Project ReportAbhijeet VatsNo ratings yet

- PORTER 5 ForcesDocument4 pagesPORTER 5 ForcesMiley MartinNo ratings yet

- P Pwake 3 Z 8 ZE1 Yb LVX 2 WKBJDocument2 pagesP Pwake 3 Z 8 ZE1 Yb LVX 2 WKBJyogica3537No ratings yet

- City CellDocument27 pagesCity CellmonirNo ratings yet

- By Rafael Junquera,: Smartphones: Are They The Real Deal?Document5 pagesBy Rafael Junquera,: Smartphones: Are They The Real Deal?kallolshyam.roy2811No ratings yet

- Business Environment Assignmnt1Document4 pagesBusiness Environment Assignmnt1Mohd AnasNo ratings yet

- Us Telecom Outlook 2019 PDFDocument8 pagesUs Telecom Outlook 2019 PDFPNG networksNo ratings yet

- The Introduction of 5G TechnologyDocument2 pagesThe Introduction of 5G TechnologyrameshNo ratings yet

- IMS-IP Multimedia Subsystem: IMS Overview and The Unified Carrier NetworkDocument11 pagesIMS-IP Multimedia Subsystem: IMS Overview and The Unified Carrier NetworkManas RanjanNo ratings yet

- Telecommunications Network Development enDocument22 pagesTelecommunications Network Development enTôi Là TôiNo ratings yet

- More For Less: Telcos Will Continue To Stretch The Life of Copper NetworksDocument17 pagesMore For Less: Telcos Will Continue To Stretch The Life of Copper Networksvignesh_velappanNo ratings yet

- HRM RelianceDocument78 pagesHRM Reliancemanwanimuki12No ratings yet

- World Telecom Industry Is An Uprising Industry, Proceeding Towards A Goal of Achieving TwoDocument52 pagesWorld Telecom Industry Is An Uprising Industry, Proceeding Towards A Goal of Achieving Twomanwanimuki12No ratings yet

- The Impact of Over The Top Service Providers On THDocument28 pagesThe Impact of Over The Top Service Providers On THVictor Andrei BodiutNo ratings yet

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyFrom EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyNo ratings yet

- Future Telco: Successful Positioning of Network Operators in the Digital AgeFrom EverandFuture Telco: Successful Positioning of Network Operators in the Digital AgePeter KrüsselNo ratings yet

- Cellular Technologies for Emerging Markets: 2G, 3G and BeyondFrom EverandCellular Technologies for Emerging Markets: 2G, 3G and BeyondNo ratings yet

- A Day in The Life of A Management Consultant From McKinsey & Company - Management Consulting Case InterviewsDocument4 pagesA Day in The Life of A Management Consultant From McKinsey & Company - Management Consulting Case InterviewsAkhilGovindNo ratings yet

- Reverse A Cleared DocumentsDocument5 pagesReverse A Cleared Documentsdude28spNo ratings yet

- The Business Model Canvas: Customer Segments Value Propositions Key Activities Key Partners Customer RelationshipsDocument1 pageThe Business Model Canvas: Customer Segments Value Propositions Key Activities Key Partners Customer RelationshipsJAISHINI SIVARAM 2023259No ratings yet

- BUS 5110 Discussion Forum Unit-4 BUS 5110 Discussion Forum Unit-4Document3 pagesBUS 5110 Discussion Forum Unit-4 BUS 5110 Discussion Forum Unit-4Emmanuel Gift Bernard100% (1)

- Shapiro Chapter 20 SolutionsDocument13 pagesShapiro Chapter 20 SolutionsRuiting ChenNo ratings yet

- Chap 4 Books of Prime EntryDocument29 pagesChap 4 Books of Prime EntrynabkillNo ratings yet

- Session 10, Assignment QuestionsDocument5 pagesSession 10, Assignment QuestionsHAMZA HASSANNo ratings yet

- Module 6 Training Module On Material Management Final1Document28 pagesModule 6 Training Module On Material Management Final1miadjafar463No ratings yet

- B. Doors C. Plays D. Students: Try To Become A Better Version of Yourself!Document5 pagesB. Doors C. Plays D. Students: Try To Become A Better Version of Yourself!Anh NguyễnNo ratings yet

- Welfare Effects of Personalized RankingsDocument49 pagesWelfare Effects of Personalized RankingsHuy NguyenNo ratings yet

- Cañete Midterm ExamDocument4 pagesCañete Midterm ExamPark WangjaNo ratings yet

- Annex F - Sample Notes To FSDocument44 pagesAnnex F - Sample Notes To FSjaymark canayaNo ratings yet

- ANU - Time Table of P.G. II, IV Semesters Reg Examinations April-2013Document41 pagesANU - Time Table of P.G. II, IV Semesters Reg Examinations April-2013Siva MeruvaNo ratings yet

- Welcome To Quality SESSION: QC QADocument30 pagesWelcome To Quality SESSION: QC QAAbou Tebba SamNo ratings yet

- 20 RLII A5.7 Management Representation Letter-2Document10 pages20 RLII A5.7 Management Representation Letter-2Elizabeth BergundoNo ratings yet

- EL201 Accounting Learning Module Lessons 51Document19 pagesEL201 Accounting Learning Module Lessons 51BabyjoyNo ratings yet

- Bba Hult Brochure 2023 24Document67 pagesBba Hult Brochure 2023 24Alexis JulianoNo ratings yet

- Effects of Debt Financing On Financial Performance of Listed Consumer Goods Firms in NigeriaDocument13 pagesEffects of Debt Financing On Financial Performance of Listed Consumer Goods Firms in NigeriaSebsibe AshangoNo ratings yet

- 05302023PMR Format 051723Document4 pages05302023PMR Format 051723Devorah Jane A. AmoloNo ratings yet

- This Study Resource Was: Add Question HereDocument4 pagesThis Study Resource Was: Add Question HereJayvee Ramos RuedaNo ratings yet

- Garrison Lecture Chapter 2Document61 pagesGarrison Lecture Chapter 2Ahmad Tawfiq Darabseh100% (2)

- 6 Skin Pharmaceuticals Private Limited: Directors' ReportDocument12 pages6 Skin Pharmaceuticals Private Limited: Directors' ReportvineminaiNo ratings yet

- Brand ImageDocument3 pagesBrand Imagemoiz ahmedNo ratings yet

- Module 4-FriaDocument71 pagesModule 4-FriaAleah Jehan AbuatNo ratings yet

- Material (Formula Sheets) : Chapter 8 Material Quantitative Models For Planning and ControlDocument3 pagesMaterial (Formula Sheets) : Chapter 8 Material Quantitative Models For Planning and Controljgfjhf arwtrNo ratings yet

- Harish Kumar Kandoi: Contact: +91 9874472220/9830714467Document3 pagesHarish Kumar Kandoi: Contact: +91 9874472220/9830714467Sabuj SarkarNo ratings yet

- Id. de Pedido Cliente Empleado Fecha de PedidoDocument10 pagesId. de Pedido Cliente Empleado Fecha de PedidoJessy Thalia Garcilazo TamayoNo ratings yet

- UntitledDocument2 pagesUntitledMamatha KerpudeNo ratings yet

- 4 5 6retailing PDFDocument61 pages4 5 6retailing PDFKimchhorng HokNo ratings yet