Professional Documents

Culture Documents

Profitability of Natural Rubber Production and Processing A Case of Delta Rubber Company Limited OkomokoUmuanyagu Etche, Rivers State

Profitability of Natural Rubber Production and Processing A Case of Delta Rubber Company Limited OkomokoUmuanyagu Etche, Rivers State

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profitability of Natural Rubber Production and Processing A Case of Delta Rubber Company Limited OkomokoUmuanyagu Etche, Rivers State

Profitability of Natural Rubber Production and Processing A Case of Delta Rubber Company Limited OkomokoUmuanyagu Etche, Rivers State

Copyright:

Available Formats

Volume 6, Issue 5, May – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Profitability of Natural Rubber Production and

Processing: A Case of Delta Rubber Company

Limited Okomoko/Umuanyagu Etche, Rivers State

IROEGBU.I., OKIDIM, I.A, EKINE, D.I

Department of Agricultural and Applied Economics

Rivers State University, Port Harcourt.

Abstract:- The study examined the profitability of rubber seed from Ken Gardens England was introduced into

Natural Rubber Production and Processing by Delta Nigeria and planted in Sapele rubber estate in 1903, and also

Rubber Company Limited, Okomoko/Umuanyagu Etche, at Nkisi rubber estate in the then Eastern Nigeria in 1912.

Rivers State. The objectives of the study were to assess the (Uraih, 1980), Giroh (2007).

average yield of rubber plants per hectare from the

different plantations, to examine the annual turn-over The rubber tree has a milky white secretion called latex

and profit of the company for the period 2001-2004 and to which is obtained by tapping (cutting the bark of the tree)

identify the problems affecting the operation of Delta spirally to allow the flow of fluid into a collecting cup. This

Rubber Company Limited. The Company has five (5) fluid when exposed to higher temperature will coagulate and

Rubber Plantations with a total hectarage of Ten form lump. The coagulated lumps are subsequently processed

Thousand Seven Hundred (10,700) hectares. Also the into dry forms for marketing. The rubber tree (Natural rubber)

company has a crumb rubber processing factory situated takes about 5-7 year before commencement of tapping,

at Umuanyagu Etche, with a capacity of about Six however, some early maturing ones have been developed by

hundred (600) matric tonnes of crumb rubber per month the rubber Research institute (RRIN), the planting space of

or 23MT per day. But it is presently operating between 6.7m x 3.3 which give about 459 plants/ha is most

20-40% capacity utilization, processing about 10-12 MT appropriate (Williams et al. 2001), Aigbekaen et al (2000).

per day. A review of the balance sheet and income

statement of the company for the years under review Improvement in yields hectare have been recorded

showed that there was an increasing inflow of profit. through breeding programmes at the Rubber Research

Various analysis based on NPV, BCR, IRR, CCR, NCR Institute (RRIN), from 200-400 ka/ha per year to about 3500

shows as follows- (NCR>1) 1.78,3.85,3.89,4.36 for the kg/ha per year (National Agric Research project (NARP

period of 2001, 2002, 2003, 2004 while (CCR>1) with 1998).

0.804, 1.28, 1.56, 1.45, Return on Assets (ROA) was

114.7%,89.7%,84.37%,77.4% all proves that the Delta The use of Natural rubber can be divided into;

Rubber Company made profits during the period under 1. Uncured National Rubber:- This is gummy- it is easily

review. However, some problems were identified such as deformed when warm and brittle when cold. The uses of

insecurity frequent stealing and vandalization by youth, this kind are for footwear, cement, insulators, blankets,

inadequate attention by the Government. The researcher adhesives and fabrication tapes.

therefore recommended that there should be improved 2. Vulcanised rubber- These are form of natural rubber

company/host community relationship, adequate security which have been subjected to chemical processes in order

arrangement and additional capital funding by the state to convert them into more durable materials by the

Government to enable the company expand its scope of addition of sulphur. This ones are less sticky and possess

operations, and produce export grade crumb to attract superior mechanical properties, they have higher

foreign exchange and boost our Agro-sector economy. resistance characteristics to abrasion. They are used for

softer kinds of rubber valuables like conveyor belts,

I. INTRODUCTION Treads and vehicle tyres, as well as other hard rubber

valuables like rubber pipes, hoes, Gloves, masks and

Rubber and Oil palm crops are closely related as flooring materials etc.

important tropical and cash crops in Nigeria, infact they have

been described as the most coveted and most publicized of all Natural rubber performs three main functions in our

tropical crops. national economy, such as provides foreign exchange

earnings and also offers employments to a sizeable portion of

Rubber is one of the agricultural products (Cash crop) Nigerian rural farming population (Aigbekean et al 2003).

that Nigeria and West Africa has been known for. National

rubber, botanically known as Heavea brasiliensis is the most In the year 1979, the Nigerian Government formulated

popular latex producing tree. The history of rubber an economic policy to increase her resources base and to

production in Nigeria dates as far back as 1894 when the first facilitate accelerated growth in the agro-sector. This however,

IJISRT21MAY384 www.ijisrt.com 624

Volume 6, Issue 5, May – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

led to the establishment of some agro-companies in which II. METHODOLOGY

Rison Palm Limited was established in Rivers State. Delta

Rubber Company Limited has a total of five rubber plantation Study Area

/Estate situated at Abara, Odagwa, Okomoko/Umuanyagu, This study was carried out in Etche Local Government

Umuoye and Ubima/Elele all in Rivers State. The total Area of Rivers State. The local Government Area is situated

hectarage of rubber plantation is about (10700) Ten thousand on the North-East Area of Rivers State. The Local

Seven hundred ha. Government Area shares inter- state boundary with other two

neighbouring states of Imo and Abia States. Etche is blessed

The crops have average of daily yield of 200kg or 0.2 with abundant wide range of fertile land which supports the

metric tons per hectare. The crumb rubber processing factory growth of several agricultural crops like Plantain, Banana,

has a capacity of processing Six (600) hundred metric tonnes citrus, vegetables, grains (maize), yam, cassava, oil palm

or 23 MT. Per day. In 1990 Nigeria became the largest trees and Rubber etc. The people of Etche are predominantly

producer of Natural rubber in Africa, this title has since been farmers and they are known for production of crops like yam,

taken over by (Ivory Coast) Cote’d Ivoire. The trend indicates cassava, plantain. The presence of the Imo Rivers, Otamiri

that total capacities for Nigeria output are expected to fall by and Ogochie rivers makes fishing activities very prominent as

at least 50% in coming years if nothing is done (DRJ-2017). well.

More so, because of neglect by the Government the value of

rubber as a cash crop is very far below its maximum Types and Sources of Data

potentials, Nigeria is loosing upwards of N86 billion in For the purpose of this study, data were collected from

potential revenues because of her inability to supply rubber both primary and secondary sources respectively. The

export, to the rest of the world market, the total Global primary data for this work includes information from

market demand for natural rubber is about 12 million administered questionnaire, personal interview and company

MT/year at a price range of about $82-3000 per tonne. This records. On the other hand, secondary source includes,

situation however, has becomes a source of great concern in Journals, News papers and textbooks. According to the

the mind of many investors and as well as scholars. It is an administrative units of the Delta Rubber Company Limited,

obvious fact that since the discovery of oil and subsequent there are five units viz; Administration, finance,

exploration and exploitation of petroleum in Nigeria, the production/factory, Estate and security departments. From

agricultural sector has suffered much neglect and set-back. each of these units/departments, four persons were

Consequently, this neglect has affected the growth of most purposively selected and research questionnaire was

agro-based industries in Nigeria and Rubber producers are administered and retrieved. Furthermore heads of each of

not left out, as there has been a downward trend in the output department were personally interviewed.

and export of natural rubber products in recent years

(FAOSTAT, 2004). The objectives of this study includes: To On the other hand, the annual reports of the Company

assess the average yield of rubber plants per hectare, annum, for the years 2001, 2002, 2003, 2004 were also examined and

from the different rubber plantation owned by the Delta information extracted for analysis.

Rubber Company. To examine the annual turn-over and profit

of the company for the period of 2001-2004. To identify if Analytical Techniques

any, the problems affecting the operations of Delta Rubber The researcher employed a number of analytical

Company limited and to make possible recommendations. measures to evaluate the performance of rubber crops from

The findings or result of this study will provide the basis for the different locations/Estates as well as the performance of

improvement and expansion of rubber production and the crumb factory/processing plant.

processing by the Delta Rubber Company Limited. It will

also serve as a basis for further studies in related field to Analytical tools like tables, chart, percentages were

improve the profitability of the company, also policy makers used to compare output and the processing plant output

will find this study useful, especially as it concerns economic capacity for the different years. Statistical evaluation based

diversification and growth. on the use of Net Present Value (NPV), Benefit cost Ratio

(BCR), Internal Rate of Returns (IRR) were carried out to

ascertain the viability of the company’s operations. Also

current Capital Ratio’s calculated for the different years under

review. These enabled the study to make adequate

comparison of the company’s output to ascertain profitability.

IJISRT21MAY384 www.ijisrt.com 625

Volume 6, Issue 5, May – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

III. RESULTS AND DISCUSSION

Table 1.0 Rubber output per day/month/year in metric tons.

Estate/Location Hectarage Output/Day Month Year

Abara 2000 400mt 12000 144,000

Odagwa 2000 400mt 12000 144,000

Okomoko/Umuanayagu 2100 420mt 12600 151,200

Umuoye 2000 400mt 12000 144,000

Ubima/Elele 2600 520 mt 15600 187,200

Total 10,700 2140 64,200 770,400

Source: Field survey, May 2005

Table 1.0 shows estimated rubber output from the day was about 2140 metric tons, while total output per month

different locations. The output per day output per month and was about 64,200 metric tons, with annual output of 770,400

annual yield of crops from the different locations shows that metric tone.

given the average yield of 0.2 ton per day, the total output per

RUBBER SALES

Table 2.0 Rubber sales in Naira for the years 2001-2004

Years Crumb Product/Sales Wood Total

Lump

2001 85,374,453 500,000 842,693 86,717,146

2002 73,520,000 8,049,363 246,358 81,815,721

2003 80,250,000 10,334,344 650,000 91,234,344

2004 70,734,000 6,628,336 204,386 77,566,722

Total 309,878,453 25,512,042 1943,437 337,333,933

Source: Annual Report Delta Rubber company Limited 2001-2005

Going through Table 2.0, it is seen that the highest sales between the company and one of the host communities,

were recorded in the year 2003 with a total sale of over Ubima/Elele when the estate was seized and company

Ninety one Million Naira (N91,234,344.00). This is also equipment were vandalized by the restive youths from the

followed by the year 2001 with a total sale of over Eighty Six area. This incident automatically affected the output of that

million Naira. (N86,717, 146.00) the lowest sales were year and resulted in low sales and low turnover.

recorded in the year 2004, this was due to the problem

Table 3.0 Estimated revenue from the crumb rubber processing factory at differrent percentage capacity utilization and at

a price range 240,000-320,000 per metric ton.

A=100%; B = 50% ; C = 22%

A: Output/Month Price/Metric Ton Price/Metric Ton

600 metric tons 240,000 320,000

Monthly Revenue 144,000,000 192,000,000

Annual Revenue 1,728,000,000 2,304,000,000

B: Output/Month Price/Metric Ton Price/Metric Ton

300 metric tons 240,000 320,000

Monthly Revenue 72,000,000 96,000,000

Annual Revenue 864,000,000 1,152,000,000

B: Output/Month Price/Metric Ton Price/Metric Ton

130 metric tons 240,000 320,000

Monthly Revenue 31,000,000 41,600,000

Annual Revenue 374,000,000 499,200,000

Sources: Field survey May, 2005

Table 3.0 shows that the crumb rubber processing 320,000/metric tone we have a monthly revenue of

factory has a full capacity of processing about 600 metric 192,000,000 and an annual revenue of about 2,304,000,000.

tons of crumb rubber in a month and given the two price This is at 100% capacity utilization.

range of 240,000-320,000/metric ton, we can see that at

240,000/metric tone we have a monthly revenue of 144,000 The table also showed that at 50% capacity utilization it

and an annual revenue of 1,728,000,000. But if sold at could process about 300 metric tons of crumb in a month,

IJISRT21MAY384 www.ijisrt.com 626

Volume 6, Issue 5, May – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

with the different prices of 240,000 and 320,000/metric ton, Comparing the two tables 2.0 and 3.0 it was shown that,

we have a monthly revenue of 72,000,000 and 96,000,000 the crumb sales in table 2.0 shows that Delta Rubber

and an annual revenue of 864,000,000 and 1,152,000,000 Company crumb factory was functioning between 20-40%

respectively. On the other hand at 22% capacity utilization, capacity utilizations. This situation is a proof of gross under

the machine process revenue of 31,000,000 and 41,600,000 utilization of the factory equipment, this trend is very

or an annual revenue of about 374,000,000 and 499,200,000 common to most Agro-equipments in Nigeria and this

respectively. eventually results in non-development of Agriculture in the

country.

Table 4.0 Estimated monthly sales of lump from the different estates/location price range of 30,000 and 35000 per metric ton.

Estate/Location Output/Month Prices in “N” N30,000

N35,000

Abara 12,000 metric ton 360,000,000 420,000,000

Oduagwa 12,000 metric ton 360,000,000 420,000,000

Okomoko/Umuanyagu 12,600 metric ton 378,000,000 441,000,000

Umuoye 12,000 metric ton 360,000,000 420,000,000

Ubima/Elele 15,600 metric ton 468,000,000 546,000,000

Total 64,200 metric tons 1,926,000,000 2,247000,000

Source: Field survey 2005.

Considering the data on Table 4.0 above, given the Delta Rubber Company Limited for proper understating of

prevalent lump prices of between 30,000 and 35,000 per the true position of the Assets and Liabilities, including the

metric tone of lump, we can rightly see the company will owner’s equity. The study took a look at the Balance sheet.

make sales that runs into Billions and Millions of Naira as And also it is proper to consider the profit and loss

displayed on the table 4.0. This sales estimated could serve as account/income statement of the company for the years under

a re-assurance to the operators of the rubber company. review. Hence the Net Present Value (NPV) the Benefit cost

ratio (BCR) the Internal Rate of Returns (IRR) as well as the

Profitability and Viability Analysis Net current Ratio (NCR) Retuen on assets (ROA) and current

At this juncture it is proper to introduce some capital Ratio (CCR) are calculated.

profitability measures to actually evaluate the operations of

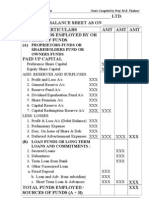

Table 5.0 Showed Delta Rubber Company Balance Sheet as at 31/12/ 2001

Delta Rubber Company LTD. Balance Sheet as At 31/12 2001

SCHEDULE VALUE (N) SCHEDULE VALUE (N)

ASSETS LIABILITIES

Fixed Assets 40,040,535

Building Under CURRENT LIABILITIES

Construction 1,391,024 Creditor 39,808,688

41,431,559 Provision for Tax 2,698,340

Current Assets: Proposed dividend: -

Stocks 8,596,356

Debtors 7,352,022

Bank & Cash Bal. 18,227,903

34,176,281 42,507,028

NET WORTH 33,100,812

TOTAL = 75,607,840 75,607,840

Source: Delta Rubber Company Ltd. Annual Report 2001

Percentage Return on Assets = 114.7%

Current Capital Ratio (CCR) = 0.804

Net Capital Ratio (NCR) = 1.78

IJISRT21MAY384 www.ijisrt.com 627

Volume 6, Issue 5, May – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Table 6.0. Showed Delta Rubber Company Balance Sheet as at 31/12/ 2002

Delta Rubber Company LTD. Balance Sheet as At 31/12 2002

SCHEDULE VALUE (N) SCHEDULE VALUE (N)

ASSETS LIABILITIES

Fixed Assets 55,570,843

Building Under CURRENT LIABILITIES

Construction 5,323,022 Creditor 21,064,155

60,893,865 Provision for Tax 2,698,340

Current Assets: Proposed dividend: - -

Stocks 9,957,790

Debtors 18,375,503 23,762,495

Bank & Cash Bal. 2,147,123 NET WORTH

34,176,281 67,609,786

TOTAL = 91,372,281 91,372,281

Source: Delta Rubber Company Ltd. Annual Report 2002

Percentage Return on Assets = 89.7%

Current Capital Ratio (CCR) = 1.28

Net Capital Ratio (NCR) = 3.85

Table 7.0. Showed Delta Rubber Company Balance Sheet as at 31/12/ 2003

Delta Rubber Company LTD. Balance Sheet as At 31/12 2003

SCHEDULE VALUE (N) SCHEDULE VALUE (N)

ASSETS LIABILITIES

Fixed Assets 58,570,384

Building Under CURRENT LIABILITIES

Construction 6,233,584 Creditor 25,056,405

64,938,968 Provision for Tax 2,698,340

Current Assets: Proposed dividend: -

Stocks 12,123,384 27,754,745

Debtors 25,333,305

Bank & Cash Bal. 5,741,321 NET WORTH 80,381,840

43,197,617 108,136,585

TOTAL = 108,136,585

Source: Delta Rubber Company Ltd. Annual Report 2003

Percentage Return on Assets = 84.37%

Current Capital Ratio (CCR) = 1.56

Net Capital Ratio (NCR) = 3.89

Table 8.0 Showed Delta Rubber Company Balance Sheet as at 31/12/ 2004

Delta Rubber Company LTD. Balance Sheet as At 31/12 2004

SCHEDULE VALUE (N) SCHEDULE VALUE (N)

ASSETS LIABILITIES

Fixed Assets 60,070,000

Building Under CURRENT LIABILITIES

Construction 6,500,000 Creditor 20,550,000

66,570,000 Provision for Tax 2,698,340

Current Assets: Proposed dividend: -

Stocks 8,025,000

Debtors 20,385,700 22,898,340

Bank & Cash Bal. 4,947,321

33,358,021 NET WORTH 77,028,021

TOTAL = 22,928,021 99,928,021

Source: Delta Rubber Company Ltd. Annual Report 2004

IJISRT21MAY384 www.ijisrt.com 628

Volume 6, Issue 5, May – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Percentage Return on Assets = 77.4%

Current Capital Ratio (CCR) = 1.45

Net Capital Ratio (NCR) = 4.36

A consideration of the Balance sheet of the company for the years 1996-1999 as shown in tables 5.0 to 8.0, The table

showed that in the year 2001 the percentage Return on Assets was very high with 114.7%, this was due to the fact that the various

machineries and equipment were all efficient and there were less depreciations but in the subsequent years depreciation on assets

increased and this results to a gradual reduction in Percentage Return on Assets to be least in 2004 with 77.4%. On the other hand

current Capital Ratio (CCR) and Net Capital Ratio (NRC) were all rising. This was so because the overall assets of the company

had increased and company stock was rising. In 2001 the Net Capital Ratio (NCR) was 1.7%, this rose considerable to 4.36% in

the year 2004 this was due to the reduction in the liabilities of the company from about Forty Two Million naira in 2001 about

twenty two million naira in 2004. Also the value of fixed assets increased from about Forty One Million naira in 2001 to about

sixty million in 2004. With this result it means that, for every naira invested on the project, the company covers cost and makes

profit or about (N1.40) on each naira spent. This is a positive sign that the project is viable. According to Adegeye et al (1985), if

the Current Capital Ratio (CCR) and the Net Capital ratio (NCR) are greater than 1, (CCR>1), (NCR>1), then accept project as

profitable, therefore we at this point conclude that the Delta Rubber company project is profitable.

The relationship between total cost (TC) and total revenue (TR) and the profit range for the different years 2001-2004 could

be seen in Table 9.0 and fig. 1.0 that follows;

Table 9.0 Delta Rubber Company Profit Range for 2001-2004

Years Total Revenue (TR) Total Cost (TC) Profits

1996 86,717,146 74,809,632 11,907,514

1997 81,815,721 61,141,140 20,667,581

1998 91,234,344 61,885,299 29,349,045

1999 77,566,722 56,605,065 20,961,657

Total 337,333,933 254,447,877 82,885,897

Source: Field survey 2005.

Figure 1.0 Graph Showing Total Revenue TR. Total Cost (TC) and Profit Margin

Key:

TR =Total Revenue

TC = Total Cost

From the above graph it is seen that in the first year community, the reduction in out affected Total Revenue

2001, the Total Revenue (TR) was slightly above the Total (TR), this could be seen in the figure 1.0 above.

cost (TC), the fact that (TR) was above (TC) shows that the

company was making profit in that year. But in the next year Further evaluation based on other statistical tools is as

2002, the margin became wider as the Total Cost (TC) began follows:

to drop sharply indicating increasing profit. In 2003 there was

an increase in output resulting to a rise in Total Revenue (TR) (1) NET PRESENT VALUE (NPV)

very high above Total cost (TC). this relationship resulted to NPV at 15% Discount Factor (Interest rate) =

a very high profit margin for that year. In 2004, total output 6,114,520.8

dropped drastically due to the seizure of one of the NPV at 30% Discount Factor (Interest rate) =

company’s estate at Ubima/Elele by the youths of the host 63,914.6

IJISRT21MAY384 www.ijisrt.com 629

Volume 6, Issue 5, May – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

NPV at 40% Discount Factor (Interest rate) = (BCR>1). We declare that Rubber production and

180,528.8 processing by Delta Rubber Company Limited for the

period under review is profitable.

Rule: Accept Project as viable if (NPV) is positive

Internal Rate Returns (IRR). The results shows that IRR

Decision: Where as our NPV at different interest rates of were all higher and above the least Bank rates. Therefore, the

15%, 30% and 40% were positive, we therefore accept that business is viable. Which implies that if the company had

the Delta, Rubber company project was viable within these borrowed money to invest, at the end they could still break-

period. even (Cover-cost) and make some profit.

II) BENEFIT COST RATIO (BCR) On the other hand, the Net Capital Ratio (NCR)and

BCR at 20% Interest rate - 1.31% Current Capita Ratio (CCR) indicated positive increments.

BCR at 30% Interest rate - 1.03% This finding supports earlier facts established by Chaudhry

BCR at 40% Interest rate - 1.27% (1996) and Fubara (1981), who opined that investment in

Delta Rubber Company Limited is a worth-while venture.

Rule: Accept project as profitable if the Benefit Cost Ratio Therefore regardless of the Craze for synthetic rubber as a

(BCR) is positive and greater than 1 cheap substitute, National rubber production and processing

is still a profitable venture. Infact, Agbolagba (2003) had

Decision: Where as our BCR at 20% is 1.131%, BCR at 30% since identified existing International Market for our Local

= 1.03% and at 40% 1.27% which are all greater than 1, rubber products.

(BCR>1) we therefore declare that the company’s operation

is profitable within the period under study RECOMMENDATIONS

iii) INTERNAL RATE OF RETURNS (IRR) There is need for the company to expand its scope of

Given the cost, Revenue and incremental benefit operation to meet export grade crumb which will attract

as shown in Table 4.11, we can calculate the (IRR) at foreign exchange earnings, the State and the country at large.

different interest rates as follows.

Efforts should be stepped up to ensure that the crumb

Therefore, IRR at 15% and 30% = 28.6% rubber processing plant operates at the normal capacity, by

IRR at 25% and 40% = 39.3% way of increasing factory capacity utilization to about 95-

IRR at 30% and 40% = 37.8% 100%.

IRR at 40% and 50% = 48.6%

Appropriate measure should be put in place to minimize

Rule: Accept project as valuable if the (IRR) is higher than waste.

the interest rates.

Operators should be encouraged through viable

Decision: Following the data and the result of the IRR at government policies and support to enhance diversification.

different interest rates, it reported

REFERENCES

That at the various Bank rates used, the IRR were all

higher and above the least Bank rates. This implies that if the [1]. Abolagba, E. O., Aigbekaen, E. O & Omakafe (2003).

company had borrowed money to invest in the business in the Farm gate marketing of Nigerian Rubber in the South

end, they could still break-even (cover cost) and make some East rubber growing zone of Nigeria. Nigerian Journal

profit on any naira invested on the business. With this results of Agric. And Rural Development 6:40-48.

the profitability of investment in Delta Rubber Company [2]. Aigbekaen, E.O., Imarhiagbe, E.O and Omokhafe, K.O

Limited within the period of study was not in doubt, and one (2000). Adoption of some recommended Agronomic

will not hesitate to encourage more investment in the Practices of Natural Rubber in Nigeria. Journal of

company (see Appendix for the computation of NPV, BCR Agriculture, Forest and Fisheries 1 and 2 : 51-56.

and (IRR). [3]. Chaudhry, S. (1996). Expanding International Markets

for Rubber Productions, International Trade forum,

IV. CONCLUSION 1996 . 3:26-33.

[4]. DRJ-Direct Research Journal (2017). Nigeria Rubber

The results from this study shows that, based on several Industries Statistics and Trend.

financial ratios and evaluation/analytical tools adopted, Delta [5]. FAO STAT. (2004) Food and Agricultural

Rubber Company Limited maintain a positive balance sheet. Organisation. Statistic 2004.

Investment in this company has been viable and profitable. [6]. Fubara, B. A (1981). Economic take-off through Agro-

* Net Present Value (NPV) at different rates of 15%, 30% based Secondary Industries in Nigeria “The case of

and 40% were all positive. Delta Rubber Company Limited”. In Abstracts of a

* Benefit Cost Ratio (BCR) at various interest rates of 20%, National Conference on Agric. Pg 91.

30% and 40% were all positive and greater than 1 (BCR>

1), therefore, BCR at various rates were greater than 1

IJISRT21MAY384 www.ijisrt.com 630

Volume 6, Issue 5, May – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[7]. Giroh, D. Y. (2007). Profitability Analysis of Natural

Rubber Tapping in Southern Nigeria. Journal of

Research in Natural Rubber Development. 5(2).

[8]. National Agricultural Research Projects NARP (1998)

External Review Panel Reports on National Agric.

Research Institute in Nigeria. P.22.

[9]. Uraih, O.B. C (1980). A study of the Tappers Training

Programme in Rubber Estates of Bendel State, Nigeria:

Unpublished M.Sc. Thesis, University of Ibadan,

Nigeria .

[10]. Williams, S. E., Van Noordwijk, M. Perot, E. Heady, J.

R, Sinclair, F. I and Wibawa, G. (2001). On farm

evaluation of the establishment of conal rubber in multi-

strata Agro-forest in Jambi. Indonesia, Agro-forest

Systems. 53:227-237

IJISRT21MAY384 www.ijisrt.com 631

You might also like

- 12 Audit of Hotel ChecklistDocument5 pages12 Audit of Hotel ChecklistPrakash Gopalkrishnan82% (11)

- RBC: Social Network Analysis: Submitted by - Group 14Document6 pagesRBC: Social Network Analysis: Submitted by - Group 14Saurabh GaiakwadNo ratings yet

- Greenpeace 2012Document1 pageGreenpeace 2012Uý ĐạiNo ratings yet

- Vertical Balance SheetDocument6 pagesVertical Balance Sheethaseeb_tankiwalaNo ratings yet

- Eun 9e International Financial Management PPT CH01 AccessibleDocument29 pagesEun 9e International Financial Management PPT CH01 AccessibleDao Dang Khoa FUG CTNo ratings yet

- Iso 17021Document121 pagesIso 17021IngDanielMartinez100% (1)

- Factors Affecting Exchange RateDocument2 pagesFactors Affecting Exchange RateTikitaka TitiNo ratings yet

- 10-4 Can Australia Learn Policy Lessons From Other CountriesDocument6 pages10-4 Can Australia Learn Policy Lessons From Other CountriesTariq Hussain100% (1)

- Concept Note On Advocacy Activities of CCIDocument8 pagesConcept Note On Advocacy Activities of CCIazizullakhanNo ratings yet

- Case 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Document14 pagesCase 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Santiago BuladacoNo ratings yet

- Aghalino Oil Exploration and Its Impact On The Nigerian EnviDocument11 pagesAghalino Oil Exploration and Its Impact On The Nigerian EnviEkele ˚͜˚ Abel100% (1)

- Copper Boom and Bust in Zambia The Commodity Currency LinkDocument16 pagesCopper Boom and Bust in Zambia The Commodity Currency LinkAndres GonzalezNo ratings yet

- State of The Nation Address 2023Document51 pagesState of The Nation Address 2023The New VisionNo ratings yet

- Diplomatic AgentsDocument9 pagesDiplomatic AgentsKusum AtriNo ratings yet

- Corporate Social Responsibility in The Mining InduDocument32 pagesCorporate Social Responsibility in The Mining InduKalompo Kaneheemia AmupandaNo ratings yet

- Influence of Bilateral Investment Treaties On Customary International LawDocument4 pagesInfluence of Bilateral Investment Treaties On Customary International LawBhavana ChowdaryNo ratings yet

- Impact of Multinationals in Developing Countries PDFDocument32 pagesImpact of Multinationals in Developing Countries PDFmubarakNo ratings yet

- Ok Tedi Mine:: Unearthing ControversyDocument10 pagesOk Tedi Mine:: Unearthing Controversyhardika putraNo ratings yet

- Trade Blocks and TreatiesDocument123 pagesTrade Blocks and TreatiesStuti Sharma GaurNo ratings yet

- MNC and EnvironmentDocument15 pagesMNC and EnvironmentAzwan AyopNo ratings yet

- The IMF (International Monetary Fund) and Its Implications in ArgentinaDocument8 pagesThe IMF (International Monetary Fund) and Its Implications in ArgentinaDora S DejeuNo ratings yet

- International Economic InstitutionsDocument43 pagesInternational Economic Institutionssangeetagoele100% (1)

- Fiat Currency - Wikipedia, The Free EncyclopediaDocument8 pagesFiat Currency - Wikipedia, The Free Encyclopediamarcus100% (3)

- Adir NgoDocument26 pagesAdir NgoGUPTE SHARVILNo ratings yet

- Strategic Business Analysis Co9 Case Study Final: Norway'S Pension GlobalDocument2 pagesStrategic Business Analysis Co9 Case Study Final: Norway'S Pension GlobalShirley Ann ValenciaNo ratings yet

- Opportunities For The Private Sector in The Climate Sector in TanzaniaDocument3 pagesOpportunities For The Private Sector in The Climate Sector in TanzaniaAnonymous FnM14a0No ratings yet

- Climate Change and FloodingDocument14 pagesClimate Change and FloodingAlissa MorriesNo ratings yet

- Natural Resource CurseDocument10 pagesNatural Resource CursehishamsaukNo ratings yet

- TENDERDOCUMENT Bareilly AlmoraDocument193 pagesTENDERDOCUMENT Bareilly AlmoraPaper BroomNo ratings yet

- Karamoja A Literature Review PDFDocument36 pagesKaramoja A Literature Review PDFStephen Kaduuli100% (1)

- CO2 To Chemicals Industrial Percpective rv1Document25 pagesCO2 To Chemicals Industrial Percpective rv1Nanda KumarNo ratings yet

- Nagoya Protocol and Its Implications On Pharmaceutical IndustryDocument10 pagesNagoya Protocol and Its Implications On Pharmaceutical IndustryBeroe Inc.No ratings yet

- Magurchara-Tengratila Gas Field Accidents and Bhopal ExperienceDocument3 pagesMagurchara-Tengratila Gas Field Accidents and Bhopal ExperienceMohammad Shahjahan Siddiqui100% (1)

- Property Tax Regimes in East AfricaDocument58 pagesProperty Tax Regimes in East AfricaUnited Nations Human Settlements Programme (UN-HABITAT)No ratings yet

- International Financial MGT JournalDocument257 pagesInternational Financial MGT Journaljonas sserumagaNo ratings yet

- GATT To WTO PesentationDocument13 pagesGATT To WTO PesentationsusanNo ratings yet

- Acquisition of Mining Claims in ZimbabweDocument8 pagesAcquisition of Mining Claims in ZimbabweErrol Smythe50% (2)

- What You Need To Know About Labour Law On Labour Day by Isaac Christopher LubogoDocument41 pagesWhat You Need To Know About Labour Law On Labour Day by Isaac Christopher LubogoIsaac Christopher LubogoNo ratings yet

- Doing Business in India A Country Commercial Guide For U S CompaniesDocument181 pagesDoing Business in India A Country Commercial Guide For U S CompaniesInsideout100% (19)

- United States Bankruptcy Court Eastern District of MichiganDocument28 pagesUnited States Bankruptcy Court Eastern District of Michiganjohnathen savannah100% (1)

- Decoupling: Natural Resource Use and Environmental Impacts From Economic GrowthDocument174 pagesDecoupling: Natural Resource Use and Environmental Impacts From Economic GrowthUnited Nations Environment ProgrammeNo ratings yet

- Case Study: Lnternet ResourcesDocument3 pagesCase Study: Lnternet ResourcesMeenakshi SinghNo ratings yet

- Research Briefing - Africa Country Insight: Egypt: AnalystDocument6 pagesResearch Briefing - Africa Country Insight: Egypt: AnalystMohammed El-GezeiryNo ratings yet

- World BankDocument20 pagesWorld Banksaad124No ratings yet

- Lecture - 8 - CompLaw - Shares N DebenturesDocument16 pagesLecture - 8 - CompLaw - Shares N DebenturestaxicoNo ratings yet

- Public Housing Delivery Strategies in NigeriaDocument9 pagesPublic Housing Delivery Strategies in NigeriaAbraham OwoseniNo ratings yet

- Agrisol Energy Tanzania - Letter To TanzaniaDocument3 pagesAgrisol Energy Tanzania - Letter To Tanzaniaserengeti_advisersNo ratings yet

- Determinants of Non Performing Loans in Commercial Banks: A Study of NBC Bank Dodoma TanzaniaDocument25 pagesDeterminants of Non Performing Loans in Commercial Banks: A Study of NBC Bank Dodoma TanzaniaEdlamu Alemie100% (1)

- Case Study The Government Pension Fund Global GPFG in Norway 1Document16 pagesCase Study The Government Pension Fund Global GPFG in Norway 1Reymond Homigop GalarpeNo ratings yet

- IMF and INDIa FileDocument23 pagesIMF and INDIa FilehocordinatoreNo ratings yet

- SPL Risk Related To Trading Financial InstrumentsDocument18 pagesSPL Risk Related To Trading Financial InstrumentsDenis DenisNo ratings yet

- Exploring Islamic Common MarketDocument3 pagesExploring Islamic Common MarketHussain Mohi-ud-Din QadriNo ratings yet

- Sustainable Development in SingaporeDocument5 pagesSustainable Development in SingaporeSuffyan OthmanNo ratings yet

- Merger Motivations: Corporate Financial Management - MSC 11 Pre-Course Assignment "Exxonmobil Merger"Document7 pagesMerger Motivations: Corporate Financial Management - MSC 11 Pre-Course Assignment "Exxonmobil Merger"Bobby Boris80% (5)

- Alternative Dispute ResolutionDocument71 pagesAlternative Dispute ResolutionAkoth ScholarNo ratings yet

- SustainabilityDocument13 pagesSustainabilityb_benillesNo ratings yet

- Blood Diamond - SummaryDocument2 pagesBlood Diamond - SummaryKaustubh TirpudeNo ratings yet

- Immigration Case StudyDocument2 pagesImmigration Case StudyPabloNo ratings yet

- Nokia Case StudyDocument39 pagesNokia Case StudySumita DattaNo ratings yet

- Presented By: David D'Penha 33 Deepa Thakkar 34 Gayatri Das 48 Kunali Shah 69Document21 pagesPresented By: David D'Penha 33 Deepa Thakkar 34 Gayatri Das 48 Kunali Shah 69David Jonathan D'PenhaNo ratings yet

- Negociating The TTIPsDocument3 pagesNegociating The TTIPsAleksandra VonicaNo ratings yet

- Foreign Direct Investment in Brazil: Post-Crisis Economic Development in Emerging MarketsFrom EverandForeign Direct Investment in Brazil: Post-Crisis Economic Development in Emerging MarketsRating: 1 out of 5 stars1/5 (1)

- A Corporate Solution to Global Poverty: How Multinationals Can Help the Poor and Invigorate Their Own LegitimacyFrom EverandA Corporate Solution to Global Poverty: How Multinationals Can Help the Poor and Invigorate Their Own LegitimacyNo ratings yet

- Reflections on the Debate Between Trade and Environment: A Study Guide for Law Students, Researchers,And AcademicsFrom EverandReflections on the Debate Between Trade and Environment: A Study Guide for Law Students, Researchers,And AcademicsNo ratings yet

- Lessons from ADB Transport Projects: Moving Goods, Connecting People, and Disseminating KnowledgeFrom EverandLessons from ADB Transport Projects: Moving Goods, Connecting People, and Disseminating KnowledgeNo ratings yet

- Gender-Based Violence: Engaging Children in the SolutionDocument10 pagesGender-Based Violence: Engaging Children in the SolutionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Investigation Model to Combat Computer Gaming Delinquency in South Africa, Server-Based Gaming, and Illegal Online GamingDocument15 pagesAn Investigation Model to Combat Computer Gaming Delinquency in South Africa, Server-Based Gaming, and Illegal Online GamingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Integrating Multimodal Deep Learning for Enhanced News Sentiment Analysis and Market Movement ForecastingDocument8 pagesIntegrating Multimodal Deep Learning for Enhanced News Sentiment Analysis and Market Movement ForecastingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Development of ‘Creative Thinking: Case Study of Basic Design StudioDocument9 pagesDevelopment of ‘Creative Thinking: Case Study of Basic Design StudioInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Comparative Analysis of Pineapples (Ananas Comosus) from Different Bioethanol Sources Available in the PhilippinesDocument39 pagesA Comparative Analysis of Pineapples (Ananas Comosus) from Different Bioethanol Sources Available in the PhilippinesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Evaluation of Causes of Visual Impairment Among Bespectacled Between the Age 18-23: A Study from Tamil Nadu, IndiaDocument3 pagesEvaluation of Causes of Visual Impairment Among Bespectacled Between the Age 18-23: A Study from Tamil Nadu, IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- An Awareness Study on Cardiac Injury during Fitness Exercises: A Study from Tamil Nadu, IndiaDocument4 pagesAn Awareness Study on Cardiac Injury during Fitness Exercises: A Study from Tamil Nadu, IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Relationship between Knowledge about Halitosis and Dental and Oral Hygiene in Patients with Fixed Orthodontics at the HK Medical Center MakassarDocument4 pagesThe Relationship between Knowledge about Halitosis and Dental and Oral Hygiene in Patients with Fixed Orthodontics at the HK Medical Center MakassarInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Synergizing for Students Success: A Collaborative Engagement of Parent-Teacher in Grade FourDocument13 pagesSynergizing for Students Success: A Collaborative Engagement of Parent-Teacher in Grade FourInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Monetary and Non-Monetary Rewards for Employees Motivation in Tanzania Public Sector: The Management PerspectivesDocument8 pagesMonetary and Non-Monetary Rewards for Employees Motivation in Tanzania Public Sector: The Management PerspectivesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Personality Factors as Predictors of the Level of Personality Functioning in Adolescence: Examining the Influence of Birth Order, Financial Status, and SexDocument10 pagesPersonality Factors as Predictors of the Level of Personality Functioning in Adolescence: Examining the Influence of Birth Order, Financial Status, and SexInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Prevalence of Metabolic Syndrome in IndiaDocument11 pagesPrevalence of Metabolic Syndrome in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Water Heritage DocumentationDocument45 pagesWater Heritage DocumentationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Modified Hourgand Graph Metric DimensionsDocument7 pagesModified Hourgand Graph Metric DimensionsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Peter's Trypanophobia and HemophobiaDocument9 pagesPeter's Trypanophobia and HemophobiaInternational Journal of Innovative Science and Research Technology100% (1)

- Unraveling the Nuanced Nature of Secrets: Psychological Implications of Concealment and DisclosureDocument6 pagesUnraveling the Nuanced Nature of Secrets: Psychological Implications of Concealment and DisclosureInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Unveiling Victor Hugo through Critical Race Theory Feminist Lens: A Social Constructivist ApproachDocument7 pagesUnveiling Victor Hugo through Critical Race Theory Feminist Lens: A Social Constructivist ApproachInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Encouraging Leadership as Mediator on Supportive Work Atmosphere and Instructional Inventiveness of TeachersDocument11 pagesEncouraging Leadership as Mediator on Supportive Work Atmosphere and Instructional Inventiveness of TeachersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Underwater Image Enhancement using GANDocument9 pagesUnderwater Image Enhancement using GANInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Bullying and Grades: Insights from Junior High Students in a Catholic InstitutionDocument12 pagesBullying and Grades: Insights from Junior High Students in a Catholic InstitutionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Appendicitis Hidden under the Facade of Addison’s Crisis: A Case ReportDocument2 pagesAppendicitis Hidden under the Facade of Addison’s Crisis: A Case ReportInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Outdoor Learning and Attitude towards Sustainability of Grade 3 TeachersDocument10 pagesOutdoor Learning and Attitude towards Sustainability of Grade 3 TeachersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- .Sense of Self-Worth as Predictor of Learning Attitude of Senior High School Students in New Corella District, Davao Del NorteDocument12 pages.Sense of Self-Worth as Predictor of Learning Attitude of Senior High School Students in New Corella District, Davao Del NorteInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Liver Abscess Caused by Foreign BodyDocument5 pagesLiver Abscess Caused by Foreign BodyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Supportive Learning Environment and Assertive Classroom Management Strategies as a Contributing Factor of the Academic Resiliency of T.L.E. StudentsDocument10 pagesSupportive Learning Environment and Assertive Classroom Management Strategies as a Contributing Factor of the Academic Resiliency of T.L.E. StudentsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Proposed Model for Fainting People Detection Using Media Pipe TechnologyDocument4 pagesA Proposed Model for Fainting People Detection Using Media Pipe TechnologyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Evaluating the Performance of Vapor Compression Cycle by Adding NanoparticleDocument12 pagesEvaluating the Performance of Vapor Compression Cycle by Adding NanoparticleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Automatic Essay Scoring with Context-based Analysis with Cohesion and CoherenceDocument8 pagesAutomatic Essay Scoring with Context-based Analysis with Cohesion and CoherenceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design Information Security in Electronic-Based Government Systems Using NIST CSF 2.0, ISO/IEC 27001: 2022 and CIS ControlDocument8 pagesDesign Information Security in Electronic-Based Government Systems Using NIST CSF 2.0, ISO/IEC 27001: 2022 and CIS ControlInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring Well-being in College Students: The Influence of Resilience and Social SupportDocument11 pagesExploring Well-being in College Students: The Influence of Resilience and Social SupportInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Program Invite On Personal Branding 1Document5 pagesProgram Invite On Personal Branding 1John DemelloNo ratings yet

- Office ManagementDocument6 pagesOffice ManagementRanjan MayanglambamNo ratings yet

- Financial Accounting - Course OutlineDocument9 pagesFinancial Accounting - Course Outlineaditya nemaNo ratings yet

- Appendix B: Pestle AnalysisDocument2 pagesAppendix B: Pestle AnalysisDerick cheruyotNo ratings yet

- Ntuthuzelo ShoshaDocument3 pagesNtuthuzelo ShoshaNtuthuzelo ShoshaNo ratings yet

- Earned-Value-Analysis SheetDocument5 pagesEarned-Value-Analysis SheetJAZPAKNo ratings yet

- HSE-P-02 Regulatory Tracking Issue 2.1Document2 pagesHSE-P-02 Regulatory Tracking Issue 2.1eng20072007No ratings yet

- Awareness Posters - ISODocument17 pagesAwareness Posters - ISOrahim80abNo ratings yet

- Service Marketing: Prepared by Prof Jitendra Patel Assistant Professor PimrDocument52 pagesService Marketing: Prepared by Prof Jitendra Patel Assistant Professor PimrShipra BhutaniNo ratings yet

- Case 28 AutozoneDocument39 pagesCase 28 AutozonePatcharanan SattayapongNo ratings yet

- Tutorial 1 Part 1. Questions For ReviewDocument4 pagesTutorial 1 Part 1. Questions For ReviewPham Thuy HuyenNo ratings yet

- NISM - Series V A - Model Question Bank With Answer KeyDocument13 pagesNISM - Series V A - Model Question Bank With Answer KeyRing RoadNo ratings yet

- Free Cash Flow (FCF) : Balance Sheet of Axis Bank - in Rs. Cr.Document4 pagesFree Cash Flow (FCF) : Balance Sheet of Axis Bank - in Rs. Cr.Kushal GuptaNo ratings yet

- Statement On Eradicating Modern Slavery in Supply ChainsDocument2 pagesStatement On Eradicating Modern Slavery in Supply ChainsladyindigoNo ratings yet

- Ducati Valuation - LPDocument11 pagesDucati Valuation - LPuygh gNo ratings yet

- Analysis of The Factors Affecting Devident PolicyDocument12 pagesAnalysis of The Factors Affecting Devident PolicyJung AuLiaNo ratings yet

- Rajkumar ResumeDocument2 pagesRajkumar ResumerajkumarjkNo ratings yet

- Case Study Exceptions and Investigations National Bank of CanadaDocument2 pagesCase Study Exceptions and Investigations National Bank of CanadaaNo ratings yet

- Collections Billing Manager in Dallas FT Worth TX Resume Mark SimsDocument2 pagesCollections Billing Manager in Dallas FT Worth TX Resume Mark SimsMarkSimsNo ratings yet

- Fee Structure 2021Document5 pagesFee Structure 2021lethabozitha41No ratings yet

- Welcome: Syamala Devi Institute of Technology, NandyalDocument68 pagesWelcome: Syamala Devi Institute of Technology, NandyalShanmuka SreenivasNo ratings yet

- Acct Statement XX0667 11102022Document8 pagesAcct Statement XX0667 11102022Mantasha Financial servicesNo ratings yet

- Best Buy Strategic Management Term PaperDocument41 pagesBest Buy Strategic Management Term Paperapi-696084904No ratings yet

- Process IntegrationDocument12 pagesProcess IntegrationYEFERSON EUSEBIO LLOCLLA ESCOBARNo ratings yet

- 5 Container Corporation of IndiaDocument19 pages5 Container Corporation of IndiaSaki Saki SakiNo ratings yet