Professional Documents

Culture Documents

M8 PP

M8 PP

Uploaded by

Gabriel OrolfoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M8 PP

M8 PP

Uploaded by

Gabriel OrolfoCopyright:

Available Formats

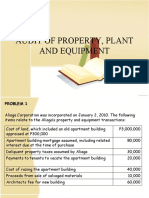

M8 Auditing PPE

PRACTICE PROBLEM

1. On February 1, 2019, CORONA Corporation purchased a parcel of land as a factory site for

P320,000. An old building on the property was demolished and construction begun on a new

warehouse that was completed April 15, 2020. Costs incurred on the construction project are

listed below.

Demolition of old building ........................... P 21,000

Architect's fees ..................................... 31,700

Legal fees--title investigation ...................... 4,100

Construction costs ................................... 950,000

Imputed interest based on stock financing ............ 14,000

Landfill for building site ........................... 19,300

Clearing of trees from building site ................. 9,600

Temporary buildings used for construction activities . 29,000

Land survey .......................................... 4,000

Excavation for basement .............................. 13,200

(Salvage materials from demolition sold for P1,800)

(Timber sold for P3,300)

If the building was constructed by the other company it will cost P1,500,000. The savings

on construction will be recognized after the audit as part of other income.

1. 1. As auditor, determine the cost of the land and new building.

2. How much savings to be recognized as part of other income?

2. On May 1, 2019, COVID Corporation purchased for P690,000 a tract of land on which a

warehouse and office building were located. The following data were collected concerning

the property:

Current Assessed Vendor's

Valuation Original Cost

Land ............................. P280,000 P180,000

Warehouse ........................ 320,000 315,000

Office Building .................. 200,000 129,000

P800,000 P624,000

Your audit shows that COVID the account used for the acquisition was Land and Building

with a total balance of P690,000 and the related accumulated depreciation account with

P69,000 balance as of December 31, 2019 for 10 year life. Straight line method was used

and the the estimated life used was correct.

1. As auditor, determine the appropriate amounts that COVID should record for the land,

warehouse, and office building and the related accumulated depreciation.

2. Give the entry for the audit adjustments.

You might also like

- ReSA B44 AFAR First PB Exam Questions Answers SolutionsDocument22 pagesReSA B44 AFAR First PB Exam Questions Answers SolutionsWes100% (1)

- Eskimo Pie CaseDocument19 pagesEskimo Pie Casedese88No ratings yet

- Afar 01 Partnership Formation OperationsDocument7 pagesAfar 01 Partnership Formation OperationsMikael James VillanuevaNo ratings yet

- Ppe ProblemsDocument4 pagesPpe ProblemsChristine joyNo ratings yet

- Unit 6. Audit of Property, Plant and Equipment - Handout - T21920 (Final)Document8 pagesUnit 6. Audit of Property, Plant and Equipment - Handout - T21920 (Final)Alyna JNo ratings yet

- Audit of Property, Plant and EquipmentDocument26 pagesAudit of Property, Plant and EquipmentJoseph SalidoNo ratings yet

- Lecture Files For Quiz 1 PDFDocument28 pagesLecture Files For Quiz 1 PDFpppppNo ratings yet

- ACCT1003 - Worksheet - 8 - Summer 2016Document5 pagesACCT1003 - Worksheet - 8 - Summer 2016sandrae brownNo ratings yet

- The FOPIP Web Based Benchmarking System-SummaryDocument4 pagesThe FOPIP Web Based Benchmarking System-SummaryteodoralexNo ratings yet

- Week 1 - 2 - Brief ExercisesDocument4 pagesWeek 1 - 2 - Brief ExercisesLorianne ObonaNo ratings yet

- Materials Inventory P148,200 ? Work-in-Process Inventory 33,000 ? Finished Goods Inventory .. 166,000 P143,200 Cost of Goods Sold 263,400Document3 pagesMaterials Inventory P148,200 ? Work-in-Process Inventory 33,000 ? Finished Goods Inventory .. 166,000 P143,200 Cost of Goods Sold 263,400NinaNo ratings yet

- Property, Plant and Equipment Sample Problems: Problem 1Document10 pagesProperty, Plant and Equipment Sample Problems: Problem 1Mark Gelo Winchester0% (1)

- Fitch Company Was Organized On January 1 During The FirstDocument1 pageFitch Company Was Organized On January 1 During The FirstM Bilal SaleemNo ratings yet

- Ac20 Quiz 4 - DGCDocument8 pagesAc20 Quiz 4 - DGCMaricar PinedaNo ratings yet

- Audit PpeDocument4 pagesAudit Ppenicole bancoroNo ratings yet

- Ashley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouDocument1 pageAshley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouMiroslav GegoskiNo ratings yet

- Acco 30053 - Audit of Ppe - MarpDocument10 pagesAcco 30053 - Audit of Ppe - MarpBanna SplitNo ratings yet

- Dado BpsDocument6 pagesDado BpsmcannielNo ratings yet

- Chapter 3 ActivityDocument2 pagesChapter 3 ActivityJml SeNo ratings yet

- LTCC AnswerDocument4 pagesLTCC AnswerRhina MagnawaNo ratings yet

- Quiz No 1 AuditingDocument11 pagesQuiz No 1 AuditingrylNo ratings yet

- Ppe&ia PDFDocument19 pagesPpe&ia PDFNicole BernardoNo ratings yet

- Katherine S Outdoor Furniture A Manufacturer Specializing in Lawn Deck andDocument1 pageKatherine S Outdoor Furniture A Manufacturer Specializing in Lawn Deck andtrilocksp SinghNo ratings yet

- Assessment No. 3-Midterm - Exam SheetDocument7 pagesAssessment No. 3-Midterm - Exam Sheetarnel buanNo ratings yet

- Mohsen Assignment AccountingDocument4 pagesMohsen Assignment AccountingabdulmutNo ratings yet

- PpeDocument7 pagesPpeJer Rama100% (1)

- ST7-Property Plant and EquipmentDocument4 pagesST7-Property Plant and EquipmentJose Conrad Nupia BagonNo ratings yet

- Valdez Blessed Nizelle - Midterm Assignemnt - Aud ProbDocument9 pagesValdez Blessed Nizelle - Midterm Assignemnt - Aud ProbEsse ValdezNo ratings yet

- Quiz 2 - 09.10.18 Set A BDocument4 pagesQuiz 2 - 09.10.18 Set A BRey Joyce AbuelNo ratings yet

- Assessment 4 2024 FARDocument7 pagesAssessment 4 2024 FARmarinel pioquidNo ratings yet

- Name: Mercado, Kath DATE: 01/15 Score: Activity Answer The Following Items On A Separate Sheet of Paper. Show Your Computations. (4 Items X 5 Points)Document2 pagesName: Mercado, Kath DATE: 01/15 Score: Activity Answer The Following Items On A Separate Sheet of Paper. Show Your Computations. (4 Items X 5 Points)Kathleen MercadoNo ratings yet

- Resa Afar 2205 Quiz 2Document14 pagesResa Afar 2205 Quiz 2Rafael Bautista100% (1)

- Quiz 1 With Correct AnswersDocument10 pagesQuiz 1 With Correct AnswersmarietorianoNo ratings yet

- Seatwork - Module 2Document4 pagesSeatwork - Module 2Alyanna Alcantara100% (1)

- Case 1Document2 pagesCase 1Alberto HidalgoNo ratings yet

- Mawn Company Bought Land and Built A Warehouse During 2016Document1 pageMawn Company Bought Land and Built A Warehouse During 2016Hassan JanNo ratings yet

- Fin2bsat Quiz1 InvProperty Fund PpeDocument5 pagesFin2bsat Quiz1 InvProperty Fund PpeMarvin San JuanNo ratings yet

- SEATWORK-LBM 1st2324 STUDENTSDocument3 pagesSEATWORK-LBM 1st2324 STUDENTSpadayonmhieNo ratings yet

- Notes - Audit of PpeDocument4 pagesNotes - Audit of PpeLeisleiRagoNo ratings yet

- Audit of Ppe and Intangible Assets - SeatworkDocument6 pagesAudit of Ppe and Intangible Assets - Seatworkderry0% (1)

- Accounting For Property Plant and Equipment Practice QuestionsDocument18 pagesAccounting For Property Plant and Equipment Practice QuestionsSophia Varias CruzNo ratings yet

- C5 (Problems) - Cost Accounting by CarterDocument7 pagesC5 (Problems) - Cost Accounting by CarterAkiNo ratings yet

- Quiz 2Document20 pagesQuiz 2randomlungs121223No ratings yet

- Problems Audit of Property Plant and Equipmentdocx PresentDocument10 pagesProblems Audit of Property Plant and Equipmentdocx PresentDominic RomeroNo ratings yet

- Audit of PpeDocument8 pagesAudit of PpeCPANo ratings yet

- AEC 118 - Assignment PPEDocument1 pageAEC 118 - Assignment PPERoi PeñalesNo ratings yet

- AUD-90 PW (Part 2 of 2)Document7 pagesAUD-90 PW (Part 2 of 2)Elaine Joyce GarciaNo ratings yet

- Additional Practical Problems-20Document16 pagesAdditional Practical Problems-20areet2701No ratings yet

- Audit of PpeDocument35 pagesAudit of Ppelordaiztrand50% (2)

- Intermediate Accounting 1 Property Plant and EquipmentDocument7 pagesIntermediate Accounting 1 Property Plant and EquipmentKristine Jewel MirandaNo ratings yet

- Finals Q3 - PPE Problems PDFDocument8 pagesFinals Q3 - PPE Problems PDFCzerielle Queens0% (1)

- CGM CGSDocument3 pagesCGM CGSZubair JuttNo ratings yet

- EXERCISES - PPE, Part 2Document5 pagesEXERCISES - PPE, Part 2Meeka CalimagNo ratings yet

- May 2020 - AP Drill 2 (PPE and Intangibles) - FinalDocument8 pagesMay 2020 - AP Drill 2 (PPE and Intangibles) - FinalROMAR A. PIGANo ratings yet

- Problem Set B: Total Manufacturing Costs and The Costs Assigned To Each JobDocument17 pagesProblem Set B: Total Manufacturing Costs and The Costs Assigned To Each JobenzoNo ratings yet

- Audit of Ppe, Int. AssetsDocument5 pagesAudit of Ppe, Int. AssetsJon SagabayNo ratings yet

- MidtermDocument11 pagesMidtermMAG MAGNo ratings yet

- FAR - Learning Assessment 2 - For PostingDocument6 pagesFAR - Learning Assessment 2 - For PostingDarlene JacaNo ratings yet

- Handout No. 2202 B Cost Accounting and ControlDocument9 pagesHandout No. 2202 B Cost Accounting and ControlJackleen Rose JubeleaNo ratings yet

- Module 1.1 - Property, Plant and EquipmentDocument6 pagesModule 1.1 - Property, Plant and EquipmentJaimell LimNo ratings yet

- The Following Payments and Receipts Are Related To Land Land 115625Document1 pageThe Following Payments and Receipts Are Related To Land Land 115625M Bilal SaleemNo ratings yet

- May 2020 - AP Drill 2 (PPE and Intangibles) - Answer KeyDocument8 pagesMay 2020 - AP Drill 2 (PPE and Intangibles) - Answer KeyROMAR A. PIGANo ratings yet

- Audit of PPE 2 - AssignmentDocument2 pagesAudit of PPE 2 - AssignmentNychi SitchonNo ratings yet

- 09-MWSS2020 Part1-Notes To FSDocument44 pages09-MWSS2020 Part1-Notes To FSGabriel OrolfoNo ratings yet

- 10-MWSS2020 Part2-Observations and RecommDocument91 pages10-MWSS2020 Part2-Observations and RecommGabriel OrolfoNo ratings yet

- 11-MWSS2020 Part3-Status of PYs RecommDocument45 pages11-MWSS2020 Part3-Status of PYs RecommGabriel OrolfoNo ratings yet

- M8 Appe LaDocument12 pagesM8 Appe LaGabriel OrolfoNo ratings yet

- 08 MWSS2020 - Part1 FSDocument6 pages08 MWSS2020 - Part1 FSGabriel OrolfoNo ratings yet

- AP 01 - Cash To Accrual BasisDocument11 pagesAP 01 - Cash To Accrual BasisGabriel OrolfoNo ratings yet

- FAR.2845 Statement of Profit or Loss and OCI PDFDocument6 pagesFAR.2845 Statement of Profit or Loss and OCI PDFGabriel OrolfoNo ratings yet

- RicchiuteGroup2 Ch1 20Document89 pagesRicchiuteGroup2 Ch1 20Gabriel OrolfoNo ratings yet

- AFAR 01 Partnership Accounting PDFDocument8 pagesAFAR 01 Partnership Accounting PDFRen EyNo ratings yet

- Trial of RizalDocument3 pagesTrial of RizalGabriel OrolfoNo ratings yet

- 01-MMSU2019 Audit ReportDocument71 pages01-MMSU2019 Audit ReportGabriel OrolfoNo ratings yet

- Problem 1 Investment in Equity SecuritiesDocument6 pagesProblem 1 Investment in Equity SecuritiesGabriel OrolfoNo ratings yet

- MX Rev Aa SiDocument6 pagesMX Rev Aa SiGabriel OrolfoNo ratings yet

- Finding No. 1 Page No. 52 (AAR) : 2,089,045.25 (Maximum Liquidated Damages)Document7 pagesFinding No. 1 Page No. 52 (AAR) : 2,089,045.25 (Maximum Liquidated Damages)Gabriel OrolfoNo ratings yet

- Rizal Module 13Document4 pagesRizal Module 13Gabriel OrolfoNo ratings yet

- DiscussionDocument8 pagesDiscussionGabriel OrolfoNo ratings yet

- Lesson ObjectivesDocument6 pagesLesson ObjectivesGabriel OrolfoNo ratings yet

- Intermediate Accounting Chap 10Document192 pagesIntermediate Accounting Chap 10Gaurav NagpalNo ratings yet

- CHAPTER 3-Treatment-Of-Data-RevisionDocument5 pagesCHAPTER 3-Treatment-Of-Data-RevisionZippy OcampoNo ratings yet

- Accounting PDFDocument64 pagesAccounting PDFSohail MerchantNo ratings yet

- Analisis Kredit (Likuiditas Dan Modal Kerja)Document42 pagesAnalisis Kredit (Likuiditas Dan Modal Kerja)Frans Willdansya FitranyNo ratings yet

- Analysis Solutions Acc 411Document13 pagesAnalysis Solutions Acc 411dre_emNo ratings yet

- Paper 1Document9 pagesPaper 1Purity muchobellaNo ratings yet

- FIN5FMA Tutorial 4 SolutionsDocument5 pagesFIN5FMA Tutorial 4 SolutionsGauravsNo ratings yet

- Math DefinitionsDocument11 pagesMath DefinitionsJohn Saniel J. EstacionNo ratings yet

- 1Document20 pages1Denver AcenasNo ratings yet

- Food Truck Financial ProjectionsDocument68 pagesFood Truck Financial ProjectionsAmy Bersalona-DimapilisNo ratings yet

- DGPC Tariff Review Report 2019 2022Document24 pagesDGPC Tariff Review Report 2019 2022Sonam PhuntshoNo ratings yet

- Pf-Compound, Notes, Debt Restruct, LeasesDocument4 pagesPf-Compound, Notes, Debt Restruct, LeasesMai SamalcaNo ratings yet

- Final Exam Economy.Document2 pagesFinal Exam Economy.keith tambaNo ratings yet

- Which of These Transactions Would ProduceDocument19 pagesWhich of These Transactions Would ProducePetra BojićNo ratings yet

- Workbook1 2Document76 pagesWorkbook1 2Mohammad AbdulhadiNo ratings yet

- Solar Energy ProjectDocument15 pagesSolar Energy Projecthafeez azizNo ratings yet

- Calculation of Weight of Equity and Debt: 2012Document13 pagesCalculation of Weight of Equity and Debt: 2012একজন নিশাচরNo ratings yet

- Revision Question BankDocument134 pagesRevision Question Bankgohasap_303011511No ratings yet

- IAS 36 Impairment of Assets Including GoodwillDocument39 pagesIAS 36 Impairment of Assets Including GoodwillSahilPatelNo ratings yet

- Chap18 (1) The Statement of CashflowsDocument77 pagesChap18 (1) The Statement of Cashflowsgsagar879No ratings yet

- Topic 2 Part 1 Impairment of PpeDocument37 pagesTopic 2 Part 1 Impairment of PpeXiao XuanNo ratings yet

- ENG233 Ch1Document15 pagesENG233 Ch1Mikaela PadernaNo ratings yet

- Management of Project and Consortium: 5.3. Plan For SustainabilityDocument5 pagesManagement of Project and Consortium: 5.3. Plan For SustainabilitySunny PardeshiNo ratings yet

- 100 Accounting Questions With AnswersDocument21 pages100 Accounting Questions With Answersanon_675918451No ratings yet

- Thesis On Ias 16Document4 pagesThesis On Ias 16BestCustomPaperWritingServiceCanada100% (2)

- Fico TicketsDocument29 pagesFico TicketsVikas MNo ratings yet