Professional Documents

Culture Documents

BA3 Mock Exam 01 - PILOT PAPER Nov 2020

BA3 Mock Exam 01 - PILOT PAPER Nov 2020

Uploaded by

Sanjeev JayaratnaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BA3 Mock Exam 01 - PILOT PAPER Nov 2020

BA3 Mock Exam 01 - PILOT PAPER Nov 2020

Uploaded by

Sanjeev JayaratnaCopyright:

Available Formats

Mock Exam 01 – PILOT PAPER

1.

Assets Liabilities

100,000 70,000

(+, - , ÷, x, Trade Receivable, Capital, 30,000, 50,000)

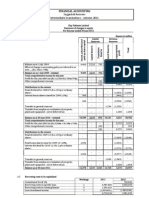

2. Draw up Broad’s Statements of Financial Position as at 31/12/2015 from the following items

and calculate the Capital balance.

$

Motor Vehicles 100,000

Office Equipment 80,000

Bank OD 5,000

Stock of goods 20,000

Payables 25,000

Receivables 30,000

3. Jack has an opening capital balance of $600,000(Cr) on 1st January 2015. During the year

there was a decrease in assets of $40,000 and a increase in liabilities of $30,000.

a) What is the balance on the capital account as at 31st December 2015?

b) If drawings amounted to $8,000, what is the profit/(loss) for 2015?

4. Goods worth $10,000 was sold for $15,000 on credit you are required to state the accounting

entry

Description Dr CR

Trade Receivables

Sales

Capital

BA3 Nov. 2020 - Mock Exam 01 – PILOT PAPER – Mallik De Silva 1

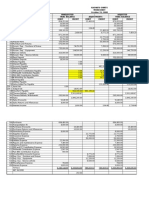

5. Tick the correct column for each of the following:

Debit Credit

1 Increases in Assets

2 Decreases in Income

3 Increases in Capital

4 Decreases in Liabilities

6.

Description Account Balance Category

Debit Credit Asset Liability Income Expense Capital

1 Trade Receivables

2 Bank OD

3 Insurance

4 Discount Received

5 Trade Payables

7. A business has a Bank Overdraft and pays for Rent. What’s the impact on

a) Expenses

b) Liabilities

8.

Bank Account

1. B/D 10,000

5. Sales 18,000 2.Salaries 5,000

6. Capital 20,000 3.Rent 1,000

4. Electricity 3,000

a) You are required to state the closing balance.

$ Dr. Cr

b) Explain Transaction No.6 above

c) Transaction No.5 relates to a cash sale or credit sale?

d) State the movement in the Bank account

BA3 Nov. 2020 - Mock Exam 01 – PILOT PAPER – Mallik De Silva 2

9. Marlon’s petty cash imprest is restored to $4,000 at the end of each month.

The following amounts were paid out of petty cash in December 2015.

1) Refreshment $50

2) Sundry materials $330(including VAT @ 10%)

3) Printing $600 + VAT @ 10%

4) Travel cost $90

You are required to state the amount to restore the imprest.

10. A company makes a sale of $800,000 and a Gross Profit of $300,000. Its opening and closing

stocks amounted to $60,000 and $80,000 respecting. What is the value of purchases?

11. The following data is available from Yoyo’s business for 2012.

$

Sales 900,000

Sales Returns 40,000

Purchases 500,000

Purchase Returns 20,000

Gross Profit 400,000

Opening Stock 30,000

What’s the value of the closing stock?

12. What does carriage inwards relate to?

A Sales

B Purchases

C Drawings

D Capital

13. BCD paid rent on 1 October 2012 for the year ended 30 September 2013 of $600, and paid rent

of $800 on 1 October 2013 for the year ended 30 September 2014.

What was the rent payable expense for the year ended 31 December 2013?

$.......................

BA3 Nov. 2020 - Mock Exam 01 – PILOT PAPER – Mallik De Silva 3

14. JKL received rent from occupiers of premises during 2015 of $25,000. Of this,

$1,600 related to the year ended 31 December 2014 and $800 related to the year ended

31 December 2016. At 31 December 2015, there was rent due but not yet received on

$500.

What was the rent receivable by JKL for the year ended 31 December 2015?

$ ............. ………

15. An entity had the following rent bills received and paid during the year ended 31 December

2007:

28 Feb $1,380

31 May $1,320

30Aug $1,170

30 Nov $1,260

Additional information:

Bill received on 28 February 2008: $1,350 (for the period 1 December 2007 - 28 February

2008)

Using the drop down lists available show the correct accounting entries for the year end journal

entry.

Debit Rent expense/ Accruals/ Prepayments / Bank $l,350/ $450/ $900/ $390

Credit Rent expense/ Accruals/ Prepayments / Bank $1,350/ $450/ $900/ $390

16. EFG bought machinery for $300,000 on 1 January 2005, and has depreciated it at 10% per

annum by the reducing instalment method.

What was the depreciation charge for the year ended 31 December 2007?

A $21,870

B $24,300

C $27,000

D $30,000

BA3 Nov. 2020 - Mock Exam 01 – PILOT PAPER – Mallik De Silva 4

17. Which one of the following items should be classified as capital expenditure?

A. Repairs to motor vans

B. Depreciation of machinery

C. Extension of premises

D. Purchase of motor vans for resale

18. Tick the correct boxes in the table below to show whether each of the following items would

be recognised as capital expenditure or revenue expenditure.

19. A non current asset register is

A. an alternative name for the fixed asset ledger account.

B. a list of the physical fixed assets rather than their financial cost.

C. a schedule of planned maintenance of fixed assets for use by the plant engineer.

D. a schedule of the cost and other information about each individual fixed asset.

BA3 Nov. 2020 - Mock Exam 01 – PILOT PAPER – Mallik De Silva 5

20. S purchased equipment for $80,000 on 1 July 2012. The company's accounting year end is 31

December. It is S's policy to charge a full year's depreciation in the year of purchase. S

depreciates its equipment on the reducing balance basis at 25% per annum.

The carrying value of the equipment at 31 December 2015 should be:

A Nil

B $25,312

C $29,531

D $33,750

21. A company has been notified that a customer has been declared bankrupt. The company had

previously made an allowance for this debt. Which of the following is the correct double entry to

account for this new information?

Debit Credit

A Irrecoverable debts Receivables

B Receivables Irrecoverable debts

C Allowance for receivables Receivables

D Receivables Allowance for receivables

22. At 1 January 2011, there was an allowance for receivables of $3,000. During the year, $1,000 of

debts were written off as irrecoverable, and $800 of. debts previously written off were recovered. At

31 December 2011, it was determined that the allowance for receivables should be adjusted to

5% of receivables, which are $20,000.

What is the total receivables expense for the year?

A $200 debit

B $1,800 debit

C $2,200 debit

D $1,800 credit

23. If an entity had increase in receivables of $750, a decrease in the bank overdraft of $400,

a decrease in payables of $3,000 and an increase in inventories of $2,000, what would be

the change in working capital?

increase/decrease of $ __________

BA3 Nov. 2020 - Mock Exam 01 – PILOT PAPER – Mallik De Silva 6

24. An increase in the allowance for receivables would result in

A an increase in liabilities

B a decrease in working capital

C a decrease in net profit

D an increase in net profit

Select All correct answers above

25. The following information is for the year ended 31 October 2010.

$

Purchases of raw materials 56,000

Returns inwards 4,000

Increase in inventory of raw materials 1,700

Direct wages 21,000

Carriage inwards 2,500

Carriage outwards 4,000

Production overheads 14,000

Decrease in work-in-progress 5,000

The value of factory cost of goods completed is

26. The prime cost of goods manufactured is the total of:

A Raw materials consumed

B Raw materials consumed and direct wages

C Raw materials consumed, direct-wages and direct expenses

D Raw materials consumed, direct wages, direct expenses and production overheads

27. If work-in-progress (WIP) decreases during the period, then:

A. Prime cost will decrease

B. Prime cost will increase

C. The factory cost of goods completed will decrease

D. The factory cost of goods completed will increase

BA3 Nov. 2020 - Mock Exam 01 – PILOT PAPER – Mallik De Silva 7

28. Paul paid $240,000 in net wages to its employees in August 2012. Employees' tax was $24,000,

employees' national insurance was $12,000 and employer's national insurance was $14,000.

Employees had contributed $6,000 to a pension scheme and had voluntarily asked for $3,000 to

be deducted for charitable giving.

The amount to be charged to the statement of profit or loss in August 2012 for wages is:

A $296,000

B $299,000

C $290,000

D $264,000

29. Double entry for payment of net wages is:

A. Dr: Wages and salaries expense Cr: Bank

B. Dr: Bank Cr: Wages control

C. Dr: Wages and salaries expense Cr: Wages control

D. Dr: Wages control Cr: Bank

30. The following is an extract from the trial balance of a business for its most recent year:

Debit ($) Credit ($)

Heat and light 22,000

Rent and local business tax 27,000

Non-current assets 80,000

Acc. depreciation on non-current assets 20,000

Gross profit has already been calculated as being $85,000.

Depreciation is to be calculated at 25 per cent on the reducing balance. At the end of the year, heat

and light accrued is $4,000, and rent and local business tax prepaid is $2,500.

The correct net profit is:

$.............................

BA3 Nov. 2020 - Mock Exam 01 – PILOT PAPER – Mallik De Silva 8

You might also like

- ACCA FA Progress Test PDFDocument21 pagesACCA FA Progress Test PDFNicat IsmayıloffNo ratings yet

- Buad 803 Ahmad Jibrilindv. AssignmentDocument3 pagesBuad 803 Ahmad Jibrilindv. AssignmentAhmad JibrilNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Leonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceDocument12 pagesLeonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceJohnMurray111100% (1)

- ACC 101 Chapter 2 Test (5Document5 pagesACC 101 Chapter 2 Test (5Ammarrylee R. Williams0% (2)

- Problem No 5.2-A Affordable Lawn Care IncDocument5 pagesProblem No 5.2-A Affordable Lawn Care IncZeeshan AjmalNo ratings yet

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- Pacilio Securtiy Service Accounting EquationDocument11 pagesPacilio Securtiy Service Accounting EquationKailash KumarNo ratings yet

- Zica T5Document30 pagesZica T5Andrew TemboNo ratings yet

- Acca Fa Test 1 - CHP 1,3,4,5 SolnDocument11 pagesAcca Fa Test 1 - CHP 1,3,4,5 SolnAkash RadhakrishnanNo ratings yet

- Financial Accounting F3 25 August RetakeDocument12 pagesFinancial Accounting F3 25 August RetakeMohammed HamzaNo ratings yet

- Job, Batch and Service CostingDocument22 pagesJob, Batch and Service CostingSanjeev JayaratnaNo ratings yet

- IGCSE Control AccountsDocument17 pagesIGCSE Control AccountsNipuni PereraNo ratings yet

- Practice Questions and SolutionsDocument7 pagesPractice Questions and SolutionsLiy TehNo ratings yet

- Worksheet QuestionsDocument1 pageWorksheet QuestionsyoantanNo ratings yet

- CH 05Document21 pagesCH 05Muhammad Nur Fazrin50% (2)

- 08 - Irrecoverable Debts and Provision For Doubtful Debts Complete Notes-1Document10 pages08 - Irrecoverable Debts and Provision For Doubtful Debts Complete Notes-1Danny FarrukhNo ratings yet

- Accacat Paper t3 Maintaining Financial ReDocument32 pagesAccacat Paper t3 Maintaining Financial ReKian Yen0% (1)

- FA1 General JournalDocument5 pagesFA1 General JournalamirNo ratings yet

- 02 MA1 LRP Questions 2014Document34 pages02 MA1 LRP Questions 2014Yahya KaimkhaniNo ratings yet

- Chapter 11 Partnership DissolutionDocument19 pagesChapter 11 Partnership DissolutionAira Nhaire Cortez MecateNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- Review Questions Final Accounts For A Sole TraderDocument3 pagesReview Questions Final Accounts For A Sole TraderdhanyasugukumarNo ratings yet

- Accounting Assignment P4-5A: Anya's Cleaning ServiceDocument10 pagesAccounting Assignment P4-5A: Anya's Cleaning ServiceTamzid Islam0% (1)

- Week6 SampleExamQuestionDocument16 pagesWeek6 SampleExamQuestionyow jing pei67% (3)

- L1 March 2014Document22 pagesL1 March 2014Metick MicaiahNo ratings yet

- Adjusting Entries & Questions PDFDocument18 pagesAdjusting Entries & Questions PDFshahroz QadriNo ratings yet

- Hit Scripts Is A Service Type Enterprise in The Entertainment FieldDocument1 pageHit Scripts Is A Service Type Enterprise in The Entertainment Fieldtrilocksp SinghNo ratings yet

- Practice Questions For Ias 16Document6 pagesPractice Questions For Ias 16Uman Imran,56No ratings yet

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- Bba 122 Fai 11 AnswerDocument12 pagesBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- Ratios - Profitability, Market &Document46 pagesRatios - Profitability, Market &Jess AlexNo ratings yet

- Correction of ErrorsDocument3 pagesCorrection of ErrorsPreviyamNo ratings yet

- Preparation of Published Financial StatementsDocument46 pagesPreparation of Published Financial StatementsBenard Bett100% (2)

- L1-June 2013-FINANCIAL REPORTINGDocument25 pagesL1-June 2013-FINANCIAL REPORTINGMetick MicaiahNo ratings yet

- Assignment 2Document6 pagesAssignment 2azimlitamellaNo ratings yet

- Sales Tax QuestionDocument3 pagesSales Tax QuestionKhushi Singh100% (1)

- M 2012 June PDFDocument21 pagesM 2012 June PDFMoses LukNo ratings yet

- ACCT 211 Introductory Accounting I Mock Final Exam 2016Document4 pagesACCT 211 Introductory Accounting I Mock Final Exam 2016Nguyễn Ngọc MaiNo ratings yet

- Day Books FA1Document3 pagesDay Books FA1amirNo ratings yet

- Financial Accounting and Reporting: RequirementsDocument4 pagesFinancial Accounting and Reporting: RequirementsebshuvoNo ratings yet

- Terrific Temps Fills Temporary Employment Positions For Local Businesses SomeDocument2 pagesTerrific Temps Fills Temporary Employment Positions For Local Businesses SomeAmit PandeyNo ratings yet

- Chap 1 - Inventory Valuation (Questions)Document4 pagesChap 1 - Inventory Valuation (Questions)90 SHAMAZNo ratings yet

- 2010 June Financial Reporting L1Document90 pages2010 June Financial Reporting L1Dixie Cheelo0% (1)

- 13-ACCA-FA2-Chp 13Document22 pages13-ACCA-FA2-Chp 13SMS PrintingNo ratings yet

- Problems Journal EntryDocument5 pagesProblems Journal EntryColleen GuimbalNo ratings yet

- A1 Basic Financial Statement Analysis Q8Document3 pagesA1 Basic Financial Statement Analysis Q8bernard cruzNo ratings yet

- Labour-PQDocument5 pagesLabour-PQRohaib MumtazNo ratings yet

- Practice Questions # 4 Internal Control and Cash With AnswersDocument9 pagesPractice Questions # 4 Internal Control and Cash With AnswersIzzahIkramIllahiNo ratings yet

- Test of Labour Overheads and Absorption and Marginal CostingDocument4 pagesTest of Labour Overheads and Absorption and Marginal CostingzairaNo ratings yet

- Accounting Irrecoverable Debts. 30/06/2021/ Wednesday Homework. Resource Pack Questions, Question # 1Document4 pagesAccounting Irrecoverable Debts. 30/06/2021/ Wednesday Homework. Resource Pack Questions, Question # 1taiba sajjadNo ratings yet

- Ilovepdf MergedDocument15 pagesIlovepdf MergedRakib KhanNo ratings yet

- 2021-06 Icmab FL 001 Pac Year Question June 2021Document3 pages2021-06 Icmab FL 001 Pac Year Question June 2021Mohammad ShahidNo ratings yet

- Limited Liability Companies - QuestionsDocument34 pagesLimited Liability Companies - QuestionsNipuni Perera100% (1)

- IAS 10 - IAS 37 Questions Final 27032024 103049amDocument8 pagesIAS 10 - IAS 37 Questions Final 27032024 103049amAbdullah ButtNo ratings yet

- All Practice Set SolutionsDocument22 pagesAll Practice Set SolutionsJohn TomNo ratings yet

- BA3 Special Revision MockDocument17 pagesBA3 Special Revision MockSanjeev JayaratnaNo ratings yet

- Fundamentals of Financial AccountingDocument9 pagesFundamentals of Financial AccountingEmon EftakarNo ratings yet

- FFA Mock Exam Set 6Document19 pagesFFA Mock Exam Set 6miss ainaNo ratings yet

- Institute of Business Management Final Assessment - Spring 2020Document6 pagesInstitute of Business Management Final Assessment - Spring 2020Shaheer KhurramNo ratings yet

- Chapter - 11 - Measurement of VariablesDocument3 pagesChapter - 11 - Measurement of VariablesSanjeev JayaratnaNo ratings yet

- Defining and Refining The ProblemDocument13 pagesDefining and Refining The ProblemSanjeev JayaratnaNo ratings yet

- Administering Questionnaires: Different Types Design Questionnaires Cross-CulturalDocument10 pagesAdministering Questionnaires: Different Types Design Questionnaires Cross-CulturalSanjeev JayaratnaNo ratings yet

- Interviews: Personal Interview. Advantages and Disadvantages Business Is Largely A Social PhenomenonDocument8 pagesInterviews: Personal Interview. Advantages and Disadvantages Business Is Largely A Social PhenomenonSanjeev JayaratnaNo ratings yet

- Chapter - 5 - Theoretical Framework & Hypothesis DevelopmentDocument10 pagesChapter - 5 - Theoretical Framework & Hypothesis DevelopmentSanjeev JayaratnaNo ratings yet

- Scientific Investigation: Hallmarks of Scientific Research Hypothetico-Deductive ResearchDocument3 pagesScientific Investigation: Hallmarks of Scientific Research Hypothetico-Deductive ResearchSanjeev JayaratnaNo ratings yet

- Critical Literature Review The Critical ReviewDocument10 pagesCritical Literature Review The Critical ReviewSanjeev JayaratnaNo ratings yet

- Data Collection Methods: ObservationDocument9 pagesData Collection Methods: ObservationSanjeev JayaratnaNo ratings yet

- Introduction To Research Definition ResearchDocument5 pagesIntroduction To Research Definition ResearchSanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 19Document10 pagesKotler, Bowen & Makens CH 19Sanjeev JayaratnaNo ratings yet

- MHT CH 01Document9 pagesMHT CH 01Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 06Document8 pagesKotler, Bowen & Makens CH 06Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 12Document9 pagesKotler, Bowen & Makens CH 12Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 08Document8 pagesKotler, Bowen & Makens CH 08Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 14Document7 pagesKotler, Bowen & Makens CH 14Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 04Document7 pagesKotler, Bowen & Makens CH 04Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 11Document8 pagesKotler, Bowen & Makens CH 11Sanjeev JayaratnaNo ratings yet

- Tute 01 - The Law of ContractDocument38 pagesTute 01 - The Law of ContractSanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 05Document8 pagesKotler, Bowen & Makens CH 05Sanjeev JayaratnaNo ratings yet

- The Law of Employment Mind MapsDocument8 pagesThe Law of Employment Mind MapsSanjeev JayaratnaNo ratings yet

- Job, Batch and Service CostingDocument22 pagesJob, Batch and Service CostingSanjeev JayaratnaNo ratings yet

- The Law of Contract Mind MapsDocument8 pagesThe Law of Contract Mind MapsSanjeev JayaratnaNo ratings yet

- Short-Term Decision MakingDocument26 pagesShort-Term Decision MakingSanjeev JayaratnaNo ratings yet

- Summarising Analysing DataDocument19 pagesSummarising Analysing DataSanjeev JayaratnaNo ratings yet

- Standard Costing and Variance AnalysisDocument24 pagesStandard Costing and Variance AnalysisSanjeev JayaratnaNo ratings yet

- Bank Alfalah Remittance DpartmentDocument11 pagesBank Alfalah Remittance Dpartmenthassan_shazaibNo ratings yet

- Intermediate Accounting 9th Edition Spiceland Test BankDocument35 pagesIntermediate Accounting 9th Edition Spiceland Test Bankslokekrameriabfofb1100% (30)

- Working Capital Management: Delivered By: Dr. Shakeel Iqbal AwanDocument48 pagesWorking Capital Management: Delivered By: Dr. Shakeel Iqbal AwanMuhammad Abdul Wajid RaiNo ratings yet

- Lin - Khan Encumbrance BB R12V1Document32 pagesLin - Khan Encumbrance BB R12V1MokhtarMCINo ratings yet

- FIA FA1 Study Notes FREE PakAccountants Com PDFDocument19 pagesFIA FA1 Study Notes FREE PakAccountants Com PDFMufaddal ShabbirNo ratings yet

- Adjusting Entries: Problem 1Document9 pagesAdjusting Entries: Problem 1Wholehearted LayoutsNo ratings yet

- MPS 55R118 01583021L 10 2011Document2 pagesMPS 55R118 01583021L 10 2011vinayak_patil72No ratings yet

- Chapter 08Document46 pagesChapter 08Ivo_NichtNo ratings yet

- Dire Dawa UniversityDocument9 pagesDire Dawa Universityanwaradem225No ratings yet

- CH 8 - Merchandising OperationsDocument70 pagesCH 8 - Merchandising OperationsJem BobilesNo ratings yet

- AccDocument5 pagesAccRachelle Isuan TusiNo ratings yet

- 2023-24 Atp Grade 10 - Term One-1Document1 page2023-24 Atp Grade 10 - Term One-1nhlesekaneneNo ratings yet

- Eofy 1363807 202307141612Document6 pagesEofy 1363807 202307141612Jeffrey BoucherNo ratings yet

- Policy On Accounts ReceivableDocument8 pagesPolicy On Accounts ReceivableMazhar Hussain Ch.No ratings yet

- I ULE0 G U2 SDP SCo SZDocument13 pagesI ULE0 G U2 SDP SCo SZAravinth KNo ratings yet

- Accp303 Prefinals Nov 15 2021 KeyDocument9 pagesAccp303 Prefinals Nov 15 2021 KeyAngelica RubiosNo ratings yet

- AppliedDocument5 pagesAppliedvhlast23No ratings yet

- Gordon College College of Business and Accountancy Financial Accounting TheoriesDocument9 pagesGordon College College of Business and Accountancy Financial Accounting TheoriesKylie Luigi Leynes BagonNo ratings yet

- Tax Audit Clauses PDFDocument13 pagesTax Audit Clauses PDFSunil KumarNo ratings yet

- How To Match Invoice To Purchase OrdersDocument17 pagesHow To Match Invoice To Purchase OrdersKiran Oluguri100% (1)

- Ram Internship Report1Document44 pagesRam Internship Report1Manoj k m Manoj k mNo ratings yet

- Suggested Answers Global Financial Reporting StandardsDocument49 pagesSuggested Answers Global Financial Reporting StandardsNagabhushanaNo ratings yet

- Smart Schema Design-V1.0Document43 pagesSmart Schema Design-V1.0Shankar Narayanan0% (1)

- Suggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingDocument6 pagesSuggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingUssama AbbasNo ratings yet

- Trial Balance For Company ABC Difference As On DD-MM-YYYY 0Document2 pagesTrial Balance For Company ABC Difference As On DD-MM-YYYY 0WaqasNo ratings yet

- Auditing NotesDocument65 pagesAuditing NotesTushar GaurNo ratings yet

- Kashato Shirts - SolutionsDocument18 pagesKashato Shirts - SolutionsAldrian Ala75% (4)

- ACCOUNTING 101-Module 6-Recording Trnasactions With VAT - EditedDocument19 pagesACCOUNTING 101-Module 6-Recording Trnasactions With VAT - EditedNic TiamzsNo ratings yet

- Cat T1Document8 pagesCat T1Sadia LakhoNo ratings yet