Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

35 viewsExcel Inc Tax 1

Excel Inc Tax 1

Uploaded by

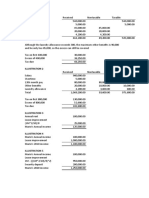

Lysss EpssssThe document shows an employee's compensation breakdown for the year. It details regular pay of $305,850, supplemental income of $63,000 and mandatory deductions of $54,150, for total regular compensation of $368,850. It also lists the amounts received for 13th month pay and other benefits totaling $101,000, with $72,600 classified as non-taxable, $33,400 as taxable excess, and a total non-taxable compensation of $216,750.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Show That The Accounting Equation Is Satisfied After Taking Into Consideration Each of The Following Transactions in The Books of MRDocument3 pagesShow That The Accounting Equation Is Satisfied After Taking Into Consideration Each of The Following Transactions in The Books of MRLysss Epssss0% (2)

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218No ratings yet

- Salary Sep 2019 PDFDocument1 pageSalary Sep 2019 PDFAnonymous eHnCyk7DYNo ratings yet

- Exercise 4. Perez Company Had The Following Transactions During JanuaryDocument3 pagesExercise 4. Perez Company Had The Following Transactions During JanuaryLysss EpssssNo ratings yet

- EXCEL INC TAX FinalDocument2 pagesEXCEL INC TAX FinalLysss EpssssNo ratings yet

- Government Rank and File Employee Summary of Compensation and Benefits in 2020Document4 pagesGovernment Rank and File Employee Summary of Compensation and Benefits in 2020kate bautistaNo ratings yet

- Quiz Gross Income SolutionsDocument1 pageQuiz Gross Income SolutionsMa Jodelyn RosinNo ratings yet

- SamplePayroll Processing and Withholding Tax On CompensationDocument2 pagesSamplePayroll Processing and Withholding Tax On CompensationReinalyn De VeraNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- COMPENSATION INCOME EXERCISES AnnualDocument1 pageCOMPENSATION INCOME EXERCISES AnnualJoyce Marie SablayanNo ratings yet

- InTax Unit 7Document1 pageInTax Unit 7ElleNo ratings yet

- Chapter 10 ProblemsDocument4 pagesChapter 10 ProblemsOnaisah TalibNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Compensation Income - (250,000 - 400,000) : Dazai OsamuDocument5 pagesCompensation Income - (250,000 - 400,000) : Dazai OsamuGideon Tangan Ines Jr.No ratings yet

- Via BIR Form 1706Document1 pageVia BIR Form 1706YnnaNo ratings yet

- Laba Rugi Standar SetahunDocument1 pageLaba Rugi Standar SetahunlavmeilaNo ratings yet

- Pajak Rizki Rahmat Putra - 20AP2Document9 pagesPajak Rizki Rahmat Putra - 20AP2Alviana RenoNo ratings yet

- Income Tax Seatwork - Answers Ver 2 PartialDocument3 pagesIncome Tax Seatwork - Answers Ver 2 PartialgillianNo ratings yet

- Fabm SolutionDocument10 pagesFabm SolutionJasmine ActaNo ratings yet

- Laporan Laba Rugi PT PUTRA BANUA - ISMI FATMASYARIDocument1 pageLaporan Laba Rugi PT PUTRA BANUA - ISMI FATMASYARIIsmi FatmasyariNo ratings yet

- Arbitrage Limit: Total Deductible Interest ExpenseDocument2 pagesArbitrage Limit: Total Deductible Interest ExpenseLyka RoguelNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Activity 1Document4 pagesActivity 1Louisa de VeraNo ratings yet

- Particulars Taka Taka TakaDocument2 pagesParticulars Taka Taka TakaTushar Mahmud SizanNo ratings yet

- Taxation AssessmentDocument8 pagesTaxation AssessmentBhanumati BhunjunNo ratings yet

- Janus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsDocument2 pagesJanus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsCHARMAINE ROSE CABLAYANNo ratings yet

- Profit & Loss (Standard) : PT Fifa - Resa HarismaDocument1 pageProfit & Loss (Standard) : PT Fifa - Resa HarismaBikin OrtubanggaNo ratings yet

- Payslip SampleDocument1 pagePayslip SampleWayo PhodangNo ratings yet

- Uas - Laba Rugi - Mohammad Rafly Tri Rizky - 023001905005Document1 pageUas - Laba Rugi - Mohammad Rafly Tri Rizky - 023001905005raflyNo ratings yet

- Additional Activities PDFDocument2 pagesAdditional Activities PDFHermosura ChristineNo ratings yet

- PT Jayatama - Dhiwa - Laba Rugi (Standar)Document1 pagePT Jayatama - Dhiwa - Laba Rugi (Standar)Dhiwa RafiantoNo ratings yet

- Laba Rugi Ud AbadiDocument1 pageLaba Rugi Ud AbadiSuci TriyaniNo ratings yet

- Deductible Non-Deductible: PenaltiesDocument6 pagesDeductible Non-Deductible: PenaltiesFerl ElardoNo ratings yet

- Casibang OEDocument2 pagesCasibang OEKrung KrungNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- FIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisDocument3 pagesFIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisBetcy RaetoraNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Laba/Rugi (Standar) : Dari 01 May 2019 Ke 31 May 2019Document1 pageLaba/Rugi (Standar) : Dari 01 May 2019 Ke 31 May 2019septherineNo ratings yet

- DownloadDocument2 pagesDownloadSowbhagya VaderaNo ratings yet

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- TX-UK Worked ExamplesDocument5 pagesTX-UK Worked ExamplesRich KishNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- 1700584538377Document1 page1700584538377Ishtiyaq RatherNo ratings yet

- Itemized Deduction Vs Optional Standard Deductions 40OSDDocument4 pagesItemized Deduction Vs Optional Standard Deductions 40OSDjason genitaNo ratings yet

- UntitledDocument1 pageUntitledAnkush SinghNo ratings yet

- Salary SleepDocument1 pageSalary Sleepdk_2k2002No ratings yet

- Laporan Laba Rugi - CybertronDocument1 pageLaporan Laba Rugi - CybertronaghaarekbasNo ratings yet

- Laporan Laba Rugi - Cybertron - Agha Nur Sabri ADocument1 pageLaporan Laba Rugi - Cybertron - Agha Nur Sabri AaghaarekbasNo ratings yet

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Document1 pageSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOONo ratings yet

- Profit or LossDocument1 pageProfit or LossKryss Clyde TabliganNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- Payroll Template Single Employee - Segun Akiode - 2022Document1 pagePayroll Template Single Employee - Segun Akiode - 2022Eben-Haezer100% (1)

- 1 Pfrs 15 SoltnDocument2 pages1 Pfrs 15 Soltnmartinfaith958No ratings yet

- Greytip Software PVT LTD: Payslip For The Month of April - 2021Document1 pageGreytip Software PVT LTD: Payslip For The Month of April - 2021vigneshNo ratings yet

- Profit and LossDocument1 pageProfit and LossBikin OrtubanggaNo ratings yet

- Funds Flow Statement and Cash Flow StatementDocument2 pagesFunds Flow Statement and Cash Flow StatementLysss EpssssNo ratings yet

- EXCEL INC TAX FinalDocument2 pagesEXCEL INC TAX FinalLysss EpssssNo ratings yet

- Ijesrt: International Journal of Engineering Sciences & Research TechnologyDocument8 pagesIjesrt: International Journal of Engineering Sciences & Research TechnologyLysss EpssssNo ratings yet

- Data Privacy Consent Form National Federation of Junior Philippine Institute of Accountants - Region III CouncilDocument4 pagesData Privacy Consent Form National Federation of Junior Philippine Institute of Accountants - Region III CouncilLysss EpssssNo ratings yet

- 3-Comprehensive Problem 1Document1 page3-Comprehensive Problem 1Lysss Epssss100% (1)

- 3-Short Answer QuestionsDocument3 pages3-Short Answer QuestionsLysss EpssssNo ratings yet

- I Want To Highlight Two Main Elements Nitong Faceshield Na ToDocument2 pagesI Want To Highlight Two Main Elements Nitong Faceshield Na ToLysss EpssssNo ratings yet

- 3 1Document1 page3 1Lysss EpssssNo ratings yet

- SM Module 4 Rev AnsDocument4 pagesSM Module 4 Rev AnsLysss EpssssNo ratings yet

- Chapter 1: The Accounting EquationDocument2 pagesChapter 1: The Accounting EquationLysss EpssssNo ratings yet

- From The Following Summary of Cash Account of X LTDDocument2 pagesFrom The Following Summary of Cash Account of X LTDLysss EpssssNo ratings yet

- Chapter 5: The Cash Flow StatementDocument3 pagesChapter 5: The Cash Flow StatementLysss EpssssNo ratings yet

- Six Ways To Solve 80% of Your Accounting Problems: 1. Know The Difference Between Profit and Cash FlowDocument3 pagesSix Ways To Solve 80% of Your Accounting Problems: 1. Know The Difference Between Profit and Cash FlowLysss EpssssNo ratings yet

- From The Following Summary of Cash Account of X LTDDocument2 pagesFrom The Following Summary of Cash Account of X LTDLysss EpssssNo ratings yet

- Cash Budget FMDocument16 pagesCash Budget FMLysss EpssssNo ratings yet

- CBA CorporationDocument1 pageCBA CorporationLysss EpssssNo ratings yet

- Chapter 7: What Is GAAP?Document4 pagesChapter 7: What Is GAAP?Lysss EpssssNo ratings yet

- Lancel PhiloDocument1 pageLancel PhiloLysss EpssssNo ratings yet

- Cash Budget FMDocument5 pagesCash Budget FMLysss EpssssNo ratings yet

Excel Inc Tax 1

Excel Inc Tax 1

Uploaded by

Lysss Epssss0 ratings0% found this document useful (0 votes)

35 views1 pageThe document shows an employee's compensation breakdown for the year. It details regular pay of $305,850, supplemental income of $63,000 and mandatory deductions of $54,150, for total regular compensation of $368,850. It also lists the amounts received for 13th month pay and other benefits totaling $101,000, with $72,600 classified as non-taxable, $33,400 as taxable excess, and a total non-taxable compensation of $216,750.

Original Description:

Original Title

EXCEL INC TAX 1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document shows an employee's compensation breakdown for the year. It details regular pay of $305,850, supplemental income of $63,000 and mandatory deductions of $54,150, for total regular compensation of $368,850. It also lists the amounts received for 13th month pay and other benefits totaling $101,000, with $72,600 classified as non-taxable, $33,400 as taxable excess, and a total non-taxable compensation of $216,750.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

35 views1 pageExcel Inc Tax 1

Excel Inc Tax 1

Uploaded by

Lysss EpssssThe document shows an employee's compensation breakdown for the year. It details regular pay of $305,850, supplemental income of $63,000 and mandatory deductions of $54,150, for total regular compensation of $368,850. It also lists the amounts received for 13th month pay and other benefits totaling $101,000, with $72,600 classified as non-taxable, $33,400 as taxable excess, and a total non-taxable compensation of $216,750.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

De minimis Non-taxable Other Benefits Taxable Benefits

Regular and supplementary compensation

Mandatory deductions 54,150.00

Regular compensation 305,850.00

Supplemental compensation

Commission income 28,000.00

Overtime pay 35,000.00

Pre-computed daily transportation allowance 20,000.00

Total - 368,850.00

13th month pay and other benefits

13th month pay 30,000.00

Other benefits:

Vacation expense paid by the employer 15,000.00

14th month pay 30,000.00

Excess de minimis

Rice subsidy 60,000.00 24,000.00 36,000.00

Monetized vacation leave 20,000.00 20,000.00 -

Monetized sick leave 10,000.00 - 10,000.00

Christmas gift 5,000.00 5,000.00 -

Laundry allowance 6,000.00 3,600.00 2,400.00

Total 101,000.00 72,600.00 123,400.00 368,850.00

Exclusion Threshold 90,000.00 - 90,000.00

Total 162,600.00 33,400.00

Total Non-taxable compensation 216,750.00

Taxable excess 13th month pay and other benefits - 33,400.00 33,400.00

Taxable Compensation Income 402,250.00

You might also like

- Show That The Accounting Equation Is Satisfied After Taking Into Consideration Each of The Following Transactions in The Books of MRDocument3 pagesShow That The Accounting Equation Is Satisfied After Taking Into Consideration Each of The Following Transactions in The Books of MRLysss Epssss0% (2)

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218No ratings yet

- Salary Sep 2019 PDFDocument1 pageSalary Sep 2019 PDFAnonymous eHnCyk7DYNo ratings yet

- Exercise 4. Perez Company Had The Following Transactions During JanuaryDocument3 pagesExercise 4. Perez Company Had The Following Transactions During JanuaryLysss EpssssNo ratings yet

- EXCEL INC TAX FinalDocument2 pagesEXCEL INC TAX FinalLysss EpssssNo ratings yet

- Government Rank and File Employee Summary of Compensation and Benefits in 2020Document4 pagesGovernment Rank and File Employee Summary of Compensation and Benefits in 2020kate bautistaNo ratings yet

- Quiz Gross Income SolutionsDocument1 pageQuiz Gross Income SolutionsMa Jodelyn RosinNo ratings yet

- SamplePayroll Processing and Withholding Tax On CompensationDocument2 pagesSamplePayroll Processing and Withholding Tax On CompensationReinalyn De VeraNo ratings yet

- ANSWER KEY Quiz On Tax On Compensation PDFDocument6 pagesANSWER KEY Quiz On Tax On Compensation PDFMeg CruzNo ratings yet

- COMPENSATION INCOME EXERCISES AnnualDocument1 pageCOMPENSATION INCOME EXERCISES AnnualJoyce Marie SablayanNo ratings yet

- InTax Unit 7Document1 pageInTax Unit 7ElleNo ratings yet

- Chapter 10 ProblemsDocument4 pagesChapter 10 ProblemsOnaisah TalibNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Compensation Income - (250,000 - 400,000) : Dazai OsamuDocument5 pagesCompensation Income - (250,000 - 400,000) : Dazai OsamuGideon Tangan Ines Jr.No ratings yet

- Via BIR Form 1706Document1 pageVia BIR Form 1706YnnaNo ratings yet

- Laba Rugi Standar SetahunDocument1 pageLaba Rugi Standar SetahunlavmeilaNo ratings yet

- Pajak Rizki Rahmat Putra - 20AP2Document9 pagesPajak Rizki Rahmat Putra - 20AP2Alviana RenoNo ratings yet

- Income Tax Seatwork - Answers Ver 2 PartialDocument3 pagesIncome Tax Seatwork - Answers Ver 2 PartialgillianNo ratings yet

- Fabm SolutionDocument10 pagesFabm SolutionJasmine ActaNo ratings yet

- Laporan Laba Rugi PT PUTRA BANUA - ISMI FATMASYARIDocument1 pageLaporan Laba Rugi PT PUTRA BANUA - ISMI FATMASYARIIsmi FatmasyariNo ratings yet

- Arbitrage Limit: Total Deductible Interest ExpenseDocument2 pagesArbitrage Limit: Total Deductible Interest ExpenseLyka RoguelNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Activity 1Document4 pagesActivity 1Louisa de VeraNo ratings yet

- Particulars Taka Taka TakaDocument2 pagesParticulars Taka Taka TakaTushar Mahmud SizanNo ratings yet

- Taxation AssessmentDocument8 pagesTaxation AssessmentBhanumati BhunjunNo ratings yet

- Janus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsDocument2 pagesJanus Elizalde Income Tax Liability For The Year Will Be Computed As FollowsCHARMAINE ROSE CABLAYANNo ratings yet

- Profit & Loss (Standard) : PT Fifa - Resa HarismaDocument1 pageProfit & Loss (Standard) : PT Fifa - Resa HarismaBikin OrtubanggaNo ratings yet

- Payslip SampleDocument1 pagePayslip SampleWayo PhodangNo ratings yet

- Uas - Laba Rugi - Mohammad Rafly Tri Rizky - 023001905005Document1 pageUas - Laba Rugi - Mohammad Rafly Tri Rizky - 023001905005raflyNo ratings yet

- Additional Activities PDFDocument2 pagesAdditional Activities PDFHermosura ChristineNo ratings yet

- PT Jayatama - Dhiwa - Laba Rugi (Standar)Document1 pagePT Jayatama - Dhiwa - Laba Rugi (Standar)Dhiwa RafiantoNo ratings yet

- Laba Rugi Ud AbadiDocument1 pageLaba Rugi Ud AbadiSuci TriyaniNo ratings yet

- Deductible Non-Deductible: PenaltiesDocument6 pagesDeductible Non-Deductible: PenaltiesFerl ElardoNo ratings yet

- Casibang OEDocument2 pagesCasibang OEKrung KrungNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- FIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisDocument3 pagesFIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisBetcy RaetoraNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Laba/Rugi (Standar) : Dari 01 May 2019 Ke 31 May 2019Document1 pageLaba/Rugi (Standar) : Dari 01 May 2019 Ke 31 May 2019septherineNo ratings yet

- DownloadDocument2 pagesDownloadSowbhagya VaderaNo ratings yet

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaNo ratings yet

- TX-UK Worked ExamplesDocument5 pagesTX-UK Worked ExamplesRich KishNo ratings yet

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghNo ratings yet

- 1700584538377Document1 page1700584538377Ishtiyaq RatherNo ratings yet

- Itemized Deduction Vs Optional Standard Deductions 40OSDDocument4 pagesItemized Deduction Vs Optional Standard Deductions 40OSDjason genitaNo ratings yet

- UntitledDocument1 pageUntitledAnkush SinghNo ratings yet

- Salary SleepDocument1 pageSalary Sleepdk_2k2002No ratings yet

- Laporan Laba Rugi - CybertronDocument1 pageLaporan Laba Rugi - CybertronaghaarekbasNo ratings yet

- Laporan Laba Rugi - Cybertron - Agha Nur Sabri ADocument1 pageLaporan Laba Rugi - Cybertron - Agha Nur Sabri AaghaarekbasNo ratings yet

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Document1 pageSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOONo ratings yet

- Profit or LossDocument1 pageProfit or LossKryss Clyde TabliganNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- Payroll Template Single Employee - Segun Akiode - 2022Document1 pagePayroll Template Single Employee - Segun Akiode - 2022Eben-Haezer100% (1)

- 1 Pfrs 15 SoltnDocument2 pages1 Pfrs 15 Soltnmartinfaith958No ratings yet

- Greytip Software PVT LTD: Payslip For The Month of April - 2021Document1 pageGreytip Software PVT LTD: Payslip For The Month of April - 2021vigneshNo ratings yet

- Profit and LossDocument1 pageProfit and LossBikin OrtubanggaNo ratings yet

- Funds Flow Statement and Cash Flow StatementDocument2 pagesFunds Flow Statement and Cash Flow StatementLysss EpssssNo ratings yet

- EXCEL INC TAX FinalDocument2 pagesEXCEL INC TAX FinalLysss EpssssNo ratings yet

- Ijesrt: International Journal of Engineering Sciences & Research TechnologyDocument8 pagesIjesrt: International Journal of Engineering Sciences & Research TechnologyLysss EpssssNo ratings yet

- Data Privacy Consent Form National Federation of Junior Philippine Institute of Accountants - Region III CouncilDocument4 pagesData Privacy Consent Form National Federation of Junior Philippine Institute of Accountants - Region III CouncilLysss EpssssNo ratings yet

- 3-Comprehensive Problem 1Document1 page3-Comprehensive Problem 1Lysss Epssss100% (1)

- 3-Short Answer QuestionsDocument3 pages3-Short Answer QuestionsLysss EpssssNo ratings yet

- I Want To Highlight Two Main Elements Nitong Faceshield Na ToDocument2 pagesI Want To Highlight Two Main Elements Nitong Faceshield Na ToLysss EpssssNo ratings yet

- 3 1Document1 page3 1Lysss EpssssNo ratings yet

- SM Module 4 Rev AnsDocument4 pagesSM Module 4 Rev AnsLysss EpssssNo ratings yet

- Chapter 1: The Accounting EquationDocument2 pagesChapter 1: The Accounting EquationLysss EpssssNo ratings yet

- From The Following Summary of Cash Account of X LTDDocument2 pagesFrom The Following Summary of Cash Account of X LTDLysss EpssssNo ratings yet

- Chapter 5: The Cash Flow StatementDocument3 pagesChapter 5: The Cash Flow StatementLysss EpssssNo ratings yet

- Six Ways To Solve 80% of Your Accounting Problems: 1. Know The Difference Between Profit and Cash FlowDocument3 pagesSix Ways To Solve 80% of Your Accounting Problems: 1. Know The Difference Between Profit and Cash FlowLysss EpssssNo ratings yet

- From The Following Summary of Cash Account of X LTDDocument2 pagesFrom The Following Summary of Cash Account of X LTDLysss EpssssNo ratings yet

- Cash Budget FMDocument16 pagesCash Budget FMLysss EpssssNo ratings yet

- CBA CorporationDocument1 pageCBA CorporationLysss EpssssNo ratings yet

- Chapter 7: What Is GAAP?Document4 pagesChapter 7: What Is GAAP?Lysss EpssssNo ratings yet

- Lancel PhiloDocument1 pageLancel PhiloLysss EpssssNo ratings yet

- Cash Budget FMDocument5 pagesCash Budget FMLysss EpssssNo ratings yet