Professional Documents

Culture Documents

Annual KSM Data

Annual KSM Data

Uploaded by

Hisham SyedCopyright:

Available Formats

You might also like

- Lesson 8 - The Global City: Education For A Fast Changing WorldDocument29 pagesLesson 8 - The Global City: Education For A Fast Changing Worldjerald love patricia100% (1)

- Project Report of Ethics in FinanceDocument42 pagesProject Report of Ethics in FinanceAlisha Sharma100% (6)

- Annual KSM DataDocument6 pagesAnnual KSM DataHisham SyedNo ratings yet

- Annual KSM DataDocument5 pagesAnnual KSM DataHisham SyedNo ratings yet

- Report On Strategic Corporate FinanceDocument21 pagesReport On Strategic Corporate Financesrohit2No ratings yet

- Investor Download DataDocument9 pagesInvestor Download Dataindradanush2608No ratings yet

- Lap. Cutting 1C-223 (BS07-KJ29-9%)Document2 pagesLap. Cutting 1C-223 (BS07-KJ29-9%)Rengga KharismaNo ratings yet

- Project Report Printin PressDocument5 pagesProject Report Printin Pressmanohar michaelNo ratings yet

- Minyak Pala - GCMSDocument31 pagesMinyak Pala - GCMSAkbarHadityaNo ratings yet

- I Am Sharing 'Vitta Hackathon 2023 PPT' With YouDocument34 pagesI Am Sharing 'Vitta Hackathon 2023 PPT' With YouRoin HiraniNo ratings yet

- ITC Financial Result Q4 FY2023 SfsDocument6 pagesITC Financial Result Q4 FY2023 Sfsaanchal prasadNo ratings yet

- Form PrintDocument3 pagesForm PrintSakura2709No ratings yet

- Godrej IndustriesDocument5 pagesGodrej Industriesshashank sagarNo ratings yet

- R D Offlc Mbic Oad, Va o A 3 003: of MaDocument10 pagesR D Offlc Mbic Oad, Va o A 3 003: of MaRavi AgarwalNo ratings yet

- MM Q3 F22 Financial Results PackDocument12 pagesMM Q3 F22 Financial Results PackBharathNo ratings yet

- Emami PNLDocument1 pageEmami PNLsZCCSZcNo ratings yet

- Appendices PDFDocument2 pagesAppendices PDFMohammed FazlullahNo ratings yet

- ตารางเหล็กDocument41 pagesตารางเหล็กสิทธิชัย หอมจรรย์No ratings yet

- Enduring ValueDocument6 pagesEnduring ValueMandeep BatraNo ratings yet

- Mehran Sugar Mills - Six Years Financial Review at A GlanceDocument3 pagesMehran Sugar Mills - Six Years Financial Review at A GlanceUmair ChandaNo ratings yet

- Kingston Educational Institute: Ratio AnalysisDocument1 pageKingston Educational Institute: Ratio Analysisdhimanbasu1975No ratings yet

- ITC Financial Result Q1 FY2024 SfsDocument3 pagesITC Financial Result Q1 FY2024 SfsAlricNo ratings yet

- Projections 20.11.20Document7 pagesProjections 20.11.20Pawan GuptaNo ratings yet

- Final F.M.Document12 pagesFinal F.M.avismlNo ratings yet

- Balance Sheet of Kansai Nerolac PaintsDocument5 pagesBalance Sheet of Kansai Nerolac Paintssunilkumar978No ratings yet

- ResultsDocument5 pagesResultssanjayvichare2020No ratings yet

- Kim's Trade Summary and StatisticsDocument11 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- Wip Ro Key Financial Ratios - in Rs. Cr.Document4 pagesWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshNo ratings yet

- Unit Cost Comparision Table 2023-24 Vs 2022-23Document1 pageUnit Cost Comparision Table 2023-24 Vs 2022-23Karthikeyan RajamanickamNo ratings yet

- Web Standalone Sep23Document7 pagesWeb Standalone Sep23coolstiffler08No ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- Daily DiagnosticsDocument7 pagesDaily DiagnosticsMohamed Abdel-Kader BeïdNo ratings yet

- ITC Financial Result Q4 FY2021 CfsDocument8 pagesITC Financial Result Q4 FY2021 CfsKaushik ViswanathanNo ratings yet

- Phần 1: Từ Số Liệu Ở Bảng 3 Và Bảng 4, Viết Phương Trình Biến Trạng Thái Hệ Xe - Lò Xo TheoDocument2 pagesPhần 1: Từ Số Liệu Ở Bảng 3 Và Bảng 4, Viết Phương Trình Biến Trạng Thái Hệ Xe - Lò Xo TheoNguyễnAnhDuyNo ratings yet

- Emami BSDocument1 pageEmami BSsZCCSZcNo ratings yet

- 2.0 MR01 - Jan 2015 Total Project Cost - Overall Summary WO Fee FOREX Below TotalDocument1 page2.0 MR01 - Jan 2015 Total Project Cost - Overall Summary WO Fee FOREX Below TotalWilmer Lapa QuispeNo ratings yet

- Financial Analysis 2 - ScribdDocument6 pagesFinancial Analysis 2 - ScribdSanjay KumarNo ratings yet

- Results Final - CastedDocument4 pagesResults Final - CastedMan Mohan KalitaNo ratings yet

- ActualRH Jan09Document2 pagesActualRH Jan09mtagossipNo ratings yet

- MM Evaluation - Expected Result - Final Reviewed by KRXDocument46 pagesMM Evaluation - Expected Result - Final Reviewed by KRXVinh TranNo ratings yet

- Webinar 6 - EPS ModelDocument10 pagesWebinar 6 - EPS ModelJeniffer RayenNo ratings yet

- WB Grading Summary ReportDocument5 pagesWB Grading Summary ReportrohmanNo ratings yet

- Pe RatiosDocument6 pagesPe RatiosRakesh SharmaNo ratings yet

- T Hi Liv S: - Ouc NG e OverDocument9 pagesT Hi Liv S: - Ouc NG e OverRavi AgarwalNo ratings yet

- 32 - Akshita - Sun Pharmaceuticals Industries.Document36 pages32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaNo ratings yet

- Sebi Release EditDocument2 pagesSebi Release Editkarthikpranesh7No ratings yet

- Suhail Assigment 1Document7 pagesSuhail Assigment 1Suhail AshrafNo ratings yet

- ITC Financial Result Q4 FY2022 SfsDocument6 pagesITC Financial Result Q4 FY2022 SfsMoksh PorwalNo ratings yet

- Performance Data: Model QAF845Document5 pagesPerformance Data: Model QAF845yr5391917No ratings yet

- Fem CareDocument16 pagesFem Careapi-3702531No ratings yet

- Kovai Medical Center and Hospital Limited: PartlcularsDocument2 pagesKovai Medical Center and Hospital Limited: PartlcularsVickyNo ratings yet

- National Advisory Committee On Accounting Standards: IND AS 116 - New Accounting Lease StandardDocument7 pagesNational Advisory Committee On Accounting Standards: IND AS 116 - New Accounting Lease StandardShubham VermaNo ratings yet

- Unit Cost Comparision Table 2023-24 Vs 2022-23Document1 pageUnit Cost Comparision Table 2023-24 Vs 2022-23Karthikeyan RajamanickamNo ratings yet

- Ar Fy11Document132 pagesAr Fy11Raj WorkNo ratings yet

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDocument6 pagesCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaNo ratings yet

- Standalone Result Mar23Document9 pagesStandalone Result Mar23Amit KumarNo ratings yet

- Experimental Data - Data AnalysisDocument3 pagesExperimental Data - Data AnalysiszakiNo ratings yet

- 3.1.projected Balance SheetDocument1 page3.1.projected Balance Sheetdhimanbasu1975No ratings yet

- High-Performance Gradient Elution: The Practical Application of the Linear-Solvent-Strength ModelFrom EverandHigh-Performance Gradient Elution: The Practical Application of the Linear-Solvent-Strength ModelNo ratings yet

- Introduction To Programming University of SiegenDocument3 pagesIntroduction To Programming University of SiegenHisham SyedNo ratings yet

- Annual KSM DataDocument5 pagesAnnual KSM DataHisham SyedNo ratings yet

- Admission Form 2018 2019Document4 pagesAdmission Form 2018 2019Hisham SyedNo ratings yet

- My ApplicationDocument4 pagesMy ApplicationHisham SyedNo ratings yet

- Annual KSM DataDocument6 pagesAnnual KSM DataHisham SyedNo ratings yet

- RainCycle Water EngineeringDocument4 pagesRainCycle Water EngineeringHisham SyedNo ratings yet

- 1 s2.0 S2211812814004180 MainDocument8 pages1 s2.0 S2211812814004180 MainHisham SyedNo ratings yet

- Terms & ConditionsDocument3 pagesTerms & ConditionsHisham SyedNo ratings yet

- Dig Uet 2013Document8 pagesDig Uet 2013Hisham SyedNo ratings yet

- J Tws 2014 09 009 PDFDocument9 pagesJ Tws 2014 09 009 PDFHisham SyedNo ratings yet

- Machine Control SystemsDocument9 pagesMachine Control SystemsHisham SyedNo ratings yet

- Innovation Management and Global CompetitivenessDocument76 pagesInnovation Management and Global CompetitivenessKristina KasalovaNo ratings yet

- Acca Aa Audit and Assurance: Control ActivitiesDocument8 pagesAcca Aa Audit and Assurance: Control ActivitiesIssa Boy100% (1)

- KikabiDocument35 pagesKikabiKikabiNo ratings yet

- Accounting For Government and Non Profit Organizations - ASSESSMENTSDocument21 pagesAccounting For Government and Non Profit Organizations - ASSESSMENTSArn KylaNo ratings yet

- Nota Semanal PerúDocument157 pagesNota Semanal PerúROSMERY MARCELO SOSANo ratings yet

- 21-Health, Safety & Environment PolicyDocument1 page21-Health, Safety & Environment Policyfdfddf dfsdfNo ratings yet

- Name: Dansel Rose Ambrocio Section: BSMA 1ADocument3 pagesName: Dansel Rose Ambrocio Section: BSMA 1AKasdeya CentrescaNo ratings yet

- Bahrain: AMB Country Risk ReportDocument4 pagesBahrain: AMB Country Risk ReportaakashblueNo ratings yet

- Accounting Document Is Not Being Created in Transaction Code J1AZ With 'Don't Post To MM' Flag Checked in The Inflation MethodDocument2 pagesAccounting Document Is Not Being Created in Transaction Code J1AZ With 'Don't Post To MM' Flag Checked in The Inflation Methodirfan aliNo ratings yet

- Altisource IIM A JDDocument2 pagesAltisource IIM A JDBipin Bansal AgarwalNo ratings yet

- Process CostingDocument4 pagesProcess CostingVidia ProjNo ratings yet

- Market Segmentation: Presented By:-Harsh Inani Roll No.: - 18014 G.H.P.I.B.MDocument27 pagesMarket Segmentation: Presented By:-Harsh Inani Roll No.: - 18014 G.H.P.I.B.MHarsh InaniNo ratings yet

- Hearing: U.S. Trade With ChinaDocument154 pagesHearing: U.S. Trade With ChinaScribd Government DocsNo ratings yet

- DedDocument23 pagesDedasdasdaNo ratings yet

- Budgeting NotesDocument3 pagesBudgeting NotesVivek KavtaNo ratings yet

- Strategic Management of Pakistan State Oil (PsoDocument8 pagesStrategic Management of Pakistan State Oil (PsoKhalid Khan100% (1)

- Microeconomics - 2022 - Session 5 - Sent - KDDocument60 pagesMicroeconomics - 2022 - Session 5 - Sent - KDSarthak KhoslaNo ratings yet

- CV Karol October 2014Document2 pagesCV Karol October 2014KarolBonatiNo ratings yet

- What Is Brexit?Document5 pagesWhat Is Brexit?anon_285948065No ratings yet

- American Economic Association The American Economic ReviewDocument10 pagesAmerican Economic Association The American Economic ReviewkNo ratings yet

- Puja Kumari Pandey MRP PresentationDocument17 pagesPuja Kumari Pandey MRP PresentationSAKET RATHI IPS Academy IndoreNo ratings yet

- Global Manufacturing of VolkswagenDocument3 pagesGlobal Manufacturing of Volkswagennarmin mammadli0% (1)

- Final Ac Problem1Document12 pagesFinal Ac Problem1Pratap NavayanNo ratings yet

- Eandis - Financing The Roll Out of Smart Meters in A Regulated EnvironmentDocument6 pagesEandis - Financing The Roll Out of Smart Meters in A Regulated EnvironmentRavi DhakarNo ratings yet

- Account Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRajwinder SandhuNo ratings yet

- Pautang AuditDocument4 pagesPautang AuditWyeth Earl Padar EndrianoNo ratings yet

- Arrighi, G. - The Long Twentieth Century (Int e 3.4)Document55 pagesArrighi, G. - The Long Twentieth Century (Int e 3.4)Day Mika'sNo ratings yet

- RBI and Its Control Over BanksDocument10 pagesRBI and Its Control Over BanksHarshad PatilNo ratings yet

Annual KSM Data

Annual KSM Data

Uploaded by

Hisham SyedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual KSM Data

Annual KSM Data

Uploaded by

Hisham SyedCopyright:

Available Formats

Detailed Key Statistical Measures (KSM) Report - 2016

This report contains detailed Key Statistical Measures (KSMs) supplemental to the Canadian Workers’ Compensation System – Year at a Glance report.

Please note, differences in population, industry mixes, coverage and legislation/policy may affect comparability between jurisdictions. These measures use

standard definitions that may differ from WCB reports. Please contact the WCB directly with any inquiries about an individual jurisdiction.

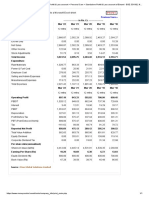

Claim Measures

Claim Measures CAN NL PE NS NB QC ON MB SK AB BC NT/NU YT

Claims

1 Claims Reported (#) 42

740,627 13,147 3,913 24,838 17,354 110,274 230,933 36,672 29,587 118,969 149,554 3,736 1,650

2 Total Lost Time Claims (#) 36 32 39

240,682 3,589 1,010 6,087 4,516 68,537 57,368 14,272 8,589 24,380 51,044 826 464

2.1 Lost Time Claims for 37 33

Assessable Employers (#) 218,779 3,298 980 5,594 3,254 67,409 43,386 12,351 8,342 23,630 49,256 815 464

2.2 Lost Time Claims for Self- 37 33 47

Insured Employers (#) 21,903 291 30 493 1,262 1,128 13,982 1,921 247 750 1,788 11 0

Injury Frequency

21 Lost Time Injury Frequency 55 37 34 25

(%) 1.54 1.58 1.44 1.81 1.41 1.80 1.07 2.91 2.11 1.25 2.20 2.03 2.10

Fatalities

3 Fatalities Accepted (#) 5

904 13 2 24 20 217 289 16 31 144 144 1 3

3.1 Fatalities Accepted - 41

Occupational Disease (#) 592 8 1 15 7 137 231 12 17 77 85 0 2

3.2 Fatalities Accepted - Injury 48

(#) 312 5 1 9 13 80 58 4 14 67 59 1 1

Coverage

22 Workforce Covered (%) 56 1 38

(%) 84.38 97.61 98.04 75.40 91.39 92.60 76.24 77.40 71.30 84.36 97.61 97.16 97.32

Duration

18 Average Composite 37 34

Duration of Claim (#) U/A 117.07 74.30 110.32 44.07 U/A N/A 34.16 56.61 65.75 70.90 49.94 30.76

Return to Work

24.1 Claims on Wage-Loss 13,37 13,34 13 13

Benefits after 2 years (%) 3.00 5.40 3.35 5.05 5.75 5.29 2.07 1.17 1.60 2.72 1.30 2.21 2.91

24.2 Claims on Wage-Loss 13,37 13,34 13 13

Benefits after 6 years (%) 1.86 3.72 3.08 4.10 1.96 3.07 1.93 0.65 0.15 1.26 0.66 0.21 0.22

25.1 Percentage of Wage-Loss 37 34 17

Claims off Wage-Loss 60.44 52.59 47.62 49.25 55.98 55.21 72.33 64.10 58.69 59.93 56.00 68.80 63.52

Benefits at 30 days (%)

25.3 Percentage of Wage-Loss 37 34 17

Claims off Wage-Loss 77.66 69.24 65.64 72.66 68.42 72.40 85.16 81.65 73.63 77.75 78.00 78.80 80.90

Benefits at 90 days (%)

Claim Measures CAN NL PE NS NB QC ON MB SK AB BC NT/NU YT

25.4 Percentage of Wage-Loss 37 34 17

Claims off Wage-Loss 74.50 70.59 78.00 73.68 76.62 87.99 85.63 77.54 83.47 83.00 81.70 83.48

Benefits at 120 days (%)

25.5 Percentage of Wage-Loss 37 34 16

Claims off Wage-Loss 86.73 80.62 76.14 83.14 80.38 82.00 91.18 90.14 84.42 89.12 88.00 86.20 88.63

Benefits at 180 days (%)

25.6 Percentage of Wage-Loss 37 34 17

Claims off Wage-Loss 92.39 89.52 82.67 88.47 89.08 89.89 95.02 94.67 93.55 94.69 92.00 91.70 97.42

Benefits at 360 days (%)

Impairment

19 Average Impairment Rating 7 34 24

(%) (%) 8.93 15.18 6.28 7.93 8.07 10.27 9.92 4.86 7.43 9.71 9.60 9.40 8.56

20 Proportion of Claims 7 37 34

Awarded Impairment 13.28 14.09 20.52 23.94 10.73 26.66 5.97 6.82 6.75 11.22 11.10 13.50 8.09

Benefits (%)

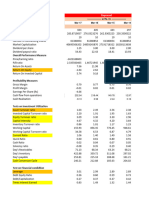

Financial Measures

Financial Measures CAN NL PE NS NB QC ON MB SK AB BC NT/NU YT

Funding / Investment

14 Market Rate of Return (%) 7

6.70 8.51 9.16 6.70 9.16 7.10 6.30 3.50 7.10 7.30 5.40 4.57 5.60

15 Percentage Funded (%) 54 46

108.70 126.10 159.40 84.10 112.10 109.00 87.90 145.90 133.07 133.76 141.75 110.00 149.80

Admin Costs

8 Administration Costs ($ 29

millions) ($) 1,750.7 34.9 5.7 41.9 29.1 356.4 646.0 66.3 54.4 193.6 289.0 25.2 8.2

IR1 Administration Costs Per 57

$100 of Assessable Payroll 0.30 0.42 0.30 0.40 0.33 0.26 0.38 0.36 0.26 0.19 0.31 0.87 0.74

($)

IR6 Administration Costs per 57 37 32

Lost Time Claim ($) 8,002 10,582 5,865 7,482 8,943 5,287 14,890 5,368 6,521 8,193 5,867 30,870 17,702

OH&S Costs

9 OH&S Costs ($ millions) 23 40

($) 613.9 9.8 1.2 12.4 11.3 181.3 193.0 19.1 24.5 68.0 86.3 4.3 2.8

IR4 OH&S Costs per $100 of

Assessable Payroll ($) 0.11 0.12 0.06 0.12 0.13 0.13 0.11 0.11 0.12 0.07 0.09 0.15 0.25

Assessment Rate

13.1 Actual Average 53 8

Assessment Rate for 1.86 2.20 1.83 2.65 1.12 1.85 2.59 1.25 1.32 1.01 1.63 2.00 1.81

Assessable Employers ($)

13.2 Provisional Average 53 6 30,50

Assessment Rate for 1.83 2.20 1.77 2.65 1.11 1.84 2.46 1.25 1.34 1.02 1.70 2.00 1.85

Assessable Employers ($)

Revenue

10 Assessment Revenue for 45 21

Assessable Employers ($ 10,960.2 173.6 34.8 283.1 97.3 2,541.1 4,785.0 226.6 281.8 994.5 1,465.3 57.0 20.2

millions) ($)

11 Total Premium Revenue ($ 44 21

millions) ($) N/A 183.8 34.8 319.0 212.7 U/A 4,858.0 256.9 281.8 994.5 1,493.8 56.9 20.7

Financial Measures CAN NL PE NS NB QC ON MB SK AB BC NT/NU YT

Payroll

12 Assessable Payroll ($ 19

billions) ($) 575.5 8.4 1.9 10.5 8.8 139.0 171.6 18.2 20.9 99.8 92.4 2.9 1.1

Benefit Costs

4.1 Current Year Benefit Costs 27 18

($ millions) ($) 5,682.1 82.1 20.8 180.2 125.2 1,743.6 1,335.0 134.8 170.7 785.6 1,065.0 27.8 11.2

6 Benefit Costs Incurred ($ 28 20,9 12 22 43 18

millions) ($) 8,197.1 161.8 20.7 248.5 255.6 2,179.2 2,094.0 148.5 278.6 1,457.7 1,274.2 62.5 15.8

IR2 Current Year Benefit Costs 57

Per $100 of Assessable 0.99 0.98 1.10 1.72 1.42 1.25 0.78 0.74 0.82 0.79 1.15 0.96 1.00

Payroll ($)

IR5 Current Year Average 57 37 32

Benefit Cost per Lost Time 25,972 24,894 21,252 32,211 38,476 25,866 30,770 10,914 20,468 33,246 21,622 34,157 24,152

Claim ($)

Benefit Liabilities

7.1 Benefit Liabilities ($ 35 18

millions) ($) 59,963.8 921.1 145.9 1,737.3 1,107.0 12,644.3 24,300.0 801.6 1,072.6 6,341.7 10,480.8 289.1 122.4

23 Real Rate of Return 3 2 4 14 49 51 26

Assumption (%) (%) N/A 3.50 3.50 3.50 3.75 3.75 2.45 3.42 3.25 2.50 3.00 3.50 3.42

Benefit Payments

5.1 Benefits Paid During the 15 27 18

Year ($ millions) ($) 7,218.0 136.0 23.0 225.7 142.8 2,001.9 2,252.0 156.8 204.1 766.4 1,259.0 36.0 14.3

16 Average Days from Injury 52,34 58 31

to First Payment (#) U/A 33.41 37.29 28.00 35.44 N/A 36.66 24.70 34.94 22.93 27.00 26.50 30.82

17 Average Days from 52,34 58 31 11,10

Registration to First U/A 27.23 29.36 20.00 22.98 N/A 27.60 19.60 26.51 19.52 20.70 10.10 27.14

Payment (#)

(Extracted on: 5/8/2021 6:07:14 PM)

Important Note to Readers:

Differences in population, industry mixes, coverage and legislation/policy may affect comparability between jurisdictions. These measures use standard definitions that may

differ from WCB reports. Please contact the WCB directly with any inquiries about an individual jurisdiction.

Source: Association of Workers’ Compensation Boards of Canada, Key Statistical Measures (www.awcbc.org)

Please find footnotes on the next page

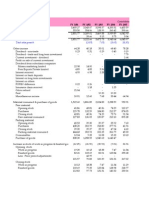

Footnotes______________________________________________________________________________________________________________________________

ID Text

1 2014 Labour Force Survey (LFS) estimates are based on 2006 Census population estimates, whereas years prior to 2011 were based on 2001 Census population

estimates.

2 A real rate of 3.0% is used to discount supplementary benefits, 4.75% is used to discount LTD and survivor pensions, 1.75% is used to discount medical aid and a real

rate of 3.5% is used for rehabilitation and non-income benefits.

3 A real rate of 4.26% is used in the first year following valuation with respect to CPI-Indexed benefits (2014-4.62%)

4 A real rate of 4.61% is used in the first year following valuation with respect to fully indexed benefits (STD & rehabilitation benefits, LTD and survivor pensions). Health

Care costs are discounted at a real rate of 0.79%.

5 Accepted Fatalities excludes Pre-1990 100% Permanent Disability Pension Fatalities.

6 All rate group rates remain unchanged from 2013 to 2016 (except for Rate Group 845 “Government and Related Services” that had a rate increase in 2015 due to

expanded coverage for presumptive legislation for firefighters).

7 Arithmetic average. Weighted average unavailable due to lack of data in some areas.

8 Based on amounts reported in KSM for Assessment Revenue for Assessable Employers and Assessable Payroll for Assessable Employers.

9 Difference due to changes in actuarial valuation of benefit liabilities. Change in actuarial valuation of benefit liabilities reflects the impact of the legislative amendment

for post-traumatic stress disorder (“PTSD”) and the strengthening of valuation assumptions and methodologies, partially offset by the continuation of favorable

experience results.

10 Does not exclude appeals.

11 Does not exclude payments made to employers.

12 Does not include any provision for future payments of claims relating to self-insurers, as they are a liability of the self-insurers.

13 Does not include cases involving permanent economic loss payments.

14 Except for the year following the valuation where 4.54% is used

15 Excludes $56M in LRI contributions and claim administration costs.

16 Excludes claims from KSM #2 for which no days were paid

17 Excludes claims from KSM #2 for which no days were paid.

18 Excludes estimated admin costs.

19 Excludes insured payroll not reported.

20 Excludes self-insured employers.

21 Excludes Surplus Distribution.

22 Figure revised to exclude self-insured portion.

23 Figures in 9.7 Other represent SAFE Work Manitoba Program Costs and WCB Sponsorships

24 Focused health care, combined with consistent assessment and application of policy has led to a notable reduction in the average PI percentage awarded.

25 For injury frequency and workforce covered calculations, NT/NU uses SEPH data, which are 3% to 6% lower than labour force data. This methodology results in the

injury frequency being overestimated due to the characteristics of the data.

26 For medical benefits, the net discount rate is 0.95%.

27 Health Care and Vocational Rehab are included in this figure.

28 In 2012, Occupational Disease liability was recorded for the first time.

29 In 2013, IAS 19 was adopted by WSIB.

30 Includes a provision for CHOICES rebates.

31 Includes employer paid claims

32 NB has a 3 day waiting period therefore, the number of lost time claims listed in this report may not reflect every lost time injury for this province. NB accepted 5,698

lost-time claims (including day of accident) in total in 2016.

33 NB has a 3 day waiting period therefore, the number of lost time claims listed in this report may not reflect every lost time injury for this province. NB accepted 5,698

lost-time claims (including day of accident) in total in 2016.

34 NB has a waiting period. This measure has been restated to include the claims with a waiting period. The total number of lost time claims for 2016 is 5852. The

number of waiting period claims included is 1528.

35 NB includes the future expense of administering claims in the Benefit Costs Incurred (KSM #6) and Total Benefit Liabilities (KSM #7).

36 NS has a 2 day waiting period therefore, the number of lost time claims listed in this report may not reflect every lost time injury for this province. The total number of

lost-time claims published in the WCB of Nova Scotia's 2016 annual report is 5,847. This annual report figure does not include permanent disability claims.

37 NS has a 2 day waiting period therefore, the number of lost time claims listed in this report may not reflect every lost time injury for this province. The total number of

lost-time claims published in the WCB of Nova Scotia's 2016 annual report is 5,847. This annual report figure does not include permanent disability claims.

38 NT/NU allows self-employed individuals with no assessable payroll to opt out of personal coverage, should they so choose.

39 On December 6, 2016, the WSIB’s Accounts and Claims Enterprise System (ACES) was fully implemented. ACES is our modernized, integrated solution for

administering employer accounts and managing worker claims. The implementation of our new system is improving our ability to respond to customers’ needs. In

addition, our eAdjudication processes are facilitating faster eligibility decisions and earlier interventions for recovery and return to work. We discovered that some

limited-entitlement cases which should have been coded as no lost time claims have, in fact, been coded as lost time through the adjudication process. Limited-

entitlement claims are claims where health care benefits are granted but loss of earnings benefits are not because appropriate modified work was available. To ensure

clarity and accuracy in future reporting, we have corrected our claims coding for 2017. Most observable for 2016 is an increase in the lost time injury rate and allowed

lost time injuries, but a decrease in the no lost time injury rate and no lost time injuries. These nuances should be taken into consideration when using the 2016 Non-

Financial KSMs.

40 Other category includes funding for the Workers Advocate.

41 Prescribed cancer legislation allowing coverage of firefighter presumptive occupational disease claims are included - Cancers in Firefighters and Fire Investigators

Legislation (Policy 23-02-01).

42 Program for Exposure Incident Reporting (PEIR) and amalgamated claims are excluded.

43 Rehabilitation is included in this number.

44 Schedule 2 revenue represents administration fees and KSM #10 before bad debt. Since 2013, Safety Groups classified as funding commitments rather than revenue.

45 Since 2013, Safety Groups are classified as funding commitments rather than revenue. Bad debt is classified as administrative expense.

46 The percentage funded for rate setting purposes is 114.5%. It corresponds to the ratio of assets to liabilities excluding latent occupational diseases yet to be reported.

47 There may be a small number of self-insured claims for the Government of Yukon. These numbers are too small to identify and break out separately for the KSM

submission.

48 This KSM will not match By the Numbers (BTN) as the traumatic fatality count in BTN is by year of death, whereas this KSM represents traumatic fatalities by year

accepted, regardless of year of death.

49 To discount partially indexed benefits other than health care costs, a real rate of 3.47% for 2017 payments and 2.45% for 2018 and later are used.

50 Variance to actual due to definitional differences, etc.

51 Wage growth is 3.25% (1% over assumed inflation rate of 2.25%) and increase in health care costs is 5.25% (3.00% over assumed inflation rate of 2.25%).

52 Waiting period claims are not captured in this measure because they never received a loss of earning payment.

53 Weighted average calculated as follows: The sum of all jurisdictional assessment revenue, calculated by multiplying the Average Assessment Rate (KSM #13) by $100

of assessable payroll (KSM #12/100), divided by the sum, for all jurisdictions, of $100 of assessable payroll (KSM #12/100).

54 Weighted average calculated as follows: The sum of the estimated jurisdictional assets divided by the sum of the total jurisdictional benefits liabilities for assessable

employers ($M) (KSM #7) expressed as a percentage, where est. assets (in $M) are calculated by multiplying the total benefits liability for assessable employers ($M)

(KSM #7) by the percentage funded (KSM #15).

55 Weighted average is calculated as follows: Total number of lost-time claims for assessable employers (KSM #2.1) divided by the total of the estimated number of

workers of assessable employers (estimated by dividing KSM #2.1 by KSM #21).

56 Weighted average is calculated as follows: Total number of workers covered divided by total Employed Labour Force. Total number of workers covered is the sum, over

all jurisdictions, of the % of workforce covered (KSM #22) multiplied by the Employed Labour Force.

57 Weighted Average.

58 WSIB issues payments approximately 2 weeks following the initial entitlement date.

You might also like

- Lesson 8 - The Global City: Education For A Fast Changing WorldDocument29 pagesLesson 8 - The Global City: Education For A Fast Changing Worldjerald love patricia100% (1)

- Project Report of Ethics in FinanceDocument42 pagesProject Report of Ethics in FinanceAlisha Sharma100% (6)

- Annual KSM DataDocument6 pagesAnnual KSM DataHisham SyedNo ratings yet

- Annual KSM DataDocument5 pagesAnnual KSM DataHisham SyedNo ratings yet

- Report On Strategic Corporate FinanceDocument21 pagesReport On Strategic Corporate Financesrohit2No ratings yet

- Investor Download DataDocument9 pagesInvestor Download Dataindradanush2608No ratings yet

- Lap. Cutting 1C-223 (BS07-KJ29-9%)Document2 pagesLap. Cutting 1C-223 (BS07-KJ29-9%)Rengga KharismaNo ratings yet

- Project Report Printin PressDocument5 pagesProject Report Printin Pressmanohar michaelNo ratings yet

- Minyak Pala - GCMSDocument31 pagesMinyak Pala - GCMSAkbarHadityaNo ratings yet

- I Am Sharing 'Vitta Hackathon 2023 PPT' With YouDocument34 pagesI Am Sharing 'Vitta Hackathon 2023 PPT' With YouRoin HiraniNo ratings yet

- ITC Financial Result Q4 FY2023 SfsDocument6 pagesITC Financial Result Q4 FY2023 Sfsaanchal prasadNo ratings yet

- Form PrintDocument3 pagesForm PrintSakura2709No ratings yet

- Godrej IndustriesDocument5 pagesGodrej Industriesshashank sagarNo ratings yet

- R D Offlc Mbic Oad, Va o A 3 003: of MaDocument10 pagesR D Offlc Mbic Oad, Va o A 3 003: of MaRavi AgarwalNo ratings yet

- MM Q3 F22 Financial Results PackDocument12 pagesMM Q3 F22 Financial Results PackBharathNo ratings yet

- Emami PNLDocument1 pageEmami PNLsZCCSZcNo ratings yet

- Appendices PDFDocument2 pagesAppendices PDFMohammed FazlullahNo ratings yet

- ตารางเหล็กDocument41 pagesตารางเหล็กสิทธิชัย หอมจรรย์No ratings yet

- Enduring ValueDocument6 pagesEnduring ValueMandeep BatraNo ratings yet

- Mehran Sugar Mills - Six Years Financial Review at A GlanceDocument3 pagesMehran Sugar Mills - Six Years Financial Review at A GlanceUmair ChandaNo ratings yet

- Kingston Educational Institute: Ratio AnalysisDocument1 pageKingston Educational Institute: Ratio Analysisdhimanbasu1975No ratings yet

- ITC Financial Result Q1 FY2024 SfsDocument3 pagesITC Financial Result Q1 FY2024 SfsAlricNo ratings yet

- Projections 20.11.20Document7 pagesProjections 20.11.20Pawan GuptaNo ratings yet

- Final F.M.Document12 pagesFinal F.M.avismlNo ratings yet

- Balance Sheet of Kansai Nerolac PaintsDocument5 pagesBalance Sheet of Kansai Nerolac Paintssunilkumar978No ratings yet

- ResultsDocument5 pagesResultssanjayvichare2020No ratings yet

- Kim's Trade Summary and StatisticsDocument11 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- Wip Ro Key Financial Ratios - in Rs. Cr.Document4 pagesWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshNo ratings yet

- Unit Cost Comparision Table 2023-24 Vs 2022-23Document1 pageUnit Cost Comparision Table 2023-24 Vs 2022-23Karthikeyan RajamanickamNo ratings yet

- Web Standalone Sep23Document7 pagesWeb Standalone Sep23coolstiffler08No ratings yet

- HDFC Bank Annual Report 2009 10Document137 pagesHDFC Bank Annual Report 2009 10yagneshroyalNo ratings yet

- Daily DiagnosticsDocument7 pagesDaily DiagnosticsMohamed Abdel-Kader BeïdNo ratings yet

- ITC Financial Result Q4 FY2021 CfsDocument8 pagesITC Financial Result Q4 FY2021 CfsKaushik ViswanathanNo ratings yet

- Phần 1: Từ Số Liệu Ở Bảng 3 Và Bảng 4, Viết Phương Trình Biến Trạng Thái Hệ Xe - Lò Xo TheoDocument2 pagesPhần 1: Từ Số Liệu Ở Bảng 3 Và Bảng 4, Viết Phương Trình Biến Trạng Thái Hệ Xe - Lò Xo TheoNguyễnAnhDuyNo ratings yet

- Emami BSDocument1 pageEmami BSsZCCSZcNo ratings yet

- 2.0 MR01 - Jan 2015 Total Project Cost - Overall Summary WO Fee FOREX Below TotalDocument1 page2.0 MR01 - Jan 2015 Total Project Cost - Overall Summary WO Fee FOREX Below TotalWilmer Lapa QuispeNo ratings yet

- Financial Analysis 2 - ScribdDocument6 pagesFinancial Analysis 2 - ScribdSanjay KumarNo ratings yet

- Results Final - CastedDocument4 pagesResults Final - CastedMan Mohan KalitaNo ratings yet

- ActualRH Jan09Document2 pagesActualRH Jan09mtagossipNo ratings yet

- MM Evaluation - Expected Result - Final Reviewed by KRXDocument46 pagesMM Evaluation - Expected Result - Final Reviewed by KRXVinh TranNo ratings yet

- Webinar 6 - EPS ModelDocument10 pagesWebinar 6 - EPS ModelJeniffer RayenNo ratings yet

- WB Grading Summary ReportDocument5 pagesWB Grading Summary ReportrohmanNo ratings yet

- Pe RatiosDocument6 pagesPe RatiosRakesh SharmaNo ratings yet

- T Hi Liv S: - Ouc NG e OverDocument9 pagesT Hi Liv S: - Ouc NG e OverRavi AgarwalNo ratings yet

- 32 - Akshita - Sun Pharmaceuticals Industries.Document36 pages32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaNo ratings yet

- Sebi Release EditDocument2 pagesSebi Release Editkarthikpranesh7No ratings yet

- Suhail Assigment 1Document7 pagesSuhail Assigment 1Suhail AshrafNo ratings yet

- ITC Financial Result Q4 FY2022 SfsDocument6 pagesITC Financial Result Q4 FY2022 SfsMoksh PorwalNo ratings yet

- Performance Data: Model QAF845Document5 pagesPerformance Data: Model QAF845yr5391917No ratings yet

- Fem CareDocument16 pagesFem Careapi-3702531No ratings yet

- Kovai Medical Center and Hospital Limited: PartlcularsDocument2 pagesKovai Medical Center and Hospital Limited: PartlcularsVickyNo ratings yet

- National Advisory Committee On Accounting Standards: IND AS 116 - New Accounting Lease StandardDocument7 pagesNational Advisory Committee On Accounting Standards: IND AS 116 - New Accounting Lease StandardShubham VermaNo ratings yet

- Unit Cost Comparision Table 2023-24 Vs 2022-23Document1 pageUnit Cost Comparision Table 2023-24 Vs 2022-23Karthikeyan RajamanickamNo ratings yet

- Ar Fy11Document132 pagesAr Fy11Raj WorkNo ratings yet

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDocument6 pagesCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaNo ratings yet

- Standalone Result Mar23Document9 pagesStandalone Result Mar23Amit KumarNo ratings yet

- Experimental Data - Data AnalysisDocument3 pagesExperimental Data - Data AnalysiszakiNo ratings yet

- 3.1.projected Balance SheetDocument1 page3.1.projected Balance Sheetdhimanbasu1975No ratings yet

- High-Performance Gradient Elution: The Practical Application of the Linear-Solvent-Strength ModelFrom EverandHigh-Performance Gradient Elution: The Practical Application of the Linear-Solvent-Strength ModelNo ratings yet

- Introduction To Programming University of SiegenDocument3 pagesIntroduction To Programming University of SiegenHisham SyedNo ratings yet

- Annual KSM DataDocument5 pagesAnnual KSM DataHisham SyedNo ratings yet

- Admission Form 2018 2019Document4 pagesAdmission Form 2018 2019Hisham SyedNo ratings yet

- My ApplicationDocument4 pagesMy ApplicationHisham SyedNo ratings yet

- Annual KSM DataDocument6 pagesAnnual KSM DataHisham SyedNo ratings yet

- RainCycle Water EngineeringDocument4 pagesRainCycle Water EngineeringHisham SyedNo ratings yet

- 1 s2.0 S2211812814004180 MainDocument8 pages1 s2.0 S2211812814004180 MainHisham SyedNo ratings yet

- Terms & ConditionsDocument3 pagesTerms & ConditionsHisham SyedNo ratings yet

- Dig Uet 2013Document8 pagesDig Uet 2013Hisham SyedNo ratings yet

- J Tws 2014 09 009 PDFDocument9 pagesJ Tws 2014 09 009 PDFHisham SyedNo ratings yet

- Machine Control SystemsDocument9 pagesMachine Control SystemsHisham SyedNo ratings yet

- Innovation Management and Global CompetitivenessDocument76 pagesInnovation Management and Global CompetitivenessKristina KasalovaNo ratings yet

- Acca Aa Audit and Assurance: Control ActivitiesDocument8 pagesAcca Aa Audit and Assurance: Control ActivitiesIssa Boy100% (1)

- KikabiDocument35 pagesKikabiKikabiNo ratings yet

- Accounting For Government and Non Profit Organizations - ASSESSMENTSDocument21 pagesAccounting For Government and Non Profit Organizations - ASSESSMENTSArn KylaNo ratings yet

- Nota Semanal PerúDocument157 pagesNota Semanal PerúROSMERY MARCELO SOSANo ratings yet

- 21-Health, Safety & Environment PolicyDocument1 page21-Health, Safety & Environment Policyfdfddf dfsdfNo ratings yet

- Name: Dansel Rose Ambrocio Section: BSMA 1ADocument3 pagesName: Dansel Rose Ambrocio Section: BSMA 1AKasdeya CentrescaNo ratings yet

- Bahrain: AMB Country Risk ReportDocument4 pagesBahrain: AMB Country Risk ReportaakashblueNo ratings yet

- Accounting Document Is Not Being Created in Transaction Code J1AZ With 'Don't Post To MM' Flag Checked in The Inflation MethodDocument2 pagesAccounting Document Is Not Being Created in Transaction Code J1AZ With 'Don't Post To MM' Flag Checked in The Inflation Methodirfan aliNo ratings yet

- Altisource IIM A JDDocument2 pagesAltisource IIM A JDBipin Bansal AgarwalNo ratings yet

- Process CostingDocument4 pagesProcess CostingVidia ProjNo ratings yet

- Market Segmentation: Presented By:-Harsh Inani Roll No.: - 18014 G.H.P.I.B.MDocument27 pagesMarket Segmentation: Presented By:-Harsh Inani Roll No.: - 18014 G.H.P.I.B.MHarsh InaniNo ratings yet

- Hearing: U.S. Trade With ChinaDocument154 pagesHearing: U.S. Trade With ChinaScribd Government DocsNo ratings yet

- DedDocument23 pagesDedasdasdaNo ratings yet

- Budgeting NotesDocument3 pagesBudgeting NotesVivek KavtaNo ratings yet

- Strategic Management of Pakistan State Oil (PsoDocument8 pagesStrategic Management of Pakistan State Oil (PsoKhalid Khan100% (1)

- Microeconomics - 2022 - Session 5 - Sent - KDDocument60 pagesMicroeconomics - 2022 - Session 5 - Sent - KDSarthak KhoslaNo ratings yet

- CV Karol October 2014Document2 pagesCV Karol October 2014KarolBonatiNo ratings yet

- What Is Brexit?Document5 pagesWhat Is Brexit?anon_285948065No ratings yet

- American Economic Association The American Economic ReviewDocument10 pagesAmerican Economic Association The American Economic ReviewkNo ratings yet

- Puja Kumari Pandey MRP PresentationDocument17 pagesPuja Kumari Pandey MRP PresentationSAKET RATHI IPS Academy IndoreNo ratings yet

- Global Manufacturing of VolkswagenDocument3 pagesGlobal Manufacturing of Volkswagennarmin mammadli0% (1)

- Final Ac Problem1Document12 pagesFinal Ac Problem1Pratap NavayanNo ratings yet

- Eandis - Financing The Roll Out of Smart Meters in A Regulated EnvironmentDocument6 pagesEandis - Financing The Roll Out of Smart Meters in A Regulated EnvironmentRavi DhakarNo ratings yet

- Account Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRajwinder SandhuNo ratings yet

- Pautang AuditDocument4 pagesPautang AuditWyeth Earl Padar EndrianoNo ratings yet

- Arrighi, G. - The Long Twentieth Century (Int e 3.4)Document55 pagesArrighi, G. - The Long Twentieth Century (Int e 3.4)Day Mika'sNo ratings yet

- RBI and Its Control Over BanksDocument10 pagesRBI and Its Control Over BanksHarshad PatilNo ratings yet