Professional Documents

Culture Documents

Republic Vs Asiapro Digest

Republic Vs Asiapro Digest

Uploaded by

Xryn MortelCopyright:

Available Formats

You might also like

- Ecal v. National Labor Relations Commission G.R. Nos.92777-78 March 13, 1991Document2 pagesEcal v. National Labor Relations Commission G.R. Nos.92777-78 March 13, 1991Pamela Camille BarredoNo ratings yet

- Martinez, Et. Al. v. Magnolia Poultry Processing Plant, G.R. Nos. 231579 and 231636, June 16, 2021Document5 pagesMartinez, Et. Al. v. Magnolia Poultry Processing Plant, G.R. Nos. 231579 and 231636, June 16, 2021AP CruzNo ratings yet

- Penaranda vs. Baganga Plywood CorpDocument2 pagesPenaranda vs. Baganga Plywood CorpZaira Gem GonzalesNo ratings yet

- Social Media ContractDocument2 pagesSocial Media ContractIkhlas AlkhatibNo ratings yet

- Joinder in International Commercial Arbitration PDFDocument27 pagesJoinder in International Commercial Arbitration PDFisadora pazNo ratings yet

- Republic vs. Asiapro DigestDocument1 pageRepublic vs. Asiapro DigestArde Butirik100% (1)

- PEOPLE vs. CARMELITA ALVAREZDocument1 pagePEOPLE vs. CARMELITA ALVAREZPolaNo ratings yet

- Macarthur Malicdem Vs Marulas Industrial CorporationDocument6 pagesMacarthur Malicdem Vs Marulas Industrial CorporationisraeljamoraNo ratings yet

- Diamond Farms Inc Vs SPFLDocument2 pagesDiamond Farms Inc Vs SPFLSaji JimenoNo ratings yet

- Television and Production Exponents Inc. v. Servana, 542 SCRA 578Document1 pageTelevision and Production Exponents Inc. v. Servana, 542 SCRA 578Mae Clare BendoNo ratings yet

- Samahang Manggagawa Sa Top Form v. NLRCDocument2 pagesSamahang Manggagawa Sa Top Form v. NLRCCZARINA ANN CASTRONo ratings yet

- Sameer Overseas v. Cabiles (Labor)Document3 pagesSameer Overseas v. Cabiles (Labor)Kev Bayona100% (4)

- Republic V. Asiapro Cooperative (G.R. No. 172101) ClemensDocument1 pageRepublic V. Asiapro Cooperative (G.R. No. 172101) ClemensReynier Molintas ClemensNo ratings yet

- Television and Production Exponents v. ServañaDocument2 pagesTelevision and Production Exponents v. ServañaBert Nazario100% (1)

- Rosewood Vs NLRCDocument2 pagesRosewood Vs NLRCMara Corteza San PedroNo ratings yet

- People V SenoronDocument3 pagesPeople V SenoronGabe Bedana100% (1)

- Manila Memorial Park Vs Ezard LluzDocument4 pagesManila Memorial Park Vs Ezard LluzJMANo ratings yet

- 4 Celestino Co - Company vs. Collector of Internal RevenueDocument2 pages4 Celestino Co - Company vs. Collector of Internal RevenueSofia David100% (1)

- Television and Production Exponents, Inc. vs. ServañaDocument10 pagesTelevision and Production Exponents, Inc. vs. ServañaJaymar DonozoNo ratings yet

- Inchong V HernandezDocument2 pagesInchong V HernandezJpSocratesNo ratings yet

- Fulache vs. ABS-CBNDocument2 pagesFulache vs. ABS-CBNscartoneros_1No ratings yet

- Virjen Shipping V NLRCDocument3 pagesVirjen Shipping V NLRCErika Angela GalceranNo ratings yet

- Melchor - Great Pacific Life Employees Vs Great Pacific Life - 5th ReportingDocument2 pagesMelchor - Great Pacific Life Employees Vs Great Pacific Life - 5th ReportingLyndon MelchorNo ratings yet

- Abbott Lab V Alcaraz Case DigestDocument3 pagesAbbott Lab V Alcaraz Case Digestyasuren2No ratings yet

- Afp Vs NLRCDocument2 pagesAfp Vs NLRCRyan AnatanNo ratings yet

- LABREL-De Jesus Vs AquinoDocument3 pagesLABREL-De Jesus Vs AquinoArcee CruzNo ratings yet

- People of The Philippines, Appellee, vs. Carmelita ALVAREZ, AppellantDocument3 pagesPeople of The Philippines, Appellee, vs. Carmelita ALVAREZ, AppellantJacqueline Wade100% (1)

- First Division G.R. No. 221241, September 14, 2016 MARIO N. FELICILDA, Petitioner, v. MANCHESTEVE H. UY, Respondent. Decision Perlas-Bernabe, J.Document5 pagesFirst Division G.R. No. 221241, September 14, 2016 MARIO N. FELICILDA, Petitioner, v. MANCHESTEVE H. UY, Respondent. Decision Perlas-Bernabe, J.joachimjackNo ratings yet

- DemocraticDocument2 pagesDemocraticCamille Eve Bardos FabulaNo ratings yet

- PT & T v. NLRC, May 23, 1997Document2 pagesPT & T v. NLRC, May 23, 1997Sean AndersonNo ratings yet

- Azcor Manufacturing, Inc. v. NLRC, 303 SCRA 26 (1999)Document9 pagesAzcor Manufacturing, Inc. v. NLRC, 303 SCRA 26 (1999)inno KalNo ratings yet

- Starpaper Corporation Vs SimbolDocument3 pagesStarpaper Corporation Vs SimbolMarcus J. ValdezNo ratings yet

- CASE 07 - PhilCom vs. de VeraDocument2 pagesCASE 07 - PhilCom vs. de Verabernadeth ranolaNo ratings yet

- Abbott Vs AlcarazDocument2 pagesAbbott Vs AlcarazPaula Gaspar100% (1)

- NIna Jewelry v. MontecilloDocument10 pagesNIna Jewelry v. MontecilloKaren Selina AquinoNo ratings yet

- Case Digest Labor Law Atty PorfiDocument9 pagesCase Digest Labor Law Atty PorfiJomar JaymeNo ratings yet

- People v. Senoron G.N. No. 119160 January 30 1997Document1 pagePeople v. Senoron G.N. No. 119160 January 30 1997Mae Clare BendoNo ratings yet

- BONILLA V. BARCENA (G.R. No. L-41715 June 18, 1976, 71 SCRA 491)Document3 pagesBONILLA V. BARCENA (G.R. No. L-41715 June 18, 1976, 71 SCRA 491)MhareyNo ratings yet

- Francisco V NLRCDocument3 pagesFrancisco V NLRCEmmanuel OrtegaNo ratings yet

- #Cielo V NLRCDocument2 pages#Cielo V NLRCKareen Baucan100% (1)

- No. 22 GR No 192998Document2 pagesNo. 22 GR No 192998Naomi InotNo ratings yet

- Santa Rosa Coca-Cola Plant Employees Union v. Coca-Cola Bottlers Phils., Inc.Document30 pagesSanta Rosa Coca-Cola Plant Employees Union v. Coca-Cola Bottlers Phils., Inc.Annie Herrera-LimNo ratings yet

- David Vs MacasioDocument3 pagesDavid Vs MacasioTanga NinyoNo ratings yet

- Singer Sewing Machine Company Case DigestDocument2 pagesSinger Sewing Machine Company Case DigestSamantha GonzalesNo ratings yet

- 36 CIR V CADocument2 pages36 CIR V CAKathNo ratings yet

- 16 Sampaguita Garments Corp. v. NLRC (Digest: Labor)Document2 pages16 Sampaguita Garments Corp. v. NLRC (Digest: Labor)Dany AbuelNo ratings yet

- SMSI v. LabitiganDocument2 pagesSMSI v. LabitiganFrancis PunoNo ratings yet

- Caltex vs. Philippine Labor Organization DigestDocument1 pageCaltex vs. Philippine Labor Organization DigestBeverly Jane H. BulandayNo ratings yet

- 22 Sim Vs NLRCDocument1 page22 Sim Vs NLRCManz Edam C. JoverNo ratings yet

- Loreche-Amit V CDO MedicalDocument3 pagesLoreche-Amit V CDO MedicalJulia Camille RealNo ratings yet

- People V MatheusDocument2 pagesPeople V MatheusJb BuenoNo ratings yet

- Neri v. NLRCDocument2 pagesNeri v. NLRCJhomel Delos ReyesNo ratings yet

- Case Digests 12Document6 pagesCase Digests 12Macy TangNo ratings yet

- Abbott Laboratories VS AlcarazDocument1 pageAbbott Laboratories VS AlcarazMay ChanNo ratings yet

- 5 - Consulta V CADocument3 pages5 - Consulta V CAJesimiel Carlos67% (3)

- Pilipino Telephone Corp v. PILTEADocument3 pagesPilipino Telephone Corp v. PILTEAMiggy CardenasNo ratings yet

- Case #2 PT&T DigestDocument2 pagesCase #2 PT&T DigestKayeCie RLNo ratings yet

- Republic of The Philippines/SSC/SSS vs. Asiapro Cooperative FactsDocument2 pagesRepublic of The Philippines/SSC/SSS vs. Asiapro Cooperative FactsGela Bea BarriosNo ratings yet

- Republic of The Philippines/SSC/SSS vs. Asiapro CooperativeDocument1 pageRepublic of The Philippines/SSC/SSS vs. Asiapro CooperativeRobert QuiambaoNo ratings yet

- Agra Notes For Finals (Focal Point - Pointers) JPD PDFDocument25 pagesAgra Notes For Finals (Focal Point - Pointers) JPD PDFSammy EscañoNo ratings yet

- Republic V AsiaPro CoopDocument4 pagesRepublic V AsiaPro CoopMikaela Denise PazNo ratings yet

- 2 SSS vs. Asiapro CooperativeDocument4 pages2 SSS vs. Asiapro CooperativeKEDNo ratings yet

- Dutch Movers, INC. vs. LequinDocument3 pagesDutch Movers, INC. vs. LequinXryn MortelNo ratings yet

- CIR vs. Norton and Harrison Company, G.R. No. 17618, August 31, 1964Document3 pagesCIR vs. Norton and Harrison Company, G.R. No. 17618, August 31, 1964Xryn MortelNo ratings yet

- De Asis and Co. vs. Court of Appeals, GR No. L-61549Document1 pageDe Asis and Co. vs. Court of Appeals, GR No. L-61549Xryn MortelNo ratings yet

- ABS-CBN vs. Court of Appeals, GR NO. 128690Document2 pagesABS-CBN vs. Court of Appeals, GR NO. 128690Xryn MortelNo ratings yet

- Baliwag Transit, Inc. vs. CADocument2 pagesBaliwag Transit, Inc. vs. CAXryn MortelNo ratings yet

- Cease vs. CA, GR NO. 33172, October 18, 1979Document3 pagesCease vs. CA, GR NO. 33172, October 18, 1979Xryn MortelNo ratings yet

- Q&A - Patents in The PhilippinesDocument7 pagesQ&A - Patents in The PhilippinesXryn MortelNo ratings yet

- Orient Air Services vs. Court of AppealsDocument2 pagesOrient Air Services vs. Court of AppealsXryn MortelNo ratings yet

- G.R. No. 154127 December 8, 2003 ROMEO C. GARCIA, Petitioner, DIONISIO V. LLAMAS, RespondentDocument8 pagesG.R. No. 154127 December 8, 2003 ROMEO C. GARCIA, Petitioner, DIONISIO V. LLAMAS, RespondentXryn MortelNo ratings yet

- Aznar vs. DuncanDocument6 pagesAznar vs. DuncanXryn MortelNo ratings yet

- Villaroel vs. EstradaDocument2 pagesVillaroel vs. EstradaXryn MortelNo ratings yet

- Eo 192Document20 pagesEo 192Xryn MortelNo ratings yet

- Shell Oil Co. vs. National Labor UnionDocument2 pagesShell Oil Co. vs. National Labor UnionXryn MortelNo ratings yet

- G.R. No. 124371 November 23, 2000 PAULA T. LLORENTE, Petitioner, Court of Appeals and Alicia F. Llorente, RespondentsDocument7 pagesG.R. No. 124371 November 23, 2000 PAULA T. LLORENTE, Petitioner, Court of Appeals and Alicia F. Llorente, RespondentsfranzNo ratings yet

- Balonan vs. Abellana, G.R. No. L-15153, Aug. 31, 1960Document3 pagesBalonan vs. Abellana, G.R. No. L-15153, Aug. 31, 1960Xryn MortelNo ratings yet

- Asian Transmission Corporation vs. Court of AppealsDocument2 pagesAsian Transmission Corporation vs. Court of AppealsXryn MortelNo ratings yet

- Republic of The Philippines Regional Trial Court BRANCH 59, Angeles City, PampangaDocument4 pagesRepublic of The Philippines Regional Trial Court BRANCH 59, Angeles City, PampangaEna MacaleNo ratings yet

- Memorandum of Agreement For Gawad KalingaDocument3 pagesMemorandum of Agreement For Gawad KalingaPatricia RodriguezNo ratings yet

- Chapter 7 Habeas CorpusDocument50 pagesChapter 7 Habeas CorpusrenjomarNo ratings yet

- SONY NEW AND 8-598-871-20 NX-6020 8-598-871-02 8-598-871-10 Flyback TransformerDocument10 pagesSONY NEW AND 8-598-871-20 NX-6020 8-598-871-02 8-598-871-10 Flyback TransformerReneNo ratings yet

- Notice of Buyer'S Termination of Contract: TREC No.38-5Document1 pageNotice of Buyer'S Termination of Contract: TREC No.38-5Michell RivNo ratings yet

- Lonni Auditors Report 2020Document6 pagesLonni Auditors Report 2020Zenita CardinesNo ratings yet

- HearsayDocument14 pagesHearsayBayoyoy NaragasNo ratings yet

- Hague Child Support Convention & ProtocolDocument24 pagesHague Child Support Convention & Protocolangielisa.razo-satorNo ratings yet

- MIAC Report: Constitution RangersDocument2 pagesMIAC Report: Constitution RangersCatherineBleishNo ratings yet

- The Maharashtra Labour Welfare Fund Act, 1953: D.R. Haibat Corporate Consultant and Consulting Lawyer NGO MemberDocument10 pagesThe Maharashtra Labour Welfare Fund Act, 1953: D.R. Haibat Corporate Consultant and Consulting Lawyer NGO MemberDeepakNo ratings yet

- Kinds of Conditions LectureDocument48 pagesKinds of Conditions LectureKristine Coma50% (2)

- Turner V Lorenzo ShippingDocument2 pagesTurner V Lorenzo ShippingChic Pabalan67% (3)

- 32ND Chahrmcc - Hypothetical CaseDocument18 pages32ND Chahrmcc - Hypothetical CaseChala Yuye KemerNo ratings yet

- Petition For Reissuance of Title - LopezDocument6 pagesPetition For Reissuance of Title - Lopezmark anthonyNo ratings yet

- RantDocument16 pagesRantbdsign94No ratings yet

- TAX 2 NotessDocument34 pagesTAX 2 NotessRedd ClosaNo ratings yet

- Sps 303B Midterm Exam: 2 April 2021Document3 pagesSps 303B Midterm Exam: 2 April 2021cisemNo ratings yet

- 9.telephone Engineering Inc Vs WCC, G.R. No. L-28694Document5 pages9.telephone Engineering Inc Vs WCC, G.R. No. L-28694Elizabeth Jade D. CalaorNo ratings yet

- Hindi Book-AASAN AUR PRANAYAM by Shri Ram Sharma PDFDocument40 pagesHindi Book-AASAN AUR PRANAYAM by Shri Ram Sharma PDFWorldcoincufflinks CufflinksNo ratings yet

- #23 Avelino Vs CADocument2 pages#23 Avelino Vs CADenise DianeNo ratings yet

- ABLE Contract Approval.Document13 pagesABLE Contract Approval.Ferris FerrisNo ratings yet

- PNP Counterpart North KoreaDocument2 pagesPNP Counterpart North KoreaHarold BuendiaNo ratings yet

- Salibo Vs Warden (Readable)Document1 pageSalibo Vs Warden (Readable)Em DraperNo ratings yet

- Judgment of Supreme Court Devi Dutt - CIVIL APPEAL NO. 7631 OF 2002Document9 pagesJudgment of Supreme Court Devi Dutt - CIVIL APPEAL NO. 7631 OF 2002ANGRYOILMANNo ratings yet

- Ibey v. Taco Bell (Motion For Reconsideration)Document10 pagesIbey v. Taco Bell (Motion For Reconsideration)Venkat BalasubramaniNo ratings yet

- Owner Manual 511-523-524 Hy25-1501v-M1 Us Volvo-Mack 20190408Document16 pagesOwner Manual 511-523-524 Hy25-1501v-M1 Us Volvo-Mack 20190408Marko BeatzzNo ratings yet

- Persons and Family Relations ReviewerDocument11 pagesPersons and Family Relations ReviewerMary Jean Luyahan PanchitoNo ratings yet

- Annotated BibliographyDocument17 pagesAnnotated BibliographyDeven MichelsNo ratings yet

Republic Vs Asiapro Digest

Republic Vs Asiapro Digest

Uploaded by

Xryn MortelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Republic Vs Asiapro Digest

Republic Vs Asiapro Digest

Uploaded by

Xryn MortelCopyright:

Available Formats

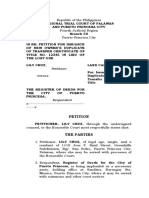

Republic of the Philippines/SSC/SSS vs.

Asiapro Cooperative of dismissal; and (4) the power to control the worker‘s conduct, with the latter

assuming primacy in the overall consideration. The most important element is the

employer‘s control. All the aforesaid elements are present in this case. The

[G.R. No. 172101 November 23, 2007] existence of an employer-employee relationship cannot be negated by

Facts: expressly repudiating it in a contract, when the terms and surrounding

circumstances show otherwise. The employment status of a person is

Asiapro, as a cooperative, is composed of owners-members. Under its by-

defined and prescribed by law and not by what the parties say it should be.

laws, owners-members are of two categories, (1)regular member, who is

A cooperative acquires juridical personality upon its registration with the

entitled to all the rights and privileges of membership ; and (2) associate

Cooperative Development Authority. It has its Board of Directors, which

member, who has no right to vote and be voted upon and shall be entitled

directs and supervises its business; meaning its Board of Directors is the

only to such rights and privileges provided in its by-laws. Its primary

one in charge in the conduct and management of its affairs. With that, a

objectives are to provide savings and credit facilities and to develop other

cooperative can be likened to a corporation with a personality separate

livelihood services for its owners-members. In the discharge of the

and distinct from its owners-members. Consequently, an owner-member of

aforesaid primary objectives, respondent cooperative entered into several

a cooperative can be an employee of the latter and the employer-

Service Contracts with Stanfilco - a division of DOLE Philippines, Inc. and a

employee relationship can exist between them.

company based in Bukidnon. The owners-members do not receive

compensation or wages from the respondent cooperative. Instead, they

receive a share in the service surplus which Asiapro earns from different 2. Petitioner SSC‘s jurisdiction is clearly stated in Section 5 of R.A. No. 8282 as well as in

areas of trade it engages in, such as the income derived from the said Section 1, Rule III of the 1997 SSS Revised Rules of Procedure. Sec. 5 of R.A.

Service Contracts with Stanfilco. In order to enjoy the benefits under 8282 provides:

the Social Security Law of 1997, the owners-members of Asiapro assigned

to Stanfilco requested the services of the latter to register them with SSS ―Sec. 5 Settlement of Disputes

as self-employed and to remit their contributions as such. On September –(a) Any dispute arising under this Act with respect to coverage, benefits,

26, 2002, petitioner SSS sent a letter to respondent cooperative contributions and penalties thereon or any other matter related thereto,

informing the latter that based on the Service Contracts it executed with shall be cognizable by the Commission

Stanfilco, Asiapro is actually manpower contractor supplying employees to , xxx‖ (Emphasis Supplied)

Stanfilco and so, it is an employer of its owners-members working with

Stanfilco. Thus, Asiapro should register itself with petitioner SSS as an Similarly, Section 1, Rule III of the 1997 SSS Revised Rules of Procedure

employer and make the corresponding report and remittance of states:

premium contributions. Despite letters received, respondent cooperative ―Section 1. Jurisdiction –

continuously ignored the demand of petitioner SSS. Accordingly, SSS filed a

Any dispute arising under the Social Security Act with respect to coverage,

petition on June 12, 2003 before SSC against Asiapro and Stanfilco praying

entitlement of benefits, collection and settlement of contributions and

that either of them be directed to register as an employer and to report Asiapro‘s

penalties thereon, or any other matter related thereto, shall be cognizable

owners-members as covered employees under the compulsory coverage

by the Commission after the SSS through its President, Manager or Officer-

of SSS and to remit the necessary contributions. Respondent cooperative

in-charge of the Department/Branch/Representative Office

filed its answer with Motion to Dismiss alleging that no employer-employee

relationship exists between it and its owners-members, thus, petitioner concerned had first taken action thereon in writing.‖ (Emphasis supplied)

SSC has no jurisdiction over the respondent cooperative.

Issues: It is clear then from the aforesaid provisions that any issue regarding the

1. Whether or not there exists an employer-employee relationship between compulsory coverage of the SSS is well within the exclusive domain of the

Asiapro Cooperative and its owners-members. petitioner SSC. It is important to note that the mandatory coverage under

the SSS Law is premised on the existence of an employer-employee

2. Whether or not petitioner has jurisdiction over the petition-complaint

relationship. Consequently, the respondent cooperative being the

filed before it by SSS against the respondent cooperative.

employer of its owners-members must register as employer and report its

owners-members as covered members of the SSS and remit the necessary

SC Ruling: premium contributions in accordance with the Social Security Law of

1997.Accordingly, based on the allegations in the petition-complaint filed

1. In determining the existence of an employer-employee relationship, the before the petitioner SSC, the case clearly falls within its jurisdiction.

following elements are considered: (1) the selection and engagement of

the workers; (2) the payment of wages by whatever means; (3) the power

You might also like

- Ecal v. National Labor Relations Commission G.R. Nos.92777-78 March 13, 1991Document2 pagesEcal v. National Labor Relations Commission G.R. Nos.92777-78 March 13, 1991Pamela Camille BarredoNo ratings yet

- Martinez, Et. Al. v. Magnolia Poultry Processing Plant, G.R. Nos. 231579 and 231636, June 16, 2021Document5 pagesMartinez, Et. Al. v. Magnolia Poultry Processing Plant, G.R. Nos. 231579 and 231636, June 16, 2021AP CruzNo ratings yet

- Penaranda vs. Baganga Plywood CorpDocument2 pagesPenaranda vs. Baganga Plywood CorpZaira Gem GonzalesNo ratings yet

- Social Media ContractDocument2 pagesSocial Media ContractIkhlas AlkhatibNo ratings yet

- Joinder in International Commercial Arbitration PDFDocument27 pagesJoinder in International Commercial Arbitration PDFisadora pazNo ratings yet

- Republic vs. Asiapro DigestDocument1 pageRepublic vs. Asiapro DigestArde Butirik100% (1)

- PEOPLE vs. CARMELITA ALVAREZDocument1 pagePEOPLE vs. CARMELITA ALVAREZPolaNo ratings yet

- Macarthur Malicdem Vs Marulas Industrial CorporationDocument6 pagesMacarthur Malicdem Vs Marulas Industrial CorporationisraeljamoraNo ratings yet

- Diamond Farms Inc Vs SPFLDocument2 pagesDiamond Farms Inc Vs SPFLSaji JimenoNo ratings yet

- Television and Production Exponents Inc. v. Servana, 542 SCRA 578Document1 pageTelevision and Production Exponents Inc. v. Servana, 542 SCRA 578Mae Clare BendoNo ratings yet

- Samahang Manggagawa Sa Top Form v. NLRCDocument2 pagesSamahang Manggagawa Sa Top Form v. NLRCCZARINA ANN CASTRONo ratings yet

- Sameer Overseas v. Cabiles (Labor)Document3 pagesSameer Overseas v. Cabiles (Labor)Kev Bayona100% (4)

- Republic V. Asiapro Cooperative (G.R. No. 172101) ClemensDocument1 pageRepublic V. Asiapro Cooperative (G.R. No. 172101) ClemensReynier Molintas ClemensNo ratings yet

- Television and Production Exponents v. ServañaDocument2 pagesTelevision and Production Exponents v. ServañaBert Nazario100% (1)

- Rosewood Vs NLRCDocument2 pagesRosewood Vs NLRCMara Corteza San PedroNo ratings yet

- People V SenoronDocument3 pagesPeople V SenoronGabe Bedana100% (1)

- Manila Memorial Park Vs Ezard LluzDocument4 pagesManila Memorial Park Vs Ezard LluzJMANo ratings yet

- 4 Celestino Co - Company vs. Collector of Internal RevenueDocument2 pages4 Celestino Co - Company vs. Collector of Internal RevenueSofia David100% (1)

- Television and Production Exponents, Inc. vs. ServañaDocument10 pagesTelevision and Production Exponents, Inc. vs. ServañaJaymar DonozoNo ratings yet

- Inchong V HernandezDocument2 pagesInchong V HernandezJpSocratesNo ratings yet

- Fulache vs. ABS-CBNDocument2 pagesFulache vs. ABS-CBNscartoneros_1No ratings yet

- Virjen Shipping V NLRCDocument3 pagesVirjen Shipping V NLRCErika Angela GalceranNo ratings yet

- Melchor - Great Pacific Life Employees Vs Great Pacific Life - 5th ReportingDocument2 pagesMelchor - Great Pacific Life Employees Vs Great Pacific Life - 5th ReportingLyndon MelchorNo ratings yet

- Abbott Lab V Alcaraz Case DigestDocument3 pagesAbbott Lab V Alcaraz Case Digestyasuren2No ratings yet

- Afp Vs NLRCDocument2 pagesAfp Vs NLRCRyan AnatanNo ratings yet

- LABREL-De Jesus Vs AquinoDocument3 pagesLABREL-De Jesus Vs AquinoArcee CruzNo ratings yet

- People of The Philippines, Appellee, vs. Carmelita ALVAREZ, AppellantDocument3 pagesPeople of The Philippines, Appellee, vs. Carmelita ALVAREZ, AppellantJacqueline Wade100% (1)

- First Division G.R. No. 221241, September 14, 2016 MARIO N. FELICILDA, Petitioner, v. MANCHESTEVE H. UY, Respondent. Decision Perlas-Bernabe, J.Document5 pagesFirst Division G.R. No. 221241, September 14, 2016 MARIO N. FELICILDA, Petitioner, v. MANCHESTEVE H. UY, Respondent. Decision Perlas-Bernabe, J.joachimjackNo ratings yet

- DemocraticDocument2 pagesDemocraticCamille Eve Bardos FabulaNo ratings yet

- PT & T v. NLRC, May 23, 1997Document2 pagesPT & T v. NLRC, May 23, 1997Sean AndersonNo ratings yet

- Azcor Manufacturing, Inc. v. NLRC, 303 SCRA 26 (1999)Document9 pagesAzcor Manufacturing, Inc. v. NLRC, 303 SCRA 26 (1999)inno KalNo ratings yet

- Starpaper Corporation Vs SimbolDocument3 pagesStarpaper Corporation Vs SimbolMarcus J. ValdezNo ratings yet

- CASE 07 - PhilCom vs. de VeraDocument2 pagesCASE 07 - PhilCom vs. de Verabernadeth ranolaNo ratings yet

- Abbott Vs AlcarazDocument2 pagesAbbott Vs AlcarazPaula Gaspar100% (1)

- NIna Jewelry v. MontecilloDocument10 pagesNIna Jewelry v. MontecilloKaren Selina AquinoNo ratings yet

- Case Digest Labor Law Atty PorfiDocument9 pagesCase Digest Labor Law Atty PorfiJomar JaymeNo ratings yet

- People v. Senoron G.N. No. 119160 January 30 1997Document1 pagePeople v. Senoron G.N. No. 119160 January 30 1997Mae Clare BendoNo ratings yet

- BONILLA V. BARCENA (G.R. No. L-41715 June 18, 1976, 71 SCRA 491)Document3 pagesBONILLA V. BARCENA (G.R. No. L-41715 June 18, 1976, 71 SCRA 491)MhareyNo ratings yet

- Francisco V NLRCDocument3 pagesFrancisco V NLRCEmmanuel OrtegaNo ratings yet

- #Cielo V NLRCDocument2 pages#Cielo V NLRCKareen Baucan100% (1)

- No. 22 GR No 192998Document2 pagesNo. 22 GR No 192998Naomi InotNo ratings yet

- Santa Rosa Coca-Cola Plant Employees Union v. Coca-Cola Bottlers Phils., Inc.Document30 pagesSanta Rosa Coca-Cola Plant Employees Union v. Coca-Cola Bottlers Phils., Inc.Annie Herrera-LimNo ratings yet

- David Vs MacasioDocument3 pagesDavid Vs MacasioTanga NinyoNo ratings yet

- Singer Sewing Machine Company Case DigestDocument2 pagesSinger Sewing Machine Company Case DigestSamantha GonzalesNo ratings yet

- 36 CIR V CADocument2 pages36 CIR V CAKathNo ratings yet

- 16 Sampaguita Garments Corp. v. NLRC (Digest: Labor)Document2 pages16 Sampaguita Garments Corp. v. NLRC (Digest: Labor)Dany AbuelNo ratings yet

- SMSI v. LabitiganDocument2 pagesSMSI v. LabitiganFrancis PunoNo ratings yet

- Caltex vs. Philippine Labor Organization DigestDocument1 pageCaltex vs. Philippine Labor Organization DigestBeverly Jane H. BulandayNo ratings yet

- 22 Sim Vs NLRCDocument1 page22 Sim Vs NLRCManz Edam C. JoverNo ratings yet

- Loreche-Amit V CDO MedicalDocument3 pagesLoreche-Amit V CDO MedicalJulia Camille RealNo ratings yet

- People V MatheusDocument2 pagesPeople V MatheusJb BuenoNo ratings yet

- Neri v. NLRCDocument2 pagesNeri v. NLRCJhomel Delos ReyesNo ratings yet

- Case Digests 12Document6 pagesCase Digests 12Macy TangNo ratings yet

- Abbott Laboratories VS AlcarazDocument1 pageAbbott Laboratories VS AlcarazMay ChanNo ratings yet

- 5 - Consulta V CADocument3 pages5 - Consulta V CAJesimiel Carlos67% (3)

- Pilipino Telephone Corp v. PILTEADocument3 pagesPilipino Telephone Corp v. PILTEAMiggy CardenasNo ratings yet

- Case #2 PT&T DigestDocument2 pagesCase #2 PT&T DigestKayeCie RLNo ratings yet

- Republic of The Philippines/SSC/SSS vs. Asiapro Cooperative FactsDocument2 pagesRepublic of The Philippines/SSC/SSS vs. Asiapro Cooperative FactsGela Bea BarriosNo ratings yet

- Republic of The Philippines/SSC/SSS vs. Asiapro CooperativeDocument1 pageRepublic of The Philippines/SSC/SSS vs. Asiapro CooperativeRobert QuiambaoNo ratings yet

- Agra Notes For Finals (Focal Point - Pointers) JPD PDFDocument25 pagesAgra Notes For Finals (Focal Point - Pointers) JPD PDFSammy EscañoNo ratings yet

- Republic V AsiaPro CoopDocument4 pagesRepublic V AsiaPro CoopMikaela Denise PazNo ratings yet

- 2 SSS vs. Asiapro CooperativeDocument4 pages2 SSS vs. Asiapro CooperativeKEDNo ratings yet

- Dutch Movers, INC. vs. LequinDocument3 pagesDutch Movers, INC. vs. LequinXryn MortelNo ratings yet

- CIR vs. Norton and Harrison Company, G.R. No. 17618, August 31, 1964Document3 pagesCIR vs. Norton and Harrison Company, G.R. No. 17618, August 31, 1964Xryn MortelNo ratings yet

- De Asis and Co. vs. Court of Appeals, GR No. L-61549Document1 pageDe Asis and Co. vs. Court of Appeals, GR No. L-61549Xryn MortelNo ratings yet

- ABS-CBN vs. Court of Appeals, GR NO. 128690Document2 pagesABS-CBN vs. Court of Appeals, GR NO. 128690Xryn MortelNo ratings yet

- Baliwag Transit, Inc. vs. CADocument2 pagesBaliwag Transit, Inc. vs. CAXryn MortelNo ratings yet

- Cease vs. CA, GR NO. 33172, October 18, 1979Document3 pagesCease vs. CA, GR NO. 33172, October 18, 1979Xryn MortelNo ratings yet

- Q&A - Patents in The PhilippinesDocument7 pagesQ&A - Patents in The PhilippinesXryn MortelNo ratings yet

- Orient Air Services vs. Court of AppealsDocument2 pagesOrient Air Services vs. Court of AppealsXryn MortelNo ratings yet

- G.R. No. 154127 December 8, 2003 ROMEO C. GARCIA, Petitioner, DIONISIO V. LLAMAS, RespondentDocument8 pagesG.R. No. 154127 December 8, 2003 ROMEO C. GARCIA, Petitioner, DIONISIO V. LLAMAS, RespondentXryn MortelNo ratings yet

- Aznar vs. DuncanDocument6 pagesAznar vs. DuncanXryn MortelNo ratings yet

- Villaroel vs. EstradaDocument2 pagesVillaroel vs. EstradaXryn MortelNo ratings yet

- Eo 192Document20 pagesEo 192Xryn MortelNo ratings yet

- Shell Oil Co. vs. National Labor UnionDocument2 pagesShell Oil Co. vs. National Labor UnionXryn MortelNo ratings yet

- G.R. No. 124371 November 23, 2000 PAULA T. LLORENTE, Petitioner, Court of Appeals and Alicia F. Llorente, RespondentsDocument7 pagesG.R. No. 124371 November 23, 2000 PAULA T. LLORENTE, Petitioner, Court of Appeals and Alicia F. Llorente, RespondentsfranzNo ratings yet

- Balonan vs. Abellana, G.R. No. L-15153, Aug. 31, 1960Document3 pagesBalonan vs. Abellana, G.R. No. L-15153, Aug. 31, 1960Xryn MortelNo ratings yet

- Asian Transmission Corporation vs. Court of AppealsDocument2 pagesAsian Transmission Corporation vs. Court of AppealsXryn MortelNo ratings yet

- Republic of The Philippines Regional Trial Court BRANCH 59, Angeles City, PampangaDocument4 pagesRepublic of The Philippines Regional Trial Court BRANCH 59, Angeles City, PampangaEna MacaleNo ratings yet

- Memorandum of Agreement For Gawad KalingaDocument3 pagesMemorandum of Agreement For Gawad KalingaPatricia RodriguezNo ratings yet

- Chapter 7 Habeas CorpusDocument50 pagesChapter 7 Habeas CorpusrenjomarNo ratings yet

- SONY NEW AND 8-598-871-20 NX-6020 8-598-871-02 8-598-871-10 Flyback TransformerDocument10 pagesSONY NEW AND 8-598-871-20 NX-6020 8-598-871-02 8-598-871-10 Flyback TransformerReneNo ratings yet

- Notice of Buyer'S Termination of Contract: TREC No.38-5Document1 pageNotice of Buyer'S Termination of Contract: TREC No.38-5Michell RivNo ratings yet

- Lonni Auditors Report 2020Document6 pagesLonni Auditors Report 2020Zenita CardinesNo ratings yet

- HearsayDocument14 pagesHearsayBayoyoy NaragasNo ratings yet

- Hague Child Support Convention & ProtocolDocument24 pagesHague Child Support Convention & Protocolangielisa.razo-satorNo ratings yet

- MIAC Report: Constitution RangersDocument2 pagesMIAC Report: Constitution RangersCatherineBleishNo ratings yet

- The Maharashtra Labour Welfare Fund Act, 1953: D.R. Haibat Corporate Consultant and Consulting Lawyer NGO MemberDocument10 pagesThe Maharashtra Labour Welfare Fund Act, 1953: D.R. Haibat Corporate Consultant and Consulting Lawyer NGO MemberDeepakNo ratings yet

- Kinds of Conditions LectureDocument48 pagesKinds of Conditions LectureKristine Coma50% (2)

- Turner V Lorenzo ShippingDocument2 pagesTurner V Lorenzo ShippingChic Pabalan67% (3)

- 32ND Chahrmcc - Hypothetical CaseDocument18 pages32ND Chahrmcc - Hypothetical CaseChala Yuye KemerNo ratings yet

- Petition For Reissuance of Title - LopezDocument6 pagesPetition For Reissuance of Title - Lopezmark anthonyNo ratings yet

- RantDocument16 pagesRantbdsign94No ratings yet

- TAX 2 NotessDocument34 pagesTAX 2 NotessRedd ClosaNo ratings yet

- Sps 303B Midterm Exam: 2 April 2021Document3 pagesSps 303B Midterm Exam: 2 April 2021cisemNo ratings yet

- 9.telephone Engineering Inc Vs WCC, G.R. No. L-28694Document5 pages9.telephone Engineering Inc Vs WCC, G.R. No. L-28694Elizabeth Jade D. CalaorNo ratings yet

- Hindi Book-AASAN AUR PRANAYAM by Shri Ram Sharma PDFDocument40 pagesHindi Book-AASAN AUR PRANAYAM by Shri Ram Sharma PDFWorldcoincufflinks CufflinksNo ratings yet

- #23 Avelino Vs CADocument2 pages#23 Avelino Vs CADenise DianeNo ratings yet

- ABLE Contract Approval.Document13 pagesABLE Contract Approval.Ferris FerrisNo ratings yet

- PNP Counterpart North KoreaDocument2 pagesPNP Counterpart North KoreaHarold BuendiaNo ratings yet

- Salibo Vs Warden (Readable)Document1 pageSalibo Vs Warden (Readable)Em DraperNo ratings yet

- Judgment of Supreme Court Devi Dutt - CIVIL APPEAL NO. 7631 OF 2002Document9 pagesJudgment of Supreme Court Devi Dutt - CIVIL APPEAL NO. 7631 OF 2002ANGRYOILMANNo ratings yet

- Ibey v. Taco Bell (Motion For Reconsideration)Document10 pagesIbey v. Taco Bell (Motion For Reconsideration)Venkat BalasubramaniNo ratings yet

- Owner Manual 511-523-524 Hy25-1501v-M1 Us Volvo-Mack 20190408Document16 pagesOwner Manual 511-523-524 Hy25-1501v-M1 Us Volvo-Mack 20190408Marko BeatzzNo ratings yet

- Persons and Family Relations ReviewerDocument11 pagesPersons and Family Relations ReviewerMary Jean Luyahan PanchitoNo ratings yet

- Annotated BibliographyDocument17 pagesAnnotated BibliographyDeven MichelsNo ratings yet