Professional Documents

Culture Documents

P 15 5. Standard Costing Chart

P 15 5. Standard Costing Chart

Uploaded by

Hari MCopyright:

Available Formats

You might also like

- Cost Accounting Formula'sDocument7 pagesCost Accounting Formula'sdigital_darwaish82% (39)

- Standard Costing: QUANTITY Standard - Indicates The Quantity of Raw Materials orDocument19 pagesStandard Costing: QUANTITY Standard - Indicates The Quantity of Raw Materials orMarielle Mae Burbos100% (2)

- Midterm 1 Review QuestionsDocument7 pagesMidterm 1 Review QuestionsDevin KosinNo ratings yet

- Service Marketing Lecture of Chapter 1 (4th Edition)Document24 pagesService Marketing Lecture of Chapter 1 (4th Edition)Biplob SarkarNo ratings yet

- IIBM Case Study AnswersDocument98 pagesIIBM Case Study AnswersAravind 9901366442 - 990278722422% (9)

- Formula List of Basic Variance PDFDocument4 pagesFormula List of Basic Variance PDFShi Yan LNo ratings yet

- Overhead and Other Variances PDFDocument26 pagesOverhead and Other Variances PDFAnuruddha RajasuriyaNo ratings yet

- Variance FormulasDocument5 pagesVariance Formulaskhanmohnoor550No ratings yet

- Formula For Calculating Variances - UpdatedDocument3 pagesFormula For Calculating Variances - UpdatedNikita ConatyNo ratings yet

- 06 Standard Costing PDFDocument5 pages06 Standard Costing PDFMarielle CastañedaNo ratings yet

- Standard Costing - UpdatedDocument38 pagesStandard Costing - UpdatedChristian TanNo ratings yet

- Costing Notes Chapter - Standard Costing: MCV Muv + MPV and Muv Myv + MMVDocument12 pagesCosting Notes Chapter - Standard Costing: MCV Muv + MPV and Muv Myv + MMVSocial SectorNo ratings yet

- Standart Costing PDFDocument3 pagesStandart Costing PDFVIHARI DNo ratings yet

- Disposition of VariancesDocument12 pagesDisposition of VariancesNors PataytayNo ratings yet

- STANDARD COSTING and Variance AnalysisDocument30 pagesSTANDARD COSTING and Variance AnalysisAlthon JayNo ratings yet

- MarginalDocument32 pagesMarginalfawad aslamNo ratings yet

- 7 - Variance AnalysisDocument15 pages7 - Variance AnalysisRakeysh RakyeshNo ratings yet

- CH 10 NotesDocument13 pagesCH 10 NotesmohamedNo ratings yet

- Summary FinalDocument28 pagesSummary FinalJackNo ratings yet

- Formulas in CostDocument3 pagesFormulas in CostHappyPurpleNo ratings yet

- STCM06 Standard CostingDocument31 pagesSTCM06 Standard Costingdin matanguihanNo ratings yet

- Module 005 Standard CostingDocument12 pagesModule 005 Standard CostinggagahejuniorNo ratings yet

- A) Direct Material Variances: Sub Usage Variance Mix VarianceDocument3 pagesA) Direct Material Variances: Sub Usage Variance Mix Variancekamalesh123No ratings yet

- Costing FormulasDocument4 pagesCosting FormulasAlkaNo ratings yet

- Formula:: High Low Method (High - Low) Break-Even PointDocument24 pagesFormula:: High Low Method (High - Low) Break-Even PointRedgie Mark UrsalNo ratings yet

- Scan - 2019-04-04 18 - 33 - 13Document1 pageScan - 2019-04-04 18 - 33 - 13zenaidaNo ratings yet

- 5-Standard Costing and GP Variance AnalysisDocument16 pages5-Standard Costing and GP Variance AnalysisMelybelle LaurelNo ratings yet

- Standard Costing and Variance Analysis As Applied ToDocument39 pagesStandard Costing and Variance Analysis As Applied TorhearomefranciscoNo ratings yet

- Standard Costing and Variance Analysis: Cost Accounting: Foundations and Evolutions, 8eDocument46 pagesStandard Costing and Variance Analysis: Cost Accounting: Foundations and Evolutions, 8eEinstein SalcedoNo ratings yet

- 08-Foh Cost VarianceDocument21 pages08-Foh Cost VariancePutri Dwi KartiniNo ratings yet

- Chap 4 MNGT Acctng PDFDocument4 pagesChap 4 MNGT Acctng PDFRose Ann YaboraNo ratings yet

- AHSQPAccountingDocument31 pagesAHSQPAccountingMUSTHARI KHANNo ratings yet

- Variance Analysis - Basic Formulas: 1) Material, Labour, Variable Overhead VariancesDocument3 pagesVariance Analysis - Basic Formulas: 1) Material, Labour, Variable Overhead VariancesAslam SiddiqNo ratings yet

- Joint & by ProductsDocument10 pagesJoint & by Productsharry severino0% (1)

- Variable Production Overhead Variance (VPOH)Document9 pagesVariable Production Overhead Variance (VPOH)Wee Han ChiangNo ratings yet

- AH Accounting FormulaeSheetVarianceAnalysis PDFDocument2 pagesAH Accounting FormulaeSheetVarianceAnalysis PDFAditi SInghNo ratings yet

- Mix and Yield VariancesDocument12 pagesMix and Yield VariancesVashisht SewsaransingNo ratings yet

- 18-19 - Greek Art NW2zVgxhbgDocument15 pages18-19 - Greek Art NW2zVgxhbgshubhangi.jain582No ratings yet

- Standard Costing: Output (Eg. Pieces Per Unit)Document4 pagesStandard Costing: Output (Eg. Pieces Per Unit)glcpaNo ratings yet

- Module 4Document4 pagesModule 4mark fernandezNo ratings yet

- Cost Accounting Foundations and Evolutions: Standard Costing and Variance AnalysisDocument54 pagesCost Accounting Foundations and Evolutions: Standard Costing and Variance AnalysismarieieiemNo ratings yet

- Material VariancesDocument2 pagesMaterial VariancestygurNo ratings yet

- SummaryDocument8 pagesSummarySittiehaina GalmanNo ratings yet

- Standard Costing 2024 - 1397583526Document20 pagesStandard Costing 2024 - 1397583526k.makwetu0No ratings yet

- Formulae On Standard CostingDocument3 pagesFormulae On Standard CostingRohit Singh Parihar83% (6)

- MS 06-06 Process CostingDocument6 pagesMS 06-06 Process CostingxernathanNo ratings yet

- Cost AccountingDocument9 pagesCost Accountingvvtrap.3003No ratings yet

- Cost Accounting Traditions and Innovations: Standard CostingDocument45 pagesCost Accounting Traditions and Innovations: Standard CostingMaricon BerjaNo ratings yet

- Mas 07Document14 pagesMas 07Christine Jane AbangNo ratings yet

- Lecture Notes - Chapter 6Document3 pagesLecture Notes - Chapter 6Saint BakemonoNo ratings yet

- Five-Page Summary of Key Concepts:: Cost ClassificationsDocument16 pagesFive-Page Summary of Key Concepts:: Cost ClassificationsDar FayeNo ratings yet

- Formulas AcountingDocument7 pagesFormulas AcountingHappy MealNo ratings yet

- Standard CostingDocument14 pagesStandard CostingRoselyn LumbaoNo ratings yet

- Scan - 2019-04-04 18 - 31 - 30 PDFDocument1 pageScan - 2019-04-04 18 - 31 - 30 PDFzenaidaNo ratings yet

- Variance ANALYSISDocument10 pagesVariance ANALYSISWaseim khan Barik zaiNo ratings yet

- Standard Costing and Variance AnalysisDocument8 pagesStandard Costing and Variance AnalysisSaad RebelNo ratings yet

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocument20 pagesMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija TalipanNo ratings yet

- Standard CostingDocument9 pagesStandard CostingRoselyn LumbaoNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Market Structure Perfect and Imperfect MarketsDocument31 pagesMarket Structure Perfect and Imperfect MarketsVirat BansalNo ratings yet

- Population Characteristics: Chapter 2: Population and The World EconomyDocument8 pagesPopulation Characteristics: Chapter 2: Population and The World EconomyHarish ChavlaNo ratings yet

- Rose Chap1Document24 pagesRose Chap1Humza ArshadNo ratings yet

- Deceitful Bawumia Must Stop Misleading Claims About Cedi Depreciation - Ato ForsonDocument5 pagesDeceitful Bawumia Must Stop Misleading Claims About Cedi Depreciation - Ato ForsonGhanaWeb EditorialNo ratings yet

- Unit 1 Summary (For Posting Online)Document63 pagesUnit 1 Summary (For Posting Online)Legogie Moses AnoghenaNo ratings yet

- Problem Set 7.2Document2 pagesProblem Set 7.2sumit jhaNo ratings yet

- Caporaso and Levine Ch1Document26 pagesCaporaso and Levine Ch1elijahNo ratings yet

- Suppose You Won The Florida Lottery and Were Offered ADocument1 pageSuppose You Won The Florida Lottery and Were Offered AAmit Pandey0% (1)

- Impact of The Currency Exchange RateDocument2 pagesImpact of The Currency Exchange RateLawrence JimenoNo ratings yet

- Valuations 1: Introduction To Methods of ValuationDocument17 pagesValuations 1: Introduction To Methods of ValuationNormande RyanNo ratings yet

- Eco QuizDocument9 pagesEco QuizAhsan IjazNo ratings yet

- Applied Economics ReviewerDocument6 pagesApplied Economics ReviewerAevan Joseph100% (1)

- Bodie10ce SM Ch01Document5 pagesBodie10ce SM Ch01beadand1No ratings yet

- Basics of Financial ManagementDocument48 pagesBasics of Financial ManagementAntónio João Lacerda Vieira100% (1)

- Meeting 10, Aggregate Expenditure and Equilibrium OutputDocument27 pagesMeeting 10, Aggregate Expenditure and Equilibrium OutputAndrian PratamaNo ratings yet

- Asset-V1 IMF+FMAx+2T2017+type@asset+block@FMAx M5 CLEAN New PDFDocument60 pagesAsset-V1 IMF+FMAx+2T2017+type@asset+block@FMAx M5 CLEAN New PDFHarpreet GillNo ratings yet

- Module 9 Earnings and Market Approach ValuationDocument46 pagesModule 9 Earnings and Market Approach ValuationJohn Paul TomasNo ratings yet

- The IS-LM/AD-AS Model: A General Framework For Macroeconomic AnalysisDocument38 pagesThe IS-LM/AD-AS Model: A General Framework For Macroeconomic AnalysisSyed Ghazanfar AliNo ratings yet

- Icsi Use MouDocument3 pagesIcsi Use MouPrashant SharmaNo ratings yet

- Operating LeverageDocument5 pagesOperating LeverageSalman MajeedNo ratings yet

- FINANCIAL MANAGEMENT MODULE 1 6 Cost of CapitalDocument27 pagesFINANCIAL MANAGEMENT MODULE 1 6 Cost of CapitalMarriel Fate CullanoNo ratings yet

- Slide AKT 405 Teori Akuntansi 12 GodfreyDocument33 pagesSlide AKT 405 Teori Akuntansi 12 Godfreyadinugroho0% (1)

- Chapter-9 Imperfect CompetitionDocument23 pagesChapter-9 Imperfect Competitiongr8_amaraNo ratings yet

- Pestle AnalysisDocument3 pagesPestle AnalysisATUL AB100% (1)

- BUSFIN 6a FINACIAL PLANNING TOOLS AND CONCEPTDocument14 pagesBUSFIN 6a FINACIAL PLANNING TOOLS AND CONCEPTRenz AbadNo ratings yet

- Social Safety Nets: BackgroundDocument13 pagesSocial Safety Nets: BackgroundFaizanAhmedNo ratings yet

- Module 1 International Marketing Notes Amity UniversityDocument7 pagesModule 1 International Marketing Notes Amity Universityrohan_jangid8No ratings yet

P 15 5. Standard Costing Chart

P 15 5. Standard Costing Chart

Uploaded by

Hari MOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P 15 5. Standard Costing Chart

P 15 5. Standard Costing Chart

Uploaded by

Hari MCopyright:

Available Formats

Satish Jalan Classes Courtesy: Shubham Chakraborty

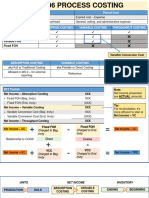

Standard Costing (bird's eye view)

Cost Variances (Production Analysis) Revenue Variances (Periodic Analysis) Reconciliation

-convert standard for actual production -convert standard for actual period

Material Quality Cost Var. Material Variances Labour Variances Variable O/H Variances Fixed O/H Variances Total O/H Variances Sales Variances Profit variances Absorption Approach Marginal Approach

1 Material Cost Variance: Material Cost Variance: Labour Cost Variance: VOH Cost Variance: FOH Cost Variance: Total O/H Cost Variances: Sales Value Variance: Sales Profit Variance: Budgeted Profit ** Budgeted Profit **

(Total Std Input Cost for (Total Std Cost for Act. (Total Std Cost for Act. (Total Std Cost for Act. (Std. FOH for Act. Output - FOH Cost Variance + VOH (Act. Sales for Act. Period - (Act. Profit for Act. Period - + Profit Price Var. ** + Contbn. Price Var. **

Act. Output - Act Input Output - Total act Cost) Output - Total act Cost) Output - Total act Cost for Act. FOH) Cost Variance Bud. Sales for Act. Period) Bud. Profit for Act. Period) + Profit Volume Var. ** + Contbn. Volume Var. **

Cost) Prdctv hrs) + Cost Var. + Cost Var.

2 Material Price Variance: Material Price Variance: labour Rate Variance: VOH Rate/Exp. Variance: FOH Exp. Variance: Total O/H Exp. Variance: Sales Price Variance: Profit Price Variance: MCV ** MCV **

(Std Pr. -Act Pr.) x Act Qt. (Std Pr. -Act Pr.) x Act Qt. (Std. Rate - Act. Rate) x Act. (Std. Rate/hr. - Act (Bud. FOH for Bud. Output - VOH Exp. Variance + FOH (Act. Price - Std. Price) x (Act. Profit/ut. - LCV ** LCV **

=Std Pr. x Act Qt.-Act Pr. x =Std Pr. x Act Qt.-Act Pr. x Hrs paid Rate/hr.) x Act. Prdctv hrs Act. FOH) Exp. Varinace. Act. output sold Std.profit/ut.) x Act. output VOHCV ** VOHCV **

Act Qt. Act Qt. = AP x AO - SP x AO sold FOH Exp. Var. ** FOH Exp. Var. ** **

= AP x AO - SP x AO FOH Vol. Var. ** **

3 Material Usage Variance: Material Usage Variance: Labour Efficiency VOH Efficiency Variance: FOH Volume Variance: VOH Efficiency Variance: Sales Volume Variance: Profit Volume Variance: Actual Profit Actual Profit

(Std Qt.-Act Qt.) x Std Pr. (Std Qt. for Act. Output-Act Variance: (Std. Hrs for Act. Output - (Act. Output - Bud. Output) (Std. Hrs for Act. Output - (Act. Output sold - Bud (Act. Output sold - Bud on Act Cost ** on Act Cost **

=Std Qt. x Std Pr. - Act Qt. x Qt.) x Std Pr. (Std. Hrs for Act. Out put - Act. Prdctv hrs) x Std. x Std. FOH/ut. Act. Prdctv hrs) x Std. output sold) x Std Selling output sold) x Std Profit/ut.

Std. Pr. =Std Qt. x Std Pr. - Act Qt. x Act. Prodctv Hrs) x Std Rate/hr. Rate/hr. price/ut. =AO x Std. Profit/ut - BO x A) Profit Price Var. = Sales

Std. Pr. Rate/hr =AO x Std. SP - BO x Std. SP Std. Profit/ut Price Var. A) Contbn. Price Var. =

Sales Price Var.

4 Material Mix Variance: Material Mix Variance: Labour Mix Variance: FOH Calendar Variance: FOH Volume Variance: Sales Mix Variance: Profit Mix Variance:

(Std. Prop. - Act. Prop.) x (Std. Prop. - Act. Prop.) x (TAPH/TSH) x TSC -(APH x (Act. Working dy - Bud. (Act. Output - Bud. Output) (Act. Prop - Std. Prop) x (Act. Prop - Std. Prop) x B) Contbn. Volume Var. =

Total std. Qt. x StdPr. Total std. Qt. x StdPr. SR) Working dy) x Std. FOH/day x Std. FOH/ut. TAO x Std. SP/ut TAO x Std. Profit/ut Profit Volume Var. + FOH

=(TAQ/TSQ) x TSC-(AQ x =(TAQ/TSQ) x TSC-(AQ x SP) =AO x Std SP - (TAO/TSO) x =AO x Std. Profit/ut - Volume Var.

SP) Total Bud. Sales (TAO/TBO) x Total Bud.

Profit

5 Material Yield Variance: Material Yield Variance: Labour Yield Variance: FOH Capacity Sales Qty. Yield Variance: Profit Qty. Variance: Note: Note:

(Total Std Qt. for Act. (Total Std Qt. for Act. (Total Std Hr. -Total Act. Var.(Revised): (Total Act. Output - Total (Total Act. Output - Total Add: Fav. Variances Add: Fav. Variances

Output - Total Act. Qt.) x Output - Total Act. Qt.) x Prdctv Hrs) x Std. Wtd. Avg. (Act. Hrs - Bud. Hrs in act Bud. Output) x Std. Wtd. Bud. Output) x Std. Wtd. Less: Adv. Variances Less: Adv. Variances

Std. Wtd. Avg. Pr. Std. Wtd. Avg. Pr. Rate dys) x Std FOH/hr Avg Price/ut. Avg Profit/ut.

6 Mat. Rework Cost Var.: Labour Idle Time Var.: FOH Idle Time Variance: Market Size Variance: Market Size Variance:

(Std Rewrk cost for Act (Std. Abnrml Idle tm - Act. (Std. Idle Tm - Act. Idle Tm) (Act. Industry Sales ut - (Act. Industry Sales ut -

Output - Act. Rewrk cost) Abnrml Idle tm) x Std x Std FOH/hr Bud. Industry sales ut) x Bud. Industry sales ut) x

Rate/hr Bud share% x Std. Wtd. Avg Bud sales% x Std. Wtd. Avg

Price/ut. Profit/ut.

(For Ab. Idle Time)

7 Mat. Scrap realisation FOH Efficiency Variance: Market Share Variance: Market Share Variance:

Variance: (Std. Hrs for Act. Output - (Act. Share% - Bud. Share%) (Act. Share% - Bud. Share%)

(Act. Scrap Rlsn-Std Scrp Act. Prdctv hrs) x Std. x Act. Industry Sales x Std. x Act. Industry Sales x Std.

Rlsn for Act. Out put) Rate/hr. Wtd. Avg Price/ut. Wtd. Avg Profit/ut.

8 Material Quality Cost Var.

(Std net Mat. Cost for Act.

Output - Act net Mat. Cost)

9 Check: 1= 2+3; 3= 4+5; Check: 1= 2+3 ; 3= 4+5 Check: 1= 2+3 ; 3= 4+5+6 Check: 1= 2+3 Check: 1= 2+3 ; Check: 1=2+3+4 Check: 1= 2+3 ;3= 4+5; Check: 1= 2+3 ;3= 4+5;

8=1+6+7 3= 4+5+6+7 5= 6+7 5= 6+7

A) Emergency Purchase A) Std. Hrs produced is out A) Can vary with output A) Marginal Approach: No A) 3 points analysis. A) Cost is constant A) Product Cost = Variable A) Product Cost = Variable

Effect. put measure for multiple produced, then no VOH Eff. FOH Vol Var. at Std. Cost Cost + Fixed Cost Cost

Additional Price over act. products. Var.

Purchase Price should be B) FOH Ratios: B) Profit Price Variance Period Cost = Selling Cost. Period Cost = Fixed Cost.

charged to Production B) Where no. of employees 1. Vol. Ratio= AO/BO = Sales Price Variance.

Manager. given take Man-Hrs. 2. Cal. Ratio= Act days/Bud B) Margin = Profit = SP-VC- B) Margin =Cont. = SP-VC

B) Single Plan: Closing st. at Days. FC

std price. & MPV on C) Std. Ab. Idle Time is 3. Capa. Ratio= AH/BH in

Purchase Qty. always "0" ; ITV is adverse. act days.

Partial Plan: Closing st. at 4. Eff. Ratio= SH for AO/AH

actual price. & MPV on Qty.

consumed. (1 = 2 x 3 x 4)

You might also like

- Cost Accounting Formula'sDocument7 pagesCost Accounting Formula'sdigital_darwaish82% (39)

- Standard Costing: QUANTITY Standard - Indicates The Quantity of Raw Materials orDocument19 pagesStandard Costing: QUANTITY Standard - Indicates The Quantity of Raw Materials orMarielle Mae Burbos100% (2)

- Midterm 1 Review QuestionsDocument7 pagesMidterm 1 Review QuestionsDevin KosinNo ratings yet

- Service Marketing Lecture of Chapter 1 (4th Edition)Document24 pagesService Marketing Lecture of Chapter 1 (4th Edition)Biplob SarkarNo ratings yet

- IIBM Case Study AnswersDocument98 pagesIIBM Case Study AnswersAravind 9901366442 - 990278722422% (9)

- Formula List of Basic Variance PDFDocument4 pagesFormula List of Basic Variance PDFShi Yan LNo ratings yet

- Overhead and Other Variances PDFDocument26 pagesOverhead and Other Variances PDFAnuruddha RajasuriyaNo ratings yet

- Variance FormulasDocument5 pagesVariance Formulaskhanmohnoor550No ratings yet

- Formula For Calculating Variances - UpdatedDocument3 pagesFormula For Calculating Variances - UpdatedNikita ConatyNo ratings yet

- 06 Standard Costing PDFDocument5 pages06 Standard Costing PDFMarielle CastañedaNo ratings yet

- Standard Costing - UpdatedDocument38 pagesStandard Costing - UpdatedChristian TanNo ratings yet

- Costing Notes Chapter - Standard Costing: MCV Muv + MPV and Muv Myv + MMVDocument12 pagesCosting Notes Chapter - Standard Costing: MCV Muv + MPV and Muv Myv + MMVSocial SectorNo ratings yet

- Standart Costing PDFDocument3 pagesStandart Costing PDFVIHARI DNo ratings yet

- Disposition of VariancesDocument12 pagesDisposition of VariancesNors PataytayNo ratings yet

- STANDARD COSTING and Variance AnalysisDocument30 pagesSTANDARD COSTING and Variance AnalysisAlthon JayNo ratings yet

- MarginalDocument32 pagesMarginalfawad aslamNo ratings yet

- 7 - Variance AnalysisDocument15 pages7 - Variance AnalysisRakeysh RakyeshNo ratings yet

- CH 10 NotesDocument13 pagesCH 10 NotesmohamedNo ratings yet

- Summary FinalDocument28 pagesSummary FinalJackNo ratings yet

- Formulas in CostDocument3 pagesFormulas in CostHappyPurpleNo ratings yet

- STCM06 Standard CostingDocument31 pagesSTCM06 Standard Costingdin matanguihanNo ratings yet

- Module 005 Standard CostingDocument12 pagesModule 005 Standard CostinggagahejuniorNo ratings yet

- A) Direct Material Variances: Sub Usage Variance Mix VarianceDocument3 pagesA) Direct Material Variances: Sub Usage Variance Mix Variancekamalesh123No ratings yet

- Costing FormulasDocument4 pagesCosting FormulasAlkaNo ratings yet

- Formula:: High Low Method (High - Low) Break-Even PointDocument24 pagesFormula:: High Low Method (High - Low) Break-Even PointRedgie Mark UrsalNo ratings yet

- Scan - 2019-04-04 18 - 33 - 13Document1 pageScan - 2019-04-04 18 - 33 - 13zenaidaNo ratings yet

- 5-Standard Costing and GP Variance AnalysisDocument16 pages5-Standard Costing and GP Variance AnalysisMelybelle LaurelNo ratings yet

- Standard Costing and Variance Analysis As Applied ToDocument39 pagesStandard Costing and Variance Analysis As Applied TorhearomefranciscoNo ratings yet

- Standard Costing and Variance Analysis: Cost Accounting: Foundations and Evolutions, 8eDocument46 pagesStandard Costing and Variance Analysis: Cost Accounting: Foundations and Evolutions, 8eEinstein SalcedoNo ratings yet

- 08-Foh Cost VarianceDocument21 pages08-Foh Cost VariancePutri Dwi KartiniNo ratings yet

- Chap 4 MNGT Acctng PDFDocument4 pagesChap 4 MNGT Acctng PDFRose Ann YaboraNo ratings yet

- AHSQPAccountingDocument31 pagesAHSQPAccountingMUSTHARI KHANNo ratings yet

- Variance Analysis - Basic Formulas: 1) Material, Labour, Variable Overhead VariancesDocument3 pagesVariance Analysis - Basic Formulas: 1) Material, Labour, Variable Overhead VariancesAslam SiddiqNo ratings yet

- Joint & by ProductsDocument10 pagesJoint & by Productsharry severino0% (1)

- Variable Production Overhead Variance (VPOH)Document9 pagesVariable Production Overhead Variance (VPOH)Wee Han ChiangNo ratings yet

- AH Accounting FormulaeSheetVarianceAnalysis PDFDocument2 pagesAH Accounting FormulaeSheetVarianceAnalysis PDFAditi SInghNo ratings yet

- Mix and Yield VariancesDocument12 pagesMix and Yield VariancesVashisht SewsaransingNo ratings yet

- 18-19 - Greek Art NW2zVgxhbgDocument15 pages18-19 - Greek Art NW2zVgxhbgshubhangi.jain582No ratings yet

- Standard Costing: Output (Eg. Pieces Per Unit)Document4 pagesStandard Costing: Output (Eg. Pieces Per Unit)glcpaNo ratings yet

- Module 4Document4 pagesModule 4mark fernandezNo ratings yet

- Cost Accounting Foundations and Evolutions: Standard Costing and Variance AnalysisDocument54 pagesCost Accounting Foundations and Evolutions: Standard Costing and Variance AnalysismarieieiemNo ratings yet

- Material VariancesDocument2 pagesMaterial VariancestygurNo ratings yet

- SummaryDocument8 pagesSummarySittiehaina GalmanNo ratings yet

- Standard Costing 2024 - 1397583526Document20 pagesStandard Costing 2024 - 1397583526k.makwetu0No ratings yet

- Formulae On Standard CostingDocument3 pagesFormulae On Standard CostingRohit Singh Parihar83% (6)

- MS 06-06 Process CostingDocument6 pagesMS 06-06 Process CostingxernathanNo ratings yet

- Cost AccountingDocument9 pagesCost Accountingvvtrap.3003No ratings yet

- Cost Accounting Traditions and Innovations: Standard CostingDocument45 pagesCost Accounting Traditions and Innovations: Standard CostingMaricon BerjaNo ratings yet

- Mas 07Document14 pagesMas 07Christine Jane AbangNo ratings yet

- Lecture Notes - Chapter 6Document3 pagesLecture Notes - Chapter 6Saint BakemonoNo ratings yet

- Five-Page Summary of Key Concepts:: Cost ClassificationsDocument16 pagesFive-Page Summary of Key Concepts:: Cost ClassificationsDar FayeNo ratings yet

- Formulas AcountingDocument7 pagesFormulas AcountingHappy MealNo ratings yet

- Standard CostingDocument14 pagesStandard CostingRoselyn LumbaoNo ratings yet

- Scan - 2019-04-04 18 - 31 - 30 PDFDocument1 pageScan - 2019-04-04 18 - 31 - 30 PDFzenaidaNo ratings yet

- Variance ANALYSISDocument10 pagesVariance ANALYSISWaseim khan Barik zaiNo ratings yet

- Standard Costing and Variance AnalysisDocument8 pagesStandard Costing and Variance AnalysisSaad RebelNo ratings yet

- MAS 2023 Module 5 Standard Costing and Variance AnalysisDocument20 pagesMAS 2023 Module 5 Standard Costing and Variance AnalysisDzulija TalipanNo ratings yet

- Standard CostingDocument9 pagesStandard CostingRoselyn LumbaoNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Market Structure Perfect and Imperfect MarketsDocument31 pagesMarket Structure Perfect and Imperfect MarketsVirat BansalNo ratings yet

- Population Characteristics: Chapter 2: Population and The World EconomyDocument8 pagesPopulation Characteristics: Chapter 2: Population and The World EconomyHarish ChavlaNo ratings yet

- Rose Chap1Document24 pagesRose Chap1Humza ArshadNo ratings yet

- Deceitful Bawumia Must Stop Misleading Claims About Cedi Depreciation - Ato ForsonDocument5 pagesDeceitful Bawumia Must Stop Misleading Claims About Cedi Depreciation - Ato ForsonGhanaWeb EditorialNo ratings yet

- Unit 1 Summary (For Posting Online)Document63 pagesUnit 1 Summary (For Posting Online)Legogie Moses AnoghenaNo ratings yet

- Problem Set 7.2Document2 pagesProblem Set 7.2sumit jhaNo ratings yet

- Caporaso and Levine Ch1Document26 pagesCaporaso and Levine Ch1elijahNo ratings yet

- Suppose You Won The Florida Lottery and Were Offered ADocument1 pageSuppose You Won The Florida Lottery and Were Offered AAmit Pandey0% (1)

- Impact of The Currency Exchange RateDocument2 pagesImpact of The Currency Exchange RateLawrence JimenoNo ratings yet

- Valuations 1: Introduction To Methods of ValuationDocument17 pagesValuations 1: Introduction To Methods of ValuationNormande RyanNo ratings yet

- Eco QuizDocument9 pagesEco QuizAhsan IjazNo ratings yet

- Applied Economics ReviewerDocument6 pagesApplied Economics ReviewerAevan Joseph100% (1)

- Bodie10ce SM Ch01Document5 pagesBodie10ce SM Ch01beadand1No ratings yet

- Basics of Financial ManagementDocument48 pagesBasics of Financial ManagementAntónio João Lacerda Vieira100% (1)

- Meeting 10, Aggregate Expenditure and Equilibrium OutputDocument27 pagesMeeting 10, Aggregate Expenditure and Equilibrium OutputAndrian PratamaNo ratings yet

- Asset-V1 IMF+FMAx+2T2017+type@asset+block@FMAx M5 CLEAN New PDFDocument60 pagesAsset-V1 IMF+FMAx+2T2017+type@asset+block@FMAx M5 CLEAN New PDFHarpreet GillNo ratings yet

- Module 9 Earnings and Market Approach ValuationDocument46 pagesModule 9 Earnings and Market Approach ValuationJohn Paul TomasNo ratings yet

- The IS-LM/AD-AS Model: A General Framework For Macroeconomic AnalysisDocument38 pagesThe IS-LM/AD-AS Model: A General Framework For Macroeconomic AnalysisSyed Ghazanfar AliNo ratings yet

- Icsi Use MouDocument3 pagesIcsi Use MouPrashant SharmaNo ratings yet

- Operating LeverageDocument5 pagesOperating LeverageSalman MajeedNo ratings yet

- FINANCIAL MANAGEMENT MODULE 1 6 Cost of CapitalDocument27 pagesFINANCIAL MANAGEMENT MODULE 1 6 Cost of CapitalMarriel Fate CullanoNo ratings yet

- Slide AKT 405 Teori Akuntansi 12 GodfreyDocument33 pagesSlide AKT 405 Teori Akuntansi 12 Godfreyadinugroho0% (1)

- Chapter-9 Imperfect CompetitionDocument23 pagesChapter-9 Imperfect Competitiongr8_amaraNo ratings yet

- Pestle AnalysisDocument3 pagesPestle AnalysisATUL AB100% (1)

- BUSFIN 6a FINACIAL PLANNING TOOLS AND CONCEPTDocument14 pagesBUSFIN 6a FINACIAL PLANNING TOOLS AND CONCEPTRenz AbadNo ratings yet

- Social Safety Nets: BackgroundDocument13 pagesSocial Safety Nets: BackgroundFaizanAhmedNo ratings yet

- Module 1 International Marketing Notes Amity UniversityDocument7 pagesModule 1 International Marketing Notes Amity Universityrohan_jangid8No ratings yet