Professional Documents

Culture Documents

Liquidity Ratios

Liquidity Ratios

Uploaded by

Czar Ysmael Rabaya0 ratings0% found this document useful (0 votes)

28 views3 pagesThis document summarizes key liquidity and profitability ratios used to analyze a company's financial statements. It defines 14 liquidity ratios that measure a company's ability to pay off short-term and long-term debt, manage inventory levels, and collect receivables. It also outlines 10 profitability ratios that evaluate a company's ability to generate profits relative to sales, assets, and equity. The document concludes by noting important concepts like return, turnover, and the DuPont model for return on assets and equity analysis.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes key liquidity and profitability ratios used to analyze a company's financial statements. It defines 14 liquidity ratios that measure a company's ability to pay off short-term and long-term debt, manage inventory levels, and collect receivables. It also outlines 10 profitability ratios that evaluate a company's ability to generate profits relative to sales, assets, and equity. The document concludes by noting important concepts like return, turnover, and the DuPont model for return on assets and equity analysis.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

28 views3 pagesLiquidity Ratios

Liquidity Ratios

Uploaded by

Czar Ysmael RabayaThis document summarizes key liquidity and profitability ratios used to analyze a company's financial statements. It defines 14 liquidity ratios that measure a company's ability to pay off short-term and long-term debt, manage inventory levels, and collect receivables. It also outlines 10 profitability ratios that evaluate a company's ability to generate profits relative to sales, assets, and equity. The document concludes by noting important concepts like return, turnover, and the DuPont model for return on assets and equity analysis.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

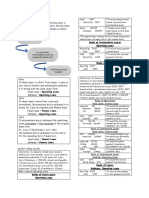

LIQUIDITY RATIOS PROFITABILITY RATIOS

Focuses on Balance Sheet Focuses on Income Statement

Focuses on CURRENT AND NON CURRENT ASSETS Focuses on Operations UPPER PORTION OF EBIT

NAME OF RATIO FORMULA SIGNIFICANCE NAME OF RATIO FORMULA SIGNIFICANCE

1.) CURRENT RATIO/ BANKER’S CURRENT ASSETS / CURRENT Test ability to pay short term debts 1.) PROFIT MARGIN NET PROFIT / NET TOTAL SALES Measures profit generated after

RATIO/ WORKING CAPITAL RATIO LIABILITIES considering all costs and expenses

2.) QUICK RATIO/ ACID TEST QUICK ASSETS / CURRENT Test ability to pay short term debts without 2.) GROSS PROFIT RATE EBIT / NET TOTAL SALES Measures profit generated after

RATIO LIABILITIES inventory considering necessary production

(CASH, MARKETABLE SECURITIES, ACCOUNTS

RECEIVABLE)

costs

3.) CURRENT ASSETS TURNOVER NET SALES / CURRENT Measures current assets efficiency 3.) RETURN ON INVESTMENT EBIT x ATr / AVERAGE TOTAL Measures Earnings Gross to its

ASSETS ASSETS Investments employed

4.) INVENTORY TURNOVER COST OF GOODS SOLD / Measures firm efficiency in selling inventory 4.) RETURN ON ASSETS NET PROFIT / AVERAGE TOTAL Measures Firm’s ability to manage

AVERAGE INVENTORY ASSETS assets to generate PROFIT

5.) AVERAGE AGE OF INVENTORY/ AVERAGE INVENTORY / Measure # of days to averagely sell the 5.) RETURN ON EQUITY NET PROFIT / AVERAGE TOTAL Measures Rate of Return on

# OF DAYS SUPPLY OF (COST OF GOODS SOLD/365) inventory EQUITY Resources provided by Owners

INVENTORY 6.) RETURN ON ORDINARY PROFIT available to OS / AVERAGE Measures Rate of Return on

6.) RECEIVABLE TURNOVER NET CREDIT SALES / AVERAGE Mesures firm efficiency in collecting its EQUITY ORDINARY EQUITY Resources applicable to Ordinary

TRADE RECEIVABLES receivables Shares

7.) AVERAGE AGE OF AVERAGE TRADE Measures liquidity of a/r and evaluate # of 7.) RETURN ON SALES NET PROFIT / NET TOTAL SALES Measures Profit generated in

RECEIVABLES/ AVERAGE RECEIVABLES / days to average collect a/r per frim proportion to sales generated

COLLECTION PERIOD (NET CREDIT SALES/365) collection policy 8.) DEGREE OF OPERATING CONTRIBUTION MARGIN / EBIT Measures How volatile EBIT to change

8.) ACCOUNTS PAYABLE NET CREDIT PURCHASES / Determine if firm is efficient i paying its LLEVERAGE in sales Volume without changed in

TURNOVER AVERAGE TRADE PAYABLES payables Fixed Costs

9.) AVERAGE AGE OF ACCOUNTS AVERAGE TRADE PAYABLES / Measures number of days to pay its 9.) EARNINGS PER SHARE (NET PROFIT – applicable Pref. Div) / Peso Return of each Ordinary Share

PAYABLE/ PAYMENT PERIOD (NET CREDIT PURCHASES/365) currently maturing payables AVERAGE OS OUTSATNDING Outstanding. THE MOST AWAITED

10.) CASH TURNOVER OPERATING EXPENSES/ Meases availability of cash to meet daily RESULT OF ALL, AND INCLUDED IN

AVERAGE CASH BALANCE expenses THE PRESENTATION OF FS.

11.) DAYS CASH AVERAGE CASH BALANCE / # Of days of cash to be available to meet 10.) DILLUTED EARNNINGS PER (ADJ. NET PROFIT – applicable Pref. Peso Return of each Ordinary Share

(OPERATING EXPENSES/365) daily expenses SHARE Div) / OS OUTSTANDING AND Outstanding and potential Ordinary

12.) OPERATING CYCLE COLLECTION PERIOD + Measures number of days to convert POTENTIAL OS Shares

INVENTORY DAYS inventories into cash

13.) ASSET TURNOVER/ NET TOTAL SALES / AVERAGE Measures the efficiency of firm in managing

INVESTMENT TURNOVER TOTAL ASSETS it’s total assets

14.) EQUITY TURNOVER NET TOTAL SALES / AVERAGE Measures the ability of equity to generate SALIENT PONTS:

TOTAL EQUITY sales

15.) CAPITAL INTENSITY AVERAGE TOTAL ASSETS/ NET Measures how much assets needed to

RETURN - (NET PROFIT) Numerator

TOTAL SALES generate its sales

TURN OVER – (SALES, COGS, PURCHASES) Numerator

16.) WORKING CAPITAL NET TOTAL SALES / AVERAGE Measures the ability of working capital to

TURNOVER WORKING CAPITAL generate sales

DU PONT MODEL

EQUITY MULTIPLIER BOOK VALUE

SALIENT PONTS: RATIO PROFIT MARGIN ASSET TURNOVER (Leverage) PER SHARE

(Profitability) (Liquidity) (Growth)

Inventory Days Supply (INVENTORY) xxx TURN OVER – (SALES, COGS, PURCHASES) Numerator RETURN ON ASSETS (ROA) NET PROFIT / NET NET TOTAL SALES /

TOTAL SALES AVERAGE TOTAL

+Collection Period (RECEIVABLE) + xxx RETURN - (NET PROFIT) Numerator ASSETS

OPERATING CYCLE xxx RETURN ON EQUITY (ROE) NET PROFIT / NET NET TOTAL SALES / AVERAGE TOTAL

-Payment Period (PAYABLES) (xxx) TOTAL SALES AVERAGE TOTAL ASSETS / AVERAGE

NET CASH CYCLE xxx ASSETS TOTAL EQUITY

EARNINGS PER SHARE NET PROFIT / NET NET TOTAL SALES / AVERAGE TOTAL AVERAGE

TOTAL SALES AVERAGE TOTAL ASSETS / AVERAGE TOTAL

Techniques: ASSETS TOTAL EQUITY EQUITY/ # OF

ACCOUNTS PAIRED NOT PAIRED ORDINARY

SHARES

BALANCE SHEET ACCOUNTS AVERAGED NET

INCOME STATEMENT ACCOUNTS NET NET

LEVERAGE RATIOS GROWTH RATIOS

Focuses on NON CURRENT LIABILITIES AND EQUITY Focuses on OUTSIDE INFORMATION AND MARKET PRICES and DIVIDENDS

Focuses on LOWER PORTION OF EBIT Focuses on Value of Shares and its Growth

NAME OF RATIO FORMULA SIGNIFICANCE NAME OF RATIO FORMULA SIGNIFICANCE

1.) TOTAL DEBT REATIO TOTAL LIABILITIES / TOTAL Measures % of Funds provided by 1.) PRICE PER EARNINGS RATIO MARKET PRICE of O/S / EARNINGS Measures Relationship between

ASSETS Creditors PER SHARE Market Price of Shares over its

Earning Potential

2.) DEBT TO EQUITY RATIO TOTAL LIABILITIES / TOTAL Compares Resources provided by Creditors

EQUITY over Investors and Owners 2.) DIVIDEND PAY OUT RATIO DIVIDEND PER O/S / EARNINGS Shows % of earnings Paid to

PER SHARE Investors

3.) EQUITY RATIO TOTAL EQUITY / TOTAL REFLECTS FINANCIAL STRENGTH OF

ASSETS OWNERS AND INVESTORS 3.) DIVIDEND YIELD RATIO DIVIDEND PER O/S / MARKET PRICE Shows the rate Earned by

PER SHARE Shareholders from Dividends Relative

4.) EQUITY MULTIPLIER AVERAGE TOTAL ASSETS / How many Times Assets is Multiplied by

to Current Price of Shares

AVERATE TOTAL EQUITY Owner and Investor Funds

4.) DIVIDEND REINVESTMENT/ 1 – DIVIDEND PAY OUT RATIO Shows % of earnings Retained by

5.) TIMES INTEREST EARNED EBIT / INTEREST EXPENSE Measures How many Times we can cover

RETENTION RATE Company as REINVESTMENT

Interest Expense using EBIT

5.) DIVIDEND PER SHARE DIVIDENDS declared or Paid / # of Shows proportion of Net Income

6.) FIXED EXPENSES EARNED EBT+FIXED CHARGES / FIXED Measures How many Times we can cover

O/S OUTSATNDING distributed to Investor on per share

RATIO CHARGES our Fixed Charges

basis they owned.

7.) DEGREE OF FINANCIAL EBIT / [EBIT – Interest Expense Measures THE Ability of Firm to use DEBT

7.) BOOK VALUE PER Liquidating Value of PS xxx Value of One Preference share over its

LEVERAGE – Preferrence Dividend as a leverage or multiply NET PROFIT

PREFERENCE SHARE + Applicable Dividend PS xxx Total Preference Shareholder’s Equity

GROSSED UP AFTER TAX]

Total Preference SHE xxx

8.) ASSET TO LIABILITY RATIO TOTAL ASSET / TOTAL Measures How much we can cover our

/ # OF PS / xx

LIABOILITIES Liabilities using our Assets

BV per PS xxx

9.) NON CURRENT ASSETS TO NON CURRENT ASSETS / NON Measures the Strength of our Non current

6.) BOOK VALUE PER ORDINARY Total Share Holder’s Equity xxx Value of One Ordinary share over its

LONG TERM LIABILITY RATIO CURRENT LIABILITIES Assets over its Non current Liabilities

SHARE Less: Total Preference SHE (xxx) Total Ordinary Shareholder’s Equity

Ordinary SHE xxx

/ # OF OS / xx

BV per OS xxx

COMPLETE MANAGEMENT INCOMENT STATEMENT 7.) BOOK VALUE PER SHARES TOTAL SHE / # OF ORDINARY Value of One share over its Total

SHARES Shareholder’s Equity

SALES P 100,000 8.) ECONOMIC VALUE ADDED NET PROFIT xxx A measure of Shareholder’s value of

[EVA] Less: TOTAL SHE x WACC (xxx) Creating Profits over its Relative Cost

LESS: VARIABLE COST (60,000)

Economic Value Added xxx of Investment or Capital

CONTRIBUTION MARGIN 40,000

9.) MARKET PRICE BOOK RATIO MARKET PRICE of O/S / BV PER O/S Measure the Current Price of SHARE

LESS: FIXED COST (30,000) over its own Book value.

Earnings Before Interest and Tax (EBIT) 10,000

LESS: INTEREST EXPENSE (2,000)

Earnings Before Taxes (EBT) 8,000 SALIENT PONTS:

LESS: 30%TAX (EBT x Tr) [8,000x30%] (2,400)

NET PROFIT 5,600

CONSIDERATION OF APPLICABLE DIVIDENDS FOR PREFERENCE SHARES EQUITY:

LESS: Applicable preferred Dividends (1,400)

Type of Preference Share Current Dividend Dividends in Arrears

PROFITS Available for O/S P 4,200

Cumulative INCLUDED INCLUDED IF PAID

Non Cumulative INCLUDED WHEN DECLARED EXCLUDED

# of Ordinary Shares 1,000 shares

IF silent INCLUDED EXCLUDED

Earnings Per Share P 4.20 per Share

RELATIONSHIP OF EPS TO DIVIDENDS AND SAVINGS:

EARNINGS DIVISION PURPOSE Amount RATE Short Term Long Term

PER of Name of Rate Investors Invstors

SHARE Partition

DIVIDENDS Distribution to inevstor/ P 1.00 40.82 Dividend Pay WANT WANT MORE

DIVIDEND RETAINED

P 2.45 owners of Shares % out Rate EARNINGS AND

MORE AND HIGH SAVNGS

SAVINGS Retained by the Company Retention/ LIQUIDITY RATE

and Saved in the Retained P 2.45 59.18 Reinvestment MV/ SHARE = MV/ SHARE =

Earnings for Reinvestment Rate DECREASE INCREASE

%

You might also like

- Wall Street Mastermind S Investment Banking Technical Interview Cheat SheetDocument2 pagesWall Street Mastermind S Investment Banking Technical Interview Cheat Sheetxandar198No ratings yet

- Finance Chapter 9Document36 pagesFinance Chapter 9mamarcus-1100% (2)

- Sleeping Beauties Bonds - Walt Disney CompanyDocument15 pagesSleeping Beauties Bonds - Walt Disney CompanyThùyDương Nguyễn100% (2)

- 3 - Sbi FFR I & II FormatDocument3 pages3 - Sbi FFR I & II FormatCA Shailendra Singh78% (9)

- Mas Handout 1Document13 pagesMas Handout 1Rue Scarlet100% (2)

- Engel, Louis & Boyd, Brendan - How To Buy StocksDocument364 pagesEngel, Louis & Boyd, Brendan - How To Buy StocksJoao Vicente Oliveira100% (2)

- Marakon ApproachDocument30 pagesMarakon ApproachVaidyanathan Ravichandran100% (1)

- Ratios PDFDocument1 pageRatios PDFSayan AcharyaNo ratings yet

- Financial Ratios - Sheet1Document4 pagesFinancial Ratios - Sheet1Melanie SamsonaNo ratings yet

- Ratio Used To Gauge Asset Management Efficiency and Liquidity Name Formula SignificanceDocument9 pagesRatio Used To Gauge Asset Management Efficiency and Liquidity Name Formula SignificanceAko Si JheszaNo ratings yet

- Financial Statement Analysis Antonio Jaramillo DayagDocument11 pagesFinancial Statement Analysis Antonio Jaramillo DayagAldrin RomeroNo ratings yet

- Commonly Used RatiosDocument12 pagesCommonly Used RatioscyrilljoypNo ratings yet

- Summary of Financial RatiosDocument9 pagesSummary of Financial RatiosEdrian CabagueNo ratings yet

- Ratios Formulas CommentsDocument5 pagesRatios Formulas CommentsMariano DumalaganNo ratings yet

- Financial Management - Compilation of Financial RatiosDocument6 pagesFinancial Management - Compilation of Financial RatiosIce AlojaNo ratings yet

- Financial PlanningDocument24 pagesFinancial PlanningDayaan ANo ratings yet

- Summary of Financial Ratios DiscussionDocument30 pagesSummary of Financial Ratios DiscussionJohn Mark CabrejasNo ratings yet

- Summary of Ratio AnalysisDocument2 pagesSummary of Ratio Analysiskristinetoledo046No ratings yet

- Commonly Used RatiosDocument12 pagesCommonly Used Ratiosg.canoneo.59990.dcNo ratings yet

- Interest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeDocument3 pagesInterest Expense: ASSET MANAGEMENT RATIOS-how The Firm Uses Its Assets To Generate Revenue and IncomeAshley Levy San PedroNo ratings yet

- Ratio Formula Comments: A. Liquidity RatiosDocument2 pagesRatio Formula Comments: A. Liquidity RatiosPaula FornollesNo ratings yet

- Current Assets Current Liabilties: Tests of LiquidityDocument5 pagesCurrent Assets Current Liabilties: Tests of LiquidityCesNo ratings yet

- Financial Accounting Analysis Cheat SheetDocument1 pageFinancial Accounting Analysis Cheat SheetMinyu LvNo ratings yet

- Formula CardDocument2 pagesFormula CardIan LicarosNo ratings yet

- Financial Mix RatiosDocument7 pagesFinancial Mix RatiosansanandresNo ratings yet

- Formula SheetDocument1 pageFormula SheetNikhil TodiNo ratings yet

- Summary of RatiosDocument1 pageSummary of RatiosShamima AkterNo ratings yet

- Previous Years Questions and AnswersDocument26 pagesPrevious Years Questions and Answerslucky420024No ratings yet

- HO 4 - Telecoms - Industry - and - Operator - Benchmarks - by - Key - Financial - Metrics - 4Q13Document28 pagesHO 4 - Telecoms - Industry - and - Operator - Benchmarks - by - Key - Financial - Metrics - 4Q13Saud HidayatullahNo ratings yet

- Kpi 1713958219Document1 pageKpi 1713958219omji5177No ratings yet

- Ratio Formula Comments: A. Liquidity RatiosDocument2 pagesRatio Formula Comments: A. Liquidity RatiosRes GosanNo ratings yet

- QTR Three ReviewerDocument5 pagesQTR Three ReviewerHannah Michaela GemidaNo ratings yet

- Accounting KpisDocument6 pagesAccounting KpisHOCININo ratings yet

- ACCCDocument6 pagesACCCAynalem KasaNo ratings yet

- Ratios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)Document3 pagesRatios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)MJNo ratings yet

- Financial Ratios ReportDocument12 pagesFinancial Ratios ReportGeloNo ratings yet

- KPI's For Accounts & Finance DeptDocument1 pageKPI's For Accounts & Finance DeptShaheryar ShahidNo ratings yet

- Guide Lines To Financial Ratios .FinalDocument4 pagesGuide Lines To Financial Ratios .Finaldavid gamalNo ratings yet

- Financial Ratios FormulaDocument2 pagesFinancial Ratios FormulaAlthea AcidreNo ratings yet

- 01 Financial Statement Analysis - LectureDocument40 pages01 Financial Statement Analysis - LectureChelsea ManuelNo ratings yet

- Topic 6 - FS AnalysisDocument43 pagesTopic 6 - FS Analysis2022495208No ratings yet

- Ratio Analysis:: Liquidity Measurement RatiosDocument8 pagesRatio Analysis:: Liquidity Measurement RatiossammitNo ratings yet

- Ratio Analysis SummaryDocument5 pagesRatio Analysis SummaryPhuoc TruongNo ratings yet

- Summary of RatiosDocument1 pageSummary of RatiosShamima AkterNo ratings yet

- Bài 10 - Đo Lư NG MarketingDocument13 pagesBài 10 - Đo Lư NG MarketingNgọc TrâmNo ratings yet

- Accounting Formulae SheetDocument3 pagesAccounting Formulae SheetShania MohammedNo ratings yet

- Kenneth Controllership 2022Document9 pagesKenneth Controllership 2022Kenneth DiabordoNo ratings yet

- Marketable Securities + Receivable: Increase. IncreaseDocument4 pagesMarketable Securities + Receivable: Increase. IncreaseVergel MartinezNo ratings yet

- Financial Statement Analysis Using RatiosDocument26 pagesFinancial Statement Analysis Using RatiosSophia NicoleNo ratings yet

- Handout Fin Man 2304Document9 pagesHandout Fin Man 2304Sheena Gallentes LeysonNo ratings yet

- Accounting FM NotesDocument2 pagesAccounting FM NotessapbuwaNo ratings yet

- 1.2 Conceptual FrameworkDocument50 pages1.2 Conceptual Frameworkrabinoadrian24No ratings yet

- Lecture 06Document21 pagesLecture 06Syed NayemNo ratings yet

- STRACOSMAN - Chapter 6Document6 pagesSTRACOSMAN - Chapter 6Rae WorksNo ratings yet

- Finance Formula BankDocument2 pagesFinance Formula BankMELISSA ANN COLOMANo ratings yet

- Ratio Analysis: 1. Liquidity RatiosDocument2 pagesRatio Analysis: 1. Liquidity RatiosJawad AliNo ratings yet

- Financial Analysis Using RatiosDocument12 pagesFinancial Analysis Using Ratiossamar RamadanNo ratings yet

- Turnover Average Average Rate: Efficiency Ratios)Document2 pagesTurnover Average Average Rate: Efficiency Ratios)Yuri MinNo ratings yet

- Financial Ratio Analysis-RatiosDocument3 pagesFinancial Ratio Analysis-RatiosMikaela LacabaNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisSHENo ratings yet

- Business Finance NotesDocument4 pagesBusiness Finance NotesKiana OrtegaNo ratings yet

- Guidance For Project AssignmentDocument3 pagesGuidance For Project AssignmentfauzinurhalimNo ratings yet

- Follow Up QuestionsDocument27 pagesFollow Up QuestionsVishal PoduriNo ratings yet

- Business Ratios and Formulas: A Comprehensive GuideFrom EverandBusiness Ratios and Formulas: A Comprehensive GuideRating: 3 out of 5 stars3/5 (1)

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Losses From Wash SalesDocument7 pagesLosses From Wash SalesCzar Ysmael RabayaNo ratings yet

- Books of Intermediate Lessor Operating LeaseDocument2 pagesBooks of Intermediate Lessor Operating LeaseCzar Ysmael RabayaNo ratings yet

- Activity Based CostingDocument7 pagesActivity Based CostingCzar Ysmael RabayaNo ratings yet

- Property of Asset Pro Training and Development All Right Reserved 2020Document10 pagesProperty of Asset Pro Training and Development All Right Reserved 2020Czar Ysmael RabayaNo ratings yet

- D. All of The Above: Supply Chain ManagementDocument11 pagesD. All of The Above: Supply Chain ManagementCzar Ysmael Rabaya100% (1)

- Business Finance - ADM - Module 1 Q1 WK 1 To 2 Introduction To Financial Management 3Document37 pagesBusiness Finance - ADM - Module 1 Q1 WK 1 To 2 Introduction To Financial Management 3Angela France LarugalNo ratings yet

- ACED 7 Financial Management Module 1Document10 pagesACED 7 Financial Management Module 1maelyn calindongNo ratings yet

- MCD 8KDocument30 pagesMCD 8KIlie Adriana-SinzianaNo ratings yet

- Gitman - Test Bank CH - 14Document41 pagesGitman - Test Bank CH - 14Hazem TharwatNo ratings yet

- Republic v. Sunlife InsuranceDocument13 pagesRepublic v. Sunlife InsuranceArnold BagalanteNo ratings yet

- FDGFDSGDFGDocument3 pagesFDGFDSGDFGJesus Colin CampuzanoNo ratings yet

- 52465bos42065final p1 cp1 U5 PDFDocument14 pages52465bos42065final p1 cp1 U5 PDFRAHUL PRASADNo ratings yet

- Chapter One: Financial Management: An OverviewDocument25 pagesChapter One: Financial Management: An OverviewnarrNo ratings yet

- ACC 309 Final Project Student WorkbookDocument46 pagesACC 309 Final Project Student Workbooknick george100% (1)

- New Business-Studies-Paper-2-Revision-BookletDocument108 pagesNew Business-Studies-Paper-2-Revision-BookletRogue12layeNo ratings yet

- Mgt211 Grand Quiz by JunaidDocument45 pagesMgt211 Grand Quiz by Junaidabbas abbas khanNo ratings yet

- BSE 2019-20 Annual ReportDocument317 pagesBSE 2019-20 Annual Reportgautham28No ratings yet

- LMD Financials As On 31st January 2018Document33 pagesLMD Financials As On 31st January 2018ravinder erramNo ratings yet

- Financial Planning and Analysis: The Master Budget: Solutions To ExercisesDocument12 pagesFinancial Planning and Analysis: The Master Budget: Solutions To ExercisesBlackBunny103No ratings yet

- Bata Company Term PaperDocument20 pagesBata Company Term Paperahmadksath100% (1)

- AS Marathon (TRG) PDFDocument84 pagesAS Marathon (TRG) PDFMahendraNo ratings yet

- .Sem - .IV Choice Base 77705 Accountancy and Financial Management IV Q.P.CODE 65538Document10 pages.Sem - .IV Choice Base 77705 Accountancy and Financial Management IV Q.P.CODE 65538Siddharth VoraNo ratings yet

- Sri Fitri Wahyuni, SE.,M.M., Muhammad Shareza Hafiz.,SE.,M.AccDocument19 pagesSri Fitri Wahyuni, SE.,M.M., Muhammad Shareza Hafiz.,SE.,M.AccSuci JuniartikaNo ratings yet

- Equity InvestmentsDocument43 pagesEquity InvestmentschingNo ratings yet

- Corporate AccountingDocument11 pagesCorporate AccountingDhruv GargNo ratings yet

- About McdonaldsDocument54 pagesAbout McdonaldsKrishnaKantpalNo ratings yet

- Financial Ratio Analysis As A Tool For Measuring Performance in An IndustryDocument38 pagesFinancial Ratio Analysis As A Tool For Measuring Performance in An IndustryJohnNo ratings yet

- United States District Court Middle District of Florida Fort Myers DivisionDocument67 pagesUnited States District Court Middle District of Florida Fort Myers Divisioncharlie minatoNo ratings yet

- Introduction To Financial ManagementDocument61 pagesIntroduction To Financial ManagementPrimoNo ratings yet

- To Study Financial Performance Analysis of Lakshmi Vilas BankDocument12 pagesTo Study Financial Performance Analysis of Lakshmi Vilas BankVel MuruganNo ratings yet