Professional Documents

Culture Documents

Risk Management

Risk Management

Uploaded by

Gellomar AlkuinoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Management

Risk Management

Uploaded by

Gellomar AlkuinoCopyright:

Available Formats

What is Risk?

(Company always prone to internal and external factors whether the company will

achieve or realize its objective. The corporation might face different uncertainties of

events or conditions and this uncertainty is what cannot be avoided at best risk can be

manage or mitigated. Need to be manage or mitigated the risk to protect the investor

and the corporation.)

Risk is Exposure to the possibility of loss, injury, or other adverse or unwelcome

circumstance; chance or situation involving such a possibility.

Risk is inherent in every business, organizations and entrepreneurship need to be

willing to take risk as without risk there can be no meaningful gain. Like stress one has

to live with risk and it cannot be avoided. At best risk can be managed or mitigated.

It a probability that some future event could adversely impact the organization. Risk

measured in terms of probability and impact.

Systematic Risk and Unsystematic Risk

Systematic Risk

It is not fully uncontrollable by organization. (SR effects the entire industry

therefore it cannot be solved particular organization alone because what is being

affecting a particular organization is also affecting the entire organization in the

market)

It is not entirely predictable. ( It is a external factor that the corporation has no

reach at all for example changes in taxation , the changes in taxation that could

bring

It is usually of a macro nature.( Affects the entire industry, entire market whether

it is in effect of investment policy changes, foreign investment policy, change in

taxation or global security threats (systematic risk) ((external factor like changes

in taxation that could bring higher tax liabilities for a particular organization that

beyond the control a corporation because that control is under the government))

It usually effects a large number of organizations operating under a similar

stream.(Example one line of industry in cotton industry or in the petroleum

industry so there are a change in an foreign investment policy in terms of

importing and exporting of petroleum products that could affect not just a single

organization but the entire organization operating in that industry)

It cannot fully assessed and anticipated in advance in terms of timing and gravity.

(Beyond control of every corporation and thus cannot mitigated to a large extent)

The example of such type of risk is Interest Rate Risk, Market Risk, Purchasing

Power Risk.

Unsystematic Risk

It usually controllable by an organization.

It is reasonably predictable.

It is normally micro in nature.

If not managed it directly effects the individual organization first.

It can usually assessed well in advance with reasonable effort and risk mitigation

can be planned with proper understanding and risk assessment techniques.

The example of risk are Compliance Risk, Credit Risk, Operational Risk.

(example compliance risk obviously affects particular firm if an entity would not

comply a particular regulatory provision then there are adverse effect, it could

bring to the entity so how would the entity manage or control this compliance

risk? These why important to have Risk Management !!!!

Since the organization itself who could just save from this type of risk then

therefore they could also to be the one who could create activities or strategies

that could mitigate this compliance risk. To make sure that they complying every

regulation which there are under the must elect or appoint a compliance officer

that will make sure and oversee that all provisions of all government regulatory

agencies where this corporation is under really complied in that sense they might

they could actually mitigate or manage possible effect of their compliance risk.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

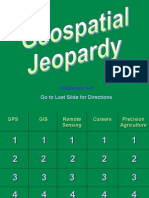

- Geospatial JeopardyDocument54 pagesGeospatial JeopardyrunnealsNo ratings yet

- TikTok Article & Questions (PART 1)Document4 pagesTikTok Article & Questions (PART 1)AqeelALTNo ratings yet

- Trans-Amf Eng Man v44Document84 pagesTrans-Amf Eng Man v44AyeminThetNo ratings yet

- Lignocellulosic Biorefinery: Integrated-Bioethanol and Chemicals Production in Pilot Plant Bioethanol G2Document1 pageLignocellulosic Biorefinery: Integrated-Bioethanol and Chemicals Production in Pilot Plant Bioethanol G2Moery MrtNo ratings yet

- Delayed Ettringite FormationDocument7 pagesDelayed Ettringite Formationvthamarai999543No ratings yet

- SAP S4 HANA Academy For Complete FreshersDocument15 pagesSAP S4 HANA Academy For Complete FreshersAdão da luzNo ratings yet

- Komal Kamble - ResumeDocument2 pagesKomal Kamble - ResumeSumit GoleNo ratings yet

- WEEK 4 Plumbing System MACRO 15sep20Document20 pagesWEEK 4 Plumbing System MACRO 15sep20qweqweNo ratings yet

- Assignent 4Document2 pagesAssignent 4Beshir Heyru Mohammed100% (1)

- Norman v1 v2 v3 Version 02 Final Feb2009 PDFDocument99 pagesNorman v1 v2 v3 Version 02 Final Feb2009 PDFsiva sankarNo ratings yet

- Emaco Nanocrete R3 - PDS - ASEAN - 241110Document3 pagesEmaco Nanocrete R3 - PDS - ASEAN - 241110Andri AjaNo ratings yet

- IMG Xios XG Supreme USB Operating InstructionsDocument80 pagesIMG Xios XG Supreme USB Operating InstructionsClarity DentalNo ratings yet

- OLGA Link User GuideDocument51 pagesOLGA Link User GuideekabudiartiNo ratings yet

- Aplicación Manual DiasysDocument63 pagesAplicación Manual DiasysbetsabevegaaNo ratings yet

- Sample Paper VIII 2023-2024Document455 pagesSample Paper VIII 2023-2024RoxtteNo ratings yet

- 2021 Main Residency Match® by The Numbers: PositionsDocument1 page2021 Main Residency Match® by The Numbers: Positionsyogitha dadiNo ratings yet

- Getting The Most Out of RootsMagic-7-BookDocument398 pagesGetting The Most Out of RootsMagic-7-Booksuntzu1869No ratings yet

- Cabinet MedicalDocument5 pagesCabinet MedicalDavid BarikaNo ratings yet

- Tutorials 1-12: Tutorial Sheet 1Document11 pagesTutorials 1-12: Tutorial Sheet 1NarasimharaoNo ratings yet

- Zoro (BA50) - SL (ZRW ZRWA) USB - Rev B 0720 PDFDocument2 pagesZoro (BA50) - SL (ZRW ZRWA) USB - Rev B 0720 PDFyencoNo ratings yet

- Rock ExcavationDocument9 pagesRock ExcavationMohammad Hadoumi SaldanNo ratings yet

- Tendernotice 1Document46 pagesTendernotice 1IMT HANDWARANo ratings yet

- Open System Theory in NursingDocument43 pagesOpen System Theory in NursingMarivic MisolaNo ratings yet

- Dual Tone Multi Frequency SignalingDocument4 pagesDual Tone Multi Frequency Signalingmrana_56No ratings yet

- LEX1 Data SheetDocument2 pagesLEX1 Data Sheetpreetharajamma6025No ratings yet

- Essay Service UkDocument7 pagesEssay Service Ukb6zm3pxh100% (2)

- GenII Main Rotor Sikorsky S76 Pushrod 1.00Document23 pagesGenII Main Rotor Sikorsky S76 Pushrod 1.00agripinaluzmilaaNo ratings yet

- I B.sc-Bca-B.sc (It) - Bca (H) - Maths II (Semester II)Document11 pagesI B.sc-Bca-B.sc (It) - Bca (H) - Maths II (Semester II)Sathish Babu Subramani NaiduNo ratings yet

- Lee Colortran ENR Wall Pack Spec Sheet 1990Document4 pagesLee Colortran ENR Wall Pack Spec Sheet 1990Alan MastersNo ratings yet

- ME2203 Subject Notes PDFDocument34 pagesME2203 Subject Notes PDFRakeshkumarceg100% (1)