Professional Documents

Culture Documents

Chapter 2

Chapter 2

Uploaded by

cindyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2

Chapter 2

Uploaded by

cindyCopyright:

Available Formats

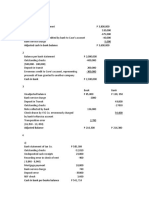

Shelt Company has the following account balances at

year-end:

Accounts receivable P80,000

Allowance for doubtful accounts 4,800

Sales discounts 3,200

Shelt should report accounts receivable at a net

amount of

The correct answer is:

P75,200

During the second year of operations, Fauna Company found itself in

financial difficulties. The entity decided to use accounts receivable as

a means of obtaining cash to continue operations.

On July 1, 2020, Fauna sold P1,500,000 of accounts receivable for

cash proceeds of P1,390,000. No bad debts allowance was associated

with these accounts.

On December 15, 2020, Fauna assigned the remainder of the accounts

receivable, P5,000,000 as collateral on a P2,500,000, 12% annual

interest rate loan. It received P2,500,000 less a 2% finance charge.

None of the assigned accounts had been collected by the end of the

year. Below is additional information:

Allowance for bad debts before adjustment, 12/31/2020 100,000

Estimated uncollectible,12/31/2020 10% of accounts receivable

Accounts receivable, not including factored and assigned 1,000,000

accounts, 12/31/2020

Accounts receivable, assigned 5,000,000

Accounts receivable, factored 1,500,000

Required: Answer the following questions:

1. What is the total amount of cash received from the financing of

accounts receivable during the current year? [3,840,000]

2. What total amount of accounts receivable should be reported as

current assets on December 31,2020? [6,000,000]

3. What is the bad debt expense for the current year? [500,000]

Wing Corp. has outstanding accounts receivable

totaling P2.54 million as of December 31 and sales on

credit during the year of P12.8 million. There is also a

debit balance of P6,000 in the allowance for doubtful

accounts. If the company estimates that 1% of its net

credit sales will be uncollectible, what will be the

balance in the allowance for doubtful accounts after

the year-end adjustment to record bad debt expense?

The correct answer is:

P122,000

On April 1, 2020, Alyjan Company discounted with recourse a 9-

month, 10% note dated January 1, 2020, with a face amount of

P6,000,000. The bank discount rate is 12%. The discounting

transaction is accounted for as a conditional sale with recognition of

contingent liability.

On October 1, 2020, the maker dishonored the note receivable. Alyjan

paid the maturity value of the note plus protest fee of P50,000 to the

bank, and charged the whole amount to the maker.

On December 31, 2020, Alyjan collected the dishonored note

receivable in full plus 12% annual interest on the total amount due.

Required: Solve the problem manually on paper. picture and upload

as part of your requirement. On every page, write your name, section,

problem number. Answer the following questions:

1. What amount was received from the note receivable discounting on

April 1, 2020? [6,063,000]

2. What amount should be recognized as loss on note receivable

discounting? [87,000]

3. What is the total amount collected from the customer on December

31, 2020? [6,695,000]

4. If the discounting is secured borrowing, what is included in the

journal entry to record the transaction? [Debit Interest Expense,

P87,000]

Ace Inc. made a P10,000 sale on account with the following terms:

1/15, n/30.

Answer the following questions:

a. If the company uses the net method to record sales made on credit,

how much should be recorded as sales revenue? [P 9,900]

b. If the company uses the gross method to record sales made on

credit, what is/are the debit(s) in the journal entry to record the

sale? [Debit Accounts Receivable for P10,000]

c. Credit terms are now: 2/10, n/30. If the company uses the net

method to record sales made on credit , what is/are the debit(s) in the

journal entry to record the sale? [Debit Accounts Receivable for

P9,800]

Etrain Roads sold P50,000 of goods and accepted the customer’s

P50,000 10%

1-year note receivable in exchange. Assuming 10% approximates the

market rate of return,

a. what would be the debit in this journal entry to record the sale?

[Debit Notes Receivable for P50,000]

b. how much interest would be recorded for the year ending December

31 if the sale was made on June 30? [P2,500]

On February 1, 2020, Henson Company factored receivables with a

carrying amount of P300,000 to Agee Company. Agee Company

assesses a finance charge of 3% of the receivables and retains 5% of the

receivables. Relative to this transaction, you are to determine the

amount of loss on sale to be reported in the income statement of

Henson Company for February.

a. Assume that Henson factors the receivables on a without guarantee

(recourse) basis. The loss to be reported is [P9,000]

b. Assume that Henson factors the receivables on a with guarantee

(recourse) basis. The amount of cash received is [P276,000]

Ding Corp. has outstanding accounts receivable totaling P3 million

as of December 31 and sales on credit during the year of P15 million.

There is also a debit balance of P12,000 in the allowance for

doubtful accounts. If the company estimates that 8% of its

outstanding receivables will be uncollectible, what will be the

balance in the allowance for doubtful accounts after the year-end

adjustment to record bad debt expense?

The correct answer is:

P 240,000

Ming Corp. has outstanding accounts receivable

totaling P6.5 million as of December 31 and sales on

credit during the year of P24 million. There is also a

credit balance of P12,000 in the allowance for

doubtful accounts. If the company estimates that 8%

of its outstanding receivables will be uncollectible,

what will be the amount of bad debt expense

recognized for the year?

The correct answer is:

P 508,000

Lester Company received a seven-year zero-interest-

bearing note on February 22, 2019, in exchange for

property it sold to Peter Company. There was no

established exchange price for this property and the

note has no ready market. The prevailing rate of

interest for a note of this type was 7% on February 22,

2019, 7.5% on December 31, 2019, 7.7% on February

22, 2020, and 8% on December 31, 2020. What

interest rate should be used to calculate the interest

revenue from this transaction for the years ended

December 31, 2019 and 2020, respectively?

The correct answer is:

7% and 7%

On January 1, 2019, West Co. exchanged equipment

for a P400,000 zero-interest-bearing note due on

January 1, 2022. The prevailing rate of interest for a

note of this type at January 1, 2019 was 10%. The

present value of P1 at 10% for three periods is 0.75.

What amount of interest revenue should be included

in West’s 2020 income statement?

The correct answer is:

P33,000

P400,000 × .75 = P300,000 present value

P300,000 × .10 = P30,000 (2019 interest)

(P300,000 + P30,000) × .10 = P33,000 (2020 interest).

SoldBank loaned P 5,000,000 to a borrower on January 1, 2018. The

terms of the loan require principal payments of P1,000,000 each year

for 5 years plus interest at 8%. The first principal and interest payment

are due on January 1, 2019. The borrower made the required

payments during 2019 and 2020.

However, during 2020, the borrower began to experience financial

difficulties, requiring the bank to reassess the collectibility of the loan.

On December 31, 2020, the bank has determined that the remaining

principal payment will be collected as originally scheduled but he

collection of the interest is unlikely. The bank did not accrue the

interest on December 31, 2020.

Present value of P1 at 8%

For one period - 0.926; two periods – 0.857; three periods – 0.794

Required: Solve the problem manually on paper, picture and upload

as part of your requirement. On every page, write your name,

section, problem number. Answer the following questions:

1. What is the impairment loss for 2020? [217,000]

2. What is the interest income for 2021? [142,640]

3. What is the carrying amount of the receivable on December 31,

2021? [1,925,640]

On January 1, 2020, Abe Company sold an equipment with a carrying

amount of P800,000, receiving a non-interest bearing note due in

three years with a face amount of P1,000,000. There is no established

market value for the equipment.

The interest rate for similar obligations is 12%. The present value of 1

at 12% for three periods is 0.712.

Required: Solve the problem manually on paper. picture and upload

as part of your requirement. On every page, write your name,

section, problem number. Answer the following questions:

1. Amount of gain or loss on the sale of equipment in 2020 [88,000

loss]

2. Reported Interest revenue for 2020 [85,440]

3. Carrying value of note receivable on December 31,

2020 [797,440]

4. Reported Interest revenue for 2021 [95,693]

5. Entry in 2020 will include a [Debit to Notes receivable]

6. Classification of Notes Receivable in the Statement of Financial

Position in 2020 [Noncurrent asset]

Before year-end adjusting entries, Dunn Company’s

account balances at December 31, 2020, for accounts

receivable and the related allowance for uncollectible

accounts were P600,000 and P45,000, respectively.

An aging of accounts receivable indicated that

P62,500 of the December 31 receivables are expected

to be uncollectible. The net realizable value of

accounts receivable after adjustment is

The correct answer is:

P537,500

Sun Inc assigns P2,000,000 of its accounts receivables as collateral

for a P1 million 8% loan with a bank. Sun Inc. also pays a finance fee

of 1% on the transaction upfront. What would be recorded as a gain

(loss) on the transfer of receivables?

The correct answer is:

P0

Lion Company has the following account balances at year-end:

Accounts receivable - P 60,000; Allowance for doubtful

accounts - 3,600; Sales discounts - 2,400

Lion should report accounts receivable at a net amount of

The correct answer is:

P 56,400.

Sun Inc. factors P2,000,000 of its accounts receivables with

guarantee (recourse) for a finance charge of 3%. The finance

company retains an amount equal to 10% of the accounts receivable

for possible adjustments. What would be recorded as a gain (loss)

on the transfer of receivables?

The correct answer is: P0

At the close of its first year of operations, December 31, 2020, Sing

Company had accounts receivable of P540,000, after deducting the

related allowance for doubtful accounts. During 2020, the company

had charges to bad debt expense of P90,000 and wrote off, as

uncollectible, accounts receivable of P40,000. What should the

company report on its statement of financial position at December

31, 2020, as accounts receivable before the allowance for doubtful

accounts?

The correct answer is:

P590,000

Sun Inc. factors P2,000,000 of its accounts

receivables without guarantee (recourse) for a finance

charge of 5%. The finance company retains an amount

equal to 10% of the accounts receivable for possible

adjustments. What would be recorded by Sun as a

gain (loss) on the transfer of receivables?

The correct answer is:

Loss of P100,000

You might also like

- PS-2 (Proof of Cash)Document1 pagePS-2 (Proof of Cash)jazonvaleraNo ratings yet

- Inventory Estimation and LCNRV Sample ProblemsDocument3 pagesInventory Estimation and LCNRV Sample Problemsaldric taclanNo ratings yet

- RecvbleDocument24 pagesRecvbleJoseph Salido100% (1)

- Amado Carrillo Fuentes - The Killer Across The River by Charles BowdenDocument16 pagesAmado Carrillo Fuentes - The Killer Across The River by Charles BowdenChad B Harper100% (1)

- Mastering Apache SparkDocument1,044 pagesMastering Apache SparkArjun Singh100% (6)

- F5 Exam P2 QuestionsDocument5 pagesF5 Exam P2 QuestionsTrevor G. Samaroo100% (3)

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- MidtermsDocument8 pagesMidtermsRhea BadanaNo ratings yet

- PAS 36 Concept MapDocument1 pagePAS 36 Concept MapMicah RamaykaNo ratings yet

- Cash AssignmentDocument2 pagesCash AssignmentRocelyn OrdoñezNo ratings yet

- Notes ReceiDocument2 pagesNotes ReceiDIANE EDRANo ratings yet

- ACC 101 - 3rd QuizDocument3 pagesACC 101 - 3rd QuizAdyangNo ratings yet

- 13 Acctg Ed 1 - Loan ReceivableDocument17 pages13 Acctg Ed 1 - Loan ReceivableNath BongalonNo ratings yet

- Accounting Textbook Solutions - 52Document19 pagesAccounting Textbook Solutions - 52acc-expert0% (1)

- Notes Receivable - Ia 1Document4 pagesNotes Receivable - Ia 1Aldrin CabangbangNo ratings yet

- Class Handout On Inventory Nov 4Document4 pagesClass Handout On Inventory Nov 4De MarcusNo ratings yet

- Loans ReceivableDocument1 pageLoans ReceivableJanidelle Swiftie67% (3)

- Problem Set 2Document4 pagesProblem Set 2Michael Jay LingerasNo ratings yet

- Assignment No. 2 (Solution)Document5 pagesAssignment No. 2 (Solution)Christine MalayoNo ratings yet

- Financial Accounting - ReceivablesDocument7 pagesFinancial Accounting - ReceivablesKim Cristian MaañoNo ratings yet

- Intacc 1a Reviewer Conceptual Framework and Accounting StandardsDocument32 pagesIntacc 1a Reviewer Conceptual Framework and Accounting StandardsKatherine Cabading InocandoNo ratings yet

- Assessment Task 1-1Document10 pagesAssessment Task 1-1hahahahaNo ratings yet

- (03A) AR NR Quiz ANSWER KEYDocument8 pages(03A) AR NR Quiz ANSWER KEYKhai Ed PabelicoNo ratings yet

- Test I - Multiple Choice - TheoryDocument6 pagesTest I - Multiple Choice - Theorycute meNo ratings yet

- Financial Assets at Fair Value (Investments) Basic ConceptsDocument2 pagesFinancial Assets at Fair Value (Investments) Basic ConceptsMonica Monica0% (1)

- Reviewer Controlling Cash Part 1Document6 pagesReviewer Controlling Cash Part 1Mikey Irwin0% (2)

- Financial Accounting Review Problem 1Document16 pagesFinancial Accounting Review Problem 1YukiNo ratings yet

- Property, Plant and EquipmentDocument40 pagesProperty, Plant and EquipmentNatalie SerranoNo ratings yet

- Intermediate Accounting - Final Output ReceivablesDocument56 pagesIntermediate Accounting - Final Output ReceivablesAnitas LimmaumNo ratings yet

- Opening Entries (Partnership Books) : (80 000 X 10%) Decrease in Allowance 72 000Document3 pagesOpening Entries (Partnership Books) : (80 000 X 10%) Decrease in Allowance 72 000AAAAANo ratings yet

- 1-1-2017 Petty Cash FundDocument4 pages1-1-2017 Petty Cash FundMr. CopernicusNo ratings yet

- Chapter 13 - Gross Profit MethodDocument7 pagesChapter 13 - Gross Profit MethodLorence IbañezNo ratings yet

- P1-01 Cash and Cash EquivalentsDocument5 pagesP1-01 Cash and Cash EquivalentsRachel LeachonNo ratings yet

- P1 Day4 RMDocument15 pagesP1 Day4 RMSharmaine Sur100% (1)

- 1Document19 pages1Angelica Castillo0% (1)

- Fin 1 Valix Chap 6Document24 pagesFin 1 Valix Chap 6Christian SampagaNo ratings yet

- P1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFDocument10 pagesP1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFrandy0% (1)

- Drill - ReceivablesDocument7 pagesDrill - ReceivablesMark Domingo MendozaNo ratings yet

- Acc-106 Sas 3Document12 pagesAcc-106 Sas 3hello millieNo ratings yet

- Chapter 14 - Retail Inventory Method PDFDocument9 pagesChapter 14 - Retail Inventory Method PDFTurksNo ratings yet

- Week 4 - Lesson 4 Cash and Cash EquivalentsDocument21 pagesWeek 4 - Lesson 4 Cash and Cash EquivalentsRose RaboNo ratings yet

- Parcor ExamDocument2 pagesParcor ExamRose Ann GarciaNo ratings yet

- Padernal BSA 1A SW Problem 3 11Document1 pagePadernal BSA 1A SW Problem 3 11Fly ThoughtsNo ratings yet

- 03 Cash and Cash Equivalents (Student)Document27 pages03 Cash and Cash Equivalents (Student)Christina Dulay50% (2)

- BANK RECON and PROOF OF CASHDocument2 pagesBANK RECON and PROOF OF CASHJay-an AntipoloNo ratings yet

- 05 Notes ReceivableDocument8 pages05 Notes Receivablesharielles /No ratings yet

- GEN 010 For BSA INVESTMENTS IN ASSOCIATESDocument6 pagesGEN 010 For BSA INVESTMENTS IN ASSOCIATESShamuel AlasNo ratings yet

- Name: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTDocument3 pagesName: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTYricaNo ratings yet

- Integrated Topic 1 (Far-004a)Document4 pagesIntegrated Topic 1 (Far-004a)lyndon delfinNo ratings yet

- Christian Paul D. Legaspi Easy Problem 1, CCEDocument16 pagesChristian Paul D. Legaspi Easy Problem 1, CCELyca Mae CubangbangNo ratings yet

- Chapter 13Document2 pagesChapter 13Jomer FernandezNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- Long Quiz in Intermediate Accounting 1 PART 1aDocument4 pagesLong Quiz in Intermediate Accounting 1 PART 1aGillian mae Garcia0% (2)

- Actg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizDocument4 pagesActg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizMarilou Arcillas PanisalesNo ratings yet

- ACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - NOTES AND LOANS RECEIVABLE QUIZDocument6 pagesACTG 431 QUIZ Week 2 Theory of Accounts Part 2 - NOTES AND LOANS RECEIVABLE QUIZMarilou Arcillas PanisalesNo ratings yet

- Chapter 3 - Bank ReconciliationDocument2 pagesChapter 3 - Bank ReconciliationJerome_JadeNo ratings yet

- AE 111 Final Summative Assessment 2Document3 pagesAE 111 Final Summative Assessment 2Djunah ArellanoNo ratings yet

- Activity 2 - ReceivableDocument2 pagesActivity 2 - ReceivableMa. Alexandra Teddy Buen0% (1)

- Quiz 2 AuditingDocument18 pagesQuiz 2 Auditingaldrin elsisuraNo ratings yet

- Answer Key - M1L2 PDFDocument4 pagesAnswer Key - M1L2 PDFEricka Mher IsletaNo ratings yet

- Correct!: Accrued and DisclosedDocument111 pagesCorrect!: Accrued and DisclosedJaeNo ratings yet

- ACCTGREV1 - 002 Notes Payable and RestructuringDocument2 pagesACCTGREV1 - 002 Notes Payable and RestructuringRenz Angel M. RiveraNo ratings yet

- Applied Economics Module 3 Q1Document21 pagesApplied Economics Module 3 Q1Jefferson Del Rosario100% (1)

- Is 3594 Fire Safety of Industrial Buildings General-Storage Ware HouseDocument11 pagesIs 3594 Fire Safety of Industrial Buildings General-Storage Ware HouseRamakrishna AgumbeNo ratings yet

- Primary School Planner Second Year of English: 11 - 20 WordsearchDocument0 pagesPrimary School Planner Second Year of English: 11 - 20 WordsearchJunaidi HamdiNo ratings yet

- Market Composition and Performance of Firms in Broiler, Chicken Egg, and Swine Production - Implications To The Philippine Competition ActDocument17 pagesMarket Composition and Performance of Firms in Broiler, Chicken Egg, and Swine Production - Implications To The Philippine Competition ActAshlley Nicole VillaranNo ratings yet

- Bricked N910FDocument2 pagesBricked N910FPhan Mem Tien ÍchNo ratings yet

- 5 ABB Cigre Jornadas Tecnicas FCLDocument35 pages5 ABB Cigre Jornadas Tecnicas FCLmayalasan1No ratings yet

- Research Methods For Commerce Lab Practical File "BRM Lab" BBA (M1) - BBA 213Document67 pagesResearch Methods For Commerce Lab Practical File "BRM Lab" BBA (M1) - BBA 213Mankeerat Singh ChannaNo ratings yet

- Exercises No 1: Exercise 1Document6 pagesExercises No 1: Exercise 1M ILHAM HATTANo ratings yet

- Multiparametric Investigation of Thermal Limitations in A Rapid-Fire Multirail Railgun Powered by A Pulsed MHD GeneratorDocument5 pagesMultiparametric Investigation of Thermal Limitations in A Rapid-Fire Multirail Railgun Powered by A Pulsed MHD GeneratorSaravana Kumar M NNo ratings yet

- Lapczyk PDFDocument22 pagesLapczyk PDFFredy PicaulyNo ratings yet

- CHUYÊN ĐỀ CHỈ SỰ NHƯỢNG BỘDocument5 pagesCHUYÊN ĐỀ CHỈ SỰ NHƯỢNG BỘĐinh DuyênNo ratings yet

- SDocument8 pagesSdebate ddNo ratings yet

- NBA 2K12 Ext Manual Wii FinalDocument10 pagesNBA 2K12 Ext Manual Wii FinalEthan TampusNo ratings yet

- اختبار الوزن النوعي و امتصاص الماء لركامDocument78 pagesاختبار الوزن النوعي و امتصاص الماء لركامحسين المهندسNo ratings yet

- Manual de Instalación - Tableros Centro de Carga - Marca GEDocument4 pagesManual de Instalación - Tableros Centro de Carga - Marca GEmariana0% (1)

- Supercapacitor Important File2Document53 pagesSupercapacitor Important File2Mina YoussefNo ratings yet

- So Sánh Interbrand V I Millward BrownDocument11 pagesSo Sánh Interbrand V I Millward BrownHồng NhungNo ratings yet

- Strand A Ilp Lesson PlanDocument3 pagesStrand A Ilp Lesson PlanyoNo ratings yet

- The Psychological Aspects of Cinematography and Its ImpactDocument21 pagesThe Psychological Aspects of Cinematography and Its Impactanastasiapiven7No ratings yet

- American Heart Association PPT - AIHA Webinar - FinalDocument49 pagesAmerican Heart Association PPT - AIHA Webinar - FinalVina WineNo ratings yet

- Special Conditions of Contract (SCC) : Section - VDocument16 pagesSpecial Conditions of Contract (SCC) : Section - VAnonymous 7ZYHilDNo ratings yet

- Sucker Rod Elevators (25-Ton)Document1 pageSucker Rod Elevators (25-Ton)CESAR SEGURANo ratings yet

- Fructin PDFDocument1 pageFructin PDFSaifur Rahman SuzonNo ratings yet

- 00 Introduction To Aviation TranscriptDocument9 pages00 Introduction To Aviation TranscriptAvtechNo ratings yet

- E W Hildick - (McGurk Mystery 05) - The Case of The Invisible Dog (siPDF) PDFDocument132 pagesE W Hildick - (McGurk Mystery 05) - The Case of The Invisible Dog (siPDF) PDFTheAsh2No ratings yet

- GSPI-QA of Teaching Staff-Draft3Document43 pagesGSPI-QA of Teaching Staff-Draft3Tempus WebsitesNo ratings yet

- An Innovative Method To Increase The Resolution of Optical EncodersDocument6 pagesAn Innovative Method To Increase The Resolution of Optical EncodersFuadMuzaki09No ratings yet