Professional Documents

Culture Documents

Member Statements-04302021

Member Statements-04302021

Uploaded by

bCopyright:

Available Formats

You might also like

- Spendwell Statement - SpendwellDocument2 pagesSpendwell Statement - SpendwellAseadNo ratings yet

- Virtual Annual Meeting Friday, June 12 at 1:30 P.M. PT: Direct Inquiries ToDocument2 pagesVirtual Annual Meeting Friday, June 12 at 1:30 P.M. PT: Direct Inquiries Tosusu ultra men100% (1)

- HSBCDocument2 pagesHSBCВлад АнгелNo ratings yet

- Bank Statement LanayaDocument3 pagesBank Statement LanayashrondaNo ratings yet

- Financial Summary Account# Balance Financial Summary Account# BalanceDocument3 pagesFinancial Summary Account# Balance Financial Summary Account# BalanceShelvya ReeseNo ratings yet

- BankStatement PDFDocument1 pageBankStatement PDFsantiago ospinaNo ratings yet

- John Wilson Randolph 1189 Nelson Hollow RD Somerville Al 35670Document5 pagesJohn Wilson Randolph 1189 Nelson Hollow RD Somerville Al 35670Paul Anderson100% (1)

- Checking Account StatementDocument2 pagesChecking Account StatementDevin GaulNo ratings yet

- Archived DataDocument2 pagesArchived DataTim SchlankNo ratings yet

- Pump Flow Characteristic - CE117 Process TrainerDocument2 pagesPump Flow Characteristic - CE117 Process TrainerKenneth FerrerNo ratings yet

- D2: Evaluate The Tools and Techniques Used To Create AnimationsDocument6 pagesD2: Evaluate The Tools and Techniques Used To Create Animationsapi-202902177100% (2)

- Guiraud Index of Lexical RichnessDocument16 pagesGuiraud Index of Lexical RichnessGerardo FrancoNo ratings yet

- Project 5 Superheterodyne AM Receiver Design in ADS June 2014 PDFDocument4 pagesProject 5 Superheterodyne AM Receiver Design in ADS June 2014 PDFBayu AziNo ratings yet

- 26 Estat PDFDocument4 pages26 Estat PDFRicky CazaresNo ratings yet

- Transaction Summary: Contact UsDocument1 pageTransaction Summary: Contact UsJesseneNo ratings yet

- NDBT Feb 2022Document5 pagesNDBT Feb 2022shamim0008No ratings yet

- May Statement TeresaDocument2 pagesMay Statement TeresaElizabeth HilsonNo ratings yet

- Your Bofa Core Checking: Account SummaryDocument1 pageYour Bofa Core Checking: Account Summaryquannbui95No ratings yet

- Ayisha Bank Statement PDFDocument6 pagesAyisha Bank Statement PDFJohn Bean0% (1)

- EstatementDocument2 pagesEstatementIKEOKOLIE HOMEPCNo ratings yet

- Shaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service RequestedDocument3 pagesShaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service Requestedshaheed taylorNo ratings yet

- Darci Bentley FNBO STMNTDocument3 pagesDarci Bentley FNBO STMNTAlex NeziNo ratings yet

- 20230601-Bank Statement - UnlockedDocument6 pages20230601-Bank Statement - UnlockedAleesha AleeshaNo ratings yet

- R PDFDocument2 pagesR PDFmariana tkachNo ratings yet

- Christopher Collins March Bank StatementDocument2 pagesChristopher Collins March Bank StatementJim BoazNo ratings yet

- Aliyu STTMNTDocument2 pagesAliyu STTMNTShelvya ReeseNo ratings yet

- Free Small Business CHCKG: A Division of BOKF, NA P.O. Box 26148Document6 pagesFree Small Business CHCKG: A Division of BOKF, NA P.O. Box 26148Sara SnowNo ratings yet

- Iesha Indi July Statement 2021Document1 pageIesha Indi July Statement 2021Sharon JonesNo ratings yet

- Checking Account StatementDocument2 pagesChecking Account Statementbrainroach15No ratings yet

- Hilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Document2 pagesHilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Shelvya ReeseNo ratings yet

- Citizens BankDocument6 pagesCitizens Bankarinzeshedrack30No ratings yet

- MCU News & Promotions: Consolidate Your Bills and Pay Off High Interest Rate Debt Today!Document5 pagesMCU News & Promotions: Consolidate Your Bills and Pay Off High Interest Rate Debt Today!Jasmine LewisNo ratings yet

- Iesha Indi June Statement 2021Document1 pageIesha Indi June Statement 2021Sharon JonesNo ratings yet

- Checking: Savings: Loans:: Cheryl Ziegler 621 Thompson Ave PO BOX 2531 NYSSA, OR 97913-0531Document3 pagesChecking: Savings: Loans:: Cheryl Ziegler 621 Thompson Ave PO BOX 2531 NYSSA, OR 97913-0531Robert TinderNo ratings yet

- Antwaun Edgecombe Bank StatementDocument3 pagesAntwaun Edgecombe Bank StatementDamion HollisNo ratings yet

- #3315 December 2022Document4 pages#3315 December 2022annie janeNo ratings yet

- Dhameer e Palmer - MetabankDocument2 pagesDhameer e Palmer - MetabankJaram JohnsonNo ratings yet

- Your Consolidated Statement: Contact UsDocument4 pagesYour Consolidated Statement: Contact UsBraeylnn bookerNo ratings yet

- Stanley C Harris JR Bank StatementDocument3 pagesStanley C Harris JR Bank StatementDamion HollisNo ratings yet

- Estmt - 2022-12-31 (1) FebreroDocument6 pagesEstmt - 2022-12-31 (1) Febrerojunior rodriguezNo ratings yet

- Company Name and Logo: Address 1 Address 2 Address 3 Address 4 Address 5Document2 pagesCompany Name and Logo: Address 1 Address 2 Address 3 Address 4 Address 5Nadiia AvetisianNo ratings yet

- Statement Ending 10/08/2022: Summary of AccountsDocument2 pagesStatement Ending 10/08/2022: Summary of Accountsmohamed elmakhzniNo ratings yet

- Estmt - 2021 05 24Document4 pagesEstmt - 2021 05 24Aditya Pangestu ArdanaNo ratings yet

- Statement Ending 000111/111999/222000222111: Summary of AccountsDocument4 pagesStatement Ending 000111/111999/222000222111: Summary of AccountsNiao PjNo ratings yet

- Account Summary Contact UsDocument5 pagesAccount Summary Contact UsJonathan RinconNo ratings yet

- Efce 32 BCDocument2 pagesEfce 32 BCsteph chengNo ratings yet

- February Bank StatementDocument1 pageFebruary Bank StatementQuiskeya LLCNo ratings yet

- Virginia Credit UnionDocument1 pageVirginia Credit Unionbaga ibakNo ratings yet

- Bank Statement: Rokeditswe R Masange 266 Sauce Town Bulawayo ZimbabweDocument2 pagesBank Statement: Rokeditswe R Masange 266 Sauce Town Bulawayo ZimbabweWierd SpecieNo ratings yet

- Account Summary - 7902819734Document2 pagesAccount Summary - 7902819734hanhNo ratings yet

- Frances Bank Statement 2Document4 pagesFrances Bank Statement 2Robert KeyNo ratings yet

- Chime Checking Statement February 2023Document3 pagesChime Checking Statement February 2023salesatregencyNo ratings yet

- ReneeDocument2 pagesReneeAseadNo ratings yet

- CmregionsstatementDocument1 pageCmregionsstatementDae MacNo ratings yet

- ShowLV2Document PDFDocument2 pagesShowLV2Document PDFAnonymous tRY1QOeNo ratings yet

- Robinhood: Account Summary Portfolio AllocationDocument3 pagesRobinhood: Account Summary Portfolio Allocationkrushnavadan5666No ratings yet

- Account Statement: Junior RecioDocument3 pagesAccount Statement: Junior RecioCamiloNo ratings yet

- Chime Bank Statement-5Document1 pageChime Bank Statement-5dmarcumNo ratings yet

- Reference QB SupportDocument10 pagesReference QB SupportTiffanyNo ratings yet

- Chyna's Dreamland Chase NovDocument5 pagesChyna's Dreamland Chase NovJonathan Seagull LivingstonNo ratings yet

- Account Statement: Gail WeirDocument2 pagesAccount Statement: Gail WeirAlexander Weir-WitmerNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Shuzette Chase StatementtDocument2 pagesShuzette Chase Statementtdesigns.vicartNo ratings yet

- CHASE 03-14-24 (xxxx41)Document2 pagesCHASE 03-14-24 (xxxx41)Riad HossainNo ratings yet

- Alejandro de Acosta How To Live Now or Never Essays and Experiments 20052013 PDFDocument286 pagesAlejandro de Acosta How To Live Now or Never Essays and Experiments 20052013 PDFallahNo ratings yet

- Commands in AVR-assembler LanguageDocument1 pageCommands in AVR-assembler LanguageFrutzNo ratings yet

- Power Electronics Drives U1Document67 pagesPower Electronics Drives U1Ruvenderan SuburamaniamNo ratings yet

- Resume - Tyrique Husbands 100667025Document2 pagesResume - Tyrique Husbands 100667025api-606777808No ratings yet

- Quality Service Management in Tourism and Hospitality 03 Worksheet 1 ARGDocument1 pageQuality Service Management in Tourism and Hospitality 03 Worksheet 1 ARGJoashley CarreonNo ratings yet

- TDP ExchangeDocument364 pagesTDP ExchangeMary CunninghamNo ratings yet

- Iran MathDocument270 pagesIran MathGiovani Milla Chonps Biologia100% (4)

- Max Like MethodDocument38 pagesMax Like MethodaribniminnakNo ratings yet

- G-Clamp Assessment NotificationDocument2 pagesG-Clamp Assessment NotificationJaewon ChangNo ratings yet

- Aluminium Alloy - Wikipedia, The Free EncyclopediaDocument13 pagesAluminium Alloy - Wikipedia, The Free EncyclopediajishnuNo ratings yet

- CPI - Lesson 3Document16 pagesCPI - Lesson 3Kim Tracey LadagaNo ratings yet

- Semi Elliptical Head Specs PDFDocument2 pagesSemi Elliptical Head Specs PDFJ.SIVIRANo ratings yet

- Interactive Catalog Replaces Catalog PagesDocument3 pagesInteractive Catalog Replaces Catalog PagesajbioinfoNo ratings yet

- Whitepaper: Trade Race ManagerDocument36 pagesWhitepaper: Trade Race ManagerGaëtan DEGUIGNENo ratings yet

- CSE460: VLSI Design: Lecture 5: Finite State Machines (Part 1)Document13 pagesCSE460: VLSI Design: Lecture 5: Finite State Machines (Part 1)Shovon BhowmickNo ratings yet

- 1.1 Background of The StudyDocument5 pages1.1 Background of The StudydigitalNo ratings yet

- Linear User Manual PDFDocument425 pagesLinear User Manual PDFasafridisNo ratings yet

- Fatwa,+07.+tateki Mipks April+2018Document14 pagesFatwa,+07.+tateki Mipks April+2018romeo wayanNo ratings yet

- Comparison MOT Regulation 63 1993 Vs New Regulation DraftDocument3 pagesComparison MOT Regulation 63 1993 Vs New Regulation DraftDianita LFNo ratings yet

- Forensic PalynologyDocument6 pagesForensic PalynologySilvana StamenkovskaNo ratings yet

- Unit 3Document18 pagesUnit 3Christel Joy TagubaNo ratings yet

- Library Management SystemDocument6 pagesLibrary Management SystemNaana SmartNo ratings yet

- Scientech 2801: PAM, PPM, PWM and Line Coding TechniquesDocument2 pagesScientech 2801: PAM, PPM, PWM and Line Coding Techniquesعلاء حسينNo ratings yet

- C++ Arrays (With Examples)Document16 pagesC++ Arrays (With Examples)Tania CENo ratings yet

- International CatalogDocument128 pagesInternational CatalogDavid HicksNo ratings yet

- Geography: Inside Listening and Speaking 3 Unit 10 Answer KeyDocument3 pagesGeography: Inside Listening and Speaking 3 Unit 10 Answer KeyLâm Duy100% (1)

Member Statements-04302021

Member Statements-04302021

Uploaded by

bOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Member Statements-04302021

Member Statements-04302021

Uploaded by

bCopyright:

Available Formats

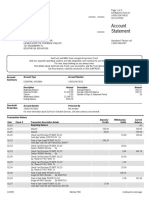

Account Statement

CDA

BE

614.235.2395 or 800.282.6420 | kemba.org

555 Officenter Place

P.O. Box 307370 Account Number xxxxxx1784

Gahanna, OH 43230-7370 Statement For 04/01/2021 - 04/30/2021

Page 1 of 2

Earn more and save more by becoming a

KEMBA Advantage member!

RETURN SERVICE REQUESTED

498841 113387 1/2 UNQ a 05-01-21 CLT

000113386 1

VICKIE KING

4916 FOX RIDGE CT

COLUMBUS OH 43228-2215

Your Account Balances as of 04/30 Need a Loan?

Primary Savings - 00 $5.49 Apply 24 hours a day:

Hassle-Free Checking - 80 0.00 kemba.org

Account Balance Total $5.49

614.235.2395

800.282.6420

Primary Savings - 00 Beginning Balance $5.00

1 Total Deposits for 5.00

3 Total Withdrawals for -4.51

Ending Balance $5.49

Post Transaction Description Transaction Balance

04/14 Withdrawal ATM Fee INQ EFT 4736 Sulivant Ave Columbus OH EX032658 -2.00 3.00

04/14 Withdrawal ATM Fee INQ EFT 4736 Sulivant Ave Columbus OH EX032658 -2.00 1.00

04/22 Deposit Home Banking Transfer From Share 80 5.00 6.00

04/30 Withdrawal Transfer To Share 80 -0.51 5.49

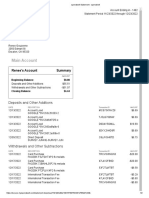

Hassle-Free Checking - 80 Beginning Balance -$12.62

2 Total Deposits for 1,400.51

17 Total Withdrawals for -1,387.89

Annual Percentage Yield earned 0.000% Ending Balance $0.00

Post Transaction Description Transaction Balance

04/10 Deposit by Check Virtual Deposit REF: 2103254Eff. Date 04/09 $1,400.00 $1,387.38

04/10 Withdrawal at ATM #348237 EFT 4736 Sulivant Ave Columbus OH EX032658 -200.79 1,186.59

04/10 Withdrawal POS #006453 SPEEDY MART COLUMBUS OH -37.62 1,148.97

04/14 Withdrawal at ATM #559240 EFT 4736 Sulivant Ave Columbus OH EX032658 -200.79 948.18

04/14 Withdrawal at ATM #559340 EFT 4736 Sulivant Ave Columbus OH EX032658 -200.79 747.39

04/14 Withdrawal ATM Fee INQ EFT 4736 Sulivant Ave Columbus OH EX032658 -2.00 745.39

04/15 Withdrawal at ATM #619075 EFT 4736 Sulivant Ave Columbus OH EX032658 -200.79 544.60

04/15 Withdrawal ATM Fee EFT 4736 Sulivant Ave Columbus OH EX032658 -2.00 542.60

04/15 Withdrawal at ATM #619153 EFT 4736 Sulivant Ave Columbus OH EX032658 -200.79 341.81

04/15 Withdrawal ATM Fee EFT 4736 Sulivant Ave Columbus OH EX032658 -2.00 339.81

04/16 Withdrawal at ATM #675496 EFT 4736 Sulivant Ave Columbus OH EX032658 -200.79 139.02

04/16 Withdrawal ATM Fee EFT 4736 Sulivant Ave Columbus OH EX032658 -2.00 137.02

04/16 Withdrawal at ATM #675549 EFT 4736 Sulivant Ave Columbus OH EX032658 -100.79 36.23

04/16 Withdrawal ATM Fee EFT 4736 Sulivant Ave Columbus OH EX032658 -2.00 34.23

04/16 Withdrawal at ATM #675636 EFT 4736 Sulivant Ave Columbus OH EX032658 -20.79 13.44

Continued on next page.

When this box is generated the

XS_Counter is incremented to

the total number of pages

Account Statement

CDA

BE

(excluding the backer.

2

614.235.2395 or 800.282.6420 | kemba.org

555 Officenter Place

P.O. Box 307370 Account Number xxxxxx1784

Gahanna, OH 43230-7370 Statement For 04/01/2021 - 04/30/2021

Page 2 of 2

Hassle-Free Checking - 80 Continued from previous page.

Post Transaction Description Transaction Balance

04/16 Withdrawal ATM Fee EFT 4736 Sulivant Ave Columbus OH EX032658 -2.00 11.44

04/22 Withdrawal Home Banking Transfer To Share 00 -5.00 6.44

04/30 Deposit Transfer From Share 00 0.51 6.95

04/30 Withdrawal HASSLE FREE FEE -6.95 0.00

This month you had 2 qualifying Advantage transactions. Visit KEMBA.org for complete

Advantage details.

IN CASE OF ERRORS OR QUESTIONS ABOUT YOUR ELECTRONIC TRANSFERS

Write us at the address shown on the front of this statement or call us at the number shown on the front of this statement as soon as you can if you

think your statement or receipt is wrong, or if you need more information about a transfer on the statement or receipt. We must hear from you no later

than 60 days after we sent you the FIRST statement on which the error or problem appeared. (NOTE: Only Consumer accounts are entitled to 60 days

after the FIRST statement is sent. Transactions in question or error on corporate accounts must be reported within two banking days from the date the

transaction settled on the account.)

(1) Tell us your name and account number.

(2) Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe there is an error or why you need

more information.

(3) Tell us the dollar amount of the suspected error.

We will investigate your complaint and will correct any error promptly. If we take more than 10 business days to do this, we will credit your account for

the amount you think is in error so that you will have use of the money during the time it takes us to complete our investigation.

CHECKING RECONCILEMENT ... THIS FORM IS PROVIDED TO ASSIST YOU IN BALANCING YOUR CHECKING ACCOUNT

LIST CHECKS OUTSTANDING NOT CHARGED TO YOUR ACCOUNT PERIOD ENDING

CHECK NUMBER AMOUNT CHECK NUMBER AMOUNT , 20

| | 1. In your check register, subtract any charges and add any dividends or

| | deposits shown on your statement which are not in your register.

| | 2. Enter ending checking balance

from statement. $ |

| |

+ $

{

| |

|

| | 3. Enter deposits made after the

| | statement ending date. + $ |

| |

| |

+ $ |

| | TOTAL

(2 Plus 3) $ |

| |

4. In your register, mark all paid checks. In the

| |

area at left, list all unpaid checks. |

| |

| | 5. Subtract total of outstanding checks. { - $ |

| | 6. This amount should equal your check

TOTAL Ø register balance. $ |

IF YOU DO NOT BALANCE

VERIFY ADDITIONS AND SUBTRACTIONS - ABOVE AND IN YOUR CHECK REGISTER

COMPARE THE DOLLAR AMOUNTS OF CHECKS LISTED ON THIS STATEMENT WITH THE CHECK AMOUNTS LISTED IN YOUR CHECK REGISTER

COMPARE THE DOLLAR AMOUNT OF DEPOSITS LISTED ON THIS STATEMENT WITH THE DEPOSIT AMOUNTS RECORDED IN YOUR CHECK REGISTER

Thank you for your membership.

You might also like

- Spendwell Statement - SpendwellDocument2 pagesSpendwell Statement - SpendwellAseadNo ratings yet

- Virtual Annual Meeting Friday, June 12 at 1:30 P.M. PT: Direct Inquiries ToDocument2 pagesVirtual Annual Meeting Friday, June 12 at 1:30 P.M. PT: Direct Inquiries Tosusu ultra men100% (1)

- HSBCDocument2 pagesHSBCВлад АнгелNo ratings yet

- Bank Statement LanayaDocument3 pagesBank Statement LanayashrondaNo ratings yet

- Financial Summary Account# Balance Financial Summary Account# BalanceDocument3 pagesFinancial Summary Account# Balance Financial Summary Account# BalanceShelvya ReeseNo ratings yet

- BankStatement PDFDocument1 pageBankStatement PDFsantiago ospinaNo ratings yet

- John Wilson Randolph 1189 Nelson Hollow RD Somerville Al 35670Document5 pagesJohn Wilson Randolph 1189 Nelson Hollow RD Somerville Al 35670Paul Anderson100% (1)

- Checking Account StatementDocument2 pagesChecking Account StatementDevin GaulNo ratings yet

- Archived DataDocument2 pagesArchived DataTim SchlankNo ratings yet

- Pump Flow Characteristic - CE117 Process TrainerDocument2 pagesPump Flow Characteristic - CE117 Process TrainerKenneth FerrerNo ratings yet

- D2: Evaluate The Tools and Techniques Used To Create AnimationsDocument6 pagesD2: Evaluate The Tools and Techniques Used To Create Animationsapi-202902177100% (2)

- Guiraud Index of Lexical RichnessDocument16 pagesGuiraud Index of Lexical RichnessGerardo FrancoNo ratings yet

- Project 5 Superheterodyne AM Receiver Design in ADS June 2014 PDFDocument4 pagesProject 5 Superheterodyne AM Receiver Design in ADS June 2014 PDFBayu AziNo ratings yet

- 26 Estat PDFDocument4 pages26 Estat PDFRicky CazaresNo ratings yet

- Transaction Summary: Contact UsDocument1 pageTransaction Summary: Contact UsJesseneNo ratings yet

- NDBT Feb 2022Document5 pagesNDBT Feb 2022shamim0008No ratings yet

- May Statement TeresaDocument2 pagesMay Statement TeresaElizabeth HilsonNo ratings yet

- Your Bofa Core Checking: Account SummaryDocument1 pageYour Bofa Core Checking: Account Summaryquannbui95No ratings yet

- Ayisha Bank Statement PDFDocument6 pagesAyisha Bank Statement PDFJohn Bean0% (1)

- EstatementDocument2 pagesEstatementIKEOKOLIE HOMEPCNo ratings yet

- Shaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service RequestedDocument3 pagesShaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service Requestedshaheed taylorNo ratings yet

- Darci Bentley FNBO STMNTDocument3 pagesDarci Bentley FNBO STMNTAlex NeziNo ratings yet

- 20230601-Bank Statement - UnlockedDocument6 pages20230601-Bank Statement - UnlockedAleesha AleeshaNo ratings yet

- R PDFDocument2 pagesR PDFmariana tkachNo ratings yet

- Christopher Collins March Bank StatementDocument2 pagesChristopher Collins March Bank StatementJim BoazNo ratings yet

- Aliyu STTMNTDocument2 pagesAliyu STTMNTShelvya ReeseNo ratings yet

- Free Small Business CHCKG: A Division of BOKF, NA P.O. Box 26148Document6 pagesFree Small Business CHCKG: A Division of BOKF, NA P.O. Box 26148Sara SnowNo ratings yet

- Iesha Indi July Statement 2021Document1 pageIesha Indi July Statement 2021Sharon JonesNo ratings yet

- Checking Account StatementDocument2 pagesChecking Account Statementbrainroach15No ratings yet

- Hilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Document2 pagesHilary Stonewall 107 N Oak ST Freemansburg Pa 18017-0000 Account 6789067948Shelvya ReeseNo ratings yet

- Citizens BankDocument6 pagesCitizens Bankarinzeshedrack30No ratings yet

- MCU News & Promotions: Consolidate Your Bills and Pay Off High Interest Rate Debt Today!Document5 pagesMCU News & Promotions: Consolidate Your Bills and Pay Off High Interest Rate Debt Today!Jasmine LewisNo ratings yet

- Iesha Indi June Statement 2021Document1 pageIesha Indi June Statement 2021Sharon JonesNo ratings yet

- Checking: Savings: Loans:: Cheryl Ziegler 621 Thompson Ave PO BOX 2531 NYSSA, OR 97913-0531Document3 pagesChecking: Savings: Loans:: Cheryl Ziegler 621 Thompson Ave PO BOX 2531 NYSSA, OR 97913-0531Robert TinderNo ratings yet

- Antwaun Edgecombe Bank StatementDocument3 pagesAntwaun Edgecombe Bank StatementDamion HollisNo ratings yet

- #3315 December 2022Document4 pages#3315 December 2022annie janeNo ratings yet

- Dhameer e Palmer - MetabankDocument2 pagesDhameer e Palmer - MetabankJaram JohnsonNo ratings yet

- Your Consolidated Statement: Contact UsDocument4 pagesYour Consolidated Statement: Contact UsBraeylnn bookerNo ratings yet

- Stanley C Harris JR Bank StatementDocument3 pagesStanley C Harris JR Bank StatementDamion HollisNo ratings yet

- Estmt - 2022-12-31 (1) FebreroDocument6 pagesEstmt - 2022-12-31 (1) Febrerojunior rodriguezNo ratings yet

- Company Name and Logo: Address 1 Address 2 Address 3 Address 4 Address 5Document2 pagesCompany Name and Logo: Address 1 Address 2 Address 3 Address 4 Address 5Nadiia AvetisianNo ratings yet

- Statement Ending 10/08/2022: Summary of AccountsDocument2 pagesStatement Ending 10/08/2022: Summary of Accountsmohamed elmakhzniNo ratings yet

- Estmt - 2021 05 24Document4 pagesEstmt - 2021 05 24Aditya Pangestu ArdanaNo ratings yet

- Statement Ending 000111/111999/222000222111: Summary of AccountsDocument4 pagesStatement Ending 000111/111999/222000222111: Summary of AccountsNiao PjNo ratings yet

- Account Summary Contact UsDocument5 pagesAccount Summary Contact UsJonathan RinconNo ratings yet

- Efce 32 BCDocument2 pagesEfce 32 BCsteph chengNo ratings yet

- February Bank StatementDocument1 pageFebruary Bank StatementQuiskeya LLCNo ratings yet

- Virginia Credit UnionDocument1 pageVirginia Credit Unionbaga ibakNo ratings yet

- Bank Statement: Rokeditswe R Masange 266 Sauce Town Bulawayo ZimbabweDocument2 pagesBank Statement: Rokeditswe R Masange 266 Sauce Town Bulawayo ZimbabweWierd SpecieNo ratings yet

- Account Summary - 7902819734Document2 pagesAccount Summary - 7902819734hanhNo ratings yet

- Frances Bank Statement 2Document4 pagesFrances Bank Statement 2Robert KeyNo ratings yet

- Chime Checking Statement February 2023Document3 pagesChime Checking Statement February 2023salesatregencyNo ratings yet

- ReneeDocument2 pagesReneeAseadNo ratings yet

- CmregionsstatementDocument1 pageCmregionsstatementDae MacNo ratings yet

- ShowLV2Document PDFDocument2 pagesShowLV2Document PDFAnonymous tRY1QOeNo ratings yet

- Robinhood: Account Summary Portfolio AllocationDocument3 pagesRobinhood: Account Summary Portfolio Allocationkrushnavadan5666No ratings yet

- Account Statement: Junior RecioDocument3 pagesAccount Statement: Junior RecioCamiloNo ratings yet

- Chime Bank Statement-5Document1 pageChime Bank Statement-5dmarcumNo ratings yet

- Reference QB SupportDocument10 pagesReference QB SupportTiffanyNo ratings yet

- Chyna's Dreamland Chase NovDocument5 pagesChyna's Dreamland Chase NovJonathan Seagull LivingstonNo ratings yet

- Account Statement: Gail WeirDocument2 pagesAccount Statement: Gail WeirAlexander Weir-WitmerNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Shuzette Chase StatementtDocument2 pagesShuzette Chase Statementtdesigns.vicartNo ratings yet

- CHASE 03-14-24 (xxxx41)Document2 pagesCHASE 03-14-24 (xxxx41)Riad HossainNo ratings yet

- Alejandro de Acosta How To Live Now or Never Essays and Experiments 20052013 PDFDocument286 pagesAlejandro de Acosta How To Live Now or Never Essays and Experiments 20052013 PDFallahNo ratings yet

- Commands in AVR-assembler LanguageDocument1 pageCommands in AVR-assembler LanguageFrutzNo ratings yet

- Power Electronics Drives U1Document67 pagesPower Electronics Drives U1Ruvenderan SuburamaniamNo ratings yet

- Resume - Tyrique Husbands 100667025Document2 pagesResume - Tyrique Husbands 100667025api-606777808No ratings yet

- Quality Service Management in Tourism and Hospitality 03 Worksheet 1 ARGDocument1 pageQuality Service Management in Tourism and Hospitality 03 Worksheet 1 ARGJoashley CarreonNo ratings yet

- TDP ExchangeDocument364 pagesTDP ExchangeMary CunninghamNo ratings yet

- Iran MathDocument270 pagesIran MathGiovani Milla Chonps Biologia100% (4)

- Max Like MethodDocument38 pagesMax Like MethodaribniminnakNo ratings yet

- G-Clamp Assessment NotificationDocument2 pagesG-Clamp Assessment NotificationJaewon ChangNo ratings yet

- Aluminium Alloy - Wikipedia, The Free EncyclopediaDocument13 pagesAluminium Alloy - Wikipedia, The Free EncyclopediajishnuNo ratings yet

- CPI - Lesson 3Document16 pagesCPI - Lesson 3Kim Tracey LadagaNo ratings yet

- Semi Elliptical Head Specs PDFDocument2 pagesSemi Elliptical Head Specs PDFJ.SIVIRANo ratings yet

- Interactive Catalog Replaces Catalog PagesDocument3 pagesInteractive Catalog Replaces Catalog PagesajbioinfoNo ratings yet

- Whitepaper: Trade Race ManagerDocument36 pagesWhitepaper: Trade Race ManagerGaëtan DEGUIGNENo ratings yet

- CSE460: VLSI Design: Lecture 5: Finite State Machines (Part 1)Document13 pagesCSE460: VLSI Design: Lecture 5: Finite State Machines (Part 1)Shovon BhowmickNo ratings yet

- 1.1 Background of The StudyDocument5 pages1.1 Background of The StudydigitalNo ratings yet

- Linear User Manual PDFDocument425 pagesLinear User Manual PDFasafridisNo ratings yet

- Fatwa,+07.+tateki Mipks April+2018Document14 pagesFatwa,+07.+tateki Mipks April+2018romeo wayanNo ratings yet

- Comparison MOT Regulation 63 1993 Vs New Regulation DraftDocument3 pagesComparison MOT Regulation 63 1993 Vs New Regulation DraftDianita LFNo ratings yet

- Forensic PalynologyDocument6 pagesForensic PalynologySilvana StamenkovskaNo ratings yet

- Unit 3Document18 pagesUnit 3Christel Joy TagubaNo ratings yet

- Library Management SystemDocument6 pagesLibrary Management SystemNaana SmartNo ratings yet

- Scientech 2801: PAM, PPM, PWM and Line Coding TechniquesDocument2 pagesScientech 2801: PAM, PPM, PWM and Line Coding Techniquesعلاء حسينNo ratings yet

- C++ Arrays (With Examples)Document16 pagesC++ Arrays (With Examples)Tania CENo ratings yet

- International CatalogDocument128 pagesInternational CatalogDavid HicksNo ratings yet

- Geography: Inside Listening and Speaking 3 Unit 10 Answer KeyDocument3 pagesGeography: Inside Listening and Speaking 3 Unit 10 Answer KeyLâm Duy100% (1)