Professional Documents

Culture Documents

Chapter 1 - Inventory Valuation: Caf-08 Cma Complete Theory

Chapter 1 - Inventory Valuation: Caf-08 Cma Complete Theory

Uploaded by

ShehrozSTOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1 - Inventory Valuation: Caf-08 Cma Complete Theory

Chapter 1 - Inventory Valuation: Caf-08 Cma Complete Theory

Uploaded by

ShehrozSTCopyright:

Available Formats

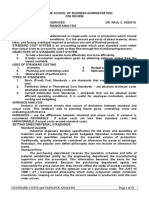

CAF-08 CMA COMPLETE THEORY

CHAPTER 1 – INVENTORY VALUATION

Advantages & Disadvantages of FIFO

Advantages

Logical (probably represents physical reality)

Easy to understand and explain to managers

Gives a value near to replacement cost

Disadvantages

Can be cumbersome to operate

Managers may find it difficult to compare costs and make decisions when they are charged with varying

prices for the same materials

In a period of high inflation, inventory issue prices will lag behind current market value

Advantages & Disadvantages of AVCO

Advantages

Smoothens out price fluctuations

Easier to administer than FIFO and LIFO (Last in First Out)

Disadvantages

Issue price is rarely what has been paid

Prices tend to lag a little behind current market values when there is gradual inflation

CHAPTER 2 - INVENTORY MANAGEMENT

1) Definitions

(i) Stock out Costs:

These costs result from not having enough inventories in stock to meet customers' needs. These costs include lost

sales, customers’ ill will, and the costs of expediting orders for goods not in stock.

(ii) Lead Time:

The time period between placing an order till the receipt of the goods from suppliers is called lead time.

(iii) Reorder Point:

The point of time when an order is required to be placed or production to be initiated to replenish depleted stocks

is called reorder point. It is determined by multiplying the lead time and average usage.

(iv) Safety Stock:

To minimize stock outs on account of increased demand or delays in delivery etc., a buffer stock is often

maintained. Such a buffer stocks is called Safety stock.

(v) Inventory control:

Inventory control can be defined as the system used in an organization to control its investment in

inventory/stocks. I.e. the overall objective of inventory control is to minimize, in total, the costs associated with

stock. This includes; the recording and monitoring of stock levels, forecasting future demands and deciding

when and how many to order.

PREPARED BY FAHAD IRFAN

CAF-08 CMA COMPLETE THEORY

2) The method of stock valuation which should be used in times of fluctuating prices:

Weighted Average stock valuation method should be used in times of fluctuating prices because this method is

rational, systematic and not subject to manipulation. It is representative of the prices that prevailed during the

entire period rather than the price at any particular point in time. It is because of this smoothening effect that this

method should be used for stock valuation in times of fluctuating prices.

3) The practical limitations/assumptions of EOQ

(i) The formula assumes that demand/usage is constant throughout the period. In practice, actual

demand/usage may be uncertain and subject to seasonal variations.

(ii) Holding cost per unit are assumed to be constant. Further, many holding costs are fixed throughout the

period and not relevant to the model whereas some costs (e.g. store keepers' salaries) are fixed but

change in steps.

(iii) Purchasing cost per unit is assumed to be constant for all purchase quantities and is ignored while

calculating order size in EOQ. In practice, quantity discounts can be available in case of bulk purchasing.

(iv) The ordering costs are assumed to be constant per order placed. In practice, most of the ordering costs

are fixed or subject to stepwise variation. It is therefore, difficult to estimate the incremental cost per

order.

4) Reasons of maintaining the safety stock:

(i) Protect against unforeseen variation in supply and/or demand.

(ii) Prevent disruption in manufacturing or deliveries.

(iii) Avoid stock-outs to keep customer service and satisfaction levels high.

5) Costs associated with holding of inventory:

(i) Cost of capital tied up

(ii) Insurance costs

(iii) Cost of warehousing

(iv) Obsolescence, deterioration and theft

CHAPTER 3 - ACCOUNTING FOR OVERHEADS

1) Treatment of under-absorbed and over-absorbed factory overheads.

The under or over applied overhead may be:

treated as period cost by closing it to Cost of Goods Sold Account or directly to Income Statement.

apportioned between inventories and cost of goods sold.

2) Reasons for under-absorbed / over absorbed factory overheads

The actual hours worked may be more or less than the estimated hours.

The estimates may not be accurate.

Actual overhead costs and actual activity levels are different from budgeted costs and activity levels.

Changes in the methods of production.

Abnormal changes in the component prices of factory overheads.

Extraordinary expenses might have been incurred during the accounting period.

Major changes might have taken place. For example, replacement of general purpose machine with

automatic high speed machines.

PREPARED BY FAHAD IRFAN

CAF-08 CMA COMPLETE THEORY

3) Factors affecting the predetermined overhead rate:

In addition to the selection of bases, the following more factors are also considered:

1. Activity level selection

2. Inclusion or exclusion of fixed overheads

3. Single rate or several rates

4) Definitions

Normal Capacity

The company expects that there is no change in the demand and therefore, the same number of units shall be

produced. This is called Normal Capacity.

Expected Actual Capacity.

If the company expects that the demand will increase or decrease and estimates a level at 90% or 70%, this is

called Expected Actual Capacity.

Direct expenses

Expenses that are fully traceable to the product, service or department that is being costed.

Examples:

Raw Materials that are specifically used for the product in consideration,

Labor which is directly involved in converting the raw material

Other expenses that are specifically incurred for the product.

Indirect expenses (Production overheads)

Indirect expenses are those expenses that incur in the course of making a product, providing of service or running

department but which cannot be traced directly and fully to the product, service or department.

Examples:

Labor which is not directly involved in the conversion of raw material but indirectly involved in

making of the product. Such as supervisor who is responsible to supervise the production

process is not directly involved and therefore treated as indirect cost,

Tools, spares and materials that are used in the machinery or equipment used in the production,

Factory rent if the factory premises are hired,

Depreciation of machinery and equipment.

Electricity and other utility expenses incurred for the production facilities

CHAPTER 4 – LABOUR COSTING

1) Types of labor cost:

a) Direct Labor Cost: Direct labor cost is any cost that is specifically incurred for or can be readily charged to

or recognized with any specific contract, job or work order. In cost accounting it is classified as direct labor

cost which becomes part of prime cost. For example: In a watch manufacturing factory, a worker operating

a molding machine to produce a part of wrist watch.

b) Indirect Labor Cost: Where the direct labor can be recognized with and charged to the job, the indirect

labor cannot be so charged and hence is treated as part of the factory overheads. For example: Wages paid

to supervisor of a factory or salary paid to driver of delivery van used for distribution of the product.

PREPARED BY FAHAD IRFAN

CAF-08 CMA COMPLETE THEORY

2) Effective labor cost control

Effective labor cost control is achieved through different tools including;

analyzing the targeted production,

preparing labor budget and standardizing labor cost per unit,

monitoring output, quality, wastage ratios, rework cost due to bad workmanship

wage incentive systems

3) High Day Rate system

Advantages

It is easier to calculate and understand.

It assures the employee a consistently high wage.

Disadvantages

Employees cannot go beyond the fixed hourly rate for the extra effort they put in. In the example given

above if the employee makes 280 units instead of 240 units in a 40 hours week, the cost per unit would

decrease even further but all the savings would go to the benefit of the employer and none would go to

the employee.

The high wages might become the accepted wage level for normal working. Management might need to

keep checks on the productivity and efficiency levels of the employees.

4) Group Bonus Scheme

Advantages

Group schemes reduce the clerical efforts to be put in for the calculations of individual incentive schemes.

They are easy to be administered.

Group schemes improve the team cohesion.

Disadvantages

Employees might demand for minimum targets for accepting the scheme.

Employees doing the best and the worst might fall victim to team’s politics

5) Profit sharing scheme

Advantages

The biggest advantage is that the organization will pay only what it can afford to pay out of the actual

profits earned.

Such schemes can be offered to indirect labor as well.

Disadvantages

Employees may be putting in best of their efforts yet the organization might still incur losses on account

of issues beyond the control of the employees.

It is a long term commitment that the organization is asking for. The employees have to wait for the

bonus until the year ends. The reward is not an immediate one

PREPARED BY FAHAD IRFAN

CAF-08 CMA COMPLETE THEORY

CHAPTER 5 – MARGINAL COSTING AND ABSORPTION COSTING

1) Advantages and disadvantages of absorption costing

Advantages of absorption costing

Inventory values include an element of fixed production overheads. This is consistent with the requirement in

financial accounting that (for the purpose of financial reporting) inventory should include production overhead

costs.

Calculating under/over absorption of overheads may be useful in controlling fixed overhead expenditure.

By calculating the full cost of sale for a product and comparing it will the selling price, it should be possible to

identify which products are profitable and which are being sold at a loss.

Disadvantages of absorption costing

Absorption costing is a more complex costing system than marginal costing.

Absorption costing does not provide information that is useful for decision making (like marginal costing

does).

Assigning of Production overheads always include an element of discretion; and

It might led to sub-optimal decision-making as a product might be discontinued due to loss which might be

caused by fixed production over head.

2) Advantages and disadvantages of marginal costing

Advantages of marginal costing

It is easy to account for fixed overheads using marginal costing. Instead of being apportioned they are treated

as period costs and written off in full as an expense the income statement for the period when they occur.

There is no under/over-absorption of overheads with marginal costing, and therefore no adjustment

necessary in the income statement at the end of an accounting period.

Marginal costing provides useful information for decision making.

Disadvantages of marginal costing

Marginal costing does not value inventory in accordance with the requirements of financial reporting.

(However, for the purpose of cost accounting and providing management information, there is no reason

why inventory values should include fixed production overhead, other than consistency with the financial

accounts.)

Marginal costing can be used to measure the contribution per unit of product, or the total contribution

earned by a product, but this is not sufficient to decide whether the product is profitable enough. Total

contribution has to be big enough to cover fixed costs and make a profit.

CHAPTER 9 – BUDGETING

1) Purpose of Budgeting

Planning

Control

Decision making

Resource allocation

Coordination of Communication

PREPARED BY FAHAD IRFAN

CAF-08 CMA COMPLETE THEORY

2) Types of Budgets

Sales Budget

Production budget

Direct material budget

Direct labor budget

Manufacturing overhead budget

Ending finished good inventory budget

Cost of goods manufactured budget

Cost of goods sold budget

Selling and administrative budget

Capital expenditure budget

Cash budget

Master Budget

3) Flexible and fixed budgets

Flexible budgets

Flexible budgets are, as their names suggest variable and flexible depending on the variability in the results

expected in the future. Such budgets are most useful for businesses that operate in an ever changing business

environment,

Fixed budgets

Fixed budgets are used in situations where the future income and expenditure can be known, with a higher

degree of certainty, and have been quite predictable over time. These types of budgets are commonly used by

organizations that do not expect much variability in the business or economic environment

CHAPTER 10 – STANDARD COSTING

1) Types of standard

Ideal standards.

These assume perfect operating conditions. No allowance is made for wastage, labour inefficiency or machine

breakdowns. The ideal standard cost is the cost that would be achievable if operating conditions and operating

performance were perfect. In practice, the ideal standard is not achieved.

Attainable standards.

These assume efficient but not perfect operating conditions. An allowance is made for waste and inefficiency.

However, the attainable standard is set at a higher level of efficiency than the current performance standard, and

some improvements will therefore be necessary in order to achieve the standard level of performance

Current standards.

These are based on current working conditions and what the entity is capable of achieving at the moment.

Current standards do not provide any incentive to make significant improvements in performance, and might be

considered unsatisfactory when current operating performance is considered inefficient.

Basic standards.

These are standards which remain unchanged over a long period of time. Variances are calculated by comparing

actual results with the basic standard, and if there is a gradual improvement in performance over time, this will be

apparent in an improving trend in reported variances.

PREPARED BY FAHAD IRFAN

CAF-08 CMA COMPLETE THEORY

CHAPTER 11 – VARIANCE ANALYSIS

1) Comments on the difference between overhead variances under marginal and absorption costing:

All variable and fixed overhead variances under marginal and absorption costing are same, except for the fixed

overhead volume (efficiency and capacity) variances which can be calculated only under absorption costing.

In absorption costing, fixed overheads are allocated to the products and these are included in the inventory

valuations. Therefore, fixed overhead volume variances can be computed under absorption costing only.

In marginal costing, only variable overheads are assigned to the product; fixed overheads are regarded as period

costs and written off as a lump sum to the profit and loss account.

Therefore, fixed overhead volume variances cannot be computed under marginal costing.

CHAPTER 13 – RELEVANT COSTING

1) Definitions

Opportunity cost:

An opportunity cost is a cost that measures the opportunity that is lost or sacrificed when the choice of one course

of action requires that an alternative course of action be given up.

Example

A company has an opportunity to obtain a contract for the production of Z which will require processing on

machine X which is already working at full capacity. The contract can only be fulfilled by reducing the present

output of machine X which will result in reduction of profit contribution by Rs. 200,000.

If the company accepts the contract, it will sacrifice a profit contribution of Rs. 200,000 from the lost output of

product Z. This loss of Rs. 200,000 represents an opportunity cost of accepting the contract.

Sunk cost

A sunk cost is a historical or past cost that the company has already incurred. These costs cannot be

changed/recovered in any case and are ignored while making a decision.

Example

A company mistakenly purchased a machine that does not completely suit its requirements. The price of the

machine already paid is a sunk cost and will not be considered while deciding whether to sell the machine or use it.

Relevant cost:

The predicted future costs that would differ depending upon the alternative courses of action, are called relevant

costs.

Example

A company purchased a raw material few years ago for Rs. 100,000. A customer is prepared to purchase it for Rs.

60,000. The material is not otherwise saleable but can be sold after further processing at a cost of Rs. 30,000.

In this case, the additional conversion cost of Rs. 30,000 is relevant cost whereas the raw material cost of Rs.

100,000 is irrelevant.

Incremental cost

An incremental cost is the additional cost that will occur if a particular decision is taken. Provided that this

additional cost is a cash flow.

PREPARED BY FAHAD IRFAN

CAF-08 CMA COMPLETE THEORY

Example:

To produce 1,000 units, a company incurred variable cost of Rs. 1.2 million. At a normal capacity of 2,000 units,

fixed cost incurred was Rs. 0.6 million.

The incremental cost of making one extra unit would be Rs. 1,200 and it would not affect the fixed cost.

Avoidable and unavoidable costs

An avoidable cost could be saved (avoided), depending whether or not a particular decision is taken. An

unavoidable cost is a cost that will be incurred anyway.

Example:

A company is paying Rs. 0.5 million annually for a warehouse on a short term lease and incurring an annual cost of

Rs. 0.4 million on maintenance and security of the warehouse. One year of the lease is remaining and the

warehouse is no more required.

The rental cost of the warehouse is unavoidable cost; therefore, it should be ignored while taking any decision.

However, by closing down the warehouse the company can avoid annual maintenance and security costs of Rs. 0.4

million.

PREPARED BY FAHAD IRFAN

You might also like

- Final Assignment On Costing MethodsDocument17 pagesFinal Assignment On Costing MethodsAlamin MohammadNo ratings yet

- CFA Sector Analysis BankingDocument10 pagesCFA Sector Analysis BankingTai NguyenNo ratings yet

- Caselets in Probability and Probability DistributionsDocument2 pagesCaselets in Probability and Probability Distributionsnishu63No ratings yet

- Caf-03 Cma Theory Notes Prepared by Fahad IrfanDocument10 pagesCaf-03 Cma Theory Notes Prepared by Fahad IrfaniamneonkingNo ratings yet

- Caf-03 Cma Theory Notes Prepared by Fahad IrfanDocument16 pagesCaf-03 Cma Theory Notes Prepared by Fahad IrfanHadeed HafeezNo ratings yet

- Essay Los 2015 Section D. Cost Management 20 %Document18 pagesEssay Los 2015 Section D. Cost Management 20 %lassaadNo ratings yet

- Theory PortionDocument6 pagesTheory Portioncontact.samamaNo ratings yet

- Compiled Cma TheoryDocument8 pagesCompiled Cma TheoryTooba MaqboolNo ratings yet

- CAT T7 Key NotesDocument30 pagesCAT T7 Key NotesSeah Chooi KhengNo ratings yet

- Overhead and AbsorptionDocument22 pagesOverhead and AbsorptionJaokumar JaoNo ratings yet

- E12 en Part 3 Session 16 IMDocument36 pagesE12 en Part 3 Session 16 IMAhmad Al-abdulghaniNo ratings yet

- Ppppppppppppppprocess CostingDocument27 pagesPpppppppppppppprocess CostingJon Jan CronicoNo ratings yet

- Costing Machine Hour RateDocument27 pagesCosting Machine Hour RateAjay SahooNo ratings yet

- Ca Final - Ama (Costing) Theory Notes: Amogh Ashtaputre @amoghashtaputre Amogh Ashtaputre Amogh AshtaputreDocument143 pagesCa Final - Ama (Costing) Theory Notes: Amogh Ashtaputre @amoghashtaputre Amogh Ashtaputre Amogh AshtaputreB GANAPATHY100% (1)

- Coppergate Educare Costing Theory NotesDocument106 pagesCoppergate Educare Costing Theory Notespratikjai100% (1)

- CAT T7 Key NotesDocument31 pagesCAT T7 Key NotesMariam NawazNo ratings yet

- DHDHDocument17 pagesDHDHpam pamNo ratings yet

- MAS Variable and Absorption CostingDocument11 pagesMAS Variable and Absorption CostingGwyneth TorrefloresNo ratings yet

- CA Final AMA Theory Complete R6R7GKB0 PDFDocument143 pagesCA Final AMA Theory Complete R6R7GKB0 PDFjjNo ratings yet

- Ch03 - Predetermined OH Rates & Absorption-Variable CostingDocument10 pagesCh03 - Predetermined OH Rates & Absorption-Variable CostingNicole ValentinoNo ratings yet

- Asb CostingDocument21 pagesAsb CostingMukesh ManwaniNo ratings yet

- Inventory ManagementDocument12 pagesInventory ManagementArya UtamaNo ratings yet

- TB Addatu - Standard Costs and Variable AnalysisDocument15 pagesTB Addatu - Standard Costs and Variable AnalysisJean Fajardo Badillo0% (3)

- Costing in BriefDocument47 pagesCosting in BriefRezaul Karim TutulNo ratings yet

- Predetermined Overhead RatesDocument17 pagesPredetermined Overhead RatesSalvador CpsNo ratings yet

- Predetermined Overhead RatesDocument16 pagesPredetermined Overhead RatesjangjangNo ratings yet

- Cost Classification: MBA 1st Sem - MBA 1104: Accounting For Managers - DR - Jyoti SinghDocument7 pagesCost Classification: MBA 1st Sem - MBA 1104: Accounting For Managers - DR - Jyoti SinghGurneet KaurNo ratings yet

- I) What Does Controllable Cost Mean?Document14 pagesI) What Does Controllable Cost Mean?Deco DewNo ratings yet

- MASB2 Inventories Pg2Document2 pagesMASB2 Inventories Pg2hyraldNo ratings yet

- Topic 3 Cost AssignmentDocument10 pagesTopic 3 Cost AssignmentEvelyn B NinsiimaNo ratings yet

- Cost Accounting Questions and Their AnswersDocument5 pagesCost Accounting Questions and Their Answerszulqarnainhaider450_No ratings yet

- Costing Theory by Indian AccountingDocument48 pagesCosting Theory by Indian AccountingIndian Accounting0% (1)

- Absorption Costing: CHAPTER 1: Specialist Cost and Management Accounting TechniquesDocument21 pagesAbsorption Costing: CHAPTER 1: Specialist Cost and Management Accounting TechniquesYashna SohawonNo ratings yet

- Differentiate Between Direct Costs and Direct CostingDocument5 pagesDifferentiate Between Direct Costs and Direct Costingmehu076No ratings yet

- See Answer See Answer See Answer See AnswerDocument5 pagesSee Answer See Answer See Answer See AnswerShams UllahNo ratings yet

- Cost Concepts AND Classification: By: Amar Raveendran Debasis BeheraDocument7 pagesCost Concepts AND Classification: By: Amar Raveendran Debasis BeheraAmar RaveendranNo ratings yet

- Cost Accounitng NotesDocument17 pagesCost Accounitng NotesDarlene JoyceNo ratings yet

- Erbil Polytechnic University Erbil Aministrative Technical College Business Management DepartmentDocument13 pagesErbil Polytechnic University Erbil Aministrative Technical College Business Management DepartmentMahsuma AliNo ratings yet

- Accounting Theory of CostingDocument2 pagesAccounting Theory of CostingOmerSyedNo ratings yet

- Chapter 15 Financial Management: QuestionsDocument30 pagesChapter 15 Financial Management: QuestionsJadeNo ratings yet

- Makerere University College of Business and Management Studies Master of Business AdministrationDocument15 pagesMakerere University College of Business and Management Studies Master of Business AdministrationDamulira DavidNo ratings yet

- Predetermined Overhead Rates, Flexible Budgets, and Absorption/Variable Costing QuestionsDocument4 pagesPredetermined Overhead Rates, Flexible Budgets, and Absorption/Variable Costing QuestionsSomething ChicNo ratings yet

- BLACKBOOK (Standard Costing and Variance Analysis)Document15 pagesBLACKBOOK (Standard Costing and Variance Analysis)Rashi Desai100% (1)

- Absorption CostingDocument3 pagesAbsorption CostingThirayuth BeeNo ratings yet

- CH 18 SMDocument45 pagesCH 18 SMNafisah Mambuay100% (1)

- Research Paper On Factory OverheadDocument8 pagesResearch Paper On Factory Overheadafmcitjzc100% (1)

- Marginal Costing 300 Level-1Document23 pagesMarginal Costing 300 Level-1simon danielNo ratings yet

- Standard CostingDocument21 pagesStandard Costingkalpesh1956No ratings yet

- MCC 202 Advanced Cost AccountingDocument4 pagesMCC 202 Advanced Cost AccountingNeoHoodaNo ratings yet

- Topics Covered in This ChapterDocument12 pagesTopics Covered in This ChapterManisha NagdaNo ratings yet

- Cost Concepts & ClassificationDocument29 pagesCost Concepts & ClassificationDebasis BeheraNo ratings yet

- ch03 Kinney 9e Smfinal PDFDocument34 pagesch03 Kinney 9e Smfinal PDFecho pNo ratings yet

- Cost ClassificationDocument9 pagesCost ClassificationPuneet TandonNo ratings yet

- Hotel Costing NotesDocument23 pagesHotel Costing NotesShashi Kumar C GNo ratings yet

- 2.4 Standard-SettingDocument2 pages2.4 Standard-SettingBisag AsaNo ratings yet

- Advantages of FIFODocument8 pagesAdvantages of FIFOVictoria NadarNo ratings yet

- Absorption CostingDocument23 pagesAbsorption Costingarman_277276271No ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Practical Guide To Production Planning & Control [Revised Edition]From EverandPractical Guide To Production Planning & Control [Revised Edition]Rating: 1 out of 5 stars1/5 (1)

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesFrom EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesRating: 4.5 out of 5 stars4.5/5 (3)

- Solutions Consolidation-FormattedDocument22 pagesSolutions Consolidation-FormattedShehrozSTNo ratings yet

- Solutions of Revision Session by AMK Sept 2020 AttemptDocument13 pagesSolutions of Revision Session by AMK Sept 2020 AttemptShehrozSTNo ratings yet

- Standard Costing Homework Questions FinalDocument2 pagesStandard Costing Homework Questions FinalShehrozSTNo ratings yet

- Solutions IAS 1 For SEPT ATTEMPT FinalDocument25 pagesSolutions IAS 1 For SEPT ATTEMPT FinalShehrozSTNo ratings yet

- Variance IQ FileDocument34 pagesVariance IQ FileShehrozSTNo ratings yet

- Standard Costing Practice Questions FinalDocument5 pagesStandard Costing Practice Questions FinalShehrozSTNo ratings yet

- Cost and Management Accounting Quiz - 1Document3 pagesCost and Management Accounting Quiz - 1ShehrozSTNo ratings yet

- Grand Mock CMA CAF 8 With Solution Sir Saud Tariq ST AcademyDocument15 pagesGrand Mock CMA CAF 8 With Solution Sir Saud Tariq ST AcademyShehrozST100% (2)

- Shortcut For TOCsDocument2 pagesShortcut For TOCsShehrozSTNo ratings yet

- Solution Ifrs 16 QuizDocument6 pagesSolution Ifrs 16 QuizShehrozSTNo ratings yet

- GIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyDocument36 pagesGIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyShehrozSTNo ratings yet

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicDocument29 pagesSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- Break-Even Point PDFDocument2 pagesBreak-Even Point PDFFaisal Rao67% (3)

- Analysis of Arcelor Mittal M&ADocument32 pagesAnalysis of Arcelor Mittal M&Aroli singhNo ratings yet

- Deng - Effects of Youth Unemployment On Income in Central Equatoria, South SudanDocument53 pagesDeng - Effects of Youth Unemployment On Income in Central Equatoria, South SudanMichelle Magallen BellezaNo ratings yet

- IC 02 Practices of Life Insurance PDFDocument268 pagesIC 02 Practices of Life Insurance PDFVishakha Tank100% (2)

- Question No.1: (3 Marks)Document25 pagesQuestion No.1: (3 Marks)Sudha SinghNo ratings yet

- The Influence of Organizational Restructuring On Employee Performance in The Housing and Residential Areas, North Sumatra Province, IndonesiaDocument5 pagesThe Influence of Organizational Restructuring On Employee Performance in The Housing and Residential Areas, North Sumatra Province, IndonesiaaijbmNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsJb De GuzmanNo ratings yet

- SSantos - Accounting Analysis Assignment 4 PDFDocument13 pagesSSantos - Accounting Analysis Assignment 4 PDFSimone SassDiddy SantosNo ratings yet

- Lecture 3BDocument33 pagesLecture 3Bsamuel.sjhNo ratings yet

- CFP&ADocument4 pagesCFP&ARohit SharmaNo ratings yet

- Exam Report June 2011Document5 pagesExam Report June 2011Ahmad Hafid HanifahNo ratings yet

- Strategic Analysis and Recommendation For TATA SteelDocument16 pagesStrategic Analysis and Recommendation For TATA SteelAbhishek SrivastavaNo ratings yet

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoNo ratings yet

- State-Owned Enterprises in Emerging Europe: The Good, The Bad, and The UglyDocument27 pagesState-Owned Enterprises in Emerging Europe: The Good, The Bad, and The UglySing A SongNo ratings yet

- Department of Labor: NJBenefitStatusLetterIndemnityDocument2 pagesDepartment of Labor: NJBenefitStatusLetterIndemnityUSA_DepartmentOfLaborNo ratings yet

- Postemployme NT Benefit: Group 6 - BSA IVDocument7 pagesPostemployme NT Benefit: Group 6 - BSA IVIrish Mae T. EspallardoNo ratings yet

- SBA Form 3508 - PPP Forgiveness ApplicationDocument11 pagesSBA Form 3508 - PPP Forgiveness ApplicationBrittany EtheridgeNo ratings yet

- Retained EarningsDocument30 pagesRetained EarningsPooja SreeNo ratings yet

- Corporate Taxation in BangladeshDocument8 pagesCorporate Taxation in Bangladeshskn092No ratings yet

- Book 1Document4 pagesBook 1Hammad MisbahNo ratings yet

- Income Tax 2Document12 pagesIncome Tax 2You're WelcomeNo ratings yet

- "Tata Motors: Can The Turnaround Plan Improve Performance?" NameDocument16 pages"Tata Motors: Can The Turnaround Plan Improve Performance?" NameMehdi BelabyadNo ratings yet

- Rise and Fall of Air IndiaDocument44 pagesRise and Fall of Air IndianARAYANNo ratings yet

- IndiamartDocument33 pagesIndiamartAnuj Agarwal100% (1)

- ICB Mutual FundDocument10 pagesICB Mutual FundDipock MondalNo ratings yet

- SS and SSS Chap 1 To 10 (2020)Document215 pagesSS and SSS Chap 1 To 10 (2020)Dinh TranNo ratings yet

- Nestle: Final Task in Fundamentals of Accountancy, Business and ManagementDocument43 pagesNestle: Final Task in Fundamentals of Accountancy, Business and ManagementApply Ako Work EhNo ratings yet

![Practical Guide To Production Planning & Control [Revised Edition]](https://imgv2-1-f.scribdassets.com/img/word_document/235162742/149x198/2a816df8c8/1709920378?v=1)