Professional Documents

Culture Documents

Tutorial 9

Tutorial 9

Uploaded by

Muntasir Ahmmed0 ratings0% found this document useful (0 votes)

177 views2 pagesThe document summarizes two tutorials on dividing partnership net income and liquidating a partnership. The first tutorial shows how to divide $57,000 net income between partners L. Lee and R. May based on their salary allowances of $15,000 and $12,000 and profit sharing ratio of 60:40. The second tutorial shows how to absorb a capital deficiency by writing off one partner's balance and distributing the remaining $45,000 cash among the partners based on their profit sharing ratios of 4:4:2.

Original Description:

Accounting Tutorial

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes two tutorials on dividing partnership net income and liquidating a partnership. The first tutorial shows how to divide $57,000 net income between partners L. Lee and R. May based on their salary allowances of $15,000 and $12,000 and profit sharing ratio of 60:40. The second tutorial shows how to absorb a capital deficiency by writing off one partner's balance and distributing the remaining $45,000 cash among the partners based on their profit sharing ratios of 4:4:2.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

177 views2 pagesTutorial 9

Tutorial 9

Uploaded by

Muntasir AhmmedThe document summarizes two tutorials on dividing partnership net income and liquidating a partnership. The first tutorial shows how to divide $57,000 net income between partners L. Lee and R. May based on their salary allowances of $15,000 and $12,000 and profit sharing ratio of 60:40. The second tutorial shows how to absorb a capital deficiency by writing off one partner's balance and distributing the remaining $45,000 cash among the partners based on their profit sharing ratios of 4:4:2.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Tutorial

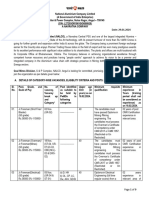

1. Lee May Company reports net income of $57,000. The partnership agreement

provides for salaries of $15,000 to L. Lee and $12,000 to R. May. They will share the

remainder on a 60:40 basis (60% to Lee). L. Lee asks your help to divide the net

income between the partners and to prepare the closing entry.

The division of net income is as follows:

Description L. Lee R, May Total

Salary Allowance $15,000 $12,000 27,000

Remaining income $30,000 (57,000-27,000)

L. Lee (60%*$30,000) $18,000

R. May (40%*$30,000) $12,000

Total remaining income $30,000

Total division of net income $33,000 $24,000 $57,000

The closing entry for net income therefore is:

Dat Accounts Name & Explanations Debit $ Credit $

e

Income Summary 57,000

L. Lee, Capital 33,000

R. May, Capital 24,000

(To close net income to partners’ capital accounts)

2. Kessington Company wishes to liquidate the firm by distributing the company’s

cash to the three partners. Prior to the distribution of cash, the company’s balances

are: Cash $45,000; Rollings, Capital (Cr.) $28,000; Havens, Capital (Dr.) $12,000;

and Ostergard, Capital (Cr.) $29,000. The income ratios of the three partners are

4:4:2, respectively. Prepare the entry to record the absorption of Havens’ capital

deficiency by the other partners and the distribution of cash to the partners with

credit balances.

Dat Accounts Name & Explanations Debit $ Credit $

e

Rollings, Capital ($12,000* 4/6) 8,000

Ostergard, Capital ($12,000* 2/6) 4,000

Havens, Capital 12,000

(To record write-off of capital deficiency)

Rollings, Capital ($28,000 - $8,000) 20,000

Ostergard, Capital ($29,000 -$4,000) 25,000

Cash 45,000

(To record distribution of cash to partners)

On January 1, 2019, the capital balances in Hollingsworth Company are Lois Holly

$26,000, and Jim Worth $24,000. In 2019 the partnership reports net income of $30,000.

The income ratio provides for salary allowances of $12,000 for Holly and $10,000 to Worth

and the remainder equally. Neither partner had any drawings in 2019.

Instructions

(a) Prepare a schedule showing the distribution of net income in 2019.

Net income $30,000

Description Lois Jim Total

Holly Worth

Salary Allowance $12,000 $10,000 $22,000

Remaining income $8,000 (30,000-22,000)

Lois Holly(50%*$8,000) $4,000

Jim Worth (50%*$8,000) $4,000

Total remaining income $8,000

Total division of net income $16,000 $14,000 $30,000

(b) Journalize the division of 2019 net income to the partners.

Date Accounts Name & Explanations Debit $ Credit $

12/31/10 Income Summary 30,000

Lois Holly, Capital 16,000

Jim Worth, Capital 14,000

(To close net income to partners’ capital accounts)

You might also like

- British Columbia Box Limited Case Study - G2 - Sec FDocument6 pagesBritish Columbia Box Limited Case Study - G2 - Sec FIsha DwivediNo ratings yet

- Tutorial 2Document2 pagesTutorial 2KHANH Du NgocNo ratings yet

- Tutorial 1Document2 pagesTutorial 1KHANH Du Ngoc0% (1)

- Chapter 2 - Income Statement QuestionsDocument3 pagesChapter 2 - Income Statement QuestionsMuntasir Ahmmed0% (1)

- CASE 10: Mcdonald'S Food Chain: # Driving Forces (Pros) Restraining Forces (Cons) #Document2 pagesCASE 10: Mcdonald'S Food Chain: # Driving Forces (Pros) Restraining Forces (Cons) #Jennifer HernandezNo ratings yet

- Finance Case StudyDocument18 pagesFinance Case StudyMuntasir Ahmmed100% (1)

- Introduction of Impiana Hotels BerhadDocument2 pagesIntroduction of Impiana Hotels BerhadAlia NursyifaNo ratings yet

- CTM Tutorial 2Document4 pagesCTM Tutorial 2crsNo ratings yet

- Bio Osmo - Announcement Dated 12 April 2018Document59 pagesBio Osmo - Announcement Dated 12 April 2018Ikhwan IlmiNo ratings yet

- Exercise 3 (2015) Managerial Economics For MBA, UUMDocument4 pagesExercise 3 (2015) Managerial Economics For MBA, UUMCherHanNo ratings yet

- Practice Quesions Fin Planning ForecastingDocument19 pagesPractice Quesions Fin Planning ForecastingAli HussainNo ratings yet

- A172 Tutorial 3 QuestionDocument7 pagesA172 Tutorial 3 Questionmpnaidu13111998100% (3)

- Assignment 1 Chapter OneDocument12 pagesAssignment 1 Chapter OneJerron Mart Salazar UrbanozoNo ratings yet

- Lab 1 - WTP, WTA WelfareDocument3 pagesLab 1 - WTP, WTA WelfarefiezaNo ratings yet

- Chapter 2 - Simple InterestDocument30 pagesChapter 2 - Simple Interestvinca08100% (1)

- Bus 100 Quiz 1 StrayerDocument6 pagesBus 100 Quiz 1 Strayervfarkus7638No ratings yet

- 01 Financial Reporting and Analysis - An IntroductionDocument29 pages01 Financial Reporting and Analysis - An IntroductionFariza MakhayNo ratings yet

- Soal Bab 16Document7 pagesSoal Bab 16AnsarNo ratings yet

- ACC TutorialDocument4 pagesACC TutorialMuntasir AhmmedNo ratings yet

- The Ford Motors StrategiesDocument25 pagesThe Ford Motors StrategiessabaNo ratings yet

- Employment Contract TilzDocument9 pagesEmployment Contract TilzKABIR RAHEEMNo ratings yet

- Intermediate Accounting 1 Lecture 1 PDFDocument9 pagesIntermediate Accounting 1 Lecture 1 PDFChavey Jean V. RenidoNo ratings yet

- Jawabab MK WayanDocument1 pageJawabab MK WayanErica LesmanaNo ratings yet

- Teori PerakaunanDocument47 pagesTeori PerakaunannabielanicoNo ratings yet

- CHAPTER 7: Managing Change and Disruptive InnovationDocument7 pagesCHAPTER 7: Managing Change and Disruptive InnovationJerome SombilonNo ratings yet

- Cost ClassificationDocument2 pagesCost ClassificationRasagnya reddyNo ratings yet

- Solution Tutorial 1Document2 pagesSolution Tutorial 1KHANH Du NgocNo ratings yet

- MINI-CASE 3 Intangible Assets AnswerDocument5 pagesMINI-CASE 3 Intangible Assets Answeryu choongNo ratings yet

- Overview of Financial Statements Using Dupont AnalysisDocument6 pagesOverview of Financial Statements Using Dupont AnalysisJose Valdivia100% (1)

- 6852397Document1 page6852397kc103038No ratings yet

- Exercise Topic 4Document7 pagesExercise Topic 4jr ylvsNo ratings yet

- Revision Questions - CH 17 - SolutionsDocument4 pagesRevision Questions - CH 17 - SolutionsMinh ThưNo ratings yet

- Tutorial 1 - Basic EoqDocument6 pagesTutorial 1 - Basic EoqdikkanNo ratings yet

- Topic 3 - Budgeting and Budgetary ControlDocument42 pagesTopic 3 - Budgeting and Budgetary ControlSYAZANA HUDA MOHD AZLINo ratings yet

- Use The Following Scale To Respond To The Item BelowDocument3 pagesUse The Following Scale To Respond To The Item BelowMuhammad HamzaNo ratings yet

- Project Paper: Professional Diploma Program UtmspaceDocument12 pagesProject Paper: Professional Diploma Program UtmspaceNur SyifaNo ratings yet

- Jawaban Answer Question Buku Akuntansi KiesoDocument3 pagesJawaban Answer Question Buku Akuntansi Kiesodutaardian100% (1)

- Chapter 1Document213 pagesChapter 1Annur SofeaNo ratings yet

- 05A Examples of Profit ComputationDocument5 pages05A Examples of Profit ComputationPrashant VishwakarmaNo ratings yet

- Chapter 3 Accounting For Branch Record ADocument14 pagesChapter 3 Accounting For Branch Record Aathirah jamaludinNo ratings yet

- Chapter 3 - Determination of National IncomeDocument54 pagesChapter 3 - Determination of National IncomeHafizul Akmal100% (4)

- Presentasi MagigDocument41 pagesPresentasi MagigCalvin WangNo ratings yet

- Analyze Transactions and Prepare Income Statement, Retained Earnings Statement, and Statement of Financial PositionDocument1 pageAnalyze Transactions and Prepare Income Statement, Retained Earnings Statement, and Statement of Financial PositionAlfonsus William BudiNo ratings yet

- Why Study Money, Banking, and Financial Markets?Document31 pagesWhy Study Money, Banking, and Financial Markets?frostriskNo ratings yet

- Tutorial 9 Year End Adjustments (Q)Document4 pagesTutorial 9 Year End Adjustments (Q)lious lii0% (1)

- The Sharpe Corporation's ProjectedDocument3 pagesThe Sharpe Corporation's Projectedmadnansajid8765No ratings yet

- Group 4 Optimal Combination of InputsDocument7 pagesGroup 4 Optimal Combination of InputsJessaNo ratings yet

- Chapter 2 Operations PerformanceDocument15 pagesChapter 2 Operations PerformanceHuten VasellNo ratings yet

- Bbmf3123 International Finance: Mds-Wealth-Shrinks-Over-Rm1b-Paper-After-Audit-IssuesDocument8 pagesBbmf3123 International Finance: Mds-Wealth-Shrinks-Over-Rm1b-Paper-After-Audit-IssuesSharon ChinNo ratings yet

- A191 Mini Case Ppe QuestionDocument4 pagesA191 Mini Case Ppe Questiondini sofiaNo ratings yet

- Solutions Chapter 21Document17 pagesSolutions Chapter 21mashko1100% (1)

- Main Business and IFA IMPIANADocument7 pagesMain Business and IFA IMPIANAAlia NursyifaNo ratings yet

- CaseDocument7 pagesCaseWHO ARE YOUNo ratings yet

- Chapter 3Document9 pagesChapter 3SiewYun Ang100% (4)

- Group 7 - 3eb03 - The Human Resources Management and Payroll CycleDocument28 pagesGroup 7 - 3eb03 - The Human Resources Management and Payroll CycleAndini dwi juliantiNo ratings yet

- Tutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)Document2 pagesTutorial Questions Chap. 13a (Topic 5 - Leverage & Capital Structure)hengNo ratings yet

- Conagra S Recipe For A Better Human Resource SystemDocument5 pagesConagra S Recipe For A Better Human Resource SystemJen Adviento100% (1)

- Homework 3Document2 pagesHomework 3Hà Phương100% (1)

- Sample Final Exam Bbek4203 - 1Document4 pagesSample Final Exam Bbek4203 - 1Marlissa Nur OthmanNo ratings yet

- Statistics RevisionDocument5 pagesStatistics RevisionNicholas TehNo ratings yet

- EstimationDocument27 pagesEstimationLaila Syaheera Md KhalilNo ratings yet

- Bbap2103 - Management Accounting 2016Document16 pagesBbap2103 - Management Accounting 2016yooheechulNo ratings yet

- Results Accountability - PPT NotesDocument72 pagesResults Accountability - PPT NotesEmma WongNo ratings yet

- Introduction To Management AccountingDocument37 pagesIntroduction To Management AccountingAmelliaS.MurtiNo ratings yet

- Solution For Chapter 12 Accounting For Partnership (13 E)Document19 pagesSolution For Chapter 12 Accounting For Partnership (13 E)RaaNo ratings yet

- ACCT 202 Managerial Accounting: Asst Prof Özlem OLGU Room: 202 Tel No: 0212 338 1457 E-Mail: Oolgu@ku - Edu.trDocument70 pagesACCT 202 Managerial Accounting: Asst Prof Özlem OLGU Room: 202 Tel No: 0212 338 1457 E-Mail: Oolgu@ku - Edu.trRazmen Ramirez PintoNo ratings yet

- Muntasir Ahmmed - Tutorial 5Document5 pagesMuntasir Ahmmed - Tutorial 5Muntasir AhmmedNo ratings yet

- Muntasir Ahmmed - Tutorial 2Document3 pagesMuntasir Ahmmed - Tutorial 2Muntasir AhmmedNo ratings yet

- Tutorial 7Document3 pagesTutorial 7Muntasir AhmmedNo ratings yet

- Muntasir Ahmmed - Tutorial 3Document3 pagesMuntasir Ahmmed - Tutorial 3Muntasir AhmmedNo ratings yet

- Accounting Group Assignment 1Document7 pagesAccounting Group Assignment 1Muntasir AhmmedNo ratings yet

- M TutorialDocument4 pagesM TutorialMuntasir AhmmedNo ratings yet

- Tutorial 6Document4 pagesTutorial 6Muntasir AhmmedNo ratings yet

- Explain The Application of Internal Control Principles To Cash ReceiptsDocument4 pagesExplain The Application of Internal Control Principles To Cash ReceiptsMuntasir AhmmedNo ratings yet

- Date Description Debit $ Credit $Document7 pagesDate Description Debit $ Credit $Muntasir AhmmedNo ratings yet

- T 4Document3 pagesT 4Muntasir AhmmedNo ratings yet

- Please Answer All The Questions.: Tutorial 4: Time Value of MoneyDocument4 pagesPlease Answer All The Questions.: Tutorial 4: Time Value of MoneyMuntasir AhmmedNo ratings yet

- Muntasir Ahmmed (AIU20092093) - Group Leader 2. Nayama (AIU20092072) 3. Wildan Azzam Shalahuddin (No Student ID) 4. Gitok Sehandra (No Student ID)Document2 pagesMuntasir Ahmmed (AIU20092093) - Group Leader 2. Nayama (AIU20092072) 3. Wildan Azzam Shalahuddin (No Student ID) 4. Gitok Sehandra (No Student ID)Muntasir AhmmedNo ratings yet

- The Tobacco Industry Negatively Contributes To Our EconomyDocument3 pagesThe Tobacco Industry Negatively Contributes To Our EconomyMuntasir AhmmedNo ratings yet

- School of Business and Social SciencesDocument16 pagesSchool of Business and Social SciencesMuntasir AhmmedNo ratings yet

- Reflection On COVID-19 DystopiaDocument2 pagesReflection On COVID-19 DystopiaMuntasir AhmmedNo ratings yet

- What Is Weighted Average Forecasting - Atlas Precision ConsultingDocument8 pagesWhat Is Weighted Average Forecasting - Atlas Precision ConsultingEhab MohamedNo ratings yet

- ISO22000 Quality ManualDocument46 pagesISO22000 Quality ManualMeg GuzmanNo ratings yet

- Advertisement For NE Posts For Coal Mines Division-2024Document9 pagesAdvertisement For NE Posts For Coal Mines Division-2024Bhushan das KewatNo ratings yet

- Adapty State of Inapp Subscriptions Report 2021Document22 pagesAdapty State of Inapp Subscriptions Report 2021Юля БолдиноваNo ratings yet

- Al-Jisr Group's Business BrochureDocument2 pagesAl-Jisr Group's Business BrochurenizarNo ratings yet

- Bsi Standards Books Catalogue Uk enDocument40 pagesBsi Standards Books Catalogue Uk enAnsarMahmoodNo ratings yet

- Innovative Practices in Rural MarketingDocument11 pagesInnovative Practices in Rural MarketingboldyNo ratings yet

- Cambridge International AS & A Level: ECONOMICS 9708/21Document4 pagesCambridge International AS & A Level: ECONOMICS 9708/21ayanda muteyiwaNo ratings yet

- Service Agreement TemplateDocument3 pagesService Agreement TemplateSheine Girao-SaponNo ratings yet

- Walmart My ExplanationDocument2 pagesWalmart My ExplanationNishan ShettyNo ratings yet

- Hosted by Adrian Davis, CEO, Whetstone Inc.: SIIA Channels WebinarsDocument24 pagesHosted by Adrian Davis, CEO, Whetstone Inc.: SIIA Channels WebinarssiiaAdminNo ratings yet

- Sonny AprilianoDocument3 pagesSonny Aprilianoaviii.avivahNo ratings yet

- CT-2 SM 2021Document5 pagesCT-2 SM 2021Incredible video'sNo ratings yet

- Syllabus Risk Management Gasal 2021-2022Document4 pagesSyllabus Risk Management Gasal 2021-2022Lia AmeliaNo ratings yet

- Haliyal Sugar IndustryDocument50 pagesHaliyal Sugar IndustryStany D'melloNo ratings yet

- B.B.M. - IB - SyllabusDocument23 pagesB.B.M. - IB - SyllabusNeeraj BagadeNo ratings yet

- Starbuck PDFDocument74 pagesStarbuck PDFAhdel Girlisonfire60% (5)

- Module 3 Service Delivery SystemDocument9 pagesModule 3 Service Delivery SystemRosalie MarzoNo ratings yet

- Quiz Week 4 - Attempt ReviewDocument11 pagesQuiz Week 4 - Attempt Reviewtalitha ameiliaNo ratings yet

- Valuation of Merger ProposalDocument14 pagesValuation of Merger ProposalSantosh....No ratings yet

- BRM-Chapter 1Document15 pagesBRM-Chapter 1YonasNo ratings yet

- John Falcone: Product Design + DevelopmentDocument1 pageJohn Falcone: Product Design + DevelopmentAnonymous KnmXfkeFLhNo ratings yet

- MGT Capstone 2 - 3Document3 pagesMGT Capstone 2 - 3Shakeel SajjadNo ratings yet

- Marketing & Communications in Nonprofit OrganizationsDocument16 pagesMarketing & Communications in Nonprofit OrganizationsAnonymous vpo0blvnNo ratings yet

- Iim Lucknow Hepp & Final Placements 2020-21: Job Description FormDocument1 pageIim Lucknow Hepp & Final Placements 2020-21: Job Description FormmanishNo ratings yet

- Synopsis RecruitmentDocument5 pagesSynopsis Recruitmentmanepally.kiranNo ratings yet

- Current Financial and Operating StructureDocument10 pagesCurrent Financial and Operating StructuremanojNo ratings yet