Professional Documents

Culture Documents

SK-PST Form

SK-PST Form

Uploaded by

Osama JavaidOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SK-PST Form

SK-PST Form

Uploaded by

Osama JavaidCopyright:

Available Formats

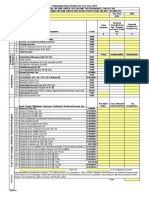

Ministry of

Finance

PROVINCIAL SALES TAX RETURN DO NOT use Staples or Paperclips

PO Box 200, Regina, Saskatchewan, S4P 2Z6

Revenue Division

Account Number Business Number EFILE Code Total Sales

(Box A from Worksheet) , , .

Return Period Due Date Net Tax Collected

(Box B from Worksheet) , , .

Consumption Tax

Legal Name: ___________________________________________ (Box C from Worksheet) , , .

Net Tax Payable

Signature Telephone Number

(Box D from Worksheet) , , .

I certify the information contained herein is to the best of my knowledge accurate Account Balance

• If no tax is due, a return must still be filed. (Box E from Worksheet) , , .

• Penalty and interest are applied to returns filed and paid after the Remittance Enclosed

due date (Box G from Worksheet) , , .

Make payment payable to the Minister of Finance.

PPFEHFHADKMPBAMGEIGDCFNNACBECBFOHIPKJPHPEFC

PPFEHKJADCOCBNHAGPGNAHLGIDNLEBONKAPKLAHPEFC

Please print in blue or black ink.

PPFEFEHIDFHMBKLOANFPAGKPICHIEFEBLOKJOAHPEFC

PST 1 18 01 999999999 00000000 Amended Return -This box must be checked to amend a

return previously filed. The amended return must be a complete

return identifying the total revised amount, not just the amended

fields.

SASKATCHEWAN PROVINCIAL SALES TAX RETURN WORKSHEET Detatch at the perforation and return the stub above with your new information .

Account Number Business Number EFILE Code Return Period Due Date Last Payment Received Last Return Processed:

Total Sales Total Sales

STEP 1 A

u Enter the total sales before taxes for the reporting period as listed in your records.

Net Tax Collected Net Tax Collected

STEP 2 u Enter the tax collected on the sale of taxable goods and services for this period, net of any credits applied internally. B

For information on calculating and applying credits see the PST worksheet supplement on our website.

Consumption Tax Consumption Tax

u Enter the total tax payable on goods and services for your own use that were taken from inventory or purchased from C

a supplier who did not charge you the tax, net of any credits applied internally. For information on calculating and

STEP 3 applying credits see the PST worksheet supplement on our website. Net Tax Payable (B + C)

Net Tax Payable D

u Box B plus box C

Balance Owing

Balance Owing (As of the date this form was printed.) Add if positive subtract if negative. E

STEP 4

Net Amount Payable Net Amount Payable (D + or – E)

u To file electronically visit our website at www.sets.gov.sk.ca F

Remittance Enclosed Remittance Enclosed

STEP 5 u If no tax is payable for this period, a “Nil” return must be filed by entering zeros in boxes B, C and D. G

Detatch at the perforation and return the stub below with your new information .

Change Notification

Address /Name Change: (Check the box & provide details below)

Business Closed: (Check the box & provide details below)

Date of Closure: YYYYMMDD

Mailing Location Business Name

Business Name (If Applicable):

Reason for Closure:

Suite Number: Street or Post Office Box

If business was sold, please provide details below.

Purchaser Name:

City: Province: Postal Code:

Purchaser Phone Number:

Phone Number:

WEBSITE: EFILE: INQUIRIES: EMAIL:

www.saskatchewan.ca www.sets.gov.sk.ca (306) 787-6645 or 1-800-667-6102 SaskTaxInfo@gov.sk.ca

You might also like

- BOA Merchant ID List As of 09/01/2020: Client Line: 3459-5116-1883 American Express Discover Visa/MastercardDocument1 pageBOA Merchant ID List As of 09/01/2020: Client Line: 3459-5116-1883 American Express Discover Visa/MastercardChristina Trigo100% (3)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Ghana Revenue Authority: Monthly Vat & Nhil Flat Rate ReturnDocument2 pagesGhana Revenue Authority: Monthly Vat & Nhil Flat Rate Returnokatakyie1990No ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- Warehouse Operations and ManagementDocument93 pagesWarehouse Operations and ManagementNashwa Saad89% (9)

- Amex Statement - Nov 2019Document5 pagesAmex Statement - Nov 2019Afzal sayedNo ratings yet

- (Name of Registered Business Entity) Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar/Fiscal YearDocument5 pages(Name of Registered Business Entity) Annual Tax Incentives Report-Income-Based Tax Incentives For Calendar/Fiscal YearRoui Jean VillarNo ratings yet

- US Internal Revenue Service: F1120icd - 2000Document6 pagesUS Internal Revenue Service: F1120icd - 2000IRSNo ratings yet

- 1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnDocument6 pages1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnIRSNo ratings yet

- 27201451249V M1 1703 Hist PDFDocument6 pages27201451249V M1 1703 Hist PDFPriyanka AgrawalNo ratings yet

- Ghana Revenue Authority: Monthly Vat & Nhil ReturnDocument2 pagesGhana Revenue Authority: Monthly Vat & Nhil Returnokatakyie1990No ratings yet

- Hopewell Fund's 2018 Tax FormsDocument72 pagesHopewell Fund's 2018 Tax FormsJoe Schoffstall100% (1)

- Tax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortDocument17 pagesTax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortMohammad Shah Alam ChowdhuryNo ratings yet

- GST 101 ADocument1 pageGST 101 AchriswoonNo ratings yet

- 27860151571V 27860151571C Venktesh Trading CompanyDocument7 pages27860151571V 27860151571C Venktesh Trading CompanyAdesh NaharNo ratings yet

- SampleRF Guidebook C2019 2 PDFDocument174 pagesSampleRF Guidebook C2019 2 PDFJessie XinyingNo ratings yet

- NCHC Public Form 990 Fye09Document27 pagesNCHC Public Form 990 Fye09nchc-scribdNo ratings yet

- US Internal Revenue Service: f1065 - 1995Document4 pagesUS Internal Revenue Service: f1065 - 1995IRSNo ratings yet

- Interest Computation Under The Look-Back Method For Property Depreciated Under The Income Forecast MethodDocument1 pageInterest Computation Under The Look-Back Method For Property Depreciated Under The Income Forecast MethodIRSNo ratings yet

- 1701 January 2018 Consov4Document2 pages1701 January 2018 Consov4Donabelle MarimonNo ratings yet

- US Internal Revenue Service: f1120pc - 1999Document8 pagesUS Internal Revenue Service: f1120pc - 1999IRSNo ratings yet

- US Internal Revenue Service: F1120a - 2005Document2 pagesUS Internal Revenue Service: F1120a - 2005IRSNo ratings yet

- US Internal Revenue Service: f1120pc - 1993Document8 pagesUS Internal Revenue Service: f1120pc - 1993IRSNo ratings yet

- New Venture Fund 2018 Tax FormsDocument146 pagesNew Venture Fund 2018 Tax FormsJoe SchoffstallNo ratings yet

- 6) CaliforniaALL 2008 Tax ReturnDocument21 pages6) CaliforniaALL 2008 Tax ReturnCaliforniaALLExposedNo ratings yet

- Shelter The Homeless 2021 PDFDocument40 pagesShelter The Homeless 2021 PDFKUTV 2NewsNo ratings yet

- Lisc 2020 990 PublicinspectionDocument832 pagesLisc 2020 990 PublicinspectionShannon DavisNo ratings yet

- US Internal Revenue Service: f1120pc - 2000Document8 pagesUS Internal Revenue Service: f1120pc - 2000IRSNo ratings yet

- US Internal Revenue Service: f1120pc - 1998Document8 pagesUS Internal Revenue Service: f1120pc - 1998IRSNo ratings yet

- US Internal Revenue Service: f1120pc - 1995Document8 pagesUS Internal Revenue Service: f1120pc - 1995IRSNo ratings yet

- MODIFIED - TIMTA Annexes For CREATE FAs of 20 June 2021Document14 pagesMODIFIED - TIMTA Annexes For CREATE FAs of 20 June 2021Sunshine PaglinawanNo ratings yet

- Form - PDF - 910658390230124 2023-24Document74 pagesForm - PDF - 910658390230124 2023-24Sameer DeshmukhNo ratings yet

- Gra Nhil ReturnDocument2 pagesGra Nhil ReturnpapapetroNo ratings yet

- Itr 2022Document75 pagesItr 2022DevNo ratings yet

- Form PDF 157585650280324Document82 pagesForm PDF 157585650280324sruthiconsultancy357No ratings yet

- US Internal Revenue Service: F1120icd - 1992Document6 pagesUS Internal Revenue Service: F1120icd - 1992IRSNo ratings yet

- GSTR-9C 09awdpk5848f1zb 29122023Document8 pagesGSTR-9C 09awdpk5848f1zb 29122023suraj888999No ratings yet

- 10 Column Worksheet TemplateDocument3 pages10 Column Worksheet TemplatejepsyutNo ratings yet

- "Individual Paper Return For Tax Year 2021: SignatureDocument25 pages"Individual Paper Return For Tax Year 2021: SignatureWaqas MehmoodNo ratings yet

- Useful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Document6 pagesUseful Life or 60 Mos. (Whichever Is Shorter) : (Attach Additional Sheet, If Necessary)Katherine OlidanNo ratings yet

- 1701 January 2018 Consov4Document2 pages1701 January 2018 Consov4RAS ConsultancyNo ratings yet

- GSTR 9cDocument1 pageGSTR 9cfintech ConsultancyNo ratings yet

- Samir MultaniDocument1 pageSamir MultaniRajendra SharmaNo ratings yet

- TaxAdministration - PHP 2Document2 pagesTaxAdministration - PHP 2Marcia BlessNo ratings yet

- Remittance VoucherDocument2 pagesRemittance VoucherЕвгений БулгаковNo ratings yet

- GSTR-9C 09absfa5984a1z3 29122023Document8 pagesGSTR-9C 09absfa5984a1z3 29122023suraj888999No ratings yet

- PAYG Instalment Notice - 2022 - Valentino Investments Pty LTDDocument2 pagesPAYG Instalment Notice - 2022 - Valentino Investments Pty LTDLaura DicelloNo ratings yet

- Form PDF 159884980300324Document12 pagesForm PDF 159884980300324uday.jee1No ratings yet

- Wa0005Document86 pagesWa0005Deepu DeepNo ratings yet

- DT 0107 Monthly Paye Deductions Return Form v1 2 PDFDocument2 pagesDT 0107 Monthly Paye Deductions Return Form v1 2 PDFpapapetroNo ratings yet

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- Form PDF 116325180180224Document11 pagesForm PDF 116325180180224otherhoaccountNo ratings yet

- Patrizio's CorporationDocument1 pagePatrizio's CorporationMarienhela MeriñoNo ratings yet

- US Internal Revenue Service: f1120pc - 1996Document8 pagesUS Internal Revenue Service: f1120pc - 1996IRSNo ratings yet

- GSTR 9C Audit ProformaDocument14 pagesGSTR 9C Audit ProformaChaitanya krishna reddy DontireddyNo ratings yet

- 1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityDocument3 pages1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityReese QuinesNo ratings yet

- Form PDF 914796000060123Document70 pagesForm PDF 914796000060123itie anejaNo ratings yet

- US Internal Revenue Service: f1066 - 1991Document4 pagesUS Internal Revenue Service: f1066 - 1991IRSNo ratings yet

- Form PDF 144753670160324Document12 pagesForm PDF 144753670160324manikangkandeka02No ratings yet

- File GSTR-9: Getting Details For Annual ReturnsDocument30 pagesFile GSTR-9: Getting Details For Annual ReturnsHarendra KumarNo ratings yet

- Vacation Request Form TemplateDocument1 pageVacation Request Form TemplateOsama JavaidNo ratings yet

- Vacation Request Form TemplateDocument1 pageVacation Request Form TemplateOsama JavaidNo ratings yet

- Manual Customer Invoice SOPDocument15 pagesManual Customer Invoice SOPOsama JavaidNo ratings yet

- Week 3 Chap 1: Enterprise Risk ManagementDocument3 pagesWeek 3 Chap 1: Enterprise Risk ManagementOsama JavaidNo ratings yet

- LIC Premium Jan 2023Document4 pagesLIC Premium Jan 2023Akriti SinghNo ratings yet

- Should We Use Cash or Credit Card When TravelingDocument2 pagesShould We Use Cash or Credit Card When TravelingNana SupriatnaNo ratings yet

- Rewarding Excellence Visa Prepaid Card FaqsDocument4 pagesRewarding Excellence Visa Prepaid Card FaqsjudahNo ratings yet

- Register No. Fa7A: (Five-Year Regular Course) Fourth Year-Seventh SemesterDocument2 pagesRegister No. Fa7A: (Five-Year Regular Course) Fourth Year-Seventh SemesterUV TunesNo ratings yet

- DQCNJVX CL4 G CswfeDocument15 pagesDQCNJVX CL4 G CswfeAmar JainNo ratings yet

- Asad Yaseen - SadaPay Account Statement 31-12-2022Document8 pagesAsad Yaseen - SadaPay Account Statement 31-12-2022Asad YaseenNo ratings yet

- Bill Overview: Jlb9Djiut Vgxfivcivc Ykpfivcuukywmxxmvc55Xpcafgaq37FDocument5 pagesBill Overview: Jlb9Djiut Vgxfivcivc Ykpfivcuukywmxxmvc55Xpcafgaq37FsupardibinabuNo ratings yet

- IncotermsDocument27 pagesIncotermssidharth13041993100% (2)

- Excise, Taxation and Narcotics - Government of SindhDocument1 pageExcise, Taxation and Narcotics - Government of SindhqqqNo ratings yet

- 2020-IA#19 Four To Score (November Promo Qualifiers) PDFDocument11 pages2020-IA#19 Four To Score (November Promo Qualifiers) PDFTrixia Kaye MedinaNo ratings yet

- 1149XXXXXX638028 10 2023Document11 pages1149XXXXXX638028 10 2023adjfg639No ratings yet

- Types of Marketing ChannelsDocument30 pagesTypes of Marketing Channelsindrajeetkmr00No ratings yet

- Proper Procedure and Applicable Time Periods For Administrative and Judicial Claims For Refund or Credit of Unutilized Excess Input VATDocument15 pagesProper Procedure and Applicable Time Periods For Administrative and Judicial Claims For Refund or Credit of Unutilized Excess Input VATMelvin PernezNo ratings yet

- CHALLANDocument1 pageCHALLANtdsbolluNo ratings yet

- Enttech 2019 - Explore India Tour PackageDocument6 pagesEnttech 2019 - Explore India Tour PackageMukul Pujari ApteNo ratings yet

- Invoice 16584 PDFDocument1 pageInvoice 16584 PDFfranshadiNo ratings yet

- Axis April-16 PDFDocument6 pagesAxis April-16 PDFAnonymous akFYwVpNo ratings yet

- Treasury Challan No: 0200136088 Treasury Challan No: 0200136088 Treasury Challan No: 0200136088Document1 pageTreasury Challan No: 0200136088 Treasury Challan No: 0200136088 Treasury Challan No: 0200136088EENo ratings yet

- Gati - Supply Chain and Warehouse Short DescriptionDocument7 pagesGati - Supply Chain and Warehouse Short DescriptionShantanu BattaNo ratings yet

- BLDocument4 pagesBLIgnacio Solo de ZaldívarNo ratings yet

- Company Profile SereneDocument8 pagesCompany Profile SereneKingstownKlang SoccerClubNo ratings yet

- PolicyScehdule - 2019-04-18T110114.809 PDFDocument1 pagePolicyScehdule - 2019-04-18T110114.809 PDFDeep KalerNo ratings yet

- 158461465384vhhDocument8 pages158461465384vhhAjit RaoNo ratings yet

- Order 111-8746916-1654648Document1 pageOrder 111-8746916-1654648Le Dinh PhongNo ratings yet

- Justification Report: Late Filing Fee Computation U/s 234EDocument2 pagesJustification Report: Late Filing Fee Computation U/s 234EkanchanNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument1 pageStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancemrcopy xeroxNo ratings yet

- EY Tax Alert: Malaysian DevelopmentsDocument12 pagesEY Tax Alert: Malaysian DevelopmentsWong Yong Sheng WongNo ratings yet