Professional Documents

Culture Documents

Quizzes - Miidter Module - Income Taxation

Quizzes - Miidter Module - Income Taxation

Uploaded by

Lorna Ignacio GuiwanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quizzes - Miidter Module - Income Taxation

Quizzes - Miidter Module - Income Taxation

Uploaded by

Lorna Ignacio GuiwanCopyright:

Available Formats

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

Quiz 1 – Dealings in Properties

1. Statement 1: Capital losses are deductible from ordinary gains but net capital loss is not deductible from

ordinary gains

Statement 2: Ordinary losses are deductible only to the extent of the capital gains but the net capital

loss is not deductible from ordinary gai n.

a) True, True

b) True, False

c) False, True

d) False, False

Answer

Explanation

Net capital gains are added to ordinary gains. However, If the result is a net capital loss, such

loss can only be deducted from the capital gain. This is to ensure that only costs or expenses

incurred in earning the income shall be deductible for income tax purposes consonant with

the requirement of the law that only necessary expenses are allowed as deductions from

gross income.

An ordinary loss is fully deductible to offset income thereby reducing the tax owed by a

taxpayer.

2. Which of the following is a capital asset?

a) A residential land previously foreclosed by PNB and is now being offered for sale to the public

b) A commercial building foreclosed by a lending institution

c) A 10-door apartment unit owned by a retired government employee

d) A residential land owned by a practicing CPA

Answer

Explanation

A residential land owned by a practicing CPA, it is a real property of the CPA owner and it is not

used in trade or business or held for sale by the tax payer and it is called a capital asset.

3. Vincent sold a residential house and lot held for P10,000,000 to his friend. Its FMV, when he inherited it

from his father was P12,000,000 although its present FMV is P15,000,000. The tax on the above

transaction is:

a) P720,000 capital gains tax

b) P900,000 capital gains tax

c) 30% donor’s tax

d) Value added tax

Answer

Explanation

Selling Price or FMV P15,000,000

Taxable rate x 6%

P 900,000

TAXABLE BASE IS THE SELLING PRICE OR FMV WHICHEVER IS HIGHER VALUE.

4. Mike, a resident citizen taxpayer owns a property converted into apartment units with a monthly rental

of P10,000 per unit. He subsequently sold the property to Leomar, a resident alien taxpayer. The sale

shall be subject to:

a) 6% capital gains tax

b) Basic income tax

c) 6% capital gains tax or basic income tax at the option of Mike

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

1|P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

d) 6% capital gains tax or basic income tax at the option of Leomar

ANSWER

EXPLANATION

THE SALE SUBJECT TO BASIC INCOME TAX , FOR THE REASON THAT MIKE A RESIDENT CITIZEN

AND HIS PROPERTY, AS HIS SOURCE OF PASSIVE INCOME WHICH IS THE APARTMENT IT IS

SITUATED IN THE PHILIPPINES. AND PROPERTY SOLD TO RESIDENT ALIEN AND THE TRANSACTION

DONE IN THE PHILIPPINES.

5. Which of the following sale transactions will be subject to capital gains tax?

a) Sale of shares of stock by a dealer in securities

b) Sale of shares of stock during an Initial Public Offering

c) Sale of shares of stock not through the local stock exchange by a person who is not a dealer in

securities

d) Sale of shares of stock through the local stock exchange by a person who is not a dealer in

securities.

ANSWER

EXPLANATION

Sale of shares of stock not through the local stock exchange by a person who is not a dealer in

securities, it is subject to capital gain tax and it is a share that sold directly to the buyer and to the

local stock exchange.

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from

the sale, exchange, or other disposition of capital assets located in the Philippines, including pacto

de retro sales and other forms of conditional sale.

6. Statement 1: Proceeds of sale of real property classified as capital asset may be exempt from the 6%

capital gains tax

Statement 2: Gain from sale of real property classified as capital asset to the Government may be taxed

under Section 24 (A) at the option the individual taxpayer

a) Only statement 1 is correct

b) Only statement 2 is correct

c) Both statements are correct

Answer

Explanation

Final Capital Gains Tax Return (For Onerous Transfer of Real Property Classified as Capital Assets

-Taxable and Exempt).

"(2) Exception. - The provisions of paragraph (1) of this Subsection to the contrary

notwithstanding, capital gains presumed to have been realized from the sale or disposition of

their principal residence by natural persons, the proceeds of which is fully utilized in acquiring

or constructing a new principal residence within eighteen (18) calendar months from the date

of sale or disposition, shall be exempt from the capital gains tax imposed under this

Subsection.

7. On September 30, 2020, Juan sold a piece of land to Pedro who correctly computed the applicable gains

tax of P1,440,000 on the transaction. The latter withheld the applicable capital gains tax and remitted

the same to the BIR before the statutory deadline. The selling price of land is P20,000,000. Which of the

following is not correct?

a) The fair market value of the land is P24,000,000

b) Juan received cash of P18,560,000 from Pedro

c) Juan applied the tax rate to the fair market value of the land, not to its selling price of

P20,000,000.

d) The land sold by Juan is classified as an ordinary asset.

Answer

Explanation

The land sold by Juan is classified as an ordinary asset, is not correct.

And theres no computation of the said statement of the problem.

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

2|P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

8. Which capital asset is not subject to regular taxes?

a) Real property held for sale by a dealer

b) Real property held as investment by a non-realty dealer

c) Domestic stocks held by a security dealer

d) Foreign stocks

Answer

Explanation

Real property held as investment by a non-realty dealer, it is a capital asset but not subject to regular

tax.

Capital assets shall refer to all real properties held by a taxpayer, whether or not connected with his

trade or business, and which are not included among the real properties considered as ordinary assets

under Sec. 39(A)(1) of the Code

9. Which of the following is subject to P6% of capital gains tax?

a) Sale of condominium units by a real estate dealer

b) Sale of real property utilized for Office use

c) Sale of apartment houses

d) Sale of vacant lot by employee

Answer

Explanation

Sale of vacant lot by employee it imposed on the gain presumed to have been realized on the

sale, exchange or disposition of lands and/or buildings which are not actually used in the

business of a corporation and are treated as capital assets and it is subject to 6% of capital gain

tax.

10. Josefa provided the following data on the sale of her personal property sold in 2018 held by her for 15

months:

Cost P225,000

Mortgage assumed by buyer 270,000

Installment collection:

2018 67,500

2019 67,500

2020 45,000

How much is the selling price?

a) 450,000

b) 270,000

c) 180,000

d) 225,000

Answer

Explanation

Mortgage assumed by buyer 270,000

Installment collection:

2018 67,500

2019 67,500

2020 45,000

Selling Price P 450,000

11. Based on No. 11, How much is the income subject to income tax in 2018, 2019, and 2020?

a) P56,250, P33,750, and P22,500, respectively

b) P112,500, 67,500 mad P45,000, respectively

c) P225,000, P0 and P0, respectively

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

3|P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

d) None of the above

Answer : bonus

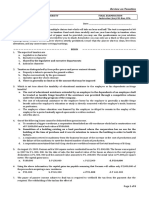

12. A taxpayer had the following dealings in properties

Short term capital gain P200,000

Long term capital gain 100,000

Short term ordinary gain 50,000

Long term ordinary gain 150,000

Short term capital loss 100,000

Long term capital loss 150,000

Short term ordinary loss 200,000

Long term ordinary loss 120,000

Assuming the taxpayer is an individual, compute respectively the total items of gross income and and

the total items deductible from gross income

a) P200,000, P260,000

b) P200,000 P320,000

c) P275,000, P320,000

d) P275,000 260,000

% RECOGNIZED Total recognized as

capital gains/losses

Short term capital gain 200,000 50% 100,000

Long term capital gain 100,000 100% 100,000

Short term capital loss (100,000) 50% (50,000)

Long term capital loss (150,000) 50% (75,000)

Total Net Capital Gains P75,000

as an item to gross

income(To ITR)

Net capital gains (above) 75,000

Short term ordinary gain 50,000

Long term ordinary gain 150,000

Total gross income P275,000

Short term ordinary loss 200,000

Long term ordinary loss 120,000

Total deductions to gross

P320,000

income

13. Ayala Mall Cebu sold its parking lot for P2,000,000. The lot has a zonal value of P2,500,000 and appraisal

value of P1,800,000. The capital gains tax on sale of lot is:

a) 0

b) 108,000

c) 120,000

d) 150,000

Answer.

TAXABLE BASE IS THE SELLING PRICE OR FMV WHICHEVER IS HIGHER VALUE.

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

4|P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

14. Mateo sold his principal residence for P5,000,000. His principal residence was acquired at 200,000,000

and has a fair value of P6,000,000 at the date of sale. within 18 months, he reconstructed a new

principal residence of P4500,000.

a) P270,000

b) P300,000

c) P360,000

d) P0

Answer.

Selling Price or FMV P6,000,000

Taxable rate x 6%

P 360,000

15. Sarah Geronimo is a stock broker and holds 10,000 ordinary stock of San Miguel Corporation, a domestic

corporation, acquired at P100 per share. Her valuation for San Miguel Corporation indicates that San

Miguel’s stocks will decline in the near future. If Sarah sells her stock investment directly to a buyer,

Divine, at P115 per share, how much is the capital gains tax payable on the transaction?

a) P5,000

b) P10,000

c) P5,750

d) P22,500

ANSWER

Selling Price ( 10,000 x 115) P 1,150,000

Cost (10,000 X 100) P 1,000,000

Gross income P150,000

X 15%

CGT PAYABLE P 22,500

Quiz 1 –Individuals

1. A Filipino Citizen is a natural person who is/has

I. Born by birth with father and mother as a Filipino Citizen

II. Born before January 17, 1973 of Filipino mother who elects Philippine citizenship upon reaching

the age of majority

III. Acquired Philippine citizenship after birth (naturalized) in accordance with Philippine laws

a) I only

b) I and II only

c) I and III only

d) I, II and III

Answer

Explanation

All of the following describes the Citizenship of a Filipino, Under Section I, Article III of the Philippine

Constitution

2. Determine the correct classification of the following:

I. Manny, a Filipino businessman, went on a business trip abroad and stayed there most of the

time during the year

II. Kyla, a Filipino professional singer, held a series of concerts in various countries around the

world during the current taxable year. She stayed abroad most of the time during the year

III. Efren, a Filipino “cue” artist went to Canada during the taxable year to train and participate in

the world cup of pool. He stayed there most of the time during the year.

A B C D

a) NRC RC RC RC

b) NRC NRC RC RC

c) NRC NRC NRC RC

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

5|P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

Answer

Explanation

All of the following are correct classification of Resident Citizen , they are still considered as RC for

that taxable year, regardless that they are abroad for work.

3. Rihanna, an American singer, was engaged to sing for one week at the Western Philippine Plaza after

which she returned to USA. For income tax purposes, she shall be classified as:

a) Resident alien

b) Nonresident alien engaged in trade or business

c) Nonresident alien not engaged in trade or business

d) Resident Citizen

Answer

Explanation

Nonresident alien not engaged in trade or business.

Rihana is not a Filipino Citizen and not a resident, she just came for a purpose which is to sing for one

week at the Western Philippine Plaza.

4. Which of the following is correct?

I. A citizen of the Philippines residing therein is taxable on all income derived from sources within

and without the Philippines

II. A non-resident citizen is taxable only on income derived from sources within the Philippines

III. An alien individual, whether a resident or not of the Philippines is taxable only on income

derived from sources within the Philippines

IV. A seaman who is a citizen of the Philippines and who receives compensation for services

rendered abroad as a member of the complement of a vessel engaged in international trade

shall be treated as an overseas contract worker

a) I, II and III only b) I, II and IV only

b) I, III and IV only c) I, II III and IV

Answer

Explanation

Individual Taxpayers are natural persons with income derived from within the territorial jurisdiction

of a taxing authority and Under the Tax Code National Internal Revenue Code of 1997 (NIRC)

5. Which of the following individual taxpayers is taxable on income derived from sources within and

without the Philippines?

a) Pedro, a native of Bacolod City, working as overseas contract worker in Iraq

b) George, naturalized Filipino citizen and married to a Filipina. He had been living in Pampanga

since 1990

c) Pao Gasul, Spanish citizen, a resident of Madrid Spain, spent one-week vacation in Boracay

d) Lee Minho, Korean singer, held a 3-day concert in Manila

Answer

Explanation

George, naturalized Filipino citizen and married to a Filipina. He had been living in Pampanga since

1990. He is taxpayer, and a pure Filipino Citizen , and his source of income just derived only within

the Philippines.

6. Allen, married, with two dependent children, received the following income:

Rent, Philippines P1,000,000

Rent, Hongkong 200,000

Interest, peso deposit, MBTC 100,000

Interest, US$ deposit (BDO $10,000 X P42) 420,000

Interest deposit in Hongkong (HK$10,000 x P5) 50,000

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

6|P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

Prize (cash) won in a local contest 8,000

Prize (TV) won in a local lottery 50,000

PCSO/Lotto winnings 2,000,000

Prize won in contest in US 300,000

Lotto winning in US 100,000

Dividend, domestic company 600,000

Assuming the taxable year is 2018, determine the taxable net income assuming he is:

RC NRC RA NRAETB

a) P80,000 P180,000 P830,000 P180,000

b) 180,000 80,000 1,000,000 1,000,000

c) 1,558,000 908,000 908,000 908,000

d) 1,658,000 1,008,000 1,008,000 1,008,000

Answer

Explanation

RC

Rent, Philippines P1,000,000

Interest deposit in Hongkong (HK$10,000 x P5) 50,000

Rent, Hongkong 200,000

Prize (cash) won in a local contest 8,000

Prize won in contest in US 300,000

Lotto winning in US 100,000

Taxable Net Income P1,658,000

NRC

Rent, Philippines P1,000,000

Prize (cash) won in a local contest 8,000

Taxable Net Income P1,008,000

RA

Rent, Philippines P1,000,000

Prize (cash) won in a local contest 8,000

Taxable Net Income P1,008,000

NRAETB

Rent, Philippines P1,000,000

Prize (cash) won in a local contest 8,000

Taxable Net Income P1,008,000

7. Based on the immediately preceding problem, assume the taxable year is 2018, determine the total final

tax assuming he is:

RC NRC RA NRAETB

a) P553,000 P490,000 P150,000 P937,500

b) 121,500 90,000 121,500 150,000

c) 131,000 90,000 90,000 90,000

d) 553,000 490,000 550,000 687,500

Answer

Explanation

RC

Interest, peso deposit, MBTC (100,000 x 20%) P20,000

Interest, US$ deposit (BDO $10,000 X P42) (420,000 x 15%) 63,000

Prize (TV) won in a local lottery (50,000 x 20%) 10,000

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

7|P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

PCSO/Lotto winnings (2,000,000 x 20%) 400,000

Dividend, domestic company (600,000 x 10%) 60,000

TOTAL FINAL TAX P553,000

NRC

Interest, peso deposit, MBTC (100,000 x 20%) P20,000

Prize (TV) won in a local lottery (50,000 x 20%) 10,000

PCSO/Lotto winnings (2,000,000 x 20%) 400,000

Dividend, domestic company (600,000 x 10%) 60,000

TOTAL FINAL TAX P490,000

RA

Interest, peso deposit, MBTC (100,000 x 20%) P20,000

Prize (TV) won in a local lottery (50,000 x 20%) 10,000

Dividend, domestic company (600,000 x 20%) 120,000

TOTAL FINAL TAX P150,000

NRAETB

Rent, Philippines (P1,000,000 x 25% P250,000

Interest, peso deposit, MBTC (100,000 x 25%) 25,000

Prize (TV) won in a local lottery (50,000 x 25%) 12,500

PCSO/Lotto winnings (2,000,000 x 25%) 500,000

Dividend, domestic company (600,000 x 25%) 150,000

TOTAL FINAL TAX P937,500

8. Ana, self-employed resident citizen provided for the following data for 2020 taxable year:

Sales P2,800,000

Cost of Sales 1,125,000

Business Expenses 650,000

Interest income from peso bank deposit 80,000

Interest income from bank deposit under FCDS 120,000

Gain on sale of land in the Philippines held as

Capital asset with cost of P1,500,000 when the

Zonal value is P1,200,000 500,000

How much is the total income tax expense?

a) P321,500

b) P342,500

c) P351,500

d) P358,000

ANSWER

Sales P2,800,000

(Cost of sales) (1,125,000)

(Business expenses) (650,000)

Net Income P1,025,000

Basic Income Tax P197,500

Basic Income Tax 197,500

Interest income from peso bank deposit (80,000 x 20%) 16,000

Interest income from bank deposit under FCDS (120,000 x 15%) 18,000

CGT on real property (2,000,000 x 6%) 120,000

Income tax expense P351,500

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

8|P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

9. How much is the total income tax of Ana assuming she opted to be taxed at 8%?

a) P321,500

b) P342,500

c) P351,500

d) P358,000

ANSWER

Gross sales P2,800,000

(Tax exempt income) (250,000)

Taxable net income 2,550,000

Multiply to: tax rate 8%

Tax due 204,000

Basic income tax 204,000

Final income tax on Interest income from peso bank deposit (80,000 x 20%) 16,000

Final income tax on Interest income from bank deposit under FCDS (120,000 x 18,000

15%)

CGT on real property (2,000,000 x 6%) 120,000

Total income tax expense 358,000

10. Ana, is a mixed income earner. She is a self-employed resident citizen and currently the Finance

manager of Omega Corporation. The following data were provided for 2018 taxable year:

Compensation Income P1,800,000

Sales 2,800,000

Cost of Sales 1,125,000

Business Expenses 650,000

Interest income from peso bank deposit 80,000

Interest income from bank deposit under FCDS 120,000

Gain on sale of land in the Philippines held as

With cost of 1,500,000 when the zonal value is

P1,200,000 500,000

How much is her total income tax expense assuming she opted to be taxed at 8%?

a) P321,500

b) P788,500

c) P808,000

d) P358,000

ANSWER

On his compensation income:

Tax on

First P800,000 P130,000

In excess of 800,000

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

9|P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

(1.8k-8k= P1,000,000x 30%) 300,000 P430,000

On his business income

**(P2.8M x 8%) 224,000

TOTAL Tax Due P654,000

BASIC INCOME TAX 654,000

Final income tax on Interest income from peso bank deposit (80,000 x 20%) 16,000

Final income tax on Interest income from bank deposit under FCDS (120,000 x 15%) 18,000

CGT on real property (2,000,000 x 6%) 120,000

Income tax expense 808,000

11. A Malaysian, occupying a managerial position in an Offshore Banking Unit located in Taguig had the

following data for the taxable year 2018

Salaries received P120,000

Other emoluments 50,000

De minimis benefits 5,000

Interest income from deposit substitutes 20,000

Interest income from long-term Philippine Bank Deposit 10,000

Dividend income from a domestic corporation 150,000

Gain from sale of shares of stock of a domestic corporation

Held as investment sold outside of the local stock exchange 175,000

The total income tax expense of the taxpayer is:

a) P73,000 c) P57,000

b) P70,500 d) P83,000

Answer: D

15% Preferential Tax (P170k x 15%) P25,500

25% on other income (P180k x 25%) 45,000

CGT [(100k x 5%) + (75k x 10%)] 12,500

Total taxes expense P83,000

NRAs-NETB and SAEs are not exempt from tax on their interest income derived from long-term bank

deposit in the Philippines.

12. Which of the following shall not be subject to the 20% final tax?

a) Amount of interest from any currency bank deposit and yield or any other monetary benefit

from deposit substitutes and from trust funds and similar arrangements

b) Winnings other than Philippine Charity Sweepstakes and Lotto winnings, regardless of amount

c) Philippine Charity Sweepstakes and Lotto winnings exceeding P10,000

d) Prizes amounting to ten thousand pesos (P10,000) or less.

Answer:

It is not subject to 20% final tax because it exempted for tax, prize winning lesser than 10,000 is

exempted from the tax. Refer to table 2.3.

13. A taxpayer received during the taxable year the following passive income derived from within the

Philippines:

Interest on bank deposit under FCDU (net) P231,250

Royalty on a software application (gross) 95,000

Dividend income RFC (gross) 150,000

If taxpayer is a non-resident alien engaged in business, the final tax on the above passive income would

amount to

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

10 | P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

a) P52,750 c) P28,250

b) P19,000 d) P37,750

Answer:

Interest on bank deposit under FCDU (net) exempt exempt

Royalty on a software application (gross) ( 95,000 x 20%) P19,000

Dividend income RFC (gross) exempt exempt

Final Tax P19,000

14. Statement 1: Any income of nonresident individual taxpayers from transactions with depository banks

under the expanded foreign currency deposit system shall be exempt from income tax

Statement 2: Any income of nonresident individual taxpayers from transactions with offshore banking

units shall be exempt from income tax

a) Only statement 1 is correct

b) Only statement 2 is correct

c) Both statements are correct

d) Both statements are incorrect

Answer

Interest Income received from depository bank under expanded foreign currency deposit system.

Only non residents are exempted from this particular income.

15. If the amount of PCSO/Philippine lotto winnings received by a resident citizen in 2020 did not exceed

P10,000, what type of income tax will apply?

a) Final withholding tax on passive income

b) Capital gains tax

c) Basic income tax

d) Exempt

Answer

For the PCSO /lotto winnings the amount is lesser than 10,000 or did not exeed 10k is exempted for

the tax.

Quiz 3 – INCOME TAX ON CORPORATIONS

1. The term “Corporation” shall include:

I. Partnerships, no matter how created or organized

II. Joint stock companies

III. Joint accounts (cuentas en participation)

IV. Associations

V. Insurance companies

VI. Mutual fund companies

VII. Regional operating headquarters of multinational corporations

a) I and II only c) I, II, III, IV and V only

b) I, II and III only d) All of the above

Answer:

For purposes of income taxation, the Tax Code provides that, the term "corporation" shall include

partnerships, no matter how created or organized, joint stock companies, joint accounts (ceuntas en

participacion), associations, or insurance companies. It also includes mutual fund companies, regional

operating headquarters of multinational corporations, and joint accounts.

2. Statement 1: Corporations exempt from income tax are not subject to income tax on incomes received

whish are incidental or necessarily connected with the purposes for which they were organized and

operating.

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

11 | P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

Statement 2: Corporations exempt from income tax are subject to income tax on income of whatever

kind and character from any of their properties (real or personal) or from any other activity conducted

for profit, regardless of the disposition of such income.

a) Only statement 1 is correct

b) Only statement 2 is correct

c) Both statements are correct

d) Both statements are incorrect

Answer:

Both statement are correct, thus, a corporation claiming tax exemption must be able to show clearly

that it is organized and operated for the purposes under Section 30 of the NIRC, and that its income is

derived pursuant thereto.

3. Which of the following statements is correct?

I. The term “domestic” when applied to a corporation, means created or organized in the

Philippines or under the laws of a foreign country as long as it maintains a Philippine branch

II. A corporation which is not domestic may be a resident (engaged in business in the Philippines)

or nonresident corporation (not engaged in business in the Philippines).

III. Resident foreign corporations are subject to income tax based on net income sources within the

Philippines

a) I only c) II and II only

b) II only d) I, II and III

Answer

Corporations, for tax purposes, are classified as domestic (DC), resident foreign corporations (RFC) and

nonresident foreign corporations (NRFC). Domestic Corporations are corporations created or

organized in the Philippines or under its laws. A foreign corporation is a corporation which is not

domestic, and may be a resident (engaged in business in the Philippines) or nonresident corporation

(not engaged in business in the Philippines). Domestic and foreign corporations may also be classified

as special corporations..

4. Which of the following is taxable based on income from all sources, within and without?

a) Domestic Corporations

b) Resident Foreign Corporation

c) Non-resident Foreign Corporations

d) All of the choices

Answer:

It is domestic corporation, because all the sources of income is done and situated within the

Philippines.

5. The following passive income received by a domestic corporation shall be subject to 20% final

withholding tax, except:

a) Interest income from peso bank deposit

b) Yield from deposit substitutes

c) Dividend Income from another domestic corporation

d) Royalties

6. Lenovo, Inc., a resident foreign corporation, has earned the following during the year 2018:

DIVIDEND INCOME FROM:

Microsoft, a non-resident foreign corporation P500,000

Intel, a resident foreign corporation (ratio of Philippine

income over world income for the past 3 years is 40%) 400,000

Panday, a domestic corporation 300,000

INTEREST INCOME FROM:

Current account, BDO 600,000

Savings deposit, ABN-AMRO bank, UK 700,000

FCDU deposits 800,000

ROYALTY INCOME from various domestic corporations 100,000

The total final tax on passive income for the taxable year is:

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

12 | P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

a) P200,000 c) P328,000

b) P260,000 d) P1,088,000

Solution:

Interest income – BDO (P600,000 x 20%) P120,000

Interest income – FCDU deposits (P800,000 x 7.5%) 60,000

Royalty income from various domestic corp. (P100,000 x 20%) 20,000

Total Final Taxes on passive income P200,000

Note:

Dividend income received by a foreign corporation (assuming the situs of the dividend is Philippines)

from foreign corporations (resident or non-resident), is subject to basic income tax/regular corporate

income tax (RCIT).

A dividend income received by an RFC from a DC is tax-exempt (intercorporate dividend)

The interest income from a bank deposit abroad is considered an income derived abroad, subject to

basic tax if received by resident citizen or domestic corp

7. A domestic corporation had the following data on income and expenses during the year 2018:

Gross income, Philippines P10,000,000

Business expenses, Philippines 2,000,000

Gross income, China 5,000,000

Business expenses, China 1,500,000

Interest income, Metrobank Philippines 300,000

Interest income, Shanghai Banking Corporation, China 100,000

Rent Income, net of 5% withholding tax 190,000

How much was the income tax payable?

a) P3,540,000 c) P3,440,000

b) P3,530,000 d) P2,480,000

Solution:

Gross income, Philippines P 10,000,000

Gross income, China 5,000,000

Business expenses, Philippines (2,000,000)

Business expenses, China (1,500,000)

Interest income, Shanghai Banking Corporation, China 100,000

Rent income, net of 5%withholding tax 200,000

(190,000/95%) ___________

Taxable net income 11,800,000

X RCIT % 30%

___________

Income Tax Due 3,540,000

Less. CWT on rental income (10,000)

___________

INCOME TAX PAYABLE P 3,530,000

8. Hannah Corporation, a corporation engaged in business in the Philippines and abroad has the following

data for the current year:

Gross income Philippines P975,000

Expenses, Philippines 750,000

Gross Income, Malaysia 770,000

Expenses, Malaysia 630,000

Interest on bank deposit 25,000

Determine the income tax due is the corporation is

Domestic Resident Foreign Corp Nonresident Foreign Corp

a) P116,800 P72,000 P320,000

b) P109,500 P67,500 P 300,000

c) P312,000 P515,850 P116,800

d) P109,500 p72,000 P300,000

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

13 | P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

Solution:

Domestic RFC NRFC

Gross Income, Phil. 975,000 975,000 975,000

Expenses, Phil. (750,000) (750,000)

Gross Income, Malaysia 770,000

Expenses, Malaysia (630,000)

Interest on bank deposit 25,000

Taxable Income 365,000 225,000 1,000,000

Tax rate __ 30% 30% 30%__

Tax Due P 109,500 P 67,500 P 300,000

9. The following information were taken from the records of ABC, Inc., a domestic corporation already in

its 5th year of operations:

Gross profit from sales P3,100,000

Capital gain on sale directly to buyer of

shares in a domestic corporation 100,000

Dividend from:

Domestic Corporation 20,000

Resident Foreign Corporations 10,000

Interest on:

Bank deposit 20,000

Trade Receivable 50,000

Business expenses 2,100,000

Income tax withheld 115,000

Quarterly income tax payments 160,000

Income tax payable per quarter (10,000)

The income tax payable at the end of the quarter:

a) P33,000

b) P43,000

c) P63,000

d) P318,000

Soulution

Gross profit from sales P3,100,000

Resident Foreign Corporations 10,000

Trade Receivable 50,000

Business expenses ( 2,100,000)

P1,060,000

X 30%

318,000

Income tax withheld (115,000)

Quarterly income tax payments (160,000)

Income tax payable per quarter (10,000)

Income Tax Payable P33,000

10. Bahala College, a proprietary educational institution provided the following data for 2018:

Income from tuition fees P3,000,000

School miscellaneous fees 250,000

Income from canteen operations 750,000

Dividend Income:

Domestic Corporation 100,000

Foreign Corporation 50,000

Rent Income (net) 5,700,000

Operating Expenses 4,125,000

Quarterly Income tax payments 250,000

The income tax payable of the school is:

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

14 | P a g e

MARICEL SARSALE QUIZZES

BSBA- 3 HRMD MIDTERM REQUIREMENTS

HRAC 103- INCOME TAXATION INSTRUCTRESS: MS. RUFFA MAE SANCHEZ, CPA

a) P37,500

b) P337,750

c) P1,212,500

d) P1,227,500

Income Tax payable - 1,227,500

The unrelated income exceeds 50% of the total income, hence, the proprietary educational institution is

not entitled to the 10% tax rate.

solution

Income from tuition fees P3,000,000

School miscellaneous fees 250,000

Income from canteen operations 750,000

Foreign Corporation 50,000

Rent Income (net) 6,000,000

GROSS SUBJECT TO TAX 10,050,000

Operating Expenses 4,125,000

Taxable Net Income P 5,925,000

Regular Corporate Tax Rate X 30%

Income Tax Due P1,777,500

Quarterly Income Tax Payments (250,000)

Creditable WithHolding Tax (300,000)

Income Tax Payable P1,227,500

Income Taxation - Midterm

Second Term / Second Semester 2020-2021

15 | P a g e

You might also like

- CPAR Fringe Benefit TaxDocument5 pagesCPAR Fringe Benefit TaxNikki75% (4)

- Quiz Dealings in Properties TAXATIONDocument10 pagesQuiz Dealings in Properties TAXATIONAngela Nicole NobletaNo ratings yet

- Gross IncomeDocument45 pagesGross Incomeannyeongchingu80% (5)

- Taxation Income MCQDocument59 pagesTaxation Income MCQMary Therese Gabrielle Estioko33% (3)

- Income-Tax Banggawan2019 CR7Document10 pagesIncome-Tax Banggawan2019 CR7Noreen Ledda11% (9)

- CHAPTER 7 & 9 Case StudyDocument2 pagesCHAPTER 7 & 9 Case StudyLorna Ignacio GuiwanNo ratings yet

- Income Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDDocument40 pagesIncome Taxation Solution Manual 2019 ED Income Taxation Solution Manual 2019 EDSha Leen100% (2)

- Acco 2033 Income TaxationDocument284 pagesAcco 2033 Income TaxationRita Daniela100% (1)

- Finals Quiz 1 Dealings in Properties Answer KeyDocument6 pagesFinals Quiz 1 Dealings in Properties Answer KeyMjhaye100% (1)

- Deductions From Gross IncomeDocument49 pagesDeductions From Gross IncomeRoronoa ZoroNo ratings yet

- Tax QuizDocument8 pagesTax Quizcleofe janeNo ratings yet

- Final TaxDocument26 pagesFinal TaxMarie MendozaNo ratings yet

- Final and Capital Gains TaxDocument7 pagesFinal and Capital Gains TaxElla Marie LopezNo ratings yet

- CH 5 Final Income TaxationDocument19 pagesCH 5 Final Income TaxationGabriel Trinidad SonielNo ratings yet

- Fringe BenefitDocument13 pagesFringe BenefitAngela Nicole Nobleta100% (2)

- Chapter 14 Income Taxation For IndividualsDocument19 pagesChapter 14 Income Taxation For IndividualsShane Sigua-Salcedo100% (2)

- Handout 3Document51 pagesHandout 3Jilian Kate Alpapara Bustamante100% (1)

- Chapter 1 Succession and Transfer Taxes Part 1Document2 pagesChapter 1 Succession and Transfer Taxes Part 1AngieNo ratings yet

- Subcontracting With Chargeable Components" and "Material LedgerDocument4 pagesSubcontracting With Chargeable Components" and "Material LedgerjoeindNo ratings yet

- Memorial RespondentDocument23 pagesMemorial RespondentDevender Yadav100% (1)

- Dealings in PropertiesDocument12 pagesDealings in PropertiesJane Tuazon50% (2)

- Exclusion From Gross IncomeDocument8 pagesExclusion From Gross IncomeRonna Mae DungogNo ratings yet

- Income Tax - Capital Gain and Final TaxesDocument4 pagesIncome Tax - Capital Gain and Final TaxesAnie Martinez0% (1)

- Income Taxation-IndividualDocument118 pagesIncome Taxation-Individualjovelyn labordoNo ratings yet

- Compensation and Fringe Benefits TaxDocument10 pagesCompensation and Fringe Benefits TaxJane TuazonNo ratings yet

- Fringe Benefit TaxDocument4 pagesFringe Benefit TaxKenneth Bryan Tegerero Tegio100% (1)

- Tax MergedDocument366 pagesTax MergedRengeline LucasNo ratings yet

- Deductions From Gross Income 2 1Document42 pagesDeductions From Gross Income 2 1Katherine EderosasNo ratings yet

- Quizes Income TaxationDocument20 pagesQuizes Income TaxationAllyssa GeronillaNo ratings yet

- Gross Income Quiz With Answer KeyDocument10 pagesGross Income Quiz With Answer KeyMylene AlfantaNo ratings yet

- Income TaxationDocument28 pagesIncome TaxationJessa Gay Cartagena TorresNo ratings yet

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- EX EX EX EX: Regular Income TaxDocument7 pagesEX EX EX EX: Regular Income TaxMary Leigh TenezaNo ratings yet

- Reviewer in Income TaxDocument97 pagesReviewer in Income TaxBianca Jane KinatadkanNo ratings yet

- Tax Review - FinalsDocument8 pagesTax Review - FinalsRobert Castillo100% (2)

- Income Taxation CHAPTER 6Document14 pagesIncome Taxation CHAPTER 6Mark67% (3)

- CPAR Tax - CorporationDocument7 pagesCPAR Tax - CorporationChristian Mark Abarquez100% (4)

- Quiz On Income TaxationDocument4 pagesQuiz On Income TaxationLenard Josh Ingalla100% (1)

- HQ05 - Capital Gains TaxationDocument10 pagesHQ05 - Capital Gains TaxationClarisaJoy Sy100% (3)

- Session 1 - Gross Income - Inclusions and ExclusionsDocument13 pagesSession 1 - Gross Income - Inclusions and ExclusionsABBIE GRACE DELA CRUZNo ratings yet

- W4-Module Income Tax On CorporationDocument18 pagesW4-Module Income Tax On CorporationDanica VetuzNo ratings yet

- Income Taxation QuizzerDocument41 pagesIncome Taxation QuizzerMarriz Tan100% (4)

- Taxation - Individual - QuizzerDocument12 pagesTaxation - Individual - QuizzerKenneth Bryan Tegerero TegioNo ratings yet

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (2)

- Introduction To Income TaxationDocument52 pagesIntroduction To Income TaxationMonica Monica33% (3)

- TAX Assessment October 2020Document8 pagesTAX Assessment October 2020FuturamaramaNo ratings yet

- Ast TX 501 Individual, Estate and Trust Taxation (Batch 22)Document7 pagesAst TX 501 Individual, Estate and Trust Taxation (Batch 22)Herald Gangcuangco100% (1)

- DYBSATax213 - Income Taxation (MODULE 1-14)Document51 pagesDYBSATax213 - Income Taxation (MODULE 1-14)MARK ANGELO PANGILINANNo ratings yet

- Chapter 8 Regular Income Tax Exclusion From Gross IncomeDocument15 pagesChapter 8 Regular Income Tax Exclusion From Gross IncomeDANICKA JANE ENERO100% (2)

- 4 Gross-IncomeDocument5 pages4 Gross-IncomeSamantha Nicole HoyNo ratings yet

- Income Taxation: Prelims-ReviewerDocument3 pagesIncome Taxation: Prelims-ReviewerFely Maata100% (1)

- Chapter 7 Introduction To Regular Income TaxDocument18 pagesChapter 7 Introduction To Regular Income TaxDANICKA JANE ENERONo ratings yet

- 2nd Semester Income Taxation Module 10 Exercises On Gross Income - Exclusion and Inclusions Part 2Document3 pages2nd Semester Income Taxation Module 10 Exercises On Gross Income - Exclusion and Inclusions Part 2nicole tolayba100% (1)

- Quizzes Taxation 1 and 2Document6 pagesQuizzes Taxation 1 and 2Ronald SaludesNo ratings yet

- Review Business and Transfer TaxDocument201 pagesReview Business and Transfer TaxReginald ValenciaNo ratings yet

- Income Taxation 2019 Chapter 13A 13C 14 BanggawanDocument8 pagesIncome Taxation 2019 Chapter 13A 13C 14 BanggawanEricka Einjhel Lachama100% (9)

- Inbound 6310719506126591666Document4 pagesInbound 6310719506126591666MarielleNo ratings yet

- FinalroundDocument35 pagesFinalroundJenny Keece RaquelNo ratings yet

- Integrated Review Prob 2Document6 pagesIntegrated Review Prob 2Regine ConsueloNo ratings yet

- Real Estate Taxation - 12.11.15Document8 pagesReal Estate Taxation - 12.11.15Juan Frivaldo100% (3)

- ReSA B44 TAX First PB Exam Questions Answers SolutionsDocument14 pagesReSA B44 TAX First PB Exam Questions Answers SolutionsWes100% (1)

- Real Estate Taxation - 12.11.15 (Wo Answers)Document7 pagesReal Estate Taxation - 12.11.15 (Wo Answers)Juan FrivaldoNo ratings yet

- Capital GainsDocument5 pagesCapital GainsJCGonzalesNo ratings yet

- Compensation (HRMP 205) Task 1: St. Mary'S College Baganga, IncDocument29 pagesCompensation (HRMP 205) Task 1: St. Mary'S College Baganga, IncLorna Ignacio GuiwanNo ratings yet

- COPUTATIONDocument30 pagesCOPUTATIONLorna Ignacio GuiwanNo ratings yet

- Final Exam - Ge 10Document2 pagesFinal Exam - Ge 10Lorna Ignacio GuiwanNo ratings yet

- X X X XY X Y: Supply For Fruits YearDocument2 pagesX X X XY X Y: Supply For Fruits YearLorna Ignacio GuiwanNo ratings yet

- X X X XY X Y: Demand For Fruits YearDocument8 pagesX X X XY X Y: Demand For Fruits YearLorna Ignacio GuiwanNo ratings yet

- B Briones, Gemar Hrmp205 Task 2Document2 pagesB Briones, Gemar Hrmp205 Task 2Lorna Ignacio GuiwanNo ratings yet

- Compensation (HRMP 205) Task 2: St. Mary'S College Baganga, IncDocument2 pagesCompensation (HRMP 205) Task 2: St. Mary'S College Baganga, IncLorna Ignacio GuiwanNo ratings yet

- Task 1 in HRMP 205: St. Mary'S College Baganga, Inc. Conception ST., Baganga, Davao OrientalDocument5 pagesTask 1 in HRMP 205: St. Mary'S College Baganga, Inc. Conception ST., Baganga, Davao OrientalLorna Ignacio GuiwanNo ratings yet

- Mid-Year Sales: Maricel Sarsale Prelim ExamDocument1 pageMid-Year Sales: Maricel Sarsale Prelim ExamLorna Ignacio GuiwanNo ratings yet

- Final Exam - Ge 10Document2 pagesFinal Exam - Ge 10Lorna Ignacio GuiwanNo ratings yet

- Activity 1 Key Questions: (Write Your Answers Succinctly)Document2 pagesActivity 1 Key Questions: (Write Your Answers Succinctly)Lorna Ignacio GuiwanNo ratings yet

- Aths Population Reports: Maricel SarsaleDocument3 pagesAths Population Reports: Maricel SarsaleLorna Ignacio GuiwanNo ratings yet

- Survey Questionnaire FinalDocument6 pagesSurvey Questionnaire FinalLorna Ignacio GuiwanNo ratings yet

- Group 7 Research Paper - ENDELITADocument22 pagesGroup 7 Research Paper - ENDELITALorna Ignacio GuiwanNo ratings yet

- Labour Laws Are Essential To Ensure Social Welfare of Workers. These Laws Help TheDocument2 pagesLabour Laws Are Essential To Ensure Social Welfare of Workers. These Laws Help TheLorna Ignacio GuiwanNo ratings yet

- Project Management HRELE 104: St. Mary'S College Baganga, IncDocument9 pagesProject Management HRELE 104: St. Mary'S College Baganga, IncLorna Ignacio GuiwanNo ratings yet

- El Cóndor Pasa: Daniel Alomía Robles / TraditionalDocument1 pageEl Cóndor Pasa: Daniel Alomía Robles / TraditionalJames Wilfrido Cardenas AmezquitaNo ratings yet

- AlmawardiDocument15 pagesAlmawardiMaryam Siddiqa Lodhi LecturerNo ratings yet

- 1st Assignment of 3rd Year 6th Semester 2023 EEPMDocument2 pages1st Assignment of 3rd Year 6th Semester 2023 EEPMSUBRATA MODAKNo ratings yet

- Adamson v. CA, GR No. 120935, May 21, 2009Document8 pagesAdamson v. CA, GR No. 120935, May 21, 2009Henry LNo ratings yet

- 2924-A300-13C67-DWG-0004 - R0.1 - Electrical Cable Routing and Tray Routing Layout Admin BuildingDocument8 pages2924-A300-13C67-DWG-0004 - R0.1 - Electrical Cable Routing and Tray Routing Layout Admin BuildingRonti ChanyangNo ratings yet

- A Bibliography of Philippine Studies by William Henry Scott, HistorianDocument24 pagesA Bibliography of Philippine Studies by William Henry Scott, HistorianKurt ZepedaNo ratings yet

- ASJ Corporation and Antonio San Juan Vs Spouses Efren and MauraDocument2 pagesASJ Corporation and Antonio San Juan Vs Spouses Efren and MauraMa Lorely Liban-CanapiNo ratings yet

- Anti-Terrorism Act of 2020Document4 pagesAnti-Terrorism Act of 2020Kyla Ellen CalelaoNo ratings yet

- Scra Series 1 CamsurDocument263 pagesScra Series 1 CamsurAlexis RancesNo ratings yet

- Facebook, Inc. v. John Does 1-10 - Document No. 7Document4 pagesFacebook, Inc. v. John Does 1-10 - Document No. 7Justia.comNo ratings yet

- Regional Staff MeetingDocument1 pageRegional Staff MeetingShintara Pagsanjan DimanzanaNo ratings yet

- 0QFtkI4DKsannQhCAdSs0M2fMXKkCiC749QDUzR0a02bpO38NKh9NoGA3 Anukritihastawala299 Nmimseduin 20220605 145713 1 25Document25 pages0QFtkI4DKsannQhCAdSs0M2fMXKkCiC749QDUzR0a02bpO38NKh9NoGA3 Anukritihastawala299 Nmimseduin 20220605 145713 1 25Balveer GodaraNo ratings yet

- Brief of 2015 S C M R 631Document10 pagesBrief of 2015 S C M R 631Raafae SooriNo ratings yet

- Aristotle PDFDocument6 pagesAristotle PDFAnonymous p5jZCn100% (1)

- LEOUEL SANTOS, Petitioner Vs COURT OF APPEALS, DefendantDocument2 pagesLEOUEL SANTOS, Petitioner Vs COURT OF APPEALS, Defendantprince pacasumNo ratings yet

- Air Waybill 074-38527576: KLM Royal Dutch Airlines RUC:0990109443001 TABABELA, NUEVO Aeropuerto Mariscal SucreDocument16 pagesAir Waybill 074-38527576: KLM Royal Dutch Airlines RUC:0990109443001 TABABELA, NUEVO Aeropuerto Mariscal SucreJosé Darío Carreño MorenoNo ratings yet

- EASA - Airspace of Iraq - 2019-10-01Document8 pagesEASA - Airspace of Iraq - 2019-10-01Dimitris SarmasNo ratings yet

- Too Dear! - English NotesDocument7 pagesToo Dear! - English NotesikeaNo ratings yet

- LOTAM - 01 Dec, 2022 PDFDocument681 pagesLOTAM - 01 Dec, 2022 PDFFaisal MustafaNo ratings yet

- RBI Mail MessageDocument2 pagesRBI Mail MessageBitan GhoshNo ratings yet

- Alveo Trading API - Apiary FundDocument2 pagesAlveo Trading API - Apiary Fundfuturegm2400No ratings yet

- IT2021112401011404338Document13 pagesIT2021112401011404338ali aabisNo ratings yet

- Schedule HDocument26 pagesSchedule HHemant GaikwadNo ratings yet

- Bautista, Maria Teresa SDocument4 pagesBautista, Maria Teresa SSarip Sharief SaripadaNo ratings yet

- Civil Case FinalDocument14 pagesCivil Case FinalPulkit AgarwalNo ratings yet

- What Is HipaaDocument4 pagesWhat Is HipaarickNo ratings yet

- 6.9 Ioe Mphil PHD by Publication 2017 18Document16 pages6.9 Ioe Mphil PHD by Publication 2017 18josiah masukaNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pandian KNo ratings yet