Professional Documents

Culture Documents

FNF 02 I33514 Ankit Shukla

FNF 02 I33514 Ankit Shukla

Uploaded by

Ankit ShuklaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FNF 02 I33514 Ankit Shukla

FNF 02 I33514 Ankit Shukla

Uploaded by

Ankit ShuklaCopyright:

Available Formats

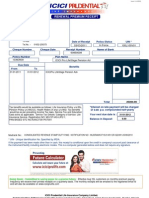

Allianz Technology SE, Pune

4 & 5th floor, Wing 4,

Cluster C, EON IT Park,

Kharadi,

Pune 411014

Full and Final Settlement Statement

Full and Final settled in Apr-2021 Date :28/04/2021

EmpNo I33514 Joining Date 02-11-2020

Name Ankit Shukla Leaving Date 16-04-2021

Location 01-Pune Designation Business Analyst

Bank Name ICICI PF No MH/PUN/308806/0012468

Bank A/c No 004101580178 PAN GBPPS5591N

Current Month April to Date

Earning / Deduction Head

Earnings Deductions Earnings Deductions

Basic 9,930.00 0.00 9,930.00 0.00

Arrears-Basic 18,618.00 0.00 18,618.00 0.00

Food Allowance 1,333.00 0.00 1,333.00 0.00

Arrears Food Allow. 2,500.00 0.00 2,500.00 0.00

LTA 827.00 0.00 827.00 0.00

Medical Allow 667.00 0.00 667.00 0.00

Arrear Medical 1,250.00 0.00 1,250.00 0.00

Conveyance Allowance 853.00 0.00 853.00 0.00

Arrear Conveyance 1,600.00 0.00 1,600.00 0.00

HRA 3,972.00 0.00 3,972.00 0.00

Arrear HRA 7,447.00 0.00 7,447.00 0.00

Other Allowance 17,495.00 0.00 17,495.00 0.00

Arrear Other Allowance 32,803.00 0.00 32,803.00 0.00

Statutory Bonus 3,164.00 0.00 3,164.00 0.00

Leave Encashment 21,923.00 0.00 21,923.00 0.00

Arrears LTA 1,551.00 0.00 1,551.00 0.00

Provident Fund 0.00 3,600.00 0.00 3,600.00

Profession Tax 0.00 200.00 0.00 200.00

Total 125,933.00 3,800.00 125,933.00 3,800.00

Amount to be paid with Final Settlement Rs. : 122,133.00

Rs. One Lakhs Twenty Two Thousand One Hundred Thirty Three Only.

Page 1 of 3 Printed On 03/05/2021 09:56:17

Processed on Ascent Payroll

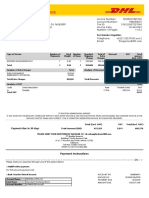

Income tax Calculation (Old Regime)

Allianz Technology SE, Pune Ascent Payroll

PAN : AAKCA4126C/ TAN : PNEA18234G F.Y. : 2021-22 / A.Y. : 2022-23

Employee: I33514 Ankit Shukla Calculation Month: April-2021

Date of Joining: 02/11/2020 PAN: GBPPS5591N Tax Category: MEN Date of Leaving: 16/04/2021

1. Gross Salary Actual(Rs.) Projection(Rs.) Total(Rs.)

Earnings

Basic 9,930 0 9,930

Arrears-Basic 18,618 0 18,618

LTA 827 0 827

Medical Allow 667 0 667

Arrear Medical 1,250 0 1,250

Conveyance Allowance 853 0 853

Arrear Conveyance 1,600 0 1,600

HRA 3,972 0 3,972

Arrear HRA 7,447 0 7,447

Other Allowance 17,495 0 17,495

Arrear Other Allowance 32,803 0 32,803

Statutory Bonus 3,164 0 3,164

Leave Encashment 21,923 0 21,923

Arrears LTA 1,551 0 1,551

Meal Allowance 1,333 0 1,333

Arrears Meal Allowance 2,500 0 2,500

Totals: 125,933 0 125,933

WORKSHEET :

1. Gross Salary 125,933

2. Less: Allowances Exempt Under Section 10

(f) Amount of any other exemption under section 10

Total

3. Balance (1-2) 125,933

4. Deductions:

Standard Deduction 50,000

Tax On Employment 200

5. Aggregate of 4 50,200

6. Income chargeable under the head 'Salaries' (3-5) 75,733

7. Add: Any other income reported by the employee

Total of above 0

8. Gross total income (6+7) 75,733

9. Deductions under Chapter VI-A Qualifying Deductible

Gross Amount

(A) Section 80C, 80CCC and 80CCD Amount Amount

(a) Section 80 C

a. Provident Fund 3,600 3,600

Total of Section 80C, 80CCC and 80CCD 3,600 3,600 3,600

(B) Other Sections under Chapter VI-A

Total of Other Sections under Chapter VI-A

10. Aggregate of deductible amount under Chapter VIA 3,600

11. Total Income (8-10) 72,140

12. Tax on total income based on Old Regime 0

*

13. Less: rebate u/s 87A 0

14. Tax payable and surcharge thereon 0 +0 0

15. Add: Education CESS 4.00% on (14) 0

16. Less: Rebate Under Section 89 0

17. Total Tax Liability (14+15-16) 0

18. Less Tax deducted at source till Last Month 0

19. Tax payable/refundable (17-18) 0

20. Tax payable/refundable this month 0

Page 2 of 3 Printed On 03/05/2021 09:56:17

Processed on Ascent Payroll

Page 3 of 3 Printed On 03/05/2021 09:56:18

Processed on Ascent Payroll

You might also like

- Receiptsreceipts 04032011 25203Document1 pageReceiptsreceipts 04032011 25203Deepak KumarNo ratings yet

- How The Economic Machine Works by Ray DalioDocument15 pagesHow The Economic Machine Works by Ray Daliolargadura100% (3)

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- Impact of Goods & Service TaxDocument76 pagesImpact of Goods & Service TaxTasmay Enterprises67% (3)

- May Salary PDFDocument1 pageMay Salary PDFomkassNo ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- OE0036Document1 pageOE0036kumud kalaNo ratings yet

- Payslip 2020 2021 2 100000000544479 IGSL 1Document1 pagePayslip 2020 2021 2 100000000544479 IGSL 1x foxNo ratings yet

- India "Preventive Manual" Central ExciseDocument205 pagesIndia "Preventive Manual" Central ExciseKuttralingam AmmaiyappanNo ratings yet

- Real Property Tax 3Document51 pagesReal Property Tax 3Nori Lola100% (3)

- Mar18 PDFDocument1 pageMar18 PDFomkassNo ratings yet

- Jan18 PDFDocument1 pageJan18 PDFomkassNo ratings yet

- April2018 PDFDocument1 pageApril2018 PDFomkassNo ratings yet

- Dec07 PDFDocument1 pageDec07 PDFomkassNo ratings yet

- PS Jul-23 MPDocument1 pagePS Jul-23 MPmyphotosfetNo ratings yet

- SAN Complex, #4, Williams Road, Cantonment, Trichy, Tamil Nadu, 620001Document2 pagesSAN Complex, #4, Williams Road, Cantonment, Trichy, Tamil Nadu, 620001Sahana yogesvaranNo ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- July 2017Document1 pageJuly 2017omkass100% (1)

- Ravi MukharjeeDocument2 pagesRavi MukharjeeDivesh RaiNo ratings yet

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MNo ratings yet

- March Salary PDFDocument1 pageMarch Salary PDFomkassNo ratings yet

- Sampangi Sowbhagya (POL11622)Document1 pageSampangi Sowbhagya (POL11622)Sowbhagya VaderaNo ratings yet

- Payslip 2019 2020 4 2380 SVATANTRADocument1 pagePayslip 2019 2020 4 2380 SVATANTRAsunil.srfcNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Pay Slip For The Month of October-2017Document1 pagePay Slip For The Month of October-2017omkassNo ratings yet

- LG PayslipDocument1 pageLG PayslipDipendra TOMARNo ratings yet

- Oct 23Document2 pagesOct 23VIKAS TIWARINo ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- April Salary PDFDocument1 pageApril Salary PDFomkassNo ratings yet

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- Payslip 2018 2019 3 2380 SVATANTRADocument1 pagePayslip 2018 2019 3 2380 SVATANTRAsunil.srfcNo ratings yet

- Manpreet Kaur: EligibilityDocument1 pageManpreet Kaur: EligibilityRajesh KumarNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- RPT Pay Slip YTDDocument1 pageRPT Pay Slip YTDTomola BlessingNo ratings yet

- Salary Slip Oct PacificDocument1 pageSalary Slip Oct PacificBHARAT SHARMANo ratings yet

- Corona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Document1 pageCorona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Emmanuel melvinNo ratings yet

- EmployeeData OctDocument2 pagesEmployeeData OctAnkit SinghNo ratings yet

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNo ratings yet

- Jyothy Laboratories LTD: Payslip For The Month of June 2019Document2 pagesJyothy Laboratories LTD: Payslip For The Month of June 2019BALUNo ratings yet

- ITCertificate PDFDocument2 pagesITCertificate PDFkumar praweenNo ratings yet

- Payslip For The Month of March 2024Document1 pagePayslip For The Month of March 2024LalitNo ratings yet

- Pirhot JuanDocument2 pagesPirhot Juanmutiya andiniNo ratings yet

- Nov 2017Document1 pageNov 2017omkassNo ratings yet

- Tushar Saini (MOB2314) - Sep23payslipDocument1 pageTushar Saini (MOB2314) - Sep23payslipvikasdixit95200No ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- Payslip 2019 2020 5 2380 SVATANTRADocument1 pagePayslip 2019 2020 5 2380 SVATANTRAsunil.srfcNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Sandy Jan PayslipDocument1 pageSandy Jan PayslipJoginderNo ratings yet

- Payslip 3 2023Document1 pagePayslip 3 2023Saurabh DugarNo ratings yet

- Pay Slip For The Month of December-2017Document1 pagePay Slip For The Month of December-2017omkassNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Payslip 2 2023Document1 pagePayslip 2 2023Saurabh DugarNo ratings yet

- Employee DataDocument2 pagesEmployee DataJitender singhNo ratings yet

- 372814-145 Jan 2024Document2 pages372814-145 Jan 2024dotcnnctNo ratings yet

- CRM Services India Private Limited: Payslip For The Month of January 2020Document1 pageCRM Services India Private Limited: Payslip For The Month of January 2020abhi.90748989No ratings yet

- Chiripal Poly Films Limited: Salary Slip For The Month of January - 2024Document1 pageChiripal Poly Films Limited: Salary Slip For The Month of January - 2024SHUBHAM PANDEYNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- June Salry PDFDocument1 pageJune Salry PDFomkassNo ratings yet

- CRM Services India Private Limited: Earnings DeductionsDocument1 pageCRM Services India Private Limited: Earnings DeductionsInnama SayedNo ratings yet

- Salary September2023Document2 pagesSalary September2023depiha5135No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- CDP Sriperumbudur14 PDFDocument432 pagesCDP Sriperumbudur14 PDFVaishali VasanNo ratings yet

- Importance of Taxation: Sir Arman S. PascualDocument36 pagesImportance of Taxation: Sir Arman S. PascualJesse OcampoNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptSandeep DangiNo ratings yet

- S RGR 001865700Document2 pagesS RGR 001865700Aan SulistyoNo ratings yet

- Statement Profit Loss StandaloneDocument1 pageStatement Profit Loss Standalonesubham not a nameNo ratings yet

- Part B (Annexture) Details of Salary Paid and Any Other Income and Tax DeductedDocument1 pagePart B (Annexture) Details of Salary Paid and Any Other Income and Tax DeductedRakesh KumarNo ratings yet

- Form 15G PDFDocument6 pagesForm 15G PDFSmitha GowdaNo ratings yet

- BESCOMDocument3 pagesBESCOMkarthikvmandyaNo ratings yet

- Project Report Shree IndustriesDocument31 pagesProject Report Shree IndustriesAKSHAY GUPTANo ratings yet

- Kaasi Annapurna AnnakshetraDocument2 pagesKaasi Annapurna Annakshetramail2cnivasNo ratings yet

- AFFIDAVIT Treasurer-Dela TorreDocument1 pageAFFIDAVIT Treasurer-Dela Torreczabina fatima delicaNo ratings yet

- 2551QDocument3 pages2551QnelsonNo ratings yet

- Edi Patit Paban Das DetailsDocument11 pagesEdi Patit Paban Das DetailsAnik ChowdhuryNo ratings yet

- Patlinghug Vs CADocument6 pagesPatlinghug Vs CAAbs PangaderNo ratings yet

- Soc - sciLET Pre Board Questions Social ScienceDocument6 pagesSoc - sciLET Pre Board Questions Social ScienceJoharah JanelNo ratings yet

- Canberra Group Handbook On Household Income StatisticsDocument208 pagesCanberra Group Handbook On Household Income StatisticsUNECE Statistical DivisionNo ratings yet

- Kotak Bank General Accounts and ChargesDocument5 pagesKotak Bank General Accounts and ChargesCraig DsouzaNo ratings yet

- BM Short Notes (PBP)Document99 pagesBM Short Notes (PBP)Asim AnsariNo ratings yet

- Presentation Mini Case MeDocument10 pagesPresentation Mini Case MeMohammad Osman GoniNo ratings yet

- Pestle Analysis Of: by Avinash S. Jadhav Roll No:11Document20 pagesPestle Analysis Of: by Avinash S. Jadhav Roll No:11Ankit SharmaNo ratings yet

- IOT OFFER OPTIMUM PetroluemDocument6 pagesIOT OFFER OPTIMUM Petroluembasil ameenNo ratings yet

- Liddle Vs La ReinaDocument12 pagesLiddle Vs La ReinaJineth PrietoNo ratings yet

- 2 Mark QuestionsDocument18 pages2 Mark Questionspreeti chhatwalNo ratings yet

- Brad Delong: Grasping Reality With The Invisible HandDocument21 pagesBrad Delong: Grasping Reality With The Invisible HandFuckingSandniggersNo ratings yet

- Nursery Care Corporation vs. Acevedo - Double TaxationDocument29 pagesNursery Care Corporation vs. Acevedo - Double TaxationVictoria aytonaNo ratings yet