Professional Documents

Culture Documents

8.3 Life and Work - Budget

8.3 Life and Work - Budget

Uploaded by

Sam TannyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

8.3 Life and Work - Budget

8.3 Life and Work - Budget

Uploaded by

Sam TannyCopyright:

Available Formats

Economics | 8.

3 Life & Work - Budget

Introduction: The following activities will guide you through the process of how to budget your money

responsibly. You will begin by deciding on a career of your choice, determining your monthly income, and

estimating your monthly expenses. You will be responsible for keeping track of money earned as well as

money spent. At the end of this lesson you will be able to: Apply math to real life situations, develop a

realistic view of the cost of living, differentiate between necessities and luxuries, and use technology as a

resource.

The Process: How likely is it that you will become a professional athlete or other elite professional? Your

first task will be to decide on a "realistic" career that would be suitable for you in the future. You are

required to research the career that you have chosen.

Once you have chosen a career, you will use the Internet, family/household information, and newspaper

classifieds to find information about various wages and expenses, which will be used to create a personal

budget. Remember, this is going to end up being hypothetical because we are asking you to look into the

future. Therefore, you should not use your family’s actual data to complete this budget, but use it as a

guide to ensure that you are using realistic values.

Part A – How much can I afford? (5 points)

Step 1: Find and choose a career of your own to use to create an actual budget.

Career choice: ___Interior Designer_ (be as specific as possible)

What are the requirements of this job (educational/other)?

(Steps I need to take after high school)

1. earn a bachelors degree in design

2. Pass the national council for interior design qualification exam

3. 60 semester hours of interior design work

4. Build a portfolio/intern at least 60 hours

What is the starting average salary as well as the top end salary?

47,300-56,000

Some resources you may utilize:

© Copyright 2019 Michigan VirtualRevised 11/4/2019Page 1

http://www.bls.gov/oes/current/oessrcst.htm

http://www.payscale.com

http://kiplinger.salary.com/

http://www.themint.org/kids/starting-salaries.html

Part B - Creating a Budget

Okay...we're not going to bore you with a lot of details here. Simply put: we want you to imagine how you

want to live once you're on your own. What kind of car are you going to buy? Where are you going to live?

Do you love to go to the movies or to the clubs every weekend? Remember, it's your life, you can do

whatever you want...or can you?

Step 1: Answer the following questions in sentence format. (5 points)

•

What is a budget?

A budget is a certain amount of money you limit yourself to for your wants and needs.

•

What does a balanced budget mean?

a balanced budget is equal parts for your needs and wants

•

What are regular expenses?

Regular expenses are expenses that you use regularly. An example is gas, food and pets.

•

What are discretionary expenses? Discretionary expenses is spending money that is’t necessary and is

based more on wants then needs.

Step 2: You are responsible for creating a monthly budget. Your budget must be realistic and you must "live"

within your means. Use the Internet, family/household information, and newspaper classifieds to complete

the budget worksheet on the back of this assignment. You must include documentation to support all of your

numbers, such as website address, copy of bill from home, copy of classified ad, etc.

Convert yearly or weekly income/expenses to monthly amounts and enter them into the budget worksheet.

For example:

● $30000 yearly salary divided by 12 = $2500 income per month

● $125 weekly groceries X 4 (roughly, number of weeks in month) = $500 per month

Step 3: Create your budget using the worksheet on the next page. (10 points)

Be particularly careful on the cells indicated with the asterisk (*) as these are places where accurate math

skills may be required. It would be wise to double check these calculations as errors here will affect your

final budget.

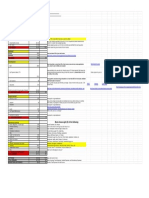

Monthly Budget

Worksheet

© Copyright 2019 Michigan VirtualRevised 11/4/2019Page 2

Income

Monthly Income 3,941.67

- Deductions (monthly income X 25%)

= Net Monthly Income 2956.25*

Monthly Expenses

Regular Expenses

Housing/Shelter 1,105

Garbage Pickup 45

Water 25

Parking Fees part of rent

Heating 38

Electricity 175

Phone 24

Renters'/Homeowners' Insurance 155

Auto Payment

208.33

Auto Insurance 90

Auto Maintenance (gas, oil, repairs, etc.) 139

Clothing 75

Food/Household (groceries, paper towels, cleaner, Etc.) 115

School Loans 150

Personal care (haircuts, manicures, etc.) 50

Total Regular Expenses 2294*

Discretionary Expenses

Internet 60

Cell Phone 30

Cable Television

Life Insurance 126

Health Care 165.76

Entertainment (movies, music, games, vacations) 21

Miscellaneous 85

Gifts 15

Savings 159.24

Total Discretionary Expenses 662*

Total Monthly Expenses 2956.25*

Balancing Budget

Net Monthly Income 1956.25*

Total Monthly Expenses 1956.25*

© Copyright 2019 Michigan VirtualRevised 11/4/2019Page 3

Balance 0*

© Copyright 2019 Michigan VirtualRevised 11/4/2019Page 4

You might also like

- Home Health Care Services Business Plan Sample - Financial PlanDocument11 pagesHome Health Care Services Business Plan Sample - Financial Plangauravj180% (1)

- Electronic Sample BillDocument1 pageElectronic Sample Billshani Chahal100% (3)

- 2.2 Interpreting InterrogativiesDocument1 page2.2 Interpreting InterrogativiesSam TannyNo ratings yet

- Payroll Canadian 1st Edition Dryden Test BankDocument38 pagesPayroll Canadian 1st Edition Dryden Test Bankriaozgas3023100% (19)

- Budgeting WorksheetsDocument9 pagesBudgeting WorksheetsCarolNo ratings yet

- The Twenty-Something ProjectDocument36 pagesThe Twenty-Something Projectapi-270947621No ratings yet

- Exercises For Final PDFDocument11 pagesExercises For Final PDFThanh HằngNo ratings yet

- Microeconomics Notes (Advanced)Document98 pagesMicroeconomics Notes (Advanced)rafay010100% (1)

- Career / Budget Project: Business Principles - 2 SemesterDocument3 pagesCareer / Budget Project: Business Principles - 2 SemesterAmitaNo ratings yet

- Career 2201: Budget Assignment: SectionDocument4 pagesCareer 2201: Budget Assignment: SectionInnocent MapaNo ratings yet

- Workbook Module ADocument16 pagesWorkbook Module AJeric TabonNo ratings yet

- ⭐_BigBudgetBundleDocument22 pages⭐_BigBudgetBundlekrystalNo ratings yet

- Expenditure ReportDocument8 pagesExpenditure ReportXYZNo ratings yet

- After College Budget 2017 - Maya Covington - Classroom Without FormulasDocument1 pageAfter College Budget 2017 - Maya Covington - Classroom Without Formulasapi-358364909No ratings yet

- After College Budget 2017Document10 pagesAfter College Budget 2017api-358027640No ratings yet

- Finanace Samatva Presentation SlidesDocument58 pagesFinanace Samatva Presentation SlidesJananiNo ratings yet

- After College Budget 2017 Nia - Classroom Without FormulasDocument1 pageAfter College Budget 2017 Nia - Classroom Without Formulasapi-358255825No ratings yet

- The Cost of Living Project (50 Points) : Income Source of IncomeDocument4 pagesThe Cost of Living Project (50 Points) : Income Source of IncomeMukesh Kumar100% (1)

- Nutes and Bolts of BudgetingDocument33 pagesNutes and Bolts of BudgetingChandra shekharNo ratings yet

- The Results!: How To Use This Budget PlannerDocument39 pagesThe Results!: How To Use This Budget PlannerMyilvahanan JothivelNo ratings yet

- Budget PlannerDocument39 pagesBudget PlannerTR BBOLLONo ratings yet

- Quản Lý Chi TiêuDocument39 pagesQuản Lý Chi Tiêudonhan91No ratings yet

- Budgeting Calculator Spreadsheet With Guidelines Ver 1 61Document4 pagesBudgeting Calculator Spreadsheet With Guidelines Ver 1 61michael odiemboNo ratings yet

- (Business English 2023-2) Zero Based Budget WorksheetDocument2 pages(Business English 2023-2) Zero Based Budget WorksheetJAHONGIRNo ratings yet

- Budgeting Assignment - .Docx-3Document5 pagesBudgeting Assignment - .Docx-3Rania IhsanNo ratings yet

- After College Budget 2017 - Kinjii Ridley - Classroom Without FormulasDocument1 pageAfter College Budget 2017 - Kinjii Ridley - Classroom Without Formulasapi-358363799No ratings yet

- My Adult LifeDocument5 pagesMy Adult Lifeapi-357699667No ratings yet

- Consumer Math Chapter 3.5Document9 pagesConsumer Math Chapter 3.5William ShevchukNo ratings yet

- Investment Planning Workbook: Getting StartedDocument8 pagesInvestment Planning Workbook: Getting StartedshanpiePLNo ratings yet

- Calculator PrintDocument2 pagesCalculator PrintRazana AqilaNo ratings yet

- Budget 2019 Public 2Document9 pagesBudget 2019 Public 2Jack CowlingNo ratings yet

- After College Budget 2017 - Meredith Newman - Classroom Without FormulasDocument1 pageAfter College Budget 2017 - Meredith Newman - Classroom Without Formulasapi-358246016No ratings yet

- Personal Finance Course. Mock Exam 2023.without AnswerDocument3 pagesPersonal Finance Course. Mock Exam 2023.without Answernguyen tungNo ratings yet

- How To Calculate Timely Rates in Software IndustryDocument21 pagesHow To Calculate Timely Rates in Software IndustrylamshNo ratings yet

- After College Budget 2017 - Raiven Jones - Classroom Without FormulasDocument1 pageAfter College Budget 2017 - Raiven Jones - Classroom Without Formulasapi-358480602No ratings yet

- For Irs For State: Origin Quick Calculator For 433f CalculationsDocument13 pagesFor Irs For State: Origin Quick Calculator For 433f CalculationsAnonymous NjNW0Gb6nNo ratings yet

- Personal Finance Course. Mock Exam 2021.2022.without AnswerDocument16 pagesPersonal Finance Course. Mock Exam 2021.2022.without AnswerHải myNo ratings yet

- Payroll Canadian 1St Edition Dryden Test Bank Full Chapter PDFDocument37 pagesPayroll Canadian 1St Edition Dryden Test Bank Full Chapter PDFhebexuyenod8q100% (7)

- AT&T Customer Service SummaryDocument1 pageAT&T Customer Service SummaryHector VillavicencioNo ratings yet

- Finc Personal FinanceDocument5 pagesFinc Personal FinanceMelanie SamarooNo ratings yet

- AgBio3-Budget ProjectDocument11 pagesAgBio3-Budget ProjectCarrieNo ratings yet

- Budgeting Calculator Spreadsheet With Guidelines Ver 1 61Document4 pagesBudgeting Calculator Spreadsheet With Guidelines Ver 1 61Thomas McquillanNo ratings yet

- Calculating Living ExpensesDocument4 pagesCalculating Living ExpensesrizviNo ratings yet

- StartUPBUDGETDocument12 pagesStartUPBUDGETAYUSHI KULTHIANo ratings yet

- PP PresDocument25 pagesPP PresAnchal SaxenaNo ratings yet

- Websitedoc 1Document4 pagesWebsitedoc 1api-550941600No ratings yet

- Business Planning WorkshopDocument49 pagesBusiness Planning WorkshopJaycel FrondozoNo ratings yet

- Retirement Planning Workbook Moving From To Check.: PaycheckDocument12 pagesRetirement Planning Workbook Moving From To Check.: PaycheckbvbenhamNo ratings yet

- Budget PlannerDocument42 pagesBudget PlannerOyewale OyelayoNo ratings yet

- Career Life Education 12 Finances Unit: Name:Tian Yilu Date: May 17th Block:ADocument9 pagesCareer Life Education 12 Finances Unit: Name:Tian Yilu Date: May 17th Block:Aapi-654446014No ratings yet

- Financial Planning For Hidden ExpensesDocument27 pagesFinancial Planning For Hidden Expensesflorinn81No ratings yet

- Early Retirement Calculator 1Document6 pagesEarly Retirement Calculator 1Chalte ChalteNo ratings yet

- Best of Refference On Develop Save Spend PlanDocument5 pagesBest of Refference On Develop Save Spend PlanJemal SeidNo ratings yet

- Personal Finance TrackerDocument69 pagesPersonal Finance Trackerqa.site.testerNo ratings yet

- Personal Finance Tracker- SampleDocument69 pagesPersonal Finance Tracker- Samplenguyenthuyss87No ratings yet

- My Budget: Your Total IncomeDocument3 pagesMy Budget: Your Total Incomeyun3No ratings yet

- Financial PlanDocument3 pagesFinancial Planapi-659515172No ratings yet

- Moving Out Project 2023Document4 pagesMoving Out Project 2023Evelin Martinez-RamirezNo ratings yet

- Tema 3 Rev3Document49 pagesTema 3 Rev3CarlosA.HurtadoNo ratings yet

- Within Your MeansDocument33 pagesWithin Your MeansLiew2020No ratings yet

- Nurayda Budget EvidenceDocument20 pagesNurayda Budget Evidenceapi-616433899No ratings yet

- Fixed Costs Cost Category Annual Expenses % of Sales PlanDocument3 pagesFixed Costs Cost Category Annual Expenses % of Sales Planapi-534115625No ratings yet

- 2.2 Interpreting Interrogatives: Asl 1ADocument2 pages2.2 Interpreting Interrogatives: Asl 1ASam TannyNo ratings yet

- 3.4 Excerpt From Self-RelianceDocument2 pages3.4 Excerpt From Self-RelianceSam TannyNo ratings yet

- 5.3 Checks and BalancesDocument2 pages5.3 Checks and BalancesSam Tanny50% (2)

- 2.1 Assignment - Metaphors and - Upon The Burning of Our House - Short ResponsesDocument1 page2.1 Assignment - Metaphors and - Upon The Burning of Our House - Short ResponsesSam TannyNo ratings yet

- Gap - AnalysisDocument14 pagesGap - AnalysisSaad AliNo ratings yet

- Guarantee of Profits: Profit & Loss Appropriation A/cDocument4 pagesGuarantee of Profits: Profit & Loss Appropriation A/cVarun RaghunathanNo ratings yet

- Examen de Time Value - Cash Flows - Financial StatementsDocument9 pagesExamen de Time Value - Cash Flows - Financial Statementsecrescy66No ratings yet

- Pricing and Revenue Management in SCMDocument19 pagesPricing and Revenue Management in SCMNagunuri SrinivasNo ratings yet

- NBPDocument25 pagesNBPShaikh JunaidNo ratings yet

- 16-1 Hospital Supply IncDocument4 pages16-1 Hospital Supply IncFrancisco Marvin100% (1)

- Nature and Scope of EconomicsDocument27 pagesNature and Scope of EconomicsMaqsood Ali JamaliNo ratings yet

- Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29102022Document45 pagesFinancial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29102022mnbvcxzqwerNo ratings yet

- Micawbernomics: A Christmas Gift of Wise Advice To Politicians and EconomistsDocument5 pagesMicawbernomics: A Christmas Gift of Wise Advice To Politicians and EconomistsIan ThorpeNo ratings yet

- Private Hospital Australia - Porter 5 ForcesDocument12 pagesPrivate Hospital Australia - Porter 5 ForcescherikokNo ratings yet

- El Atmani Fatima Zahra - FI.CCA TERME EN ANGLAISDocument6 pagesEl Atmani Fatima Zahra - FI.CCA TERME EN ANGLAISFATIMA ZAHRA EL ATMANINo ratings yet

- Republic of The Phllippines Securities and Exchange CommissionDocument4 pagesRepublic of The Phllippines Securities and Exchange CommissionWill GipalNo ratings yet

- Expenses (Deductible)Document14 pagesExpenses (Deductible)RNo ratings yet

- Markets For Factor Inputs, Labour Market Economic Rent: Chapter 10 & 11Document24 pagesMarkets For Factor Inputs, Labour Market Economic Rent: Chapter 10 & 11Sapna RohitNo ratings yet

- Copies of Exercises Per TopicDocument10 pagesCopies of Exercises Per TopicRolan PalquiranNo ratings yet

- Prelim Assignment 3 - Quiz 1Document1 pagePrelim Assignment 3 - Quiz 1ANGELO JUSTINE CATALANNo ratings yet

- Intellinews - Romania Construction Materials ReportDocument9 pagesIntellinews - Romania Construction Materials ReportmumuletNo ratings yet

- Management Information Question Bank 2019Document336 pagesManagement Information Question Bank 2019k20b.lehoangvu100% (1)

- Fringe Benefits - HRM ProjectDocument37 pagesFringe Benefits - HRM Projectsunny_panchal3697100% (2)

- Hima16 SM 11Document53 pagesHima16 SM 11vahid teymooriNo ratings yet

- Infinite Horizon Consumption-Saving Decision Under CertaintyDocument13 pagesInfinite Horizon Consumption-Saving Decision Under CertaintyhmmfonsecaNo ratings yet

- 2 - Cost Concept and Cost BehaviorDocument42 pages2 - Cost Concept and Cost BehaviorMiks EnriquezNo ratings yet

- Income and Changes in Retained Earnings: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking CasesDocument57 pagesIncome and Changes in Retained Earnings: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking CasesRosenna99No ratings yet

- Basic Accounting Equation ExercisesDocument7 pagesBasic Accounting Equation ExerciseshIgh QuaLIty SVT100% (1)

- CH 04Document76 pagesCH 04Mai LinhNo ratings yet

- DipIFR June 2015 - QuestionsDocument10 pagesDipIFR June 2015 - QuestionsSoňa SlovákováNo ratings yet

- Zwelihle Community Profile Published 2011Document44 pagesZwelihle Community Profile Published 2011Archie MwamukaNo ratings yet

- Practical Investment Management by Robert.A.Strong Slides ch07Document38 pagesPractical Investment Management by Robert.A.Strong Slides ch07mzqaceNo ratings yet