Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

20 viewsReturn On Total Assets

Return On Total Assets

Uploaded by

JaneThis document contains information on return on total assets and financial leverage ratios for the years 2017-2021. Return on total assets measures overall profitability of assets and increased each year from 7.10% to 9.21%, indicating better management of assets. However, these increases should be compared to industry averages. Financial leverage measures risk, showing the percentage of assets financed through debt versus equity. This ratio decreased each year from 192.44% to 138.78%, suggesting the company relied less on debt financing over time. However, relying too much on debt poses long-term risks to the partnership.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- PF2 S01-15 - The Blooming CatastropheDocument35 pagesPF2 S01-15 - The Blooming CatastropheJared PrestonNo ratings yet

- Ezz Steel Financial AnalysisDocument31 pagesEzz Steel Financial Analysismohamed ashorNo ratings yet

- BTVS 5x16 "The Body" Audio CommentaryDocument12 pagesBTVS 5x16 "The Body" Audio CommentarynjzNo ratings yet

- Debt To Asset RatioDocument3 pagesDebt To Asset RatioJaneNo ratings yet

- Financial Statement: Bachelor of Science in Business Administration DepartmentDocument16 pagesFinancial Statement: Bachelor of Science in Business Administration DepartmentChristian Job ReniedoNo ratings yet

- Asset Management and Profitability RatioDocument3 pagesAsset Management and Profitability RatioJaneNo ratings yet

- Asset Management and Profitability RatioDocument3 pagesAsset Management and Profitability RatioJaneNo ratings yet

- Analysis and InterpretationDocument5 pagesAnalysis and InterpretationAakankshaNo ratings yet

- Financial Ratio - LiquidityDocument2 pagesFinancial Ratio - LiquidityJaneNo ratings yet

- Financial Ratios FinaaaaaaalDocument8 pagesFinancial Ratios FinaaaaaaalHeidi Estuye MarceloNo ratings yet

- Accounting AssignmentDocument15 pagesAccounting AssignmentYusef ShaqeelNo ratings yet

- Course Name Course Code Student Name Student ID DateDocument7 pagesCourse Name Course Code Student Name Student ID Datemona asgharNo ratings yet

- Financial Analysis Ratio - Formula ElaborationDocument11 pagesFinancial Analysis Ratio - Formula ElaborationBen AzarelNo ratings yet

- Ratio AnalysisDocument29 pagesRatio AnalysisatharNo ratings yet

- ACC For Managers NewDocument7 pagesACC For Managers NewGodfred OpokuNo ratings yet

- LectureDocument29 pagesLectureatharNo ratings yet

- mệt vãi ò đi thuiDocument5 pagesmệt vãi ò đi thuihuynhnhu260304No ratings yet

- Chapter 2 Revision Exercises + SolutionsDocument12 pagesChapter 2 Revision Exercises + SolutionsSanad RousanNo ratings yet

- PGSF 1931 CF VoltasDocument8 pagesPGSF 1931 CF Voltasriya guptaNo ratings yet

- Gas PetronasDocument33 pagesGas PetronasNour FaizahNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- Financial Ratios Financial Ratios Are Comparisons of Important Financial Data Used To Evaluate BusinessDocument12 pagesFinancial Ratios Financial Ratios Are Comparisons of Important Financial Data Used To Evaluate BusinessAaxAm KhAnNo ratings yet

- Financing DecisionsDocument5 pagesFinancing DecisionsMr. Pravar Mathur Student, Jaipuria LucknowNo ratings yet

- Financial Analysis of Exxonmobil 2016-2018: Francisco Orta Oksana Zakharova Savvas SapalidisDocument16 pagesFinancial Analysis of Exxonmobil 2016-2018: Francisco Orta Oksana Zakharova Savvas SapalidisFranciscoNo ratings yet

- Mindtree Company PROJECTDocument16 pagesMindtree Company PROJECTSanjay KuriyaNo ratings yet

- FABMDocument14 pagesFABMMavi BalabboNo ratings yet

- Year 2018 2019 2020: Task 1Document9 pagesYear 2018 2019 2020: Task 1Prateek ChandnaNo ratings yet

- Calculation of The Financial Ratios of GPH Ispat - 2019-2020Document10 pagesCalculation of The Financial Ratios of GPH Ispat - 2019-2020Yasir ArafatNo ratings yet

- Gross Profit Margin: MeaningDocument7 pagesGross Profit Margin: Meaningthai hoangNo ratings yet

- Profitiability Ratios: Return On Total AssetDocument3 pagesProfitiability Ratios: Return On Total Assetنمرا ملکNo ratings yet

- CC 0742 - 2031 AnnuityDocument1 pageCC 0742 - 2031 AnnuityterrygohNo ratings yet

- Army IbaDocument34 pagesArmy IbaZayed Islam SabitNo ratings yet

- Lesson 4.3Document4 pagesLesson 4.3crisjay ramosNo ratings yet

- Mat 2Document2 pagesMat 2kms195kds2007No ratings yet

- Order #440942254Document9 pagesOrder #440942254David ComeyNo ratings yet

- Eicher Motors CFProject Group11Document10 pagesEicher Motors CFProject Group11Greeshma SharathNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisShamim IqbalNo ratings yet

- FINAL (WCM)Document12 pagesFINAL (WCM)Takibul HasanNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Weighted Average Cost of Capital: WACC X + X (1-t)Document10 pagesWeighted Average Cost of Capital: WACC X + X (1-t)abhi vermaNo ratings yet

- Methods of AnalysisDocument7 pagesMethods of AnalysisjenniferNo ratings yet

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72No ratings yet

- Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsDocument9 pagesChapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsShaharyar AsifNo ratings yet

- Vertical Analysis 1. Asset Management, or Turnover, Ratios: A. Inventory TurnoverDocument5 pagesVertical Analysis 1. Asset Management, or Turnover, Ratios: A. Inventory TurnoverNhi ChuNo ratings yet

- Vertical Analysis 1. Asset Management, or Turnover, Ratios: A. Inventory TurnoverDocument5 pagesVertical Analysis 1. Asset Management, or Turnover, Ratios: A. Inventory TurnoverNhi ChuNo ratings yet

- Lã Minh Ngọc - 18071385 - INS3007Document15 pagesLã Minh Ngọc - 18071385 - INS3007Ming NgọhNo ratings yet

- Comparative Study of Financial Statement Ratios Between Dell and EpsonDocument7 pagesComparative Study of Financial Statement Ratios Between Dell and EpsonMacharia NgunjiriNo ratings yet

- Retail:: Fundamental Analysis: (In Millions Except Percentages and Per Share Data) Ratios Data ResultDocument11 pagesRetail:: Fundamental Analysis: (In Millions Except Percentages and Per Share Data) Ratios Data Result1711........No ratings yet

- Kelani Cables: Ratio AnalysisDocument9 pagesKelani Cables: Ratio AnalysisannNo ratings yet

- Assignment Fin420 - Individual & Group EditDocument58 pagesAssignment Fin420 - Individual & Group EditHakim SantiagoNo ratings yet

- Assesment Task - Tutorial Questions Question No.1: Capital BudgetingDocument10 pagesAssesment Task - Tutorial Questions Question No.1: Capital BudgetingJaydeep KushwahaNo ratings yet

- HW 2 - Ch03 P15 Build A Model - HrncarDocument2 pagesHW 2 - Ch03 P15 Build A Model - HrncarsusikralovaNo ratings yet

- A. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Document6 pagesA. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Phạm Thu HuyềnNo ratings yet

- Acc Ca3Document7 pagesAcc Ca3Shay ShayNo ratings yet

- Operating Margin RatioDocument9 pagesOperating Margin RatiorideralfiNo ratings yet

- MMP Corfin Study Case - GalihAbimataDocument2 pagesMMP Corfin Study Case - GalihAbimataDImas AntonioNo ratings yet

- Final Project FMGT 80Document12 pagesFinal Project FMGT 80Alma UriasNo ratings yet

- AST-Assessment 3 - CleanDocument10 pagesAST-Assessment 3 - CleanSammy MutuaNo ratings yet

- Accumulated Carrying Year Description Depreciation Depreciation Amount 18,666.67 18,666.67Document5 pagesAccumulated Carrying Year Description Depreciation Depreciation Amount 18,666.67 18,666.67BARANGAY SIXTYNo ratings yet

- Assignment 01Document18 pagesAssignment 01Md. Real MiahNo ratings yet

- Financial AnalysisDocument14 pagesFinancial Analysismuzaffarovh271No ratings yet

- Turning Dreams Into GoalsDocument8 pagesTurning Dreams Into GoalsJaneNo ratings yet

- Linear Inequalities WorksheetDocument2 pagesLinear Inequalities WorksheetJaneNo ratings yet

- Linear Inequalities WorksheetDocument2 pagesLinear Inequalities WorksheetJane100% (1)

- Inequalities Worksheet: Name: - DateDocument2 pagesInequalities Worksheet: Name: - DateJaneNo ratings yet

- Inequalities Worksheet: Solve. 6 (V + 9) + 9 10 Solve. - 9 3 (R + 3)Document2 pagesInequalities Worksheet: Solve. 6 (V + 9) + 9 10 Solve. - 9 3 (R + 3)JaneNo ratings yet

- Asset Management and Profitability RatioDocument3 pagesAsset Management and Profitability RatioJaneNo ratings yet

- Inequalities Worksheet: Name: - DateDocument2 pagesInequalities Worksheet: Name: - DateJaneNo ratings yet

- Classification and Types of Historical SourcesDocument2 pagesClassification and Types of Historical SourcesJaneNo ratings yet

- Vi. Factors Affecting The Market A. DemandDocument3 pagesVi. Factors Affecting The Market A. DemandJaneNo ratings yet

- Financial Ratio - LiquidityDocument2 pagesFinancial Ratio - LiquidityJaneNo ratings yet

- Debt To Asset RatioDocument3 pagesDebt To Asset RatioJaneNo ratings yet

- Asset Management and Profitability RatioDocument3 pagesAsset Management and Profitability RatioJaneNo ratings yet

- The Repositories of Historical SourcesDocument2 pagesThe Repositories of Historical SourcesJaneNo ratings yet

- Sia Pandemic ReportDocument10 pagesSia Pandemic ReportJaneNo ratings yet

- Assumptions On SourcesDocument2 pagesAssumptions On SourcesJane0% (1)

- Where Are You NowDocument9 pagesWhere Are You NowJaneNo ratings yet

- Forensic Science International - Volume 164 PDFDocument199 pagesForensic Science International - Volume 164 PDFeduardNo ratings yet

- Liquid Marijuana Cocktail Recipe - How To Make A Liquid Marijuana Cocktail - Drink Lab Cocktail & Drink RecipesDocument1 pageLiquid Marijuana Cocktail Recipe - How To Make A Liquid Marijuana Cocktail - Drink Lab Cocktail & Drink RecipesJazymine WrightNo ratings yet

- Jewish NumerologyDocument3 pagesJewish NumerologyDivino Henrique SantanaNo ratings yet

- Group 4Document25 pagesGroup 4Gemmadel Galang DuaquiNo ratings yet

- Boosting ART Uptake and Retention Among HIV Infected Women and Their InfantsDocument4 pagesBoosting ART Uptake and Retention Among HIV Infected Women and Their InfantsDouglas ChukwuNo ratings yet

- STD 6 SSSV SST Hist CH 1 1st SemDocument2 pagesSTD 6 SSSV SST Hist CH 1 1st Sempurvesh2510No ratings yet

- 05 Május.-Uj-Beo-AlapDocument16 pages05 Május.-Uj-Beo-AlapPéter MészárosNo ratings yet

- POL - UniverDocument6 pagesPOL - Univerrahim maamriNo ratings yet

- 08 - Chapter 2 PDFDocument48 pages08 - Chapter 2 PDFpradeep bandaru0% (1)

- Admas University: Faculty of BusinessDocument5 pagesAdmas University: Faculty of Businesseyob negashNo ratings yet

- 1.2. Rules For TranslationsDocument9 pages1.2. Rules For TranslationsEmail ExampleNo ratings yet

- Food at The Restaurant Vocabulary Picture Dictionaries - 97154Document7 pagesFood at The Restaurant Vocabulary Picture Dictionaries - 97154ErmiNo ratings yet

- Embodied Yoga Principles Posture Guide Author Embodied Yoga Principles Online Teacher TrainingDocument222 pagesEmbodied Yoga Principles Posture Guide Author Embodied Yoga Principles Online Teacher TrainingKartheek ChandraNo ratings yet

- Tanween (Nunation) of The Arabic Nouns in 25 Sayings of Prophet Muhammad (PBUH)Document22 pagesTanween (Nunation) of The Arabic Nouns in 25 Sayings of Prophet Muhammad (PBUH)Jonathan MorganNo ratings yet

- BSP Bhilai Steel Plant Training ProjectDocument31 pagesBSP Bhilai Steel Plant Training ProjectAysha Rahman100% (1)

- EOU UNIT 11 - Đáp Án Eou 11Document8 pagesEOU UNIT 11 - Đáp Án Eou 11Trường Sơn NguyễnNo ratings yet

- MCES Envelop 1Document36 pagesMCES Envelop 1ralpdulayliboonNo ratings yet

- Daily Lesson Plan in Computer System Servicing Grade 9 Computer Systems Servicing Ghreven T. AngabDocument5 pagesDaily Lesson Plan in Computer System Servicing Grade 9 Computer Systems Servicing Ghreven T. AngabJerry G. GabacNo ratings yet

- Chapter 5 Part 3 - 202205161151Document6 pagesChapter 5 Part 3 - 202205161151ClydeNo ratings yet

- Culture of HaryanaDocument2 pagesCulture of HaryanaanittaNo ratings yet

- Nojpetén: EtymologyDocument6 pagesNojpetén: EtymologyOrgito LekaNo ratings yet

- Instructions To Candidate: REAS - SPL - 2019 TEST ID - RAB-87148324Document4 pagesInstructions To Candidate: REAS - SPL - 2019 TEST ID - RAB-87148324Jitendra GautamNo ratings yet

- Twelfth Night ShakespeareDocument86 pagesTwelfth Night ShakespeareCorina JulaNo ratings yet

- REVIEWER Physical-ScienceDocument6 pagesREVIEWER Physical-ScienceKyle JoseNo ratings yet

- Sample PayrollDocument6 pagesSample PayrollDeborah Fajardo ManabatNo ratings yet

- Trends in Maternal Mortality 2000 To 2020Document108 pagesTrends in Maternal Mortality 2000 To 2020shouka.inNo ratings yet

- KS0 Operation Manual-EN-V2.0Document19 pagesKS0 Operation Manual-EN-V2.0Freddie ChanNo ratings yet

- The Sales ProcessDocument19 pagesThe Sales ProcessHarold Dela FuenteNo ratings yet

Return On Total Assets

Return On Total Assets

Uploaded by

Jane0 ratings0% found this document useful (0 votes)

20 views2 pagesThis document contains information on return on total assets and financial leverage ratios for the years 2017-2021. Return on total assets measures overall profitability of assets and increased each year from 7.10% to 9.21%, indicating better management of assets. However, these increases should be compared to industry averages. Financial leverage measures risk, showing the percentage of assets financed through debt versus equity. This ratio decreased each year from 192.44% to 138.78%, suggesting the company relied less on debt financing over time. However, relying too much on debt poses long-term risks to the partnership.

Original Description:

Original Title

Return on total assets

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains information on return on total assets and financial leverage ratios for the years 2017-2021. Return on total assets measures overall profitability of assets and increased each year from 7.10% to 9.21%, indicating better management of assets. However, these increases should be compared to industry averages. Financial leverage measures risk, showing the percentage of assets financed through debt versus equity. This ratio decreased each year from 192.44% to 138.78%, suggesting the company relied less on debt financing over time. However, relying too much on debt poses long-term risks to the partnership.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

20 views2 pagesReturn On Total Assets

Return On Total Assets

Uploaded by

JaneThis document contains information on return on total assets and financial leverage ratios for the years 2017-2021. Return on total assets measures overall profitability of assets and increased each year from 7.10% to 9.21%, indicating better management of assets. However, these increases should be compared to industry averages. Financial leverage measures risk, showing the percentage of assets financed through debt versus equity. This ratio decreased each year from 192.44% to 138.78%, suggesting the company relied less on debt financing over time. However, relying too much on debt poses long-term risks to the partnership.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

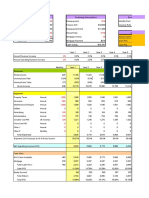

RETURN ON TOTAL ASSETS

Return on Total Assets = Net Income ÷ Average Total Assets

2017 2018 2019 2020 2021

Net ₱ ₱ ₱ ₱ ₱

Income 1,899,508.07 2,249,319.02 2,452,252.61 2,712,850.00 2,911,085.38

Ave. Total ₱ ₱ ₱ ₱ ₱

Assets 26,747,801.29 27,624,906.13 28,696,480.09 30,068,366.52 31,600,014.71

Ratio 7.10% 8.14% 8.55% 9.02% 9.21%

Return on Total Assets measure overall asset profitability and indicates

management’s effective use of total assets. The ratio is considered an

indicator of how effectively a company is using its assets to generate

earnings before contractual obligations must be paid. It is similar to the

fixed asset turnover ratio but takes into consideration the totality of the

assets in raising revenue. The higher the ratio is, the better the firm

manages its assets. Even though the ratio increases, its increases should

be measured against the industry average to know if it is high enough or

not.

FINANCIAL LEVERAGE

Financial Leverage = Average Total Assets ÷ Average Total Equity

2017 2018 2019 2020 2021

Ave. Total ₱ ₱ ₱ ₱

Assets ₱26,747,801.2 27,624,906.1 28,696,480.0 30,068,366.5 31,600,014.7

9 3 9 2 1

₱ ₱ ₱ ₱

Ave. Total ₱13,899,508.0 15,024,167.5 17,374,953.3 19,957,504.7 22,769,472.3

Equity 7 8 9 0 9

Ratio 192.44% 183.87% 165.16% 150.66% 138.78%

Financial Leverage measure the risk in financing the business through

debt. The financial leverage computed in this table refers to the equity

multiplier. Equity multiplier measures how much of the assets are

financed by the owners. The table above shows that 1.92 of the assets

are supported by the owners, and the remaining portion must be financed

by debt. In the long-run, there is a danger to the partnership that it will

rely more on debt financing than equity financing basing from the ratios

above as lesser portion of the assets are supported by the partners’

capital.

You might also like

- PF2 S01-15 - The Blooming CatastropheDocument35 pagesPF2 S01-15 - The Blooming CatastropheJared PrestonNo ratings yet

- Ezz Steel Financial AnalysisDocument31 pagesEzz Steel Financial Analysismohamed ashorNo ratings yet

- BTVS 5x16 "The Body" Audio CommentaryDocument12 pagesBTVS 5x16 "The Body" Audio CommentarynjzNo ratings yet

- Debt To Asset RatioDocument3 pagesDebt To Asset RatioJaneNo ratings yet

- Financial Statement: Bachelor of Science in Business Administration DepartmentDocument16 pagesFinancial Statement: Bachelor of Science in Business Administration DepartmentChristian Job ReniedoNo ratings yet

- Asset Management and Profitability RatioDocument3 pagesAsset Management and Profitability RatioJaneNo ratings yet

- Asset Management and Profitability RatioDocument3 pagesAsset Management and Profitability RatioJaneNo ratings yet

- Analysis and InterpretationDocument5 pagesAnalysis and InterpretationAakankshaNo ratings yet

- Financial Ratio - LiquidityDocument2 pagesFinancial Ratio - LiquidityJaneNo ratings yet

- Financial Ratios FinaaaaaaalDocument8 pagesFinancial Ratios FinaaaaaaalHeidi Estuye MarceloNo ratings yet

- Accounting AssignmentDocument15 pagesAccounting AssignmentYusef ShaqeelNo ratings yet

- Course Name Course Code Student Name Student ID DateDocument7 pagesCourse Name Course Code Student Name Student ID Datemona asgharNo ratings yet

- Financial Analysis Ratio - Formula ElaborationDocument11 pagesFinancial Analysis Ratio - Formula ElaborationBen AzarelNo ratings yet

- Ratio AnalysisDocument29 pagesRatio AnalysisatharNo ratings yet

- ACC For Managers NewDocument7 pagesACC For Managers NewGodfred OpokuNo ratings yet

- LectureDocument29 pagesLectureatharNo ratings yet

- mệt vãi ò đi thuiDocument5 pagesmệt vãi ò đi thuihuynhnhu260304No ratings yet

- Chapter 2 Revision Exercises + SolutionsDocument12 pagesChapter 2 Revision Exercises + SolutionsSanad RousanNo ratings yet

- PGSF 1931 CF VoltasDocument8 pagesPGSF 1931 CF Voltasriya guptaNo ratings yet

- Gas PetronasDocument33 pagesGas PetronasNour FaizahNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- Financial Ratios Financial Ratios Are Comparisons of Important Financial Data Used To Evaluate BusinessDocument12 pagesFinancial Ratios Financial Ratios Are Comparisons of Important Financial Data Used To Evaluate BusinessAaxAm KhAnNo ratings yet

- Financing DecisionsDocument5 pagesFinancing DecisionsMr. Pravar Mathur Student, Jaipuria LucknowNo ratings yet

- Financial Analysis of Exxonmobil 2016-2018: Francisco Orta Oksana Zakharova Savvas SapalidisDocument16 pagesFinancial Analysis of Exxonmobil 2016-2018: Francisco Orta Oksana Zakharova Savvas SapalidisFranciscoNo ratings yet

- Mindtree Company PROJECTDocument16 pagesMindtree Company PROJECTSanjay KuriyaNo ratings yet

- FABMDocument14 pagesFABMMavi BalabboNo ratings yet

- Year 2018 2019 2020: Task 1Document9 pagesYear 2018 2019 2020: Task 1Prateek ChandnaNo ratings yet

- Calculation of The Financial Ratios of GPH Ispat - 2019-2020Document10 pagesCalculation of The Financial Ratios of GPH Ispat - 2019-2020Yasir ArafatNo ratings yet

- Gross Profit Margin: MeaningDocument7 pagesGross Profit Margin: Meaningthai hoangNo ratings yet

- Profitiability Ratios: Return On Total AssetDocument3 pagesProfitiability Ratios: Return On Total Assetنمرا ملکNo ratings yet

- CC 0742 - 2031 AnnuityDocument1 pageCC 0742 - 2031 AnnuityterrygohNo ratings yet

- Army IbaDocument34 pagesArmy IbaZayed Islam SabitNo ratings yet

- Lesson 4.3Document4 pagesLesson 4.3crisjay ramosNo ratings yet

- Mat 2Document2 pagesMat 2kms195kds2007No ratings yet

- Order #440942254Document9 pagesOrder #440942254David ComeyNo ratings yet

- Eicher Motors CFProject Group11Document10 pagesEicher Motors CFProject Group11Greeshma SharathNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisShamim IqbalNo ratings yet

- FINAL (WCM)Document12 pagesFINAL (WCM)Takibul HasanNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Weighted Average Cost of Capital: WACC X + X (1-t)Document10 pagesWeighted Average Cost of Capital: WACC X + X (1-t)abhi vermaNo ratings yet

- Methods of AnalysisDocument7 pagesMethods of AnalysisjenniferNo ratings yet

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72No ratings yet

- Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsDocument9 pagesChapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsShaharyar AsifNo ratings yet

- Vertical Analysis 1. Asset Management, or Turnover, Ratios: A. Inventory TurnoverDocument5 pagesVertical Analysis 1. Asset Management, or Turnover, Ratios: A. Inventory TurnoverNhi ChuNo ratings yet

- Vertical Analysis 1. Asset Management, or Turnover, Ratios: A. Inventory TurnoverDocument5 pagesVertical Analysis 1. Asset Management, or Turnover, Ratios: A. Inventory TurnoverNhi ChuNo ratings yet

- Lã Minh Ngọc - 18071385 - INS3007Document15 pagesLã Minh Ngọc - 18071385 - INS3007Ming NgọhNo ratings yet

- Comparative Study of Financial Statement Ratios Between Dell and EpsonDocument7 pagesComparative Study of Financial Statement Ratios Between Dell and EpsonMacharia NgunjiriNo ratings yet

- Retail:: Fundamental Analysis: (In Millions Except Percentages and Per Share Data) Ratios Data ResultDocument11 pagesRetail:: Fundamental Analysis: (In Millions Except Percentages and Per Share Data) Ratios Data Result1711........No ratings yet

- Kelani Cables: Ratio AnalysisDocument9 pagesKelani Cables: Ratio AnalysisannNo ratings yet

- Assignment Fin420 - Individual & Group EditDocument58 pagesAssignment Fin420 - Individual & Group EditHakim SantiagoNo ratings yet

- Assesment Task - Tutorial Questions Question No.1: Capital BudgetingDocument10 pagesAssesment Task - Tutorial Questions Question No.1: Capital BudgetingJaydeep KushwahaNo ratings yet

- HW 2 - Ch03 P15 Build A Model - HrncarDocument2 pagesHW 2 - Ch03 P15 Build A Model - HrncarsusikralovaNo ratings yet

- A. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Document6 pagesA. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Phạm Thu HuyềnNo ratings yet

- Acc Ca3Document7 pagesAcc Ca3Shay ShayNo ratings yet

- Operating Margin RatioDocument9 pagesOperating Margin RatiorideralfiNo ratings yet

- MMP Corfin Study Case - GalihAbimataDocument2 pagesMMP Corfin Study Case - GalihAbimataDImas AntonioNo ratings yet

- Final Project FMGT 80Document12 pagesFinal Project FMGT 80Alma UriasNo ratings yet

- AST-Assessment 3 - CleanDocument10 pagesAST-Assessment 3 - CleanSammy MutuaNo ratings yet

- Accumulated Carrying Year Description Depreciation Depreciation Amount 18,666.67 18,666.67Document5 pagesAccumulated Carrying Year Description Depreciation Depreciation Amount 18,666.67 18,666.67BARANGAY SIXTYNo ratings yet

- Assignment 01Document18 pagesAssignment 01Md. Real MiahNo ratings yet

- Financial AnalysisDocument14 pagesFinancial Analysismuzaffarovh271No ratings yet

- Turning Dreams Into GoalsDocument8 pagesTurning Dreams Into GoalsJaneNo ratings yet

- Linear Inequalities WorksheetDocument2 pagesLinear Inequalities WorksheetJaneNo ratings yet

- Linear Inequalities WorksheetDocument2 pagesLinear Inequalities WorksheetJane100% (1)

- Inequalities Worksheet: Name: - DateDocument2 pagesInequalities Worksheet: Name: - DateJaneNo ratings yet

- Inequalities Worksheet: Solve. 6 (V + 9) + 9 10 Solve. - 9 3 (R + 3)Document2 pagesInequalities Worksheet: Solve. 6 (V + 9) + 9 10 Solve. - 9 3 (R + 3)JaneNo ratings yet

- Asset Management and Profitability RatioDocument3 pagesAsset Management and Profitability RatioJaneNo ratings yet

- Inequalities Worksheet: Name: - DateDocument2 pagesInequalities Worksheet: Name: - DateJaneNo ratings yet

- Classification and Types of Historical SourcesDocument2 pagesClassification and Types of Historical SourcesJaneNo ratings yet

- Vi. Factors Affecting The Market A. DemandDocument3 pagesVi. Factors Affecting The Market A. DemandJaneNo ratings yet

- Financial Ratio - LiquidityDocument2 pagesFinancial Ratio - LiquidityJaneNo ratings yet

- Debt To Asset RatioDocument3 pagesDebt To Asset RatioJaneNo ratings yet

- Asset Management and Profitability RatioDocument3 pagesAsset Management and Profitability RatioJaneNo ratings yet

- The Repositories of Historical SourcesDocument2 pagesThe Repositories of Historical SourcesJaneNo ratings yet

- Sia Pandemic ReportDocument10 pagesSia Pandemic ReportJaneNo ratings yet

- Assumptions On SourcesDocument2 pagesAssumptions On SourcesJane0% (1)

- Where Are You NowDocument9 pagesWhere Are You NowJaneNo ratings yet

- Forensic Science International - Volume 164 PDFDocument199 pagesForensic Science International - Volume 164 PDFeduardNo ratings yet

- Liquid Marijuana Cocktail Recipe - How To Make A Liquid Marijuana Cocktail - Drink Lab Cocktail & Drink RecipesDocument1 pageLiquid Marijuana Cocktail Recipe - How To Make A Liquid Marijuana Cocktail - Drink Lab Cocktail & Drink RecipesJazymine WrightNo ratings yet

- Jewish NumerologyDocument3 pagesJewish NumerologyDivino Henrique SantanaNo ratings yet

- Group 4Document25 pagesGroup 4Gemmadel Galang DuaquiNo ratings yet

- Boosting ART Uptake and Retention Among HIV Infected Women and Their InfantsDocument4 pagesBoosting ART Uptake and Retention Among HIV Infected Women and Their InfantsDouglas ChukwuNo ratings yet

- STD 6 SSSV SST Hist CH 1 1st SemDocument2 pagesSTD 6 SSSV SST Hist CH 1 1st Sempurvesh2510No ratings yet

- 05 Május.-Uj-Beo-AlapDocument16 pages05 Május.-Uj-Beo-AlapPéter MészárosNo ratings yet

- POL - UniverDocument6 pagesPOL - Univerrahim maamriNo ratings yet

- 08 - Chapter 2 PDFDocument48 pages08 - Chapter 2 PDFpradeep bandaru0% (1)

- Admas University: Faculty of BusinessDocument5 pagesAdmas University: Faculty of Businesseyob negashNo ratings yet

- 1.2. Rules For TranslationsDocument9 pages1.2. Rules For TranslationsEmail ExampleNo ratings yet

- Food at The Restaurant Vocabulary Picture Dictionaries - 97154Document7 pagesFood at The Restaurant Vocabulary Picture Dictionaries - 97154ErmiNo ratings yet

- Embodied Yoga Principles Posture Guide Author Embodied Yoga Principles Online Teacher TrainingDocument222 pagesEmbodied Yoga Principles Posture Guide Author Embodied Yoga Principles Online Teacher TrainingKartheek ChandraNo ratings yet

- Tanween (Nunation) of The Arabic Nouns in 25 Sayings of Prophet Muhammad (PBUH)Document22 pagesTanween (Nunation) of The Arabic Nouns in 25 Sayings of Prophet Muhammad (PBUH)Jonathan MorganNo ratings yet

- BSP Bhilai Steel Plant Training ProjectDocument31 pagesBSP Bhilai Steel Plant Training ProjectAysha Rahman100% (1)

- EOU UNIT 11 - Đáp Án Eou 11Document8 pagesEOU UNIT 11 - Đáp Án Eou 11Trường Sơn NguyễnNo ratings yet

- MCES Envelop 1Document36 pagesMCES Envelop 1ralpdulayliboonNo ratings yet

- Daily Lesson Plan in Computer System Servicing Grade 9 Computer Systems Servicing Ghreven T. AngabDocument5 pagesDaily Lesson Plan in Computer System Servicing Grade 9 Computer Systems Servicing Ghreven T. AngabJerry G. GabacNo ratings yet

- Chapter 5 Part 3 - 202205161151Document6 pagesChapter 5 Part 3 - 202205161151ClydeNo ratings yet

- Culture of HaryanaDocument2 pagesCulture of HaryanaanittaNo ratings yet

- Nojpetén: EtymologyDocument6 pagesNojpetén: EtymologyOrgito LekaNo ratings yet

- Instructions To Candidate: REAS - SPL - 2019 TEST ID - RAB-87148324Document4 pagesInstructions To Candidate: REAS - SPL - 2019 TEST ID - RAB-87148324Jitendra GautamNo ratings yet

- Twelfth Night ShakespeareDocument86 pagesTwelfth Night ShakespeareCorina JulaNo ratings yet

- REVIEWER Physical-ScienceDocument6 pagesREVIEWER Physical-ScienceKyle JoseNo ratings yet

- Sample PayrollDocument6 pagesSample PayrollDeborah Fajardo ManabatNo ratings yet

- Trends in Maternal Mortality 2000 To 2020Document108 pagesTrends in Maternal Mortality 2000 To 2020shouka.inNo ratings yet

- KS0 Operation Manual-EN-V2.0Document19 pagesKS0 Operation Manual-EN-V2.0Freddie ChanNo ratings yet

- The Sales ProcessDocument19 pagesThe Sales ProcessHarold Dela FuenteNo ratings yet