Professional Documents

Culture Documents

Cost Residual Value Expected Life

Cost Residual Value Expected Life

Uploaded by

Mandil BhandariCopyright:

Available Formats

You might also like

- TaxDocument8 pagesTaxClaire BarrettoNo ratings yet

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- Cafes Monte Bianco Cash Flow HLCDocument1 pageCafes Monte Bianco Cash Flow HLCDavid BolleNo ratings yet

- DocxDocument21 pagesDocxDhiananda zhuNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income Taxchowchow123No ratings yet

- Mpu3123 Titas c2Document36 pagesMpu3123 Titas c2Beatrice Tan100% (2)

- Accounting For Income Tax QuestionsDocument13 pagesAccounting For Income Tax QuestionszeyyahjiNo ratings yet

- Invoice Bag PDFDocument1 pageInvoice Bag PDFRam Kishor SinghNo ratings yet

- Workshop 6 SOL Additional QuestionDocument5 pagesWorkshop 6 SOL Additional Questiontimlee38100% (1)

- Income Tax Part 01 Question and Solution AnalysisDocument13 pagesIncome Tax Part 01 Question and Solution AnalysisRosemarie Mae DezaNo ratings yet

- As 22Document1 pageAs 22Sajish RaiNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- Multiple Choice: Chapter 16 - SolvingDocument19 pagesMultiple Choice: Chapter 16 - SolvingElla LopezNo ratings yet

- Accounting For Income TaxesDocument12 pagesAccounting For Income TaxesRMG Career Society BDNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Chapter 19 HWDocument4 pagesChapter 19 HWAarti J. KaushalNo ratings yet

- Chapter 17 & 18 SolutionsDocument4 pagesChapter 17 & 18 SolutionsSheena CarrouthersNo ratings yet

- Ias 12 Question With AnswersDocument5 pagesIas 12 Question With AnswersPrince Daniels TutorNo ratings yet

- Latihan Dan Jawab Income Tax - BlankDocument6 pagesLatihan Dan Jawab Income Tax - BlankAhmad SandiNo ratings yet

- Accounting For Income Tax QuizDocument5 pagesAccounting For Income Tax QuizTorico BryanNo ratings yet

- ACCT1101 Wk6 Tutorial 5 SolutionsDocument7 pagesACCT1101 Wk6 Tutorial 5 SolutionskyleNo ratings yet

- Sample Test (Extract)Document6 pagesSample Test (Extract)Julie KimNo ratings yet

- Ethiopia D3S4 Income TaxesDocument81 pagesEthiopia D3S4 Income TaxesyididiyayibNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- ACC-ACF2100 Lecture 2 HandoutDocument9 pagesACC-ACF2100 Lecture 2 HandoutDanNo ratings yet

- EXAMPLE 12.1 (Current Tax Liability)Document8 pagesEXAMPLE 12.1 (Current Tax Liability)KaiWenNgNo ratings yet

- Assignment 4 - SolutionsDocument2 pagesAssignment 4 - SolutionsstoryNo ratings yet

- Chapter 4 - Income Taxes Problems Luzon CorporationDocument8 pagesChapter 4 - Income Taxes Problems Luzon CorporationJohanna Raissa CapadaNo ratings yet

- Book 3Document1 pageBook 3Quincy Lawrence DimaanoNo ratings yet

- Tugas PA Bab 16Document7 pagesTugas PA Bab 16Adrian BatubaraNo ratings yet

- IASSS16e Ch16.Ab - AzDocument33 pagesIASSS16e Ch16.Ab - AzLovely DungcaNo ratings yet

- Questions 2Document12 pagesQuestions 2venice cambryNo ratings yet

- Advanced Financial Accounting IDocument21 pagesAdvanced Financial Accounting IAbdiNo ratings yet

- 2542 - Tut1Document14 pages2542 - Tut1(Alumna 2018-6A07) CHUCK LONG YAU 卓朗悠No ratings yet

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxRyll BedasNo ratings yet

- Accounting For Taxes 6Document7 pagesAccounting For Taxes 6charlene kate bunaoNo ratings yet

- Exercise Topic 2Document4 pagesExercise Topic 2TEIK LOONG KHORNo ratings yet

- Submit in Schoology Using " " 1.: Shirwin - Sandoval@olivarezcollege - Edu.phDocument2 pagesSubmit in Schoology Using " " 1.: Shirwin - Sandoval@olivarezcollege - Edu.phCherry MirabuenoNo ratings yet

- Financial Accounting 3A Assignment 2Document10 pagesFinancial Accounting 3A Assignment 2Mikaeel MohamedNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument171 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionRengeline LucasNo ratings yet

- IFRS Week 6Document4 pagesIFRS Week 6AleksandraNo ratings yet

- PAS 12 - Income Tax - AssignmentDocument8 pagesPAS 12 - Income Tax - Assignmentviva nazarenoNo ratings yet

- Apostila 00 Sem RespostasDocument14 pagesApostila 00 Sem Respostasandrea mendonçaNo ratings yet

- Appendix D Accounting For Deferred Income TaxesDocument2 pagesAppendix D Accounting For Deferred Income TaxesLan Hương Trần ThịNo ratings yet

- IAS#12Document31 pagesIAS#12Shah KamalNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- ActivityDocument3 pagesActivitycaryl remillaNo ratings yet

- Practice Set Review - Current LiabilitiesDocument12 pagesPractice Set Review - Current LiabilitiesKayla MirandaNo ratings yet

- Income Taxes: ProblemsDocument12 pagesIncome Taxes: ProblemsCharles MateoNo ratings yet

- Chapter 6: Accounting For Income Tax: Review QuestionsDocument10 pagesChapter 6: Accounting For Income Tax: Review QuestionsShek Kwun HeiNo ratings yet

- GT Company (GTC) : Balance Sheet As On 31 March .Document1 pageGT Company (GTC) : Balance Sheet As On 31 March .Karthikeyan RamamoorthyNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Acc 304 Module 1Document31 pagesAcc 304 Module 1vzu53350No ratings yet

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Jasmine LTD: Exercise 6.8 Calculation of Deferred Tax, and Prior Year AmendmentDocument5 pagesJasmine LTD: Exercise 6.8 Calculation of Deferred Tax, and Prior Year AmendmentSiRo WangNo ratings yet

- LMT School of Management, Thapar University Masters of Business AdministrationDocument9 pagesLMT School of Management, Thapar University Masters of Business Administrationtechnical sNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- DocxDocument5 pagesDocxMandil BhandariNo ratings yet

- Class 5Document59 pagesClass 5Mandil Bhandari100% (1)

- 3 I+ J 3 I+ J: See Send Up Exam, 2075Document3 pages3 I+ J 3 I+ J: See Send Up Exam, 2075Mandil BhandariNo ratings yet

- Fluorescent Secondary School: Testing GrammarDocument2 pagesFluorescent Secondary School: Testing GrammarMandil BhandariNo ratings yet

- See Send-Up Exam 2075: Subject: Compulsory English Time: 2:15 Hrs. Full Marks: 75Document3 pagesSee Send-Up Exam 2075: Subject: Compulsory English Time: 2:15 Hrs. Full Marks: 75Mandil BhandariNo ratings yet

- Kofa G, Sf7Df8F) F Kofa G P O (O (JF) 8 (K/Liff-@) &$Document5 pagesKofa G, Sf7Df8F) F Kofa G P O (O (JF) 8 (K/Liff-@) &$Mandil BhandariNo ratings yet

- Pre See Send Up Exam, 2075: Subject: Compulsory Science Time: 2:15 Hrs. Full Marks: 75Document3 pagesPre See Send Up Exam, 2075: Subject: Compulsory Science Time: 2:15 Hrs. Full Marks: 75Mandil BhandariNo ratings yet

- Pre See Send Up, Exam, 2075Document4 pagesPre See Send Up, Exam, 2075Mandil Bhandari100% (1)

- Account SolutionDocument25 pagesAccount SolutionMandil BhandariNo ratings yet

- Transitionwordsandphrases: Linking Words - A Complete List - Sorted by Categories Freely Available FromDocument2 pagesTransitionwordsandphrases: Linking Words - A Complete List - Sorted by Categories Freely Available FromMandil BhandariNo ratings yet

- As Per Nepal Rastra BankDocument2 pagesAs Per Nepal Rastra BankMandil BhandariNo ratings yet

- Shukra Raj ShastriDocument1 pageShukra Raj ShastriMandil BhandariNo ratings yet

- !fusion Tax - CompleteDocument3 pages!fusion Tax - Completewaste wasteNo ratings yet

- Alvin Chan QADocument4 pagesAlvin Chan QAkelly yuNo ratings yet

- Corporate Tax Planning: Tax Evasion and AvoidanceDocument8 pagesCorporate Tax Planning: Tax Evasion and AvoidanceShainaNo ratings yet

- Price List 1950sft.Document1 pagePrice List 1950sft.IKONIC GROUPNo ratings yet

- Invoice 120Document1 pageInvoice 120Sarfaraz suajri0% (1)

- Excel Online Assignment - InstructionsDocument2 pagesExcel Online Assignment - Instructionsjantkahlon7No ratings yet

- Appointment of Company SecretaryDocument11 pagesAppointment of Company SecretaryGoutham Appu100% (2)

- Accounting Journal Entries For Taxation - Excise, Service Tax, Vat, Tds - Accounts Knowledge HubDocument7 pagesAccounting Journal Entries For Taxation - Excise, Service Tax, Vat, Tds - Accounts Knowledge HubSureshArigelaNo ratings yet

- Contrato Alquiler Habitacione MslataDocument2 pagesContrato Alquiler Habitacione MslataLuiz Celso PinhoNo ratings yet

- Salary SlipDocument11 pagesSalary SlipGAURAV KUMARNo ratings yet

- Garima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265Document3 pagesGarima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265The Cultural CommitteeNo ratings yet

- Computation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) - 30362 1Document8 pagesComputation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) - 30362 1Divya Kanwar KanawatNo ratings yet

- Manila Electric Company v. Province of LagunaDocument1 pageManila Electric Company v. Province of LagunaRukmini Dasi Rosemary GuevaraNo ratings yet

- 1702-MX June 2013 GuidelinesDocument4 pages1702-MX June 2013 GuidelinesvicsNo ratings yet

- Annex D RR 11-2018-Revised Witholding Tax TableDocument1 pageAnnex D RR 11-2018-Revised Witholding Tax TableDuko Alcala EnjambreNo ratings yet

- 2008 Digest-Sc Taxation CasesDocument19 pages2008 Digest-Sc Taxation Caseschiclets777100% (2)

- TAX3247N 3226N May 2024 Assignment Question PaperDocument10 pagesTAX3247N 3226N May 2024 Assignment Question PaperfortuinpdNo ratings yet

- Bm2221i000172896Document19 pagesBm2221i000172896SHIRIDI SAI INDUSTRIESNo ratings yet

- Renewal NoticeDocument1 pageRenewal NoticevishalmprojectNo ratings yet

- Morales Reviewer Bus MathDocument4 pagesMorales Reviewer Bus MathKevin MoralesNo ratings yet

- Bonded Warehouses PDFDocument5 pagesBonded Warehouses PDFDaisy Anita SusiloNo ratings yet

- Date: 02/10/2022: Sale PriceDocument2 pagesDate: 02/10/2022: Sale PriceSiva PriyaNo ratings yet

- Monetory and FiscalDocument2 pagesMonetory and FiscalMosNo ratings yet

- 1.rpli Premium Cum Profit CalculatorDocument7 pages1.rpli Premium Cum Profit Calculatorshanku_bietNo ratings yet

- 078 Federal Income TaxDocument67 pages078 Federal Income Taxcitygirl518No ratings yet

- Om Prakash Comp Ay 2020-21Document4 pagesOm Prakash Comp Ay 2020-21Soumya SwainNo ratings yet

- SalarySlipwithTaxDetails JUNEDocument2 pagesSalarySlipwithTaxDetails JUNEParveen SainiNo ratings yet

Cost Residual Value Expected Life

Cost Residual Value Expected Life

Uploaded by

Mandil BhandariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Residual Value Expected Life

Cost Residual Value Expected Life

Uploaded by

Mandil BhandariCopyright:

Available Formats

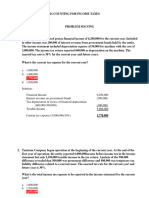

2. Please solve the following Numerical and send the solution.

A. Jaguar Ltd purchased a machine on 1 July 2016 at the cost of $640,000. The machine is

expected to have a useful life of 5 years (straight-line basis) and no residual value. For taxation

purposes, the ATO allows the company to depreciate the asset over 4 years. The profit before tax

for the company for the year ending 30 June 2017 is $600,000. To calculate this profit the

company has deducted $60,000 entertainment expense, and $80,000 salary expense that has not

yet been paid. Also, the company has included $70,000 interest as income that the company has

not yet received. The tax rate is 30%.

Required:

(a) Calculate the company’s taxable profit and hence its tax payable for 2017.

(b) Determine the deferred tax liability and/or deferred tax asset that will result.

(c) Prepare the necessary journal entries on 30 June 2017.

Soln:

Cost of Machinery = $640,000

Expected life of Machinery = 5 years

Expected life of Machinery for Tax purpose = 4 years

Residual value after 5 years = 0

Calculation of Depreciation

Cost−Residual Value

Depreciation =

Expected life

640000−0

=

5

= $128,000

a) Calculation of company's taxable profit

Profit before tax excluding depreciation 600,000

Add: Entertainment expenses 60,000

Salary expenses 80000

Less: Interest not received (70000)

Depreciation (128000)

Earning before tax 542,000

Less: Tax (30%) (162,600)

Earning after tax 379,400

Therefore, the company's taxable profit is $542,000.

b) Calculation of the deferred tax liability/deferred tax assets

Earning before tax 542,000

Add; Depreciation 128,000

Depreciation as tax rule 160,000

Taxable income 440,000

Tax payable 132,000

Tax expense 162600

Deferred tax liability/tax assets 30,600

Therefore, the deferred tax liability is $30,600.

c) Journal

Date Particulars L.F. Debit ($) Credit ($)

30/06/2017 Tax expense $162,600

Deferred tax liability $30,600

Income tax payable $132,000

You might also like

- TaxDocument8 pagesTaxClaire BarrettoNo ratings yet

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- Cafes Monte Bianco Cash Flow HLCDocument1 pageCafes Monte Bianco Cash Flow HLCDavid BolleNo ratings yet

- DocxDocument21 pagesDocxDhiananda zhuNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income Taxchowchow123No ratings yet

- Mpu3123 Titas c2Document36 pagesMpu3123 Titas c2Beatrice Tan100% (2)

- Accounting For Income Tax QuestionsDocument13 pagesAccounting For Income Tax QuestionszeyyahjiNo ratings yet

- Invoice Bag PDFDocument1 pageInvoice Bag PDFRam Kishor SinghNo ratings yet

- Workshop 6 SOL Additional QuestionDocument5 pagesWorkshop 6 SOL Additional Questiontimlee38100% (1)

- Income Tax Part 01 Question and Solution AnalysisDocument13 pagesIncome Tax Part 01 Question and Solution AnalysisRosemarie Mae DezaNo ratings yet

- As 22Document1 pageAs 22Sajish RaiNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- Multiple Choice: Chapter 16 - SolvingDocument19 pagesMultiple Choice: Chapter 16 - SolvingElla LopezNo ratings yet

- Accounting For Income TaxesDocument12 pagesAccounting For Income TaxesRMG Career Society BDNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Chapter 19 HWDocument4 pagesChapter 19 HWAarti J. KaushalNo ratings yet

- Chapter 17 & 18 SolutionsDocument4 pagesChapter 17 & 18 SolutionsSheena CarrouthersNo ratings yet

- Ias 12 Question With AnswersDocument5 pagesIas 12 Question With AnswersPrince Daniels TutorNo ratings yet

- Latihan Dan Jawab Income Tax - BlankDocument6 pagesLatihan Dan Jawab Income Tax - BlankAhmad SandiNo ratings yet

- Accounting For Income Tax QuizDocument5 pagesAccounting For Income Tax QuizTorico BryanNo ratings yet

- ACCT1101 Wk6 Tutorial 5 SolutionsDocument7 pagesACCT1101 Wk6 Tutorial 5 SolutionskyleNo ratings yet

- Sample Test (Extract)Document6 pagesSample Test (Extract)Julie KimNo ratings yet

- Ethiopia D3S4 Income TaxesDocument81 pagesEthiopia D3S4 Income TaxesyididiyayibNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- ACC-ACF2100 Lecture 2 HandoutDocument9 pagesACC-ACF2100 Lecture 2 HandoutDanNo ratings yet

- EXAMPLE 12.1 (Current Tax Liability)Document8 pagesEXAMPLE 12.1 (Current Tax Liability)KaiWenNgNo ratings yet

- Assignment 4 - SolutionsDocument2 pagesAssignment 4 - SolutionsstoryNo ratings yet

- Chapter 4 - Income Taxes Problems Luzon CorporationDocument8 pagesChapter 4 - Income Taxes Problems Luzon CorporationJohanna Raissa CapadaNo ratings yet

- Book 3Document1 pageBook 3Quincy Lawrence DimaanoNo ratings yet

- Tugas PA Bab 16Document7 pagesTugas PA Bab 16Adrian BatubaraNo ratings yet

- IASSS16e Ch16.Ab - AzDocument33 pagesIASSS16e Ch16.Ab - AzLovely DungcaNo ratings yet

- Questions 2Document12 pagesQuestions 2venice cambryNo ratings yet

- Advanced Financial Accounting IDocument21 pagesAdvanced Financial Accounting IAbdiNo ratings yet

- 2542 - Tut1Document14 pages2542 - Tut1(Alumna 2018-6A07) CHUCK LONG YAU 卓朗悠No ratings yet

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxRyll BedasNo ratings yet

- Accounting For Taxes 6Document7 pagesAccounting For Taxes 6charlene kate bunaoNo ratings yet

- Exercise Topic 2Document4 pagesExercise Topic 2TEIK LOONG KHORNo ratings yet

- Submit in Schoology Using " " 1.: Shirwin - Sandoval@olivarezcollege - Edu.phDocument2 pagesSubmit in Schoology Using " " 1.: Shirwin - Sandoval@olivarezcollege - Edu.phCherry MirabuenoNo ratings yet

- Financial Accounting 3A Assignment 2Document10 pagesFinancial Accounting 3A Assignment 2Mikaeel MohamedNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument171 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionRengeline LucasNo ratings yet

- IFRS Week 6Document4 pagesIFRS Week 6AleksandraNo ratings yet

- PAS 12 - Income Tax - AssignmentDocument8 pagesPAS 12 - Income Tax - Assignmentviva nazarenoNo ratings yet

- Apostila 00 Sem RespostasDocument14 pagesApostila 00 Sem Respostasandrea mendonçaNo ratings yet

- Appendix D Accounting For Deferred Income TaxesDocument2 pagesAppendix D Accounting For Deferred Income TaxesLan Hương Trần ThịNo ratings yet

- IAS#12Document31 pagesIAS#12Shah KamalNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- ActivityDocument3 pagesActivitycaryl remillaNo ratings yet

- Practice Set Review - Current LiabilitiesDocument12 pagesPractice Set Review - Current LiabilitiesKayla MirandaNo ratings yet

- Income Taxes: ProblemsDocument12 pagesIncome Taxes: ProblemsCharles MateoNo ratings yet

- Chapter 6: Accounting For Income Tax: Review QuestionsDocument10 pagesChapter 6: Accounting For Income Tax: Review QuestionsShek Kwun HeiNo ratings yet

- GT Company (GTC) : Balance Sheet As On 31 March .Document1 pageGT Company (GTC) : Balance Sheet As On 31 March .Karthikeyan RamamoorthyNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Acc 304 Module 1Document31 pagesAcc 304 Module 1vzu53350No ratings yet

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Jasmine LTD: Exercise 6.8 Calculation of Deferred Tax, and Prior Year AmendmentDocument5 pagesJasmine LTD: Exercise 6.8 Calculation of Deferred Tax, and Prior Year AmendmentSiRo WangNo ratings yet

- LMT School of Management, Thapar University Masters of Business AdministrationDocument9 pagesLMT School of Management, Thapar University Masters of Business Administrationtechnical sNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- DocxDocument5 pagesDocxMandil BhandariNo ratings yet

- Class 5Document59 pagesClass 5Mandil Bhandari100% (1)

- 3 I+ J 3 I+ J: See Send Up Exam, 2075Document3 pages3 I+ J 3 I+ J: See Send Up Exam, 2075Mandil BhandariNo ratings yet

- Fluorescent Secondary School: Testing GrammarDocument2 pagesFluorescent Secondary School: Testing GrammarMandil BhandariNo ratings yet

- See Send-Up Exam 2075: Subject: Compulsory English Time: 2:15 Hrs. Full Marks: 75Document3 pagesSee Send-Up Exam 2075: Subject: Compulsory English Time: 2:15 Hrs. Full Marks: 75Mandil BhandariNo ratings yet

- Kofa G, Sf7Df8F) F Kofa G P O (O (JF) 8 (K/Liff-@) &$Document5 pagesKofa G, Sf7Df8F) F Kofa G P O (O (JF) 8 (K/Liff-@) &$Mandil BhandariNo ratings yet

- Pre See Send Up Exam, 2075: Subject: Compulsory Science Time: 2:15 Hrs. Full Marks: 75Document3 pagesPre See Send Up Exam, 2075: Subject: Compulsory Science Time: 2:15 Hrs. Full Marks: 75Mandil BhandariNo ratings yet

- Pre See Send Up, Exam, 2075Document4 pagesPre See Send Up, Exam, 2075Mandil Bhandari100% (1)

- Account SolutionDocument25 pagesAccount SolutionMandil BhandariNo ratings yet

- Transitionwordsandphrases: Linking Words - A Complete List - Sorted by Categories Freely Available FromDocument2 pagesTransitionwordsandphrases: Linking Words - A Complete List - Sorted by Categories Freely Available FromMandil BhandariNo ratings yet

- As Per Nepal Rastra BankDocument2 pagesAs Per Nepal Rastra BankMandil BhandariNo ratings yet

- Shukra Raj ShastriDocument1 pageShukra Raj ShastriMandil BhandariNo ratings yet

- !fusion Tax - CompleteDocument3 pages!fusion Tax - Completewaste wasteNo ratings yet

- Alvin Chan QADocument4 pagesAlvin Chan QAkelly yuNo ratings yet

- Corporate Tax Planning: Tax Evasion and AvoidanceDocument8 pagesCorporate Tax Planning: Tax Evasion and AvoidanceShainaNo ratings yet

- Price List 1950sft.Document1 pagePrice List 1950sft.IKONIC GROUPNo ratings yet

- Invoice 120Document1 pageInvoice 120Sarfaraz suajri0% (1)

- Excel Online Assignment - InstructionsDocument2 pagesExcel Online Assignment - Instructionsjantkahlon7No ratings yet

- Appointment of Company SecretaryDocument11 pagesAppointment of Company SecretaryGoutham Appu100% (2)

- Accounting Journal Entries For Taxation - Excise, Service Tax, Vat, Tds - Accounts Knowledge HubDocument7 pagesAccounting Journal Entries For Taxation - Excise, Service Tax, Vat, Tds - Accounts Knowledge HubSureshArigelaNo ratings yet

- Contrato Alquiler Habitacione MslataDocument2 pagesContrato Alquiler Habitacione MslataLuiz Celso PinhoNo ratings yet

- Salary SlipDocument11 pagesSalary SlipGAURAV KUMARNo ratings yet

- Garima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265Document3 pagesGarima Bajaj: Address: House No.1327, Rani Bagh, Delhi-110034 Email: Contact No.: 8860199265The Cultural CommitteeNo ratings yet

- Computation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) - 30362 1Document8 pagesComputation of Total Income (As Per Normal Provisions) Income From House Property (Chapter IV C) - 30362 1Divya Kanwar KanawatNo ratings yet

- Manila Electric Company v. Province of LagunaDocument1 pageManila Electric Company v. Province of LagunaRukmini Dasi Rosemary GuevaraNo ratings yet

- 1702-MX June 2013 GuidelinesDocument4 pages1702-MX June 2013 GuidelinesvicsNo ratings yet

- Annex D RR 11-2018-Revised Witholding Tax TableDocument1 pageAnnex D RR 11-2018-Revised Witholding Tax TableDuko Alcala EnjambreNo ratings yet

- 2008 Digest-Sc Taxation CasesDocument19 pages2008 Digest-Sc Taxation Caseschiclets777100% (2)

- TAX3247N 3226N May 2024 Assignment Question PaperDocument10 pagesTAX3247N 3226N May 2024 Assignment Question PaperfortuinpdNo ratings yet

- Bm2221i000172896Document19 pagesBm2221i000172896SHIRIDI SAI INDUSTRIESNo ratings yet

- Renewal NoticeDocument1 pageRenewal NoticevishalmprojectNo ratings yet

- Morales Reviewer Bus MathDocument4 pagesMorales Reviewer Bus MathKevin MoralesNo ratings yet

- Bonded Warehouses PDFDocument5 pagesBonded Warehouses PDFDaisy Anita SusiloNo ratings yet

- Date: 02/10/2022: Sale PriceDocument2 pagesDate: 02/10/2022: Sale PriceSiva PriyaNo ratings yet

- Monetory and FiscalDocument2 pagesMonetory and FiscalMosNo ratings yet

- 1.rpli Premium Cum Profit CalculatorDocument7 pages1.rpli Premium Cum Profit Calculatorshanku_bietNo ratings yet

- 078 Federal Income TaxDocument67 pages078 Federal Income Taxcitygirl518No ratings yet

- Om Prakash Comp Ay 2020-21Document4 pagesOm Prakash Comp Ay 2020-21Soumya SwainNo ratings yet

- SalarySlipwithTaxDetails JUNEDocument2 pagesSalarySlipwithTaxDetails JUNEParveen SainiNo ratings yet