Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

90 viewsCBP Form 6059y

CBP Form 6059y

Uploaded by

Henry DoeU.S. Customs and Border Protection is responsible for protecting the United States from illegal imports. CBP officers have the authority to question travelers and examine their personal property to enforce import restrictions and collect duties on certain items. Travelers selected for examination will be treated professionally and questions can be directed to CBP supervisors.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Affidavit For Non Prosecution 2018Document3 pagesAffidavit For Non Prosecution 2018Errand Mercado100% (1)

- Usa CBP Form 6059bDocument1 pageUsa CBP Form 6059bnramesh8733% (3)

- Comprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedFrom EverandComprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedNo ratings yet

- CBP Form 6059B English (Sample Watermark)Document2 pagesCBP Form 6059B English (Sample Watermark)abhiNo ratings yet

- TRANSFER TAX, Estate Tax 2Document9 pagesTRANSFER TAX, Estate Tax 2JunivenReyUmadhayNo ratings yet

- AZ 2012 Elk and Pronghorn Hunting RegsDocument48 pagesAZ 2012 Elk and Pronghorn Hunting RegsRoeHuntingResourcesNo ratings yet

- Standard Operating Procedure 180 - Missing Persons - 180-MissingpersonsDocument15 pagesStandard Operating Procedure 180 - Missing Persons - 180-MissingpersonsDisability Rights AllianceNo ratings yet

- Eco ChicDocument19 pagesEco Chicoananichi7386No ratings yet

- Commodities Mba ProjectDocument61 pagesCommodities Mba ProjectHari Prasad67% (3)

- U.S. Customs Form: CBP Form 3227 - Certificate of Disposition of Imported MerchandiseDocument2 pagesU.S. Customs Form: CBP Form 3227 - Certificate of Disposition of Imported MerchandiseCustoms FormsNo ratings yet

- CBP Form 6059B - English-1 PDFDocument7 pagesCBP Form 6059B - English-1 PDFSachinNo ratings yet

- Texas Magistrate's Guide To Consular NotificationDocument67 pagesTexas Magistrate's Guide To Consular NotificationMartin ParedesNo ratings yet

- Ineligibilities and Waivers LawsDocument1 pageIneligibilities and Waivers Lawserada.alsaidiNo ratings yet

- E311 EngDocument1 pageE311 EngMarvy QuijalvoNo ratings yet

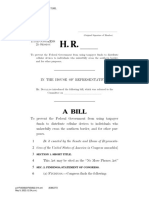

- No More Phones Act DraftDocument7 pagesNo More Phones Act DraftMichael GinsbergNo ratings yet

- CBPForm6059B English (Fillable) - 0Document1 pageCBPForm6059B English (Fillable) - 0pipul360% (1)

- Permit To Destroy Wildlife: Application InformationDocument10 pagesPermit To Destroy Wildlife: Application Informationmv_santiago_bNo ratings yet

- U.S. Customs Form: CBP Form I-736 - Guam-CNMI Visa Waiver InformationDocument1 pageU.S. Customs Form: CBP Form I-736 - Guam-CNMI Visa Waiver InformationCustoms FormsNo ratings yet

- Senior Pass ApplicationDocument2 pagesSenior Pass Applicationklumer_xNo ratings yet

- USDA APHIS Pet Travel - Bringing Pet Dogs Into The United StatesDocument2 pagesUSDA APHIS Pet Travel - Bringing Pet Dogs Into The United StatesMartinaNo ratings yet

- Endurance David Inegbedion: WelcomeDocument1 pageEndurance David Inegbedion: Welcomeeddie1011No ratings yet

- Iranian American Community Advisory - Travel and Border English Final PDFDocument5 pagesIranian American Community Advisory - Travel and Border English Final PDFparsequalityNo ratings yet

- Icici Lombard General Insurance Company LTDDocument2 pagesIcici Lombard General Insurance Company LTDApex Basnet0% (1)

- Immigration System ENG 04-14-15Document3 pagesImmigration System ENG 04-14-152xfhc47z9gNo ratings yet

- 2023-03-24 Committees To CBP On Del Rio IncidentDocument3 pages2023-03-24 Committees To CBP On Del Rio IncidentFox NewsNo ratings yet

- TRANSFER TAXES - 2020pptxDocument14 pagesTRANSFER TAXES - 2020pptxMikhael OngNo ratings yet

- Filed: Patrick FisherDocument22 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Cancelling A VisaDocument7 pagesCancelling A VisadhawalgmehtaNo ratings yet

- 808 Chapman FATCA Tax International Clients Assets 1017Document19 pages808 Chapman FATCA Tax International Clients Assets 1017FreeInformation4ALLNo ratings yet

- Oversight Committee Parole Letter To Sec MayorkasDocument4 pagesOversight Committee Parole Letter To Sec MayorkasFox NewsNo ratings yet

- Rep. Culver Sportmen's ReportDocument4 pagesRep. Culver Sportmen's ReportPAHouseGOPNo ratings yet

- Residency Fact SheetDocument1 pageResidency Fact SheetmehralsmenschNo ratings yet

- Nonnative Pet Amnesty Day Is Nov. 5 at Sea WorldDocument8 pagesNonnative Pet Amnesty Day Is Nov. 5 at Sea WorldFlorida Fish and Wildlife Conservation CommissionNo ratings yet

- Chapter 55 Enforcement of Immigration Related LawsDocument8 pagesChapter 55 Enforcement of Immigration Related Lawsnkotisso100% (1)

- REACT ActDocument2 pagesREACT ActThe Western JournalNo ratings yet

- WP Contentuploadstransamerica Foreign National Underwriting Guide PDFDocument16 pagesWP Contentuploadstransamerica Foreign National Underwriting Guide PDFDiego martinezNo ratings yet

- Civil Immigration Enforcement PrioritiesDocument4 pagesCivil Immigration Enforcement PrioritiesskuhagenNo ratings yet

- Transfer Taxes Estate Tax: Atty. JRS Umadhay's Tax ReviewerDocument9 pagesTransfer Taxes Estate Tax: Atty. JRS Umadhay's Tax ReviewerJunivenReyUmadhayNo ratings yet

- 2019 Mig Bird & Webless FINAL For WebDocument12 pages2019 Mig Bird & Webless FINAL For WebLowell SmithNo ratings yet

- Anne Arundel County Police Department Policy On Illegal Immigration (September 9, 2008)Document5 pagesAnne Arundel County Police Department Policy On Illegal Immigration (September 9, 2008)J CoxNo ratings yet

- U.S. Immigration Law HandbookDocument36 pagesU.S. Immigration Law HandbookSubham MohantyNo ratings yet

- Dos119 Public Records Exemption FormDocument2 pagesDos119 Public Records Exemption FormJOHN PubliusNo ratings yet

- Offshore HumanitarianDocument11 pagesOffshore HumanitarianSri Sakthi SumananNo ratings yet

- PETA vs. Waccatee Zoo LawsuitDocument123 pagesPETA vs. Waccatee Zoo LawsuitABC15 News100% (1)

- Harassment PackageDocument163 pagesHarassment PackageMichael BordelonNo ratings yet

- Qualifying Family Relationships and Eligibility For Visas: Families & Immigration October 2013Document56 pagesQualifying Family Relationships and Eligibility For Visas: Families & Immigration October 2013Awi TiosenNo ratings yet

- Customer Acknowledgement Form: Risk Factors Associated With Injury or Death During Pet TravelDocument2 pagesCustomer Acknowledgement Form: Risk Factors Associated With Injury or Death During Pet TravelJeremy GuzmanNo ratings yet

- This Document Is Scheduled To Be Published in The Federal Register On 08/15/2014 and Available Online atDocument238 pagesThis Document Is Scheduled To Be Published in The Federal Register On 08/15/2014 and Available Online atLaney SommerNo ratings yet

- ICE Guidance Memo - Age Determination Procedures For Custody Decisions (8/20/04)Document7 pagesICE Guidance Memo - Age Determination Procedures For Custody Decisions (8/20/04)J CoxNo ratings yet

- Case 1:19-mj-00149-SKCDocument9 pagesCase 1:19-mj-00149-SKCJustin RohrlichNo ratings yet

- b465 Version20oct2020Document1 pageb465 Version20oct2020Paul mulderNo ratings yet

- The 5 Most Common Airport Customs Questions: Safety & Insurance Visa & PassportsDocument3 pagesThe 5 Most Common Airport Customs Questions: Safety & Insurance Visa & PassportsVicSana KazakevichNo ratings yet

- DHS 'Parole-in-Place MemoDocument9 pagesDHS 'Parole-in-Place MemoFederation for American Immigration ReformNo ratings yet

- 2012-2013 New Mexico Fishing RegulationsDocument24 pages2012-2013 New Mexico Fishing RegulationsRoeHuntingResourcesNo ratings yet

- Enforcement Actions 2011Document7 pagesEnforcement Actions 2011special humanNo ratings yet

- 6.0 Arriving English FactsheetDocument2 pages6.0 Arriving English FactsheethardikNo ratings yet

- Wills and Trusts OutlineDocument16 pagesWills and Trusts Outlinejarabbo50% (2)

- Recognizing and Reporting Elder AbuseDocument6 pagesRecognizing and Reporting Elder AbusejongNo ratings yet

- CBP Information Guide: Legalization of Marijuana in CanadaDocument25 pagesCBP Information Guide: Legalization of Marijuana in CanadaKate RobertsonNo ratings yet

- 2019 Salt Extended IPIDDocument2 pages2019 Salt Extended IPIDFlavio Paiva Batista HarderNo ratings yet

- Httpslaw - Loyno.edusitesdefaultfilessocial - Security - PDF 22Document44 pagesHttpslaw - Loyno.edusitesdefaultfilessocial - Security - PDF 22Adrienne BrownNo ratings yet

- Supervision of Aliens Commensurate With RiskDocument26 pagesSupervision of Aliens Commensurate With RiskAnouk LenkoNo ratings yet

- Know Before You Go: Traveling the U.S. and AbroadFrom EverandKnow Before You Go: Traveling the U.S. and AbroadNo ratings yet

- Interim Report EDUMENTORDocument17 pagesInterim Report EDUMENTORRajat Gaulkar100% (1)

- Primitive Turbulence: Kinetics, Prandtl's Mixing Length, and Von K Arm An's ConstantDocument12 pagesPrimitive Turbulence: Kinetics, Prandtl's Mixing Length, and Von K Arm An's ConstantHector BurgueñoNo ratings yet

- SAP User Manual PDFDocument55 pagesSAP User Manual PDFmadesuendaNo ratings yet

- Aci 308.1Document9 pagesAci 308.1Velmurugan Balasubramanian100% (2)

- 1 Shuttering/ Formwork: Direct Labour HoursDocument11 pages1 Shuttering/ Formwork: Direct Labour HoursCherryl Chrissie JamesNo ratings yet

- United States v. Delwright T. Dyman, Cosimo Mezzapella, A/K/A Joe Cosimo, A/K/A Joseph Rusello, Richard D. Spainhower and Joseph A. Valentino, 739 F.2d 762, 2d Cir. (1984)Document15 pagesUnited States v. Delwright T. Dyman, Cosimo Mezzapella, A/K/A Joe Cosimo, A/K/A Joseph Rusello, Richard D. Spainhower and Joseph A. Valentino, 739 F.2d 762, 2d Cir. (1984)Scribd Government DocsNo ratings yet

- Ies, Iia and IpDocument46 pagesIes, Iia and IpRosalie E. BalhagNo ratings yet

- Employee Engagement PDFDocument33 pagesEmployee Engagement PDFVhonek PangetNo ratings yet

- 83 - SUDO - Root Programme Unter User Laufen: SpecificationsDocument3 pages83 - SUDO - Root Programme Unter User Laufen: SpecificationssaeeddeepNo ratings yet

- User Guide For Stock Overview (HANA and non-HANA) : SymptomDocument2 pagesUser Guide For Stock Overview (HANA and non-HANA) : SymptomAshok MohanNo ratings yet

- Cost Accounting For Ultratech Cement LTD.Document10 pagesCost Accounting For Ultratech Cement LTD.ashjaisNo ratings yet

- Gtu Paper QaDocument3 pagesGtu Paper Qaamit patelNo ratings yet

- Assess 311 WEEK1Document8 pagesAssess 311 WEEK1cloe reginaldoNo ratings yet

- Medina College Graduate School Department Comprehensive Examination Master of Arts in Nursing N 131 - The Administration ProcessDocument3 pagesMedina College Graduate School Department Comprehensive Examination Master of Arts in Nursing N 131 - The Administration ProcessRose Rebollos MaligroNo ratings yet

- Atm / Debit Card Application Form: Khumneicha G A O NG NDocument2 pagesAtm / Debit Card Application Form: Khumneicha G A O NG NLalrinpuii Joute0% (1)

- Darwnian RevolutionDocument13 pagesDarwnian RevolutionXy-nique De LeonNo ratings yet

- Tieng Anh 11 Friends Global - Unit 7&8 - Test 1Document7 pagesTieng Anh 11 Friends Global - Unit 7&8 - Test 1Bảo NghiNo ratings yet

- BIIS - PTA Resolution 2021Document2 pagesBIIS - PTA Resolution 2021Stephanie PayumoNo ratings yet

- Modeling and Simulation of Mechatronic Systems Using SimscapeDocument42 pagesModeling and Simulation of Mechatronic Systems Using SimscapePavaniNo ratings yet

- Mayring 2000 - Qualitative Content AnalysisDocument10 pagesMayring 2000 - Qualitative Content Analysispist81100% (2)

- MIRCS: A Mobile USSD-SMS Interactive Result Checking System For Resource-Constrained SettingsDocument5 pagesMIRCS: A Mobile USSD-SMS Interactive Result Checking System For Resource-Constrained Settingsabdulg abdulNo ratings yet

- Photons and Atoms Introduction To Quantum Electrodynamics Wiley ProfessionalDocument481 pagesPhotons and Atoms Introduction To Quantum Electrodynamics Wiley Professionalarturo_mulas100% (2)

- Business Intelligence Solutions Buyers GuideDocument22 pagesBusiness Intelligence Solutions Buyers GuideJulio BazanNo ratings yet

- William Duarte - Delphi® para Android e iOS - Desenvolvendo Aplicativos MóveisDocument1 pageWilliam Duarte - Delphi® para Android e iOS - Desenvolvendo Aplicativos MóveisRonaldo NascimentoNo ratings yet

- Progressive Revelation: The Unfolding of God's RevelationDocument2 pagesProgressive Revelation: The Unfolding of God's Revelationgrace10000No ratings yet

- 2017 Unesco StyleDocument27 pages2017 Unesco StyleLittlequanNo ratings yet

- 1 EF1A - HDT - Money - To - Bitcoins - CSP20B1B PDFDocument15 pages1 EF1A - HDT - Money - To - Bitcoins - CSP20B1B PDFMohit KumarNo ratings yet

CBP Form 6059y

CBP Form 6059y

Uploaded by

Henry Doe0 ratings0% found this document useful (0 votes)

90 views1 pageU.S. Customs and Border Protection is responsible for protecting the United States from illegal imports. CBP officers have the authority to question travelers and examine their personal property to enforce import restrictions and collect duties on certain items. Travelers selected for examination will be treated professionally and questions can be directed to CBP supervisors.

Original Description:

Original Title

Cbp Form 6059y

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentU.S. Customs and Border Protection is responsible for protecting the United States from illegal imports. CBP officers have the authority to question travelers and examine their personal property to enforce import restrictions and collect duties on certain items. Travelers selected for examination will be treated professionally and questions can be directed to CBP supervisors.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

90 views1 pageCBP Form 6059y

CBP Form 6059y

Uploaded by

Henry DoeU.S. Customs and Border Protection is responsible for protecting the United States from illegal imports. CBP officers have the authority to question travelers and examine their personal property to enforce import restrictions and collect duties on certain items. Travelers selected for examination will be treated professionally and questions can be directed to CBP supervisors.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

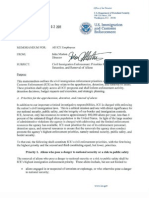

This Space For Official Use Only

U.S. Customs and Border Protection Welcomes You to the

United

U.S. States

customs and Border Protection is responsible for protecting the

United States against the illegal importation of prohibited items. CBP

officers have the authority to question you and to examine you and your

personal property. If you are one of the travelers selected for an

examination, you will be treated in a courteous, professional, and

dignifiedmanner.CBPSupervisorsandPassengerService

Representatives are available to answer your questions. Comment cards

are available to compliment or provide

feedback.

Important

Information

U.S. Residents—declare all articles that you have acquired abroad and

Customs DeclarationFORM APPROVED are bringing into the United States.

19 CFR 122.27, 148.12, 148.13, 148.110, 148.111, 1498; 31 CFR 5316OMB NO.1651-0009Visitors (Non-Residents)—Declare the value of all articles that will

Each arriving traveler or responsible family member must provide theremain in the United States.

following information (only ONE written declaration per family is Declare all articles on this declaration form and show the value in U.S.

required).

The term "family" is defined as "members of a family residing in the dollars. For gifts, please indicate the retail

same

household who are related by blood, marriage, domestic relationship, or value. officers will determine duty. U.S. residents are normally

Duty—CBP

adoption. entitled to a duty-free exemption of $800 on items accompanying

" them. Visitors (non-residents) are normally entitled to an exemption

1 Family Name of $100. Duty will be assessed at the current rate on the first $1,000

First (Given) Middle above the exemption.

Agricultural and Wildlife Products—To prevent the entry of dangerous

2 Birth dateMonth DayYear

agricultural pests and prohibited wildlife, the following are restricted:

3 Number of Family members traveling with youFruits, vegetables, plants, plant products, soil, meat, meat products,

birds, snails, and other live animals or animal products. Failure to

4 (a) U.S. Street Address (hotel name/destination)

declare such items to a Customs and Border Protection Officer/

Customs and Border Protection Agriculture Specialist/Fish and

(b) City(c) State Wildlife Inspector can result in penalties and the items may be

subject to

5 Passport issued by (country) seizure.substances, obscene articles, and toxic substances are

Controlled

6 Passport number generally prohibited entry. The importation of merchandise into the

U.S. that infringes intellectual property rights may subject travelers

7 Country of Residence to

civil or criminal penalties and may pose serious risk to safety or

8 Countries visited on this health.

trip prior to U.S. The transportation of currency or monetary instruments, regardless of

arrival the amount, is legal. However, if you bring in to or take out of the United

9 Airline/Flight No. or Vessel Name States more than $10,000 (U.S. or foreign equivalent, or a combination

10 The primary purpose of this trip is business:YesNo of both), you are required by law to file a report on FinCEN 105 (formerly

Customs Form 4790) with U.S. Customs and Border Protection.

11 I am (We are) bringing Monetary instruments include coin, currency, travelers checks and

(a) fruits, vegetables, plants, seeds, food, insects:YesNo bearer instruments such as personal or cashiers checks and stocks and

bonds. If you have someone else carry the currency or monetary

(b) meats, animals, animal/wildlife products:YesNo instrument for you, you must also file a report on FinCEN 105. Failure to

(c) disease agents, cell cultures, snails:YesNo file the required report or failure to report the total amount that you are

carrying may lead to the seizure of all the currency or monetary

(d) soil or have been on a farm/ranch/pasture:YesNo instruments, and may subject you to civil penalties and/or criminal

12 I have (We have) been in close proximity of livestock:YesNo prosecution. SIGN ON THE OPPOSITE SIDE OF THIS FORM AFTER

YOU HAVE READ THE IMPORTANT INFORMATION ABOVE AND

(such as touching or handling)

MADE A TRUTHFUL DECLARATION.

13 I am (We are) carrying currency or monetary instruments

Description of CBP

over $10,000 U.S. or foreign equivalent:YesNo

Articles

(List may continue on another CBP Form 6059B)Value Use

(see definition of monetary instruments on reverse) Only

14 I have (We have) commercial merchandise:YesNo

(articles for sale, samples used for soliciting orders,

or goods that are not considered personal effects )

15 RESIDENTS—the total value of all goods, including commercial

merchandise I/we have purchased or acquired abroad,

(including

gifts for someone else but not items mailed

to

the U.S.) and am/are bringing to the U.S. $

is:

VISITORS—the total value of all articles that $

will remain in the U.S., including commercial

merchandise

is:

Read the instructions on the back of this form. Space is provided to listTotal

all the items you must declare.PAPERWORK REDUCTION ACT STATEMENT: An agency may not conduct or

sponsor an information collection and a person is not required to respond to this

I HAVE READ THE IMPORTANT INFORMATION ON THE REVERSE SIDE OF THIS FORM

AND HAVE MADE A TRUTHFUL DECLARATION. information unless it displays a current valid OMB control number. The control

number for this collection is 1651-0009. The estimated average time to complete

X this application is 4 minutes. Your response is mandatory. If you have any

comments regarding the burden estimate you can write to U.S. Customs and

SignatureDate (month/day/year)Border Protection Office of Regulations and Rulings, 90 K Street, NE, 10th Floor,

Washington, DC 20229.

CBP Form 6059B (03/16)CBP Form 6059B (03/16)

You might also like

- Affidavit For Non Prosecution 2018Document3 pagesAffidavit For Non Prosecution 2018Errand Mercado100% (1)

- Usa CBP Form 6059bDocument1 pageUsa CBP Form 6059bnramesh8733% (3)

- Comprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedFrom EverandComprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedNo ratings yet

- CBP Form 6059B English (Sample Watermark)Document2 pagesCBP Form 6059B English (Sample Watermark)abhiNo ratings yet

- TRANSFER TAX, Estate Tax 2Document9 pagesTRANSFER TAX, Estate Tax 2JunivenReyUmadhayNo ratings yet

- AZ 2012 Elk and Pronghorn Hunting RegsDocument48 pagesAZ 2012 Elk and Pronghorn Hunting RegsRoeHuntingResourcesNo ratings yet

- Standard Operating Procedure 180 - Missing Persons - 180-MissingpersonsDocument15 pagesStandard Operating Procedure 180 - Missing Persons - 180-MissingpersonsDisability Rights AllianceNo ratings yet

- Eco ChicDocument19 pagesEco Chicoananichi7386No ratings yet

- Commodities Mba ProjectDocument61 pagesCommodities Mba ProjectHari Prasad67% (3)

- U.S. Customs Form: CBP Form 3227 - Certificate of Disposition of Imported MerchandiseDocument2 pagesU.S. Customs Form: CBP Form 3227 - Certificate of Disposition of Imported MerchandiseCustoms FormsNo ratings yet

- CBP Form 6059B - English-1 PDFDocument7 pagesCBP Form 6059B - English-1 PDFSachinNo ratings yet

- Texas Magistrate's Guide To Consular NotificationDocument67 pagesTexas Magistrate's Guide To Consular NotificationMartin ParedesNo ratings yet

- Ineligibilities and Waivers LawsDocument1 pageIneligibilities and Waivers Lawserada.alsaidiNo ratings yet

- E311 EngDocument1 pageE311 EngMarvy QuijalvoNo ratings yet

- No More Phones Act DraftDocument7 pagesNo More Phones Act DraftMichael GinsbergNo ratings yet

- CBPForm6059B English (Fillable) - 0Document1 pageCBPForm6059B English (Fillable) - 0pipul360% (1)

- Permit To Destroy Wildlife: Application InformationDocument10 pagesPermit To Destroy Wildlife: Application Informationmv_santiago_bNo ratings yet

- U.S. Customs Form: CBP Form I-736 - Guam-CNMI Visa Waiver InformationDocument1 pageU.S. Customs Form: CBP Form I-736 - Guam-CNMI Visa Waiver InformationCustoms FormsNo ratings yet

- Senior Pass ApplicationDocument2 pagesSenior Pass Applicationklumer_xNo ratings yet

- USDA APHIS Pet Travel - Bringing Pet Dogs Into The United StatesDocument2 pagesUSDA APHIS Pet Travel - Bringing Pet Dogs Into The United StatesMartinaNo ratings yet

- Endurance David Inegbedion: WelcomeDocument1 pageEndurance David Inegbedion: Welcomeeddie1011No ratings yet

- Iranian American Community Advisory - Travel and Border English Final PDFDocument5 pagesIranian American Community Advisory - Travel and Border English Final PDFparsequalityNo ratings yet

- Icici Lombard General Insurance Company LTDDocument2 pagesIcici Lombard General Insurance Company LTDApex Basnet0% (1)

- Immigration System ENG 04-14-15Document3 pagesImmigration System ENG 04-14-152xfhc47z9gNo ratings yet

- 2023-03-24 Committees To CBP On Del Rio IncidentDocument3 pages2023-03-24 Committees To CBP On Del Rio IncidentFox NewsNo ratings yet

- TRANSFER TAXES - 2020pptxDocument14 pagesTRANSFER TAXES - 2020pptxMikhael OngNo ratings yet

- Filed: Patrick FisherDocument22 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Cancelling A VisaDocument7 pagesCancelling A VisadhawalgmehtaNo ratings yet

- 808 Chapman FATCA Tax International Clients Assets 1017Document19 pages808 Chapman FATCA Tax International Clients Assets 1017FreeInformation4ALLNo ratings yet

- Oversight Committee Parole Letter To Sec MayorkasDocument4 pagesOversight Committee Parole Letter To Sec MayorkasFox NewsNo ratings yet

- Rep. Culver Sportmen's ReportDocument4 pagesRep. Culver Sportmen's ReportPAHouseGOPNo ratings yet

- Residency Fact SheetDocument1 pageResidency Fact SheetmehralsmenschNo ratings yet

- Nonnative Pet Amnesty Day Is Nov. 5 at Sea WorldDocument8 pagesNonnative Pet Amnesty Day Is Nov. 5 at Sea WorldFlorida Fish and Wildlife Conservation CommissionNo ratings yet

- Chapter 55 Enforcement of Immigration Related LawsDocument8 pagesChapter 55 Enforcement of Immigration Related Lawsnkotisso100% (1)

- REACT ActDocument2 pagesREACT ActThe Western JournalNo ratings yet

- WP Contentuploadstransamerica Foreign National Underwriting Guide PDFDocument16 pagesWP Contentuploadstransamerica Foreign National Underwriting Guide PDFDiego martinezNo ratings yet

- Civil Immigration Enforcement PrioritiesDocument4 pagesCivil Immigration Enforcement PrioritiesskuhagenNo ratings yet

- Transfer Taxes Estate Tax: Atty. JRS Umadhay's Tax ReviewerDocument9 pagesTransfer Taxes Estate Tax: Atty. JRS Umadhay's Tax ReviewerJunivenReyUmadhayNo ratings yet

- 2019 Mig Bird & Webless FINAL For WebDocument12 pages2019 Mig Bird & Webless FINAL For WebLowell SmithNo ratings yet

- Anne Arundel County Police Department Policy On Illegal Immigration (September 9, 2008)Document5 pagesAnne Arundel County Police Department Policy On Illegal Immigration (September 9, 2008)J CoxNo ratings yet

- U.S. Immigration Law HandbookDocument36 pagesU.S. Immigration Law HandbookSubham MohantyNo ratings yet

- Dos119 Public Records Exemption FormDocument2 pagesDos119 Public Records Exemption FormJOHN PubliusNo ratings yet

- Offshore HumanitarianDocument11 pagesOffshore HumanitarianSri Sakthi SumananNo ratings yet

- PETA vs. Waccatee Zoo LawsuitDocument123 pagesPETA vs. Waccatee Zoo LawsuitABC15 News100% (1)

- Harassment PackageDocument163 pagesHarassment PackageMichael BordelonNo ratings yet

- Qualifying Family Relationships and Eligibility For Visas: Families & Immigration October 2013Document56 pagesQualifying Family Relationships and Eligibility For Visas: Families & Immigration October 2013Awi TiosenNo ratings yet

- Customer Acknowledgement Form: Risk Factors Associated With Injury or Death During Pet TravelDocument2 pagesCustomer Acknowledgement Form: Risk Factors Associated With Injury or Death During Pet TravelJeremy GuzmanNo ratings yet

- This Document Is Scheduled To Be Published in The Federal Register On 08/15/2014 and Available Online atDocument238 pagesThis Document Is Scheduled To Be Published in The Federal Register On 08/15/2014 and Available Online atLaney SommerNo ratings yet

- ICE Guidance Memo - Age Determination Procedures For Custody Decisions (8/20/04)Document7 pagesICE Guidance Memo - Age Determination Procedures For Custody Decisions (8/20/04)J CoxNo ratings yet

- Case 1:19-mj-00149-SKCDocument9 pagesCase 1:19-mj-00149-SKCJustin RohrlichNo ratings yet

- b465 Version20oct2020Document1 pageb465 Version20oct2020Paul mulderNo ratings yet

- The 5 Most Common Airport Customs Questions: Safety & Insurance Visa & PassportsDocument3 pagesThe 5 Most Common Airport Customs Questions: Safety & Insurance Visa & PassportsVicSana KazakevichNo ratings yet

- DHS 'Parole-in-Place MemoDocument9 pagesDHS 'Parole-in-Place MemoFederation for American Immigration ReformNo ratings yet

- 2012-2013 New Mexico Fishing RegulationsDocument24 pages2012-2013 New Mexico Fishing RegulationsRoeHuntingResourcesNo ratings yet

- Enforcement Actions 2011Document7 pagesEnforcement Actions 2011special humanNo ratings yet

- 6.0 Arriving English FactsheetDocument2 pages6.0 Arriving English FactsheethardikNo ratings yet

- Wills and Trusts OutlineDocument16 pagesWills and Trusts Outlinejarabbo50% (2)

- Recognizing and Reporting Elder AbuseDocument6 pagesRecognizing and Reporting Elder AbusejongNo ratings yet

- CBP Information Guide: Legalization of Marijuana in CanadaDocument25 pagesCBP Information Guide: Legalization of Marijuana in CanadaKate RobertsonNo ratings yet

- 2019 Salt Extended IPIDDocument2 pages2019 Salt Extended IPIDFlavio Paiva Batista HarderNo ratings yet

- Httpslaw - Loyno.edusitesdefaultfilessocial - Security - PDF 22Document44 pagesHttpslaw - Loyno.edusitesdefaultfilessocial - Security - PDF 22Adrienne BrownNo ratings yet

- Supervision of Aliens Commensurate With RiskDocument26 pagesSupervision of Aliens Commensurate With RiskAnouk LenkoNo ratings yet

- Know Before You Go: Traveling the U.S. and AbroadFrom EverandKnow Before You Go: Traveling the U.S. and AbroadNo ratings yet

- Interim Report EDUMENTORDocument17 pagesInterim Report EDUMENTORRajat Gaulkar100% (1)

- Primitive Turbulence: Kinetics, Prandtl's Mixing Length, and Von K Arm An's ConstantDocument12 pagesPrimitive Turbulence: Kinetics, Prandtl's Mixing Length, and Von K Arm An's ConstantHector BurgueñoNo ratings yet

- SAP User Manual PDFDocument55 pagesSAP User Manual PDFmadesuendaNo ratings yet

- Aci 308.1Document9 pagesAci 308.1Velmurugan Balasubramanian100% (2)

- 1 Shuttering/ Formwork: Direct Labour HoursDocument11 pages1 Shuttering/ Formwork: Direct Labour HoursCherryl Chrissie JamesNo ratings yet

- United States v. Delwright T. Dyman, Cosimo Mezzapella, A/K/A Joe Cosimo, A/K/A Joseph Rusello, Richard D. Spainhower and Joseph A. Valentino, 739 F.2d 762, 2d Cir. (1984)Document15 pagesUnited States v. Delwright T. Dyman, Cosimo Mezzapella, A/K/A Joe Cosimo, A/K/A Joseph Rusello, Richard D. Spainhower and Joseph A. Valentino, 739 F.2d 762, 2d Cir. (1984)Scribd Government DocsNo ratings yet

- Ies, Iia and IpDocument46 pagesIes, Iia and IpRosalie E. BalhagNo ratings yet

- Employee Engagement PDFDocument33 pagesEmployee Engagement PDFVhonek PangetNo ratings yet

- 83 - SUDO - Root Programme Unter User Laufen: SpecificationsDocument3 pages83 - SUDO - Root Programme Unter User Laufen: SpecificationssaeeddeepNo ratings yet

- User Guide For Stock Overview (HANA and non-HANA) : SymptomDocument2 pagesUser Guide For Stock Overview (HANA and non-HANA) : SymptomAshok MohanNo ratings yet

- Cost Accounting For Ultratech Cement LTD.Document10 pagesCost Accounting For Ultratech Cement LTD.ashjaisNo ratings yet

- Gtu Paper QaDocument3 pagesGtu Paper Qaamit patelNo ratings yet

- Assess 311 WEEK1Document8 pagesAssess 311 WEEK1cloe reginaldoNo ratings yet

- Medina College Graduate School Department Comprehensive Examination Master of Arts in Nursing N 131 - The Administration ProcessDocument3 pagesMedina College Graduate School Department Comprehensive Examination Master of Arts in Nursing N 131 - The Administration ProcessRose Rebollos MaligroNo ratings yet

- Atm / Debit Card Application Form: Khumneicha G A O NG NDocument2 pagesAtm / Debit Card Application Form: Khumneicha G A O NG NLalrinpuii Joute0% (1)

- Darwnian RevolutionDocument13 pagesDarwnian RevolutionXy-nique De LeonNo ratings yet

- Tieng Anh 11 Friends Global - Unit 7&8 - Test 1Document7 pagesTieng Anh 11 Friends Global - Unit 7&8 - Test 1Bảo NghiNo ratings yet

- BIIS - PTA Resolution 2021Document2 pagesBIIS - PTA Resolution 2021Stephanie PayumoNo ratings yet

- Modeling and Simulation of Mechatronic Systems Using SimscapeDocument42 pagesModeling and Simulation of Mechatronic Systems Using SimscapePavaniNo ratings yet

- Mayring 2000 - Qualitative Content AnalysisDocument10 pagesMayring 2000 - Qualitative Content Analysispist81100% (2)

- MIRCS: A Mobile USSD-SMS Interactive Result Checking System For Resource-Constrained SettingsDocument5 pagesMIRCS: A Mobile USSD-SMS Interactive Result Checking System For Resource-Constrained Settingsabdulg abdulNo ratings yet

- Photons and Atoms Introduction To Quantum Electrodynamics Wiley ProfessionalDocument481 pagesPhotons and Atoms Introduction To Quantum Electrodynamics Wiley Professionalarturo_mulas100% (2)

- Business Intelligence Solutions Buyers GuideDocument22 pagesBusiness Intelligence Solutions Buyers GuideJulio BazanNo ratings yet

- William Duarte - Delphi® para Android e iOS - Desenvolvendo Aplicativos MóveisDocument1 pageWilliam Duarte - Delphi® para Android e iOS - Desenvolvendo Aplicativos MóveisRonaldo NascimentoNo ratings yet

- Progressive Revelation: The Unfolding of God's RevelationDocument2 pagesProgressive Revelation: The Unfolding of God's Revelationgrace10000No ratings yet

- 2017 Unesco StyleDocument27 pages2017 Unesco StyleLittlequanNo ratings yet

- 1 EF1A - HDT - Money - To - Bitcoins - CSP20B1B PDFDocument15 pages1 EF1A - HDT - Money - To - Bitcoins - CSP20B1B PDFMohit KumarNo ratings yet