Professional Documents

Culture Documents

Af201 Final Exam Revision Package - S2, 2020 Face-to-Face & Blended Modes Suggested Partial Solutions

Af201 Final Exam Revision Package - S2, 2020 Face-to-Face & Blended Modes Suggested Partial Solutions

Uploaded by

Chand DivneshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Af201 Final Exam Revision Package - S2, 2020 Face-to-Face & Blended Modes Suggested Partial Solutions

Af201 Final Exam Revision Package - S2, 2020 Face-to-Face & Blended Modes Suggested Partial Solutions

Uploaded by

Chand DivneshCopyright:

Available Formats

AF201 FINAL EXAM REVISION PACKAGE – s2, 2020

Face-to- Face & Blended Modes Suggested Partial Solutions

SECTION A: MULTIPLE CHOICE

Coverage: Chapters 12, 15, 16, 17, & 19

Attempt all the relevant multiple choice questions in the Past Exam papers (See

the Final Exam Revision Resources folder under the ‘Course Resources.’

MULTIPLE CHOICE SOLUTIONS

Question S1, 2018 S2, 2018 S1, 2019 S2, 2019

1 C C B D

2 B C C D

3 D D B C

4 B C C B

5 D D D A

6 D D B B

7 C A D D

8 D D D C

9 A C D D

10 D D B B

11 C A D D

12 B B B D

13 B D B C

14 D D B C

15 D D C C

16 B D C A

17 A D B D

18 A C D B

19 D C D A

20 A D D C

AF201 Final Exam S2, 2020 Revision Package – Suggested Solutions | 1

SECTION B: PROBLEM SOLVING QUESTIONS REVISION QUESTIONS

Coverage: Chapters 12, 13, 16, & 20

QUESTION 1 – COST MANAGEMENT - CHAPTER 16

SEMESTER 1 2011 DFL MST

(A) The bottleneck department is the Assembly department. This is because if

Moulding department produces 700 units per hour, 100 units per hour will be

piling up at the Assembly department as it can only produce 600 units per hour.

(B) 600 units

(C) 600 units

(D) 200 units

(E) Increase the capacity of the Assembly department so that it can produce say

700 units per hour. This will result in delivering 700 units to customers every hour; a

100 units increase from the current situation.

PROBLEM 16.41 (25 minutes) The theory of constraints; business

process re-engineering: service organisation

1 Only 140 licences per hour can be completed, because this is the capacity of

Area D.

2 Areas C and D need to increase their output to be able to reach the requirement

of 250 returns per hour; C by 100 licenses and D by 110 licences.

3 Area A has the right staffing.

Area B has eight people who are processing 350 licences per hour, or 43.75

licences per hour each. To work at the required rate of 250 licences, the section

needs 250 / 43.75 = 5.7 staff. Two staff can be released.

Area C has ten people, who are processing 150 licences per hour, or 15 licences

per hour each. To produce at the right level they need 250 / 15 = 16.7 people; so

they need seven more.

Area D has 17 people who are processing 140 licences per hour, or 8.2 licences

per hour each. They need

250 / 8.2 = 30.5 people, or 14 more.

AF201 Final Exam S2, 2020 Revision Package – Suggested Solutions | 2

Area E has five people, who are processing 280 returns per hour, or 56 returns per

hour each. To get to the required level it needs 250 / 56 = 4.5 staff, so there is not

much spare capacity.

The re-engineered process needs 0 – 2 + 7 + 14 = 19 more people. This cannot be

done within the constraint of 45 people so the branch manager needs to think of

a new process. In fact, the re-engineered process requires more people to process

250 returns per hour than the original process did! Management needs to closely

study the activities in the major bottlenecks (C and D) to see how average

throughput can be improved. In C, the solution may lie in increasing the number of

cameras. The activities in D are obviously very time-consuming, since this has the

slowest throughput per person. Staff may be released from areas A and B by

combining these activities in some fashion. It would appear from the description

that the applications are handled twice, whereas the same person could possibly

undertake the two activities.

QUESTION 2 – FINANCIAL PERFORMANCE – CHAPTER 13

S2, 2016 FE

QUESTION 1: FINANCIAL PERFORMANCE

1. Residual income

Residual

Income

MP3 Player $20,000

Voice Recorder $15,000

2. Residual income

Residual

Income

a Division + $560,000

MP3 Player

b Division + $555,000

Voice

Recorder

c Division + $575,000

MP3 +

Voice

Recorder

d Division $540,000

AF201 Final Exam S2, 2020 Revision Package – Suggested Solutions | 3

e. The divisional manager will choose alternative ‘c’, which is to invest in both

projects because it gives the highest RI

3. Return on investment

Return on

Investment

MP3 Player 14.50%

Voice 14.00%

Recorder

4. Return on investment

Return on

Investment

a Division + 14.98%

MP3 Player

b Division + 14.96%

Voice

Recorder

c Division + 14.94%

MP3 +

Voice

Recorder

d Division 15.00%

(e) The divisional manager will choose alternative (d), which is not to invest in

both projects because it has the highest ROI percentage.

S2, 2019 FE

QUESTION 2: FINANCIAL PERFORMANCE.

1. ROI = 10.33%

2. (i) Return on Sales = 8.99%

(ii) Investment turnover = 1.15 times

(iii) ROI = 10.34% (difference due to rounding errors)

3. (i) ROI (with new investment) = 10.5%

AF201 Final Exam S2, 2020 Revision Package – Suggested Solutions | 4

(ii) The manager will approve the investment because the ROI (10.5%) is greater

than the return required by the company, which is 7%.

4. (i) Return on sales (with new investment) = 9.13%

(ii) Investment turnover (with new investment) = 1.15 times

(iii) Comparing these answers to those calculated in requirement (2) above, the

return on sales has increased from 8.99% to 9.13% but the investment turnover

has remained constant at 1.15 times.

5.

(i) ROI (without new investment) = 14.09%

ROI (with new investment) = 13.61%

(ii) The manager will most likely reject the investment because it lowers the

divisional ROI from 14.09% to 13.61%. However, considering the minimum rate of

return required by the company is 7%, the new investment should be accepted

because it increases total profits, which is evidenced by the ROI of 13.61%.

6. (i) ROS (without new investment) = 8.99%

(ii) Investment turnover (without new investment) = 1.57 times

S1, 2016 FINAL EXAM

QUESTION 3: PERFORMANCE MEASUREMENT

1. Alternatives ($ in Millions)

With Answering With Video Game With Both With

Neither

Machine Only Player Only Projects Project

ROI 17.41% 17.90% 17.35% 18.00%

2. The manager will choose to invest in neither since the ROI is highest for that

alternative.

AF201 Final Exam S2, 2020 Revision Package – Suggested Solutions | 5

3.

($ in Millions)

Scenarios EVA

With Answering Machine $4.6

With Video game player $4.66

With Both projects $4.76

With Neither projects $4.5

4. The manager will choose to invest in both since the EVA of each is positive and

also the total capital employed is less than the required $15 million for new capital

investment

QUESTION 3 – TRANSFER PRICING

S1, 2017/s1,2019 FE:

QUESTION 3

1. Maximum transfer price = market price = $42

Minimum transfer price = $15

Only variable costs are relevant for the minimum transfer price since the Furniture Division has

excess capacity.

Yes, the transfer should take place.

2. Benefit to Furniture Division (Carrie Burnside):

Benefit (Contribution margin) $ 150,000

Benefit to Motel Division (George Sanchez):

Benefit (savings) $ 120,000

Benefit to company = 270,000

3. Maximum transfer price = market price = $42

Minimum transfer price = $42

AF201 Final Exam S2, 2020 Revision Package – Suggested Solutions | 6

It does not matter whether or not the transfer takes place because the cost to the

company is the same whether the Motel Division buys from the outside supplier or

from the internal supplier (the Furniture Division).

S2, 2017 FE

QUESTION 2

1. Supplying division – TP is a revenue that will increase the division’s profit

Buying division – TP is a variable cost that will be matched against the sales that

the department will earn when selling the product to the market, which will

affect its profitability.

Firm as a whole – Any profit or cost savings made by the division when dealing

with the external market will increase the profit of the firm.

2. a. Minimum TP(SD) = $92

b. Max TP (AD) = $107

3. Excess capacity issue

a. Minimum TP = $65

b. From the point of view of Slate’s management, all of the SD’s output

should be transferred to the AD. This would avoid the $7 per screen

variable purchasing cost that is incurred by the AD when it purchases

screens from the outside market and it would also save the $8 marketing

and distribution cost the SD would incur to sell each screen to the outside

market.

c.

(i) TP = $86.00

(ii) Yes because AD will save $21 ($107 - $86) and SD will also earn an

incremental revenue of $21 ($86 - $65).

(iii) In negotiation method, transfer price negotiation starts with the

maximum – market price and through negotiation decreases this price

until a price is agreed upon where both managers can make profit.

AF201 Final Exam S2, 2020 Revision Package – Suggested Solutions | 7

Question 4 PRODUCT MIX DECISIONS

S2, 2019 FE

QUESTION 4: PRODUCT MIX DECISIONS

1. Product B should be the product produced first because it has the highest

contribution margin per machine hour.

Product A: = $140 per MH

Product B: $220 per MH

2. $900,000

3. $940,000

Semester 2, 2017 FINAL EXAM PAPER

Question 4

1. Contribution margin per kg

A110 B382 C657

CM per kg. $4.00 $2.80 $7.00

2. Excess pounds after producing the minimum requirement

A110 B382 C657 Total

Excess kg 1,800

The excess pound of 1,800 will be devoted to producing product C657 because it has the

highest CM per pound.

3. Since each unit of C657 requires 3 kg of Bistide, the remaining 1,800 kg can be used

to produce another 600 units of C657 (1,800 pounds ÷ 3 kg per unit).

AF201 Final Exam S2, 2020 Revision Package – Suggested Solutions | 8

The following combination yields the highest contribution margin given the 5,000

pounds constraint on availability of Bistide

A110: 200 units

B382: 200 units

C657: 800 units (200 minimum + 600 extra)

S2, 2016 Final Exam

QUESTION 5: PRODUCT MIX DECISIONS

1. Model 14-D Model 33-P

Contribution margin/hours on lathe $ 3 $ 5

Produce 6,000 units of Model 33-P and Zero units of Model 14-D

2. Produce 5,000 units of Model 33-P and 500 units of Model 14-D.

AF201 Final Exam S2, 2020 Revision Package – Suggested Solutions | 9

You might also like

- Fitness Equipment Business PlanDocument15 pagesFitness Equipment Business PlanMohsin KhanNo ratings yet

- Prologue: Managerial Accounting and The Business EnvironmentDocument156 pagesPrologue: Managerial Accounting and The Business EnvironmentMarcus MonocayNo ratings yet

- CH 1 Assignment - An Overview of Financial Management PDFDocument13 pagesCH 1 Assignment - An Overview of Financial Management PDFPhil SingletonNo ratings yet

- Wallace Garden SupplyDocument4 pagesWallace Garden SupplyestoniloannNo ratings yet

- The Finance Director of Stenigot Is Concerned About The LaxDocument1 pageThe Finance Director of Stenigot Is Concerned About The LaxAmit PandeyNo ratings yet

- Assignment Solution Question 2 and 3Document8 pagesAssignment Solution Question 2 and 3Grace Versoni100% (4)

- 9Document76 pages9Navindra Jaggernauth100% (1)

- Af201 Final Exam Revision PackageDocument12 pagesAf201 Final Exam Revision PackageChand DivneshNo ratings yet

- Bab Vii BalandcorcardDocument17 pagesBab Vii BalandcorcardCela Lutfiana100% (1)

- Chapter 8Document30 pagesChapter 8carlo knowsNo ratings yet

- ABCQuestionsDocument4 pagesABCQuestionsAdiltufail AdilNo ratings yet

- Chapter 04 - IfRS Part IDocument11 pagesChapter 04 - IfRS Part IDianaNo ratings yet

- OSCMExercises2 200416 WITHSOLUTIONS PDFDocument22 pagesOSCMExercises2 200416 WITHSOLUTIONS PDFManuel ManuNo ratings yet

- Investments Levy and Post PDFDocument82 pagesInvestments Levy and Post PDFDivyanshi SatsangiNo ratings yet

- AnswerDocument8 pagesAnswerJericho PedragosaNo ratings yet

- Af201 Final Exam Revision PackageDocument12 pagesAf201 Final Exam Revision PackageChand DivneshNo ratings yet

- Group 2 IMC Gillette (A)Document14 pagesGroup 2 IMC Gillette (A)ankit_mahendru_1No ratings yet

- Decathlon ReportDocument8 pagesDecathlon ReportCharan YadavNo ratings yet

- Chapter 9 Test With AnswersDocument33 pagesChapter 9 Test With AnswersMenatalla KhedrNo ratings yet

- ACC51112 Transfer PricingDocument7 pagesACC51112 Transfer PricingjasNo ratings yet

- MA2 (100 QS)Document30 pagesMA2 (100 QS)Alina NaeemNo ratings yet

- Https Doc 0k 0s Apps Viewer - GoogleusercontentDocument4 pagesHttps Doc 0k 0s Apps Viewer - GoogleusercontentAnuranjan Tirkey0% (1)

- Asset Recognition and Operating Assets: Fourth EditionDocument55 pagesAsset Recognition and Operating Assets: Fourth EditionAyush JainNo ratings yet

- FM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Document4 pagesFM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Tanice WhyteNo ratings yet

- Doc-20230205-Wa0215 230205 191422Document45 pagesDoc-20230205-Wa0215 230205 191422Silvia alfonsNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Management Accounting Practice QuestionsDocument6 pagesManagement Accounting Practice QuestionsSayantan NandyNo ratings yet

- CH 13Document28 pagesCH 13ReneeNo ratings yet

- Mock Test QuestionsDocument36 pagesMock Test QuestionsKish VNo ratings yet

- Chapter 15 Budgeting Profit Sales Cost ExpensesDocument19 pagesChapter 15 Budgeting Profit Sales Cost ExpensesFarhan Khan MarwatNo ratings yet

- Chapter 1 StudentsDocument7 pagesChapter 1 StudentsArah Opalec0% (1)

- F3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Document31 pagesF3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Md Enayetur Rahman100% (1)

- Assigment 3Document4 pagesAssigment 3anita teshome100% (1)

- 8318 - Making Investment Decision - Case StudyDocument1 page8318 - Making Investment Decision - Case Studyanon_593009167No ratings yet

- Duo PLC Produces Two Products A and B Each HasDocument2 pagesDuo PLC Produces Two Products A and B Each HasAmit Pandey50% (2)

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyDocument33 pagesChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- R35 Capital Budgeting Q BankDocument15 pagesR35 Capital Budgeting Q BankAhmedNo ratings yet

- Ilide - Info Review Qs PRDocument93 pagesIlide - Info Review Qs PRMobashir KabirNo ratings yet

- Fcma Mock ($i I) .Document49 pagesFcma Mock ($i I) .ShahbazNo ratings yet

- Abubaker Muhammad Haroon 55127Document4 pagesAbubaker Muhammad Haroon 55127Abubaker NathaniNo ratings yet

- 7 LP Sensitivity AnalysisDocument9 pages7 LP Sensitivity AnalysiszuluagagaNo ratings yet

- ch#5 of CFDocument2 pagesch#5 of CFAzeem KhalidNo ratings yet

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocument90 pagesCost-Volume-Profit Relationships: Solutions To QuestionsKathryn Teo100% (1)

- Handout 3 - Plant Assets, Natural Resources, and Intangible AssetsDocument81 pagesHandout 3 - Plant Assets, Natural Resources, and Intangible Assetsyoussef abdellatifNo ratings yet

- PS3 ADocument10 pagesPS3 AShrey BudhirajaNo ratings yet

- Case 1-4 Boeing's E-Enabled AdvantageDocument12 pagesCase 1-4 Boeing's E-Enabled AdvantageanjiroNo ratings yet

- Cost Accounting AssignmentDocument3 pagesCost Accounting AssignmentMkaeDizonNo ratings yet

- Exam281 20131Document14 pagesExam281 20131AsiiSobhiNo ratings yet

- Advanced Accounting New Syllabus Compiler 1.0 Nov 23 RTP UpdatedDocument635 pagesAdvanced Accounting New Syllabus Compiler 1.0 Nov 23 RTP Updatedsiddharthtripathi.gsaNo ratings yet

- Interest Under Debt Alternative $50 (Million) × 10% $5 (Million) EPS (Debt Financing) EPS (Equity Financing)Document6 pagesInterest Under Debt Alternative $50 (Million) × 10% $5 (Million) EPS (Debt Financing) EPS (Equity Financing)Sthephany GranadosNo ratings yet

- Hello PDFDocument57 pagesHello PDFMursalin HossainNo ratings yet

- CS Executive MCQ and Risk AnalysisDocument17 pagesCS Executive MCQ and Risk Analysis19101977No ratings yet

- Score:: Points %Document3 pagesScore:: Points %Ketan KulkarniNo ratings yet

- DocxDocument6 pagesDocxVịt HoàngNo ratings yet

- Macro Environment of The Mobile IndustryDocument2 pagesMacro Environment of The Mobile IndustryAbhinandanMalhotraNo ratings yet

- Assignment 2 PDFDocument10 pagesAssignment 2 PDFvamshiNo ratings yet

- Ama Long QuestionDocument30 pagesAma Long Questionmalikahsanrazaawan7No ratings yet

- Zakaria Ch1Document8 pagesZakaria Ch1Zakaria HasaneenNo ratings yet

- Depreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Document3 pagesDepreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Charles Kevin Mina100% (1)

- 5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsDocument37 pages5.1 Questions: Chapter 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsLiyana ChuaNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- AF201 FINAL EXAM REVISION PACKAGE - Partial SolutionsDocument9 pagesAF201 FINAL EXAM REVISION PACKAGE - Partial SolutionsShiv AchariNo ratings yet

- The University of The South Pacific: School of Accounting and FinanceDocument7 pagesThe University of The South Pacific: School of Accounting and FinanceTetzNo ratings yet

- AF201 REVISION PACKAGE s1, 2021Document4 pagesAF201 REVISION PACKAGE s1, 2021Chand DivneshNo ratings yet

- Week 2 Tutorial QuestionsDocument2 pagesWeek 2 Tutorial QuestionsChand DivneshNo ratings yet

- Af201 Mid-Test-S2 2019 - FINALDocument10 pagesAf201 Mid-Test-S2 2019 - FINALChand DivneshNo ratings yet

- AF201 Final Exam s2, 2019 - Suggested Solution Q3 Q4Document2 pagesAF201 Final Exam s2, 2019 - Suggested Solution Q3 Q4Chand DivneshNo ratings yet

- Tutorial 07: Project ManagementDocument1 pageTutorial 07: Project ManagementChand DivneshNo ratings yet

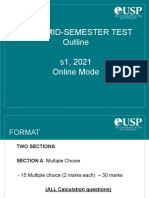

- Af201 Mid-Semester Test Outline s1, 2021 Online ModeDocument4 pagesAf201 Mid-Semester Test Outline s1, 2021 Online ModeChand DivneshNo ratings yet

- Week 9: Tutorial 08 Questions With Possible Solutions: IS333: Project Management - Semester I 2021Document3 pagesWeek 9: Tutorial 08 Questions With Possible Solutions: IS333: Project Management - Semester I 2021Chand DivneshNo ratings yet

- AF201 Final Exam - Suggested Solution - s1, 2018 - Final Qs 1, 2, 3Document2 pagesAF201 Final Exam - Suggested Solution - s1, 2018 - Final Qs 1, 2, 3Chand DivneshNo ratings yet

- Tutorial 09: Questions With Possible SolutionsDocument4 pagesTutorial 09: Questions With Possible SolutionsChand DivneshNo ratings yet

- Af302 Semester 1 - 2017 Mid-Test Solutions: Question 1 Multiple Choice SolutionsDocument9 pagesAf302 Semester 1 - 2017 Mid-Test Solutions: Question 1 Multiple Choice SolutionsChand DivneshNo ratings yet

- Tutorial 05 Questions With Possible Solutions: IS333: Project Management - Semester I 2021Document3 pagesTutorial 05 Questions With Possible Solutions: IS333: Project Management - Semester I 2021Chand DivneshNo ratings yet

- Mid-Semester Exam: Af 302 - Information SystemsDocument14 pagesMid-Semester Exam: Af 302 - Information SystemsChand DivneshNo ratings yet

- Tutorial 04 Questions With Possible Solutions: IS333: Project Management - Semester I 2021Document2 pagesTutorial 04 Questions With Possible Solutions: IS333: Project Management - Semester I 2021Chand DivneshNo ratings yet

- AF302chapter 4 Tutorial SolutionsDocument7 pagesAF302chapter 4 Tutorial SolutionsChand DivneshNo ratings yet

- Tutorial 03: Questions With Partial SolutionsDocument4 pagesTutorial 03: Questions With Partial SolutionsChand DivneshNo ratings yet

- Chapter 3 Tutorial SolutionsDocument8 pagesChapter 3 Tutorial SolutionsChand DivneshNo ratings yet

- AF302chapter 5 Tutorial SolutionsDocument10 pagesAF302chapter 5 Tutorial SolutionsChand DivneshNo ratings yet

- AF302 Chapter-2-SolutionsDocument6 pagesAF302 Chapter-2-SolutionsChand DivneshNo ratings yet

- Tutorial 01 Questions With Possible SolutionsDocument3 pagesTutorial 01 Questions With Possible SolutionsChand DivneshNo ratings yet

- Fraud, Ethics & Internal Controls: Chapter 3 Cont' Week 4: Lecture # 2Document27 pagesFraud, Ethics & Internal Controls: Chapter 3 Cont' Week 4: Lecture # 2Chand DivneshNo ratings yet

- AF302 Ch01-Tutorial-Answers-For-Chapter-01Document18 pagesAF302 Ch01-Tutorial-Answers-For-Chapter-01Chand DivneshNo ratings yet

- Is226 Tutorial 6 Problems For Week 7: Modeling Systems Requirements - DfdsDocument4 pagesIs226 Tutorial 6 Problems For Week 7: Modeling Systems Requirements - DfdsChand DivneshNo ratings yet

- AF121 Week 3-UNIT 2 Cont....Document10 pagesAF121 Week 3-UNIT 2 Cont....Chand DivneshNo ratings yet

- AF121 Week 4 - Fraud Ethics NewDocument18 pagesAF121 Week 4 - Fraud Ethics NewChand DivneshNo ratings yet

- The University of The South Pacific: School of Computing, Information and Mathematical SciencesDocument8 pagesThe University of The South Pacific: School of Computing, Information and Mathematical SciencesChand DivneshNo ratings yet

- Tutorial 5 - Sols - Modeling System RequirementsDocument6 pagesTutorial 5 - Sols - Modeling System RequirementsChand Divnesh100% (1)

- Corporate FinanceDocument8 pagesCorporate FinanceArijit BhattacharyaNo ratings yet

- UH SBDC Marketing Plan TemplateDocument4 pagesUH SBDC Marketing Plan TemplateOjong YvesNo ratings yet

- Press Publication 2009 Annual Report UkDocument268 pagesPress Publication 2009 Annual Report UkMalkeet SinghNo ratings yet

- Measuring Relevant Costs and Revenues For Decision-MakingDocument26 pagesMeasuring Relevant Costs and Revenues For Decision-Making潘伟杰No ratings yet

- Mec-001/101: Microeconomic Analysis: Assignment (TMA)Document23 pagesMec-001/101: Microeconomic Analysis: Assignment (TMA)nitikanehi50% (2)

- Chapter 3Document16 pagesChapter 3Abrha636No ratings yet

- Brand Management: Chitkara Business School MBA Course 2 YearDocument21 pagesBrand Management: Chitkara Business School MBA Course 2 YearMOHIT VIGNo ratings yet

- Consumer Buyer Behavior: Smartphone Industry BangladeshDocument11 pagesConsumer Buyer Behavior: Smartphone Industry BangladeshArminAhsanNo ratings yet

- Demand TheoryDocument15 pagesDemand TheoryJasdeep SinghNo ratings yet

- Quiz 5 SolutionDocument5 pagesQuiz 5 SolutionMichel BanvoNo ratings yet

- Marketing Strategy For Walton GroupDocument12 pagesMarketing Strategy For Walton Groupmahmodul hasanNo ratings yet

- Imperfect Competition IssuesDocument21 pagesImperfect Competition IssuesVina OktavianiNo ratings yet

- Penawaran Grabtaxi-BillboardDocument18 pagesPenawaran Grabtaxi-BillboardheryNo ratings yet

- Growth StrategiesDocument5 pagesGrowth StrategiesKingSalmanFareedNo ratings yet

- 4 Quarter Modular Learning Guide 1 Expected Time Completion: 20 Hours Topic # 3: Opportunity Seeking, Screening, and Seizing A. Learning OutcomeDocument9 pages4 Quarter Modular Learning Guide 1 Expected Time Completion: 20 Hours Topic # 3: Opportunity Seeking, Screening, and Seizing A. Learning OutcomeMichael John LozanoNo ratings yet

- Retail Question Bank AnswersDocument14 pagesRetail Question Bank AnswersJenish P. KeniaNo ratings yet

- Return On EquityDocument7 pagesReturn On EquityTumwine Kahweza ProsperNo ratings yet

- Resunga Multiple Campus: Resunga Municipality, Gulmi Internal Examination - 2079Document2 pagesResunga Multiple Campus: Resunga Municipality, Gulmi Internal Examination - 2079KAMAL POKHRELNo ratings yet

- MicronotesDocument79 pagesMicronotesmanikant kumarNo ratings yet

- Me443 CH5Document55 pagesMe443 CH5abhi9119No ratings yet

- Chapter Three The Balance Sheet and Financial DisclosuresDocument33 pagesChapter Three The Balance Sheet and Financial Disclosuressan marcoNo ratings yet

- Edpm 2Document17 pagesEdpm 2virenhariNo ratings yet

- Introducing Messenger Marketing Into BusinessDocument11 pagesIntroducing Messenger Marketing Into Businesszayn ahmedNo ratings yet

- PathaoDocument11 pagesPathaoOmar FarukNo ratings yet

- The University O THE: F West IndiesDocument3 pagesThe University O THE: F West IndiesDom PowellNo ratings yet

- Consolidated Financial Statement ExerciseDocument4 pagesConsolidated Financial Statement ExerciseAnonymous OzWtUONo ratings yet

- Corporate Action - Thomson Reuters.Document12 pagesCorporate Action - Thomson Reuters.adjipramNo ratings yet