Professional Documents

Culture Documents

File 000030

File 000030

Uploaded by

Nicholas Gunnell0 ratings0% found this document useful (0 votes)

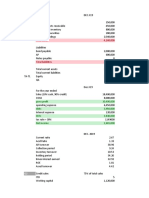

18 views4 pagesGold Equipment Company's income statement for the year ended December 31 shows total sales of $600,000 with cost of goods sold of $460,000, resulting in gross profit of $140,000. Operating expenses totaled $60,000, giving operating profit of $80,000. After subtracting interest and taxes, net profit was $42,900, of which $20,000 was paid out as dividends, leaving $22,900 added to retained earnings. The balance sheet shows total assets of $408,300 including current assets of $138,300 and plant/equipment of $270,000, financed by current liabilities of $75,000, long-term debt of $150,000

Original Description:

Original Title

file000030

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGold Equipment Company's income statement for the year ended December 31 shows total sales of $600,000 with cost of goods sold of $460,000, resulting in gross profit of $140,000. Operating expenses totaled $60,000, giving operating profit of $80,000. After subtracting interest and taxes, net profit was $42,900, of which $20,000 was paid out as dividends, leaving $22,900 added to retained earnings. The balance sheet shows total assets of $408,300 including current assets of $138,300 and plant/equipment of $270,000, financed by current liabilities of $75,000, long-term debt of $150,000

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views4 pagesFile 000030

File 000030

Uploaded by

Nicholas GunnellGold Equipment Company's income statement for the year ended December 31 shows total sales of $600,000 with cost of goods sold of $460,000, resulting in gross profit of $140,000. Operating expenses totaled $60,000, giving operating profit of $80,000. After subtracting interest and taxes, net profit was $42,900, of which $20,000 was paid out as dividends, leaving $22,900 added to retained earnings. The balance sheet shows total assets of $408,300 including current assets of $138,300 and plant/equipment of $270,000, financed by current liabilities of $75,000, long-term debt of $150,000

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 4

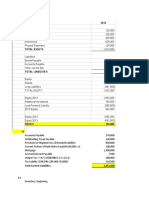

INCOME STATEMENT

GOLD EQUIPMENT COMPANY

FOR THE YEAR ENDED DECEMBER 31

Sales (all on credit) $600,000

Less: Cost of goods sold 460,000

Gross profit $140,000

Less: Operating expenses

General and administrative expense $30,000

Depreciation 30,000

Total: $60,000

Operating profit 80,000

Less: Interest 10,000

Net profit before taxes $70,000

Less: Taxes 27,100

Net profit after taxes $42,900

Less: Cash dividends 20,000

To retained earnings $22,900

BALANCE SHEET

GOLD SHIPMENT COMPANY

DECEMBER 31

Assets

Cash $15,000

Marketable securities 7,200

Accounts receivable 33,000

Inventory 82,000

Prepaid rent 1,100

Total current assets $138,300

Net plant and equipment $270,000

Total assets $408,300

Liabilities

Accounts payable $57,000

Notes payable 13,000

Accounts 5,000

Total current liabilities $75,000

Long -term debt $150,000

Stockholder’s equity

Common stock equity (20,000 shares outstanding) $110,200

Retained earnings 73,100

Total stockholder’s equity $183,300

Total liabilities and stockholder’s equity $408,300

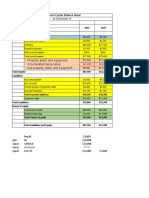

Ratio Industry Gold Equipment

average Company

Net Working Capital $125,000 $63,300

Current Ratio 2.35 1.84

Quick Ratio .87 .75

Inventory Turnover 4.55 5.61

Average Collection Period 35.3 days 20.1 days

Fixed Asset Turnover 1.97 2.22

Total Asset Turnover 1.09 1.47

Debt Ratio .30 .55

Debt-equity Ratio .62 .82

Times Interest Earned Ratio 12.3 8

Gross Profit Margin .202 .233

Operating Profit Margin .135 .133

Net Profit Margin .091 .072

Return on Investment (ROI) .099 .105

Return on Equity (ROE) .167 .234

Earnings Per Share (EPS) $3.10 $2.15

You might also like

- Fin Man Case Problems Financial Ratio AnalysisDocument5 pagesFin Man Case Problems Financial Ratio AnalysisCoreen Andrade50% (2)

- BV - Assignement 2Document7 pagesBV - Assignement 2AkshatAgarwal50% (2)

- Partnership FormatDocument2 pagesPartnership FormatGlenn Taduran100% (2)

- Business Administration Past PapersDocument35 pagesBusiness Administration Past PapersBilal Hussain0% (3)

- Case Study: Financial Ratios Analysis: Pulp, Paper, and Paperboard, IncDocument3 pagesCase Study: Financial Ratios Analysis: Pulp, Paper, and Paperboard, Inchelsamra0% (2)

- Chapter 12 ExercisesDocument2 pagesChapter 12 ExercisesAreeba QureshiNo ratings yet

- Commonly Found Non-Compliances of SCH II&III of Companies Act - CA - Akshat BahetiDocument37 pagesCommonly Found Non-Compliances of SCH II&III of Companies Act - CA - Akshat BahetiCIBIL CHURUNo ratings yet

- Happiness Express, IncDocument6 pagesHappiness Express, Inclulupuspitaa50% (2)

- Chapter 2 Team ProjectDocument2 pagesChapter 2 Team ProjectRaisa TasnimNo ratings yet

- Ch02 P14 Build A Model SolutionDocument6 pagesCh02 P14 Build A Model SolutionSeee OoonNo ratings yet

- Financial Management (Problems)Document12 pagesFinancial Management (Problems)Prasad GowdNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- AnalysisDocument6 pagesAnalysisMariane Joy Valdez BatalonaNo ratings yet

- Work Sheet RatiosDocument4 pagesWork Sheet Ratiosmohammad mueinNo ratings yet

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDocument7 pagesHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNo ratings yet

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- Assignment#01Document8 pagesAssignment#01Aaisha AnsariNo ratings yet

- Quiz IntAccDocument12 pagesQuiz IntAccTrixie HicaldeNo ratings yet

- China Tea CompanyDocument4 pagesChina Tea CompanyLeika Gay Soriano OlarteNo ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- 2008-03-07 181349 Linda 4Document2 pages2008-03-07 181349 Linda 4gianghoanganh79No ratings yet

- Thumbs Up & ChemaliteDocument8 pagesThumbs Up & ChemaliteVaibhav MahajanNo ratings yet

- Finance ProblemsDocument50 pagesFinance ProblemsRandallroyce0% (1)

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- Scenario Summary: Changing CellsDocument10 pagesScenario Summary: Changing CellsLệ NguyễnNo ratings yet

- (123doc) Question Financial Statement AnalysisDocument9 pages(123doc) Question Financial Statement AnalysisUyển's MyNo ratings yet

- Pro Forma Statement of Financial Position: Warner CompanyDocument6 pagesPro Forma Statement of Financial Position: Warner CompanysunflowerNo ratings yet

- Mid Term ExamDocument6 pagesMid Term ExamWaizin KyawNo ratings yet

- Chapter 3. CH 03-10 Build A Model: AssetsDocument4 pagesChapter 3. CH 03-10 Build A Model: AssetsAngel L Rolon TorresNo ratings yet

- Chemalite AnswersDocument2 pagesChemalite AnswersMine SayracNo ratings yet

- Assigment 4Document3 pagesAssigment 4Syakil AhmedNo ratings yet

- Sherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingDocument7 pagesSherlyne Balqist Setyo Afrilin 008201800085 Exercises Intermediate AccountingSTEFANI NUGRAHANo ratings yet

- CH 13Document4 pagesCH 13Sri HimajaNo ratings yet

- Prelim - Case Study (Answer Sheet)Document5 pagesPrelim - Case Study (Answer Sheet)Rona P. AguirreNo ratings yet

- Midterm Practice QuestionsDocument4 pagesMidterm Practice QuestionsGio RobakidzeNo ratings yet

- DifferenceDocument10 pagesDifferencethalibritNo ratings yet

- CfasDocument2 pagesCfassyramaebillones26No ratings yet

- Practice CF Scooter KeyDocument4 pagesPractice CF Scooter KeyAllie LinNo ratings yet

- ABM 14 - Casañas - BALANCE SHEETDocument1 pageABM 14 - Casañas - BALANCE SHEETCasañas, Gillian DrakeNo ratings yet

- Deber Capitulo 2 - 3 FINDocument3 pagesDeber Capitulo 2 - 3 FINMiguel TapiaNo ratings yet

- Group 8-SW Income Statement & Balance SheetDocument2 pagesGroup 8-SW Income Statement & Balance SheetDiễm Quỳnh QuáchNo ratings yet

- RIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningDocument4 pagesRIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningRizka OktavianiNo ratings yet

- Non-Current Asset: Balance Sheet 31-Dec-20Document4 pagesNon-Current Asset: Balance Sheet 31-Dec-20Shehzadi Mahum (F-Name :Sohail Ahmed)No ratings yet

- Comp XMDocument1 pageComp XMlogeshkounderNo ratings yet

- Tutor UtsDocument9 pagesTutor UtsRAFLI RIFALDI -No ratings yet

- Study Unit Three Activity Ratios and Special IssuesDocument11 pagesStudy Unit Three Activity Ratios and Special IssuessimarjeetNo ratings yet

- Tutorial 6-Long-Term Debt-Paying Ability and ProfitabilityDocument2 pagesTutorial 6-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- ACCT 3061 Asignación Cap 4 y 5Document4 pagesACCT 3061 Asignación Cap 4 y 5gpm-81No ratings yet

- Computer Project 1Document5 pagesComputer Project 1Alex SmallzNo ratings yet

- Financial Management Assignment 1Document3 pagesFinancial Management Assignment 12K22DMBA67 kushankNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Notes For Ratios: Accounting Principles AssetsDocument14 pagesNotes For Ratios: Accounting Principles AssetsSudhanshu MathurNo ratings yet

- Practice 3 Balance SheetDocument4 pagesPractice 3 Balance SheetsherinaNo ratings yet

- Problem 2-14 & 2-15Document12 pagesProblem 2-14 & 2-15Qudsiya KalhoroNo ratings yet

- Scrap 5Document14 pagesScrap 5Bryent GawNo ratings yet

- 3463afdcb438dc833d95f8d1814e4b36_8f5c0d43171d85063d48300fbb6274faDocument4 pages3463afdcb438dc833d95f8d1814e4b36_8f5c0d43171d85063d48300fbb6274faChelsea VisperasNo ratings yet

- HARD ROCK COMPANY Statement of Financial PositionDocument3 pagesHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNo ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowTang De MelanciaNo ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowBarbara H.CNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Your Bentley Continental GT V8 Mulliner Convertible: PresentingDocument9 pagesYour Bentley Continental GT V8 Mulliner Convertible: PresentingNicholas GunnellNo ratings yet

- File 000100Document1 pageFile 000100Nicholas GunnellNo ratings yet

- File 000018Document2 pagesFile 000018Nicholas GunnellNo ratings yet

- Capital Budgeting: The Process of Determining Which Fixed Asset To PurchaseDocument10 pagesCapital Budgeting: The Process of Determining Which Fixed Asset To PurchaseNicholas GunnellNo ratings yet

- File 000019Document2 pagesFile 000019Nicholas GunnellNo ratings yet

- Bottomless Bowls: Why Visual Cues of Portion Size May Influence IntakeDocument8 pagesBottomless Bowls: Why Visual Cues of Portion Size May Influence IntakeNicholas GunnellNo ratings yet

- NPCLFY2021-22 Digitally Signed-pdf826202162116PMDocument693 pagesNPCLFY2021-22 Digitally Signed-pdf826202162116PMDirector Distribution UPPCLNo ratings yet

- Annual: For The Year Ended 31 December 2019Document184 pagesAnnual: For The Year Ended 31 December 2019ирина щурNo ratings yet

- Amity School of Business Amity University, Noida, Uttar PradeshDocument11 pagesAmity School of Business Amity University, Noida, Uttar PradeshGautam TandonNo ratings yet

- Kier Ar 2023 Final PDFDocument248 pagesKier Ar 2023 Final PDFrab.nawaz1625No ratings yet

- Coop Updates 3Document52 pagesCoop Updates 3nelsonpm81No ratings yet

- Story of Kuroiler' From IndiaDocument4 pagesStory of Kuroiler' From Indiaeqbal.sayed@exensys.com100% (1)

- Chapter 11 SummaryDocument3 pagesChapter 11 SummaryXiaoyu KensameNo ratings yet

- Fundamentals of Accounting - Adjusting EntriesDocument4 pagesFundamentals of Accounting - Adjusting EntriesAuroraNo ratings yet

- Laporan Keuangan Tahunan PT Ultrajaya MilkDocument205 pagesLaporan Keuangan Tahunan PT Ultrajaya MilkAnushkians IndonesiaNo ratings yet

- Reading 10 Multinational Operations - AnswersDocument95 pagesReading 10 Multinational Operations - Answerstristan.riolsNo ratings yet

- You Exec - Key Account Management FreeDocument11 pagesYou Exec - Key Account Management FreeEnrique ArinNo ratings yet

- Lesson Plan in Bookkeeping-Final DemoDocument4 pagesLesson Plan in Bookkeeping-Final DemoJuadjie ParbaNo ratings yet

- 268 821-1Document8 pages268 821-1hydrophonic100% (1)

- Coffee Shop Business PlanDocument31 pagesCoffee Shop Business PlanMahdy Hasan100% (1)

- Kvat RulesDocument56 pagesKvat RulesShreyas IyengarNo ratings yet

- Account ListDocument96 pagesAccount ListNikit ShahNo ratings yet

- Marketing Finance: Marketing Management With A Finance Emphasis OR Marketing Finance InterfaceDocument39 pagesMarketing Finance: Marketing Management With A Finance Emphasis OR Marketing Finance Interfaceahmedkhatib21No ratings yet

- PRIA FAR - 018 Financial Statements (PAS 1, Etc.) Notes and SolutionDocument12 pagesPRIA FAR - 018 Financial Statements (PAS 1, Etc.) Notes and SolutionEnrique Hills RiveraNo ratings yet

- Travails of A Training ManagerDocument4 pagesTravails of A Training ManagerSammir Malhotra0% (3)

- NotesDocument146 pagesNoteshudaNo ratings yet

- Universal Robina Corporation: Prepared By: Garcia, Leriz Peñalosa, Rena Daniel Pescasio, LeonardDocument15 pagesUniversal Robina Corporation: Prepared By: Garcia, Leriz Peñalosa, Rena Daniel Pescasio, LeonardLeriz GarciaNo ratings yet

- Effects of Cash Management Practice On Financial Performance of Las Pinas Florita Trading 2Document82 pagesEffects of Cash Management Practice On Financial Performance of Las Pinas Florita Trading 2Rubie Grace ManaigNo ratings yet

- Ar&Inventory ManagementDocument10 pagesAr&Inventory ManagementKarlo D. ReclaNo ratings yet

- Module 2 Introduction To Cost Terms and ConceptsDocument52 pagesModule 2 Introduction To Cost Terms and ConceptsChesca AlonNo ratings yet

- Chapter 4 FinaccDocument4 pagesChapter 4 Finaccv lNo ratings yet