Professional Documents

Culture Documents

Problema 11

Problema 11

Uploaded by

zimbolix0 ratings0% found this document useful (0 votes)

26 views8 pagesLo, Inc. is considering investing $435,000 in an asset with a 5 year life. In year 1, revenues are estimated at $275,000 and expenses at $87,000, growing 3% annually. The company will use straight-line depreciation over 5 years to reduce the asset value to the $55,000 salvage value. A $15,000 working capital investment is required upfront but recovered at year 5. The project's nominal cash flows are calculated for each year over the 5 years.

Original Description:

Original Title

problema 11

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLo, Inc. is considering investing $435,000 in an asset with a 5 year life. In year 1, revenues are estimated at $275,000 and expenses at $87,000, growing 3% annually. The company will use straight-line depreciation over 5 years to reduce the asset value to the $55,000 salvage value. A $15,000 working capital investment is required upfront but recovered at year 5. The project's nominal cash flows are calculated for each year over the 5 years.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

26 views8 pagesProblema 11

Problema 11

Uploaded by

zimbolixLo, Inc. is considering investing $435,000 in an asset with a 5 year life. In year 1, revenues are estimated at $275,000 and expenses at $87,000, growing 3% annually. The company will use straight-line depreciation over 5 years to reduce the asset value to the $55,000 salvage value. A $15,000 working capital investment is required upfront but recovered at year 5. The project's nominal cash flows are calculated for each year over the 5 years.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 8

21 Calculating Nominal Cash Flow. Lo, Inc.

, is considering an investment of $435,000 in an asset with an economic life

Tasa de crecimiento: 0.03 VALOR DE RESCATE: FLUJO

Cálculo de la depreciación: Entrada de efecti: 55000 55000

Importe a depreciar: 435000 Valor en libros 0

Tiempo de la deprecia 5 Utilidad gravable 55000

Importe de la depreci 87000 Impuesto 11550 11550

Tasa de impuestos: 0.21 FLUJO DE EFECTIVO…… 43450

estado de resultados

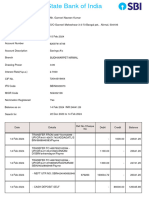

Año 0Año 1 Año 2 Año 3 Año 4 Año 5

Ventas 275000 283250 291747.5 300499.9 309514.9

Gastos 87000 89610 92298.3 95067.25 97919.27

Depreciación 87000 87000 87000 87000 87000

Utilidad antes de impuestos 101000 106640 112449.2 118432.7 124595.7

Menos: impuestos al 34 % 21210 22394.4 23614.33 24870.86 26165.09

Utilidad Neta 79790 84245.6 88834.87 93561.81 98430.57

Más: depreciación 87000 87000 87000 87000 87000

FLUJO DE EFECTIVO DE OPERAC 166790 171245.6 175834.9 180561.8 185430.6

Gasto de capital: -435000

Nuevo Capital en Trab -15000 15000

Flujo de efectivo por valor de rescate. 43450

TOTAL DE FLUJO DE E -450000 166790 171245.6 175834.9 180561.8 243880.6

n asset with an economic life of five years. The firm estimates that the nominal annual cash revenues and expenses at the end of the first

xpenses at the end of the first year will be $275,000 and $87,000, respectively. Both revenues and expenses will grow thereafter at the ann

will grow thereafter at the annual inflation rate of 3 percent. The company will use the straight-line method to depreciate its asset to zero

to depreciate its asset to zero over five years. The salvage value of the asset is estimated to be $55,000 in nominal terms at that time. The

ominal terms at that time. The one-time net working capital investment of $15,000 is required immediately and will be recovered at the en

and will be recovered at the end of the project. The corporate tax rate is 21 percent. What is the project’s total nominal cash flow from ass

tal nominal cash flow from assets for each year?

You might also like

- West Twelve Mile RD Southfield, Michigan 48034-1846 Phone 800-634-1506Document1 pageWest Twelve Mile RD Southfield, Michigan 48034-1846 Phone 800-634-1506Wayne Lund50% (2)

- Dentists and TaxesDocument9 pagesDentists and TaxesZHAREIGHNEILE C. MAMOLONo ratings yet

- Cash Flow Statement StudentDocument60 pagesCash Flow Statement StudentJanine MosatallaNo ratings yet

- Assignment 1 - 2021 - 2022Document4 pagesAssignment 1 - 2021 - 2022Assya El MoukademNo ratings yet

- Simple Numbers Presentation SlidesDocument28 pagesSimple Numbers Presentation SlidesPratiiek Mor100% (6)

- Analysis of Project Cash FlowsDocument16 pagesAnalysis of Project Cash FlowsTanmaye KapurNo ratings yet

- Fm-Answer-Key 2Document5 pagesFm-Answer-Key 2Kitheia Ostrava Reisenchauer100% (3)

- Financial Model Forecasting - Case StudyDocument15 pagesFinancial Model Forecasting - Case Study唐鹏飞No ratings yet

- Pffcu Auto Event March 18-27. Get Your Autodraft Today-Shop With Financing in Hand. Rates As Low As 2.24% Apr . Easy To Apply. Fast Loan Decisions. See The Shield For DetailsDocument5 pagesPffcu Auto Event March 18-27. Get Your Autodraft Today-Shop With Financing in Hand. Rates As Low As 2.24% Apr . Easy To Apply. Fast Loan Decisions. See The Shield For DetailsSimone TurnerNo ratings yet

- Homework N3Document24 pagesHomework N3Maiko KopadzeNo ratings yet

- Financial Analysis LiquidityDocument22 pagesFinancial Analysis LiquidityRochelle ArpilledaNo ratings yet

- Chapter 03Document29 pagesChapter 03andi.w.rahardjoNo ratings yet

- Chapter 6Document26 pagesChapter 6dshilkarNo ratings yet

- After Tax Analysis Model v1.12Document8 pagesAfter Tax Analysis Model v1.12Michael OdiemboNo ratings yet

- After Tax Analysis Model v1.12Document8 pagesAfter Tax Analysis Model v1.12Michael OdiemboNo ratings yet

- Delta Project and Repco AnalysisDocument9 pagesDelta Project and Repco AnalysisvarunjajooNo ratings yet

- Trần Hoài Anh Hs150639 Ib1602Document3 pagesTrần Hoài Anh Hs150639 Ib1602Vũ Nhi AnNo ratings yet

- Assignment No.02: Submitted To: Mam FatimaDocument10 pagesAssignment No.02: Submitted To: Mam FatimassamminaNo ratings yet

- Assignment N3Document12 pagesAssignment N3Maiko KopadzeNo ratings yet

- Pepsi-Cola Products Philippines Inc: - Income Statement For The Year 2014-2017Document2 pagesPepsi-Cola Products Philippines Inc: - Income Statement For The Year 2014-2017Graciel Dela CruzNo ratings yet

- Written Assignment Unit 3Document6 pagesWritten Assignment Unit 3Aby ZuñigaNo ratings yet

- Year Revenue Cogs Depreciation S&A Taxable Income After-Tax Operating IncomeDocument6 pagesYear Revenue Cogs Depreciation S&A Taxable Income After-Tax Operating IncomeSpandana AchantaNo ratings yet

- Form of Ownership Chosen and ReasoningDocument14 pagesForm of Ownership Chosen and ReasoningSheikh MarufNo ratings yet

- Financial Management: Submitted By: ANILA T. VARGHESE (FK-3006) and VINU D. (FK-3044)Document15 pagesFinancial Management: Submitted By: ANILA T. VARGHESE (FK-3006) and VINU D. (FK-3044)Vinu DNo ratings yet

- Group4 SectionA SampavideoDocument5 pagesGroup4 SectionA Sampavideokarthikmaddula007_66No ratings yet

- Solution Manual - Capital Budgeting Part 2Document21 pagesSolution Manual - Capital Budgeting Part 2Lab Dema-alaNo ratings yet

- Cash Flows Capital BudgetingDocument57 pagesCash Flows Capital Budgetingvivek patelNo ratings yet

- Chapter 6 - Section 2 The Baldwin Company: An Example: Year 1 Year 2 Year 3Document11 pagesChapter 6 - Section 2 The Baldwin Company: An Example: Year 1 Year 2 Year 3Meghana ErapagaNo ratings yet

- The Valuation and The Use of Free CashDocument29 pagesThe Valuation and The Use of Free CashAlkhair SangcopanNo ratings yet

- Cash Flows Capital BudgetingDocument55 pagesCash Flows Capital Budgetingvishal198900No ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Risk Analysis, Real Options and Capital BudgetingDocument28 pagesRisk Analysis, Real Options and Capital BudgetingArnab SenNo ratings yet

- Financial Plan: Important AssumptionsDocument15 pagesFinancial Plan: Important AssumptionsjehooniesunshineNo ratings yet

- BU7300 - Corporate Finance Capital Budgeting Week 1Document21 pagesBU7300 - Corporate Finance Capital Budgeting Week 1Moony TamimiNo ratings yet

- Cash Management WorkbookDocument10 pagesCash Management Workbookanna reham lucmanNo ratings yet

- Assignment Capital BudgetingDocument29 pagesAssignment Capital BudgetingYasha Sahu0% (1)

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Lecture Financial Management Chap 2 RATIOSDocument15 pagesLecture Financial Management Chap 2 RATIOSLizette Janiya SumantingNo ratings yet

- Excel Advanced Excel For Finance - EXERCISEDocument106 pagesExcel Advanced Excel For Finance - EXERCISEghodghod123100% (1)

- Steps in Financial Planning ProcessDocument9 pagesSteps in Financial Planning ProcessMylene SalvadorNo ratings yet

- Capital Budgeting Sample ProblemsDocument10 pagesCapital Budgeting Sample ProblemsMark Gelo WinchesterNo ratings yet

- Fap All AnswersDocument192 pagesFap All Answerssahudhruv1908No ratings yet

- Statement of Comprehensive Income (Income Statement)Document29 pagesStatement of Comprehensive Income (Income Statement)Alphan SofyanNo ratings yet

- ACCTG 115 Lecture (01-27-2022)Document3 pagesACCTG 115 Lecture (01-27-2022)Janna Mari FriasNo ratings yet

- 3capital Budgeting AnsDocument106 pages3capital Budgeting AnsKenneth KwokNo ratings yet

- Capital Budgeting Practice Question With Solution (EXAM)Document10 pagesCapital Budgeting Practice Question With Solution (EXAM)imfondofNo ratings yet

- SMChap 006Document22 pagesSMChap 006Anonymous mKjaxpMaLNo ratings yet

- Cash FlowDocument15 pagesCash FlowCandy BayonaNo ratings yet

- Module 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsDocument15 pagesModule 3 - 6 - Capital Budgeting - CF From Acs - APV - Leasing - EAC - International ProjectsBaher WilliamNo ratings yet

- The Amortization of Fixed Assets in Terms of Deferred TaxesDocument12 pagesThe Amortization of Fixed Assets in Terms of Deferred TaxesMessiNo ratings yet

- Ee Assignment Lu 6Document6 pagesEe Assignment Lu 6NethiyaaRajendranNo ratings yet

- Value-Based ManagementDocument21 pagesValue-Based ManagementPrathamesh411No ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- Managerial Accounting FiDocument32 pagesManagerial Accounting FiJo Segismundo-JiaoNo ratings yet

- Cash Flow StatementDocument18 pagesCash Flow Statementriya SharmaNo ratings yet

- Finance Report Group 2Document35 pagesFinance Report Group 2AbigailNo ratings yet

- Untitled DocumentDocument6 pagesUntitled DocumentAman SinghNo ratings yet

- Laporan Keuangan Dan PajakDocument39 pagesLaporan Keuangan Dan PajakFerry JohNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- UBS Lesson 1Document4 pagesUBS Lesson 1Yau Xiang YingNo ratings yet

- Transaction TableDocument1 pageTransaction TableASHIQ HUSSAINNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAnton Elena-CarmenNo ratings yet

- It SiaDocument180 pagesIt Siasupriya gupta100% (1)

- Account StatementDocument12 pagesAccount Statementpancard2323No ratings yet

- General Awareness: Salient FeaturesDocument144 pagesGeneral Awareness: Salient FeaturesShubham SaindreNo ratings yet

- MES Schedule of Rates 2021Document2 pagesMES Schedule of Rates 2021sajidkhan.fiver100% (1)

- Atal Pension Yojna (Apy)Document17 pagesAtal Pension Yojna (Apy)binalamitNo ratings yet

- Bar 2018 - MlquDocument138 pagesBar 2018 - MlquTimmy GonzalesNo ratings yet

- Tarea Traducción EstadísticaDocument3 pagesTarea Traducción EstadísticaJENNY ALEXANDRA BERMUDEZ RODRIGUEZ - EstudianteNo ratings yet

- Power Plant Cinema Spider-Man No Way Home Sat 15 Jan 1200 TicketsDocument2 pagesPower Plant Cinema Spider-Man No Way Home Sat 15 Jan 1200 TicketsJohn Edzel RequeNo ratings yet

- Short Notes On Public FinanceDocument3 pagesShort Notes On Public FinanceJakir_bnkNo ratings yet

- DigiDocument4 pagesDigiWellter JitapNo ratings yet

- International Tax EnvironmentDocument14 pagesInternational Tax EnvironmentAnonymous VstguMKrb50% (2)

- Academeic Research Book - 1Document1 pageAcademeic Research Book - 1kvchandrahasanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pavan ÇherryNo ratings yet

- A Guide To Taxation in The PhilippinesDocument3 pagesA Guide To Taxation in The PhilippinesPhia CustodioNo ratings yet

- SSPUSADVDocument1 pageSSPUSADVLuz AmparoNo ratings yet

- Invoice: Bill To: Sold ToDocument2 pagesInvoice: Bill To: Sold ToSethuramanNo ratings yet

- Taxation - Agricultural IncomeDocument5 pagesTaxation - Agricultural IncomeAmogha GadkarNo ratings yet

- CIR V AlgueDocument5 pagesCIR V AlgueSpidermanNo ratings yet

- Department of Labor: w-234Document2 pagesDepartment of Labor: w-234USA_DepartmentOfLaborNo ratings yet

- Effective Interest Rate CalculatorDocument2 pagesEffective Interest Rate CalculatormmahaliNo ratings yet

- 0 - Receipt - 1303668Document1 page0 - Receipt - 1303668Vaibhav ShindeNo ratings yet

- S6610B A9710cDocument120 pagesS6610B A9710cElizabeth BenjaminNo ratings yet

- Kentucky Tax Registration Application and Instructions: WWW - Revenue.ky - GovDocument28 pagesKentucky Tax Registration Application and Instructions: WWW - Revenue.ky - GovCharles Lamont BrewerNo ratings yet

- CSD HP Scheme Remittance of InsDocument4 pagesCSD HP Scheme Remittance of InsJack Al100% (1)