Professional Documents

Culture Documents

Exercise 6 - 1 Multiple Choice Questions

Exercise 6 - 1 Multiple Choice Questions

Uploaded by

YricaCopyright:

Available Formats

You might also like

- Thumbs Up Video Financial StatementsDocument4 pagesThumbs Up Video Financial Statementsamitmehta2967% (6)

- Accounting 111B (Journalizing)Document3 pagesAccounting 111B (Journalizing)Yrica100% (1)

- Actvity 4.1Document4 pagesActvity 4.1Marie Frances SaysonNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Classwork - Valuations 011621 PDFDocument2 pagesClasswork - Valuations 011621 PDFJasmine Acta0% (2)

- Accounting Part 2: Problem SolvingDocument10 pagesAccounting Part 2: Problem Solvingnd555No ratings yet

- Disclosure Checklist For Medium Sized CompaniesDocument54 pagesDisclosure Checklist For Medium Sized Companiesghulam hussain67% (3)

- Finals Reviewer Intacc TheoriesDocument5 pagesFinals Reviewer Intacc TheoriesGirly CrisostomoNo ratings yet

- LiabilitiesDocument9 pagesLiabilitiesNeriza maningasNo ratings yet

- Quiz - Wasting Assets - EQUIPADODocument2 pagesQuiz - Wasting Assets - EQUIPADOarvsNo ratings yet

- Long-Quiz CFASDocument20 pagesLong-Quiz CFASAya AlayonNo ratings yet

- FinAcc 3 QuizzesDocument9 pagesFinAcc 3 QuizzesStella SabaoanNo ratings yet

- Cag QuestionsDocument24 pagesCag QuestionsJason Dave VidadNo ratings yet

- Singson DM A. Concept Map RevisionDocument2 pagesSingson DM A. Concept Map RevisionDonna Mae SingsonNo ratings yet

- Exercise - Part 2Document5 pagesExercise - Part 2lois martinNo ratings yet

- QUIZ 4.1 Investments PDFDocument4 pagesQUIZ 4.1 Investments PDFGirly CrisostomoNo ratings yet

- Lecture Notes On PPE - Acq & RecDocument6 pagesLecture Notes On PPE - Acq & Recjudel ArielNo ratings yet

- Investments (Theories)Document41 pagesInvestments (Theories)Iris Mnemosyne100% (1)

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- Chapter 1 PFRS 1 AnswerDocument1 pageChapter 1 PFRS 1 Answer03LJNo ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash EquivalentsJohn Michael SorianoNo ratings yet

- Cfas Theories QuizletDocument4 pagesCfas Theories Quizletagm25No ratings yet

- Learning Activity 5 - Classification of CostsDocument1 pageLearning Activity 5 - Classification of CostsAra Joyce PermalinoNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- Answer: DDocument13 pagesAnswer: DKevin T. Onaro100% (1)

- 2ND Online Quiz Level 1 Set B (Answers)Document5 pages2ND Online Quiz Level 1 Set B (Answers)Vincent Larrie Moldez100% (1)

- EXAM About INTANGIBLE ASSETS 2Document3 pagesEXAM About INTANGIBLE ASSETS 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- Audit ProblemsDocument47 pagesAudit ProblemsShane TabunggaoNo ratings yet

- This Study Resource Was: Assessment Task 3Document5 pagesThis Study Resource Was: Assessment Task 3maria evangelistaNo ratings yet

- Chapter A A 1 So LaDocument13 pagesChapter A A 1 So LaMark Kenneth Chan BalicantaNo ratings yet

- Chapter 2Document8 pagesChapter 2cindyNo ratings yet

- Quiz in Intacc 1 & 2 (Finals)Document1 pageQuiz in Intacc 1 & 2 (Finals)Sandra100% (1)

- Financial Accounting Review Problem 1Document16 pagesFinancial Accounting Review Problem 1YukiNo ratings yet

- Audit of Notes PayableDocument4 pagesAudit of Notes Payablehazel alvarezNo ratings yet

- Fin Acc Valix PDFDocument58 pagesFin Acc Valix PDFKyla Renz de LeonNo ratings yet

- Polytechnic University of The Philippines: Use The Following Information For The Next Two (2) QuestionsDocument2 pagesPolytechnic University of The Philippines: Use The Following Information For The Next Two (2) QuestionsSean ThyrdeeNo ratings yet

- Chapter 1 17 PROBLEMS PDFDocument46 pagesChapter 1 17 PROBLEMS PDFSARAH ANDREA TORRESNo ratings yet

- Chapter 28 LeaseDocument5 pagesChapter 28 LeaseGelmar GloriaNo ratings yet

- The Following Data Pertain To Lincoln Corporation On December 31Document8 pagesThe Following Data Pertain To Lincoln Corporation On December 31Eiuol Nhoj Arraeugse100% (3)

- Accounting For Cash-receivables-InventoriesDocument12 pagesAccounting For Cash-receivables-InventoriesPaupau100% (1)

- Review of The Accounting Process Straight Problems Problem 1Document13 pagesReview of The Accounting Process Straight Problems Problem 1angielynNo ratings yet

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- Cost Accounting Final Exam ReviewerDocument9 pagesCost Accounting Final Exam ReviewerCzarhiena SantiagoNo ratings yet

- Exercise 5-25 Activity Levels and Cost Drivers: RequiredDocument20 pagesExercise 5-25 Activity Levels and Cost Drivers: RequiredDilsa JainNo ratings yet

- Financial Assets at Fair Value (Investments) Basic ConceptsDocument2 pagesFinancial Assets at Fair Value (Investments) Basic ConceptsMonica Monica0% (1)

- Investments: IFRS Questions Are Available at The End of This ChapterDocument44 pagesInvestments: IFRS Questions Are Available at The End of This Chapteralexstets4553No ratings yet

- National Mock Board Examination 2017 Financial Accounting and ReportingDocument9 pagesNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- Intermacc Receivables Postlec WaDocument3 pagesIntermacc Receivables Postlec WaClarice Awa-aoNo ratings yet

- Group Activity No. 2-Noncurrent Asset Held For Sale-2Document3 pagesGroup Activity No. 2-Noncurrent Asset Held For Sale-2Jericho VillalonNo ratings yet

- Activity in E3 - LiabilitiesDocument9 pagesActivity in E3 - LiabilitiesPaupau100% (1)

- Quiz 4 - With Answers Part IIDocument6 pagesQuiz 4 - With Answers Part IIjanus lopezNo ratings yet

- Pfrs 14: Regulatory Deferral AccountsDocument5 pagesPfrs 14: Regulatory Deferral AccountsLALALA LULULUNo ratings yet

- MODULE 2 - Discussion and Sample ProblemsDocument15 pagesMODULE 2 - Discussion and Sample ProblemsUSD 654No ratings yet

- Test Bank Notes ReceivableDocument5 pagesTest Bank Notes ReceivableErrold john DulatreNo ratings yet

- Depletion of Universal CompanyDocument2 pagesDepletion of Universal CompanyJerbert JesalvaNo ratings yet

- Current Liability - DiamonDocument1 pageCurrent Liability - DiamonMa Teresa B. CerezoNo ratings yet

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- 13 Acctg Ed 1 - Loan ReceivableDocument17 pages13 Acctg Ed 1 - Loan ReceivableNath BongalonNo ratings yet

- Audit of Cash ProblemsDocument23 pagesAudit of Cash ProblemsReign Ashley RamizaresNo ratings yet

- CPA Review On FARDocument5 pagesCPA Review On FARYlor NoniuqNo ratings yet

- Seatwork 02 InvestmentsDocument2 pagesSeatwork 02 InvestmentsJella Mae YcalinaNo ratings yet

- FINANCIAL INSTRUMENTS MCQNDocument3 pagesFINANCIAL INSTRUMENTS MCQNJoelo De Vera100% (1)

- Investments: Pas 32 Financial Instruments - PresentationDocument11 pagesInvestments: Pas 32 Financial Instruments - PresentationBromanine100% (1)

- Rizal Act.2Document2 pagesRizal Act.2Yrica100% (1)

- Name: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTDocument3 pagesName: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTYricaNo ratings yet

- Acctg 121Document3 pagesAcctg 121YricaNo ratings yet

- Acctg 121 - Trade and Other ReceivablesDocument6 pagesAcctg 121 - Trade and Other ReceivablesYrica100% (2)

- Acctg 121 - Trade and Other ReceivablesDocument6 pagesAcctg 121 - Trade and Other ReceivablesYricaNo ratings yet

- ULTIMATE Sample Paper 3Document22 pagesULTIMATE Sample Paper 3Vansh RanaNo ratings yet

- What Is An Accounting Transaction - Example & Types of Accounting TransactionDocument4 pagesWhat Is An Accounting Transaction - Example & Types of Accounting TransactionMd Manajer RoshidNo ratings yet

- Week 8 Tutorial SolutionsDocument21 pagesWeek 8 Tutorial SolutionsKashif Munir IdreesiNo ratings yet

- Accounting StandardsDocument296 pagesAccounting StandardsPalbhai Divyasai100% (1)

- Kotak Multi Asset Allocation Fund 2-Page (Front-Back) Leaflet A4 Printab...Document2 pagesKotak Multi Asset Allocation Fund 2-Page (Front-Back) Leaflet A4 Printab...rajbir singh ChauhanNo ratings yet

- PWC Illustrative Ifrs Consolidated Financial Statements 2018 Year EndDocument239 pagesPWC Illustrative Ifrs Consolidated Financial Statements 2018 Year Endiamnahid100% (1)

- PRDocument26 pagesPRAayush ShrivastavNo ratings yet

- 2.the Life Cycle of A TradeDocument73 pages2.the Life Cycle of A TradeAnand Joshi100% (1)

- 286-Article Text-497-2-10-20200402Document18 pages286-Article Text-497-2-10-20200402Dia-wiNo ratings yet

- Investment Services Agreement For ClientsDocument37 pagesInvestment Services Agreement For ClientsPetar I. StijovicNo ratings yet

- Financial Reporting CH 1 & CH 2Document11 pagesFinancial Reporting CH 1 & CH 2DIVA RTHININo ratings yet

- Introduction To Corporate Finance - Unit 1Document21 pagesIntroduction To Corporate Finance - Unit 1VEDANT SAININo ratings yet

- The Art of A PitchDocument16 pagesThe Art of A PitchsanelisofuturemoyoNo ratings yet

- 2Document67 pages2Rahul AnandNo ratings yet

- Solution To Trina Haldane - Question 4Document2 pagesSolution To Trina Haldane - Question 4Debbie Debz100% (2)

- Introduction of IDBI BankDocument4 pagesIntroduction of IDBI Bankomy123100% (2)

- Investment Decision Under Conditions of UncertainityDocument15 pagesInvestment Decision Under Conditions of UncertainityjassubharathiNo ratings yet

- Specialized Industry ReviewerDocument5 pagesSpecialized Industry ReviewerKelly CardejonNo ratings yet

- Business Documents Grade 10Document4 pagesBusiness Documents Grade 10Tyanna TaylorNo ratings yet

- Business Finance Lesson-Exemplar - Module 1Document7 pagesBusiness Finance Lesson-Exemplar - Module 1Divina Grace Rodriguez - LibreaNo ratings yet

- U3A2 The Journal PPDocument21 pagesU3A2 The Journal PPceline freitasNo ratings yet

- Introduction To FinanceDocument12 pagesIntroduction To FinanceSeuwandi KeerthiratneNo ratings yet

- Mba Project ReportDocument4 pagesMba Project Reportkambleharsh358100% (2)

- What Is Meant by Book BuildingDocument2 pagesWhat Is Meant by Book BuildingParul PrasadNo ratings yet

- Meaning and Scope of Financial Engineering and Financial Engineering Vs Financial AnalysisDocument17 pagesMeaning and Scope of Financial Engineering and Financial Engineering Vs Financial AnalysisVikas Sahota67% (3)

- Financial Management: Professional Stage Application ExaminationDocument5 pagesFinancial Management: Professional Stage Application Examinationcima2k15No ratings yet

- e-StatementBRImo 770801009273530 Nov2023 20231106 180226Document2 pagese-StatementBRImo 770801009273530 Nov2023 20231106 180226Taufik AfdillahNo ratings yet

- OptionsDocument24 pagesOptionsHaider MalikNo ratings yet

Exercise 6 - 1 Multiple Choice Questions

Exercise 6 - 1 Multiple Choice Questions

Uploaded by

YricaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 6 - 1 Multiple Choice Questions

Exercise 6 - 1 Multiple Choice Questions

Uploaded by

YricaCopyright:

Available Formats

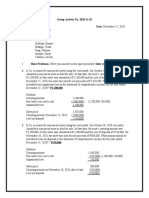

Name :_ Score : ______________

Instructor : Schedule : _

EXERCISE 6 – 1

MULTIPLE CHOICE QUESTIONS

1. It is a contract that gives rise to both a financial asset of one entity and a financial liability or

equity instrument of another entity.

a. Financial instrument c. Debt instrument

b. Equity instrument d. Derivative instrument

2. A financial asset is any asset that is (choose the incorrect one)

a. Cash

b. A contractual right to receive cash or another financial asset from another entity.

c. A contractual right to exchange financial instruments with another entity under conditions

that are potentially unfavorable.

d. An equity instrument of another entity.

3. A financial liability is any liability that is a contractual obligation. I. To deliver cash or

other financial asset to another entity.

II. To exchange financial instruments with another entity under conditions that are

potentially unfavorable

a. I only b. II only c. Both I and II d. Neither I nor II

4. It is any contract that evidences residual interest in the assets of an entity after deducting all

of its liabilities.

a. Equity instrument

b. Debt instrument

c. Loan and receivable

d. Financial asset with indeterminable fair value

5. Financial assets include all of the following, except

a. Prepaid expenses c. Trade accounts receivable

b. Cash in bank d. Loans receivable

6. Financial liabilities include all of the following, except

a. Trade accounts payable c. Bonds payable

b. Notes payable d. Income taxes payable

7. Equity instruments include all of the following, except

a. Ordinary shares

b. Preference shares

c. Warrants or options that allow the holder to purchase a fixed number of ordinary shares

of the issuing entity in exchange for a fixed amount of cash or another financial asset.

d. Corporate bonds and other debt instruments issued by the entity.

146

8. A preference share that provides for mandatory redemption on a specific date or at the option

of the holder is

a. A financial asset c. An equity instrument

b. A financial liability d. None of the above

9. Which of the following is not a financial instrument?

a. Cash deposited in bank

b. Gold bullion deposited in bank

c. A perpetual debt instrument, meaning no maturity date, that pays interest annually

extending into the indefinite future.

d. Ordinary share capital issued by the entity.

10. Which of the following statements in relation to dividends is true?

I. Dividends in respect of ordinary shares are debited directly to equity.

II. Dividends in respect of redeemable preference shares are debited directly to

equity.

a. I only b. II only c. Both I and II d. Neither I nor II

11. Which of the following is not classified as a financial instrument?

a. Convertible bond c. Warranty provision

b. Foreign currency contract d. Loan receivable

12. Which should be classified as financial instruments?

a. Patents b. Trade receivables c. Inventories d. Land and building

13. Which is not a financial asset?

a. Cash

b. An equity instrument of another entity

c. A contract that may or will be settled in the entity’s own instrument and is not classified

as an equity instrument of the entity.

d. Prepaid expense

14. Which instrument is best described as a contract that evidences a residual interest in the

assets of an entity after deducting the liabilities?

a. Financial liability c. Equity

b. Guarantee d. Financial asset

15. Changes in fair value of securities are reported in the income statement for which type of

securities?

a. Marketable equity securities c. Trading securities

b. Available-for-sale securities d. Held-to-maturity securities

147

You might also like

- Thumbs Up Video Financial StatementsDocument4 pagesThumbs Up Video Financial Statementsamitmehta2967% (6)

- Accounting 111B (Journalizing)Document3 pagesAccounting 111B (Journalizing)Yrica100% (1)

- Actvity 4.1Document4 pagesActvity 4.1Marie Frances SaysonNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Classwork - Valuations 011621 PDFDocument2 pagesClasswork - Valuations 011621 PDFJasmine Acta0% (2)

- Accounting Part 2: Problem SolvingDocument10 pagesAccounting Part 2: Problem Solvingnd555No ratings yet

- Disclosure Checklist For Medium Sized CompaniesDocument54 pagesDisclosure Checklist For Medium Sized Companiesghulam hussain67% (3)

- Finals Reviewer Intacc TheoriesDocument5 pagesFinals Reviewer Intacc TheoriesGirly CrisostomoNo ratings yet

- LiabilitiesDocument9 pagesLiabilitiesNeriza maningasNo ratings yet

- Quiz - Wasting Assets - EQUIPADODocument2 pagesQuiz - Wasting Assets - EQUIPADOarvsNo ratings yet

- Long-Quiz CFASDocument20 pagesLong-Quiz CFASAya AlayonNo ratings yet

- FinAcc 3 QuizzesDocument9 pagesFinAcc 3 QuizzesStella SabaoanNo ratings yet

- Cag QuestionsDocument24 pagesCag QuestionsJason Dave VidadNo ratings yet

- Singson DM A. Concept Map RevisionDocument2 pagesSingson DM A. Concept Map RevisionDonna Mae SingsonNo ratings yet

- Exercise - Part 2Document5 pagesExercise - Part 2lois martinNo ratings yet

- QUIZ 4.1 Investments PDFDocument4 pagesQUIZ 4.1 Investments PDFGirly CrisostomoNo ratings yet

- Lecture Notes On PPE - Acq & RecDocument6 pagesLecture Notes On PPE - Acq & Recjudel ArielNo ratings yet

- Investments (Theories)Document41 pagesInvestments (Theories)Iris Mnemosyne100% (1)

- ReceivablesDocument1 pageReceivablesLight MaidenNo ratings yet

- Chapter 1 PFRS 1 AnswerDocument1 pageChapter 1 PFRS 1 Answer03LJNo ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash EquivalentsJohn Michael SorianoNo ratings yet

- Cfas Theories QuizletDocument4 pagesCfas Theories Quizletagm25No ratings yet

- Learning Activity 5 - Classification of CostsDocument1 pageLearning Activity 5 - Classification of CostsAra Joyce PermalinoNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- Answer: DDocument13 pagesAnswer: DKevin T. Onaro100% (1)

- 2ND Online Quiz Level 1 Set B (Answers)Document5 pages2ND Online Quiz Level 1 Set B (Answers)Vincent Larrie Moldez100% (1)

- EXAM About INTANGIBLE ASSETS 2Document3 pagesEXAM About INTANGIBLE ASSETS 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- Audit ProblemsDocument47 pagesAudit ProblemsShane TabunggaoNo ratings yet

- This Study Resource Was: Assessment Task 3Document5 pagesThis Study Resource Was: Assessment Task 3maria evangelistaNo ratings yet

- Chapter A A 1 So LaDocument13 pagesChapter A A 1 So LaMark Kenneth Chan BalicantaNo ratings yet

- Chapter 2Document8 pagesChapter 2cindyNo ratings yet

- Quiz in Intacc 1 & 2 (Finals)Document1 pageQuiz in Intacc 1 & 2 (Finals)Sandra100% (1)

- Financial Accounting Review Problem 1Document16 pagesFinancial Accounting Review Problem 1YukiNo ratings yet

- Audit of Notes PayableDocument4 pagesAudit of Notes Payablehazel alvarezNo ratings yet

- Fin Acc Valix PDFDocument58 pagesFin Acc Valix PDFKyla Renz de LeonNo ratings yet

- Polytechnic University of The Philippines: Use The Following Information For The Next Two (2) QuestionsDocument2 pagesPolytechnic University of The Philippines: Use The Following Information For The Next Two (2) QuestionsSean ThyrdeeNo ratings yet

- Chapter 1 17 PROBLEMS PDFDocument46 pagesChapter 1 17 PROBLEMS PDFSARAH ANDREA TORRESNo ratings yet

- Chapter 28 LeaseDocument5 pagesChapter 28 LeaseGelmar GloriaNo ratings yet

- The Following Data Pertain To Lincoln Corporation On December 31Document8 pagesThe Following Data Pertain To Lincoln Corporation On December 31Eiuol Nhoj Arraeugse100% (3)

- Accounting For Cash-receivables-InventoriesDocument12 pagesAccounting For Cash-receivables-InventoriesPaupau100% (1)

- Review of The Accounting Process Straight Problems Problem 1Document13 pagesReview of The Accounting Process Straight Problems Problem 1angielynNo ratings yet

- (Drills - Ppe) Acc.107Document10 pages(Drills - Ppe) Acc.107Boys ShipperNo ratings yet

- Cost Accounting Final Exam ReviewerDocument9 pagesCost Accounting Final Exam ReviewerCzarhiena SantiagoNo ratings yet

- Exercise 5-25 Activity Levels and Cost Drivers: RequiredDocument20 pagesExercise 5-25 Activity Levels and Cost Drivers: RequiredDilsa JainNo ratings yet

- Financial Assets at Fair Value (Investments) Basic ConceptsDocument2 pagesFinancial Assets at Fair Value (Investments) Basic ConceptsMonica Monica0% (1)

- Investments: IFRS Questions Are Available at The End of This ChapterDocument44 pagesInvestments: IFRS Questions Are Available at The End of This Chapteralexstets4553No ratings yet

- National Mock Board Examination 2017 Financial Accounting and ReportingDocument9 pagesNational Mock Board Examination 2017 Financial Accounting and ReportingSam0% (1)

- Intermacc Receivables Postlec WaDocument3 pagesIntermacc Receivables Postlec WaClarice Awa-aoNo ratings yet

- Group Activity No. 2-Noncurrent Asset Held For Sale-2Document3 pagesGroup Activity No. 2-Noncurrent Asset Held For Sale-2Jericho VillalonNo ratings yet

- Activity in E3 - LiabilitiesDocument9 pagesActivity in E3 - LiabilitiesPaupau100% (1)

- Quiz 4 - With Answers Part IIDocument6 pagesQuiz 4 - With Answers Part IIjanus lopezNo ratings yet

- Pfrs 14: Regulatory Deferral AccountsDocument5 pagesPfrs 14: Regulatory Deferral AccountsLALALA LULULUNo ratings yet

- MODULE 2 - Discussion and Sample ProblemsDocument15 pagesMODULE 2 - Discussion and Sample ProblemsUSD 654No ratings yet

- Test Bank Notes ReceivableDocument5 pagesTest Bank Notes ReceivableErrold john DulatreNo ratings yet

- Depletion of Universal CompanyDocument2 pagesDepletion of Universal CompanyJerbert JesalvaNo ratings yet

- Current Liability - DiamonDocument1 pageCurrent Liability - DiamonMa Teresa B. CerezoNo ratings yet

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- 13 Acctg Ed 1 - Loan ReceivableDocument17 pages13 Acctg Ed 1 - Loan ReceivableNath BongalonNo ratings yet

- Audit of Cash ProblemsDocument23 pagesAudit of Cash ProblemsReign Ashley RamizaresNo ratings yet

- CPA Review On FARDocument5 pagesCPA Review On FARYlor NoniuqNo ratings yet

- Seatwork 02 InvestmentsDocument2 pagesSeatwork 02 InvestmentsJella Mae YcalinaNo ratings yet

- FINANCIAL INSTRUMENTS MCQNDocument3 pagesFINANCIAL INSTRUMENTS MCQNJoelo De Vera100% (1)

- Investments: Pas 32 Financial Instruments - PresentationDocument11 pagesInvestments: Pas 32 Financial Instruments - PresentationBromanine100% (1)

- Rizal Act.2Document2 pagesRizal Act.2Yrica100% (1)

- Name: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTDocument3 pagesName: Course & Yr: Schedule: Score: - : Subscribed and Paid-Up Shares Amou NTYricaNo ratings yet

- Acctg 121Document3 pagesAcctg 121YricaNo ratings yet

- Acctg 121 - Trade and Other ReceivablesDocument6 pagesAcctg 121 - Trade and Other ReceivablesYrica100% (2)

- Acctg 121 - Trade and Other ReceivablesDocument6 pagesAcctg 121 - Trade and Other ReceivablesYricaNo ratings yet

- ULTIMATE Sample Paper 3Document22 pagesULTIMATE Sample Paper 3Vansh RanaNo ratings yet

- What Is An Accounting Transaction - Example & Types of Accounting TransactionDocument4 pagesWhat Is An Accounting Transaction - Example & Types of Accounting TransactionMd Manajer RoshidNo ratings yet

- Week 8 Tutorial SolutionsDocument21 pagesWeek 8 Tutorial SolutionsKashif Munir IdreesiNo ratings yet

- Accounting StandardsDocument296 pagesAccounting StandardsPalbhai Divyasai100% (1)

- Kotak Multi Asset Allocation Fund 2-Page (Front-Back) Leaflet A4 Printab...Document2 pagesKotak Multi Asset Allocation Fund 2-Page (Front-Back) Leaflet A4 Printab...rajbir singh ChauhanNo ratings yet

- PWC Illustrative Ifrs Consolidated Financial Statements 2018 Year EndDocument239 pagesPWC Illustrative Ifrs Consolidated Financial Statements 2018 Year Endiamnahid100% (1)

- PRDocument26 pagesPRAayush ShrivastavNo ratings yet

- 2.the Life Cycle of A TradeDocument73 pages2.the Life Cycle of A TradeAnand Joshi100% (1)

- 286-Article Text-497-2-10-20200402Document18 pages286-Article Text-497-2-10-20200402Dia-wiNo ratings yet

- Investment Services Agreement For ClientsDocument37 pagesInvestment Services Agreement For ClientsPetar I. StijovicNo ratings yet

- Financial Reporting CH 1 & CH 2Document11 pagesFinancial Reporting CH 1 & CH 2DIVA RTHININo ratings yet

- Introduction To Corporate Finance - Unit 1Document21 pagesIntroduction To Corporate Finance - Unit 1VEDANT SAININo ratings yet

- The Art of A PitchDocument16 pagesThe Art of A PitchsanelisofuturemoyoNo ratings yet

- 2Document67 pages2Rahul AnandNo ratings yet

- Solution To Trina Haldane - Question 4Document2 pagesSolution To Trina Haldane - Question 4Debbie Debz100% (2)

- Introduction of IDBI BankDocument4 pagesIntroduction of IDBI Bankomy123100% (2)

- Investment Decision Under Conditions of UncertainityDocument15 pagesInvestment Decision Under Conditions of UncertainityjassubharathiNo ratings yet

- Specialized Industry ReviewerDocument5 pagesSpecialized Industry ReviewerKelly CardejonNo ratings yet

- Business Documents Grade 10Document4 pagesBusiness Documents Grade 10Tyanna TaylorNo ratings yet

- Business Finance Lesson-Exemplar - Module 1Document7 pagesBusiness Finance Lesson-Exemplar - Module 1Divina Grace Rodriguez - LibreaNo ratings yet

- U3A2 The Journal PPDocument21 pagesU3A2 The Journal PPceline freitasNo ratings yet

- Introduction To FinanceDocument12 pagesIntroduction To FinanceSeuwandi KeerthiratneNo ratings yet

- Mba Project ReportDocument4 pagesMba Project Reportkambleharsh358100% (2)

- What Is Meant by Book BuildingDocument2 pagesWhat Is Meant by Book BuildingParul PrasadNo ratings yet

- Meaning and Scope of Financial Engineering and Financial Engineering Vs Financial AnalysisDocument17 pagesMeaning and Scope of Financial Engineering and Financial Engineering Vs Financial AnalysisVikas Sahota67% (3)

- Financial Management: Professional Stage Application ExaminationDocument5 pagesFinancial Management: Professional Stage Application Examinationcima2k15No ratings yet

- e-StatementBRImo 770801009273530 Nov2023 20231106 180226Document2 pagese-StatementBRImo 770801009273530 Nov2023 20231106 180226Taufik AfdillahNo ratings yet

- OptionsDocument24 pagesOptionsHaider MalikNo ratings yet