Professional Documents

Culture Documents

Suryoday Small Finance Bank Limited: Corporate Social Responsibility Policy

Suryoday Small Finance Bank Limited: Corporate Social Responsibility Policy

Uploaded by

Kumar RockyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suryoday Small Finance Bank Limited: Corporate Social Responsibility Policy

Suryoday Small Finance Bank Limited: Corporate Social Responsibility Policy

Uploaded by

Kumar RockyCopyright:

Available Formats

Suryoday Small Finance Bank Limited

Corporate Social Responsibility Policy

Version: FY: 19-20/1.0

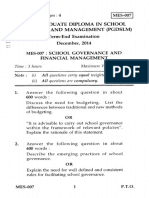

Table of Contents

1. Introduction ........................................................................................................................................ 2

2. Objectives of the CSR Policy ................................................................................................................ 2

3. Governance Structure ........................................................................................................................ 2

4. CSR Principles of the Bank .................................................................................................................. 4

5. CSR Activities of the Bank ................................................................................................................... 5

6. CSR Funds ............................................................................................................................................ 6

8. Monitoring and reporting requirements ............................................................................................ 7

9. Policy Review and Updates ................................................................................................................. 7

10. Regulatory References ...................................................................................................................... 8

Private & Confidential Page 1 of 9

1. Introduction

1)SSFB (The Bank) was set up with the objective of, inter alia undertaking basic banking activities of

acceptance of deposits and lending to unserved and underserved sections of the society including

small business units, small and marginal farmers, micro and small industries and unorganised sector

entities.

2) the Companies Act,2013 (the Act) contains provisions with respect to Corporate Social

Responsibility (CSR) and the term” CSR” as per the Companies (Corporate Social Responsibility) Rules,

2014 includes, but is not limited to:

Projects or programs relating to activities specified in Schedule VII; or

Projects or programs relating to activities undertaken by the Board in pursuance of recommendations

of the CSR Committee as per the declared CSR policy subject to the condition that such policy covers

activities enumerated in the said Schedule.

3) The Corporate Social Responsibility Policy (CSR Policy) of the Bank sets out the broad framework

guiding the Bank’s CSR activities. The Policy also sets out the principles and the rules that need to be

adhered to while taking up and implementing CSR activities to be undertaken as specified in Schedule

VII of the Companies’ Act, 2013 (excluding the activities pursued in the normal course of business) and

the expenditure thereon.

CSR Vision Statement:

The Bank, as part of its social responsibility, endeavours to positively contribute towards the

economic, environmental and social well-being of the unserved and underserved sections of the

society, thereby contributing to achieving inclusiveness in their growth and improving the quality of

their lives.

2. Objectives of the CSR Policy

The following are the objectives of formulating the CSR Policy:

• To comply with the statutory and regulatory requirements pertaining to corporate social

responsibility.

• To lay down the approach for undertaking CSR activities. To lay down the CSR governance

structure within the Bank

• To outline the guidelines & mechanism for carrying out CSR programs/projects by the Bank

• To identify areas of CSR intervention and projects that will be taken up by the Bank as part of

its CSR plan with the implementation schedules

• To lay down a review mechanism for monitoring the progress of CSR projects/ programs and

implementation of CSR policy by the CSR Committee

3. Governance Structure

The Bank shall have a 3tier governance structure for the CSR activities comprising of the Board of

Directors of the Bank (the Board), CSR Committee and the Head-CSR. The roles and responsibilities of

each of the tiers are as mentioned below:

Private & Confidential Page 2 of 9

The Board: The Board of the Bank shall oversee the CSR plan and the achievement of the

CSR objectives of the Bank. The Board has duly constituted the Corporate Social

Responsibility Committee (CSR Committee) in accordance with the provisions of the Act

and it shall review the composition and terms of reference of the CSR Committee as and

when required.

The Board shall:

(a) after taking into account the recommendations made by the Corporate Social Responsibility

Committee, approve the Corporate Social Responsibility Policy for the Bank and disclose the contents

of such Policy in its Report and also place it on the Bank’s website, if any, in such manner as may be

prescribed; and

(b) ensure that the activities as are included in Corporate Social Responsibility Policy of the Bank are

undertaken by the Bank.

The Board of the Bank shall ensure that the Bank spends, in every financial year, at least two percent

of the average net profits of the Bank made during the three immediately preceding financial years,

in pursuance of its Corporate Social Responsibility activities:

Provided that the Bank, shall give preference to the local area and surrounding areas where it

operates, for spending the amount earmarked for Corporate Social responsibility activities:

Provided further that if for any reason the Bank fails to spend the required amount for its CSR

activities, the Board shall ensure that the provisions of section 135 of the Act in this regard are adhered

to and relevant reporting is included in its Report to the shareholders , giving such details as are

required to be given under the provisions of the Act.

(i) CSR Committee:

The CSR committee shall comprise of three or more Directors including at least 1 Independent Director

and 1 Investor Director.

The CSR Committee is the governing body that shall define the scope of CSR activities for the Bank and

approve and implement the CSR policy as well as review the Policy as and when required. The CSR

Committee will report to the Board of Directors.

The functions of CSR Committee shall be as under:

(a) formulate and recommend to the Board a CSR Policy which shall indicate the activities to be

undertaken by the Bank as specified under Schedule VII of the Act;

(b) recommend the amount of expenditure to be incurred on the CSR activities of the Bank;

(c) approve and recommend any registered Trust/ Society for undertaking CSR activities;

(d) monitor the CSR Policy and its implementation.

(e) review the CSR Policy as and when required.

(f) Provide the CSR Report to the Board of Directors at the end of every Financial year.

Head- CSR:

Private & Confidential Page 3 of 9

The Head of the CSR Department shall report to the CSR Committee on the CSR activities undertaken

by the Bank and the status of achievement of the CSR plan of the Bank. The prime responsibility of the

Head of CSR Department shall be to review the progress of the CSR activities and ensure that the

progress is in line with the CSR plan as approved by the Committee. If there are any shortfalls or

challenges in implementation, the Head of CSR Department shall report the same to the CSR

Committee who shall suggest appropriate action to be taken.

4. CSR Principles of the Bank

Identification of CSR activities and formulation of the CSR Plan of the Bank will be based on the

following principles:

• Sustainability

The Bank shall use resources optimally and shall strive to be internally efficient and responsible.

The Bank shall regularly review and improve upon the process of new technology development,

deployment and commercialization, incorporating social, ethical and environmental

considerations. The Bank shall promote sustainable consumption and support recycling of

resources.

• Accountability

The Bank shall follow ethical conduct in all its functions and processes and shall promote a culture

of integrity and ethics throughout the organization. The Bank shall ensure that all mandatory

disclosures are made transparently and fairly and must communicate decisions and ensure access

of information to all stakeholders. The Bank shall not engage in practices that are abusive, corrupt

or anti-competition.

• Promotion of human rights and respect interests of all stakeholders, especially the

disadvantaged, vulnerable and marginalised

The Bank shall integrate respect for human rights in management systems in particular through

assessing and managing human rights impact of operations and ensuring that all individuals have

access to appropriate grievance mechanisms. The Bank shall follow a system to identify its

stakeholders particularly those who are disadvantaged or vulnerable, understand their concerns,

define the purpose and scope of engagement and commit to engaging, with them. The Bank shall

be transparent about its policies, products and services to its stakeholders.

• Environment protection

The Bank shall utilize natural and other resources responsibly and ensure recycling of resources,

wherever applicable. The Bank shall develop Environment Management Systems and contingency

plans and/ or processes that help in preventing, mitigating and controlling environmental

damages and disasters which may be caused as a result of its operations. The Bank shall take

appropriate measures to conserve and protect the environment.

• Inclusive growth and equitable development

The Bank shall recognise the challenges of the social and economic development and shall build

upon the development agenda as articulated in government policies and procedures. The Bank

shall make efforts to complement and support the development priorities at local and national

levels and provide for appropriate resettlement and rehabilitation of communities who have been

displaced.

Private & Confidential Page 4 of 9

5. CSR Activities of the Bank

The Bank shall constantly strive to ensure strong corporate culture which emphasizes on integrating

CSR values with business objectives. While the Bank’s CSR activities shall focus on the following five

key areas with an objective to holistically improve the quality of lives of the underserved through

social development projects, the CSR Committee/ Board may decide any other CSR activity as specified

under Schedule VII to the Companies’ Act, 2013.

• Community infrastructure development projects

Minor construction and renovations such as bus stands (waiting sheds), public parks, schools

and anganwadis, public toilets, water connections and public taps, public library, Construction

of foot over bridges, reconstruction / renovation of existing damaged infrastructure etc.

• Environmental Projects

Ensuring environmental sustainability, recharge-pit for bore wells, solar lamps at public

places, quality of soil, air and water, encouraging communities to plant saplings which helps

in maintaining the ecological balance, improving general living and health conditions of

communities.

• Public amenities, Health and Hygiene

a) Providing safe drinking water facility at public places (bus stand, schools, hospitals etc),

b) Undertaking primary healthcare camps. Undertaking projects to improve public health

and hygiene (supporting PHCs & maternity homes, cleaning public places, clearing

garbage dumps, providing dust bins, improving drainage, area spraying for Malaria,

Chikengunya, Dengue, etc).

c)Provide linkage to various schemes, benefits or support offered by Government and/or

private health care agencies

c) Conducting public awareness programs on health and hygiene.

d) Conducting Health Camps in collaboration with local hospitals.

e) undertake preventive healthcare projects.

• Promoting Education

Providing facilities in schools & Anganwadis, Initiatives for educating the Girl child, merit

scholarships for technical education, conducting financial literacy programmes for adult

population with special focus on women empowerment.

• Promoting Employability Skills

Undertaking upskilling programs for those with basic education with the objective of making

them employable, employment enhancing vocational skill training for women,

• Social Welfare

Promote gender equality, conduct programs for empowering women, undertake relief

programs and facilities

Private & Confidential Page 5 of 9

The abovementioned activities are identified as the main areas for undertaking the CSR projects/

programs by the Bank and actual distribution of funds will determined based on the identification of

specific needs from time to time.

6. CSR Funds

The corpus for the purpose of carrying on the aforesaid CSR activities would include the following:

• 2% of the average Net Profit made by the Bank during immediately preceding three Financial

Years.

• Any income arising therefrom.

• Surplus arising out of CSR activities carried out by the Bank (such surplus will not be part of

business profit of the Bank).

The “Net Profit” means the net profit of the Bank’s as per its financial statement prepared in

accordance with the applicable provisions of the Companies’ Act, but shall not include the following:

(i) Any profit arising from any overseas branch or branches of the Bank, whether operated

as a separate company or otherwise; and

(ii) Any dividend received from other companies in India, which are covered under and

complying with the provisions of section 135 of the Act:

The allocation of CSR funds towards one or more of the CSR activities as identified above shall be

decided by the CSR Committee from time to time.

Any surplus arising out of the contribution made for CSR Activities shall not form part of the business

profit of the Bank and redeployed for such activities.

Any unspent / unutilised CSR allocation in any particular year, will be dealt with in the manner

proposed by the Act and the CSR Rules thereto

All the utilization certificates, agreements, invoices with actual spend will be diligently documented

and the records shall be available as and when required for scrutiny by auditors or regulators or other

stakeholder.

The following shall not be treated as expenditure under CSR activities:

a) Any expenditure that benefits only employees or their families

b) Any CSR expenditure undertaken out of India

c) Contribution of any amount directly or indirectly to any political party

d) Any other activities pursued in the normal course of business of the Bank.

7. Implementation of CSR Activities

The CSR Committee may decide to implement the CSR plans of the Bank either directly or through any

eligible NGO/ Trust / company etc., provided that:

a) The trust or company has a track record of 3 years in undertaking similar programs or projects.

b) The Bank shall specify the project/ programs to be undertaken, the modalities for utilization of

funds on such projects/ programs and the monitoring and reporting mechanism for the same.

The Bank shall give preference to the local areas and the areas around where it operates for spending

the amount earmarked for CSR activities.

Private & Confidential Page 6 of 9

The Bank may also directly or through any of its channels enter into alliances/ partnerships with other

institutions/ companies (whether NGOs or otherwise), not-for-profit agencies to further its CSR

activities.

The CSR Committee may decide to build CSR capacities of its staff undertaking CSR activities and of

the employees of the implementing agencies (if any).

8. Monitoring and reporting requirements

The CSR Committee would be responsible for monitoring CSR initiatives, progress on approved

projects and shortfalls in achieving the CSR plan, if any.

The Head-CSR shall provide a half-yearly progress report to the CSR Committee, which would inter alia

include the following:

I. Details of CSR projects undertaken;

II. Year-to-date achievement in terms of coverage and beneficiaries;

III. Actual year-to-date spends compared to the budget and reasons for variance

IV. Area-wise expenditure with respect to CSR projects

V. Disclosures on corporate social responsibility as required to be incorporated in the annual

results

The CSR Committee may also call for details with respect to achievement since last progress report in

terms of coverage compared to the target, and provide the required support in terms of plans to

overcome shortfalls, if any. The CSR Committee shall review the CSR activities at least twice a year

including an annual review.

The CSR Committee shall be responsible to report to the Board on the status of achievement of the

CSR initiatives and its activities on annual basis. The Committee shall also report significant CSR

activities and achievements in the Director’s Report.

The CSR Committee at its discretion, shall also commission evaluation status of the impact of CSR

activities and place its findings before the Board of Directors.

The Board’s report of the Bank shall include composition of the CSR Committee, an annual report on

the CSR, contents of the policy developed and implemented by the Bank on CSR initiatives as per the

format given in the CSR Rules prescribed under the Act. . The aggregate expenditure on CSR activities

shall also be disclosed by way of notes to accounts.

The CSR Policy and programs will also be disclosed on the website after requisite Board approval.

9. Policy Review and Updates

The Board approved policy shall be reviewed by CSR Committee/ Board of Directors as and when

required.

Private & Confidential Page 7 of 9

10. Regulatory References

• Companies’ Act, 2013.

• Companies’ (Corporate Social Responsibility) Rules, 2014

National Voluntary Guidelines on Social, Environmental & Economic Responsibilities of Business of

Ministry of Corporate Affairs

Version Control Table

Version Board Approval Date Maintained by

FY 16-17 23rd January 2017 Risk & Policy

FY 17-18/1.0 24th October 2017 Risk & Policy

FY 18-19/1.0 02nd November 2018 Risk & Policy

FY 19-20/1.0 07th November 2019 Risk & Policy

Private & Confidential Page 8 of 9

You might also like

- The British Student's Guide To Obtaining Your Visa To Study at The Islamic University of Madinah v.2Document76 pagesThe British Student's Guide To Obtaining Your Visa To Study at The Islamic University of Madinah v.2Nouridine El KhalawiNo ratings yet

- Research in Daily Life 2 Q1 Module 1Document22 pagesResearch in Daily Life 2 Q1 Module 1anggee100% (4)

- Physical Education Lesson Plan-2Document3 pagesPhysical Education Lesson Plan-2api-459799295No ratings yet

- Classroom Supervisory Practices and Teacher Effectiveness Fil AuthorDocument13 pagesClassroom Supervisory Practices and Teacher Effectiveness Fil AuthorLAGUIO ELEMENTARY SCHOOLNo ratings yet

- M. Ashraf Adeel - Epistemology of The Quran - Elements of A Virtue Approach To Knowledge and Understanding-Springer Internati PDFDocument141 pagesM. Ashraf Adeel - Epistemology of The Quran - Elements of A Virtue Approach To Knowledge and Understanding-Springer Internati PDFimreadingNo ratings yet

- Kenneth Clark PDFDocument12 pagesKenneth Clark PDFsuryanandiniNo ratings yet

- HDFC Bank LTD CSR Policy #:1 Effective Date: (1 April 2021)Document10 pagesHDFC Bank LTD CSR Policy #:1 Effective Date: (1 April 2021)6038 Mugilan kNo ratings yet

- Group Activity-Hdfc Life CSRDocument21 pagesGroup Activity-Hdfc Life CSRAnoop AnilNo ratings yet

- CSR Policy 2023-2024Document10 pagesCSR Policy 2023-2024keshnathjnpNo ratings yet

- CSR Policy and CompositionDocument6 pagesCSR Policy and CompositionAbhishek27decNo ratings yet

- Commercial Bank of Ethiopia: Environmental and Social PolicyDocument8 pagesCommercial Bank of Ethiopia: Environmental and Social PolicyAshenafi TechaneNo ratings yet

- CSR PolicyDocument5 pagesCSR PolicyRitik SinghalNo ratings yet

- Citibank CSRDocument3 pagesCitibank CSRJack JainNo ratings yet

- Axix Bank Corporate Social Responsibility Policy 2021Document12 pagesAxix Bank Corporate Social Responsibility Policy 2021ASWIN RAMNATHNo ratings yet

- Corporate Responsibility Corporate Social Responsibility PolicyDocument9 pagesCorporate Responsibility Corporate Social Responsibility PolicySanowar ShamimNo ratings yet

- Asian Paints Limited: Corporate Social Responsibility (CSR) PolicyDocument5 pagesAsian Paints Limited: Corporate Social Responsibility (CSR) PolicyNainisha SawantNo ratings yet

- Corporate Social Responsibility Policy of Axis Bank LimitedDocument8 pagesCorporate Social Responsibility Policy of Axis Bank Limitedhh ggjNo ratings yet

- Preamble: Corporate Social Responsibility (CSR) Policy of Anik Industries LimitedDocument4 pagesPreamble: Corporate Social Responsibility (CSR) Policy of Anik Industries LimitedSeshangNo ratings yet

- Indus TowersDocument6 pagesIndus TowersShivansh SharmaNo ratings yet

- Aarav CSRDocument64 pagesAarav CSRAbhay Singh ParmarNo ratings yet

- CSR PolicyDocument5 pagesCSR Policyshivangicroissance2024No ratings yet

- CSRDocument4 pagesCSRRISHAV CHOPRANo ratings yet

- State Bank of India Business Responsibility Policy: Annexure ADocument20 pagesState Bank of India Business Responsibility Policy: Annexure ANAMAN kumarNo ratings yet

- Corporate Social Responsibility ("CSR") Policy BMW India Private LimitedDocument7 pagesCorporate Social Responsibility ("CSR") Policy BMW India Private LimitedAyan Karmakar100% (1)

- Corporate Social Responsibility ("CSR") Policy BMW India Private LimitedDocument7 pagesCorporate Social Responsibility ("CSR") Policy BMW India Private LimitednehaNo ratings yet

- CSR Policy of DredgingDocument3 pagesCSR Policy of DredgingSunny SinghNo ratings yet

- Corporate Social Responsibility PolicyDocument8 pagesCorporate Social Responsibility PolicyDroupathy100% (1)

- CSR of IrctcDocument17 pagesCSR of IrctcswathiNo ratings yet

- Honeycomb Logistics Private Limited: Corporate Social Responsibility Policy (Financial Year 2021-22)Document10 pagesHoneycomb Logistics Private Limited: Corporate Social Responsibility Policy (Financial Year 2021-22)vinod kumarNo ratings yet

- Annual Report 18Document11 pagesAnnual Report 18shashi shekharNo ratings yet

- CSR Policy New JBMLDocument7 pagesCSR Policy New JBMLKimmi KatariaNo ratings yet

- CSR Assignment of UBL BankDocument6 pagesCSR Assignment of UBL BankZubair AhmedNo ratings yet

- Unitile, India - CSRDocument9 pagesUnitile, India - CSRHakimuddin GheewalaNo ratings yet

- AMBUJA CEMENTS LIMITED Final DraftDocument14 pagesAMBUJA CEMENTS LIMITED Final DraftankitaprakashsinghNo ratings yet

- Basf CSR Policy 2019Document7 pagesBasf CSR Policy 2019André CharanNo ratings yet

- CSR Policy ContentsDocument7 pagesCSR Policy Contentsvtejas842No ratings yet

- Corporate Social Responsibility PolicyDocument6 pagesCorporate Social Responsibility Policychandra mouliNo ratings yet

- Corporate Social Responsibility PolicyDocument7 pagesCorporate Social Responsibility Policyraj bhutiyaNo ratings yet

- DBS Bank CSR Policy PDFDocument10 pagesDBS Bank CSR Policy PDFArun KumarNo ratings yet

- CSR PolicyDocument14 pagesCSR PolicyJilla Vishwas100% (1)

- CSR - Axis Bank IMPDocument7 pagesCSR - Axis Bank IMProhitNo ratings yet

- Corporate Social Responsibility PolicyDocument4 pagesCorporate Social Responsibility PolicyOMKAR PARULEKARNo ratings yet

- Commercial Bank of Ethiopia: Environmental and Social PolicyDocument9 pagesCommercial Bank of Ethiopia: Environmental and Social Policyabraham mengstieNo ratings yet

- Business Environment Ii (CSR)Document6 pagesBusiness Environment Ii (CSR)OMKAR PARULEKARNo ratings yet

- CSR PolicyDocument8 pagesCSR PolicyChandra KumarNo ratings yet

- CSR PolicyDocument7 pagesCSR PolicyFast LikerNo ratings yet

- CSR PolicyDocument6 pagesCSR PolicychaitanyaNo ratings yet

- CSR PolicyDocument5 pagesCSR Policysaurabh patilNo ratings yet

- Corporate Social Responsibility Policy CiplaDocument5 pagesCorporate Social Responsibility Policy CiplaRupeshKumarNo ratings yet

- Kajaria CSRDocument5 pagesKajaria CSRASHISH BHATNo ratings yet

- Ihcl CSR PolicyDocument4 pagesIhcl CSR PolicyBhomik J ShahNo ratings yet

- DS Sons Private LimitedDocument4 pagesDS Sons Private LimitedMohd ShariqNo ratings yet

- BMW India CSR Policy V2.PDF - Asset.1633331834130Document9 pagesBMW India CSR Policy V2.PDF - Asset.1633331834130arupNo ratings yet

- Corporate Social Responsibility: Media Research Users CouncilDocument6 pagesCorporate Social Responsibility: Media Research Users CouncilUbed ShaikhNo ratings yet

- CSR Policies of Various BanksDocument11 pagesCSR Policies of Various BanksRahul JainNo ratings yet

- Corporate Social Responsibility Policy in PDFDocument7 pagesCorporate Social Responsibility Policy in PDFpolina.kosolap100% (1)

- Corporate Social Responsibility Policy of Nalco (2019)Document8 pagesCorporate Social Responsibility Policy of Nalco (2019)indian Boy1887No ratings yet

- CSR Policy of JK Cement LTD 20.11.14Document5 pagesCSR Policy of JK Cement LTD 20.11.14PRAKHAR JAINNo ratings yet

- Aiib - EsfDocument57 pagesAiib - Esfshahzad hasanNo ratings yet

- Business Plan 2021-2025 FOR Kituuka Juwakali Savings and Credit Cooperative Society LimitedDocument24 pagesBusiness Plan 2021-2025 FOR Kituuka Juwakali Savings and Credit Cooperative Society LimitedOCIRABIDHE CHRISTOPHER VictorNo ratings yet

- CSR Policy 26052017Document7 pagesCSR Policy 26052017shaikhjavid576No ratings yet

- CSR - Policy of IciciDocument7 pagesCSR - Policy of IciciComedy Freak showNo ratings yet

- CSR PolicyDocument6 pagesCSR PolicykaleemNo ratings yet

- Company Law CIA III CSRDocument6 pagesCompany Law CIA III CSRVedant GoswamiNo ratings yet

- Suryoday Small Finance Bank Limited: Policy Under The Sebi (Prohibition of Insider Trading) Regulations, 2015Document24 pagesSuryoday Small Finance Bank Limited: Policy Under The Sebi (Prohibition of Insider Trading) Regulations, 2015Kumar RockyNo ratings yet

- Customer Grievance Redressal PolicyDocument4 pagesCustomer Grievance Redressal PolicyKumar RockyNo ratings yet

- Deposit Policy: 3.1.1 Savings AccountDocument15 pagesDeposit Policy: 3.1.1 Savings AccountKumar RockyNo ratings yet

- Familiarisation: Suryoday Small Finance BankDocument4 pagesFamiliarisation: Suryoday Small Finance BankKumar RockyNo ratings yet

- HDFC Bank Credit Card ChargesDocument12 pagesHDFC Bank Credit Card ChargesKumar RockyNo ratings yet

- Ec6602 2M Rejinpaul IiDocument20 pagesEc6602 2M Rejinpaul IiKumar RockyNo ratings yet

- Sri Vidya College of Engineering & Technology Course Material (Lecture Notes)Document47 pagesSri Vidya College of Engineering & Technology Course Material (Lecture Notes)Kumar RockyNo ratings yet

- Sri Vidya College of Engineering & Technology Course Material (Lecture Notes)Document47 pagesSri Vidya College of Engineering & Technology Course Material (Lecture Notes)Kumar RockyNo ratings yet

- Ec6602 - Antenna and Wave Propagation: Part-B Question BankDocument6 pagesEc6602 - Antenna and Wave Propagation: Part-B Question BankKumar RockyNo ratings yet

- Department of Electronics and Communication Engineering: Ec6602 - Antenna and Wave PropagationDocument17 pagesDepartment of Electronics and Communication Engineering: Ec6602 - Antenna and Wave PropagationKumar RockyNo ratings yet

- Mes 007Document4 pagesMes 007dr_ashishvermaNo ratings yet

- Group Poject CONTRACT ESTIMATION BaruDocument21 pagesGroup Poject CONTRACT ESTIMATION BarualnzNo ratings yet

- Weaning Meal Plan 7 9 MonthsDocument1 pageWeaning Meal Plan 7 9 MonthsDeborah EvangelineNo ratings yet

- CH 19-Def Volumetrica de Solucionario de GroverDocument36 pagesCH 19-Def Volumetrica de Solucionario de Grover1rubena1No ratings yet

- Guidelines On Good Research PracticeDocument9 pagesGuidelines On Good Research PracticeAndre SetiawanNo ratings yet

- FIN201 CF T3 2021 BBUS Unit Guide V2 07092021Document11 pagesFIN201 CF T3 2021 BBUS Unit Guide V2 07092021Nguyen Quynh AnhNo ratings yet

- Public Space Thesis ArchitectureDocument5 pagesPublic Space Thesis Architecturestephaniejohnsonsyracuse100% (2)

- Gce Chemistry ReviewDocument41 pagesGce Chemistry Review7a4374 hisNo ratings yet

- The Literature of Bibliometrics Scientometrics and Informetrics-2Document24 pagesThe Literature of Bibliometrics Scientometrics and Informetrics-2Juan Ruiz-UrquijoNo ratings yet

- (Lines - of - Thought - ) Robert - C. - Stalnaker-Our - Knowledge - of - The - Internal - World - (Lines - of - Thought) - Oxford - University - Press, - USA (2008) (1) by Stalnaker PDFDocument20 pages(Lines - of - Thought - ) Robert - C. - Stalnaker-Our - Knowledge - of - The - Internal - World - (Lines - of - Thought) - Oxford - University - Press, - USA (2008) (1) by Stalnaker PDFPriyanka DeNo ratings yet

- Nep Schools - VZM Dist - 26072021Document27 pagesNep Schools - VZM Dist - 26072021WHO IS ITNo ratings yet

- Spoken Cues To DeceptionDocument32 pagesSpoken Cues To DeceptionSruthy KrishnaNo ratings yet

- Sample Diary Curriculum Map SUBJECT: Mathematics QUARTER: Second Grade Level: 10 TOPIC: CircleDocument3 pagesSample Diary Curriculum Map SUBJECT: Mathematics QUARTER: Second Grade Level: 10 TOPIC: CircleRichimon LicerioNo ratings yet

- Alfafara V Acebedo Optical CompanyDocument1 pageAlfafara V Acebedo Optical CompanyMaria Cristina MartinezNo ratings yet

- Boat and StreamDocument4 pagesBoat and StreamAllin 1No ratings yet

- Tifr SSRDocument972 pagesTifr SSRAbhishek UpadhyayNo ratings yet

- III Year A EEEDocument2 pagesIII Year A EEEshenbagaraman cseNo ratings yet

- Sample .Doc and .Docx Download - File Examples DownloadDocument2 pagesSample .Doc and .Docx Download - File Examples DownloadgjgdfbngfnfgnNo ratings yet

- Shark Tank Episodes: Season 2 Episode ProductsDocument2 pagesShark Tank Episodes: Season 2 Episode ProductsAdelfa Alap-apNo ratings yet

- Linda Hutcheon - Historiographic MetafictionDocument30 pagesLinda Hutcheon - Historiographic Metafictiongrebucko100% (2)

- AfterMath RulesDocument185 pagesAfterMath RulesWilliam May II67% (3)

- Kitchen Cabinet AND Wardrobe ClosetDocument23 pagesKitchen Cabinet AND Wardrobe ClosetAndrea Ann Arabiana AguinaldoNo ratings yet

- Primary Health Care NewDocument18 pagesPrimary Health Care NewSarika YadavNo ratings yet

- s3 Rooted GuideDocument14 pagess3 Rooted GuideRyn HtNo ratings yet